The Beginner’s Guide to Forex Market Sentiment: Dive into the wild world of forex trading, where gut feelings and cold, hard data collide. Understanding market sentiment isn’t just about reading tea leaves; it’s about deciphering the collective psyche of traders, anticipating their moves, and potentially riding the wave to profit. Think of it as crowd-surfing on Wall Street – exhilarating, risky, and potentially incredibly rewarding.

This guide will unpack the intricacies of forex market sentiment, showing you how to identify key indicators, interpret the data, and develop strategies that leverage this powerful force. We’ll explore various tools and techniques, from analyzing news headlines and social media buzz to understanding the psychological factors driving market trends. Get ready to sharpen your intuition and boost your trading game.

Introduction to Forex Market Sentiment

Forex trading, at its core, is about predicting price movements. But what if you could tap into the collective wisdom – or perhaps, the collective anxieties – of thousands of traders worldwide? That’s where forex market sentiment comes in. It’s essentially the overall feeling or prevailing attitude towards a particular currency pair (or the market as a whole). Understanding this sentiment can give you a significant edge, acting as a valuable indicator alongside traditional technical and fundamental analysis.

Forex market sentiment reflects the aggregated expectations and feelings of market participants, ranging from individual retail traders to large institutional investors. It’s a powerful force that can influence price trends, sometimes even overriding fundamental economic data. Imagine it as a giant scale, with one side representing bullish (positive) sentiment and the other bearish (negative) sentiment. The weight on each side dictates the direction of price movement.

Understanding Market Sentiment and its Impact

Market sentiment is not a precise, quantifiable metric like the price of a currency. Instead, it’s a gauge of the collective psychology of the market. A predominantly bullish sentiment suggests that most traders anticipate price increases, leading to buying pressure and potentially pushing prices higher. Conversely, a bearish sentiment, where most traders expect price decreases, leads to selling pressure and potentially lower prices. This doesn’t mean sentiment dictates price movements unilaterally; other factors play a role, but sentiment significantly influences the speed and strength of price changes.

Illustrative Analogy: The Stock Market Rollercoaster

Think of a rollercoaster. The initial climb represents building bullish sentiment; as more people get on, the excitement (and price) builds. The thrilling descent is the sudden shift to bearish sentiment – everyone wants off, causing a rapid drop. Similarly, in the forex market, periods of strong bullish sentiment often lead to rapid price increases, followed by a potential correction when sentiment shifts.

Real-World Examples of Sentiment’s Impact

The Swiss Franc’s dramatic appreciation in 2015 provides a stark example. The unexpected decision by the Swiss National Bank to abandon its peg against the Euro sent shockwaves through the market. The previously bullish sentiment towards the Euro evaporated almost instantly, leading to a massive and rapid sell-off. Conversely, consider the period leading up to Brexit. The uncertainty surrounding the referendum fueled significant bearish sentiment towards the British Pound, driving its value down considerably even before the actual vote. These examples highlight how rapidly shifting sentiment can significantly impact currency prices, sometimes more dramatically than anticipated economic data.

Identifying Market Sentiment Indicators: The Beginner’s Guide To Forex Market Sentiment

Deciphering the collective mood of forex traders – market sentiment – is crucial for navigating the often-turbulent waters of currency trading. While not a crystal ball predicting future price movements, understanding sentiment can significantly improve your trading strategy by helping you identify potential turning points and manage risk more effectively. Several indicators can help you gauge this collective feeling, each with its own strengths and weaknesses.

Understanding the nuances of these indicators is key to making informed trading decisions. Different indicators offer various perspectives on market sentiment, and a combination of approaches often yields the most comprehensive view.

Types of Market Sentiment Indicators

Forex market sentiment is a complex beast, not easily captured by a single metric. Instead, traders rely on a variety of tools and techniques to build a comprehensive picture. These range from the readily available, like news headlines, to more specialized data sources, such as trader surveys. Each approach provides unique insights, but it’s vital to understand their limitations.

