Free forex trading signals: the siren song of easy money in the forex market. Sounds tempting, right? But before you dive headfirst into the world of free signals, promising instant riches, let’s unpack the reality. This isn’t some get-rich-quick scheme; it’s a complex landscape of potential gains and significant risks. Understanding the nuances of free signals is crucial before you risk your hard-earned cash.

This guide will navigate you through the world of free forex trading signals, exploring their different types, sources, and limitations. We’ll arm you with the knowledge to assess the credibility of signal providers, interpret signals effectively, and manage risk responsibly. We’ll even look at real-world scenarios – both successes and failures – to give you a realistic picture of what to expect.

Understanding “Free Forex Trading Signals”

Forex trading, the global exchange of currencies, can be a lucrative but risky venture. Navigating this complex market requires significant knowledge, experience, and often, a helping hand. This is where free forex trading signals come in, offering potentially valuable insights to traders of all levels. However, understanding their nature, limitations, and potential pitfalls is crucial before relying on them.

Free forex trading signals are essentially recommendations provided by various sources indicating the potential direction of a currency pair’s price movement. These signals typically suggest whether to buy (go long) or sell (go short) a specific currency pair at a given time. They can range from simple buy/sell recommendations to more complex analyses incorporating technical indicators and fundamental data. Essentially, they aim to take some of the guesswork out of trading, although they come with their own set of caveats.

Types of Free Forex Trading Signals

Free forex trading signals are disseminated through various channels, each with its own methodology and reliability. Some common types include signals generated by automated trading software (robots or Expert Advisors), signals based on technical analysis (chart patterns, indicators), and signals based on fundamental analysis (economic news, geopolitical events). Signals might be delivered via email, SMS, or through a dedicated trading platform. The source and method of signal generation significantly impact their accuracy and reliability.

Advantages and Disadvantages of Using Free Forex Trading Signals

While free forex signals can seem like a silver bullet, it’s essential to weigh their advantages against their limitations. On the plus side, they offer readily available market insights, potentially saving traders time and effort in conducting their own research. They can be particularly helpful for beginners learning the ropes or for experienced traders seeking supplementary information. However, the significant drawback is the often-lower accuracy compared to paid signals. Free signals frequently lack the in-depth analysis and personalized support provided by paid services, and their reliability can be questionable due to a lack of accountability or transparency from the provider. The potential for bias or manipulation is also higher with free services.

Comparison of Free Forex Signal Providers

It’s impossible to guarantee the accuracy of any signal provider, free or paid. However, a comparison based on reported performance (which should be viewed with healthy skepticism) can offer a glimpse into the potential variations between providers. Note that past performance is not indicative of future results.

| Provider | Accuracy (Claimed) | Frequency | Asset Coverage |

|---|---|---|---|

| Signal Provider A | 70% | Multiple per day | Major and Minor Pairs |

| Signal Provider B | 60% | 1-2 per day | Major Pairs only |

| Signal Provider C | 55% | Daily Summary | Major Pairs and Indices |

| Signal Provider D | Unknown | Varies | Unspecified |

Sources of Free Forex Trading Signals

So, you’re looking for free forex trading signals? Smart move, saving money is always a plus. But let’s be real, free often comes with a catch. Navigating the world of free signals requires a discerning eye and a healthy dose of skepticism. Understanding where these signals come from is the first step in protecting your hard-earned cash.

Finding reliable free forex signals isn’t like finding a winning lottery ticket; it requires research and a critical approach. Many websites and platforms offer them, but quality varies wildly. Some are genuine attempts to help beginners, while others are thinly veiled attempts to lure you into paid services or, worse, scams. Let’s break down how to find the good, the bad, and the downright ugly.

Reputable Websites and Platforms Offering Free Forex Signals

While pinpointing specific “reputable” websites is tricky (as reputations can change), look for established financial news sites or educational platforms that offer signals as a supplementary service. These sites often have a strong track record, a commitment to transparency, and a dedicated community. Think of platforms that focus on forex education; their signals might be less frequent, but are more likely to be based on sound analysis rather than hype. It’s also worth checking forums and communities frequented by experienced forex traders; they often share their insights and sometimes even free signals, but always remember to treat this information with caution and verify it independently. Remember, even from seemingly reputable sources, always perform your own due diligence.

