Forex Trading for Beginners: Everything You Need to Know – sounds daunting, right? But imagine this: you, mastering the global currency market, making smart moves, and potentially building wealth. It’s not magic, it’s understanding the game. This guide breaks down the complexities of forex trading, from understanding currency pairs to mastering risk management, all in a way that’s both informative and, dare we say, fun. Get ready to ditch the intimidation and dive into a world of financial opportunity.

We’ll cover the basics – what forex trading actually *is*, different account types, and the crucial role of brokers. Then, we’ll explore the mechanics: placing trades, understanding leverage (yes, that’s a thing!), and navigating the world of market and limit orders. Think of it as your personal crash course in the exciting world of global finance. We’ll even show you how to use fundamental and technical analysis to make informed decisions, all while keeping your risk in check.

Introduction to Forex Trading

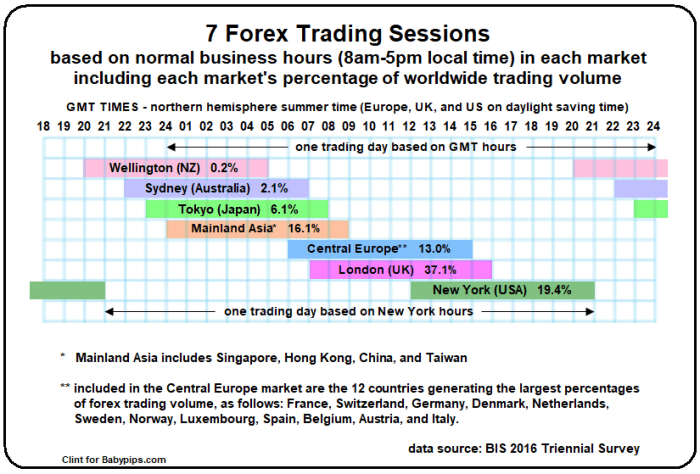

Forex trading, or foreign exchange trading, is the global marketplace where currencies are bought and sold. It’s a massive, decentralized market operating 24/5, connecting banks, businesses, and individual traders worldwide. Unlike stocks traded on specific exchanges, forex trading happens electronically across a network of banks and brokers. This accessibility and constant activity make it a potentially lucrative but also risky venture.

Forex trading fundamentally involves exchanging one currency for another, aiming to profit from fluctuations in their relative values. Understanding these fluctuations is key to successful trading.

Currency Pairs and Their Notation

Currency pairs represent the relative value of two currencies. The notation follows a standard format: the first currency is the base currency, and the second is the quote currency. For example, EUR/USD means one euro can be exchanged for a certain number of US dollars. The price quoted reflects how much of the quote currency is needed to buy one unit of the base currency.

Examples of Currency Pairs

Forex markets feature a vast array of currency pairs, broadly categorized into major, minor, and exotic pairs.

Major pairs involve the US dollar (USD) paired with other major global currencies like the euro (EUR), Japanese yen (JPY), British pound (GBP), Swiss franc (CHF), Canadian dollar (CAD), and Australian dollar (AUD). Examples include EUR/USD, USD/JPY, GBP/USD.

Minor pairs involve one major currency paired with a non-major currency, excluding the USD. Examples include EUR/GBP, EUR/JPY, GBP/CHF.

Exotic pairs involve a major currency paired with the currency of a smaller or emerging economy. These pairs often exhibit higher volatility due to less liquidity and factors specific to the smaller economy. Examples include USD/MXN (US dollar/Mexican peso), USD/TRY (US dollar/Turkish lira), EUR/CZK (Euro/Czech Koruna).

Factors Influencing Forex Exchange Rates

Numerous factors influence forex exchange rates, creating dynamic market conditions. These include:

* Economic data: Economic indicators like inflation rates, interest rates, GDP growth, unemployment figures, and trade balances significantly impact currency values. Strong economic data usually boosts a currency’s value.

* Political stability: Political uncertainty or instability in a country can negatively affect its currency. Geopolitical events also play a significant role.

* Market sentiment: Investor confidence and speculation heavily influence exchange rates. Positive sentiment tends to drive prices up, while negative sentiment can lead to declines.

* Central bank actions: Central banks’ monetary policies, such as interest rate adjustments or interventions in the forex market, can have a substantial impact on currency values.

