Best forex trading system? Sounds like a holy grail, right? Except in the forex world, “best” is as subjective as your favorite pizza topping. What works wonders for a seasoned swing trader might be a complete disaster for a scalper. This isn’t about finding the *one* perfect system; it’s about understanding your trading style, risk tolerance, and finding a system that aligns with *your* unique needs. We’ll dive deep into different system types, crucial components for success, and the common pitfalls to avoid—so you can build a strategy that’s genuinely *your* best.

From understanding the nuances of scalping versus position trading to mastering risk management and backtesting, we’ll break down the essentials of crafting a winning forex trading strategy. We’ll even explore hypothetical examples to illustrate how different systems work in practice, offering a practical, hands-on approach to help you navigate the exciting (and sometimes chaotic) world of forex trading.

Defining “Best” in Forex Trading Systems

Let’s be real, there’s no single “best” forex trading system. The search for the holy grail of automated riches is a siren song in the forex world, luring many to their financial doom. The truth is far more nuanced and depends entirely on the individual trader. What works wonders for one person might be a complete disaster for another. This isn’t just about finding a system; it’s about finding the *right* system for *you*.

Subjective Nature of “Best” in Forex Trading

The term “best” is inherently subjective in forex trading. It’s not a mathematical equation with a single, definitive solution. Success hinges on a complex interplay of factors, including market conditions, personal risk tolerance, trading style, and the trader’s overall financial situation. A system boasting a 90% win rate might be disastrous for a trader with a low risk tolerance and a small account, while a more conservative system with a lower win rate might be perfect for someone seeking steady, long-term growth.

Trader Profiles and System Needs

Different traders have different needs and goals. Consider these examples:

| Trader Profile | Trading Style | Risk Tolerance | Ideal System Characteristics |

|---|---|---|---|

| Day Trader | Short-term, high-frequency trades | High | Fast execution, clear entry/exit signals, high win rate (even with smaller profits per trade) |

| Swing Trader | Medium-term trades (holding positions for days or weeks) | Medium | Reliable indicators, moderate win rate, potential for larger profits per trade |

| Position Trader | Long-term trades (holding positions for months or years) | Low | Fundamental analysis integration, lower frequency of trades, focus on risk management |

| Scalper | Extremely short-term trades (seconds or minutes) | Very High | Ultra-fast execution, very tight stop-losses, high volume trading, high win rate needed to offset losses |

Factors Contributing to a Successful Trading System

A truly effective trading system isn’t just about generating winning trades; it’s about a holistic approach. Key components include:

* Robust Strategy: The core of your system, outlining entry and exit rules, based on technical or fundamental analysis, or a combination. A poorly defined strategy is a recipe for disaster.

* Effective Risk Management: This is paramount. Stop-loss orders, position sizing, and diversification are crucial to protect your capital and prevent catastrophic losses. Without solid risk management, even the best strategy can fail. For example, never risk more than 1-2% of your account on any single trade.

* Backtesting and Optimization: Thorough backtesting on historical data is essential to evaluate the system’s performance and identify potential weaknesses. Optimization should focus on improving the system’s robustness and profitability without overfitting to past data.

* Forward Testing and Adaptation: After backtesting, forward testing (live trading with real money, but with small amounts) is crucial to assess the system’s performance in real-market conditions. Markets are dynamic, so adapting your system based on observed results is necessary for long-term success.

* Discipline and Emotional Control: Sticking to your system’s rules, regardless of emotional impulses, is crucial. Fear and greed can lead to poor decisions that undermine even the best strategies.

Types of Forex Trading Systems

So, you’re ready to dive into the wild world of forex trading, huh? Choosing the right system is like picking the perfect surfboard – you need one that matches your style and the size of the waves you’re tackling. Different systems cater to different trading personalities and risk tolerances. Let’s break down the main types.

Forex trading systems aren’t one-size-fits-all; they’re as diverse as the traders themselves. Understanding the nuances of each approach is crucial for success. This isn’t about finding the *holy grail*, but about finding the system that best aligns with your skills, time commitment, and risk appetite.

Scalping

Scalping involves making many trades throughout the day, profiting from tiny price movements. Think of it as picking up pennies in a busy marketplace. Traders use very short timeframes (seconds to minutes) and aim for small, frequent profits. The risk is high, as even small price reversals can wipe out gains, but the potential for quick returns is also significant. A successful scalper needs lightning-fast reflexes, a robust trading platform, and nerves of steel. They rely heavily on technical indicators and chart patterns to identify fleeting opportunities. Profit targets are usually modest, and trades are closed quickly to minimize exposure.

