Forex Scalping: What It Is and How to Profit – sounds intense, right? It is, but mastering this high-speed trading strategy could be your ticket to potentially lucrative returns. Think lightning-fast trades, riding tiny price fluctuations for consistent gains. But beware, it’s not for the faint of heart; scalping demands intense focus, iron discipline, and nerves of steel. This guide dives deep into the world of forex scalping, revealing its intricacies and potential pitfalls, so you can decide if it’s the right game for you.

We’ll cover everything from understanding market dynamics and choosing the right currency pairs to mastering crucial technical indicators and developing a rock-solid risk management plan. We’ll even share some real-world examples – both successes and failures – to illustrate the ups and downs of this thrilling trading approach. Get ready to learn the secrets of consistently profiting from those minuscule market moves.

What is Forex Scalping?

Forex scalping is a high-speed trading strategy where traders aim to profit from small price fluctuations in currency pairs. Unlike other strategies that hold positions for days, weeks, or even months, scalpers typically hold their trades for only seconds or minutes. This fast-paced approach requires intense focus, quick reflexes, and a deep understanding of market dynamics.

Forex scalping differs significantly from other trading strategies like swing trading or day trading. Swing traders hold positions for several days or weeks, capitalizing on medium-term price movements. Day traders hold positions throughout the trading day, aiming for larger price swings within a 24-hour period. Scalping, however, focuses on the tiniest price discrepancies, aiming for numerous small profits throughout the day.

Timeframes Used in Forex Scalping

Scalpers primarily use very short timeframes, typically one-minute, five-minute, or even fifteen-minute charts. These charts provide a highly granular view of price action, allowing traders to identify fleeting opportunities. The shorter the timeframe, the more frequent the trading opportunities, but also the higher the risk. Successful scalping hinges on the ability to quickly identify and react to these minute price changes. Using longer timeframes would defeat the purpose of scalping, as the goal is to profit from extremely short-term price movements.

Psychological Aspects of Forex Scalping: Stress Management and Discipline

Scalping is incredibly demanding psychologically. The fast-paced nature and high frequency of trades can lead to significant stress and emotional strain. Effective stress management is crucial. This involves techniques like mindfulness, deep breathing exercises, and maintaining a disciplined approach to risk management. Discipline is equally important; sticking to a pre-defined trading plan, managing emotions, and avoiding impulsive decisions are key to long-term success. Scalpers need to be able to detach from individual trades and focus on the overall strategy. A common mistake is letting one losing trade derail the entire day’s trading plan.

Common Currency Pairs for Scalping

The choice of currency pair significantly impacts a scalper’s success. Some pairs are more volatile and offer more frequent trading opportunities, while others are more stable and less prone to rapid price swings. Here’s a table highlighting some popular choices:

| Currency Pair | Advantages | Disadvantages | Typical Spread |

|---|---|---|---|

| EUR/USD | High liquidity, tight spreads, consistent volatility | Can be susceptible to large, unexpected price movements | 0.5-1 pip |

| GBP/USD | High liquidity, significant volatility, often trending | Wider spreads compared to EUR/USD during certain periods | 0.7-1.5 pips |

| USD/JPY | High liquidity, generally stable, known for trending behavior | Can experience sudden, sharp reversals | 0.2-0.5 pips |

| USD/CHF | Relatively low volatility, good for beginners, tight spreads | Lower frequency of trading opportunities compared to more volatile pairs | 0.3-0.7 pips |

Note: Spreads can vary depending on the broker and market conditions. These are typical values and can fluctuate.

Understanding Market Dynamics for Scalping

Scalping, with its lightning-fast trades, demands a deep understanding of market dynamics. Unlike longer-term strategies, scalping hinges on predicting minuscule, short-term price fluctuations. This requires a keen eye for detail and a mastery of technical analysis tools. Success isn’t about predicting the overall market trend; it’s about capitalizing on the constant ebb and flow of price action.

Technical analysis forms the bedrock of successful scalping. It involves interpreting price charts and using various indicators to identify potential entry and exit points for trades within seconds or minutes. Without a solid grasp of technical analysis, scalping becomes pure speculation, significantly increasing the risk of losses. The ability to quickly interpret charts and react to subtle price shifts is paramount.