* Supply and demand: Like any market, the supply and demand for a particular currency determine its price. High demand pushes the price up, while low demand pushes it down.

Types of Forex Trading Accounts

Different forex brokers offer various account types catering to different trading styles and capital levels. Here’s a comparison:

| Account Type | Features | Suitable For | Leverage |

|---|---|---|---|

| Demo Account | Practice trading with virtual money; risk-free environment | Beginners learning the ropes | Variable, often high |

| Standard Account | Standard lot sizes (100,000 units); suitable for experienced traders | Experienced traders with larger capital | Variable, often high |

| Mini Account | Smaller lot sizes (10,000 units); lower capital requirement | Beginners and traders with limited capital | Variable, often high |

| Micro Account | Smallest lot sizes (1,000 units); ideal for micro-trading | Beginners with very limited capital | Variable, often high |

Understanding Forex Market Mechanics

Navigating the forex market successfully requires a solid grasp of its underlying mechanics. Understanding how brokers operate, leveraging works, and different order types are crucial for both beginners and experienced traders alike. This section breaks down these essential components to equip you with the knowledge you need to confidently participate in the forex market.

The Roles of Brokers and Dealing Desks

Forex brokers act as intermediaries, connecting you to the global forex market. They provide the trading platform, access to liquidity, and execution services. Different brokers employ different models, the most common being dealing desks and no-dealing desks (NDDs). Dealing desk brokers act as counterparties to your trades, essentially taking the opposite side of your position. NDDs, on the other hand, route your orders to multiple liquidity providers, aiming for the best possible price execution. Understanding your broker’s model is key to understanding potential conflicts of interest and pricing transparency. The choice between a dealing desk and an NDD broker depends on your individual priorities; some traders prefer the tighter spreads offered by NDD brokers, while others might value the personalized service offered by dealing desk brokers.

Leverage and Risk Management in Forex Trading

Leverage is a powerful tool in forex trading, allowing you to control larger positions with a smaller initial investment. For example, a 1:100 leverage means you can control $100,000 in the market with just $1,000 of your own capital. While leverage magnifies potential profits, it equally amplifies potential losses. Effective risk management is paramount when using leverage. This typically involves setting stop-loss orders to limit potential losses and only risking a small percentage of your trading capital on any single trade. For instance, a trader might risk only 1-2% of their account balance per trade, regardless of the leverage used. Inadequate risk management when using leverage can lead to significant losses and even account wipeouts.

Forex Order Types

Several order types are available in forex trading, each designed for specific trading strategies and risk tolerances.

Market Orders: These orders are executed immediately at the best available market price. They are simple and straightforward but may not always result in the most favorable price, especially during volatile market conditions.

Limit Orders: A limit order allows you to specify the exact price at which you want to buy or sell a currency pair. This ensures you only enter a trade at your desired price or better. However, there’s no guarantee your order will be filled if the market doesn’t reach your specified price.

Stop-Loss Orders: This order is crucial for risk management. It automatically closes your position when the price moves against you by a predetermined amount, limiting potential losses. For example, if you buy EUR/USD at 1.1000 and set a stop-loss at 1.0950, your position will be automatically closed if the price drops to 1.0950, minimizing your losses.

Take-Profit Orders: Similar to stop-loss orders, take-profit orders automatically close your position when the price reaches a predetermined level, securing your profits. Setting take-profit orders helps to lock in gains and avoid giving back profits due to market reversals.

Placing a Trade: A Step-by-Step Guide

Let’s assume you are using a MetaTrader 4 (MT4) platform.

1. Log in: Access your MT4 trading account.

2. Select Currency Pair: Choose the currency pair you wish to trade (e.g., EUR/USD).

3. Choose Order Type: Select “New Order” from the menu or click the “New Order” button.

4. Specify Trade Details: Enter the volume (lot size), stop-loss, and take-profit levels.

5. Set Order Type: Select “Buy” (long position) or “Sell” (short position).

6. Place Order: Click “Place Order” to execute the trade. The platform will confirm the order execution. Your trade will now appear in the “Terminal” window.

Executing a Forex Trade: A Flowchart

[Imagine a flowchart here. The flowchart would start with “Log in to Trading Platform,” then branch to “Select Currency Pair,” followed by “Choose Order Type (Market, Limit, Stop-Loss, Take-Profit),” then “Specify Trade Details (Volume, Stop-Loss, Take-Profit),” then “Place Order,” and finally “Order Confirmation/Trade Execution”. Arrows would connect each step, visually illustrating the process.]

