Forex and CFD trading: Dive into the thrilling world of global markets where fortunes are made and lost in the blink of an eye. This isn’t your grandpa’s savings account; we’re talking about leveraging financial instruments to potentially ride the wave of market fluctuations. Understanding the nuances of forex (foreign exchange) and CFDs (contracts for difference) is crucial, from grasping the mechanics of trades to mastering risk management. This guide breaks down the essentials, equipping you with the knowledge to navigate this exciting, yet potentially risky, landscape.

We’ll explore the different players – from retail traders dipping their toes in to institutional giants moving mountains of capital – and dissect the processes behind opening and closing trades. We’ll delve into the critical role of leverage, explaining how it amplifies both profits and losses. Learn about the various strategies employed, from short-term scalping to longer-term swing trading, and discover how to choose the approach that best aligns with your risk tolerance and investment goals. Finally, we’ll emphasize the paramount importance of risk management, providing you with the tools to protect your capital and navigate the inevitable market volatility.

Introduction to Forex and CFD Trading

Forex and CFD trading represent two popular avenues for investors seeking to profit from price fluctuations in various markets. While both involve speculating on price movements, they differ significantly in their underlying mechanisms and the assets they cover. Understanding these differences is crucial for navigating these potentially lucrative, yet risky, markets.

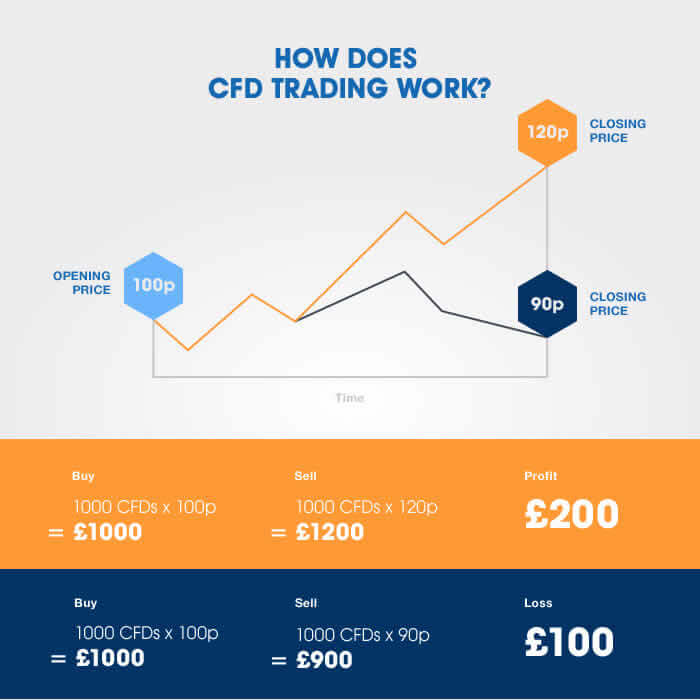

Forex, or foreign exchange, trading involves the buying and selling of currencies. CFD, or contract for difference, trading allows investors to speculate on the price movement of a wide range of underlying assets without actually owning them. The key difference lies in the ownership: forex trading implies direct ownership of a currency pair, while CFD trading is a derivative contract focused on the price difference between the opening and closing of the trade.

Underlying Assets in Forex and CFD Trading

Forex trading focuses solely on currency pairs. These pairs are typically quoted against each other, for example, EUR/USD (Euro against the US dollar), GBP/JPY (British Pound against the Japanese Yen), or USD/CHF (US dollar against the Swiss Franc). The value of one currency relative to another fluctuates constantly based on a variety of economic and geopolitical factors. In contrast, CFD trading offers a far broader range of underlying assets. These can include currencies (mirroring forex trading), indices (like the S&P 500 or FTSE 100), commodities (gold, oil, natural gas), shares (individual company stocks), and even bonds. This diversity allows for greater diversification and strategic options for CFD traders.

