How to Implement a Scalping Strategy in Forex: Dive into the high-octane world of forex scalping! This isn’t your grandpappy’s slow-and-steady investment; we’re talking rapid-fire trades, aiming for small profits on quick price movements. Think of it as the day trading equivalent of a Formula 1 race – exhilarating, potentially lucrative, but demanding precision and nerves of steel. We’ll equip you with the knowledge to navigate this thrilling landscape, from choosing the right currency pairs to mastering essential tools and minimizing risk.

This guide breaks down the scalping strategy step-by-step, from understanding its core principles and advantages to developing a robust strategy with risk management built-in. We’ll cover essential indicators, optimal order placement, and crucial post-trade analysis. Get ready to learn how to ride the waves of the forex market with speed and efficiency – mastering the art of the quick profit.

Understanding Scalping in Forex: How To Implement A Scalping Strategy In Forex

Scalping, in the forex market, is a high-frequency trading strategy where traders aim to profit from small price movements within seconds or minutes. Unlike longer-term strategies that hold positions for days or weeks, scalpers focus on capturing tiny pips, accumulating these small gains over numerous trades throughout the day. It’s a fast-paced, intense style of trading that demands quick reflexes, discipline, and a solid understanding of market mechanics.

Scalping relies on exploiting short-term price fluctuations, often driven by news events, economic data releases, or even algorithmic trading activity. The core principle is to enter and exit trades rapidly, capitalizing on the brief momentum shifts before the market reverses. Success hinges on precise entry and exit points, minimizing risk and maximizing the frequency of profitable trades.

Advantages and Disadvantages of Scalping

Scalping offers several advantages, but it also comes with significant drawbacks. Understanding both sides is crucial before embarking on this trading style.

The primary advantage is the potential for rapid profit generation. Successful scalpers can accumulate substantial gains over a day through numerous small profits. Another advantage lies in the reduced exposure to overnight gaps and significant market swings, as positions are typically held for very short durations. This minimizes the risk associated with unexpected market events that can drastically affect longer-term trades. However, scalping requires intense focus and discipline, demanding constant monitoring of the market. The high frequency of trades also leads to increased brokerage fees, potentially offsetting profits if not managed carefully. Furthermore, scalping necessitates a robust internet connection and a low-latency trading platform to execute trades swiftly and efficiently. The high-stress environment can also be mentally taxing, leading to burnout if not approached strategically.

Identifying Suitable Currency Pairs for Scalping

Choosing the right currency pairs is paramount for successful scalping. High liquidity and volatility are key characteristics to look for.

Currency pairs with high liquidity, such as EUR/USD, GBP/USD, and USD/JPY, are ideal for scalping. High liquidity ensures that trades can be executed quickly and efficiently without significant slippage. Volatility, while presenting risk, also provides opportunities for quick profits. Pairs exhibiting relatively consistent volatility are generally preferred, as this predictability allows for better risk management. Conversely, pairs with low liquidity or extremely unpredictable price movements are generally less suitable for scalping due to the increased risk of slippage and difficulty in accurately predicting short-term price fluctuations. A trader might analyze historical price data and volatility indicators to identify currency pairs that consistently display the desired characteristics. For example, the EUR/USD pair, due to its high trading volume and frequent price fluctuations, often presents more opportunities for scalping than a less-traded pair.

Essential Tools and Indicators for Scalping

Scalping, the art of snatching tiny profits from rapid price fluctuations, demands precision and speed. Success hinges not just on strategy, but also on the right tools and indicators to provide real-time market insights and facilitate quick order execution. Choosing the right arsenal is crucial for maximizing your chances of profitable trades.

Efficient scalping relies heavily on a combination of charting tools and technical indicators that help identify fleeting opportunities. These tools provide visual representations of market dynamics, allowing you to react swiftly to price movements and capitalize on even the smallest price changes. The key is to choose tools that are both reliable and quick to interpret, allowing you to make decisions within seconds.

You also can investigate more thoroughly about How to Choose the Best Forex Trading Strategy to enhance your awareness in the field of How to Choose the Best Forex Trading Strategy.

Charting Tools for Scalping

A clean and efficient chart is your battleground. Essential charting tools enhance your ability to quickly identify entry and exit points. These tools are not merely visual aids; they are integral to your decision-making process.

The most crucial elements include:

- Candlestick Charts: These provide a visual representation of price action over a specific time period, showing the open, high, low, and closing prices. Their visual nature makes it easy to identify patterns and trends quickly.

