Forex trading profit per day: It’s the holy grail, right? The dream of consistent daily gains in the volatile world of currency trading. But let’s ditch the get-rich-quick fantasies and dive into the reality. This isn’t about magic formulas; it’s about understanding the market, managing risk like a boss, and employing smart strategies. We’ll explore realistic profit targets, effective risk management techniques, and proven trading strategies to help you navigate the forex market and potentially achieve your daily profit goals.

We’ll cover everything from choosing the right currency pairs and utilizing technical indicators to mastering emotional discipline and selecting the perfect trading tools. Think of this as your survival guide to the wild, wild west of daily forex trading – complete with real-world examples, potential pitfalls, and strategies to help you avoid them. Buckle up, it’s going to be a ride.

Daily Forex Trading Profit Potential: Forex Trading Profit Per Day

The allure of daily forex trading profits is undeniable, but the reality is far more nuanced than get-rich-quick schemes suggest. Understanding the factors that influence your daily earnings is crucial for setting realistic expectations and developing a sustainable trading strategy. Profitability isn’t guaranteed, and consistent success requires discipline, knowledge, and risk management.

Factors Influencing Daily Forex Trading Profits

Several interconnected factors determine your daily forex trading profits. These include market volatility, your trading strategy, position sizing, risk tolerance, and the specific currency pairs you trade. High volatility can lead to significant gains or losses in a short period, while a well-defined strategy minimizes emotional trading and maximizes the probability of successful trades. Proper position sizing prevents significant losses from wiping out your account, while a balanced risk tolerance helps you navigate market fluctuations. Finally, some currency pairs are naturally more volatile and offer greater profit potential (but also higher risk) than others.

Realistic Daily Profit Targets for Different Trading Strategies

Setting realistic profit targets is paramount. Aggressive day traders aiming for multiple trades per day might target 1-3% of their account balance, understanding that not every trade will be profitable. Scalpers, who focus on small price movements, might aim for smaller gains, perhaps 0.5-1% per trade, accumulating profits over numerous transactions. Swing traders, holding positions for longer periods, might have more modest daily targets, potentially aiming for 0.2-0.5% of their account balance, depending on their chosen holding period and market conditions. These are merely examples, and individual targets should be adjusted based on risk tolerance and trading style.

Case Study: A Successful Day of Forex Trading

Let’s consider a hypothetical example of a successful day for a swing trader. Imagine a trader with a $10,000 account focusing on the EUR/USD pair. They identify a potential upward trend and enter a long position at 1.1000, buying 10,000 units of EUR. Throughout the day, the EUR/USD rises to 1.1020. The trader then closes their position, realizing a profit of 20 pips (1 pip = 0.0001). With a typical lot size of 10,000 units, this translates to a profit of $200 (20 pips x $10 per pip). This represents a 2% gain on their daily investment, exceeding their daily target of 0.5%. This success, however, is dependent on their analysis and risk management, and future results will not necessarily replicate this scenario.

Daily Profit Potential of Different Currency Pairs

The following table compares the daily profit potential of different currency pairs, considering their average daily volatility. Remember, higher volatility means higher potential profits but also higher risk. These are average values and can fluctuate significantly.

| Currency Pair | Average Daily Volatility (Pips) | Potential Daily Profit Range (%) | Risk Level |

|---|---|---|---|

| EUR/USD | 80-120 | 0.5% – 3% | Medium |

| GBP/USD | 90-150 | 0.7% – 4% | Medium-High |

| USD/JPY | 60-100 | 0.3% – 2% | Medium |

| USD/CHF | 50-80 | 0.2% – 1.5% | Low-Medium |

Risk Management and Daily Forex Trading

Daily forex trading offers the allure of quick profits, but without a robust risk management strategy, it’s a gamble, not a business. Consistent profitability hinges not just on identifying winning trades, but on protecting your capital from devastating losses. This section dives into the crucial aspects of risk management for those aiming for daily gains in the forex market.

