Forex trading simulator? Yeah, it’s basically your own personal playground for mastering the wild world of forex. Before you risk real cash, a forex trading simulator lets you hone your skills, test strategies, and basically become a forex ninja without the financial fallout. Think of it as the ultimate sandbox for budding traders, where you can experiment with different approaches and learn from your mistakes – all without emptying your wallet.

We’re diving deep into everything you need to know about these powerful tools, from choosing the right platform to mastering advanced techniques. We’ll uncover the secrets to effective strategy development, the importance of risk management, and even the limitations you need to be aware of. Get ready to level up your forex game!

Introduction to Forex Trading Simulators

So, you’re thinking about dipping your toes into the wild world of forex trading? Before you risk your hard-earned cash, consider this: a forex trading simulator is your best friend. Think of it as a virtual playground where you can hone your skills, test strategies, and learn the ropes without the sting of real-world losses. It’s like practicing your free throws before stepping onto the basketball court – except instead of hoops, you’re aiming for profitable trades.

Forex trading simulators provide a risk-free environment to experiment with different trading styles, analyze market trends, and understand the nuances of currency exchange. They are invaluable tools for both beginners taking their first steps and experienced traders looking to refine their approach. The benefits extend beyond just avoiding financial losses; they encompass a deeper understanding of market dynamics and the development of disciplined trading habits.

Types of Forex Trading Simulators

Forex trading simulators come in various forms, each offering a unique set of features and functionalities. Understanding these differences is crucial for choosing the right simulator to match your needs and experience level. The main categories include standalone software, web-based platforms, and those integrated within larger trading platforms.

Standalone Forex Trading Simulators

Standalone simulators are independent applications that you download and install on your computer. They often provide a comprehensive suite of features, including historical data, customizable settings, and advanced charting tools. Popular examples might include software offering detailed backtesting capabilities, allowing you to test strategies on past market data. These often provide a more immersive and customizable experience compared to web-based alternatives, but require dedicated installation and might lack the real-time market data integration found in some web-based platforms. The level of detail and functionality can vary greatly depending on the specific software. Some might offer more sophisticated risk management tools, while others might focus on simpler interfaces for beginners.

Web-Based Forex Trading Simulators

Web-based simulators are accessed directly through a web browser, eliminating the need for downloads or installations. This accessibility is a major advantage, allowing users to access the simulator from any device with an internet connection. However, the functionality might be more limited compared to standalone software. Web-based simulators often rely on a simplified interface, prioritizing ease of use over advanced features. While they may lack the in-depth backtesting capabilities of some standalone options, they provide a convenient entry point for beginners. The speed and reliability can depend heavily on the internet connection.

Integrated Forex Trading Simulators

Some larger forex brokerage platforms incorporate simulators directly into their trading interfaces. This integration allows for a seamless transition from simulated trading to live trading. The advantage here is the consistency of the trading environment; the tools and interface are identical whether you’re practicing or trading with real money. However, the features might be limited by the brokerage’s platform. These integrated simulators are typically designed to be user-friendly, often focusing on the basic functionalities needed to learn the platform and trading mechanics.

Comparison of Forex Trading Simulator Features

A direct comparison requires specifying individual platforms, but generally, we can highlight key features. Standalone simulators often boast advanced charting, backtesting, and strategy optimization tools. Web-based options prioritize accessibility and ease of use, while integrated platforms focus on a consistent trading experience. Consider factors such as the historical data range available, the types of order execution supported, the availability of technical indicators, and the overall user interface when making your selection. The best simulator for you will depend on your experience level, trading style, and technical proficiency.

Key Features of a Forex Trading Simulator

So, you’re diving into the world of forex trading, but want to test the waters before risking real cash? Smart move! A forex trading simulator is your virtual playground, letting you hone your skills and experiment with strategies without the sting of potential losses. But not all simulators are created equal. Choosing the right one hinges on understanding its key features.

A good forex trading simulator should feel as close to the real thing as possible. This means accurate market data, flexible settings to mirror your trading style, and powerful tools to analyze market trends. Think of it as a high-fidelity replica of the forex market, offering a realistic training environment.