Typical Participants in Forex and CFD Trading

A diverse range of participants populate both forex and CFD markets. Retail traders, often individuals trading with smaller capital, represent a significant portion of the market. These individuals may use online trading platforms to execute trades based on their own analysis or trading strategies. Institutional investors, such as hedge funds, investment banks, and pension funds, also play a significant role. These institutions typically trade with much larger sums and employ sophisticated trading strategies and algorithmic trading systems. Banks are major players, facilitating trades for both retail and institutional clients and often engaging in proprietary trading themselves, profiting from market movements. Finally, central banks also influence these markets through monetary policy decisions, impacting currency values and, consequently, influencing CFD prices on currency pairs and other related assets.

Market Mechanics: Forex And Cfd Trading

Forex and CFD trading might seem intimidating at first, but understanding the underlying mechanics simplifies the process. This section breaks down the core elements, from executing trades to managing risk and understanding costs. Think of it as your backstage pass to the financial markets.

Opening and Closing Forex Trades

Executing a forex trade involves a straightforward process, essentially buying one currency while simultaneously selling another. The steps are similar for CFDs, though the underlying asset differs.

| Step | Action (Forex Example: Buying EUR/USD) | Action (CFD Example: Buying Apple Stock CFD) | Explanation |

|---|---|---|---|

| 1. Analysis | Analyze EUR/USD charts and news to predict price movement. | Analyze Apple stock charts and news to predict price movement. | Research is key! Identify potential opportunities based on your trading strategy. |

| 2. Order Placement | Place a “buy” order for EUR/USD at a specific price or market price. | Place a “buy” order for Apple stock CFD at a specific price or market price. | Specify the trade size (lot size for forex, number of shares for CFDs) and desired entry price. |

| 3. Trade Execution | Your broker executes the trade if the price reaches your order’s conditions. | Your broker executes the trade if the price reaches your order’s conditions. | The trade opens once the order is filled. |

| 4. Monitoring | Monitor the EUR/USD price and your position’s profit/loss. | Monitor the Apple stock CFD price and your position’s profit/loss. | Regularly check your open positions. |

| 5. Closing the Trade | Place a “sell” order for EUR/USD to close your position. | Place a “sell” order for Apple stock CFD to close your position. | This locks in your profit or loss. |

Leverage and Risk, Forex and cfd trading

Leverage is a powerful tool that magnifies both profits and losses. In forex and CFD trading, it allows you to control a larger position than your initial capital would normally allow. For example, a 1:100 leverage means you can control $100,000 worth of assets with only $1,000 of your own money.

Leverage amplifies gains, but it also amplifies losses. Use it cautiously.

While leverage can lead to substantial profits, it significantly increases the risk of substantial losses. A small adverse price movement can wipe out your entire trading account if leverage is not managed properly. Risk management strategies, such as stop-loss orders, are crucial when using leverage.

Spreads and Commissions

Trading costs are primarily determined by spreads and commissions. The spread is the difference between the bid (selling) and ask (buying) price of a currency pair or CFD. Commissions are fees charged by the broker for executing trades.

Spreads vary depending on market volatility and the specific instrument being traded. Lower spreads generally mean lower trading costs. Commissions can be fixed or variable, depending on your broker and trading volume. Understanding these costs is essential for calculating your overall profitability.

Risk Management in Forex and CFD Trading

Navigating the volatile world of forex and CFD trading requires a steely nerve and a robust risk management strategy. Without it, even the most brilliant trading ideas can quickly evaporate into thin air. Think of risk management as your financial parachute – you hope you never need it, but you’ll be eternally grateful you had it when things go south. This section delves into crucial techniques to protect your capital and ensure longevity in these high-stakes markets.

Successful trading isn’t just about making profits; it’s about preserving your capital and ensuring you can trade another day. Risk management isn’t about avoiding losses entirely – that’s impossible – it’s about controlling them and limiting their impact on your overall trading performance. A well-defined risk management plan is the cornerstone of sustainable trading success.

Risk Management Techniques

Several key techniques can significantly reduce your risk exposure in forex and CFD trading. Implementing these strategies, individually or in combination, forms a powerful defense against unexpected market movements.

