Profitable forex trading isn’t just about luck; it’s a blend of strategy, discipline, and understanding the market’s rhythm. This isn’t your grandpa’s investment advice; we’re diving deep into the nitty-gritty, exploring everything from risk management and technical analysis to the often-overlooked psychological aspects of consistent wins. Get ready to trade smarter, not harder.

We’ll unravel the secrets behind successful forex trading strategies, comparing short-term bursts with the long game. We’ll dissect risk management – because knowing when to pull back is just as crucial as knowing when to strike. Then, we’ll equip you with the tools to interpret market signals, from candlestick patterns to economic indicators, helping you make informed decisions. Think of this as your cheat sheet to conquering the forex world.

Defining Profitable Forex Trading

Profitable forex trading isn’t about getting rich quick; it’s a disciplined approach to managing risk and capitalizing on market movements. It requires a deep understanding of market dynamics, technical analysis, fundamental analysis, and, crucially, effective risk management. Many believe it’s a get-rich-quick scheme, but successful traders consistently demonstrate that consistent profitability stems from a well-defined strategy and unwavering discipline.

Factors Contributing to Profitable Forex Trading

Profitable forex trading hinges on several interconnected factors. A robust trading plan, encompassing entry and exit strategies, risk management techniques, and a clear understanding of your trading style, forms the foundation. Thorough market analysis, using both technical indicators (like moving averages and RSI) and fundamental factors (like economic news and geopolitical events), is crucial for identifying potential trading opportunities. Effective money management, limiting risk per trade and overall portfolio exposure, is paramount to long-term survival and profitability. Finally, emotional discipline – avoiding impulsive trades driven by fear or greed – is often the most challenging yet essential component of consistent success.

Short-Term Versus Long-Term Profitability Strategies

Short-term strategies, like scalping or day trading, aim for small profits from frequent trades. These strategies require intense focus, quick decision-making, and a high tolerance for volatility. Long-term strategies, like swing trading or position trading, hold positions for days, weeks, or even months, capitalizing on larger price swings. These strategies demand patience, a strong understanding of market trends, and the ability to withstand periods of drawdown. The choice between short-term and long-term strategies depends on individual risk tolerance, time commitment, and trading style.

Examples of Successful Forex Trading Strategies and Their Risk Profiles

One example of a successful short-term strategy is the “mean reversion” strategy, which capitalizes on price fluctuations around a moving average. This strategy involves buying when the price falls below the average and selling when it rises above, aiming for small, consistent profits. Its risk profile is moderate to high due to the frequent trading and potential for quick price reversals. A successful long-term strategy could be a trend-following approach, identifying and riding established market trends. This strategy typically involves lower frequency trading and has a lower risk profile than mean reversion, but requires patience and the ability to withstand periods of sideways movement. Another strategy, the “carry trade,” involves borrowing in a low-interest-rate currency and investing in a high-interest-rate currency, profiting from the interest rate differential. The risk here is primarily currency fluctuations.

Comparison of Different Trading Styles and Their Profitability Potential

Different trading styles, such as scalping, day trading, swing trading, and position trading, each offer unique approaches to forex trading with varying levels of risk and potential profitability. Scalping, with its rapid trades and small profit targets, demands high levels of concentration and quick reflexes, and while potentially profitable, carries a high degree of risk. Day trading, involving holding positions for a single day, requires a good understanding of intraday market dynamics and the ability to manage risk effectively. Swing trading, focusing on medium-term price swings, involves holding positions for several days or weeks, balancing risk and reward. Position trading, holding positions for extended periods, is a long-term strategy that relies on fundamental analysis and market trends, with a lower frequency of trades but potentially higher rewards and lower risk relative to short-term strategies. The most profitable style depends heavily on individual trader characteristics and risk tolerance.

Risk Management in Forex Trading

Forex trading, while potentially lucrative, is inherently risky. Ignoring risk management is akin to sailing a ship without a compass – you might get lucky, but you’re far more likely to crash. A robust risk management plan is the cornerstone of successful and sustainable forex trading, protecting your capital and ensuring longevity in the market. This section Artikels essential risk management strategies for a hypothetical trader with a $10,000 account.