Day Trading

Day traders hold positions for a single trading session. They open and close all their trades before the market closes for the day. Timeframes range from minutes to hours. Day trading demands focus and discipline; traders need to constantly monitor the market and react to changing conditions. While the risk is lower than scalping, it’s still substantial. Day traders typically use technical analysis, focusing on price action, volume, and momentum to identify entry and exit points. They might employ strategies like breakouts, reversals, or range trading.

Swing Trading

Swing trading involves holding positions for several days or weeks, capitalizing on intermediate-term price swings. Traders aim to capture a significant portion of these movements. Timeframes used are typically daily or four-hour charts. Swing trading offers a balance between risk and reward; it requires less constant monitoring than day trading or scalping, but still necessitates careful analysis and risk management. Fundamental analysis might play a larger role here, considering economic news and events that could influence price trends.

Position Trading

Position trading is the long-term approach, where traders hold positions for weeks, months, or even years. This strategy focuses on identifying major trends and riding them for substantial gains. Timeframes can be weekly or monthly charts. Position traders often rely on fundamental analysis, studying economic indicators, company financials, and geopolitical events. While the risk is potentially high due to the length of time involved, the potential rewards are also much greater. Patience and discipline are key attributes for a successful position trader.

Key Differences Between Scalping and Swing Trading Systems

Understanding the core differences between these two popular strategies is crucial for selecting the right approach. Here’s a quick comparison:

- Timeframe: Scalping uses very short timeframes (seconds to minutes), while swing trading uses longer timeframes (days to weeks).

- Holding Period: Scalpers hold positions for seconds to minutes, while swing traders hold positions for days to weeks.

- Profit Targets: Scalpers aim for small, frequent profits, while swing traders aim for larger, less frequent profits.

- Risk Tolerance: Scalping involves higher risk due to the frequency of trades and potential for quick losses, while swing trading generally involves lower risk due to the longer holding periods.

- Trading Style: Scalping requires quick decision-making and constant market monitoring, while swing trading allows for more relaxed monitoring and less frequent trading.

Key Components of a Successful Forex Trading System: Best Forex Trading System

Building a consistently profitable forex trading system isn’t about finding a holy grail; it’s about crafting a robust, adaptable framework that aligns with your trading personality and risk tolerance. Success hinges on three critical pillars: a solid trading plan, effective risk management, and a meticulously developed trading strategy. Let’s delve into each.

Trading Plan Importance, Best forex trading system

A well-defined trading plan acts as your forex trading roadmap. It’s your guide through market volatility, preventing emotional decisions driven by fear or greed. A comprehensive plan Artikels your trading goals (e.g., annual profit target, acceptable drawdown), your chosen currency pairs, your preferred trading timeframe (scalping, day trading, swing trading, or long-term investing), and your entry and exit strategies. Without a plan, you’re essentially navigating a complex market blindfolded, increasing your chances of significant losses. Consider it your personal forex constitution; it’s the foundation upon which everything else is built. For example, a trader aiming for consistent, modest returns might focus on a low-risk strategy using a longer timeframe, while a trader seeking higher returns might accept greater risk with a shorter timeframe strategy.

Effective Risk Management Techniques

Risk management isn’t just about protecting your capital; it’s about ensuring your trading longevity. Effective techniques involve setting stop-loss orders to limit potential losses on each trade, using position sizing to control the amount of capital risked per trade (often expressed as a percentage of your total account balance), and diversifying your portfolio across multiple currency pairs to reduce the impact of any single trade going against you. For instance, a common risk management rule is to never risk more than 1-2% of your account balance on any single trade. If your account balance is $10,000, this translates to a maximum risk of $100-$200 per trade. Another crucial technique is to maintain a detailed trading journal, tracking your wins, losses, and the reasons behind them. This allows for continuous improvement and adaptation of your risk management strategy.

Developing a Comprehensive Trading Strategy

A trading strategy is the specific set of rules you follow to identify and execute trades. It’s the engine of your trading system. This includes identifying market opportunities (using technical indicators, fundamental analysis, or a combination of both), determining entry and exit points based on pre-defined criteria, and managing your positions. A successful strategy often involves backtesting (as discussed below) and forward testing to validate its effectiveness and identify potential weaknesses. For example, a common strategy might involve using moving averages to identify trends and using support and resistance levels to determine entry and exit points. A robust strategy is clear, concise, and rigorously tested. It shouldn’t be overly complex or rely on hunches; it should be based on observable market patterns and quantifiable data.