- Diversification: Don’t put all your eggs in one basket. Spread your investments across different currency pairs or CFDs to reduce the impact of any single losing trade. For example, instead of solely trading EUR/USD, consider adding GBP/USD and USD/JPY to your portfolio. This way, a downturn in one market won’t cripple your entire trading strategy.

- Position Sizing: This involves determining the appropriate amount of capital to allocate to each trade. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. This limits potential losses and prevents a single bad trade from wiping out your account. For instance, with a $10,000 account and a 1% risk tolerance, your maximum loss per trade should be $100.

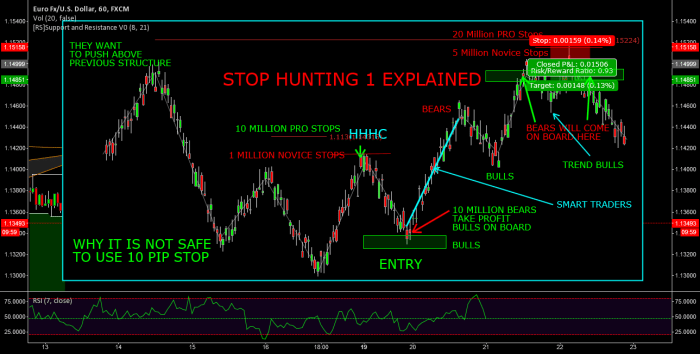

- Stop-Loss Orders: These are crucial orders that automatically close a trade when it reaches a predetermined price level, limiting potential losses. Setting stop-loss orders is not optional; it’s a non-negotiable element of responsible trading. Imagine you buy a CFD at $100; a stop-loss order at $95 would automatically sell your position if the price drops to that level, preventing further losses.

- Take-Profit Orders: While stop-losses protect against losses, take-profit orders help you lock in profits when a trade reaches your target price. This ensures you capitalize on successful trades and avoid letting profits slip away due to market reversals. If you buy a CFD at $100 and set a take-profit order at $105, your position will be automatically closed once the price reaches that level.

- Hedging: This strategy involves taking offsetting positions to reduce risk. For instance, if you’re long on one currency pair, you might take a short position on another to mitigate potential losses. Hedging can be complex and should be approached with caution.

Position Sizing and Stop-Loss Orders

Position sizing and stop-loss orders are inextricably linked and form the bedrock of effective risk management. Incorrect position sizing can negate the protective effect of stop-loss orders, while neglecting stop-losses leaves your capital vulnerable to significant losses, regardless of your position size.

Expand your understanding about forex trading academy near me with the sources we offer.

Let’s illustrate: Imagine you have a $5,000 trading account and decide to risk 2% per trade ($100). If you buy 100 units of a currency pair with a pip value of $1, your stop-loss should be placed 10 pips away from your entry price to limit your potential loss to $100 (10 pips x $1/pip = $10). This simple calculation demonstrates the interplay between position sizing and stop-loss order placement.

Hypothetical Trading Plan

Let’s consider a hypothetical trade on the EUR/USD pair. Assume you believe the Euro will appreciate against the US dollar.

- Trade Idea: Long EUR/USD

- Entry Price: 1.1000

- Position Size: 10,000 units (assuming a pip value of $1 per 10,000 units)

- Stop-Loss: 1.0980 (20 pips from entry price, limiting potential loss to $200 or 2% of a $10,000 account)

- Take-Profit: 1.1050 (50 pips from entry price, targeting a profit of $500)

- Risk/Reward Ratio: 1:2.5 (Potential loss of $200 vs. potential profit of $500)

This plan clearly defines the trade parameters, risk limits, and profit targets. The 1:2.5 risk/reward ratio indicates that for every $1 risked, the trader aims for a $2.5 return, enhancing the potential for profitable trading.

Trading Strategies for Forex and CFDs

Choosing the right trading strategy is crucial for success in the forex and CFD markets. Your approach will depend heavily on your risk tolerance, available time, and trading goals. There’s no one-size-fits-all solution; what works for one trader might be disastrous for another. This section will explore several popular strategies and their characteristics.