Criteria for Evaluating the Credibility of Free Signal Providers

Assessing the credibility of any signal provider, free or paid, is crucial. Look for transparency in their methodology. Do they explain their rationale behind each signal? Do they provide historical performance data (though past performance doesn’t guarantee future success)? Are they upfront about their limitations and potential risks? A credible provider will openly discuss these aspects, avoiding vague promises of guaranteed profits. Avoid providers who rely solely on hype and flashy marketing tactics, emphasizing unrealistic returns. A steady, consistent approach, even with smaller gains, is often a more reliable indicator of a well-researched strategy. Finally, check for independent reviews and testimonials; while not foolproof, a consistent pattern of negative reviews should raise serious concerns.

Potential Risks Associated with Free Signals from Unknown Sources

Relying on free signals from unknown sources is like navigating a minefield blindfolded. The risks are significant and can include inaccurate or misleading information, potentially leading to substantial financial losses. These sources might promote unrealistic profit expectations, lack transparency in their methods, or even be outright scams designed to steal your money or personal information. They may also be affiliated with brokers who profit from your losses, creating a conflict of interest. Furthermore, the signals themselves might be delayed or unreliable, making it impossible to execute trades effectively. Essentially, you’re putting your financial well-being in the hands of individuals whose motivations and expertise are unknown and potentially untrustworthy.

Red Flags to Watch Out for When Choosing a Free Signal Provider

Before entrusting your money to any free signal provider, be wary of the following:

- Guaranteed Profits: No one can guarantee profits in forex trading. Any provider making such claims is likely untrustworthy.

- High-Pressure Sales Tactics: Legitimate providers don’t need to pressure you into anything. Run if you encounter aggressive sales pitches.

- Lack of Transparency: If a provider is secretive about their methods or refuses to share performance data, it’s a major red flag.

- Unrealistic Return Promises: Extremely high returns are usually a sign of a scam. Sustainable profits in forex are typically modest.

- Poorly Designed Website or Social Media Presence: A professional provider will have a well-maintained online presence.

- Negative Reviews or Complaints: Thoroughly research the provider online and look for any negative feedback.

- Request for Personal Information Beyond Necessary Account Details: Be cautious of providers asking for excessive personal information.

Analyzing Free Forex Trading Signals

So, you’ve got your hands on some free forex trading signals. Great! But before you jump in headfirst, remember that these signals aren’t magic bullets. Understanding how to interpret and use them effectively is crucial to maximizing their potential and minimizing your risk. This section will equip you with the knowledge to navigate the world of free forex signals and make informed trading decisions.

Free forex trading signals come in various forms, each requiring a slightly different approach to analysis. Understanding the signal’s format, source reliability, and potential risks is key to successful implementation. Let’s break down how to approach interpreting and using these signals effectively.