Backtesting a Trading System: A Step-by-Step Guide

Backtesting involves evaluating your trading strategy on historical market data to assess its potential performance. This is a crucial step before risking real capital. Here’s a step-by-step guide:

1. Gather Historical Data: Obtain reliable historical forex data, ensuring it covers a sufficient period to accurately reflect market conditions.

2. Select Your Strategy: Clearly define your entry and exit rules, including any technical indicators or fundamental factors you’ll be using.

3. Implement Your Strategy: Use trading software or spreadsheets to simulate your strategy on the historical data. This will involve automatically applying your entry and exit rules to the historical price data.

4. Analyze the Results: Evaluate the performance of your strategy using key metrics like win rate, average win/loss ratio, maximum drawdown, and overall profitability. Identify any weaknesses or areas for improvement.

5. Refine and Repeat: Based on the backtesting results, refine your strategy and repeat the process until you achieve satisfactory performance. Remember that backtesting doesn’t guarantee future success, but it significantly increases your chances of developing a profitable system.

Evaluating and Selecting a Forex Trading System

Finding the “best” forex trading system isn’t about picking a magic bullet; it’s about finding the system that best aligns with your individual trading personality and risk appetite. A system that rakes in millions for a seasoned trader might be a recipe for disaster for someone just starting out. This evaluation process is crucial, and understanding its nuances can be the difference between consistent profits and frustrating losses.

Choosing a forex trading system requires a careful assessment of its performance metrics and a realistic understanding of your own trading style. Ignoring either aspect is a recipe for disappointment. Think of it like choosing a car – a powerful sports car is great for speed enthusiasts, but less practical for someone who prioritizes fuel efficiency and family space. Similarly, a high-risk, high-reward forex system might suit an experienced trader with a large account, but it would be terrifying for a beginner.

Personal Trading Style and Risk Tolerance

Before even looking at backtested results, you need to honestly assess your trading style and risk tolerance. Are you a day trader, swing trader, or long-term investor? Do you prefer frequent, smaller trades or fewer, larger positions? Your answers will drastically influence which systems are suitable. Someone who thrives on quick trades and short-term price movements will find a scalping system more appealing than a long-term trend-following strategy, which might require significant patience and a longer time horizon to see results. Similarly, your risk tolerance determines how much capital you’re comfortable losing on any single trade. A higher risk tolerance might allow you to explore systems with higher potential rewards but also greater potential losses. A conservative trader, on the other hand, will prefer a system with lower risk, even if it means lower potential profits.

Metrics for Evaluating Trading System Performance

Several key metrics help evaluate a forex trading system’s performance. These metrics offer a quantitative view of a system’s historical success, providing insights into its potential for future profitability. However, it’s crucial to remember that past performance doesn’t guarantee future results.

- Win Rate: This is the percentage of trades that resulted in profit. A high win rate suggests the system is consistently identifying profitable opportunities. However, a high win rate alone is insufficient; the average profit per winning trade must also be considered.

- Average Trade Size: This indicates the average amount of currency traded per position. Larger average trade sizes can lead to greater profits but also significantly higher risk.

- Average Profit/Loss per Trade: This metric considers both winning and losing trades, giving a more holistic view of profitability. A positive average profit/loss suggests the system is generating profits over time.

- Maximum Drawdown: This is the largest peak-to-trough decline during a specific period. It measures the system’s resilience to market downturns and indicates the maximum potential loss a trader might experience.

- Sharpe Ratio: This ratio measures risk-adjusted return. A higher Sharpe ratio suggests better performance relative to the risk taken. The formula is:

Sharpe Ratio = (Rp – Rf) / σp

where Rp is the portfolio return, Rf is the risk-free return, and σp is the portfolio standard deviation.

Interpreting Backtesting Results and Identifying Potential Flaws

Backtesting involves simulating a trading system’s performance on historical data. While valuable, backtesting results should be interpreted cautiously. Over-optimization, where a system is tweaked to fit past data too closely, can lead to unrealistic expectations. Look for systems that perform consistently across different time periods and market conditions. For example, a system that performs exceptionally well during a specific bull market might fail miserably during a bear market. Similarly, data mining – excessively searching for patterns in historical data – can create false positives. Always check for robustness and consistency across various datasets and timeframes. Consider using out-of-sample testing, where the system is tested on data it hasn’t seen before, to validate its performance.

Checklist for Selecting a Forex Trading System

Before committing to a forex trading system, consider these factors:

- Alignment with your trading style and risk tolerance: Does the system’s trading frequency and risk profile match your preferences?

- Robust backtesting results: Does the system demonstrate consistent profitability across different time periods and market conditions? Is it over-optimized?

- Clear trading rules and signals: Are the entry and exit rules well-defined and easy to understand and follow?