Comparison of Trading Strategies

The forex and CFD markets offer diverse opportunities, and understanding different trading styles is essential for effective participation. Three popular strategies – scalping, day trading, and swing trading – each present unique characteristics and risk profiles. The table below provides a concise comparison.

| Strategy | Timeframe | Holding Period | Risk Profile |

|---|---|---|---|

| Scalping | Seconds to minutes | Seconds to minutes | High risk, high reward potential; requires intense focus and quick decision-making. |

| Day Trading | Minutes to hours | Within the same trading day | Moderate to high risk; requires active monitoring and management throughout the day. |

| Swing Trading | Hours to days | Days to weeks | Moderate risk; allows for more flexibility and less constant monitoring. |

Technical Indicators in Forex and CFD Analysis

Technical indicators provide valuable insights into market trends and momentum, aiding traders in making informed decisions. These tools analyze price charts and volume data to identify potential entry and exit points. Some commonly used indicators include:

Moving Averages: Moving averages smooth out price fluctuations, revealing underlying trends. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) are frequently used. Traders often use multiple moving averages with different periods to identify support and resistance levels, as well as potential trend changes. For example, a crossover of a shorter-period EMA above a longer-period EMA might be interpreted as a bullish signal.

Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 is generally considered overbought, suggesting a potential price reversal, while an RSI below 30 suggests an oversold condition, potentially indicating a price bounce. However, RSI divergence (price making new highs/lows while RSI fails to confirm) can also be a powerful signal.

Browse the multiple elements of is iraqi dinar trading on forex to gain a more broad understanding.

Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It consists of a MACD line, a signal line, and a histogram. Crossovers of the MACD line above the signal line can indicate bullish signals, while crossovers below can suggest bearish signals. Divergences between the MACD and price action can also provide valuable insights.

Implementing a Swing Trading Strategy: A Step-by-Step Guide

Swing trading focuses on capturing price swings over several days or weeks. This strategy requires less active monitoring than scalping or day trading. Here’s a step-by-step approach:

- Identify a potential trade setup: This involves analyzing charts to find assets showing clear price patterns or signals, potentially using technical indicators like moving averages, RSI, or MACD. For instance, a stock breaking out above a significant resistance level might be a potential long entry.

- Determine entry and exit points: Based on the identified setup, establish clear entry and exit points, considering support and resistance levels, and potentially setting stop-loss and take-profit orders. This limits potential losses and secures profits.

- Place the trade: Execute the trade according to your plan, adhering to your pre-determined risk management rules.

- Monitor the trade: While swing trading requires less constant monitoring than other strategies, regular checks are crucial to assess market conditions and adjust your strategy if needed. This might involve reacting to significant news events or changing market sentiment.

- Manage risk: Implement a robust risk management plan to limit potential losses. This could include using stop-loss orders to automatically exit a trade if the price moves against your position.

- Exit the trade: Exit the trade when your predetermined exit criteria are met, either through reaching your take-profit target or if your stop-loss order is triggered.

Regulatory Landscape and Legal Aspects

Navigating the world of forex and CFD trading requires understanding the legal framework governing these markets. This isn’t just about avoiding trouble; it’s about ensuring your trading activities are conducted safely and within the bounds of the law, protecting your investments and your future. This section Artikels the key regulatory bodies and legal considerations involved.

The regulatory landscape for forex and CFD trading varies significantly across jurisdictions. Understanding these differences is crucial for traders, as the level of protection and the legal implications can change dramatically depending on where your broker is based and where you are trading from. Choosing a regulated broker is paramount, not just for compliance, but also for the peace of mind it offers.

Key Regulatory Bodies

Several international and national bodies oversee forex and CFD trading. These organizations establish rules and regulations designed to protect investors and maintain market integrity. The specific regulatory body will depend on the location of the broker and, in some cases, the trader’s location. For example, the UK’s Financial Conduct Authority (FCA) regulates brokers operating within the UK, while the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) oversee futures and options trading in the United States. Other prominent regulatory bodies include the Australian Securities and Investments Commission (ASIC) in Australia and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. It’s vital to research the regulatory status of any broker you consider using.