Stop-Loss Orders: Limiting Daily Losses

Stop-loss orders are your safety net. They automatically close a trade when the price reaches a predetermined level, preventing further losses. Imagine a scenario where you’ve entered a long position on EUR/USD, anticipating a price increase. However, the market moves against you. A pre-set stop-loss order at, say, 10 pips below your entry point, will automatically sell your position once that price is hit, limiting your potential loss to those 10 pips. This prevents emotionally driven decisions when the market turns against you, safeguarding your capital from significant erosion. The key is to strategically place your stop-loss order based on technical analysis, considering factors like support levels and risk tolerance. A poorly placed stop-loss can still lead to substantial losses, so careful planning is paramount.

Position Sizing Strategies for Effective Risk Management, Forex trading profit per day

Position sizing is about determining how much capital to allocate to each trade. It’s not about how much you *can* risk, but how much you *should* risk. A common approach is to risk a fixed percentage of your account balance on each trade – for instance, 1% or 2%. This means if you have a $10,000 account and risk 1%, your maximum loss per trade would be $100. This approach helps prevent a single losing trade from significantly impacting your overall account balance. Calculating your position size requires considering your stop-loss order and the pip value of your trading pair. For example, if your stop-loss is 10 pips and the pip value is $10, you would adjust your trade size to ensure your maximum loss remains within your predetermined risk percentage.

A Risk Management Plan for Consistent Daily Profits

A comprehensive risk management plan is more than just stop-losses and position sizing. It encompasses several key elements. First, define your risk tolerance. How much are you willing to lose on a daily or weekly basis without impacting your overall trading strategy? Second, establish clear entry and exit rules. This includes defining your stop-loss and take-profit levels before entering a trade, sticking to them regardless of market fluctuations. Third, maintain a trading journal. Document each trade, noting your rationale, entry and exit points, profits and losses, and any lessons learned. This provides valuable data for refining your strategy and identifying areas for improvement. Finally, regularly review and adjust your plan. Market conditions change, and your risk management plan should evolve with them.

Comparing Risk Management Techniques for Daily Forex Trading

Several techniques can be combined for a robust approach. Fixed fractional position sizing, as described earlier, offers a consistent risk level across all trades. Conversely, a volatility-based approach adjusts position size based on the market’s volatility. In high-volatility periods, traders might reduce their position size to mitigate risk. Another technique is the use of trailing stop-loss orders, which automatically adjust the stop-loss level as the price moves in your favor, locking in profits while minimizing losses. The choice of technique depends on individual trading styles, risk tolerance, and market conditions. A blend of these approaches, tailored to your specific needs, is often the most effective strategy.

Trading Strategies for Daily Forex Profits

Daily forex trading offers the potential for significant returns, but success hinges on employing effective strategies. Choosing the right approach depends on your risk tolerance, trading experience, and time commitment. Here, we’ll explore three distinct strategies, ordered from least to most risky, illustrating their application with hypothetical examples. Remember, past performance doesn’t guarantee future results, and forex trading always involves risk.

Scalping

Scalping involves profiting from small price movements within a short timeframe, often just minutes. This strategy requires quick reflexes, a deep understanding of market dynamics, and a low-risk tolerance. Entry and exit points are determined by technical indicators like moving averages and candlestick patterns, focusing on minor price fluctuations. The goal is to accumulate small profits repeatedly throughout the day.

Example: Let’s say you’re scalping EUR/USD. You identify a bullish candlestick pattern on a 1-minute chart, coupled with a positive crossover of a fast and slow moving average. You enter a long position at 1.1000. The price rises to 1.1005 within minutes, and you close your position, realizing a profit of 5 pips (assuming 1 pip = $10 per lot, a profit of $50 per lot). If the trade goes against you and the price drops to 1.0995, you’d cut your losses at a 5-pip loss ($50 per lot).

Range Trading

Range trading focuses on identifying and trading within established price boundaries (support and resistance levels). This strategy is considered moderately risky as it limits potential gains but also caps potential losses. Entry points are typically near support levels (for long positions) or resistance levels (for short positions). Exit points are usually set at the opposite boundary or when a price breakout occurs, indicating a potential trend reversal.

Example: Suppose GBP/USD is trading within a range of 1.2500-1.2600. You anticipate the price to remain within this range. You enter a long position at 1.2520 (near support). Your stop-loss is placed at 1.2490 (below support), and your take-profit is set at 1.2580 (near resistance). If the price reaches your take-profit, you’ll earn a profit of 60 pips ($600 per lot). If the price hits your stop-loss, your loss will be 30 pips ($300 per lot). If a breakout occurs, outside of the 1.2500-1.2600 range, you would exit the position to avoid larger losses.