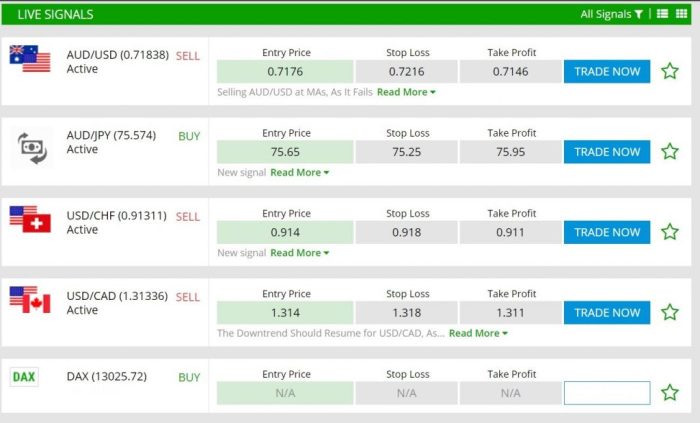

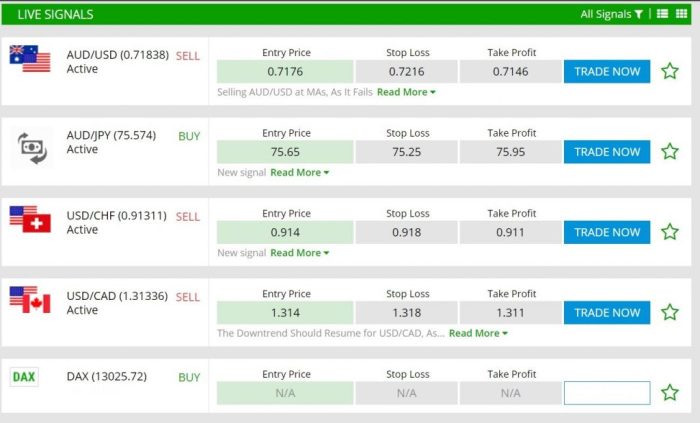

Interpreting and Using Free Forex Signals: A Step-by-Step Guide, Free forex trading signals

First, identify the signal’s core components. This typically includes the currency pair (e.g., EUR/USD), the recommended trade type (buy or sell), the entry price, the stop-loss order, and the take-profit order. Next, verify the signal’s source. Is it from a reputable provider with a proven track record? Compare the signal with your own technical analysis. Does it align with your understanding of the market trends? Finally, execute the trade only if the signal aligns with your risk tolerance and trading strategy. Remember, even the best signals can fail, so proper risk management is paramount. For instance, a signal might suggest buying EUR/USD at 1.1000 with a stop-loss at 1.0980 and a take-profit at 1.1030. This means you’d buy EUR/USD hoping it rises to 1.1030, but you’d exit the trade at 1.0980 if it falls to limit your losses.

Signal Formats

Free forex signals can appear in several formats. Text alerts might simply state: “Buy EUR/USD at 1.1000, SL 1.0980, TP 1.1030.” Chart patterns, such as head and shoulders or double tops/bottoms, visually indicate potential reversal points. These require understanding of candlestick patterns and chart formations. Indicators, like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), provide numerical data points to suggest overbought or oversold conditions, signaling potential buy or sell opportunities. Each format requires a different level of interpretation. For example, a text alert provides concise information, while chart patterns require visual analysis and experience.

Integrating Signals with Trading Platforms

Integrating free signals into your trading platform depends on the signal provider and your platform’s capabilities. Some providers offer direct integration with popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), often through automated scripts or plugins. Others might provide signals via email or a dedicated website. Manual entry is usually required for signals received through email or websites. This means you would manually place the trade based on the signal’s parameters within your trading platform.

Risk Management with Free Forex Signals

Proper risk management is crucial when using any trading signal, especially free ones. Never risk more than you can afford to lose. Diversify your portfolio and don’t put all your eggs in one basket. Always use stop-loss orders to limit potential losses on each trade.

| Parameter | Low Risk | Medium Risk | High Risk |

|---|---|---|---|

| Position Size | 1% of trading capital | 2-3% of trading capital | >3% of trading capital |

| Stop-Loss | Tight stop-loss, close to entry price | Moderate stop-loss | Wide stop-loss, far from entry price |

| Take-Profit | Conservative take-profit, small gains | Moderate take-profit | Aggressive take-profit, aiming for large gains |

| Signal Source Reliability | Proven track record, multiple confirmations | Moderate track record, some confirmations | Unproven track record, limited confirmations |

The Limitations of Free Forex Trading Signals

Let’s be real: free stuff rarely comes without a catch. While free forex trading signals might seem like a golden ticket to easy profits, they often come with significant limitations that can actually hurt your trading more than help it. Understanding these limitations is crucial before you blindly follow any signal.

Free forex signals, while seemingly helpful, are often plagued by inaccuracies and biases. The providers, often lacking transparency, may have their own agendas – perhaps promoting a specific broker or simply aiming for increased website traffic. This can lead to signals that are strategically skewed, benefiting the provider more than the user. Furthermore, the algorithms or methods behind the signals may be outdated, overly simplistic, or based on unreliable data. This lack of robust methodology increases the chance of inaccurate predictions and ultimately, losses for the trader.