- Money management strategy: Does the system incorporate a clear and well-defined money management plan to protect your capital?

- Account size requirements: Does the system’s minimum account size align with your available capital?

- Transaction costs: Have you considered the impact of commissions, spreads, and slippage on profitability?

- Emotional discipline: Can you stick to the system’s rules even during losing streaks?

Common Pitfalls to Avoid When Using Forex Trading Systems

Successfully navigating the forex market with a trading system requires more than just finding a profitable strategy; it demands a deep understanding of potential pitfalls and the discipline to avoid them. Many traders, seduced by the promise of automated profits, fall prey to common mistakes that can quickly erode their capital and shatter their confidence. This section highlights these crucial areas to watch out for.

Over-optimization and curve fitting represent significant dangers in developing and using any forex trading system. These practices, while seemingly enhancing backtested performance, often lead to disastrous real-world results. The allure of a seemingly perfect system, meticulously tweaked to fit past data, is strong, but it masks a critical flaw: the system may be highly adapted to the specific historical data used, making it unreliable for predicting future market movements.

Over-optimization and Curve Fitting

Over-optimization involves excessively adjusting parameters within a trading system to achieve the best possible backtested results. This often involves testing numerous combinations of indicators, timeframes, and entry/exit rules until a highly profitable backtest is found. The problem is that this optimized system may perform exceptionally well on historical data but poorly in live trading because it has essentially memorized the past rather than learned generalizable patterns. Curve fitting is a similar issue where the system is specifically designed to fit the historical data, often by using overly complex rules or incorporating irrelevant factors. Imagine fitting a complex polynomial curve to a set of scattered data points – it might look perfect for that specific data, but it won’t accurately predict future points. A robust trading system should be based on a well-defined trading strategy with minimal parameter adjustments, focusing on consistent profitability across different market conditions rather than exceptional performance on a limited dataset. Real-world trading conditions are far more dynamic and unpredictable than historical data.

The Importance of Consistent Discipline and Emotional Control

Even the best forex trading system is useless without consistent discipline and emotional control. Trading involves inherent risk, and experiencing losing streaks is inevitable. The ability to stick to the system’s rules, regardless of emotional impulses, is paramount. Fear and greed are powerful forces that can lead traders to deviate from their strategy, often at the worst possible times. For example, fear might cause a trader to exit a position prematurely, locking in a loss when the market was about to reverse. Conversely, greed might tempt a trader to hold onto a winning position for too long, allowing profits to evaporate as the market turns. Developing a robust trading plan that includes risk management rules and a clear set of emotional coping mechanisms is crucial for long-term success.

Managing Losing Streaks

The following flowchart illustrates a structured approach to handling losing streaks. It emphasizes the importance of reviewing the system, managing risk, and maintaining emotional resilience.

[Flowchart Description: The flowchart would begin with a “Losing Streak?” decision point. A “Yes” branch leads to “Review System Performance: Are there obvious flaws or external factors influencing results?” This leads to a decision point: “System Flaws Identified?” A “Yes” branch leads to “Revise System/Strategy.” A “No” branch leads to “Maintain Discipline: Stick to the plan, review risk management.” A “No” branch from the initial “Losing Streak?” decision point leads to “Continue Trading as Planned.” All branches eventually converge at “Evaluate Performance Regularly.”]

Illustrative Examples of Forex Trading Systems (without specific system names)

Understanding how different forex trading systems work is crucial for successful trading. While no system guarantees profit, studying diverse approaches illuminates the strengths and weaknesses inherent in various strategies. Let’s explore two hypothetical examples: one based on moving averages and another on candlestick patterns.