- Tick Charts: These charts display price movements for every single trade executed, offering the most granular view of market activity. This level of detail is essential for detecting the subtle shifts that often precede larger price swings.

- Volume Indicators: These indicators show the trading volume alongside price movements, helping to confirm price action and identify potential breakouts or reversals. High volume often accompanies significant price changes.

Technical Indicators for Scalping, How to Implement a Scalping Strategy in Forex

Technical indicators provide quantitative data to support your visual analysis of price charts. Their purpose is to provide signals that confirm or contradict your interpretation of price action. While numerous indicators exist, some prove more effective than others for scalping.

Here’s a comparison of common indicators:

| Indicator | Purpose | Effectiveness in Scalping | Limitations |

|---|---|---|---|

| Moving Averages (MA) | Identify trends and potential support/resistance levels. | Moderate; useful for identifying short-term trends, but can lag behind fast price movements. | Can generate false signals in highly volatile markets; requires careful selection of period length. |

| Relative Strength Index (RSI) | Measure momentum and identify overbought/oversold conditions. | High; can signal potential reversals, but needs confirmation from other indicators. | Prone to whipsaws in highly volatile conditions; requires careful interpretation of divergence. |

| Moving Average Convergence Divergence (MACD) | Identify momentum changes and potential trend reversals. | Moderate to High; useful for confirming trends and identifying potential crossovers. | Can generate false signals in sideways markets; requires careful interpretation of histogram and lines. |

Real-Time Data and Low-Latency Platforms

The speed of execution is paramount in scalping. Real-time data and low-latency trading platforms are not luxuries; they are necessities.

Real-time data feeds provide the most up-to-the-minute price information, ensuring you’re always working with the latest market data. Delays, even fractions of a second, can mean the difference between profit and loss in this fast-paced trading style. Low-latency platforms minimize the time it takes for your orders to reach the market and be executed, crucial for capitalizing on fleeting opportunities. A delay of even a few milliseconds can mean missing out on a profitable trade, particularly in fast-moving markets. For example, during periods of high volatility, like news releases, a slow platform could result in a missed opportunity to buy low and sell high, leading to lost profits.

Developing a Scalping Strategy

Crafting a successful scalping strategy requires a meticulous blend of technical analysis, risk management, and adaptability. It’s not about hitting home runs; it’s about consistently accumulating small gains, capitalizing on minor price fluctuations. Remember, patience and discipline are your most valuable assets in this fast-paced trading style.

A well-defined scalping strategy should incorporate specific indicators, clearly defined entry and exit rules, and a robust risk management plan. Without these elements, your scalping efforts will likely be erratic and unprofitable. Let’s explore how to build such a strategy.

Sample Scalping Strategy Utilizing the RSI and Moving Averages

This strategy uses the Relative Strength Index (RSI) and two moving averages – a fast-moving average (e.g., 5-period EMA) and a slow-moving average (e.g., 20-period EMA) – to identify potential entry and exit points.

Entry Rules: A long position is taken when the 5-period EMA crosses above the 20-period EMA, and the RSI is below 30, indicating oversold conditions. A short position is taken when the 5-period EMA crosses below the 20-period EMA, and the RSI is above 70, indicating overbought conditions. The currency pair should exhibit relatively low volatility at the time of entry to minimize risk.

Exit Rules: Positions are closed when the price moves against the trade by a predetermined amount (stop-loss), or when the RSI reverses its trend and moves into neutral territory (between 30 and 70). Alternatively, a profit target can be set, closing the position once the price reaches that level. This strategy prioritizes quick trades with small profits, aiming for consistent gains rather than large, infrequent wins.

Risk Management Techniques for Scalping

Effective risk management is paramount in scalping due to the high frequency of trades. Uncontrolled risk can quickly erode your trading capital.

Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade. The stop-loss level should be set based on the volatility of the currency pair and your risk tolerance. A common approach is to set the stop-loss at a fixed pip value, such as 5-10 pips, or based on a technical indicator like support/resistance levels. For example, if your entry is at 1.1000, a stop-loss could be set at 1.0990.

Position Sizing: Position sizing determines how much capital you risk on each trade. A common rule is to risk no more than 1-2% of your trading account on any single trade. This limits potential losses and prevents significant drawdowns. For instance, with a $10,000 account and a 1% risk tolerance, the maximum loss per trade would be $100.