Importance of Choosing a Regulated Broker

Choosing a regulated broker is not merely a suggestion; it’s a fundamental aspect of responsible trading. A regulated broker operates under the oversight of a recognized authority, meaning they are subject to regular audits, compliance checks, and strict rules designed to protect client funds and prevent fraudulent activities. This regulatory framework offers a degree of security that unregulated brokers simply cannot match. Regulated brokers typically have client segregation policies, meaning your funds are kept separate from the broker’s operational funds, reducing the risk of losing your money in the event of broker insolvency. Furthermore, regulated brokers are often required to maintain adequate capital reserves, providing an additional layer of protection for traders. In contrast, unregulated brokers operate outside this framework, leaving traders vulnerable to a wider range of risks.

Legal Implications of Forex and CFD Trading

Engaging in forex and CFD trading carries several legal implications that traders need to be aware of. One of the most significant is the tax implications. Profits generated from forex and CFD trading are generally considered taxable income in most jurisdictions. The specific tax treatment will vary depending on your location and the type of account you are using. It’s crucial to understand your local tax laws and seek professional tax advice to ensure you are complying with all relevant regulations. Furthermore, it’s important to understand the legal ramifications of leverage and margin trading. Leverage amplifies both profits and losses, and traders can incur significant debt if they are not careful. Understanding the risks associated with leverage is vital to avoiding potential legal issues. Finally, it is essential to understand the terms and conditions of your trading agreement with your broker to avoid any contractual disputes.

Tools and Platforms for Forex and CFD Trading

Navigating the world of forex and CFD trading requires more than just market knowledge; it demands the right tools and platforms to execute your strategies effectively. The choice of platform can significantly impact your trading experience, from order execution speed to the availability of advanced analytical tools. Understanding the nuances of different platforms is crucial for optimizing your trading workflow.

Choosing the right platform is a crucial step in your forex and CFD trading journey. The features and functionalities offered by different platforms vary considerably, impacting your ability to analyze markets, execute trades, and manage risk. This section will explore some popular platforms and their key features.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) Platform Comparison

MT4 and MT5 are arguably the most widely used platforms in the forex and CFD trading world. While both offer robust functionalities, they cater to slightly different needs.

- MetaTrader 4 (MT4): Known for its user-friendly interface and vast community support, MT4 is a popular choice for beginners and experienced traders alike. Its strengths lie in its simplicity and extensive customization options.

- Features: Automated trading (Expert Advisors), a wide range of technical indicators, charting tools, and a large library of third-party add-ons.

- Functionalities: Order execution, market analysis, and backtesting of trading strategies.

- MetaTrader 5 (MT5): MT5 is the successor to MT4, offering enhanced features and functionalities. While it retains the user-friendly interface of its predecessor, it incorporates more advanced tools.

- Features: Improved charting capabilities, a wider range of order types, more advanced technical indicators, and a more sophisticated backtesting environment. It also offers a built-in economic calendar and news feed.

- Functionalities: Similar to MT4, but with enhanced capabilities for algorithmic trading and market analysis.

cTrader Platform Overview

cTrader is another popular platform known for its speed and advanced charting capabilities. It’s favored by traders who prioritize fast execution and sophisticated technical analysis.

- Features: High-speed order execution, advanced charting tools with multiple timeframes, a wide range of technical indicators, and a clean, intuitive interface.

- Functionalities: Automated trading (cBots), market depth visualization, and a strong focus on algorithmic trading strategies.

The Role of Charting Software in Technical Analysis

Charting software is an indispensable tool for technical analysis. It allows traders to visualize price movements, identify trends, and spot potential trading opportunities. Features such as candlestick patterns, moving averages, and oscillators provide valuable insights into market dynamics. Sophisticated charting software often includes backtesting capabilities, allowing traders to test their strategies on historical data. The visual representation of market data aids in decision-making, reducing reliance solely on numerical data. For example, a trader might identify a head and shoulders pattern on a chart, indicating a potential price reversal, leading to a short-selling opportunity.

