Forex Trading Tips for Beginners: Dive into the thrilling world of foreign exchange trading! Think global markets, fluctuating currencies, and the potential for serious profit (or loss, so heed our advice!). This isn’t get-rich-quick; it’s about smart strategies, calculated risks, and understanding the nuances of a complex but potentially rewarding financial landscape. We’ll break down the basics, from understanding currency pairs to mastering technical analysis, equipping you with the knowledge to navigate this exciting arena. Get ready to level up your financial game.

This guide will walk you through essential steps, from opening a demo account and crafting a solid risk management plan to understanding fundamental and technical analysis. We’ll also help you choose a reliable broker and avoid common beginner pitfalls. Prepare to learn the ropes and start your forex journey with confidence.

Understanding the Forex Market

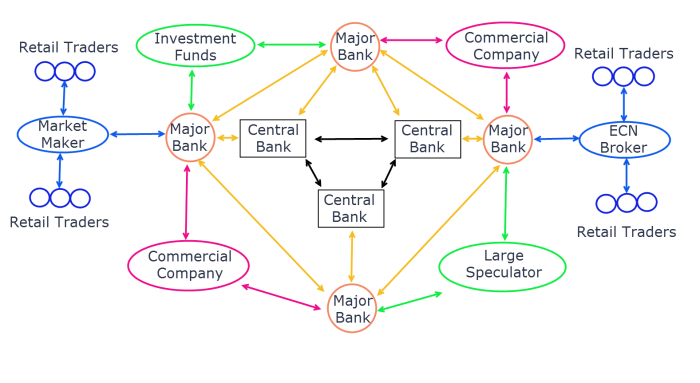

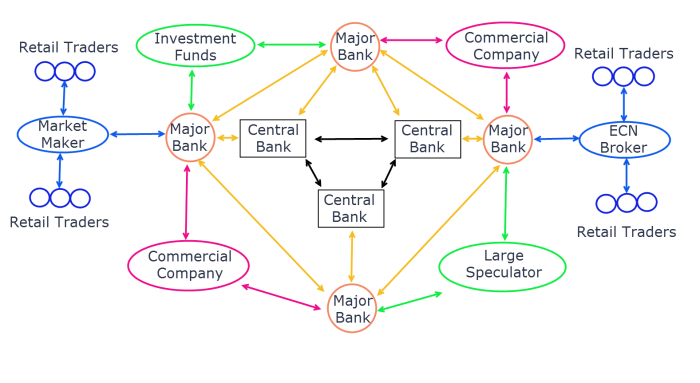

Forex trading, or foreign exchange trading, might sound intimidating, but at its core, it’s simply the buying and selling of currencies. Think of it like exchanging money when you travel – except instead of exchanging small amounts at an airport, you’re dealing with potentially large sums in a global market. Understanding this market is crucial before even considering placing a trade.

The forex market operates 24 hours a day, five days a week, across multiple global financial centers. This constant activity means there’s always an opportunity – and a risk. The sheer scale of the market, with trillions of dollars traded daily, makes it both incredibly dynamic and potentially lucrative.

Currency Pairs and Exchange Rates

Forex trading involves currency pairs. These pairs represent the exchange rate between two currencies. For example, EUR/USD represents the exchange rate of the Euro against the US dollar. If the EUR/USD rate is 1.10, it means one Euro can be exchanged for 1.10 US dollars. These rates constantly fluctuate based on various factors, creating opportunities for profit or loss. Understanding how these rates move is fundamental to successful forex trading. A rise in the EUR/USD rate means the Euro has strengthened against the dollar, while a fall signifies the opposite.

Factors Influencing Forex Prices

Numerous factors influence forex prices, making it a complex but fascinating market. Economic indicators play a significant role. For instance, a strong GDP report for a country will usually strengthen its currency, as investors anticipate economic growth. Interest rate changes also have a substantial impact; higher interest rates tend to attract foreign investment, increasing demand for the currency and driving up its value. Political events, such as elections or geopolitical instability, can create significant volatility in the market, leading to sudden and sometimes dramatic price swings. Market sentiment, driven by news and speculation, also contributes to price fluctuations. A positive outlook on a particular economy might lead to increased demand for its currency.

Opening a Demo Trading Account

Before risking real money, it’s essential to practice with a demo account. This allows you to familiarize yourself with the trading platform, test different strategies, and understand how the market behaves without financial consequences. Here’s a step-by-step guide:

1. Choose a Broker: Research reputable forex brokers that offer demo accounts. Consider factors like regulation, trading platform features, and customer support.

