Spot trading forex: Dive into the thrilling world of immediate currency exchange! This isn’t your grandpa’s investment; it’s a fast-paced, globally connected market where fortunes are made and lost in the blink of an eye. We’ll break down the mechanics, the risks, and the strategies you need to navigate this exciting landscape, from understanding different order types to mastering technical analysis and choosing the right broker. Get ready to learn the ropes and potentially unlock a world of financial opportunity.

We’ll cover everything from defining spot forex trading and its mechanics to exploring various trading strategies, including scalping, day trading, and swing trading. We’ll also delve into crucial risk management techniques and the importance of choosing the right trading platform and broker. Real-world examples of successful and unsuccessful trades will illustrate the complexities and potential rewards of this dynamic market. By the end, you’ll have a solid foundation to confidently approach the world of spot forex trading.

Defining Spot Forex Trading: Spot Trading Forex

Spot forex trading is, simply put, the buying and selling of currencies at the current market exchange rate for immediate delivery. Unlike futures or options contracts, which involve agreements to buy or sell at a future date, spot forex transactions settle within two business days. This immediacy makes it a dynamic and potentially lucrative, yet risky, market for traders of all levels. Understanding the mechanics is key to navigating its complexities.

Spot Forex Trading Mechanics

The core of spot forex trading lies in exchanging one currency for another. Traders speculate on the relative value of these currencies, profiting from fluctuations in exchange rates. For example, a trader might buy the EUR/USD pair, anticipating the euro will strengthen against the dollar. This means they’re essentially betting that they can buy euros at a lower price and sell them later at a higher price, pocketing the difference. The exchange rate is constantly changing, driven by a multitude of factors including economic news, political events, and market sentiment. The mechanics involve accessing a trading platform, selecting a currency pair, specifying the amount to trade, and executing the order. The process is typically facilitated by a forex broker who acts as an intermediary between the trader and the interbank market.

Types of Forex Orders in Spot Trading

Several order types are used in spot forex trading, each offering a different level of control and risk management. Market orders execute immediately at the best available price, providing speed but potentially less favorable rates. Limit orders allow traders to specify the exact price at which they want to buy or sell, offering more control but the risk of the order not being filled if the price doesn’t reach the specified level. Stop orders are used to limit potential losses or secure profits, automatically triggering a trade when the price reaches a predetermined level. Stop-limit orders combine aspects of both stop and limit orders, offering more control over the execution price.

Executing a Spot Forex Trade: A Step-by-Step Guide

1. Open a Forex Trading Account: This involves choosing a reputable broker, providing necessary documentation, and funding your account.

2. Choose a Currency Pair: Select a pair based on your market analysis and risk tolerance (e.g., EUR/USD, GBP/JPY, USD/CHF).

3. Determine Trade Size: Calculate the amount of currency you want to trade, considering your account balance and risk management strategy. Remember leverage magnifies both profits and losses.

4. Select an Order Type: Choose a market, limit, stop, or stop-limit order based on your trading strategy and price expectations.

5. Place the Order: Enter your order details into your trading platform and confirm the execution.

6. Monitor the Trade: Track the price movement and manage your position accordingly, potentially adjusting stop-loss or take-profit levels.

7. Close the Trade: Sell the currency pair to realize your profit or limit your losses.

Comparison of Spot Forex Trading with Other Methods

| Feature | Spot Forex | Forex Futures | Forex Options |

|---|---|---|---|

| Settlement | T+2 (two business days) | Specified future date | Option to buy or sell at a specified price on or before a specified date |

| Risk | High, potentially unlimited losses | High, defined by contract size and margin | Limited to the premium paid; potential for unlimited profit (call options) |

| Leverage | High leverage often available | High leverage often available | Leverage depends on the strategy |

| Liquidity | Highly liquid | High liquidity for major currency pairs | Liquidity varies depending on the contract |

Market Analysis for Spot Forex Trading

Spot forex trading, with its fast-paced and dynamic nature, demands a robust understanding of market analysis to navigate its complexities and potentially profit. Successful traders don’t rely on luck; they leverage a combination of fundamental and technical analysis to make informed trading decisions. This section explores the key elements of market analysis crucial for navigating the spot forex market.