A Risk Management Plan for a $10,000 Account

For a trader starting with $10,000, a conservative approach is crucial. A good rule of thumb is to never risk more than 1-2% of your account balance on any single trade. This means risking a maximum of $100-$200 per trade for this account. This limitation helps to prevent significant losses that could wipe out your account. Furthermore, diversification across different currency pairs is recommended to avoid overexposure to a single market’s volatility. Regularly reviewing and adjusting the plan based on market conditions and trading performance is also essential. For instance, after a series of winning trades, the trader might consider slightly increasing the risk percentage, but never exceeding a comfortable threshold. Conversely, after a string of losses, reducing the risk percentage can help prevent further capital erosion.

The Importance of Position Sizing and Stop-Loss Orders

Position sizing determines the amount of capital allocated to each trade. In our example, a $100-$200 risk per trade translates to a specific position size depending on the currency pair and the stop-loss order placement. For example, if a trader identifies a trade opportunity with a stop-loss of 50 pips, and each pip costs $1, then a $100 risk translates to a position size of 100 units (100 pips * $1/pip = $100). This calculation ensures the trader stays within their predefined risk tolerance.

Stop-loss orders automatically close a trade when the price moves against the trader’s position by a predetermined amount. They are essential for limiting potential losses. Without stop-losses, a single adverse market movement could wipe out a significant portion or even the entirety of the account. The placement of stop-loss orders should be based on technical analysis and risk tolerance, often outside key support or resistance levels.

Common Pitfalls in Forex Risk Management and Their Solutions

Overtrading, driven by greed or fear, is a significant pitfall. Traders often take on more positions than they can manage, leading to increased stress and potentially large losses. The solution is to stick to a trading plan and avoid impulsive decisions. Another common mistake is neglecting proper risk assessment, either through inadequate research or ignoring potential downsides. Thorough market analysis and careful consideration of risk-reward ratios are crucial to mitigate this. Finally, ignoring stop-loss orders or placing them too tightly can lead to premature exits from profitable trades or significant losses. Discipline in adhering to predetermined stop-loss levels is paramount.

Managing Emotional Responses to Market Fluctuations

Forex trading can be emotionally taxing. Fear and greed often lead to poor decision-making. To manage these emotions, it’s crucial to maintain a detached perspective. This can be achieved through techniques like journaling, mindfulness, and regular breaks from trading. Sticking to the trading plan, regardless of emotional impulses, is essential. It’s also helpful to remember that losses are part of trading; they are learning opportunities, not failures. A consistent approach and a focus on long-term success are vital in mitigating the negative effects of emotional responses.

Technical Analysis for Profitable Trading

Technical analysis is the backbone of many successful forex trading strategies. It involves studying price charts and using various indicators to predict future price movements. Unlike fundamental analysis, which focuses on economic factors, technical analysis solely relies on historical price data and trading volume to identify trends and patterns. Mastering technical analysis is crucial for making informed trading decisions and maximizing your profitability.

