How to Analyze Forex News for Better Trading Decisions: Navigating the wild world of forex trading? Think of news as your secret weapon. This isn’t about blindly following headlines; it’s about understanding how global events, economic indicators, and market sentiment directly impact currency pairs. Mastering news analysis isn’t just about making informed trades; it’s about minimizing risk and maximizing your potential profits. Get ready to unlock the power of information in the forex market.

We’ll break down how to identify reliable news sources, interpret economic data like a pro, and anticipate market reactions to geopolitical events. You’ll learn to decipher market sentiment, integrate news analysis into your trading strategy, and manage risk effectively. By the end, you’ll be confidently using news to make smarter, more profitable forex trading decisions. Let’s dive in!

Understanding Forex News Sources

Navigating the forex market successfully hinges on understanding and interpreting news events. However, not all news sources are created equal. Differentiating between reliable and unreliable information is crucial for making informed trading decisions and avoiding costly mistakes. This section explores how to identify trustworthy sources, compare their reporting styles, filter out noise, and establish a consistent monitoring schedule.

Reliable sources of forex news offer timely, accurate, and unbiased information. Their credibility stems from their reputation, journalistic standards, and rigorous fact-checking processes. Conversely, unreliable sources may present biased perspectives, outdated information, or even outright misinformation.

Reliable Forex News Sources and Their Credibility

Identifying reliable news sources is paramount. Reputable financial news organizations, such as Reuters, Bloomberg, and the Financial Times, are generally considered highly credible. Their teams of experienced journalists and economists provide in-depth analysis and reporting, backed by rigorous fact-checking procedures. Central bank websites, such as the Federal Reserve (for the US dollar) or the European Central Bank (for the Euro), also offer official statements and data releases that are essential for understanding monetary policy shifts. These sources are considered highly reliable due to their official status and commitment to accuracy. In contrast, less reputable sources might include blogs, social media posts, or websites with clear biases or agendas. These should be treated with considerable caution, as their information may not be verified or even factual.

Comparison of Information from Different News Outlets

Different news outlets often present the same news events with varying perspectives and emphasis. For example, while Reuters might focus on the purely economic implications of a central bank announcement, Bloomberg might analyze the impact on specific currency pairs. The Financial Times might offer a broader geopolitical analysis. This difference in approach doesn’t necessarily mean one source is more “accurate” than another, but rather that they cater to different audiences and analytical priorities. Understanding these nuances allows traders to gain a more comprehensive understanding of the event’s overall significance. It’s beneficial to consult multiple sources to get a well-rounded view, avoiding relying solely on a single perspective.

System for Filtering Irrelevant or Unreliable News, How to Analyze Forex News for Better Trading Decisions

A systematic approach to filtering forex news is essential. First, prioritize official announcements from central banks and government agencies. Second, focus on reputable news organizations with a proven track record of accuracy. Third, be wary of sensational headlines or overly optimistic/pessimistic predictions. Finally, cross-reference information from multiple sources to verify its accuracy. If a piece of news seems too good (or too bad) to be true, it likely is. Remember that the forex market is influenced by a multitude of factors; don’t let a single news item sway your decisions drastically without proper analysis.

Schedule for Regularly Monitoring Key News Sources

Establishing a regular schedule for monitoring key news sources is crucial. A practical approach involves checking these sources multiple times daily, particularly before and after major economic data releases or central bank announcements. Consider using news aggregators or setting up alerts for specific s related to currencies you trade. A sample schedule could include checking Reuters and Bloomberg headlines at the start and end of each trading session, and reviewing central bank websites for official announcements. This consistent monitoring allows you to stay informed and react promptly to market-moving events. Remember to adjust your schedule based on your trading style and the specific currencies you’re focusing on.

Interpreting Economic Indicators

Forex trading is a global game, and like any game, understanding the rules is key to winning. Economic indicators are the scorecard, providing crucial insights into a country’s economic health and, consequently, its currency’s strength. Ignoring these signals is like playing blindfolded – you might get lucky, but consistent success is unlikely.