Comparing Sentiment Indicator Reliability

The reliability of a sentiment indicator depends heavily on its source and the methodology used to collect and interpret the data. News headlines, for example, can be subjective and influenced by the biases of the news outlet. Social media sentiment, while offering real-time data, is often noisy and can be easily manipulated. In contrast, professional trader surveys, while potentially less timely, may offer a more refined and less emotionally charged view of market sentiment. Ultimately, a balanced approach, incorporating multiple indicators, is recommended for a more accurate assessment.

| Indicator Name | Description | Data Source | Strengths | Weaknesses |

|---|---|---|---|---|

| News Headlines | Analysis of major financial news outlets’ headlines and articles for bullish or bearish bias. | Bloomberg, Reuters, Financial Times, etc. | Readily available, provides a general market overview. | Subjective, potentially biased, may lag actual market sentiment. |

| Social Media Sentiment | Analysis of social media posts (Twitter, forums) to gauge public opinion on specific currencies or market events. | Twitter, Forex forums, Reddit, etc. | Real-time data, provides insights into retail trader sentiment. | Highly volatile, susceptible to manipulation, noise, and emotional biases. |

| Professional Trader Surveys | Surveys of professional forex traders regarding their outlook on the market. | Various financial institutions, research firms. | More refined view, less susceptible to emotional swings. | Limited sample size, may not represent the entire market, potentially delayed data. |

Analyzing Sentiment Data for Trading Decisions

Interpreting market sentiment data effectively requires a nuanced approach, going beyond simply looking at whether the overall sentiment is bullish or bearish. Successful traders integrate sentiment analysis with traditional technical and fundamental analysis to form a comprehensive trading strategy. This holistic view allows for a more accurate assessment of market dynamics and reduces reliance on any single indicator, minimizing potential risks.

Sentiment data, whether derived from social media analysis, news sentiment scores, or trader surveys, provides valuable context. It helps gauge the collective emotion of the market, revealing potential overbought or oversold conditions that might not be immediately apparent from price charts alone. For instance, a strongly bullish sentiment despite a bearish technical pattern could signal an impending price correction, suggesting a potential shorting opportunity. Conversely, a bearish sentiment coupled with a strong upward trend might indicate a buying opportunity as the market potentially underestimates the underlying strength.

Interpreting Sentiment Data in Conjunction with Technical and Fundamental Analysis

Successful trading hinges on a balanced approach. Technical analysis, focusing on price charts and indicators like moving averages and RSI, provides insights into price trends and momentum. Fundamental analysis examines economic data, company earnings, and geopolitical events to assess the intrinsic value of an asset. Sentiment data complements these approaches by adding a crucial psychological dimension. Imagine a scenario where a company announces strong earnings (positive fundamental data), leading to a surge in its stock price (positive technical data). However, if sentiment analysis reveals a growing wave of skepticism or profit-taking among traders, it might suggest that the price increase is unsustainable, prompting a more cautious approach. A trader might choose to take profits or avoid further investment despite the positive technical and fundamental signals. Conversely, a seemingly negative fundamental event (e.g., a temporary dip in earnings) might not significantly impact the price if sentiment analysis reveals strong underlying investor confidence.

Pitfalls of Relying Solely on Sentiment Analysis

While sentiment analysis provides valuable insights, relying solely on it is extremely risky. Sentiment is subjective and can be easily manipulated. Fake news, coordinated social media campaigns, or even a sudden shift in market narrative can distort sentiment readings, leading to inaccurate trading decisions. For example, a sudden surge in negative sentiment due to a viral tweet might trigger a sell-off, even if the underlying fundamentals remain strong. A trader relying solely on this negative sentiment might miss out on a significant buying opportunity. Moreover, sentiment indicators often lag behind actual price movements. By the time a strong bearish sentiment becomes apparent, the price might have already significantly declined, limiting profit potential or increasing the risk of losses.

Hypothetical Trading Scenario

Let’s consider a hypothetical scenario involving the EUR/USD currency pair. Fundamental analysis suggests a strong Eurozone economy, while technical analysis indicates an upward trend. However, sentiment analysis, based on various sources, reveals a growing bearish sentiment among forex traders. This bearish sentiment could be attributed to concerns about rising inflation in the Eurozone or geopolitical uncertainties. A trader using a balanced approach might decide to cautiously reduce their long EUR/USD positions, taking some profits while remaining partially invested. They would be hedging against the potential for a price correction driven by the negative market sentiment, even though fundamental and technical indicators initially suggest an upward trend. This approach demonstrates how incorporating sentiment analysis can enhance risk management and improve trading outcomes.

Common Sentiment-Based Trading Strategies

Forex trading, at its core, is about predicting price movements. While fundamental and technical analysis play significant roles, understanding market sentiment offers a powerful edge. Sentiment gauges the collective feeling of traders towards an asset, providing insights into potential price shifts. Several strategies effectively utilize this information.