2. Registration: Visit the broker’s website and create an account. You’ll typically need to provide some basic personal information.

3. Account Verification (Sometimes Required): Some brokers might require you to verify your identity before accessing a demo account. This usually involves providing a copy of your ID and proof of address.

4. Fund Your Demo Account (Virtual Funds): Most brokers will automatically credit your demo account with a predetermined amount of virtual currency.

5. Start Trading: Begin practicing with the virtual funds. Experiment with different strategies and analyze your performance. Remember that the experience is different from live trading, but the practice will be invaluable.

Risk Management Strategies for Beginners

Forex trading, while potentially lucrative, is inherently risky. Success isn’t just about making profitable trades; it’s about surviving the inevitable losses. A robust risk management plan is your lifeline, protecting your capital and ensuring longevity in this volatile market. Without it, even the most astute trading strategies can crumble.

Effective risk management boils down to two key elements: position sizing and stop-loss orders. Position sizing determines how much capital you risk on each trade, while stop-loss orders automatically limit your potential losses on a single trade. Combining these two creates a safety net, preventing catastrophic losses that could wipe out your account.

Stop-Loss Orders and Position Sizing

A stop-loss order is a crucial tool. It’s an instruction to your broker to automatically sell a currency pair when it reaches a predetermined price, limiting your potential loss. Imagine you’re buying EUR/USD at 1.1000. A stop-loss order at 1.0950 means your trade will be closed automatically if the price drops to that level, limiting your loss to 50 pips (0.0050). The amount you lose will depend on your position size – the number of units of the currency pair you’re trading.

Position sizing is about determining how many units of a currency pair to trade based on your account balance and your risk tolerance. A common approach is to risk a maximum of 1-2% of your account balance on any single trade. If you have a $10,000 account and risk 1%, your maximum loss per trade would be $100. This ensures that even a series of losing trades won’t devastate your account.

Finish your research with information from The Top Forex Trading Strategies for 2025.

Risk 1-2% of your account balance per trade.

Examples of Successful Risk Management

Experienced traders often employ sophisticated risk management techniques. One common strategy is to diversify their portfolio across multiple currency pairs and trading strategies, reducing the impact of losses in any single position. Another approach involves using trailing stop-loss orders, which adjust the stop-loss level as the price moves in your favor, locking in profits while limiting potential losses. For example, a trader might initially set a stop-loss at 1.0950, but as the price rises to 1.1050, they might move their stop-loss to 1.1000, securing a portion of their profit while allowing for further upside potential. This strategy helps to protect profits while still participating in potential market movements.

Emotional Control in Forex Trading

Emotional control is paramount in forex trading. Fear and greed can lead to impulsive decisions, often resulting in significant losses. Fear can cause traders to exit profitable trades prematurely, while greed can lead to holding onto losing trades for too long, hoping for a reversal that may never come. Developing strategies to manage emotions is crucial for long-term success.

In this topic, you find that How to Trade Forex with a Demo Account is very useful.

Techniques for managing emotions include maintaining a trading journal to track trades and identify emotional biases, sticking rigidly to your trading plan, and taking regular breaks from trading to avoid emotional exhaustion. Furthermore, setting realistic expectations and accepting that losses are an inevitable part of trading can significantly improve emotional resilience. Remember that consistent profitability in forex trading is a marathon, not a sprint.

Fundamental Analysis in Forex Trading

Understanding the bigger picture—the global economic forces—is crucial for successful forex trading. Fundamental analysis dives deep into these forces, helping you predict how currency values might shift based on economic news and events. It’s about more than just charts; it’s about understanding the why behind the price movements.

Key Economic Indicators to Monitor

Several key economic indicators offer valuable insights into a country’s economic health and, consequently, its currency’s strength. Monitoring these indicators allows traders to anticipate potential currency fluctuations. Ignoring these indicators can lead to uninformed trading decisions.

Among the most important are:

- Gross Domestic Product (GDP): A measure of a country’s overall economic output. A strong GDP growth usually boosts the currency’s value.

- Inflation Rate: The rate at which prices for goods and services are rising. High inflation can weaken a currency, as it erodes purchasing power.

- Interest Rates: Set by central banks, these rates influence borrowing costs and investment. Higher interest rates generally attract foreign investment, strengthening the currency.

- Unemployment Rate: The percentage of the workforce that is unemployed. Low unemployment suggests a strong economy and a potentially stronger currency.