Fundamental Analysis in Forex Trading

Fundamental analysis in forex trading delves into the economic and political factors that influence currency values. Unlike technical analysis, which focuses on price charts, fundamental analysis examines the underlying forces driving supply and demand for a currency. Understanding these forces is crucial for making informed trading decisions and potentially profiting from market movements.

Economic Indicators and Currency Values

Economic indicators provide a snapshot of a country’s economic health, directly impacting its currency’s value. A strong economy generally attracts foreign investment, increasing demand for its currency and pushing its value higher. Conversely, a weak economy can lead to a decline in currency value. Three key indicators are Gross Domestic Product (GDP), inflation, and interest rates. High GDP growth often signifies a robust economy, boosting currency value. High inflation, however, erodes purchasing power and typically weakens a currency. Interest rate hikes, aiming to curb inflation, can attract foreign investment and strengthen the currency, while interest rate cuts often have the opposite effect. For example, a country with consistently high GDP growth and low inflation might see its currency appreciate against those of countries experiencing slower growth or higher inflation.

Geopolitical Events and Forex Markets

Geopolitical events – such as wars, political instability, and changes in government – can significantly impact currency markets. These events create uncertainty, influencing investor sentiment and leading to rapid currency fluctuations. For instance, a sudden political upheaval in a major economy can cause investors to flee the market, weakening its currency. Conversely, positive geopolitical developments, like the signing of a major trade agreement, can boost investor confidence and strengthen the relevant currency. The impact of these events is often unpredictable and can lead to both short-term and long-term effects on currency values.

Fundamental Analysis Techniques: A Comparison

Various fundamental analysis techniques exist, each offering a different perspective on currency valuation. One common approach involves comparing a country’s economic performance against its trading partners. This involves analyzing relative GDP growth, inflation rates, and interest rate differentials. Another technique focuses on analyzing a country’s balance of payments, which reflects the flow of money into and out of the country. A large current account surplus (more money coming in than going out) often suggests a strong economy and a potentially appreciating currency. Finally, some analysts utilize qualitative factors, such as political stability and investor confidence, to assess currency prospects. While quantitative methods offer numerical data, qualitative analysis relies on interpreting news and events to gauge market sentiment.

Key Economic Calendars and Their Importance

Economic calendars are crucial tools for fundamental analysis. These calendars list the release dates and times for various economic indicators, allowing traders to anticipate potential market movements. Knowing when key data is released enables traders to prepare for potential volatility and adjust their trading strategies accordingly. Missing a major economic announcement can lead to missed opportunities or unexpected losses. For example, a surprise increase in inflation could cause a currency to depreciate rapidly, impacting traders unprepared for the event. Reputable financial websites and news sources regularly publish these calendars.

Reliable Sources for Economic Data

Accessing reliable economic data is paramount for effective fundamental analysis. Several sources provide high-quality, timely information. These include central banks (like the Federal Reserve in the US or the European Central Bank), international organizations (such as the International Monetary Fund and the World Bank), and reputable financial news agencies (like Bloomberg and Reuters). Government statistical agencies also publish essential economic data. It’s crucial to use multiple sources to verify information and obtain a comprehensive view of the economic landscape. Cross-referencing data ensures accuracy and minimizes the risk of relying on biased or inaccurate information.

Technical Analysis in Forex Trading

Technical analysis is a powerful tool for forex traders, allowing them to predict future price movements based on past price action and market sentiment. Unlike fundamental analysis, which focuses on economic indicators and news events, technical analysis uses charts and various indicators to identify trends, support and resistance levels, and potential entry and exit points. Mastering technical analysis can significantly improve your trading decisions and risk management.

Charting and Technical Indicators

Charts are the foundation of technical analysis. Forex traders primarily use candlestick charts, which visually represent price movements over specific timeframes (e.g., 1-minute, 5-minute, daily). These charts show the opening, closing, high, and low prices for each period. Technical indicators are mathematical calculations applied to price data, providing additional insights into market trends and momentum. Moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are among the most popular indicators. Moving averages smooth out price fluctuations, helping identify trends; RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions; and MACD identifies changes in momentum by comparing two moving averages.