Contrarian Trading

Contrarian trading involves betting against the prevailing market sentiment. When the majority of traders are bullish (expecting price increases), a contrarian trader might take a short position, anticipating a price drop. Conversely, if widespread pessimism prevails, they might go long, betting on a price rebound. This strategy thrives on the principle that extreme sentiment often precedes a market correction. For example, if an overwhelmingly positive news cycle drives the EUR/USD pair to extreme highs, a contrarian trader might anticipate a pullback, placing a short position. The inherent risk lies in the potential for sentiment to remain extreme for an extended period, leading to significant losses. Successfully implementing this strategy requires a keen understanding of market psychology and the ability to identify unsustainable price movements.

Confirmation Trading

Confirmation trading involves using sentiment indicators to confirm signals generated by other forms of analysis, such as technical indicators or fundamental news. For instance, a trader might use a moving average crossover to identify a potential buy signal. If sentiment indicators, such as the Commitment of Traders (COT) report, simultaneously show increasing bullishness, this confirms the buy signal, increasing the trader’s confidence. This approach reduces risk by requiring multiple confirmations before entering a trade. A trader might observe a bullish engulfing candlestick pattern on the EUR/USD chart (a technical signal). If, concurrently, the VIX index (a measure of market volatility) is falling, indicating decreasing fear and potentially increasing confidence, it adds weight to the bullish outlook and strengthens the decision to buy.

Trend Following with Sentiment Filters

Trend following strategies aim to capitalize on established price trends. Sentiment analysis can be used as a filter to enhance the effectiveness of these strategies. For example, a trader might only enter long positions during an uptrend if sentiment indicators suggest continued bullish momentum. This reduces the risk of entering a trade near the top of a trend, where the probability of a reversal is higher. Consider a strong uptrend in the GBP/USD pair. A trend follower might use a 200-day moving average as a confirmation of the trend. However, before entering a long position, they would consult sentiment indicators like the average trader sentiment from a reputable provider. If the sentiment remains strongly bullish, the trader proceeds with their long position, adding an extra layer of confirmation.

Comparison of Strategies

The following table summarizes the risk and reward profiles of the three strategies:

- Contrarian Trading: High risk, potentially high reward. Requires a deep understanding of market psychology and the ability to identify unsustainable price movements. Successful execution hinges on correctly predicting sentiment reversals.

- Confirmation Trading: Moderate risk, moderate reward. Reduces risk by requiring multiple confirmations before entering a trade. Requires familiarity with various technical and sentiment indicators.

- Trend Following with Sentiment Filters: Moderate risk, moderate reward. Reduces the risk of entering trades near trend reversals. Requires knowledge of trend-following techniques and sentiment analysis.

Managing Risk with Sentiment Analysis

Forex trading, even when armed with the sharpest sentiment analysis tools, is inherently risky. Ignoring risk management when using sentiment to inform your trades is like sailing a yacht without a rudder – you might look stylish, but you’ll likely end up shipwrecked. Smart traders understand that incorporating robust risk management is crucial for long-term success, regardless of how accurate their sentiment readings might be. This section details how to integrate risk management into your sentiment-based trading strategies.

Sentiment analysis can give you a powerful edge, but it’s not a crystal ball. Market sentiment is fickle, and even the most reliable indicators can sometimes be wrong. Therefore, it’s vital to use sentiment analysis to inform your trading decisions, not dictate them. Your risk management plan should act as a safety net, limiting your potential losses and protecting your capital even when the market moves against your predictions.