Technical Analysis in Scalping

Technical analysis empowers scalpers to identify fleeting opportunities. By studying price charts, traders can spot patterns and trends that indicate imminent price movements. This analysis goes beyond simply looking at price; it involves understanding volume, momentum, and the overall market sentiment reflected in the price action. For instance, a sudden surge in volume accompanied by a price breakout might signal a strong short-term trend, presenting a scalping opportunity. Conversely, a lack of volume during a price movement could indicate weakness and a potential reversal.

Identifying Short-Term Price Movements and Trends

Recognizing short-term price movements and trends is crucial for successful scalping. This involves closely monitoring price action on charts with shorter timeframes, such as 1-minute, 5-minute, or 15-minute charts. Looking for patterns like head and shoulders, double tops/bottoms, and flags can help identify potential reversal points. Also crucial is understanding support and resistance levels, which often act as temporary barriers to price movements, creating opportunities for entry and exit. For example, a price bouncing off a strong support level could signal a potential upward trend, providing a buy signal for a scalper.

The Role of Indicators in Scalping Decisions

Several technical indicators are commonly used in scalping to confirm price action and enhance decision-making.

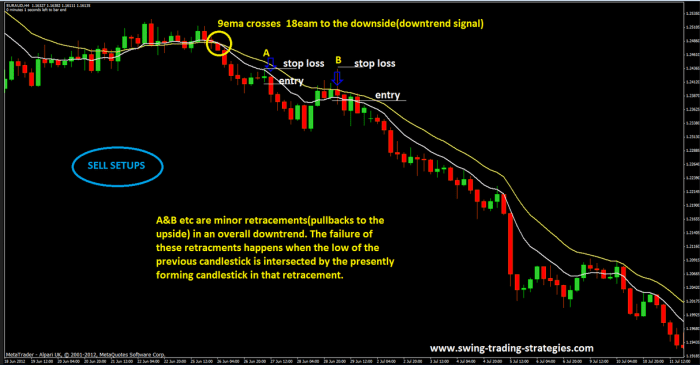

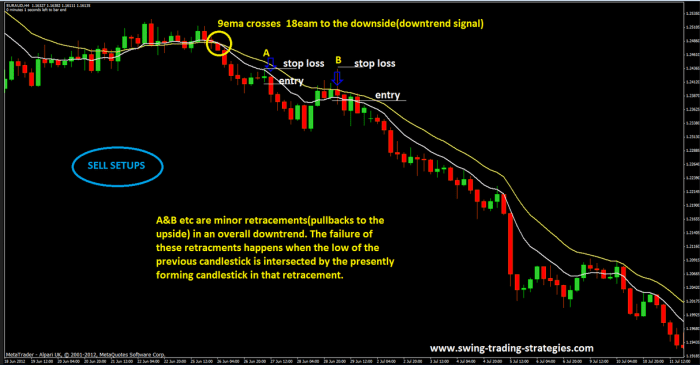

Moving Averages: These smooth out price fluctuations, helping identify the overall trend. A fast-moving average (e.g., 5-period) crossing above a slower-moving average (e.g., 20-period) can be interpreted as a bullish signal, suggesting a short-term upward trend. The opposite signals a bearish trend.

RSI (Relative Strength Index): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 often indicates an overbought market, suggesting a potential price correction, while an RSI below 30 suggests an oversold market, potentially signaling a price rebound. Scalpers often use RSI divergences to confirm potential trend reversals.

MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that identifies changes in the strength, direction, momentum, and duration of a trend. A MACD crossover (the fast line crossing above the slow line) is a bullish signal, while a crossover in the opposite direction suggests a bearish trend. Scalpers look for confirmations from other indicators and price action before acting on MACD signals.

Chart Types for Scalping

Candlestick and bar charts are the most prevalent chart types used in scalping.

Candlestick Charts: These charts visually represent the opening, closing, high, and low prices of an asset over a specific period. The visual representation of price action makes them ideal for identifying patterns and trends quickly. The “body” of the candlestick shows the price range between the open and close, while the “wicks” represent the high and low prices. Long bullish candles (green) often indicate strong buying pressure, while long bearish candles (red) suggest strong selling pressure.