Swing Trading

Swing trading aims to capture price movements over several days or even weeks. This strategy is considered higher risk due to the longer timeframe and potential for larger price swings. Entry and exit points are determined by analyzing longer-term charts, identifying trend reversals, and using technical and fundamental analysis.

Example: You’re swing trading USD/JPY. After observing a bearish trend reversal pattern on a daily chart and considering negative economic news impacting Japan, you enter a short position at 110.00. Your stop-loss is placed at 110.50 (above resistance), allowing for a larger potential loss. Your take-profit target is set at 108.00, aiming for a significant price decline. If the price reaches your take-profit, you’ll make a profit of 200 pips ($2000 per lot). If the price hits your stop-loss, your loss will be 50 pips ($500 per lot).

Examine how trading signals forex can boost performance in your area.

Market Analysis for Daily Forex Trading

Daily forex trading hinges on accurate market analysis. Successfully navigating the volatile forex market requires a keen understanding of both technical and fundamental factors influencing currency pairs. This involves identifying potential trading opportunities using technical indicators, understanding the impact of fundamental news, and combining these analyses for informed decision-making.

Technical Indicator Usage for Daily Trading Opportunities

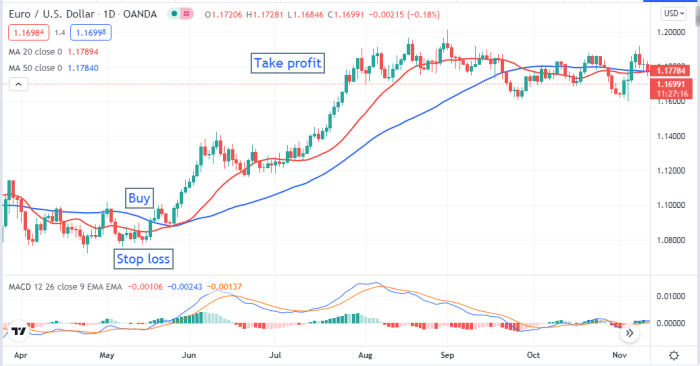

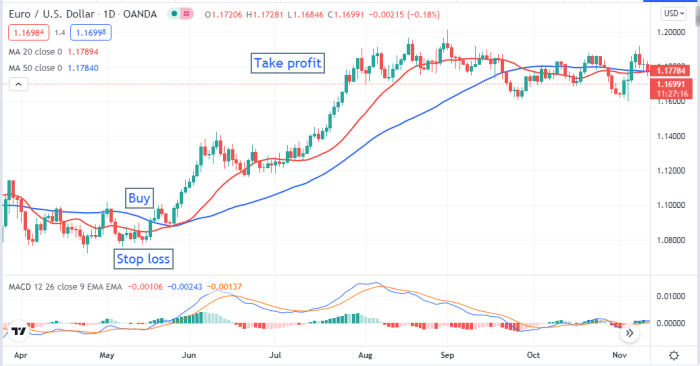

Technical analysis uses price charts and indicators to predict future price movements. Traders employ various indicators to identify potential entry and exit points. For instance, the Relative Strength Index (RSI) helps determine overbought and oversold conditions, suggesting potential reversals. Moving averages, such as the 20-day and 50-day moving averages, identify trends and potential support and resistance levels. The MACD (Moving Average Convergence Divergence) indicator highlights momentum changes, indicating potential buying or selling opportunities. By observing these indicators in conjunction with price action, traders can identify potential daily trading opportunities. For example, a bullish crossover of the 20-day and 50-day moving averages, coupled with an RSI reading below 30, could signal a potential long entry.

Fundamental News Events Impacting Daily Forex Prices

Fundamental analysis considers macroeconomic factors impacting currency values. Major news events, such as interest rate announcements from central banks (like the Federal Reserve or the European Central Bank), significantly influence forex prices. Economic data releases, including employment figures (Non-Farm Payroll in the US), inflation rates (CPI), and GDP growth, also cause considerable market movement. Geopolitical events, such as political instability or international conflicts, can also create significant volatility. For example, an unexpected interest rate hike by the Federal Reserve will generally strengthen the US dollar against other currencies, while negative GDP growth data might weaken a currency.