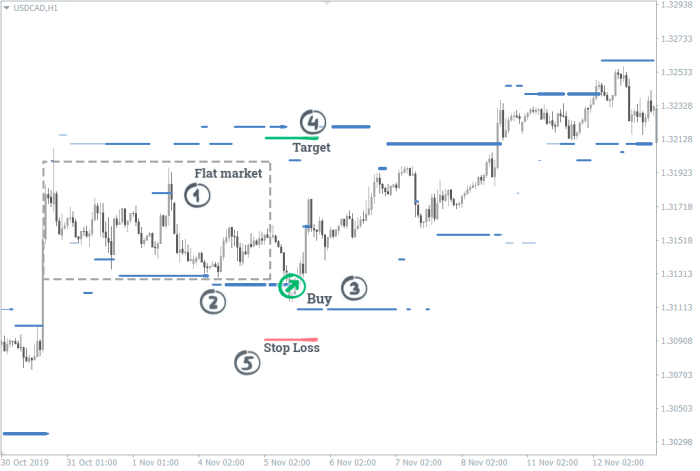

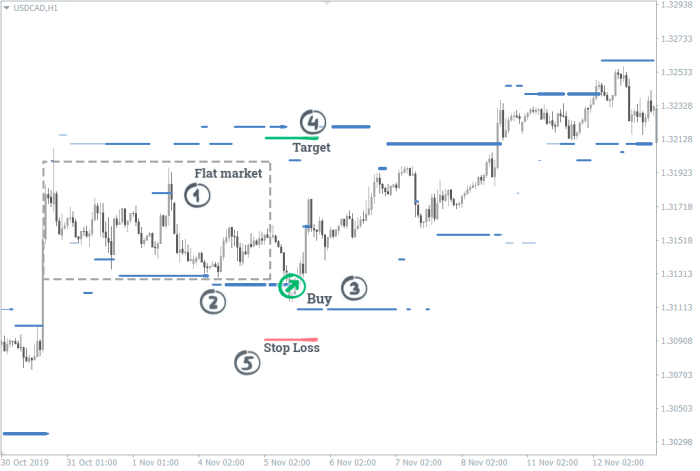

Stop-Loss Orders and Position Sizing Based on Sentiment Shifts

Stop-loss orders are your first line of defense against significant losses. They automatically sell your position when the price reaches a predetermined level, limiting your potential downside. When using sentiment analysis, your stop-loss order placement should be dynamic, adjusting based on the strength and volatility of the sentiment signal. For instance, if a strong bearish sentiment emerges unexpectedly, you might place your stop-loss order slightly above your entry price to quickly exit a long position. Conversely, with a strong bullish sentiment, a tighter stop-loss might be appropriate for a short position. Position sizing is equally important. A larger position in a trade supported by a strong, consistent sentiment signal might be justified, but it also increases potential losses. Conversely, smaller positions are suitable for trades based on weaker or less consistent sentiment indicators. Consider a scenario where a sudden shift in sentiment leads to increased volatility. A smaller position size would limit potential losses during this period of heightened uncertainty.

Adjusting Trading Positions Based on Changing Market Conditions

Sentiment is not static; it constantly evolves. Therefore, your trading positions must adapt accordingly. Continuous monitoring of sentiment indicators is key. If the initial sentiment that supported your trade begins to weaken or reverse, you might consider reducing your position size or even exiting the trade altogether, avoiding larger losses. Imagine a scenario where you’ve entered a long position based on positive sentiment around a particular currency pair. However, if news emerges that significantly undermines this sentiment, leading to a rapid price drop, you should be prepared to adjust your position accordingly, perhaps by taking partial profits or moving your stop-loss order to protect your capital. Conversely, if the sentiment strengthens beyond your initial expectations, you might consider adding to your position, carefully managing your risk exposure. This dynamic approach ensures your trading strategy remains flexible and adaptable to the ever-changing landscape of the forex market.

The Psychology of Market Sentiment

Forex trading, while seemingly driven by charts and indicators, is fundamentally a human endeavor. Understanding the psychological forces at play—both within yourself and the broader market—is crucial for consistent success. Market sentiment, a collective emotional state of traders, is heavily influenced by these psychological factors, creating both opportunities and pitfalls for the astute trader.

Fear and Greed in Forex Trading

Fear and greed are primal emotions that significantly impact trading decisions. Fear, often manifesting as a fear of missing out (FOMO) or a fear of loss, can lead to impulsive entries at inflated prices or premature exits at losses. Conversely, greed can cause traders to hold onto winning positions for too long, hoping for even greater profits, only to see those profits evaporate. These emotions cloud judgment, overriding rational analysis and leading to suboptimal trading outcomes. Consider the example of a trader who, gripped by FOMO, jumps into a trending market late, only to be caught in a sudden reversal. Alternatively, a trader driven by greed might miss a perfectly timed exit, allowing a profitable trade to turn into a loss.

Herd Behavior and its Impact on Market Sentiment

Herd behavior, the tendency to follow the actions of the crowd, is a powerful force in forex markets. Traders, especially inexperienced ones, often mimic the actions of others, believing that the collective wisdom of the market always prevails. This can lead to price bubbles and crashes, as everyone piles into a particular trade at the same time, regardless of fundamental or technical analysis. The infamous dot-com bubble is a prime example of herd behavior leading to irrational exuberance and ultimately a market crash. Similarly, in forex, a sudden surge in buying pressure based purely on herd mentality can artificially inflate the price of a currency pair, creating a short-lived opportunity for profit before the inevitable correction.