Bar Charts: Similar to candlestick charts, bar charts display the open, high, low, and close prices. However, they use vertical bars instead of candlesticks. Bar charts are less visually appealing than candlestick charts but provide the same essential information. Both are suitable for scalping, with the choice often coming down to personal preference.

Scalping Strategies and Techniques: Forex Scalping: What It Is And How To Profit

Scalping, the art of snatching tiny profits from rapid price fluctuations, demands precision and speed. Successful scalping isn’t about predicting major market shifts; it’s about identifying and exploiting minor price movements within a very short timeframe. Mastering effective strategies and understanding your entry and exit points is crucial for consistent profitability.

Three Distinct Scalping Strategies

Effective scalping hinges on a well-defined strategy, adapted to your risk tolerance and market conditions. Here are three distinct approaches, each with its own nuances in entry and exit point identification.

- News Scalping: This high-risk, high-reward strategy capitalizes on the volatility surrounding major economic news releases. Entry points are typically placed immediately before or after the news announcement, anticipating a sharp price movement. Exit points are determined by pre-set profit targets or by the appearance of counter-trend signals. For example, a positive surprise in employment data might trigger a rapid price surge, offering a window for quick profit-taking. However, unexpected news can lead to substantial losses if not managed carefully.

- Range Scalping: This strategy focuses on established price ranges or consolidation periods. Entry points are identified at the support or resistance levels within the range, aiming to profit from short-term bounces or breakouts. Exit points are often set at the opposite end of the range or triggered by a break of the range boundaries. For instance, if a currency pair consistently trades between 1.1000 and 1.1050, a range scalper might enter long near 1.1000 and exit near 1.1050, or vice-versa. Successful range scalping requires patience and discipline to avoid chasing breakouts that may fail.

- Momentum Scalping: This strategy leverages the speed and direction of price movements. Entry points are identified when a strong trend is confirmed by momentum indicators, such as RSI or MACD. Exit points are often triggered by a slowdown in momentum or a change in trend direction. For example, a strong upward trend, confirmed by a rising MACD histogram, might signal a long entry, with an exit triggered when the MACD histogram begins to flatten or turn downward. Successful momentum scalping requires a keen understanding of momentum indicators and the ability to identify trend reversals quickly.

Utilizing Support and Resistance Levels in Scalping, Forex Scalping: What It Is and How to Profit

Support and resistance levels represent key price points where buyers and sellers tend to clash. In scalping, these levels serve as crucial entry and exit points. Support is a price level where buying pressure is expected to overcome selling pressure, preventing further price declines. Resistance, conversely, is a price level where selling pressure is expected to overcome buying pressure, halting further price increases. Scalpers often look for bounces off support or breakouts above resistance for quick trades. A successful scalping trade might involve entering long at a support level and exiting at a nearby resistance level, or vice-versa. However, it’s crucial to remember that support and resistance are not absolute barriers and can be broken.

A Simple Scalping Strategy Using Two Technical Indicators

A straightforward scalping strategy can be built using the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI). The MACD identifies momentum shifts, while the RSI gauges overbought and oversold conditions. This strategy might involve entering long when the MACD crosses above its signal line and the RSI is below 30 (oversold), and exiting when the MACD crosses below its signal line or the RSI rises above 70 (overbought). Conversely, a short position might be entered when the MACD crosses below its signal line and the RSI is above 70, with an exit triggered when the MACD crosses above its signal line or the RSI falls below 30. This strategy, like all others, requires careful risk management and consistent monitoring.

Executing a Scalping Trade: A Step-by-Step Guide

Executing a successful scalping trade requires a structured approach.

- Identify a Setup: Locate a potential trade opportunity based on your chosen strategy, considering support/resistance levels and indicator signals.

- Place Your Order: Enter your trade with a pre-determined stop-loss order to limit potential losses and a take-profit order to secure profits.

- Monitor the Trade: Closely observe price action and indicator readings. Be prepared to adjust your stop-loss or take-profit levels as needed.

- Manage Risk: Always use appropriate position sizing and risk management techniques to protect your capital.

- Exit the Trade: Close your position when your take-profit order is hit or when your stop-loss order is triggered, or when you identify a change in market conditions.

