How to Create a Forex Trading Journal? Unlocking consistent profits in the forex market isn’t just about gut feeling; it’s about meticulous record-keeping. This guide dives deep into building your own forex trading journal, transforming chaotic trades into a roadmap to success. We’ll cover everything from choosing the right format to analyzing your wins and losses, turning data into actionable strategies for a more profitable trading journey.

From simple spreadsheets to dedicated software, we’ll show you how to design a journal that fits your style. Learn to track crucial details like entry and exit points, stop-losses, and take-profits. We’ll reveal the secrets to uncovering hidden patterns in your trades, identifying recurring mistakes, and ultimately, fine-tuning your approach for maximum impact. Get ready to transform your trading game.

Introduction to Forex Trading Journals

Consistently logging your trades might seem tedious, but a forex trading journal is your secret weapon for consistent growth. It’s more than just a record; it’s a powerful tool for self-reflection, strategy refinement, and ultimately, boosting your profitability. Think of it as a personal trading coach, always available to analyze your past performance and guide your future decisions.

A forex trading journal meticulously tracks your trades, allowing you to identify patterns, pinpoint mistakes, and celebrate successes. By analyzing this data, you can refine your trading strategies, manage risk more effectively, and develop a deeper understanding of the forex market. This continuous learning process is crucial for long-term success in this dynamic and often unpredictable market.

Types of Forex Trading Journals

Choosing the right journal format is key to making the process manageable and effective. The ideal format depends on your personal preferences and technological comfort level. Different methods cater to various needs and organizational styles, ensuring that you find a system that works best for you.

- Spreadsheet Journals: These offer a highly customizable and easily analyzable approach. Using software like Microsoft Excel or Google Sheets, you can create columns for key data points, allowing for easy sorting, filtering, and charting of your trading performance. This approach is particularly helpful for those who enjoy data analysis and prefer a structured format.

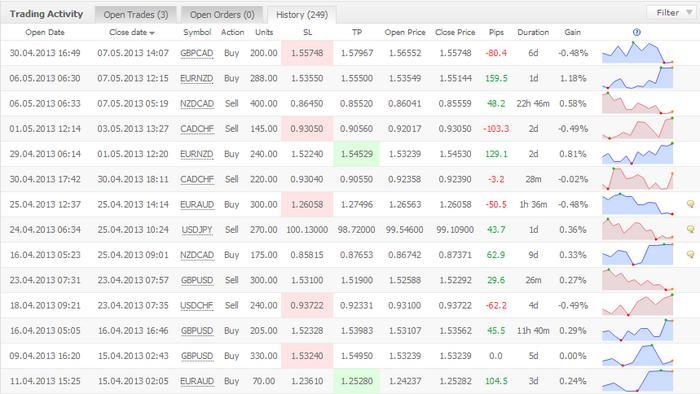

- Dedicated Forex Trading Software: Many platforms offer built-in journaling features or integrate with third-party journaling software. These often provide advanced analytics and charting capabilities, streamlining the process and providing valuable insights beyond basic data recording. This is a great option for traders who want a more comprehensive and automated solution.

- Notebook Journals: The classic, pen-and-paper approach offers a tactile experience and can be surprisingly effective. The act of physically writing down your trades can foster a deeper level of reflection. This method might be preferable for traders who value a more intuitive and less structured approach.

Key Information to Include in a Forex Trading Journal

The information you record should provide a comprehensive picture of each trade, facilitating thorough post-trade analysis. Don’t just record the outcome; delve into the reasoning behind your decisions. The more detailed your entries, the richer your insights will be.

- Trade Date and Time: Essential for chronological tracking and identifying potential patterns linked to specific timeframes.

- Currency Pair: Clearly identify the specific pair traded (e.g., EUR/USD, GBP/JPY).

- Trade Type: Specify whether the trade was a long (buy) or short (sell) position.

- Entry Price: Record the exact price at which you entered the trade.

- Exit Price: Record the exact price at which you exited the trade.

- Stop Loss and Take Profit Levels: Document your risk management strategy, including the levels set for stop losses and take profits.

- Lot Size/Position Size: Record the amount of currency traded in each position.

- Reason for Entry: This is crucial. Explain the technical or fundamental analysis that led to your decision to enter the trade. Include indicators used, chart patterns observed, news events considered, etc.