Factors Influencing Spot Forex Prices

Numerous interconnected factors influence the price fluctuations in the spot forex market. These factors can be broadly categorized as economic, political, and psychological. Economic factors include interest rate differentials between countries, inflation rates, economic growth data (GDP), government debt levels, and trade balances. Political factors encompass geopolitical events, changes in government policies, and international relations. Finally, psychological factors, such as market sentiment and trader psychology, can significantly impact price movements, often leading to short-term volatility. Understanding the interplay of these factors is crucial for predicting potential price movements. For example, a surprise interest rate hike by a central bank will typically strengthen the respective currency, while negative economic news might weaken it.

Fundamental Analysis Techniques in Spot Forex

Fundamental analysis focuses on evaluating the underlying economic and political factors affecting a currency’s value. This involves examining macroeconomic indicators, news events, and geopolitical developments. Traders might analyze a country’s current account balance to assess its economic health and sustainability. A large and persistent current account deficit could signal potential weakness in the currency. Similarly, analyzing central bank statements and policy decisions helps gauge the future direction of monetary policy and its impact on exchange rates. For example, if a central bank is expected to raise interest rates, this might attract foreign investment, thus strengthening the currency.

Technical Indicators Used in Spot Forex Trading

Technical analysis uses historical price and volume data to identify trends and predict future price movements. Numerous technical indicators exist, each with its strengths and weaknesses. Moving averages (MA), such as simple moving averages (SMA) and exponential moving averages (EMA), smooth out price fluctuations and identify trends. Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. The RSI value ranges from 0 to 100; readings above 70 often suggest an overbought market, while readings below 30 suggest an oversold market. Other popular indicators include the MACD (Moving Average Convergence Divergence), which identifies momentum changes, and Bollinger Bands, which measure price volatility.

Hypothetical Trading Strategy Combining Fundamental and Technical Analysis

A hypothetical strategy might involve identifying a currency pair poised for appreciation based on fundamental analysis, then using technical indicators to pinpoint optimal entry and exit points. For instance, suppose fundamental analysis suggests the Euro (EUR) is likely to strengthen against the US Dollar (USD) due to positive economic data from the Eurozone and expectations of a future interest rate hike by the European Central Bank. Technically, we might wait for the EUR/USD to reach a support level indicated by a moving average or Bollinger Band, confirming an oversold condition as indicated by the RSI. A stop-loss order would be placed below the support level to limit potential losses. A take-profit order would be set at a predetermined price target based on the expected appreciation of the Euro, potentially at a resistance level identified through technical analysis. This approach aims to combine the long-term perspective of fundamental analysis with the precision of technical analysis for more informed trading decisions.

Risk Management in Spot Forex Trading

Spot forex trading, while offering the potential for significant profits, is inherently risky. Understanding and mitigating these risks is crucial for long-term success. Ignoring risk management can lead to substantial losses, quickly eroding your trading capital. This section will delve into the key risks and provide practical strategies to protect your investments.

Major Risks in Spot Forex Trading

The forex market is characterized by high volatility and leverage, creating several potential pitfalls for traders. These risks aren’t insurmountable, but understanding them is the first step towards effective management. Failure to adequately address these risks can result in significant financial losses.

- Market Volatility: Currency prices fluctuate constantly due to various economic and geopolitical factors. Sudden shifts can lead to unexpected losses, even with well-planned trades.

- Leverage Risk: Forex trading often involves leverage, allowing traders to control larger positions with smaller amounts of capital. While this amplifies profits, it also magnifies losses. A small adverse price movement can wipe out your entire account if leverage is not managed carefully.

- Liquidity Risk: While the forex market is generally considered highly liquid, there can be times when it becomes difficult to execute trades quickly at desired prices, especially during periods of high volatility or news events. This can lead to slippage and potentially larger losses than anticipated.

- Geopolitical and Economic Risks: Unexpected political events, economic announcements, or natural disasters can dramatically impact currency values, creating significant trading risks.

Stop-Loss Orders and Position Sizing, Spot trading forex

Effective risk management relies heavily on two key strategies: stop-loss orders and position sizing. These are not merely suggestions; they are essential tools for protecting your capital.