Chart Patterns

Recognizing chart patterns can help anticipate future price movements. A head and shoulders pattern, for example, suggests a potential price reversal after a significant upward trend. This pattern is characterized by three peaks, with the middle peak (the head) being the highest. Conversely, an inverse head and shoulders pattern indicates a potential bullish reversal. Triangles are consolidation patterns that often precede a breakout in either direction. Symmetrical triangles suggest equal probability of upward or downward breakouts, while ascending and descending triangles suggest a breakout in the respective direction.

Candlestick Patterns

Candlestick patterns offer valuable insights into short-term price movements. A bullish engulfing pattern, where a large green candlestick completely engulfs the previous red candlestick, often signals a potential price reversal to the upside. Conversely, a bearish engulfing pattern, with a large red candlestick engulfing the previous green candlestick, suggests a potential downward reversal. Other common patterns include hammer (bullish reversal), hanging man (bearish reversal), and doji (indecision). These patterns are best interpreted in conjunction with other technical indicators and chart patterns.

Strategies for Identifying Entry and Exit Points

Technical analysis helps identify potential entry and exit points by pinpointing support and resistance levels, trendlines, and breakout points. Traders often use indicators like RSI to gauge overbought or oversold conditions, signaling potential reversal points. MACD crossovers can also indicate changes in momentum, providing potential entry signals. Breakouts from chart patterns, such as triangles or head and shoulders, can also be used to identify entry points, while stop-loss orders help manage risk by limiting potential losses. The exit strategy should be pre-defined based on profit targets or technical indicators suggesting a potential trend reversal.

Strengths and Weaknesses of Technical Indicators

| Indicator | Strengths | Weaknesses | Best Used For |

|---|---|---|---|

| Moving Averages | Identifies trends, smooths price data | Lagging indicator, can generate false signals | Identifying trend direction, setting stop-loss and take-profit levels |

| RSI | Identifies overbought and oversold conditions, potential reversal points | Can generate false signals, particularly in sideways markets | Identifying potential reversal points, confirming trend changes |

| MACD | Identifies changes in momentum, potential trend changes | Can generate false signals, sensitive to parameter adjustments | Identifying momentum shifts, confirming trend direction |

Risk Management Strategies in Forex Trading

Forex trading, while potentially lucrative, is inherently risky. Success hinges not just on accurate market predictions, but also on a robust risk management strategy that protects your capital and ensures longevity in the market. Without a solid plan, even the most skilled trader can quickly find themselves on the losing side. This section delves into essential risk management techniques that every beginner should master.

Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are fundamental tools for controlling risk. A stop-loss order automatically closes a losing trade when the price reaches a predetermined level, limiting potential losses. Conversely, a take-profit order automatically closes a winning trade when the price hits a specified target, securing your profits. Setting these orders before entering a trade is crucial; it removes emotion from the equation, preventing impulsive decisions driven by fear or greed. For example, if you buy EUR/USD at 1.1000, you might set a stop-loss at 1.0950 to limit your loss to 50 pips and a take-profit at 1.1050 to secure a 50-pip profit. This approach defines your risk and reward before the trade even begins.

Position Sizing

Position sizing determines how much capital you allocate to each trade. It’s about managing your risk relative to your account balance. A common approach is to risk only a small percentage (e.g., 1-2%) of your account on any single trade. This prevents a single losing trade from significantly impacting your overall portfolio. For instance, with a $10,000 account and a 2% risk tolerance, you would only risk $200 on each trade. This translates to your stop-loss order, determining the position size accordingly. This disciplined approach helps you withstand inevitable losing streaks.

Risk Management Techniques: Diversification and Hedging

Diversification involves spreading your investments across different currency pairs or asset classes. This reduces the impact of a single losing trade or a downturn in a specific market. Instead of focusing solely on one pair, consider diversifying your portfolio. Hedging, on the other hand, involves taking an offsetting position to reduce risk. For example, if you are long on EUR/USD, you might hedge by taking a short position on a related pair like USD/CHF to mitigate potential losses if the USD strengthens. Both techniques contribute to a more resilient trading strategy.

Emotional Control in Trading

Emotional discipline is arguably the most critical aspect of successful trading. Fear and greed can lead to impulsive decisions, often resulting in losses. Developing emotional control involves sticking to your trading plan, avoiding overtrading, and managing stress. Keeping a trading journal, regularly reviewing your performance, and practicing mindfulness techniques can significantly improve your emotional resilience in the face of market volatility. Remember, successful trading is a marathon, not a sprint.