- Trade Balance: The difference between a country’s exports and imports. A trade surplus (more exports than imports) usually supports the currency.

Comparison of Fundamental Analysis Techniques

While the core principle remains the same—analyzing economic factors to predict currency movements—different approaches exist within fundamental analysis.

Two prominent techniques are:

- Top-Down Approach: This starts with analyzing global economic trends, then narrowing down to specific countries and their currencies. It’s a broad perspective, ideal for long-term strategies.

- Bottom-Up Approach: This focuses on specific economic data related to a particular currency pair, such as analyzing the financial reports of a company heavily influencing a country’s economy. This is more granular and useful for short-to-medium-term trading.

Impact of Major Economic Events on Currency Pairs, Forex Trading Tips for Beginners

Economic events can significantly impact currency pairs. Understanding their potential effects is vital for informed trading decisions. Unexpected events can lead to sharp and volatile price movements.

| Event | Currency Pair Affected | Expected Impact | Example |

|---|---|---|---|

| Surprise Interest Rate Hike by the Fed | USD/JPY | USD strengthens against JPY | If the Fed unexpectedly raises interest rates, investors might move funds into US dollar-denominated assets, increasing demand for the USD and strengthening it against the JPY. |

| Stronger-than-expected GDP growth in Germany | EUR/USD | EUR strengthens against USD | Positive economic news from Germany could boost investor confidence in the Eurozone, leading to increased demand for the Euro and a stronger EUR/USD exchange rate. |

| Geopolitical Instability in a Region | Various Pairs Involving Affected Currencies | Affected Currency Weakens | Political unrest in a particular country could trigger capital flight, weakening its currency against other major currencies. For example, a crisis in a major oil-producing nation could weaken its currency against the USD. |

| Announcement of a major trade deal | Currencies of the involved countries | Currencies of involved countries strengthen | A new trade agreement between the US and Japan might strengthen both the USD and JPY against other currencies as it boosts economic activity and investor confidence. |

Technical Analysis for Beginners

So, you’ve grasped the fundamentals of Forex and are ready to dive into the exciting world of charting and predicting price movements? Welcome to technical analysis! This isn’t about reading tea leaves; it’s about using historical price data and patterns to identify potential trading opportunities. Think of it as deciphering the market’s secret language, expressed through charts and indicators.

Technical analysis focuses on price action and volume to forecast future price movements. Unlike fundamental analysis, which examines economic factors, technical analysis is purely based on chart patterns and indicators derived from past price data. It’s a powerful tool, but like any tool, requires practice and understanding to use effectively.

Common Technical Indicators in Forex Trading

Technical indicators are mathematical calculations applied to price data, designed to generate buy or sell signals. They can help confirm trends, identify potential reversals, and gauge market momentum. While there are hundreds of indicators, understanding a few key ones provides a solid foundation.

- Moving Averages (MAs): MAs smooth out price fluctuations, revealing underlying trends. A simple moving average (SMA) averages prices over a specific period (e.g., 20-day SMA), while an exponential moving average (EMA) gives more weight to recent prices. A bullish crossover occurs when a shorter-term MA crosses above a longer-term MA, suggesting a potential uptrend. A bearish crossover is the opposite. For example, a 50-day EMA crossing above a 200-day EMA could signal a long-term bullish trend.

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. It ranges from 0 to 100. Readings above 70 are generally considered overbought (potential sell signal), while readings below 30 are considered oversold (potential buy signal). However, RSI divergences, where price makes a new high but RSI fails to, can also signal a potential trend reversal. For example, a stock price making a new high while the RSI remains below 70 could be a sign of weakening bullish momentum.

Interpreting Candlestick Charts

Candlestick charts are a visual representation of price action over a specific period. Each candle shows the open, high, low, and closing price. Understanding how to interpret these candles is crucial for technical analysis.

A green (or white) candle indicates that the closing price was higher than the opening price (bullish), while a red (or black) candle shows the opposite (bearish). The body of the candle represents the price range between the open and close, while the wicks (shadows) show the high and low prices for that period. Specific candlestick patterns, such as hammer, engulfing patterns, and doji, can signal potential trend reversals or continuations. For example, a hammer candlestick at the bottom of a downtrend could signal a potential bullish reversal.