Major economic indicators like GDP, inflation, and unemployment rates significantly impact currency pairs. Strong economic data usually strengthens a nation’s currency, while weak data weakens it. This is because strong economies attract foreign investment, increasing demand for the associated currency. Conversely, weak economic data suggests instability, potentially leading investors to move their funds elsewhere.

Gross Domestic Product (GDP) and Currency Value

GDP, the total value of goods and services produced within a country’s borders, is a fundamental indicator of economic growth. A higher-than-expected GDP growth usually signals a healthy economy, boosting investor confidence and strengthening the currency. For example, if the US announces a surprisingly robust GDP growth figure, the USD (US dollar) might appreciate against other currencies like the EUR (Euro) or JPY (Japanese Yen). Conversely, a lower-than-expected GDP growth often leads to a currency depreciation. Imagine the opposite scenario – a disappointing US GDP report might trigger a sell-off in the USD, causing it to weaken against other major currencies.

Inflation and Interest Rates

Inflation, the rate at which prices for goods and services increase, is another crucial indicator. High inflation erodes purchasing power and can trigger central bank intervention. Central banks often raise interest rates to combat inflation. Higher interest rates attract foreign investment, as investors seek higher returns, strengthening the currency. For instance, if the European Central Bank (ECB) unexpectedly raises interest rates, the Euro might strengthen against the US dollar, as investors shift their funds to benefit from higher yields in the Eurozone. Conversely, low inflation or deflation might lead to lower interest rates, potentially weakening the currency. Consider a scenario where Japan experiences prolonged deflation. The Bank of Japan (BOJ) might keep interest rates extremely low, making the Yen less attractive to investors and causing its value to fall.

Unemployment Rate and Currency Performance

The unemployment rate, the percentage of the workforce actively seeking employment but unable to find it, reflects the health of the labor market. A low unemployment rate typically indicates a strong economy, boosting investor confidence and strengthening the currency. If the UK reports a significantly lower unemployment rate than expected, the GBP (British Pound) could rise against other currencies. However, a high unemployment rate can signal economic weakness, potentially leading to currency depreciation. For example, if a country experiences a sharp increase in unemployment, it might indicate a weakening economy, leading investors to sell off the associated currency.

Central Bank Announcements and Market Reactions

Central bank announcements, particularly interest rate decisions and monetary policy statements, have a powerful impact on currency movements. These announcements often cause significant volatility in the forex market as traders react to the news. For example, a surprise interest rate hike by the Federal Reserve (the US central bank) often leads to a sharp appreciation of the US dollar. Conversely, a dovish (less hawkish) statement from the central bank might cause the currency to depreciate. Predicting market reactions to these announcements requires careful analysis of the central bank’s communication, economic conditions, and market sentiment. A well-anticipated rate hike might have a smaller impact than a surprise one, highlighting the importance of understanding market expectations.

Analyzing Geopolitical Events

Geopolitical events, encompassing wars, elections, and political instability, significantly influence forex markets. These events introduce uncertainty, impacting investor sentiment and causing shifts in currency values. Understanding how these events unfold and their potential consequences is crucial for navigating the forex landscape successfully. The ripple effects can be dramatic and far-reaching, making a robust understanding of geopolitical risk a necessity for any serious forex trader.

Geopolitical Events and Their Impact on Currency Values

Geopolitical events create volatility in the forex market primarily through their impact on investor confidence and economic forecasts. Wars, for example, disrupt supply chains, increase inflation, and generally damage economic prospects, leading to capital flight and currency depreciation in affected regions. Elections, while often anticipated, can introduce uncertainty depending on the candidates and their proposed policies. Political instability, such as coups or civil unrest, can severely destabilize a nation’s economy and its currency, triggering significant market reactions. These impacts are often felt not just in the directly affected country but also globally, due to interconnectedness of modern economies.

Historical Examples of Geopolitical Impact on Forex

The 2014 annexation of Crimea by Russia led to significant devaluation of the ruble against major currencies like the US dollar and the euro. Sanctions imposed on Russia further exacerbated the situation. Conversely, the election of Donald Trump in 2016 initially caused a strengthening of the US dollar due to expectations of pro-growth policies. However, the subsequent trade wars initiated by his administration led to global market uncertainty and volatility in various currency pairs. The Brexit vote in 2016 resulted in a sharp decline in the value of the British pound, reflecting concerns about the UK’s economic future outside the European Union. These examples highlight the significant and sometimes unpredictable impact geopolitical events can have on currency values.