Adapting Scalping Strategies to Market Conditions

Market volatility significantly impacts scalping strategies. What works during periods of low volatility might fail miserably during high volatility.

High Volatility: During periods of high volatility, widening your stop-loss to account for larger price swings might be necessary. You might also consider reducing your position size or even temporarily suspending trading until volatility subsides. This prevents significant losses during periods of unpredictable price movements. News events or macroeconomic announcements often trigger high volatility.

Low Volatility: Conversely, during low volatility periods, you might be able to tighten your stop-loss and increase your position size slightly, aiming for smaller, more frequent profits. The tighter stop-loss allows for greater precision and increased profitability in range-bound markets. However, it’s crucial to remain vigilant for any unexpected shifts in market sentiment.

Notice Advanced Forex Trading Techniques for Experienced Traders for recommendations and other broad suggestions.

Practical Implementation and Execution

Successfully implementing a scalping strategy hinges on precise order placement and a disciplined approach. Understanding the nuances of order types and developing a robust pre-trade, intra-trade, and post-trade checklist is crucial for consistent profitability. This section details the practical steps involved in executing a scalping trade effectively.

Order placement in scalping demands speed and precision. The tight timeframe necessitates a clear understanding of order types and their suitability for different market conditions. A slight delay can significantly impact your profit potential, especially given the small price movements targeted by scalpers.

Order Types and Parameters

Scalpers primarily utilize market orders, limit orders, and stop orders, each with specific applications. Market orders execute immediately at the best available price, ideal for swift entry and exit in fast-moving markets. Limit orders allow you to specify the exact price at which you want to buy or sell, providing more control but risking missed opportunities if the price doesn’t reach your specified level. Stop orders automatically trigger a market order when the price reaches a predetermined level, acting as a protective measure against adverse price movements. Setting appropriate parameters, such as take-profit and stop-loss levels, is critical to manage risk and secure profits. For example, a scalper might place a market order to buy at the current bid price, setting a take-profit 2 pips above the entry price and a stop-loss 1 pip below. The specific pip values would be adjusted based on the volatility of the currency pair and the trader’s risk tolerance.

Pre-Trade, Intra-Trade, and Post-Trade Checklist

A structured checklist enhances consistency and reduces emotional decision-making, vital for scalping success.

Before executing a trade:

- Confirm market conditions align with your scalping strategy.

- Identify a high-probability setup based on your chosen indicators.

- Determine your entry and exit points, including take-profit and stop-loss levels.

- Calculate position size based on your risk management plan.

- Ensure your trading platform is functioning correctly and your order settings are accurate.

During a trade:

- Monitor price action closely and be prepared to adjust your strategy based on market developments.

- Maintain composure and avoid emotional trading decisions.

- Strictly adhere to your pre-determined take-profit and stop-loss levels.

After a trade:

- Analyze the trade to identify areas for improvement.

- Record your trades in a journal to track performance and refine your strategy.

- Review your risk management procedures to ensure continued effectiveness.

Comparison of Order Execution Methods

The choice of order execution method significantly impacts scalping outcomes. Market orders offer speed but lack price control, potentially leading to slippage in volatile markets. Limit orders provide price control but risk missed opportunities if the price doesn’t reach the specified level. Stop orders protect against adverse price movements but can be triggered by temporary price fluctuations, leading to premature exits. Scalpers often combine these methods, using limit orders to set entry points and stop orders to manage risk, while employing market orders for quick exits when the target is reached. The optimal approach depends on the specific trading conditions and the trader’s risk tolerance. For instance, a scalper might use a limit order to enter a long position at a specific support level, setting a stop-loss order below the support and a market order to exit once the target profit is achieved. This approach balances price control with the speed needed for scalping.

Monitoring and Adapting Your Strategy

Scalping, with its breakneck speed and razor-thin margins, demands constant vigilance. Success isn’t just about executing trades; it’s about understanding how your strategy performs and adjusting it to remain profitable in the ever-shifting forex landscape. Ignoring this crucial aspect is a recipe for consistent losses, no matter how slick your initial strategy seems.

Consistent monitoring and adaptation are vital for long-term success in scalping. It’s about continuously refining your approach based on real-time performance and market feedback. Think of it as a feedback loop: your strategy acts, the market reacts, and you adjust accordingly. This iterative process allows you to optimize your winning potential and minimize losses.