Combining Technical and Fundamental Analysis for Daily Trading Decisions

Effective forex trading often combines technical and fundamental analysis. Fundamental analysis provides the context – why a currency might strengthen or weaken – while technical analysis helps identify optimal entry and exit points. For instance, if fundamental analysis suggests the US dollar is likely to strengthen due to positive economic data, a trader might use technical indicators like RSI and moving averages to identify a favorable entry point with minimal risk. This combined approach offers a more comprehensive understanding of market dynamics, leading to more informed trading decisions. A trader might wait for a price pullback to a support level (technical) after positive US employment data (fundamental) to enter a long position on the USD/JPY pair.

Step-by-Step Guide for Daily Market Analysis

A systematic approach to daily market analysis is crucial.

- Review Overnight News: Begin by reviewing overnight news and economic releases that might have impacted currency pairs.

- Analyze Charts: Examine relevant currency pair charts, focusing on price action, support and resistance levels, and key technical indicators.

- Identify Potential Trades: Based on technical and fundamental analysis, identify potential trading opportunities with clearly defined entry and exit points.

- Develop a Trading Plan: Create a detailed trading plan, specifying entry and exit prices, stop-loss levels, and take-profit targets.

- Execute Trades: Execute trades according to the trading plan, adhering to risk management principles.

- Monitor and Manage Trades: Continuously monitor open positions and adjust stop-loss or take-profit levels as needed.

- Review and Adapt: After the trading day, review the performance of executed trades and adjust the trading strategy accordingly.

Psychological Aspects of Daily Forex Trading

The forex market is a relentless test of mental fortitude. While technical analysis and trading strategies are crucial, your emotional resilience often determines your long-term success. Ignoring the psychological dimension can lead to impulsive decisions, crippling losses, and ultimately, burnout. Mastering your emotions is as vital as mastering the charts.

Emotional discipline is the cornerstone of successful daily forex trading. It’s the ability to consistently apply your trading plan, regardless of market fluctuations and your emotional state. This means sticking to your risk management rules, even when facing potential profits or losses, and avoiding impulsive trades driven by fear or greed. A trader with strong emotional discipline can navigate market volatility with calm and calculated precision, increasing their chances of long-term profitability.

Common Psychological Pitfalls Leading to Losses

Several psychological traps can sabotage even the most well-crafted trading plans. These pitfalls often stem from cognitive biases and emotional responses to market events. Understanding these pitfalls is the first step towards mitigating their impact.

Fear and Greed

Fear and greed are the twin demons of forex trading. Fear of loss can lead to premature exits from profitable trades, while greed can encourage holding onto losing positions far too long, hoping for a reversal that may never come. Consider the example of a trader who enters a long position and sees it immediately move in their favor. Fear of losing this early profit might cause them to exit prematurely, missing out on substantial gains. Conversely, a trader holding a losing position might refuse to cut their losses, hoping the market will turn around, only to see their losses accumulate.

Overconfidence and Confirmation Bias

Overconfidence can lead to excessive risk-taking, while confirmation bias causes traders to selectively focus on information that confirms their existing beliefs, ignoring contradictory evidence. A trader experiencing a winning streak might become overconfident, increasing their position sizes without adjusting their risk management, making them vulnerable to significant losses when the market turns against them. Similarly, a trader convinced a currency pair is about to rise might only look for information supporting that belief, ignoring bearish signals that could indicate an impending drop.

Revenge Trading

Revenge trading is the impulsive act of taking on more risk after a loss, attempting to recoup losses quickly. This is often fueled by anger and frustration, leading to irrational decisions and further losses. Imagine a trader who suffers a significant loss. Driven by a desire for revenge, they might enter another trade with a larger position size and tighter stop-loss, increasing their risk exposure and potentially compounding their losses.

Strategies for Maintaining Emotional Control

Developing strategies to manage emotions is vital for long-term success. These strategies involve both proactive measures and reactive responses to market events.