Framework for Assessing Geopolitical News Impact

A robust framework for analyzing geopolitical news requires a multi-faceted approach. First, identify the nature and severity of the event. Is it a localized conflict, a widespread war, a relatively stable election, or a significant political upheaval? Second, assess the potential economic consequences. Will the event disrupt trade, investment, or tourism? Will it affect inflation or interest rates? Third, gauge investor sentiment. Are markets reacting with fear and uncertainty, or is there a sense of resilience and opportunity? Finally, consider the potential impact on specific currency pairs. Which currencies are most directly affected? How might the event impact central bank policy decisions? By systematically analyzing these factors, traders can develop a more informed perspective on the potential market impact of geopolitical news.

Comparison of Geopolitical Event Impacts on Major Currency Pairs

| Event Type | Currency Pair Affected | Market Impact | Example |

|---|---|---|---|

| War | USD/RUB, EUR/RUB | Significant devaluation of Ruble | 2022 Russian invasion of Ukraine |

| Election | USD/MXN | Volatility depending on election outcome | Mexican Presidential Elections |

| Political Instability | GBP/USD | Sharp decline in Pound | Brexit Referendum |

| Terrorist Attack | EUR/USD | Short-term volatility, potential safe-haven flow to USD | 9/11 Attacks |

Identifying Market Sentiment

Gauging market sentiment is crucial for successful Forex trading. It’s essentially reading the collective mood of traders, predicting whether they’re optimistic (bullish) or pessimistic (bearish) about a currency pair’s future price. This allows you to anticipate potential price movements and make more informed trading decisions. Understanding how sentiment shifts can be the difference between profit and loss.

Market sentiment is reflected in various ways, primarily through news headlines and expert opinions. News articles often reveal the overall direction of market feeling. For example, positive economic data releases tend to generate positive headlines, fueling bullish sentiment, while negative news tends to have the opposite effect. Expert opinions, from analysts and economists, further amplify this sentiment, providing a more nuanced understanding of the market’s direction. These experts’ predictions and interpretations of events heavily influence how other traders react.

Gauging Market Sentiment from News and Expert Opinions

Analyzing news requires a critical eye. Don’t just focus on the headline; delve into the details. Look for s that indicate optimism or pessimism, such as “surge,” “plummet,” “robust growth,” or “economic slowdown.” Pay attention to the tone of the article – is it positive, negative, or neutral? Compare multiple news sources to avoid bias. Regarding expert opinions, note the reputation and track record of the expert. A consistently accurate analyst carries more weight than someone with a history of inaccurate predictions. Consider the context of their opinion – are they taking a long-term or short-term view?

Identifying Bullish and Bearish Trends from News Analysis

Bullish trends are characterized by widespread optimism. News headlines will likely showcase positive economic indicators, strong corporate earnings, and positive geopolitical developments. Expert opinions will generally support further upward price movement. Conversely, bearish trends emerge when negative news dominates. Headlines might feature weak economic data, geopolitical tensions, or disappointing corporate results. Expert opinions will reflect this pessimism, predicting price declines. A sustained period of negative news often leads to a bearish market. Conversely, a consistent stream of positive news can drive a bullish market.

Examples of Market Sentiment’s Effect on Price Action

Consider the release of unexpectedly strong US employment data. This positive news would likely trigger a surge in bullish sentiment for the US dollar (USD). Traders, emboldened by this positive news, would buy USD, leading to an appreciation in its value against other currencies. Conversely, if the US unexpectedly enters a recession, this negative news would likely create a bearish sentiment, causing traders to sell USD, leading to its depreciation. The price action directly reflects the shift in market sentiment. The Brexit vote in 2016 is another example. The unexpected vote to leave the European Union caused immediate and significant drops in the value of the British Pound, reflecting the immediate shift to a strongly bearish sentiment.