Stop-loss orders automatically close a trade when the price reaches a predetermined level, limiting potential losses. For example, if you buy EUR/USD at 1.1000 and set a stop-loss at 1.0950, your trade will automatically close if the price falls to that level, preventing further losses.

Position sizing determines how much capital you allocate to each trade. A common rule is to risk no more than 1-2% of your trading capital on any single trade. If your account is $10,000, you should only risk $100-$200 per trade. This helps to prevent a single losing trade from significantly impacting your overall account balance.

Risk Management Techniques for Different Trading Styles

Risk management strategies need to be tailored to your specific trading style.

- Scalpers: Scalpers, who aim for small profits from frequent trades, might use tighter stop-losses and smaller position sizes to limit risk per trade, given the high frequency of their trades.

- Swing Traders: Swing traders, holding positions for several days or weeks, might use wider stop-losses to account for larger price swings but still maintain a strict position sizing strategy to limit overall risk.

- Long-Term Investors: Long-term investors, holding positions for months or years, might use wider stop-losses and focus on fundamental analysis to identify strong, long-term trends, accepting that drawdowns might occur over the holding period.

Risk Assessment Checklist Before Executing a Spot Forex Trade

Before entering any trade, a thorough risk assessment is paramount. This checklist helps ensure you’ve considered all relevant factors.

- Define your trading plan: Clearly Artikel your entry and exit strategies, including stop-loss and take-profit levels.

- Analyze market conditions: Assess current market trends, volatility, and potential news events that could impact your trade.

- Determine position size: Calculate the appropriate position size based on your risk tolerance and account balance, adhering to the 1-2% risk rule.

- Set stop-loss and take-profit orders: Place your stop-loss order to limit potential losses and your take-profit order to secure profits when your target is reached.

- Review your risk-reward ratio: Ensure the potential profit outweighs the potential loss, considering the stop-loss and take-profit levels.

- Monitor your trades: Regularly monitor your open positions and adjust your stop-loss orders if necessary, based on market movements.

Spot Forex Trading Platforms and Brokers

Navigating the world of spot forex trading requires more than just market savvy; you need the right tools and a trustworthy partner. Choosing the right forex trading platform and broker is crucial for a smooth and potentially profitable trading experience. The platform is your interface to the market, and the broker acts as the intermediary, facilitating your trades. Making informed decisions in this area is paramount to success.

Choosing a forex trading platform and broker is like choosing the right car for a road trip. You wouldn’t pick a beat-up jalopy for a cross-country adventure, would you? Similarly, a poorly chosen platform or broker can severely hinder your trading journey.

Comparison of Spot Forex Trading Platforms

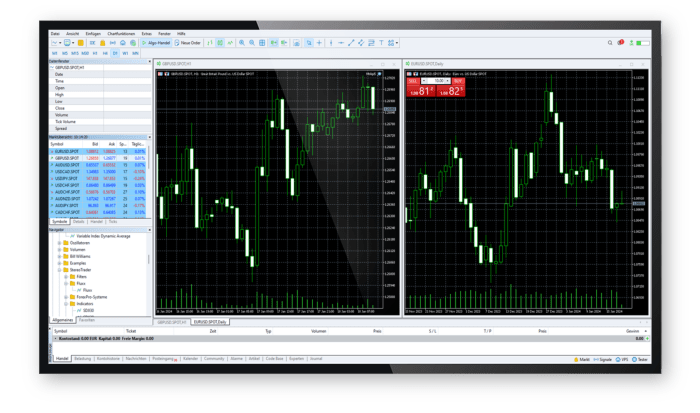

Different platforms offer varying features and fee structures. Some cater to beginners with user-friendly interfaces and educational resources, while others are geared towards experienced traders who need advanced charting tools and analytical capabilities. Fees can vary significantly, including commissions, spreads, and overnight financing costs. It’s essential to compare these aspects carefully before committing to a platform. For example, MetaTrader 4 (MT4) is known for its extensive customization options and vast library of indicators, making it popular among technical analysts. cTrader, on the other hand, focuses on speed and low latency, appealing to scalpers and high-frequency traders. Each platform’s strengths and weaknesses should be weighed against your individual trading style and needs.