- Reason for Exit: Similarly, justify your exit strategy. Did you hit your take profit? Was it a stop loss? Or was it a discretionary exit based on market conditions?

- Profit/Loss: Calculate the profit or loss for each trade in your chosen currency.

- Overall Assessment: After the trade concludes, reflect on your performance. What went well? What could have been improved? What did you learn?

Setting Up Your Forex Trading Journal: How To Create A Forex Trading Journal

Starting a forex trading journal might seem daunting, but it’s the cornerstone of consistent improvement. Think of it as your personal forex training ground – a place to track wins, analyze losses, and refine your trading strategy. A well-maintained journal isn’t just about recording trades; it’s about fostering self-awareness and building a data-driven approach to your trading.

A structured journal helps you identify patterns in your trading behavior, pinpoint areas for improvement, and ultimately, boost your profitability. By consistently recording your trades, you transform raw experience into valuable insights. This systematic approach is key to developing a successful forex trading strategy.

Sample Journal Layout for Beginners, How to Create a Forex Trading Journal

Creating a simple yet effective journal layout is crucial. Avoid overwhelming yourself with complex spreadsheets; start with the basics and gradually add more detail as your confidence and experience grow. A clear, concise layout will ensure you maintain the habit of consistent journaling. The focus should be on clarity and ease of use, so you’ll actually use it!

A Simple Forex Trading Journal Table

| Date | Trade Details | Analysis | Outcome |

|---|---|---|---|

| 2024-10-27 | EUR/USD, Buy, 1.1000, 1 lot | Strong bullish momentum on the 1-hour chart, supported by positive economic news. | Profit: $100 |

| 2024-10-28 | GBP/USD, Sell, 1.2500, 0.5 lot | Bearish candlestick pattern, resistance level reached. | Loss: $50 |

| 2024-10-29 | USD/JPY, Buy, 145.00, 1 lot | Potential breakout from a consolidation pattern, positive RSI. | Profit: $150 |

This simple table allows you to track essential information. The “Trade Details” column should include the currency pair, the direction of the trade (buy or sell), the entry price, and the lot size. The “Analysis” column is for recording your reasoning behind the trade, including technical indicators, chart patterns, and fundamental analysis. Finally, the “Outcome” column records whether the trade was profitable or resulted in a loss, along with the monetary amount.

The Importance of Consistent Record-Keeping

Consistency is paramount. Even if you only trade once a week, record every trade. Missed entries create gaps in your data, hindering your ability to identify patterns and improve your trading strategy. Regular journaling helps you maintain discipline and promotes a more analytical approach to forex trading. Treat your journal as a valuable tool for continuous learning and refinement. Think of it as your secret weapon to becoming a consistently profitable trader. The more data you have, the better your insights will be.

Recording Trade Details in Your Journal

Keeping a detailed record of each trade is the cornerstone of a successful forex trading journal. It’s not just about noting wins and losses; it’s about building a database of your trading decisions and their outcomes, allowing you to identify patterns, refine your strategy, and ultimately improve your profitability. This meticulous approach transforms your journal from a simple diary into a powerful tool for self-improvement.

The information you record for each trade should be comprehensive and consistent. This allows you to perform meaningful analysis later. Inconsistency in recording will render your data useless.

Essential Trade Details

To maximize the value of your forex trading journal, ensure you capture the following key details for every trade, regardless of whether it’s profitable or not. The more data you have, the more insightful your analysis will be.

| Data Point | Description | Example |

|---|---|---|

| Trade Date & Time | Precise timestamp of entry and exit. | 2024-10-27 10:30 AM (Entry), 2024-10-27 12:00 PM (Exit) |

| Currency Pair | The specific pair traded (e.g., EUR/USD, GBP/JPY). | EUR/USD |

| Trade Type | Long (Buy) or Short (Sell). | Long |

| Entry Price | The price at which you entered the trade. | 1.1000 |

| Exit Price | The price at which you exited the trade. | 1.1050 |

| Lot Size | The volume of the trade (e.g., 0.1, 0.5, 1.0 lots). | 0.1 |

| Stop-Loss | The price at which your trade was automatically closed to limit potential losses. | 1.0950 |

| Take-Profit | The price at which your trade was automatically closed to secure profits. | 1.1075 |

| Profit/Loss (Pips) | The net profit or loss in pips (price points). | 50 pips |

| Reason for Entry | The rationale behind entering the trade (e.g., chart pattern, fundamental analysis). | Bullish engulfing candlestick pattern |

| Reason for Exit | The reason for exiting the trade (e.g., stop-loss hit, take-profit reached, market reversal). | Take-profit reached |

| Overall Assessment | Your subjective evaluation of the trade’s execution and outcome. | Successful trade; good risk management |

Examples of Successful and Unsuccessful Trade Recordings

Consistent recording is key. Here’s how to record both successful and unsuccessful trades to glean valuable insights.