Strategies for Capitalizing on Shifts in Market Sentiment

One strategy involves using sentiment indicators. These tools aggregate news and social media data to gauge overall market sentiment. A strong bullish signal from these indicators might suggest entering a long position, while a bearish signal might suggest shorting or hedging. Another strategy is to use contrarian trading. This involves betting against the prevailing sentiment. If everyone is bullish, a contrarian trader might anticipate a correction and short the market. However, this strategy requires careful analysis and risk management, as it’s inherently riskier. Finally, understanding sentiment allows for better risk management. If sentiment is overwhelmingly bullish, a trader might take a smaller position, recognizing the potential for a sudden reversal.

Integrating News Analysis into Trading Strategies

Successfully incorporating forex news analysis into your trading isn’t about randomly reacting to headlines; it’s about strategically using information to refine your existing strategies or build entirely new ones. This involves understanding how specific news events impact currency pairs and aligning your trades with those anticipated movements. The key is to integrate news analysis, not let it dictate your every move.

A well-structured trading plan, whether it’s based on technical analysis, fundamental analysis, or a hybrid approach, can be significantly enhanced by incorporating news analysis. Instead of relying solely on charts or indicators, you gain a deeper understanding of the underlying economic and geopolitical factors driving price fluctuations. This allows for more informed entry and exit points, improved risk management, and potentially higher profitability.

Check what professionals state about The Importance of Backtesting in Forex Trading and its benefits for the industry.

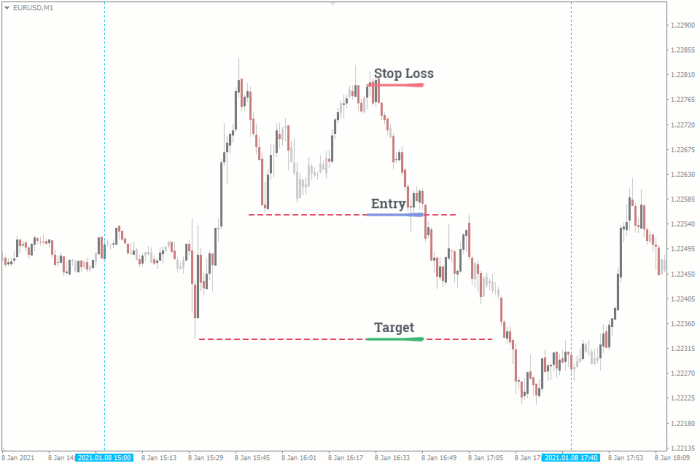

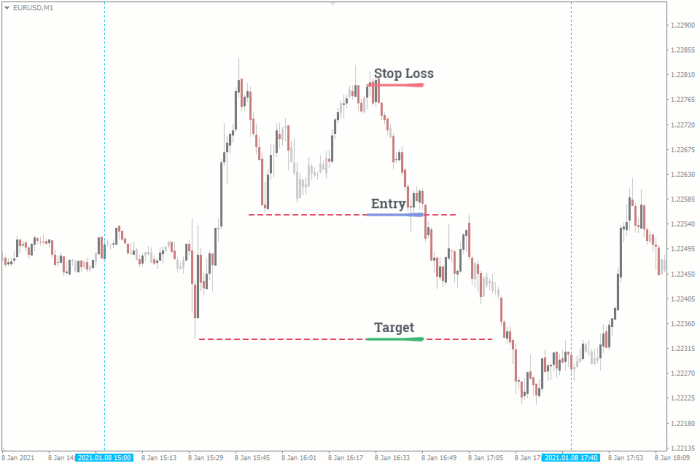

News-Driven Trading Strategy Design

A trading strategy heavily reliant on forex news could focus on high-impact economic releases. For example, a trader might anticipate a significant increase in the USD/JPY exchange rate following a positive US Non-Farm Payroll report. Their strategy would involve pre-positioning long trades before the announcement, aiming to capitalize on the expected upward movement. Stop-loss orders would be placed to limit potential losses if the report is unexpectedly negative or market reaction is less than anticipated. This approach requires precise timing and a thorough understanding of how different currency pairs react to specific economic data. It also emphasizes the importance of risk management, as significant price swings can occur immediately following news releases.