Sample Trading Plan

A comprehensive trading plan incorporates all aspects of risk management. Here’s a basic example:

* Account Size: $5,000

* Risk Tolerance: 1% per trade ($50)

* Trading Strategy: Identifying breakout opportunities using technical analysis on the EUR/USD pair.

* Position Sizing: Based on the 1% risk, position size will be adjusted according to stop-loss placement.

* Stop-Loss Order: Always placed before entering a trade, limiting loss to $50 per trade.

* Take-Profit Order: Set at a risk/reward ratio of 1:2 (profit target is double the potential loss).

* Diversification: Allocate capital to a maximum of 3 currency pairs simultaneously.

* Review and Adjustment: Regularly review trading performance, adjust the plan as needed, and maintain a trading journal.

Demo Accounts and Practice Trading

Diving headfirst into live Forex trading without any prior experience is like jumping off a cliff without a parachute – exhilarating, maybe, but incredibly risky. That’s where demo accounts come in: your safety net and training ground before you start risking your hard-earned cash. Think of it as a virtual playground where you can hone your skills and test your strategies without the pressure of real financial consequences.

Demo accounts offer a risk-free environment to experiment with different trading strategies, learn the platform’s intricacies, and understand market fluctuations. They allow you to familiarize yourself with the emotional rollercoaster of trading without the stomach-churning feeling of actual losses. Mastering the art of Forex trading takes time and practice, and a demo account provides the perfect space for that crucial learning curve.

Opening and Using a Demo Account

Opening a demo account is usually a straightforward process. Most Forex brokers offer them directly on their websites. Typically, you’ll need to provide some basic information, such as your name and email address. Once registered, you’ll receive access to a virtual trading account funded with virtual currency. You can then start practicing trading using the same platform and tools available in a live account. Many brokers offer tutorials and educational resources to help you navigate the platform effectively. The process generally involves: creating an account, selecting the demo account option, choosing your preferred trading platform (MetaTrader 4 or 5 are common choices), and then you’re ready to start trading with virtual funds.

Effective Practice Trading Techniques

Effective practice goes beyond simply placing random trades. It involves simulating real-world scenarios and developing a robust trading plan. This includes setting realistic trading goals, defining your risk tolerance, and sticking to your chosen strategy. Focus on developing discipline, managing emotions, and learning to identify and analyze market trends. Don’t be afraid to make mistakes – they’re invaluable learning opportunities. Regularly review your trades, analyze what worked and what didn’t, and adjust your strategy accordingly. Remember, consistency and discipline are key to success in Forex trading, whether in a demo or live environment.

Differences Between Demo and Live Trading

While demo accounts provide a realistic simulation, there are key differences between demo and live trading. The most significant difference is the psychological aspect. The lack of real financial risk in a demo account can lead to overconfidence and less cautious trading practices. In live trading, emotions like fear and greed play a much more significant role, influencing decision-making. Another difference is the speed and accuracy of order execution. While demo accounts generally provide instantaneous execution, live trading may experience slight delays due to market conditions and server load. Finally, demo accounts often don’t reflect the full range of market volatility and unexpected events that can occur in live trading.

Reputable Forex Brokers Offering Demo Accounts

Several reputable Forex brokers offer demo accounts. It’s crucial to research and choose a broker with a strong regulatory track record and a user-friendly platform. The availability of educational resources and customer support should also be considered. Note: This is not an exhaustive list, and the suitability of a broker depends on individual needs and preferences. Always conduct thorough research before choosing a broker.

| Broker | Regulation | Platform |

|---|---|---|

| XM | CySEC, ASIC, FCA | MetaTrader 4, MetaTrader 5 |

| FXTM | CySEC, FCA, FSC | MetaTrader 4, MetaTrader 5, cTrader |

| AvaTrade | Various (depending on region) | MetaTrader 4, MetaTrader 5, AvaTradeGO |

| eToro | Various (depending on region) | eToro platform |

| IG | FCA, ASIC, SFC | IG Trading platform |

Common Forex Trading Mistakes to Avoid

Stepping into the world of forex trading can feel exhilarating, but it’s crucial to understand that many beginners fall prey to common pitfalls. These mistakes can lead to significant losses, eroding your confidence and potentially derailing your trading journey. By understanding these common errors and implementing preventative strategies, you can significantly improve your chances of success.