Risk Management in Forex Scalping

Forex scalping, while potentially lucrative, is inherently risky. The rapid-fire nature of the strategy, aiming for small profits on numerous trades, magnifies the impact of even minor errors. Effective risk management isn’t just a good idea; it’s absolutely crucial for survival in this high-octane trading environment. Without a robust plan, even the most skilled scalper can quickly lose their capital.

Successful scalping hinges on a disciplined approach to risk. This involves understanding the inherent dangers, implementing appropriate protective measures, and consistently adhering to a pre-defined strategy. Neglecting risk management is akin to driving a Formula 1 car without brakes – exciting, but ultimately disastrous.

Common Risks Associated with Forex Scalping

Scalping exposes traders to several unique risks. The speed of execution means that even small market fluctuations can quickly wipe out profits, or worse, lead to significant losses. High transaction costs, resulting from numerous trades, can also eat into profits. Slippage, the difference between the expected price and the actual execution price, is another significant concern. Finally, the psychological pressure of constantly monitoring the market and making rapid decisions can lead to emotional trading, a major pitfall for many scalpers.

The Importance of Position Sizing and Stop-Loss Orders

Position sizing and stop-loss orders are the cornerstones of any effective scalping risk management strategy. Position sizing dictates the amount of capital allocated to each trade. A common rule of thumb is to risk no more than 1-2% of your total trading capital on any single trade. This limits potential losses and prevents a series of losing trades from decimating your account. Stop-loss orders automatically exit a trade when the price reaches a predetermined level, minimizing potential losses. They act as a safety net, preventing runaway losses. For example, if a trader risks 1% of a $10,000 account, their maximum loss per trade would be $100. They would set their stop-loss accordingly.

Risk Management Techniques for Scalping

Several risk management techniques are particularly well-suited to scalping. These include using trailing stop-losses, which adjust the stop-loss order as the price moves in your favor, locking in profits. Another useful technique is to diversify your trades across multiple currency pairs, reducing the impact of a single losing trade. Furthermore, maintaining a detailed trading journal, recording each trade and its outcome, helps to identify patterns, refine your strategy, and improve your overall risk management. Regularly reviewing your performance and adapting your strategy accordingly is crucial for long-term success.

Hypothetical Scalping Trading Plan with Risk Management

This hypothetical plan demonstrates how risk management can be integrated into a scalping strategy. The key is to be consistent and disciplined in following the plan.

- Trading Capital: $5,000

- Risk per Trade: 1% ($50)

- Currency Pairs: EUR/USD, GBP/USD, USD/JPY

- Trading Hours: London and New York trading sessions (overlap provides increased liquidity)

- Position Sizing: Calculate position size based on the 1% risk rule and the stop-loss order placement.

- Stop-Loss Order: Placed at a level that limits potential loss to $50 per trade. This will vary depending on the currency pair and the volatility of the market.

- Take-Profit Order: Set a take-profit order at a level that provides a risk-reward ratio of at least 1:1. This means that the potential profit is at least equal to the potential loss.

- Trailing Stop-Loss: Implement a trailing stop-loss to lock in profits as the trade moves in your favor.

- Trading Journal: Maintain a detailed trading journal, recording each trade’s entry and exit points, profit or loss, and any relevant market conditions.

- Review and Adjustment: Regularly review your trading journal and adjust your strategy as needed based on your performance and market conditions.

Tools and Platforms for Scalping

Forex scalping, with its lightning-fast trades, demands a trading platform that can keep pace. The right platform isn’t just a pretty interface; it’s your weapon in the high-stakes world of short-term trading. Choosing wisely can significantly impact your success, or lack thereof. The speed and efficiency of your platform directly correlate with your ability to capitalize on fleeting market opportunities.

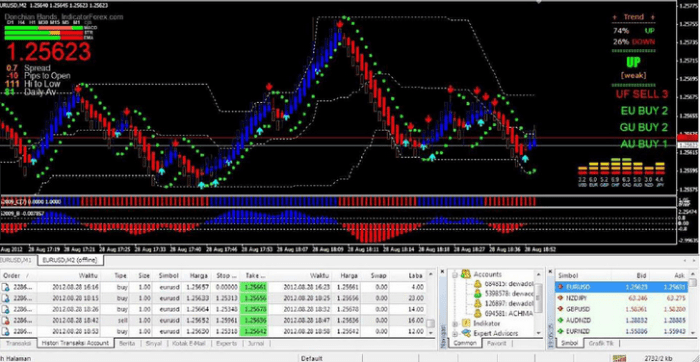

Choosing the right forex trading platform for scalping is crucial. The platform needs to be fast, reliable, and offer the tools necessary to execute trades quickly and efficiently. Several factors, including execution speed, charting capabilities, and order types, must be considered. Let’s delve into the specifics.