Successful Trade Example:

Date: 2024-10-26, Time: 9:00 AM; Pair: EUR/USD; Type: Long; Entry: 1.0950; Exit: 1.1020; Lot Size: 0.05; Stop-Loss: 1.0900; Take-Profit: 1.1050; Profit: 70 pips; Reason for Entry: Identified a strong support level; Reason for Exit: Take-profit hit; Assessment: Excellent trade execution, good risk-reward ratio.

Unsuccessful Trade Example:

You also can understand valuable knowledge by exploring How to Build a Forex Trading Plan.

Date: 2024-10-27, Time: 2:00 PM; Pair: GBP/USD; Type: Short; Entry: 1.2300; Exit: 1.2350; Lot Size: 0.1; Stop-Loss: 1.2380; Take-Profit: 1.2250; Loss: 50 pips; Reason for Entry: Weak resistance level; Reason for Exit: Stop-loss hit; Assessment: Poor risk management; entry signal was questionable.

Further details about How to Choose a Forex Trading Style That Suits You is accessible to provide you additional insights.

Common Mistakes to Avoid

Avoiding these common pitfalls will significantly improve the quality and usefulness of your forex trading journal.

- Inconsistent Data Recording: Maintain a standardized format and record all relevant details for every trade.

- Lack of Detail: Don’t just record the outcome; explain your reasoning for entering and exiting each trade.

- Emotional Entries: Avoid subjective and emotional language; focus on objective facts and analysis.

- Ignoring Unsuccessful Trades: Learn just as much from your losses as your wins; analyze them carefully.

- Inaccurate Data: Double-check all entries to ensure accuracy. Incorrect data will skew your analysis.

Analyzing Your Trades and Identifying Patterns

So, you’ve diligently recorded your trades. Now comes the fun (and potentially profitable) part: analyzing your data to unearth hidden gems and improve your trading strategy. Your forex trading journal isn’t just a record; it’s a treasure map to consistent profitability. Let’s dive into turning raw data into actionable insights.

Analyzing your trading performance isn’t about beating yourself up over losses; it’s about understanding your strengths and weaknesses to refine your approach. By objectively examining your past trades, you can identify recurring patterns and improve your overall strategy. This systematic analysis is crucial for long-term success in the volatile forex market.

Win Rate and Average Profit/Loss Calculation

Calculating your win rate and average profit/loss provides a clear picture of your overall trading performance. Your win rate is simply the percentage of trades that resulted in profit. For instance, if you made 10 trades and 7 were profitable, your win rate is 70%. Average profit/loss is calculated by summing your profits and losses, then dividing by the total number of trades. A positive average indicates profitable trading, while a negative average shows losses outweighing profits. These metrics, though simple, offer a valuable starting point for identifying areas for improvement. For example, a high win rate with a low average profit per trade might indicate a tendency to take small profits, while a low win rate with a high average profit suggests infrequent but highly successful trades.

Identifying Recurring Patterns in Successful and Unsuccessful Trades

To identify patterns, systematically review your journal. Look for commonalities among your winning trades. Did they share specific entry or exit points? Were they all based on a particular indicator or trading strategy? Conversely, analyze your losing trades. Were there consistent mistakes, such as poor risk management or ignoring crucial market signals? Let’s say you consistently profit from trades entering at the 50-day moving average and exiting at the 200-day moving average, but lose money when you ignore these levels. This is a clear pattern you can leverage. Document these patterns meticulously in your journal, annotating observations and insights.