Managing Emotional Biases in Forex Trading

Successfully navigating the forex market requires actively managing emotional biases. Developing a robust trading plan, sticking to it religiously, and utilizing risk management techniques are vital steps. Keeping a detailed trading journal, documenting both successes and failures, allows for a retrospective analysis of emotional influences on trading decisions. Furthermore, practicing mindfulness and stress-reduction techniques, such as meditation or deep breathing exercises, can help to calm the mind and improve decision-making under pressure. Remember that forex trading is a marathon, not a sprint. Consistent, disciplined trading based on a well-defined strategy is more likely to yield long-term success than impulsive trades fueled by emotion.

Avoiding Psychological Traps in Sentiment-Driven Trading

Several psychological traps frequently ensnare sentiment-driven traders. Confirmation bias, the tendency to seek out information that confirms pre-existing beliefs, is a common pitfall. Traders might selectively focus on data that supports their chosen trade, ignoring contradictory evidence. Overconfidence, another significant trap, can lead to excessive risk-taking and ignoring stop-loss orders. This often results in substantial losses. Finally, anchoring bias, the tendency to rely too heavily on the first piece of information received, can distort perceptions of fair value and lead to poor entry and exit points. To avoid these traps, traders should strive for objectivity, critically evaluate all available information, and rigorously adhere to their trading plan. Diversifying trading strategies and regularly reviewing trading performance can also help to mitigate these psychological risks.

Resources for Monitoring Forex Market Sentiment

Unlocking the secrets of the forex market often hinges on understanding its collective mood – the market sentiment. Knowing whether traders are generally bullish or bearish can significantly impact your trading strategy. But how do you actually *gauge* this sentiment? Fortunately, several reliable resources provide valuable insights into the prevailing market mood. Let’s explore some key options.

Reliable Sources of Forex Market Sentiment Data

Several tools and platforms offer detailed insights into forex market sentiment. These resources vary in their methodologies and the type of data they provide, but all contribute to a more comprehensive understanding of market psychology. Choosing the right resource depends on your specific trading style and needs.

TradingView

TradingView is a popular social trading platform and charting tool that offers a wealth of information, including sentiment indicators. While it doesn’t directly provide a single, definitive “market sentiment” score, it allows users to analyze various sentiment indicators derived from trader activity on the platform. This includes the percentage of bullish versus bearish traders for specific currency pairs, providing a snapshot of the collective opinion of its user base.

Strengths: TradingView offers a vast community of traders, resulting in a potentially large and diverse dataset. Its charting tools are robust, allowing for easy integration of sentiment data with technical analysis. The platform is also free to use, although premium features are available.

Weaknesses: The sentiment data is based solely on TradingView’s user base, which may not be entirely representative of the overall forex market. It’s also crucial to remember that sentiment can be influenced by the platform’s own community dynamics and can be subject to herding behavior.

IG Client Sentiment

IG, a major forex broker, provides its clients with access to its “Client Sentiment” data. This data reflects the proportion of IG’s clients who are currently holding long (buy) versus short (sell) positions on specific currency pairs. This offers a valuable insight into the collective behavior of a large group of traders.

Strengths: IG’s client base is extensive, potentially offering a more representative sample of market sentiment than smaller platforms. The data is readily accessible to IG clients and is updated frequently.

Weaknesses: Similar to TradingView, the sentiment data is specific to IG’s client base and may not perfectly reflect the overall market. Furthermore, the data can be influenced by the broker’s own client demographics and trading strategies. It’s essential to use this data in conjunction with other indicators for a more comprehensive picture.

Bloomberg Terminal

For professional traders, the Bloomberg Terminal is an indispensable tool. While expensive, it provides access to a vast array of data, including various sentiment indicators derived from news sentiment analysis, order flow data, and other proprietary sources. The Terminal’s sophisticated analytical capabilities allow for in-depth analysis of market sentiment in conjunction with other market factors.

Strengths: The breadth and depth of data available are unparalleled. The sophisticated analytical tools allow for nuanced interpretation of sentiment data.

Weaknesses: The high cost makes it inaccessible to most retail traders. The complexity of the platform requires significant training and expertise to use effectively.