Get the entire information you require about live forex trading signals free on this page.

Realistic Market Data

The backbone of any effective forex simulator is its data. It needs to accurately reflect real-world market fluctuations, including price movements, spreads, and trading volume. Simulators that use historical data should clearly state the source and timeframe of that data. A simulator with poor or outdated data will lead to flawed strategies and unrealistic results. Imagine practicing golf with misaligned tees – you’d never improve your swing! Similarly, inaccurate market data renders your simulated trading experience useless.

Customizable Settings

A one-size-fits-all approach doesn’t work in forex trading, and neither should it in a simulator. Look for a platform that lets you customize key parameters like account size, leverage, and trading instruments. This allows you to tailor your simulated environment to match your actual trading goals and risk tolerance. For example, you might want to start with a smaller account size to practice risk management before simulating high-stakes trades.

Charting Tools

Charts are the forex trader’s best friend. Your simulator needs robust charting capabilities, allowing you to analyze price movements using various indicators (like moving averages, RSI, MACD) and chart types (candlestick, bar, line). Powerful charting tools will help you identify patterns, test your strategies, and ultimately, make better trading decisions. Think of it as having a sophisticated toolkit for dissecting market behavior.

Backtesting Capabilities

Backtesting is the process of testing your trading strategy on historical data. This allows you to evaluate its performance under different market conditions and identify potential flaws before deploying it with real money. A good simulator will provide comprehensive backtesting features, allowing you to easily input your strategy parameters and analyze the results. It’s like a time machine for your trading ideas, revealing their strengths and weaknesses before they cost you money.

Comparison of Forex Trading Simulators

| Feature | Simulator A | Simulator B | Simulator C |

|---|---|---|---|

| Realistic Market Data | Uses historical data from a reputable provider, updated daily. | Uses simulated data, may not accurately reflect real market volatility. | Offers both historical and simulated data options. |

| Customizable Settings | Highly customizable, allowing for adjustments to account size, leverage, and trading instruments. | Limited customization options. | Offers a good range of customizable settings. |

| Charting Tools | Provides a wide array of charting tools and technical indicators. | Basic charting capabilities, limited indicators. | Offers advanced charting features and a selection of popular indicators. |

| Backtesting Capabilities | Robust backtesting functionality, allows for detailed analysis of strategy performance. | Limited backtesting capabilities. | Offers comprehensive backtesting, with detailed performance reports. |

Risk Management in a Simulated Environment

Forex trading, even in a simulated environment, carries inherent risks. Understanding and implementing effective risk management strategies is crucial for developing sound trading habits and preventing significant losses – even when virtual money is involved. A simulator allows you to experiment with different risk management techniques without the financial consequences of real-world trading, making it an invaluable learning tool.

The beauty of a forex trading simulator lies in its ability to offer a safe space for practicing risk mitigation. You can test various strategies, observe their impact on your simulated portfolio, and adjust your approach accordingly before venturing into live trading. This iterative process of testing, analyzing, and refining is key to becoming a more disciplined and successful trader.

Stop-Loss Orders in Simulated Trading

Stop-loss orders are essential for limiting potential losses. In a simulated environment, you can practice setting stop-loss orders at various price points to see how they perform under different market conditions. For example, you might set a stop-loss order 1% below your entry price to limit potential losses on a long position. By repeatedly using stop-loss orders in the simulator, you’ll become comfortable with their implementation and understand their role in protecting your capital. You can experiment with different stop-loss strategies, such as trailing stop-losses, to see which ones best suit your trading style and risk tolerance. Observing how your simulated trades react to stop-loss triggers will hone your risk management instincts.

Position Sizing Strategies in a Simulated Setting

Position sizing determines the amount of capital allocated to each trade. In a simulator, you can experiment with different position sizing techniques, such as allocating a fixed percentage of your account balance to each trade (e.g., 1% or 2%). This allows you to test the impact of different position sizes on your overall portfolio performance and risk exposure. For instance, you can compare the results of trading with a 1% risk per trade versus a 5% risk per trade to understand how a smaller position size can lead to greater resilience during periods of market volatility. The simulator provides a safe environment to discover the position sizing method that best aligns with your risk profile and trading objectives.