Using Technical Analysis Tools to Identify Trading Opportunities

Many platforms offer technical analysis tools. Let’s Artikel a simplified approach:

1. Choose your chart: Select a timeframe (e.g., daily, hourly) depending on your trading style.

2. Apply indicators: Add MAs (e.g., 20-day and 50-day SMA) and RSI to your chart.

3. Identify patterns: Look for candlestick patterns and chart formations (e.g., head and shoulders, triangles).

4. Look for confirmations: A buy signal might be confirmed when the price crosses above a moving average, RSI is oversold, and a bullish candlestick pattern appears. Conversely, a sell signal could be confirmed by a price break below a moving average, RSI is overbought, and a bearish candlestick pattern appears.

5. Manage risk: Always use stop-loss orders to limit potential losses.

Remember, technical analysis is just one piece of the puzzle. Combining it with fundamental analysis and sound risk management significantly increases your chances of success in Forex trading.

Choosing a Forex Broker

Navigating the world of forex trading requires more than just understanding charts and indicators; it necessitates choosing the right partner – your forex broker. This crucial decision can significantly impact your trading experience, from the fees you pay to the tools at your disposal. Selecting a reliable broker is paramount for a successful and stress-free trading journey.

Choosing the right forex broker is a critical step for beginners. The broker you select will be your gateway to the forex market, influencing everything from your trading costs to the overall user experience. Factors like regulation, platform usability, and available tools all play a vital role in determining the best fit for your needs and trading style.

Broker Features: Spreads, Leverage, and Trading Platforms

Different forex brokers offer varying features, and understanding these differences is crucial for making an informed decision. Spreads, the difference between the bid and ask price, directly impact your profitability. Lower spreads translate to lower trading costs. Leverage, the ability to control larger positions with smaller amounts of capital, magnifies both profits and losses. Therefore, it’s essential to choose a broker offering suitable leverage for your risk tolerance. Finally, the trading platform itself is your workspace. A user-friendly platform with advanced charting tools and order execution capabilities can significantly enhance your trading efficiency. Some brokers offer proprietary platforms, while others support popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Consider your familiarity with different platforms and the features most important to your trading style. For example, a scalper might prioritize a platform with extremely fast execution speeds, while a swing trader might focus on charting tools and indicators.

Factors to Consider When Selecting a Reputable Broker

Selecting a reputable and reliable forex broker requires careful consideration of several key factors. Regulation is paramount; ensure your chosen broker is licensed and regulated by a recognized financial authority. This provides a layer of protection for your funds and ensures adherence to industry standards. Transparency in fees and commissions is another crucial aspect. Understand all associated costs, including spreads, commissions, overnight financing fees, and any other potential charges. Furthermore, the broker’s customer support should be readily available and responsive, offering assistance through various channels like phone, email, and live chat. A robust and secure trading platform is also essential, offering features such as order management tools, charting capabilities, and advanced analytical features. Finally, the broker’s reputation within the trading community should be thoroughly researched. Look for reviews and testimonials to gauge the overall experience of other traders.

Questions Beginners Should Ask Potential Brokers

Before committing to a forex broker, beginners should proactively seek answers to crucial questions. Information regarding the broker’s regulatory status and licensing details is paramount. Details about the spreads, commissions, and other fees associated with trading should be clearly understood. An assessment of the broker’s trading platform, its features, and its user-friendliness is essential. Inquiries about the broker’s customer support services, including their availability and responsiveness, are crucial. A clear understanding of the broker’s leverage offerings and the associated risks is necessary. Finally, accessing and reviewing client testimonials and reviews to gauge the broker’s reputation is a vital step before making a final decision.

Developing a Trading Plan

A trading plan is your roadmap to success in the forex market. It’s not just a document; it’s a living, breathing strategy that guides your decisions, helps you manage risk, and ultimately determines your profitability. Without a well-defined plan, your forex trading will likely be haphazard and prone to emotional decision-making, leading to losses. A solid plan provides structure and discipline, crucial elements for long-term success.

A comprehensive trading plan Artikels your goals, risk tolerance, and the specific strategies you’ll employ. It should be tailored to your individual circumstances, trading style, and risk appetite. Regular review and adjustment are key to its effectiveness, ensuring it remains relevant to changing market conditions and your evolving trading experience.

Sample Trading Plan

This example illustrates a basic trading plan. Remember, this is a template; you need to customize it based on your own research and understanding of the forex market.

Trading Goals: Achieve a consistent monthly profit of 5% on invested capital while maintaining a maximum drawdown of 10%. This means aiming for a 5% increase in your trading account each month, but accepting a potential loss of no more than 10% of your capital at any given time.