Potential Inaccuracies and Biases in Free Forex Signals

The accuracy of free forex signals is questionable. Many providers lack the resources or expertise to perform thorough market analysis. Their signals might be based on lagging indicators, ignoring crucial fundamental factors like geopolitical events or economic releases. Imagine a signal suggesting a buy order for a currency just before a major negative news announcement – a situation that could easily lead to significant losses. The bias often stems from the provider’s desire to attract users, leading to a higher number of signals, some of which are bound to be inaccurate. This constant stream of signals can create a false sense of opportunity, leading traders to over-trade and increase their risk exposure.

The Importance of Independent Verification and Due Diligence

Before acting on any free forex signal, independent verification is absolutely essential. Don’t just blindly trust the signal provider’s claims. Research the currency pair, understand the underlying market conditions, and cross-reference the signal with your own analysis. This involves checking news sources, reviewing economic calendars, and examining chart patterns. Only after conducting your own due diligence should you consider implementing the signal. Think of it like this: you wouldn’t buy a used car without inspecting it first, would you? The same principle applies to forex signals.

Risks of Over-Reliance on Free Signals and Neglecting Fundamental Analysis

Over-reliance on free forex signals can be detrimental to your trading success. These signals often lack context and fail to incorporate crucial fundamental analysis. Focusing solely on signals without understanding the ‘why’ behind the market movements can lead to uninformed decisions and significant losses. A successful forex trader needs a holistic approach, combining technical analysis with a solid understanding of fundamental economic factors. Ignoring this fundamental aspect is like navigating a ship using only a compass without considering the map or weather conditions.

Alternative Resources for Forex Traders

Relying solely on free signals is risky. Fortunately, there are several alternative resources available for forex traders. These include:

- Educational Resources: Online courses, webinars, and books provide in-depth knowledge of forex trading strategies and risk management.

- Paid Signal Providers (with transparency): While costly, reputable paid signal providers often offer greater accuracy and transparency, backing their signals with proven track records and detailed analysis.

- Economic Calendars and News Sources: Staying updated on economic releases and global news is crucial for informed decision-making.

- Charting Software and Technical Indicators: Learning to use charting software and various technical indicators allows you to conduct your own analysis and develop your own trading strategies.

- Forex Forums and Communities: Engaging in discussions with experienced traders can provide valuable insights and perspectives.

Case Studies of Free Forex Signals: Free Forex Trading Signals

Navigating the world of free forex signals can feel like a gamble. Success and failure often hinge on factors beyond the signal itself – your risk management, understanding of market dynamics, and even a bit of luck. Let’s examine some hypothetical scenarios to illustrate both the potential rewards and the inherent risks.

Successful Use of a Free Forex Signal

Imagine you receive a free signal recommending a long position on EUR/USD at 1.1000 with a stop-loss at 1.0980 and a take-profit at 1.1050. This signal is based on a confluence of technical indicators suggesting a bullish trend. You carefully analyze the provided rationale, confirming it aligns with your own market assessment. You enter the trade with a small portion of your capital, adhering to proper risk management principles. Over the next few hours, the EUR/USD pair rises steadily, hitting your take-profit target of 1.1050. You successfully exit the trade, securing a modest but satisfying profit. This success wasn’t just about the signal; it was about your disciplined approach and independent verification.

Potential Pitfalls of Using a Free Forex Signal

Now, consider a different scenario. A free signal suggests a short position on GBP/USD at 1.3000, with a stop-loss at 1.3020 and a take-profit at 1.2950. The signal’s rationale is less clear, relying on a single, potentially unreliable indicator. You enter the trade, but unexpectedly, significant geopolitical news causes a surge in the GBP, pushing the pair well beyond your stop-loss. You experience a loss exceeding your initial risk assessment. This example highlights the dangers of blindly following signals without thorough analysis and understanding of underlying market forces. The signal itself wasn’t inherently bad, but your reliance on it without independent verification proved costly.