Moving Average Crossover System

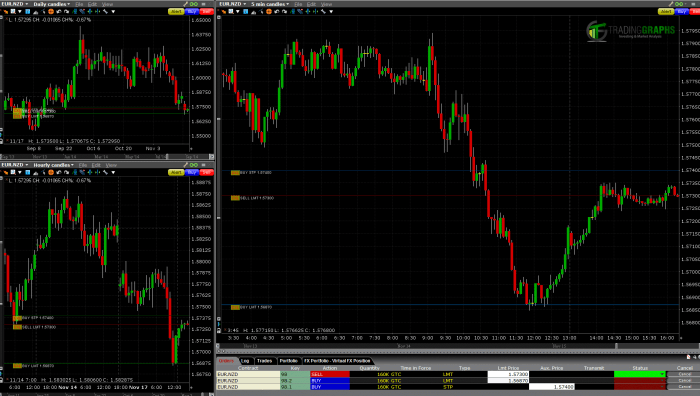

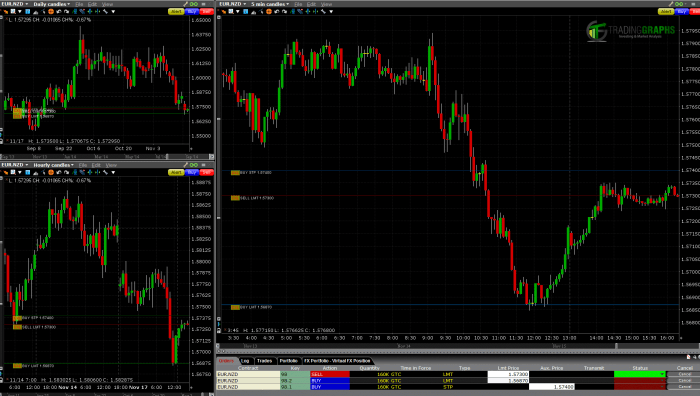

This system uses two moving averages – a faster one (e.g., a 10-period simple moving average) and a slower one (e.g., a 20-period simple moving average) – to generate buy and sell signals. The core principle is that crossovers between these averages indicate potential trend changes.

A buy signal occurs when the faster moving average crosses above the slower moving average. This suggests a potential uptrend is beginning. Conversely, a sell signal is generated when the faster moving average crosses below the slower moving average, signaling a potential downtrend.

Let’s imagine a hypothetical EUR/USD chart. The price is initially trending downwards. The 10-period MA is below the 20-period MA. Then, the 10-period MA crosses above the 20-period MA. This is our buy signal. We enter a long position (buying EUR/USD). The price subsequently rises, confirming our trade. We might set a take-profit order at a predetermined level, say, 20 pips above the entry price, and a stop-loss order below the recent swing low to limit potential losses. If the price reverses and the 10-period MA crosses below the 20-period MA, this would generate a sell signal. We would then close our long position or potentially enter a short position (selling EUR/USD). This system relies heavily on trend identification. A strong trend will yield better results than a sideways or ranging market.

Imagine another scenario: the price is trending upwards. The 10-period MA is above the 20-period MA. Then, the 10-period MA crosses below the 20-period MA. This is our sell signal. We enter a short position (selling EUR/USD). The price subsequently falls, confirming our trade. We might set a take-profit order at a predetermined level, say, 20 pips below the entry price, and a stop-loss order above the recent swing high. This illustrates how the system adapts to both upward and downward price movements. Note that the specific pip values for take-profit and stop-loss orders are illustrative and would be adjusted based on individual risk tolerance and market volatility.

Candlestick Pattern Trading System

This system utilizes specific candlestick patterns to identify potential reversal or continuation points in the market. For example, a bullish engulfing pattern might signal a potential bullish reversal at a support level. A bearish engulfing pattern might indicate a potential bearish reversal at a resistance level.

Consider a hypothetical GBP/USD chart showing a downtrend. The price reaches a low point, forming a large bearish candlestick. The following candlestick is a significantly larger bullish candlestick that completely engulfs the previous bearish candlestick. This bullish engulfing pattern suggests a potential bullish reversal. We would enter a long position (buying GBP/USD) at the open of the candlestick following the engulfing pattern. Our stop-loss order would be placed below the low of the engulfing pattern, and our take-profit order could be set at a level representing a target price based on the size of the engulfing pattern or a nearby resistance level.

Conversely, imagine an uptrend. The price reaches a high point, forming a large bullish candlestick. The following candlestick is a significantly larger bearish candlestick that completely engulfs the previous bullish candlestick. This bearish engulfing pattern suggests a potential bearish reversal. We would enter a short position (selling GBP/USD) at the open of the candlestick following the engulfing pattern. Our stop-loss order would be placed above the high of the engulfing pattern, and our take-profit order could be set at a level representing a target price based on the size of the engulfing pattern or a nearby support level. This system requires a keen eye for identifying candlestick patterns accurately and understanding their context within the broader market trend. False signals are possible, highlighting the need for risk management and confirmation from other indicators.

Final Thoughts

So, there’s no magic bullet, no single “best” forex trading system. But armed with the knowledge of different approaches, a solid understanding of risk management, and a disciplined approach, you can significantly increase your chances of success. Remember, consistency, adaptation, and a relentless focus on self-improvement are key. Your journey to mastering forex trading is a marathon, not a sprint. Embrace the learning process, and you’ll be well on your way to finding the system that’s truly best for *you*.

Find out about how forex trading how to read charts can deliver the best answers for your issues.

Obtain recommendations related to best technical indicators for forex trading that can assist you today.