Risk Tolerance: Conservative. Only risk 1% of the trading account on each trade. This means if you have a $10,000 account, the maximum loss per trade will be $100. This approach prioritizes capital preservation.

Trading Strategies: Primarily using technical analysis with moving averages and RSI indicators to identify entry and exit points in trending markets. Will focus on major currency pairs (EUR/USD, GBP/USD, USD/JPY) to minimize volatility risk. Trades will be placed only after confirming signals from both moving averages and RSI, reducing the risk of false signals.

Backtesting Trading Strategies

Before implementing any trading strategy in live trading, it’s essential to backtest it. Backtesting involves applying your strategy to historical market data to see how it would have performed. This allows you to identify potential weaknesses and refine your approach before risking real money. Many platforms offer backtesting tools, or you can manually backtest using historical price charts. A successful backtest doesn’t guarantee future profits, but it significantly increases your chances of success by identifying potential flaws and refining your strategy. Consider different market conditions during backtesting (e.g., high volatility, low volatility, trending, ranging markets).

Adjusting a Trading Plan

Market conditions are constantly changing. What worked yesterday might not work today. Your trading plan should be dynamic, not static. Regularly review your performance and adjust your strategy accordingly. If you consistently lose trades using a specific indicator or strategy, consider removing it from your plan. If a new market pattern emerges, research its potential and integrate it into your plan. Likewise, adjust your risk tolerance based on your experience and performance. If you’re consistently exceeding your target profit, you may consider increasing your risk (while still maintaining risk management principles). Conversely, if you consistently hit your drawdown limit, it may be necessary to reduce your risk per trade. Consistent monitoring and adaptation are crucial for long-term success.

Common Mistakes to Avoid

Stepping into the forex market is exciting, but naivety can quickly lead to losses. Beginner forex traders often fall prey to common pitfalls that can significantly impact their trading journey. Understanding these mistakes and implementing preventative measures is crucial for long-term success. This section highlights some of the most frequent errors and offers strategies to navigate them effectively.

Overconfidence and Impatience are Two Sides of the Same Coin

Overconfidence, fueled by early wins, and impatience, driven by the desire for quick profits, are common culprits. Beginners might jump into trades without proper research or risk management, believing their intuition or a hot tip will guarantee success. This often results in significant losses, eroding confidence and capital. Conversely, an overly cautious approach, where traders hesitate to enter promising positions, can lead to missed opportunities and stagnation. A balanced approach, combining thorough analysis with calculated risk-taking and patience, is key. Successful traders often employ strategies that emphasize consistent, incremental gains over chasing large, unpredictable wins. For example, a scalping strategy, focusing on small profits from many quick trades, mitigates the impact of individual losses and requires less time commitment than longer-term strategies.

Ignoring Risk Management

Effective risk management is the cornerstone of successful forex trading. Many beginners neglect to set stop-loss orders, which limit potential losses on a trade. Without these safeguards, a single unfavorable market movement can wipe out an entire account. Furthermore, failing to diversify investments, concentrating solely on a few currency pairs, increases vulnerability to market fluctuations. A robust risk management strategy includes setting appropriate stop-loss and take-profit levels for each trade, diversifying across multiple currency pairs, and never risking more than a small percentage (e.g., 1-2%) of your total capital on any single trade. This approach limits potential losses and protects your trading account.

Emotional Trading

Letting emotions dictate trading decisions is a recipe for disaster. Fear and greed can lead to impulsive trades based on panic or unrealistic expectations. For instance, fear of missing out (FOMO) might prompt a trader to enter a trade without sufficient analysis, while greed might cause them to hold onto a losing position hoping for a reversal, leading to further losses. Developing a disciplined trading plan and sticking to it, regardless of market sentiment, is essential. This plan should include clear entry and exit strategies, risk management rules, and emotional checkpoints to prevent impulsive decisions. Journaling trades, noting emotions and their impact on decisions, can help identify patterns and improve emotional control.

Lack of a Trading Plan

Trading without a well-defined plan is like sailing without a map – you’re likely to get lost. A trading plan should Artikel your trading goals, risk tolerance, preferred trading style (e.g., scalping, day trading, swing trading), and specific entry and exit strategies for each trade. Without a plan, traders often react impulsively to market changes, leading to inconsistent results and potentially significant losses. A robust trading plan provides structure, discipline, and a framework for making rational decisions, even during periods of market volatility. Regularly reviewing and adjusting the plan based on performance and market conditions is also crucial.