Key Performance Metrics for Scalping

Tracking the right metrics provides a clear picture of your scalping strategy’s effectiveness. Blindly trading without data-driven insights is like sailing without a compass – you might get lucky, but you’re unlikely to reach your destination consistently. Focusing on these key indicators provides crucial feedback.

- Win Rate: This is the percentage of your trades that result in profit. A higher win rate generally indicates a more robust strategy, although it’s not the sole indicator of success. For example, a win rate of 60% might be excellent if your average winning trades significantly outweigh your average losing trades.

- Average Profit/Loss: This metric reveals the average amount you gain on winning trades and lose on losing trades. A large difference between average profit and average loss is essential for profitability, even with a moderate win rate. Imagine a scenario where your average win is $10 and your average loss is $5; even with a 50% win rate, you’re still profitable.

- Profit Factor: This is the ratio of your total profits to your total losses. A profit factor greater than 1 indicates profitability. For example, a profit factor of 2.0 means that your total profits are double your total losses.

- Maximum Drawdown: This is the peak-to-trough decline during a specific period. Monitoring this helps manage risk and prevent significant capital loss. A strategy with a lower maximum drawdown is generally considered less risky.

Analyzing Trade Logs for Improvement

Maintaining detailed trade logs is paramount. These logs act as a historical record of your trading activity, providing invaluable insights into your strengths and weaknesses. Without this data, improvements are merely guesswork.

Analyzing your trade logs involves more than just looking at the bottom line. You should identify patterns in your winning and losing trades. Were there specific market conditions that consistently led to profits? Conversely, what situations repeatedly resulted in losses? Perhaps your entry points were consistently off, or your stop-loss levels were too tight.

For instance, if you consistently lose on trades taken during high-volatility periods, you might adjust your strategy to avoid trading during those times or use tighter stop-losses. Similarly, if you frequently take profits too early, you might adjust your take-profit levels to capture more potential gains.

Adapting to Changing Market Conditions

The forex market is dynamic; what works today might not work tomorrow. Therefore, your scalping strategy must be adaptable to changing market conditions. This involves continuously monitoring news events, economic indicators, and overall market sentiment.

Unexpected events, such as geopolitical shifts or major economic announcements, can significantly impact market volatility and liquidity. During such times, it might be wise to reduce trading frequency or even temporarily halt trading altogether until the market stabilizes. Alternatively, you might adjust your strategy to take advantage of increased volatility, perhaps by using wider stop-losses to accommodate larger price swings. Remember, flexibility is key to survival in this environment.

Illustrative Examples of Scalping Scenarios

Understanding scalping success and failure through real-world examples is crucial for refining your strategy. Let’s analyze both a profitable and an unprofitable trade to illustrate key decision-making processes and highlight critical learning points.

Successful Scalping Trade Example

This example focuses on a EUR/USD trade executed during a period of relatively low volatility. Using a 5-minute chart, the trader identified a potential long position based on the convergence of the 5-period and 20-period moving averages, suggesting a potential bullish trend reversal. The Relative Strength Index (RSI) was hovering around 30, indicating oversold conditions. The trader placed a buy order just above the resistance level formed by the previous swing high. A stop-loss order was set below the recent swing low, limiting potential losses. The take-profit order was placed at a level representing a 10-pip profit target, based on the anticipated short-term price movement. Within minutes, the price moved favorably, reaching the take-profit level, resulting in a successful scalping trade. The trader’s quick decision-making, informed by the technical indicators and clear risk management, contributed to the trade’s success. This demonstrates how combining technical analysis with precise risk management can lead to consistent profits in scalping.

Unsuccessful Scalping Trade Example

This scenario involved a short position on the GBP/USD pair. The trader observed a temporary price spike and, based solely on this visual observation without considering other indicators, entered a short position anticipating a reversal. No stop-loss order was initially set, reflecting a lack of proper risk management. Instead of reversing, the price continued its upward trend, leading to a significant loss. The trader eventually closed the position after a substantial drawdown. The lack of confirmation from technical indicators, the absence of a stop-loss order, and impulsive decision-making based on a single price action without considering broader market context contributed to this loss. This highlights the importance of using multiple indicators for confirmation and the critical role of risk management in mitigating potential losses. The lesson learned is the need for a disciplined approach, utilizing a comprehensive strategy, and adhering strictly to pre-defined risk management rules.