Moving Averages for Entry and Exit Points

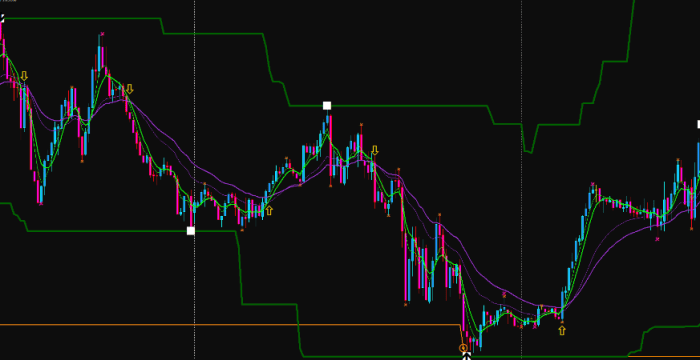

Moving averages are among the most popular technical indicators used in forex trading. They smooth out price fluctuations, making it easier to identify trends. A simple moving average (SMA) calculates the average price over a specific period, while an exponential moving average (EMA) gives more weight to recent prices. Traders often use multiple moving averages with different timeframes to generate trading signals. For instance, a crossover of a shorter-term moving average (e.g., 20-period SMA) above a longer-term moving average (e.g., 50-period SMA) is often considered a bullish signal, suggesting a potential entry point. Conversely, a crossover below indicates a potential exit point or a bearish signal. It’s important to remember that moving averages lag the price action, meaning they confirm trends rather than predict them. Therefore, combining them with other indicators can improve accuracy.

Comparison of Technical Indicators

Understanding the strengths and weaknesses of different indicators is essential for choosing the right tools for your trading strategy. The following table compares several popular technical indicators:

| Indicator Name | Description | Strengths | Weaknesses | Typical Use Cases |

|---|---|---|---|---|

| Relative Strength Index (RSI) | Measures the magnitude of recent price changes to evaluate overbought or oversold conditions. | Identifies potential reversals; easy to understand and use. | Can generate false signals; susceptible to whipsaws in sideways markets. | Identifying overbought/oversold conditions, confirming trend changes. |

| Moving Average Convergence Divergence (MACD) | Shows the relationship between two moving averages; identifies momentum changes. | Identifies trend changes and momentum shifts; versatile indicator. | Can generate false signals; requires understanding of histogram interpretation. | Identifying trend changes, confirming breakouts, identifying divergences. |

| Stochastic Oscillator | Compares a security’s closing price to its price range over a given period. | Identifies overbought/oversold conditions; can detect momentum shifts. | Prone to whipsaws; requires careful interpretation in ranging markets. | Identifying overbought/oversold conditions, confirming trend changes. |

| Bollinger Bands | Shows the volatility of an asset’s price by plotting standard deviations around a moving average. | Shows volatility levels; identifies potential support and resistance levels. | Can be difficult to interpret in sideways markets; doesn’t predict direction. | Identifying potential breakouts, measuring volatility, setting stop-loss orders. |

Candlestick Patterns for Profitable Trading

Candlestick patterns provide visual representations of price action over a specific period. Understanding these patterns can help traders anticipate potential price movements. A step-by-step guide to using candlestick patterns for profitable trading involves:

1. Identifying the pattern: Learn to recognize common bullish (e.g., hammer, engulfing) and bearish (e.g., hanging man, dark cloud cover) patterns.

2. Confirming the pattern: Don’t rely on a single candlestick pattern. Confirm the signal with other indicators or price action confirmations (e.g., support/resistance levels, volume).

3. Setting stop-loss and take-profit orders: Always protect your capital by setting stop-loss orders to limit potential losses. Determine your take-profit level based on your risk tolerance and the pattern’s potential.

4. Monitoring the trade: Once you’ve entered a trade, monitor the market and be prepared to adjust your strategy if necessary. Consider trailing stop-losses to lock in profits.

Combining Multiple Technical Indicators

Combining multiple technical indicators can enhance the accuracy of your trading signals and reduce the risk of false signals. For example, a trader might use the RSI to identify overbought/oversold conditions and the MACD to confirm trend changes. A bullish crossover of the MACD combined with an RSI reading below 30 could signal a strong buying opportunity. Similarly, a bearish crossover of the MACD with an RSI reading above 70 might suggest a potential selling opportunity. The key is to select indicators that complement each other and provide a comprehensive view of the market. Remember that no combination of indicators guarantees success, but it significantly improves your odds.

Fundamental Analysis in Forex Trading

Understanding the bigger picture is crucial for successful forex trading. While technical analysis focuses on chart patterns and price action, fundamental analysis delves into the economic and political factors that drive currency values. By analyzing these underlying forces, traders can anticipate potential price movements and make informed trading decisions. This isn’t about predicting the future with certainty, but rather improving your odds by understanding the context in which price changes occur.