Forex Trading Platforms for Scalping

The choice of platform significantly impacts a scalper’s success. Different platforms cater to different needs and trading styles. Below is a comparison of popular platforms, highlighting their strengths and weaknesses for scalping.

| Platform Name | Pros | Cons | Features Relevant to Scalping |

|---|---|---|---|

| MetaTrader 4 (MT4) | Widely used, large community support, extensive customization options, relatively low cost. | Can be slow compared to newer platforms, charting capabilities can be improved for some scalping strategies. | Advanced charting tools (though some customization may be needed for optimal scalping), Expert Advisors (EAs) for automated trading, various order types including pending orders. |

| MetaTrader 5 (MT5) | Improved charting capabilities compared to MT4, more advanced order types, built-in economic calendar. | Steeper learning curve than MT4, fewer brokers support it compared to MT4. | Advanced charting, depth of market (DOM) for improved market visibility, multiple order execution options including one-click trading, hedging capabilities. |

| cTrader | Extremely fast execution speed, excellent charting and analysis tools specifically designed for scalping, advanced order management. | Smaller community support compared to MT4/MT5, may not be offered by all brokers. | Advanced charting tools with customizable indicators, Level II market depth, fast order execution, advanced order management features. |

| NinjaTrader | Powerful charting and analysis tools, extensive automation capabilities, DOM, backtesting capabilities. | Steeper learning curve, can be expensive depending on the features used. | Highly customizable charting, DOM, advanced order entry and management, backtesting for strategy optimization. |

Essential Features of a Good Scalping Platform

A successful scalping strategy relies heavily on the platform’s capabilities. Low latency, advanced charting tools, and efficient order execution are paramount.

Low latency, meaning minimal delay between placing an order and its execution, is critical for scalping. Even fractions of a second can mean the difference between profit and loss in this fast-paced trading style. Advanced charting tools, including customizable indicators and drawing tools, allow scalpers to identify and react to short-term price movements quickly. Efficient order execution features, such as one-click trading and hotkeys, streamline the trading process, enabling rapid order placement and modification.

Tools Enhancing Scalping Performance

Several tools can significantly boost a scalper’s performance. These range from sophisticated charting packages to specialized order execution software.

Order execution tools, such as those offered by many platforms, allow for quick order placement and modification. Features like one-click trading and hotkeys can significantly reduce execution time, a crucial factor in scalping. Many platforms also offer advanced charting packages that include a wide array of technical indicators specifically designed for short-term trading analysis. These indicators help scalpers identify potential entry and exit points quickly and efficiently.

Reliable Internet Connectivity for Scalping

Reliable internet connectivity is non-negotiable for scalping. A stable, high-speed connection with low latency is crucial to ensure timely order execution and prevent missed opportunities. Any disruption in connectivity can lead to significant losses. Consider investing in a high-quality internet service provider and using a wired connection for maximum stability. A backup internet connection is also a wise precaution.

Successful Scalping

Forex scalping, while potentially lucrative, is far from a guaranteed path to riches. Success hinges on a deep understanding of market dynamics, disciplined execution, and a relentless focus on risk management. Examining both successful and unsuccessful trades provides invaluable insights into refining your approach and maximizing your chances of profitability.

Successful scalping isn’t about luck; it’s about consistent, informed decision-making. Let’s explore some real-world scenarios to illustrate this point.

Successful Scalp Trade Examples

The following examples highlight successful scalping trades, emphasizing the reasoning behind each decision. Note that these are simplified representations for illustrative purposes and do not encompass all the factors a trader would consider.

Example 1: EUR/USD

You also can investigate more thoroughly about How to Avoid Overtrading in Forex to enhance your awareness in the field of How to Avoid Overtrading in Forex.