Risk Management Effectiveness Tracking

Your forex trading journal is invaluable for monitoring your risk management. Track your maximum drawdown (the largest peak-to-trough decline during a specific period), your risk per trade (typically expressed as a percentage of your account balance), and your stop-loss effectiveness. For example, if you consistently set stop-losses but they are frequently triggered, this might indicate the need to adjust your entry points or improve your trade selection criteria. If your maximum drawdown exceeds your predetermined risk tolerance, you’ll need to revise your risk management plan. By meticulously tracking these metrics, you can identify weaknesses in your risk management and make necessary adjustments to safeguard your capital.

Improving Trading Strategies Based on Journal Data

Your forex trading journal isn’t just a record of wins and losses; it’s a goldmine of information waiting to be mined for strategic improvements. By meticulously analyzing your journal entries, you can identify recurring patterns, pinpoint weaknesses in your approach, and ultimately, refine your trading strategies for greater profitability. This process is crucial for consistent growth as a forex trader.

By consistently recording your trades and analyzing the data, you gain invaluable insights into your strengths and weaknesses, allowing you to refine your entry and exit strategies, ultimately leading to more successful trades. This data-driven approach transforms your trading from guesswork to a strategic endeavor.

Refining Entry and Exit Strategies

Analyzing your journal entries for consistent patterns in successful and unsuccessful trades allows for the refinement of both entry and exit strategies. For example, if your journal consistently shows profitable trades entered during periods of low volatility and unprofitable trades entered during high volatility, you can adjust your strategy to favor low-volatility entries. Similarly, if you consistently exit trades too early, resulting in missed profits, your journal will highlight this pattern, allowing you to develop strategies for more patient and calculated exits, perhaps using trailing stops or other risk management techniques. This iterative process of reviewing, analyzing, and adjusting based on data will steadily improve your trading performance.

Identifying Biases and Emotional Influences

Your trading journal serves as a mirror reflecting your trading psychology. By reviewing your entries, you can identify emotional biases that may be impacting your decisions. For instance, a journal might reveal a tendency to hold onto losing trades hoping for a recovery (hope bias) or to exit winning trades too early to secure a small profit (fear of missing out). Identifying these biases is the first step toward mitigating their negative effects. This self-awareness, gained through consistent journal review, is essential for developing a more disciplined and emotionally intelligent trading approach. For example, if you consistently see that you panic-sell during market dips, you can work on developing strategies to counter this, such as setting predetermined stop-loss orders.

Adapting Strategies Based on Journal Insights

Let’s imagine a trader whose journal consistently reveals that their trades taken after 2 PM consistently underperform. Based on this data, the trader can adapt their strategy to avoid taking trades during this time of day. Alternatively, a trader might notice a correlation between successful trades and specific economic indicators. This insight could lead to the development of a strategy that incorporates these indicators into their trading decisions. This adaptive approach, driven by the insights gained from their journal, allows the trader to continuously optimize their trading strategy for improved results. The journal becomes a tool for continuous improvement, not just a record of past trades.

Visualizing Your Trading Performance

Turning raw data into insightful visuals is key to understanding your forex trading journey. A well-designed chart can reveal trends and patterns that might be hidden in spreadsheets, helping you refine your strategies and ultimately, boost your profitability. Let’s explore how to visualize your trading performance using charts.

Account Equity Progression Chart

A line chart is perfect for tracking your account equity over time. Imagine a chart with “Date” on the X-axis and “Account Equity (USD)” on the Y-axis. The line itself would represent the fluctuation of your account balance. For example, let’s say you started with $1000 on January 1st. The line would begin at the point (January 1st, $1000). If your equity rose to $1200 by January 15th, the line would ascend to the point (January 15th, $1200). Subsequent gains and losses would be reflected in the upward and downward movements of the line. Sharp peaks would indicate periods of significant profit, while valleys would show periods of drawdown. This visual representation allows you to quickly identify trends, such as consistent growth or recurring periods of losses, helping you pinpoint the effectiveness of your strategies at a glance.

Comparison of Trading Strategy Performance

A bar chart is ideal for comparing the performance of different trading strategies. Consider a chart with “Trading Strategy” on the X-axis and “Average Return (%)” on the Y-axis. Each bar represents a specific strategy (e.g., Scalping, Day Trading, Swing Trading). The height of each bar corresponds to the average return achieved using that strategy over a defined period. For instance, if Scalping yielded an average return of 5%, the bar would reach the 5% mark on the Y-axis. A taller bar indicates better performance. This chart offers a direct visual comparison, allowing you to easily identify which strategy produced the best results and which ones need improvement or should be discarded. You can also add error bars to represent the standard deviation of returns, providing a measure of the risk associated with each strategy.