Overconfidence and lack of proper risk management are frequently cited as major reasons for forex trading failures. Ignoring market volatility, emotional trading decisions, and neglecting continuous learning are other significant hurdles. This section will delve into these specific issues, providing actionable advice to help you navigate the complexities of the forex market effectively.

Ignoring Risk Management Strategies

Ignoring proper risk management is arguably the biggest mistake a beginner forex trader can make. This involves failing to set stop-loss orders, over-leveraging your account, or not diversifying your trades. The consequences can be devastating, potentially leading to the complete loss of your trading capital. A robust risk management strategy should always be in place, limiting potential losses on any single trade to a percentage of your overall capital, typically no more than 1-2%. For example, if you have a $1000 account and risk 1%, your maximum loss per trade should be $10. This disciplined approach helps prevent catastrophic losses and allows you to stay in the game for the long term.

Emotional Trading, Forex Trading for Beginners: Everything You Need to Know

Letting emotions like fear and greed dictate your trading decisions is a recipe for disaster. Fear can lead to premature exits from profitable trades, while greed can tempt you to hold onto losing positions for too long, hoping for a reversal. This emotional rollercoaster can cloud your judgment and prevent you from making rational trading choices. Developing a disciplined trading plan, sticking to your strategy, and maintaining a detached, analytical approach are crucial to overcoming emotional trading. Journaling your trades and analyzing your emotional responses can also be helpful in identifying patterns and improving self-awareness.

Overtrading

Overtrading, or making too many trades too frequently, is another common mistake. It often stems from a desire for quick profits or a lack of patience. However, it frequently leads to increased transaction costs and a higher probability of making impulsive, poorly informed decisions. A well-defined trading plan that includes clear entry and exit strategies, coupled with patience and discipline, is essential to avoid overtrading. Focus on quality over quantity; fewer, well-planned trades are generally more profitable than numerous hasty ones.

Lack of a Trading Plan

Trading without a well-defined plan is like sailing a ship without a map – you’re likely to get lost and end up far from your intended destination. A trading plan should Artikel your trading goals, risk tolerance, preferred trading strategies, and money management rules. Without a plan, you’re vulnerable to impulsive decisions based on market noise rather than a reasoned assessment of the market conditions. Developing a structured plan that you can consistently adhere to is vital for success.

Neglecting Continuous Learning and Adaptation

The forex market is constantly evolving, making continuous learning and adaptation essential for long-term success. New trading strategies emerge, economic conditions shift, and market dynamics change. Staying informed through reputable sources, attending webinars, reading trading books, and engaging with experienced traders is crucial for staying ahead of the curve. Regularly reviewing your trading performance, identifying areas for improvement, and adapting your strategies accordingly is key to sustainable success.

Resources for Further Learning and Development

Several resources are available to enhance your forex trading knowledge and skills. These include reputable online trading courses, books by experienced traders, educational materials provided by brokers, and online forex forums and communities where you can engage with other traders and learn from their experiences. Remember to always verify the credibility of your sources before relying on their information. Choosing reliable and regulated brokers is also a crucial step in your trading journey.

Ending Remarks: Forex Trading For Beginners: Everything You Need To Know

So, you’ve just cracked the code to the forex trading universe. Remember, this isn’t a get-rich-quick scheme; it’s about building a solid foundation of knowledge and understanding. Mastering the art of forex trading takes time, patience, and a willingness to learn. But with the right tools and mindset, you’re equipped to navigate the thrilling world of currency trading and potentially achieve your financial goals. Now go out there and make some smart moves!

FAQ

What’s the minimum amount I need to start forex trading?

It varies greatly depending on the broker and account type. Some brokers allow you to start with as little as a few hundred dollars, while others may require a higher minimum deposit.

How much can I realistically make trading forex?

There’s no guaranteed return in forex trading. Profits depend on many factors, including your trading strategy, risk management, and market conditions. It’s crucial to manage expectations and focus on consistent, sustainable growth rather than quick riches.

Is forex trading legal?

Yes, forex trading is legal in most countries, but it’s essential to ensure you’re using regulated brokers to avoid scams.

How much time should I dedicate to forex trading?

The time commitment depends on your trading style. Some traders dedicate hours daily, while others may only trade a few times a week. It’s important to find a balance that works for your lifestyle.