A trader observes a short-term bearish divergence on the 1-minute chart of the EUR/USD pair. The price action shows lower lows despite higher highs in the RSI indicator. They anticipate a price reversal and enter a short position at 1.1050, placing a stop-loss order at 1.1055 and a take-profit order at 1.1040. The price promptly drops to 1.1042, allowing the trader to exit the trade with a small but profitable gain. The trader’s understanding of technical indicators and their ability to identify a potential reversal point proved crucial.

Example 2: GBP/JPY

Analyzing the 5-minute chart of GBP/JPY, a trader notices a strong bullish momentum following a news event related to UK economic data. The price breaks through a significant resistance level, confirming the upward trend. They enter a long position at 150.00, setting a stop-loss at 149.90 and a take-profit at 150.20. The price rises rapidly to 150.18 before pulling back slightly. The trader closes the position at 150.18, securing a profitable trade based on their quick identification of the momentum shift and timely entry.

Unsuccessful Scalp Trade Examples and Lessons Learned

Analyzing unsuccessful trades is just as, if not more, important than analyzing successful ones. It allows for identifying weaknesses and improving future strategies.

Example 1: USD/JPY

A trader enters a long position on USD/JPY based on a perceived breakout, without considering the overall market sentiment, which was slightly bearish. The price initially moves in their favor, but a sudden news event causes a sharp reversal, resulting in a loss. The stop-loss order was triggered, but the loss was still significant.

Ignoring broader market context and relying solely on a single indicator can lead to substantial losses. Thorough analysis is paramount.

Example 2: AUD/USD

A trader ignores their predetermined risk management plan and over-leverages a scalp trade on AUD/USD. A small adverse price movement leads to a margin call and a substantial loss.

Disciplined risk management is non-negotiable in forex scalping. Always adhere to your pre-defined risk parameters.

The Importance of Journaling and Trade Review

Maintaining a detailed trading journal is crucial for continuous improvement. This journal should include: entry and exit points, rationale for each trade, indicators used, and the resulting profit or loss. Regularly reviewing this journal allows you to identify recurring patterns, both successful and unsuccessful, to refine your strategies and adapt to changing market conditions.

Characteristics of a Successful Forex Scalper

Successful forex scalpers possess a unique blend of skills and characteristics. They are typically:

Highly disciplined: They adhere strictly to their trading plan and risk management rules, avoiding emotional decision-making.

Technically proficient: They possess a strong understanding of technical analysis and utilize various indicators effectively.

Patient and focused: They wait for high-probability setups and avoid impulsive trades.

Enhance your insight with the methods and methods of How to Choose the Best Forex Trading Platform.

Adaptable: They adjust their strategies based on market conditions and learn from their mistakes.

Fast and efficient: They execute trades swiftly and manage their positions effectively.

Mentally resilient: They can handle losses without letting them affect their future trading decisions.

End of Discussion

So, is forex scalping the holy grail of trading? Not quite. But with the right knowledge, skills, and a healthy dose of discipline, it can be a powerful tool in your arsenal. Remember, consistent profitability requires meticulous planning, unwavering execution, and a willingness to learn from both your wins and losses. Master the art of scalping, and you’ll unlock a world of potential, but always remember that risk management is paramount. This isn’t a get-rich-quick scheme; it’s a high-octane strategy demanding dedication and precision. Now go forth and conquer (the markets, that is!).

Essential Questionnaire

What’s the minimum account size needed for forex scalping?

There’s no magic number, but smaller accounts might struggle with spreads and commissions eating into profits. A decent starting point is often considered to be around $1,000 – $5,000, allowing for sufficient position sizing and risk management.

How many hours a day should I dedicate to scalping?

It depends on your strategy and market conditions. Some scalpers focus on high-volatility periods, dedicating a few hours daily, while others might trade for longer stretches. Consistency is key; even short, focused sessions can be effective.

Is automated scalping software reliable?

Automated software can help, but it’s not a guaranteed path to riches. Thorough testing and understanding of the underlying algorithms are crucial. Blindly relying on automated systems is risky; human oversight remains essential.

Can I scalpe using a mobile app?

Yes, many forex brokers offer mobile trading platforms suitable for scalping, but ensure low latency and reliable connectivity for optimal performance. The mobile experience might not be as feature-rich as desktop platforms, though.