Using Visual Representations for Enhanced Insights

Visual representations of your trading data are not merely pretty pictures; they are powerful tools for analysis. By transforming numerical data into charts and graphs, you can quickly identify key trends, patterns, and anomalies. For example, a clear downward trend in your equity chart might signal a need to reassess your risk management. Similarly, consistently poor performance of a specific strategy, as highlighted in a bar chart, might suggest a need for modification or abandonment. The visual nature of these representations allows for quicker identification of these issues compared to manually sifting through raw data. Moreover, these visualizations can facilitate better communication of your trading performance to others, whether it’s a mentor, colleague, or even yourself when reviewing your progress over time. Remember, the goal is to use these visual aids to improve your decision-making and ultimately, enhance your trading success.

Maintaining Your Journal for Long-Term Success

Your forex trading journal isn’t a one-and-done project; it’s a living document that evolves with your trading journey. Consistent use and regular analysis are key to unlocking its full potential and achieving long-term success in the forex market. Think of it as your personal trading GPS, constantly guiding and refining your approach.

Regular review and analysis of your trading journal provide invaluable insights into your trading performance and psychology. By meticulously tracking your trades, you’re building a historical record that allows you to identify recurring patterns, both positive and negative. This data-driven approach empowers you to make informed decisions, optimize your strategies, and ultimately, improve your profitability. Ignoring your journal is like navigating without a map – you might stumble upon some wins, but consistent success becomes far less likely.

Regular Journal Review and Analysis Strategies

Effective review isn’t just about passively looking at your data; it requires a structured approach. Schedule dedicated time each week, perhaps at the end of the week or the beginning of a new one, to analyze your trading activity. This allows you to reflect on recent trades, identify areas for improvement, and refine your approach before making new trades. Consider using a spreadsheet program or dedicated trading journal software to facilitate this process, allowing for easy filtering and sorting of your data. For instance, you might filter your trades by currency pair, timeframe, or trading strategy to pinpoint specific areas of strength and weakness.

Maintaining Motivation and Consistency in Journal Keeping

Staying motivated with your journal can be challenging. To combat this, treat journal keeping as an integral part of your trading routine, not an optional extra. Make it a habit, just like reviewing your charts or preparing your trading plan. Set realistic goals for yourself; perhaps aim for a daily or weekly review, depending on your trading frequency. Reward yourself for consistent journaling, celebrating milestones and recognizing your dedication. Remember, the more diligent you are, the more valuable your insights will become.

Adapting Your Journal as Your Trading Experience Grows

Your trading style and strategies will inevitably evolve as you gain experience. Your journal needs to adapt to this growth. Initially, you might focus on basic trade details. As you progress, you may incorporate more sophisticated metrics, such as risk-reward ratios, expectancy, or specific indicators used in your analysis. You might also add sections to track your emotional state during trades, noting instances of fear, greed, or overconfidence. This self-awareness is crucial for consistent profitability. Think of your journal as a tool that continuously adapts to your trading maturity, providing ever more valuable insights.

Closure

Mastering forex trading isn’t a sprint; it’s a marathon. Building a consistent forex trading journal is your key to long-term success. By diligently tracking your trades, analyzing your performance, and adapting your strategies based on data, you’ll move beyond guesswork and into a world of informed decisions. Remember, consistency is key – regularly reviewing and refining your journal will pave the way for a more profitable and sustainable trading future. So, grab your pen (or keyboard!), and let’s start building your path to forex mastery.

FAQ Overview

What if I don’t have much trading experience?

Start simple! A basic spreadsheet with date, trade details, analysis, and outcome is perfect for beginners. Focus on consistency, not complexity.

How often should I review my journal?

Aim for a weekly or monthly review, depending on your trading frequency. Regular review helps you identify patterns and adjust your strategy quickly.

What if I consistently lose trades?

Don’t panic! Your journal is a tool for learning. Analyze your losing trades meticulously to pinpoint recurring errors and adjust your strategy accordingly. Consider seeking mentorship or further education.

Can I use my journal for tax purposes?

Yes, a detailed trading journal is crucial for accurate tax reporting. Consult with a tax professional for specific guidance in your jurisdiction.