Characteristics of a Reputable Forex Broker

A reputable forex broker operates with transparency and adheres to strict regulatory standards. Key characteristics include proper licensing and regulation by a recognized financial authority, robust security measures to protect client funds, competitive pricing and transparent fee structures, and readily available customer support. A reputable broker will also provide educational resources and risk management tools to help traders make informed decisions. Avoid brokers who promise unrealistic returns or lack transparency about their operations. Think of it as choosing a trusted financial advisor – you wouldn’t want to entrust your investments to someone with a shady track record.

Essential Features of a Forex Trading Platform

Several essential features should be on your checklist when selecting a trading platform. These include user-friendly interface and navigation, advanced charting tools with customizable indicators, a wide range of tradable instruments (currency pairs, indices, commodities, etc.), order types to suit different trading strategies (market orders, limit orders, stop-loss orders), real-time market data feeds, secure and reliable execution, and robust backtesting capabilities for strategy development. Additionally, access to educational resources and customer support is crucial for traders of all skill levels. A platform that lacks these features may leave you feeling frustrated and ill-equipped to navigate the market effectively.

Comparison of Broker Types

| Broker Type | Pros | Cons |

|---|---|---|

| Market Maker | Often offers tighter spreads and faster execution | Potential for conflicts of interest; may not always offer the best price |

| ECN/STP Broker | Generally offers better price transparency and execution; more suitable for scalpers | Potentially higher commissions and spreads |

| Dealing Desk Broker | Provides personalized customer service; can offer more flexible trading conditions | Less transparency; potential for manipulation |

| No Dealing Desk Broker | Offers transparency and faster execution | May have higher commissions |

Trading Strategies for Spot Forex

Spot forex trading offers a dynamic environment with various strategies to suit different risk appetites and time commitments. Choosing the right strategy hinges on understanding your personal trading style, risk tolerance, and available time. Let’s explore some popular approaches.

Scalping in Spot Forex

Scalping involves taking advantage of very small price movements over short periods, typically seconds or minutes. Scalpers aim for numerous small profits throughout the day, relying on high trading volume and tight spreads.

Advantages of scalping include the potential for quick profits and the ability to react rapidly to market changes. However, scalping requires intense focus, rapid decision-making, and a low-latency trading platform. The high frequency of trades also leads to increased transaction costs. Furthermore, significant losses can accumulate quickly if trades don’t go as planned.

An example of a scalping strategy might involve identifying a currency pair with high liquidity, like EUR/USD, and placing multiple small trades based on minor price fluctuations detected using technical indicators like moving averages or RSI. A trader might aim for a profit of just a few pips per trade, accumulating these small gains throughout the day.

Day Trading in Spot Forex

Day trading involves opening and closing positions within a single trading day. Day traders aim to profit from intraday price swings, using technical analysis to identify short-term trends and opportunities.

The advantages of day trading include flexibility, as positions are closed before market closure, minimizing overnight risk. However, it requires dedicated time and concentration throughout the trading day, and can be highly stressful. Day trading necessitates a keen understanding of market dynamics and the ability to interpret technical indicators effectively. Unsuccessful trades can quickly lead to losses.

A common day trading strategy focuses on identifying breakout patterns. For example, a trader might observe a currency pair consolidating within a range, and place a buy order if the price decisively breaks above the upper resistance level, expecting further upward momentum. Conversely, a sell order could be placed if the price breaks below the lower support level.

Swing Trading in Spot Forex

Swing trading involves holding positions for several days, or even weeks, to capitalize on larger price swings. Swing traders utilize a combination of technical and fundamental analysis to identify potential entry and exit points.

Swing trading offers the advantage of potentially larger profits compared to scalping or day trading. However, it requires patience and the ability to manage risk effectively, as positions are held overnight and are therefore exposed to overnight gaps and news events. Swing traders need to be comfortable with holding positions for longer periods, potentially weathering temporary price declines.

A swing trading strategy might involve identifying a currency pair exhibiting a clear upward trend, confirmed by indicators such as moving averages and MACD. A trader might enter a long position at a support level, expecting the price to continue its upward movement, setting a stop-loss order below the support level to manage risk. The position would be held until a pre-determined profit target is reached or a reversal pattern emerges.

Chart Patterns for Identifying Trading Opportunities

Chart patterns are recurring formations on price charts that can indicate potential shifts in market momentum. Identifying these patterns can provide valuable insights into potential entry and exit points for trades.