Comparison of News Analysis Approaches in Forex Trading

Different traders employ varying approaches to integrating news analysis. Some prefer a reactive approach, waiting for news releases and then making trades based on immediate market reactions. Others adopt a more proactive approach, using anticipated news events to inform their trading strategies in advance. A third approach combines technical and fundamental analysis, using news as a filter to identify high-probability setups within established technical patterns. Each method presents unique advantages and disadvantages, and the optimal approach depends on individual trading styles, risk tolerance, and market conditions. For example, a reactive trader might excel in fast-paced, high-volatility environments, while a proactive trader might prefer more stable markets allowing for careful pre-positioning.

Step-by-Step Guide to Incorporating News Analysis into Trading Decisions

Effectively integrating news analysis requires a structured approach. This step-by-step guide Artikels a practical method:

- Identify Key Economic Releases and Geopolitical Events: Consult economic calendars to pinpoint high-impact news events affecting your chosen currency pairs. This includes events like interest rate decisions, employment data, inflation reports, and major political announcements.

- Analyze Potential Market Impact: Assess how the anticipated news might affect the specific currency pairs you are trading. Consider historical data and market sentiment to predict the potential direction and magnitude of price movements.

- Develop a Trading Plan: Based on your analysis, define precise entry and exit points, stop-loss orders, and take-profit levels. This plan should account for both positive and negative news outcomes.

- Monitor Market Reaction: During and after the news release, carefully observe the market’s reaction. Be prepared to adjust your trading plan if the actual market movement deviates significantly from your predictions.

- Review and Refine: After each trade, analyze your performance. Identify areas where your news analysis was accurate or inaccurate, and adjust your strategy accordingly. This continuous improvement process is crucial for long-term success.

Managing Risk Based on News Events

Forex news can dramatically shift market sentiment, leading to periods of heightened volatility. Effective risk management is crucial during these times to protect your trading capital and prevent significant losses. Ignoring news-driven volatility can quickly transform a profitable trade into a substantial loss. This section details strategies to navigate these turbulent waters.

Successful forex trading, particularly when reacting to news, hinges on a proactive and disciplined approach to risk management. This involves not only understanding the potential impact of news events but also implementing specific techniques to limit exposure and protect your trading capital. A robust risk management plan is your safety net during periods of market uncertainty.

Reduced Position Sizing During High Volatility

One of the most effective ways to manage risk during news-driven volatility is to significantly reduce your position size. This means trading smaller lot sizes than you normally would. For example, if you usually trade 0.1 lots, you might reduce this to 0.05 lots or even less depending on the expected volatility of the news event. This limits your potential losses if the market moves against your prediction. The reduction should be proportional to the anticipated volatility; a highly impactful news event warrants a much smaller position size than a less significant one.

Discover how Swing Trading Strategies for Forex has transformed methods in this topic.

Utilizing Stop-Loss Orders

Stop-loss orders are essential during periods of high volatility. These orders automatically close your position when the market reaches a predetermined price level, limiting your potential losses. It’s crucial to place stop-loss orders at a level that reflects the potential price swings associated with the news event. For instance, if you anticipate a significant price gap following a major economic announcement, you should set your stop-loss order wider than usual to account for this potential jump. Failing to use stop-losses during news events is akin to sailing without a life vest – you’re taking an unnecessary and potentially catastrophic risk.

Tightening Stop-Loss Orders After Profitable Trades

A strategy employed by many experienced traders involves tightening stop-loss orders after a trade has moved in their favor. This allows them to lock in profits and reduce their risk exposure as the market reacts to news. For example, if a trader has a long position that has moved 20 pips in profit, they might move their stop-loss order to break-even or even a small profit level. This protects their profits if the market reverses, even if the reversal is partially caused by news. This approach is particularly useful when dealing with volatile news events.