Essential Tools and Resources for Successful Forex and CFD Trading

Beyond trading platforms, several other tools and resources contribute to successful trading.

- Economic Calendar: Provides information on upcoming economic events that can impact market movements. A surprise interest rate hike, for instance, can trigger significant price volatility.

- News Sources: Reliable news sources are essential for staying informed about market-moving events and geopolitical developments. Major news outlets and specialized financial news websites are invaluable resources.

- Risk Management Tools: Tools like position sizing calculators and stop-loss order management systems are crucial for mitigating risk. For example, a position sizing calculator helps determine the appropriate trade size to limit potential losses.

- Trading Journals: Keeping a detailed trading journal allows traders to track their performance, identify areas for improvement, and refine their strategies. This aids in long-term growth.

Illustrative Examples

Let’s ditch the theory and dive into the real-world drama of forex and CFD trading. Success and failure are two sides of the same volatile coin, and understanding both is crucial. These case studies will illuminate the decision-making processes behind both profitable and losing trades, offering valuable lessons for your own trading journey.

Successful Forex Trade: EUR/USD Long Position

This example focuses on a long position in the EUR/USD pair. The trader, let’s call him Alex, identified a potential upward trend based on fundamental and technical analysis. He noticed positive economic news releases from the Eurozone, suggesting increased investor confidence and a potential strengthening of the Euro. Technically, the EUR/USD pair was approaching a key support level, indicated by a strong upward trendline on the daily chart. He also observed a bullish divergence on the RSI indicator, a sign that the price might be ready to reverse its downward trend.

Alex decided to enter a long position at 1.1050. His risk management strategy involved setting a stop-loss order at 1.1000, limiting his potential loss to 50 pips. His take-profit order was set at 1.1150, aiming for a 100-pip profit. The trade was executed with a relatively small position size, representing only 2% of his trading capital. This strategy was designed to minimize risk and maximize potential profit. Over the next few days, the EUR/USD pair moved as predicted, reaching Alex’s take-profit level, resulting in a successful trade. The positive economic news reinforced the upward trend, and the technical indicators confirmed the breakout. The combination of fundamental and technical analysis, coupled with effective risk management, resulted in a profitable outcome.

Loss-Making CFD Trade: Apple Stock Short Sell

Now, let’s look at a hypothetical CFD trade on Apple stock that ended in a loss. Imagine a trader, let’s call her Sarah, who believed Apple’s stock price was overvalued. Based on her analysis, she anticipated a short-term correction. She decided to enter a short position (selling a CFD) at $150 per share. She set a stop-loss order at $155, which means if the price increased to $155, the position would be automatically closed, limiting her loss. However, she didn’t set a take-profit order, believing the price would decline gradually.

Unfortunately, unexpected positive news about Apple’s upcoming product launch significantly boosted investor sentiment, causing the stock price to surge. The price quickly exceeded Sarah’s stop-loss level, leading to a loss on her trade. This highlights the importance of setting a take-profit order, even when anticipating a gradual price movement. The absence of a take-profit order meant that Sarah was exposed to unlimited potential losses. This trade illustrates that even with careful analysis, unexpected market events can lead to losses. A more comprehensive risk management strategy, including setting both stop-loss and take-profit orders, would have mitigated the losses in this scenario. The lesson here is the importance of always having a clear exit strategy and understanding that even the best analyses can be wrong in the face of unforeseen market developments.

Ending Remarks

Mastering forex and CFD trading is a journey, not a sprint. It requires discipline, continuous learning, and a keen understanding of risk management. While the potential for significant returns exists, it’s crucial to remember that losses are equally possible. This guide provides a solid foundation, but remember that real-world trading involves constant adaptation and learning. By understanding the mechanics, implementing effective strategies, and maintaining a disciplined approach, you can significantly improve your chances of success in this dynamic and challenging market. So, buckle up and prepare for a thrilling ride!