Economic news and events exert a significant influence on currency prices. Major announcements, such as interest rate decisions, GDP reports, and inflation figures, can cause immediate and substantial market reactions. Positive economic data generally strengthens a currency, while negative news tends to weaken it. The speed and magnitude of these reactions depend on the unexpectedness of the news and its perceived impact on the economy. For example, an unexpectedly high inflation reading might trigger a sharp sell-off in a currency as investors anticipate potential interest rate hikes.

Key Economic Indicators and Their Interpretation

Interpreting key economic indicators requires understanding their implications for a country’s economy and its currency. Gross Domestic Product (GDP) measures the total value of goods and services produced within a country’s borders. A strong GDP growth rate usually indicates a healthy economy, which is positive for the country’s currency. Inflation, measured by the Consumer Price Index (CPI) or Producer Price Index (PPI), reflects the rate at which prices for goods and services are increasing. High inflation can erode purchasing power and may lead to central bank intervention, potentially impacting the currency’s value. Interest rates, set by central banks, influence borrowing costs and investment decisions. Higher interest rates typically attract foreign investment, increasing demand for the currency and strengthening its value. Conversely, lower interest rates can weaken a currency.

Evaluating Political and Geopolitical Factors

Political stability and geopolitical events significantly impact forex markets. Political instability, such as elections, regime changes, or social unrest, can create uncertainty and volatility. Geopolitical events, including wars, trade disputes, and sanctions, can also have a profound impact on currency values. For instance, a major geopolitical crisis could lead to a flight to safety, boosting the value of currencies considered safe havens, like the US dollar or Japanese yen, while weakening others. Analyzing political risk assessments and news from reliable sources is crucial for navigating these turbulent waters. Consider the impact of Brexit on the British Pound as a prime example – the uncertainty surrounding the UK’s departure from the European Union led to significant fluctuations in the GBP’s value.

Fundamental vs. Technical Analysis in Trading Strategies

The relative importance of fundamental and technical analysis varies depending on the trading strategy employed. Some traders primarily rely on fundamental analysis, focusing on long-term investments based on their assessment of economic and political factors. They might hold positions for weeks, months, or even years, waiting for the underlying economic conditions to reflect in currency prices. Others favor technical analysis, concentrating on chart patterns and indicators to identify short-term trading opportunities. However, many successful traders integrate both approaches. Fundamental analysis helps identify potential trends, while technical analysis assists in determining optimal entry and exit points. A balanced approach allows traders to capitalize on both long-term economic trends and short-term market fluctuations. For instance, a trader might use fundamental analysis to identify a weakening economy and then use technical analysis to pinpoint the best time to short the currency based on chart patterns.

Trading Psychology and Discipline

Forex trading isn’t just about charts and indicators; it’s a mental game. Success hinges on your ability to manage your emotions and stick to a well-defined plan, even when the market throws curveballs. Ignoring the psychological aspect can lead to impulsive decisions, crippling losses, and ultimately, failure. This section explores the crucial role of psychology and discipline in achieving consistent profitability.

The forex market is a breeding ground for emotional volatility. Fear, greed, and hope – powerful emotions that can cloud judgment and lead to poor trading decisions. Fear of loss can cause traders to prematurely exit profitable positions, while greed can lead to holding onto losing trades for too long, hoping for a miraculous recovery. Conversely, hope can fuel unrealistic expectations, blinding traders to objective market realities. These emotional responses, often driven by cognitive biases, directly impact trading performance.

Psychological Challenges Faced by Forex Traders

The psychological challenges in forex trading are significant and often underestimated. Traders frequently grapple with confirmation bias, where they selectively seek information confirming their pre-existing beliefs, ignoring contradictory evidence. Overconfidence, stemming from a few early wins, can lead to excessive risk-taking and ultimately, devastating losses. Conversely, experiencing a series of losses can trigger a feeling of helplessness, causing traders to doubt their strategies and make rash decisions. This cycle of emotional highs and lows can be exhausting and detrimental to long-term success. Understanding these biases and developing strategies to mitigate their impact is crucial.