Learning from Successful and Unsuccessful Trades

Both scenarios offer valuable lessons. The successful trade emphasizes the importance of due diligence – verifying the signal’s rationale, confirming it aligns with your own analysis, and employing strict risk management. The unsuccessful trade underscores the necessity of critical thinking and understanding the limitations of free signals. Never rely solely on a free signal; use it as one piece of information within a broader trading strategy. Keep a detailed trading journal, noting the reasons behind your decisions, both successful and unsuccessful. Analyze what worked and what didn’t, continuously refining your approach.

Visual Representation of Profit and Loss Scenarios

Imagine a simple bar chart. The horizontal axis represents different trading scenarios using free signals, and the vertical axis represents the percentage profit or loss. A green bar extending upwards represents the successful EUR/USD trade, reaching perhaps a +0.5% profit level. A red bar extending downwards represents the unsuccessful GBP/USD trade, possibly reaching a -2% loss level. The difference in bar lengths visually emphasizes the disparity in outcomes, highlighting the importance of careful signal selection and risk management. Additional bars could represent other trades, showing a distribution of both profitable and unprofitable outcomes. This chart would visually demonstrate that while free signals can yield profits, losses are also a significant possibility, and consistent profitability isn’t guaranteed.

Ethical Considerations of Free Forex Trading Signals

The world of free forex trading signals is a double-edged sword. While offering potentially lucrative opportunities for novice traders, it also presents a minefield of ethical concerns. The lack of regulation and the inherent anonymity of many providers create fertile ground for manipulation, misleading information, and ultimately, financial losses for unsuspecting users. Understanding these ethical dilemmas is crucial for both signal providers and those who rely on their services.

The potential for manipulation and misleading information in free signal services is significant. Providers might inflate their success rates, cherry-pick profitable trades while concealing losses, or even deliberately provide inaccurate signals to benefit themselves at the expense of their followers. This lack of accountability can lead to substantial financial losses for traders who blindly trust these signals without conducting their own due diligence. The allure of “easy money” often overshadows the inherent risks, leaving traders vulnerable to exploitation.

Transparency and Disclosure from Free Signal Providers

Transparency and full disclosure are paramount in building trust and ensuring ethical practices within the free forex signal industry. Providers should clearly state their track record, including both winning and losing trades, using verifiable data. They must also disclose any potential conflicts of interest, such as affiliations with brokers or other financial institutions that might influence their signal recommendations. A lack of transparency raises red flags and should immediately trigger caution from potential users. For example, a provider consistently boasting high win rates without providing detailed performance data should be viewed with suspicion.

Responsibilities of Traders Using Free Forex Signals

Traders who utilize free forex signals bear a significant responsibility for their own financial well-being. Blindly following signals without understanding the underlying market dynamics or conducting independent analysis is reckless. Traders should always verify the provider’s claims, analyze the signals critically, and develop their own risk management strategies. Remember, even the most reputable signal provider cannot guarantee profits, and losses are an inherent part of forex trading. A responsible trader would never invest more than they can afford to lose, regardless of the source of their trading signals.

Ethical Guidelines for Providers and Users of Free Forex Trading Signals

It’s essential to establish clear ethical guidelines for both providers and users of free forex signals. This promotes a more responsible and transparent ecosystem.

For Providers:

- Accurately represent past performance, including both wins and losses.

- Disclose any conflicts of interest or affiliations.

- Provide clear and concise explanations for each signal.

- Avoid making unrealistic promises of guaranteed profits.

- Respect user privacy and data security.

For Users:

- Conduct thorough due diligence on signal providers before relying on their services.

- Never invest more than they can afford to lose.

- Develop their own risk management strategies and don’t solely rely on signals.

- Verify the provider’s claims using independent sources.

- Understand the inherent risks of forex trading.

End of Discussion

Navigating the world of free forex trading signals requires a healthy dose of skepticism and a commitment to continuous learning. While free signals can be a helpful tool for beginners, they shouldn’t be your sole trading strategy. Remember, due diligence is key. By understanding the potential pitfalls and leveraging the information provided here, you can approach free forex trading signals with a more informed and responsible perspective, maximizing your chances of success and minimizing potential losses. The forex market is a marathon, not a sprint; smart decisions, not just free signals, win the race.

Discover how best forex trading training course has transformed methods in this topic.

Finish your research with information from forex trading for dummies.