Identifying and Adjusting Strategies Based on Simulated Results

A forex trading simulator provides invaluable data for post-trade analysis. After completing a series of simulated trades, you can review your performance, noting instances where your risk management strategies were effective and where they fell short. For example, if you consistently experience significant losses due to neglecting stop-loss orders, the simulator highlights the need to improve your discipline in this area. By meticulously reviewing your simulated trading history, you can identify patterns, weaknesses in your approach, and areas for improvement. This data-driven approach to self-improvement is a significant advantage of using a forex simulator. The simulator allows for continuous refinement of your risk management strategies, enabling you to develop a robust and adaptable approach to trading.

Limitations and Considerations of Forex Trading Simulators

Forex trading simulators are invaluable tools for learning and practicing forex trading strategies, but they’re not perfect crystal balls predicting real-market performance. Understanding their limitations is crucial to avoid overconfidence and unrealistic expectations. The simulated environment, while helpful, differs significantly from the dynamic and unpredictable nature of the actual forex market.

The gap between simulated and real-world trading is significant. Simulators often lack the emotional and psychological pressures of live trading. The adrenaline rush, fear of loss, and the constant influx of real-time news impacting market sentiment are all absent in a simulated environment. This lack of emotional involvement can lead to a skewed perception of risk and reward, creating a false sense of security and potentially leading to poor decision-making in live trading. Furthermore, simulators typically don’t fully replicate the complexities of real market liquidity, slippage, and order execution issues. These factors can significantly impact profitability and are often overlooked in the controlled environment of a simulator. A sudden spike in volatility, for instance, might lead to your order being filled at a less favorable price than anticipated in a real market scenario, a situation rarely perfectly mirrored in a simulator.

Simulated versus Real Market Conditions

Simulators provide a controlled environment with historical data or algorithmic price generation. This contrasts sharply with the real market’s unpredictable nature, influenced by geopolitical events, economic announcements, and unpredictable shifts in market sentiment. For example, a simulator might accurately reflect past price movements, but it can’t predict the market reaction to a surprise interest rate hike by a central bank – a scenario that can drastically impact currency pairs. The speed and volume of transactions also differ. Real-time trading involves dealing with high transaction volumes and rapid price fluctuations, which can test a trader’s reflexes and ability to adapt to dynamic market conditions. These rapid shifts aren’t always replicated with the same accuracy in simulated environments. A simulator might show a gradual price change, while the real market could experience a sudden jump or drop due to unexpected news.

Ethical Considerations and Overconfidence

The ease of success in a simulated environment can breed overconfidence. Consistently profitable simulated trades might lead a trader to believe they possess superior skills, potentially resulting in excessive risk-taking and significant losses when transitioning to live trading. This overconfidence can be detrimental, leading to poor risk management and ignoring crucial aspects of responsible trading. For example, a trader might use excessive leverage in live trading based on their simulated successes, ignoring the significantly higher risk of substantial losses in a real-market setting. It’s crucial to remember that simulated success does not guarantee real-world success. The ethical responsibility lies in recognizing the limitations of the simulator and maintaining a realistic assessment of one’s skills and risk tolerance before committing capital in the live market.

Advanced Techniques and Applications

Forex trading simulators aren’t just for beginners; they’re powerful tools for seasoned traders looking to refine their strategies and explore advanced concepts. By leveraging the controlled environment, you can test ideas that would be too risky to implement in live trading, ultimately leading to better risk management and potentially higher profits. This section dives into some advanced applications and techniques that can significantly enhance your trading prowess.

Beyond basic buy/sell orders, simulators allow for sophisticated strategy development and testing. The ability to backtest and optimize strategies is invaluable, particularly for those interested in algorithmic trading or exploring complex market dynamics.