For instance, the “head and shoulders” pattern, often considered a bearish reversal pattern, suggests a potential price decline. This pattern is characterized by three peaks, with the middle peak (the “head”) being the highest. A trader might place a sell order once the price breaks below the neckline of the pattern, anticipating a downward move. Conversely, an “inverse head and shoulders” pattern, with three troughs, signals a potential upward price movement. A trader might place a buy order if the price breaks above the neckline in this case. Other patterns, such as triangles, flags, and pennants, also offer clues about potential price movements.

Illustrative Examples of Spot Forex Trades

Spot forex trading, while potentially lucrative, is inherently risky. Understanding both successful and unsuccessful trades is crucial for developing a robust trading strategy. The following examples illustrate key aspects of trade execution, risk management, and the importance of thorough market analysis.

Successful Spot Forex Trade: EUR/USD Long Position

This example details a successful long position on the EUR/USD pair. The trader identified a bullish trend based on fundamental analysis (positive economic data releases in the Eurozone) and technical analysis (a breakout above a key resistance level). They entered a long position at 1.1000, placing a stop-loss order at 1.0970 (30 pips below the entry price) to limit potential losses to a manageable level. Their take-profit order was set at 1.1050 (50 pips above the entry price), representing a risk-reward ratio of 1:1.67. The EUR/USD pair subsequently moved as predicted, reaching the take-profit level within a few days. The trader successfully closed their position, realizing a profit of 50 pips. This trade showcases the importance of setting clear entry and exit points, utilizing stop-loss orders, and managing risk effectively.

Unsuccessful Spot Forex Trade: GBP/USD Short Position

In contrast, this trade exemplifies a losing scenario. The trader, anticipating a weakening of the British Pound, entered a short position on the GBP/USD pair at 1.2500. However, unexpected positive news regarding the UK economy triggered a sharp upward movement in the GBP/USD pair. The trader, lacking a properly placed stop-loss order, experienced significant losses as the pair continued to rise. This resulted in a substantial loss, highlighting the critical role of stop-loss orders in mitigating risk and preventing significant losses. The key lesson learned was the importance of having a robust risk management plan and adhering to it strictly, regardless of market sentiment or personal expectations.

Hypothetical Spot Forex Trade: USD/JPY Long Position

Let’s imagine a scenario where a trader anticipates a weakening of the Japanese Yen against the US dollar. Based on analysis of recent economic indicators (a rise in US interest rates and a decline in Japanese economic growth), and technical indicators (a bullish engulfing candlestick pattern on the daily chart), they decide to enter a long position on the USD/JPY pair. The current market price is 110.00. They place a stop-loss order at 109.70 (30 pips) and a take-profit order at 110.50 (50 pips). The trader’s risk tolerance is limited, and they only use a small portion of their trading capital for this trade. If the USD/JPY pair rises to 110.50 as anticipated, the trade would be closed for a profit of 50 pips. Conversely, if the price falls to 109.70, the stop-loss order would limit their losses to 30 pips. This hypothetical trade illustrates the importance of combining fundamental and technical analysis to form a trading strategy, while adhering to a disciplined risk management approach.

Visual Representation of a Successful Spot Forex Trade

Imagine a price chart showing the EUR/USD pair. The chart displays a clear upward trend. A horizontal line represents the entry point at 1.1000. Another horizontal line, slightly below, represents the stop-loss order at 1.0970. A third horizontal line, higher than the entry point, depicts the take-profit order at 1.1050. The price line on the chart shows a steady rise from the entry point, surpassing the take-profit level before any significant drop. This visual representation illustrates a successful trade where the price moved in the predicted direction, allowing the trader to profit from their position and exit at their predetermined take-profit level.

Conclusive Thoughts

Spot forex trading presents a high-octane path to potential profits, but it’s a double-edged sword. Mastering the intricacies of market analysis, risk management, and choosing the right trading platform are crucial for success. While the potential rewards are significant, remember that informed decisions, coupled with a disciplined approach, are your best allies in this exciting but volatile market. So, are you ready to take the plunge?

Remember to click best forex system trading to understand more comprehensive aspects of the best forex system trading topic.

Finish your research with information from live forex trading graphs.