Importance of Maintaining Trading Discipline and Avoiding Emotional Trading

Discipline is the bedrock of successful forex trading. It involves adhering to a pre-defined trading plan, regardless of market conditions or emotional impulses. This means sticking to your risk management rules, entering and exiting trades based on objective criteria, and avoiding impulsive actions driven by fear or greed. A disciplined trader meticulously follows their strategy, even during losing streaks, knowing that consistent execution over time is key to long-term profitability. Emotional trading, on the other hand, leads to inconsistency, increased risk-taking, and ultimately, diminished returns.

Developing a Consistent Trading Routine

Creating and adhering to a consistent trading routine is essential for maintaining discipline. This routine should include dedicated time for market analysis, trade planning, execution, and post-trade review. A sample routine might involve:

- Morning: Review overnight market news and analyze charts.

- Midday: Identify potential trading opportunities based on your strategy.

- Afternoon: Execute trades and monitor positions.

- Evening: Review trading performance, analyze mistakes, and adjust your strategy as needed.

Consistency in this routine fosters discipline and minimizes impulsive decisions. It’s important to establish a schedule that works best for you and stick to it as much as possible.

Managing Stress and Avoiding Impulsive Decisions During Market Volatility

Market volatility is inevitable. During periods of heightened uncertainty, it’s crucial to manage stress and avoid making impulsive decisions. Techniques like mindfulness meditation, deep breathing exercises, and regular physical activity can help regulate emotional responses. Taking breaks from the market when feeling overwhelmed is also crucial. Stepping away allows for a clearer perspective and prevents emotionally driven trades. Maintaining a detailed trading journal can also provide valuable insights into your emotional state and trading patterns, helping you identify triggers and develop coping mechanisms.

Forex Trading Platforms and Tools

Navigating the forex market successfully hinges on choosing the right tools and platforms. The sheer number of options available can be overwhelming, so understanding their features, costs, and user-friendliness is crucial for maximizing your trading potential and minimizing frustration. The right platform can streamline your workflow, provide critical insights, and ultimately contribute to more informed trading decisions.

Comparison of Forex Trading Platforms

Choosing a forex trading platform involves careful consideration of several key factors. The table below compares three popular platforms, highlighting their strengths and weaknesses. Remember that individual needs and preferences will significantly influence the best choice for any particular trader.

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | cTrader |

|---|---|---|---|

| Ease of Use | User-friendly interface, suitable for beginners. | Slightly steeper learning curve than MT4, but offers more advanced features. | Intuitive and modern interface, known for its speed and efficiency. |

| Charting Tools | Wide range of technical indicators and charting tools. | Expanded charting capabilities compared to MT4, including more advanced studies. | Excellent charting tools with advanced features like depth of market (DOM) visualization. |

| Automated Trading (EAs) | Extensive support for Expert Advisors (EAs). | Supports EAs, but with some differences in coding language compared to MT4. | Strong support for automated trading strategies. |

| Fees & Commissions | Varies depending on broker; typically involves spreads and potentially commissions. | Similar to MT4, with variations based on the broker. | Often utilizes a commission-based pricing model, which can be transparent and competitive. |

| Mobile Accessibility | Mobile apps available for iOS and Android. | Mobile apps available for iOS and Android. | Mobile apps available for iOS and Android. |

Charting Tools and Technical Analysis

Charting tools are indispensable for technical analysis. They allow traders to visualize price movements, identify patterns, and apply various indicators to predict future price action. Common tools include line charts, candlestick charts, bar charts, and a wide array of technical indicators (e.g., moving averages, RSI, MACD). For example, a moving average can smooth out price fluctuations, helping to identify trends, while the Relative Strength Index (RSI) helps gauge the momentum of price changes and potential overbought or oversold conditions. Traders can overlay multiple indicators on a single chart to gain a comprehensive view of the market.