Overtrading

Overtrading, or making too many trades in a short period, often stems from impatience and a desire for quick profits. It increases the likelihood of making mistakes and exposes the trader to higher risks. The increased transaction costs also erode profitability. A disciplined approach, focusing on quality over quantity, is far more effective. This means carefully selecting trades based on thorough analysis and sticking to your trading plan, even if it means fewer trades. This approach prioritizes consistency and risk management over volume.

Neglecting Continuous Learning

The forex market is constantly evolving. Beginners who fail to continuously learn and adapt their strategies risk falling behind. Staying updated on market trends, economic indicators, and new trading techniques is crucial for long-term success. This involves reading market analysis, attending webinars, and engaging with other traders. Continuous learning helps refine trading strategies, improve risk management, and adapt to changing market conditions.

Educational Resources and Further Learning

Conquering the forex market isn’t a sprint; it’s a marathon requiring continuous learning and refinement. While this guide has provided a solid foundation, further exploration is key to honing your skills and maximizing your potential. This section Artikels valuable resources to help you on your journey, from reputable websites to insightful books and supportive communities.

The forex market is constantly evolving, influenced by global events and technological advancements. Staying updated is crucial for success. Supplementing your knowledge with diverse resources allows for a well-rounded understanding, mitigating risks and maximizing opportunities. Engaging with a community adds a practical dimension, fostering collaboration and shared learning.

Reputable Websites and Online Courses

Numerous websites and online platforms offer forex education. Choosing reputable sources is crucial to avoid misleading information. Look for sites with transparent credentials, experienced instructors, and a focus on risk management. Many reputable brokers offer educational resources as part of their services. Some well-regarded sources include websites affiliated with established financial institutions, educational platforms specializing in finance, and experienced traders who provide verified educational content. Always critically evaluate any information you find online.

Benefits of Joining a Forex Trading Community

Joining a forex trading community or forum offers invaluable benefits beyond formal education. These communities provide a platform for networking with experienced traders, sharing insights, and learning from others’ experiences. Discussions on market analysis, trading strategies, and risk management offer a dynamic learning environment. The collaborative nature of these communities allows for the exchange of diverse perspectives and the identification of potential trading opportunities. However, it’s essential to approach these communities critically, verifying information and recognizing that not all advice is sound.

Recommended Books for Beginner Forex Traders

Reading books dedicated to forex trading provides a structured approach to learning. These books often delve deeper into specific aspects of trading, offering practical examples and case studies. While many books exist, selecting those written by experienced traders and focusing on fundamental concepts is vital.

- “Trading in the Zone” by Mark Douglas: This book focuses less on technical analysis and more on the psychological aspects of trading, emphasizing discipline and emotional control – crucial for long-term success.

- “Japanese Candlestick Charting Techniques” by Steve Nison: A classic guide to understanding and interpreting candlestick charts, a fundamental tool in technical analysis.

- “How to Make Money in Stocks” by William J. O’Neil: While focused on stocks, O’Neil’s CAN SLIM methodology offers valuable insights into identifying strong trends and managing risk, applicable to forex trading as well.

Final Conclusion: Forex Trading Tips For Beginners

So, you’re ready to tackle the forex market? Awesome! Remember, consistent learning, disciplined trading, and a well-defined strategy are your keys to success. Don’t be afraid to start small, learn from your mistakes (everyone makes them!), and constantly adapt your approach. The forex market is dynamic, so continuous education is crucial. With the right knowledge and a smart approach, you can navigate this exciting world and potentially reap the rewards. Happy trading!

FAQ Section

What’s the minimum amount I need to start Forex trading?

The minimum deposit varies widely between brokers, ranging from a few hundred dollars to even less for some platforms. However, remember that starting with a smaller account might limit your trading options and potential profits.

How much can I realistically earn from Forex trading?

There’s no guaranteed income in Forex. Potential earnings depend heavily on your trading skills, risk tolerance, and market conditions. While substantial profits are possible, significant losses are also a risk. Realistic expectations and careful risk management are key.

Is Forex trading legal?

The legality of Forex trading depends on your location. Most countries regulate Forex trading, but the specifics vary. It’s crucial to ensure you comply with all relevant laws and regulations in your jurisdiction.

How much time do I need to dedicate to Forex trading?

The time commitment depends on your trading style. Day trading requires significant daily attention, while swing trading allows for more flexibility. Even with automated strategies, monitoring and adjustments are necessary.