Develop a Detailed Trading Plan

A well-defined trading plan acts as a roadmap, guiding your decisions and reducing the impact of emotional impulses. This plan should include clear entry and exit strategies, risk management rules, and position sizing guidelines. Adhering strictly to this plan, regardless of market conditions or emotional state, provides a framework for consistent and disciplined trading.

Practice Mindfulness and Stress Management Techniques

Mindfulness techniques, such as meditation or deep breathing exercises, can help you stay grounded and focused during trading sessions. Regular exercise, sufficient sleep, and a healthy diet also contribute to emotional well-being and reduce stress levels.

Maintain a Trading Journal

Keeping a detailed trading journal allows you to track your performance, identify patterns in your trading behavior, and analyze your emotional responses to different market situations. This self-reflection can help you identify and address emotional biases and improve your decision-making process.

Seek External Support

Don’t hesitate to seek support from mentors, experienced traders, or a therapist. Discussing your trading experiences and emotional challenges with someone objective can provide valuable insights and help you develop effective coping mechanisms.

Managing Stress and Maintaining Focus

Daily forex trading can be incredibly stressful. Implementing strategies to manage stress and maintain focus is critical for making rational decisions and avoiding emotional trading.

Establish a Dedicated Trading Space

Create a dedicated trading environment free from distractions. This space should be comfortable, well-organized, and conducive to concentration. Minimize interruptions from phone calls, emails, or other sources of distraction.

Set Realistic Goals and Time Limits

Avoid trading for excessively long periods. Set realistic daily trading goals and stick to them. Taking breaks throughout the day is crucial for maintaining focus and preventing burnout. Avoid trying to “catch up” on losses by extending trading sessions or increasing risk.

Regularly Review Your Performance

Regularly reviewing your trading performance, both successes and failures, helps you learn from your mistakes and improve your overall trading strategy. This review should include an honest assessment of your emotional state during different trading scenarios.

Tools and Resources for Daily Forex Trading

Navigating the dynamic world of daily forex trading requires more than just market knowledge; it demands the right tools and resources to effectively analyze, execute, and manage your trades. The right arsenal can significantly enhance your trading efficiency and potentially improve your profitability, while the wrong tools can lead to confusion and costly mistakes. Choosing wisely is crucial for success.

Charting Platforms

Charting platforms are the cornerstone of daily forex trading. They provide the visual representation of price movements, allowing traders to identify trends, patterns, and potential trading opportunities. Different platforms offer varying features, impacting the overall trading experience.

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These are industry-standard platforms known for their wide range of technical indicators, customizable charts, automated trading capabilities (Expert Advisors or EAs), and large community support. However, some might find the interface somewhat dated compared to newer platforms.

- TradingView: This platform boasts a user-friendly interface, powerful charting tools, and a vast social community where traders can share ideas and strategies. While it doesn’t offer direct brokerage services, it integrates seamlessly with many brokers. A drawback can be its reliance on a strong internet connection for optimal performance.

- cTrader: This platform is favored by many for its speed, advanced charting capabilities, and sophisticated order management tools. It excels in algorithmic trading but may have a steeper learning curve for beginners.

Reputable Forex Brokers

Choosing a reliable forex broker is paramount. Brokers provide access to the forex market, offering various account types, trading platforms, and leverage options. Different brokers cater to different trading styles and risk tolerances.

- Example Broker A (fictional): Offers tight spreads, excellent customer support, and a user-friendly platform. However, their leverage options might be limited compared to others.

- Example Broker B (fictional): Provides a wide range of account types, high leverage, and access to advanced trading tools. However, their spreads might be slightly wider, and customer support could be less responsive.

- Example Broker C (fictional): Known for its advanced trading platform and educational resources, ideal for beginners. However, its fees might be slightly higher than some competitors.

Note: Always thoroughly research and compare brokers before choosing one. Consider factors like regulation, security, trading conditions, and customer support.

Choosing the Right Tools Based on Trading Style

The ideal combination of tools and resources depends heavily on individual trading styles. Scalpers, for example, need platforms with extremely low latency and fast order execution, while swing traders might prioritize platforms with robust charting and technical analysis tools.