Hypothetical Trading Platform: “TradeZenith”

Imagine “TradeZenith,” a hypothetical platform designed for both beginners and experienced traders. Its user interface is clean and intuitive, featuring a customizable dashboard allowing users to arrange widgets displaying real-time market data, news feeds, and open positions. TradeZenith boasts advanced charting tools with drag-and-drop functionality for adding indicators, drawing trend lines, and creating custom studies. It supports automated trading through a robust backtesting engine, allowing users to evaluate the performance of their trading strategies before deploying them in live markets. Furthermore, TradeZenith offers integrated risk management tools, including customizable stop-loss and take-profit orders, and real-time alerts for significant price movements or news events. The platform is available on web, desktop, and mobile devices, ensuring accessibility from anywhere.

Automated Trading Systems (Expert Advisors)

Expert Advisors (EAs) are automated trading programs that execute trades based on pre-programmed algorithms. They offer the potential for 24/7 market monitoring and execution, eliminating emotional biases and allowing for consistent strategy implementation. However, EAs also present drawbacks. The reliance on pre-programmed rules can lead to significant losses if market conditions deviate significantly from the assumptions underlying the EA’s strategy. Furthermore, poorly designed or inadequately tested EAs can lead to substantial financial losses. Thorough backtesting and forward testing, coupled with careful risk management, are crucial before deploying any EA in live trading. For example, an EA designed for a trending market might perform poorly during periods of sideways consolidation, leading to unnecessary trades and losses.

Backtesting and Optimization

Backtesting, in the world of forex trading, is like a test drive for your trading strategy before you unleash it on the real market. It allows you to see how your system would have performed historically, giving you valuable insights into its potential profitability and risk levels. Optimization, on the other hand, is the fine-tuning process – tweaking parameters to improve performance and reduce the likelihood of painful losses. Think of it as upgrading your car’s engine for better fuel efficiency and speed. Both are crucial for building a robust and profitable forex trading system.

A well-designed backtesting strategy should encompass several key elements to ensure its reliability and usefulness. Ignoring these steps can lead to overly optimistic results and ultimately, costly mistakes in live trading.

Designing a Backtesting Strategy

A robust backtesting strategy involves defining clear parameters, selecting appropriate historical data, and meticulously tracking performance metrics. First, you need to precisely define your trading system, including entry and exit rules, position sizing, and risk management protocols. Then, you select historical data that accurately reflects market conditions relevant to your strategy. Finally, you choose key performance indicators (KPIs) to evaluate the system’s effectiveness, such as win rate, average win/loss, maximum drawdown, and Sharpe ratio. A thorough backtest should account for slippage, commissions, and swap fees to accurately reflect real trading costs.

Optimizing Trading Parameters, Profitable forex trading

Optimizing trading parameters involves systematically adjusting variables within your strategy to improve its performance. This process often involves experimenting with different settings for indicators, timeframes, or risk management rules. The goal is to find the optimal balance between profitability and risk. However, it’s crucial to avoid over-optimization, which can lead to a system that performs exceptionally well during backtesting but poorly in live trading due to its over-fitting to past data. Robust optimization techniques, such as walk-forward analysis, help mitigate this risk by testing the system’s performance on different data subsets.

Backtesting a Simple Moving Average Crossover Strategy

Let’s illustrate the backtesting process using a simple moving average (SMA) crossover strategy. We’ll use hypothetical data for a EUR/USD pair over a 100-day period. The strategy involves using a 5-day SMA and a 20-day SMA. A buy signal is generated when the 5-day SMA crosses above the 20-day SMA, and a sell signal is generated when the 5-day SMA crosses below the 20-day SMA. We’ll assume a fixed lot size and a stop-loss of 20 pips and a take-profit of 40 pips.

| Date | EUR/USD Close | 5-Day SMA | 20-Day SMA | Signal | Result (Pips) |

|---|---|---|---|---|---|

| Day 1 | 1.1000 | 1.0990 | 1.0980 | – | – |

| Day 2 | 1.1020 | 1.1000 | 1.0985 | – | – |

| Day 3 | 1.1050 | 1.1010 | 1.0995 | – | – |

| Day 10 | 1.1100 | 1.1050 | 1.1000 | Buy | +40 |

| Day 25 | 1.1050 | 1.1080 | 1.1100 | Sell | -20 |

| Day 100 | 1.1200 | 1.1180 | 1.1150 | Buy | +40 |

(Note: This is simplified hypothetical data. A real backtest would involve significantly more data points.)