Increased Monitoring and Vigilance

During periods of high volatility, increased monitoring and vigilance are paramount. You need to actively watch the market’s reaction to the news, adjusting your positions or strategies as needed. This may involve constantly checking price charts, news feeds, and economic calendars. It’s about being proactive and responsive to the changing market conditions rather than passively waiting for your trade to play out. This constant vigilance helps in mitigating losses and capitalizing on sudden shifts in the market.

Avoiding Trading During High-Impact News Releases

Sometimes, the best risk management strategy is to avoid trading altogether during periods of extremely high volatility. The uncertainty surrounding major news events can lead to unpredictable price swings, making it difficult to predict market direction with accuracy. Opting out of trading during these times is a conservative approach that minimizes risk. This doesn’t mean completely ignoring the news; you can still observe the market’s reaction and identify potential trading opportunities once the volatility subsides.

Visualizing News Impact

Forex news doesn’t just whisper; it shouts on currency charts. Understanding how these announcements translate visually is crucial for successful trading. By recognizing characteristic patterns and indicator shifts, you can gain a significant edge in anticipating market reactions and capitalizing on opportunities. This section will explore how major news events visually impact currency charts.

News events often manifest on charts as sudden and significant price movements. The intensity and direction of these movements depend on the nature of the news and the market’s pre-existing sentiment. Consider a surprise interest rate hike announcement – you’d likely see a sharp, vertical increase in the value of the affected currency’s pair if the market reacted positively. Conversely, negative news could trigger a rapid decline. The visual representation of this is often characterized by long candlestick bodies and increased trading volume.

Candlestick Patterns and News Events

Significant news events frequently lead to distinctive candlestick patterns. A bullish engulfing pattern, for example, might appear after a positive economic report, showing a large green candle completely swallowing the preceding red candle, indicating a shift in market sentiment from bearish to bullish. Conversely, a bearish engulfing pattern, where a large red candle engulfs a prior green candle, could follow disappointing economic data. These patterns provide visual confirmation of the news impact on price action. The size of the candle body often reflects the magnitude of the news impact – larger bodies indicating stronger reactions.

Technical Indicators and News Response

Technical indicators offer additional insights into how news affects price. For instance, a positive surprise in employment data might cause the Relative Strength Index (RSI) to jump above the overbought level (typically 70), signaling a potential short-term price correction. Similarly, negative news could drive the RSI below the oversold level (typically 30), indicating potential upward momentum. Moving averages, like the 200-day moving average, might also experience a significant shift following a major news event. A sudden break above or below this moving average could highlight a strong trend change. Analyzing these indicator shifts in conjunction with candlestick patterns provides a more comprehensive understanding of the news impact.

Volume and News Significance

Trading volume often acts as a confirming factor for news-driven price movements. A significant increase in volume accompanying a sharp price change after a major news announcement confirms the market’s reaction to the news. High volume signifies strong conviction behind the price movement, increasing the reliability of the observed pattern. Conversely, a price movement with low volume may suggest a weaker reaction, potentially indicating a temporary fluctuation rather than a sustained trend change. This distinction is critical for distinguishing genuine market shifts from noise.

Last Word

So, you’ve learned to analyze forex news like a seasoned trader. Remember, it’s not just about reading the headlines; it’s about understanding the context, anticipating market reactions, and managing risk. Consistent practice, staying updated, and adapting your strategies are key to long-term success. The forex market is dynamic, but with the right knowledge and approach, you can turn news events into opportunities for profit. Now go out there and conquer the forex world!

Detailed FAQs: How To Analyze Forex News For Better Trading Decisions

What are some common pitfalls to avoid when analyzing forex news?

Beware of confirmation bias (only seeking information confirming your existing beliefs), emotional trading (letting fear or greed dictate decisions), and relying solely on one news source.

How often should I check for forex news updates?

The frequency depends on your trading style. Scalpers need near-constant updates, while swing traders might check daily or even weekly, focusing on major economic releases.

Are there any free resources for accessing reliable forex news?

Yes, many reputable financial news websites offer free forex news, but be discerning and compare information across multiple sources.

How can I improve my news interpretation skills over time?

Practice consistently, keep a journal tracking your analysis and actual market movements, and continuously learn about economic and geopolitical factors impacting the forex market.