A day trader focused on technical analysis would benefit from a platform with a wide range of indicators, drawing tools, and backtesting capabilities. A fundamental trader, on the other hand, might prioritize access to economic news and data, potentially utilizing a dedicated economic calendar alongside their charting platform. Understanding your personal trading style is the first step in building your ideal trading toolkit.

Discover the crucial elements that make swing trading forex the top choice.

Illustrative Examples of Daily Trading Scenarios

Daily forex trading offers the potential for substantial profits but also carries significant risk. Understanding various scenarios, both successful and unsuccessful, is crucial for developing a robust trading strategy. The following examples illustrate the diverse possibilities and the importance of risk management and market analysis.

A Day of Significant Profit

This scenario involves a trader who identified a bullish breakout on the EUR/USD pair. Prior market analysis indicated strong support at 1.1000 and resistance at 1.1100. The trader observed a significant increase in trading volume and a clear break above the 1.1100 resistance level. Based on this, they entered a long position at 1.1105, setting a stop-loss order at 1.0995 (10 pips below the support level) and a take-profit order at 1.1200 (95 pips above the entry price). The EUR/USD continued its upward trajectory, reaching the take-profit level within a few hours. The trader successfully exited the trade, realizing a profit of 95 pips. This scenario highlights the importance of identifying strong trends and utilizing well-defined risk management strategies. A chart would show a clear upward trend with the entry, stop-loss, and take-profit levels clearly marked. The volume increase would be visible, confirming the breakout’s strength. The rationale behind the trade was the confirmation of a bullish breakout, supported by volume and prior technical analysis.

A Day of Losses

In this scenario, a trader entered a short position on the GBP/USD pair based on a perceived overbought condition. However, unexpected positive economic news regarding the UK economy was released, causing a sharp upward movement in the GBP/USD. The trader’s stop-loss order was triggered, resulting in a loss. The trader failed to account for the potential impact of significant news events. Furthermore, the stop-loss order was placed too close to the entry price, limiting the potential for profit but magnifying potential losses. The lesson learned here is the critical importance of fundamental analysis, incorporating news events into trading decisions, and setting stop-loss orders at levels that appropriately balance risk and reward. A chart would illustrate the sudden upward spike following the news release, showing how the stop-loss was triggered. The lack of fundamental analysis in this scenario led to a poorly timed and ultimately unsuccessful trade.

Successful Risk Management

A trader identified a potential trading opportunity in the USD/JPY pair, but the market conditions were uncertain. Instead of entering a large position, they decided to implement a conservative approach. They entered a small position, using a tight stop-loss order to limit potential losses. The market moved against their initial prediction, but the stop-loss order was triggered before the loss exceeded their predetermined risk tolerance. Although the trade was ultimately unsuccessful, the trader avoided a significant loss due to their prudent risk management strategy. This scenario underscores the value of discipline and risk control in daily forex trading. The chart would demonstrate a small loss, but the overall portfolio remained stable due to the small position size and tight stop-loss. The trader’s rationale was to prioritize risk management over potentially high gains in an uncertain market.

Impact of News Events

A trader was expecting a decline in the EUR/USD due to anticipated negative economic data from the Eurozone. They entered a short position before the data release. The economic data was indeed negative, initially causing the EUR/USD to drop as expected. However, the market reaction was short-lived. A subsequent unexpected positive announcement from the European Central Bank caused a sharp reversal, leading to a significant loss for the trader. This scenario highlights the unpredictable nature of the forex market and the significant impact that news events can have. A chart would show an initial downward movement followed by a sharp upward reversal after the unexpected ECB announcement. The trader’s initial prediction was correct, but the subsequent news event drastically altered market sentiment, resulting in an unexpected loss.

Final Review

So, can you make a forex trading profit per day? Absolutely, but it’s not a guaranteed win. Consistent profitability hinges on a solid understanding of market dynamics, a robust risk management plan, and the discipline to stick to your strategy. Remember, the journey to daily forex profits is a marathon, not a sprint. It requires continuous learning, adaptation, and a healthy dose of patience. By mastering the strategies and insights shared here, you’ll be well-equipped to navigate the complexities of the forex market and increase your chances of achieving your daily trading goals. Now go forth and conquer (responsibly!).