Useful Resources for Tracking Forex Market Sentiment, The Beginner’s Guide to Forex Market Sentiment

Understanding market sentiment is crucial for informed trading decisions. Here are some additional resources to enhance your understanding:

- Websites: ForexLive, DailyFX, Investing.com (offer news and analysis that often incorporates sentiment indicators)

- Publications: Financial Times, Wall Street Journal (provide market analysis and commentary that often reflects prevailing sentiment)

- Tools: Sentiment analysis software (various commercial tools exist that analyze news articles and social media for sentiment clues)

Case Studies

Let’s dive into the real world and see how market sentiment has dramatically impacted the forex market. Analyzing past events helps us understand how sentiment can drive significant price swings and how traders can potentially leverage this knowledge. We’ll explore two compelling case studies to illustrate these points.

Swiss Franc Shock of 2015

In January 2015, the Swiss National Bank (SNB) unexpectedly abandoned its three-year-old policy of capping the Swiss franc against the euro. This decision sent shockwaves through the forex market, causing the franc to appreciate sharply against the euro. The market had become accustomed to the SNB’s intervention, leading to a strong sentiment of a stable EUR/CHF exchange rate. This expectation was dramatically shattered.

The factors contributing to the pre-decision sentiment included the SNB’s consistent pronouncements maintaining the cap, a relatively stable economic environment in Switzerland, and a perception of low risk associated with the CHF. Traders, believing the SNB would continue to defend the cap, held significant long positions in EUR/CHF, expecting the euro to remain relatively strong against the franc. The sudden removal of the cap completely reversed this sentiment. The resulting rapid appreciation of the franc caught many traders off guard, leading to significant losses for those with long EUR/CHF positions. Sentiment analysis tools that tracked trader positioning and news sentiment could have signaled a potential shift before the announcement. Traders who identified a growing divergence between the prevailing sentiment and the underlying economic fundamentals might have reduced their exposure or even profited from the subsequent price movement by shorting EUR/CHF.

Brexit Referendum and the Pound

The 2016 Brexit referendum saw the United Kingdom vote to leave the European Union. The lead-up to the vote was characterized by intense uncertainty and fluctuating market sentiment. Initially, the market seemed to favor “Remain,” with the pound trading relatively strong. However, as the vote neared, polls indicated a tightening race, creating significant volatility. The “Leave” victory triggered an immediate and dramatic sell-off in the pound, representing a massive shift in market sentiment.

The sentiment shift was driven by several factors: the uncertainty surrounding the economic consequences of Brexit, the political instability it would create, and the potential disruption to trade and investment. Before the vote, positive sentiment towards the pound was largely based on assumptions of a “Remain” victory. As the “Leave” campaign gained traction, this sentiment eroded. Sentiment analysis tools that tracked social media, news articles, and expert opinions could have revealed this shifting sentiment, potentially warning traders of the increased risk. Those who anticipated a “Leave” vote could have profited by shorting the pound, while those who held long positions might have implemented risk management strategies such as stop-loss orders to limit potential losses. The rapid and significant devaluation of the pound following the “Leave” vote underscores the profound impact that sentiment can have on forex markets.

Closing Summary

Mastering forex market sentiment isn’t about predicting the future, but about understanding the present. By combining sentiment analysis with fundamental and technical analysis, you can significantly improve your trading decisions and manage risk effectively. Remember, the market is a reflection of human emotion – learn to read the room (or the charts!), and you’ll be well on your way to navigating the forex landscape with confidence. So, ditch the crystal ball and embrace the power of informed trading.

FAQ Corner

How often should I check market sentiment indicators?

The frequency depends on your trading style. Scalpers might check every few minutes, while long-term investors may only check daily or weekly.

Can I use sentiment analysis alone to make trading decisions?

No. Sentiment analysis should be used in conjunction with technical and fundamental analysis for a well-rounded approach. Relying solely on sentiment is risky.

What are some common mistakes beginners make with sentiment analysis?

Over-reliance on a single indicator, ignoring contradictory signals, and letting emotions cloud judgment are common pitfalls.

Where can I find free resources for learning more about forex sentiment?

Many online forums, blogs, and educational websites offer free resources. However, always be critical of the information you find.

For descriptions on additional topics like The Pros and Cons of Trading Forex Full-Time, please visit the available The Pros and Cons of Trading Forex Full-Time.

You also will receive the benefits of visiting How to Use Bollinger Bands in Forex today.