Based on this hypothetical data, the strategy shows a net profit. However, this is a simplified example and doesn’t account for various market conditions.

Limitations and Biases of Backtesting

Backtesting, while valuable, has inherent limitations. One major limitation is the reliance on historical data, which may not accurately reflect future market conditions. Over-optimization, as mentioned earlier, can lead to overly optimistic results. Data mining bias occurs when a strategy is tweaked repeatedly until it fits the historical data, resulting in a system that doesn’t generalize well to new data. Survivorship bias can also affect results if the backtest only considers successful strategies and ignores those that failed. Furthermore, backtests often fail to fully capture the psychological impact of trading, including emotional decision-making under pressure. It’s crucial to remember that backtesting provides insights, but it’s not a guarantee of future success.

Education and Continuous Learning

The forex market is a dynamic beast, constantly evolving and presenting new challenges and opportunities. Profitable trading isn’t a destination; it’s a journey of continuous learning and adaptation. Ignoring this crucial aspect is akin to sailing a ship without a map – you might get lucky, but consistent success requires ongoing education and a commitment to staying ahead of the curve.

The forex market is constantly evolving, influenced by global events, economic indicators, and shifting investor sentiment. To navigate this complex landscape successfully, traders must commit to lifelong learning. This involves not just acquiring initial knowledge but also actively seeking out new information, refining existing strategies, and adapting to changing market conditions. Ignoring this principle can lead to outdated strategies and ultimately, losses.

Reliable Sources of Forex Trading Information

Identifying trustworthy information is paramount in the forex world, a space often plagued by misleading gurus and get-rich-quick schemes. Discerning reliable sources requires critical thinking and a healthy dose of skepticism. Look for sources that provide factual information, avoid making unrealistic promises, and offer diverse perspectives rather than pushing a single, biased approach. Reputable websites, educational platforms, and books authored by experienced traders with a proven track record are your best bet. Be wary of sources that promise guaranteed profits or rely heavily on testimonials without verifiable data.

Resources for Continuous Forex Education

Several avenues exist for continuous learning. Books offer in-depth analysis and structured learning. Websites provide up-to-date market news and analysis, while courses offer structured learning experiences with expert guidance. A blend of these resources provides a well-rounded educational experience.

- Books: “Japanese Candlestick Charting Techniques” by Steve Nison, “Trading in the Zone” by Mark Douglas, “How to Make Money in Stocks” by William J. O’Neil (applicable principles translate to forex).

- Websites: ForexLive, DailyFX (offer news, analysis, and educational resources), Investopedia (for foundational knowledge).

- Courses: Many online platforms like Coursera, Udemy, and Babypips offer forex trading courses, ranging from beginner to advanced levels. Be sure to check reviews and instructor credentials before enrolling.

The Importance of Mentorship and Community Support

While self-learning is valuable, the support and guidance of a mentor or a thriving trading community can significantly accelerate your progress and reduce costly mistakes. A mentor can provide personalized feedback, share insights from their experience, and help you navigate the emotional challenges of trading. A supportive community allows you to learn from others’ successes and failures, share ideas, and build a network of like-minded individuals. Finding a reputable mentor might involve seeking out experienced traders within your network or joining established online trading communities. Remember to vet potential mentors thoroughly and be wary of those promising unrealistic results.

Conclusion

Mastering profitable forex trading is a journey, not a sprint. It requires consistent learning, adapting to market shifts, and honing your trading psychology. By understanding the interplay of technical and fundamental analysis, implementing robust risk management, and developing unwavering discipline, you’ll significantly increase your chances of success. So, buckle up, and let’s turn your forex aspirations into reality.

Obtain a comprehensive document about the application of how to read forex trading charts that is effective.

Remember to click forex trading mentors to understand more comprehensive aspects of the forex trading mentors topic.