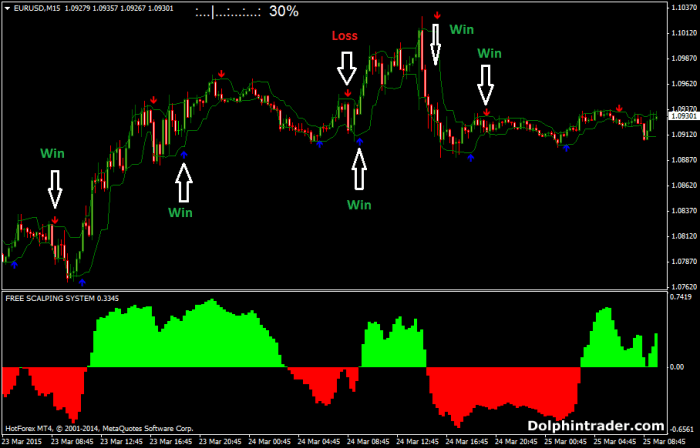

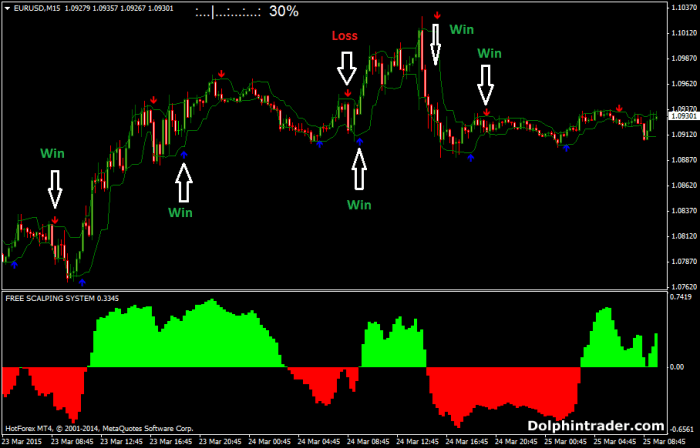

Typical Scalping Chart Representation

Imagine a 5-minute candlestick chart of the USD/JPY pair. The chart shows a recent upward trend. A horizontal line represents the resistance level at 110.50. The price briefly touches this level and then experiences a minor pullback. At 110.45, the 5-period and 20-period moving averages cross, indicating potential bullish momentum. The RSI is around 40, not oversold but suggesting potential for upward movement. The trader places a buy order at 110.46. The stop-loss order is set at 110.40, representing a 6-pip stop. The take-profit order is placed at 110.55, a 9-pip target. The price then moves quickly upwards, hitting the 110.55 level, resulting in a successful trade. This visual representation, though textual, illustrates the key elements of a typical scalping trade: clear entry and exit points, well-defined stop-loss and take-profit levels, and the use of technical indicators to confirm trading decisions.

Summary

Conquering the forex market through scalping requires discipline, precision, and a keen understanding of market dynamics. While the potential for rapid profits is enticing, remember that risk management is paramount. By mastering the tools and techniques Artikeld in this guide, you’ll be well-equipped to navigate the fast-paced world of forex scalping. Remember to continuously refine your strategy based on performance analysis and market shifts. The journey to becoming a successful forex scalper is ongoing, demanding consistent learning and adaptation. So, sharpen your skills, stay informed, and prepare for the thrill of the chase.

Question & Answer Hub

What are the typical transaction costs associated with forex scalping?

Transaction costs in forex scalping primarily involve spreads (the difference between the bid and ask price) and potentially commissions, depending on your broker. Minimizing these costs is crucial for profitability given the small profit targets of scalping.

How much capital do I need to start scalping Forex?

The capital required depends on your risk tolerance and trading strategy. While you can start with a smaller amount, sufficient capital is essential to manage risk effectively and withstand potential losses. It’s advisable to start with an amount you’re comfortable losing and gradually increase capital as your experience and confidence grow.

Is automated scalping software reliable?

Automated scalping software can be helpful, but it’s not a guaranteed path to success. It’s crucial to thoroughly test and understand any automated system before using it with real money. Market conditions change constantly, and even the best algorithms may not always adapt effectively.

What are the psychological challenges of forex scalping?

Scalping’s fast-paced nature can lead to emotional decision-making. Maintaining discipline, avoiding impulsive trades, and managing stress are crucial for long-term success. Developing a robust trading plan and sticking to it, even during losing streaks, is vital.