Automated Trading Strategies and Algorithmic Testing

Forex simulators provide a sandbox for developing and testing automated trading strategies. You can program your own algorithms or use pre-built expert advisors (EAs) to execute trades based on predefined rules. This allows for rigorous backtesting, optimizing parameters like entry/exit points, stop-loss levels, and take-profit targets. For example, you could test a mean reversion strategy, where the algorithm identifies overbought or oversold conditions and automatically places trades accordingly. The simulator will then show you the results, allowing you to tweak the algorithm until you achieve optimal performance within the simulated environment. Backtesting, however, is only one piece of the puzzle. Forward testing on a demo account using real-time market data is a crucial next step before deploying to a live account.

Analyzing Market Event Impact on Trading Strategies

Simulators are invaluable for stress-testing trading strategies against various market scenarios. You can simulate significant news events, economic data releases, or geopolitical shifts to see how your strategy performs under pressure. For instance, you could simulate the impact of a surprise interest rate hike on a carry trade strategy. By observing the simulated results, you can identify potential weaknesses and refine your strategy to better withstand unexpected market volatility. This process allows for a more robust and resilient trading plan.

Resources for Advanced Forex Trading Simulator Techniques

Understanding the intricacies of advanced forex trading simulator techniques requires dedicated learning. Here are some resources to help you delve deeper:

- Books: “Algorithmic Trading and Quantitative Analysis of Financial Markets” by Ernest Chan offers a comprehensive guide to algorithmic trading principles applicable to forex simulators. “Trading in the Zone” by Mark Douglas emphasizes the psychological aspects of trading, crucial for developing robust automated strategies.

- Websites: Many online forums and communities dedicated to algorithmic trading offer valuable insights and code examples. MetaTrader 4 and 5 platforms have extensive documentation and tutorials on building and testing expert advisors.

- Tutorials: YouTube channels specializing in algorithmic trading and forex automation provide step-by-step tutorials on various techniques, including backtesting, optimization, and strategy development. Many educational platforms also offer online courses focusing on advanced forex trading simulator usage.

Illustrative Example: A Simulated Trade

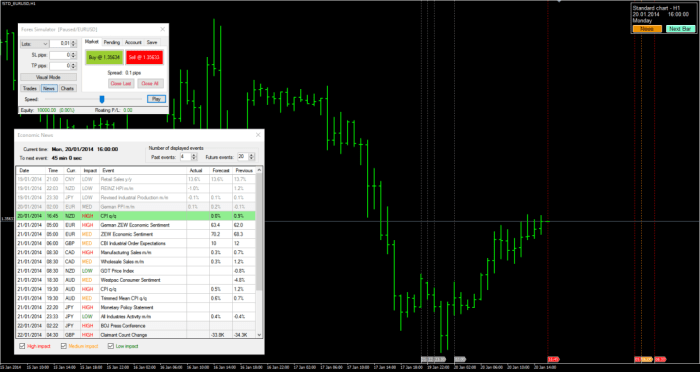

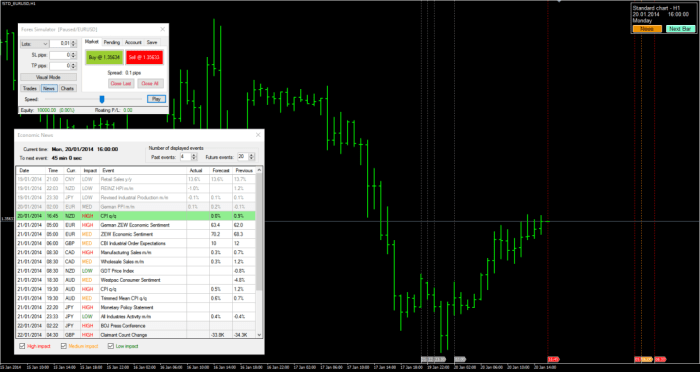

Let’s dive into a realistic scenario of a forex trade using a simulator, highlighting the decision-making process and risk management involved. This example focuses on the EUR/USD pair, a highly liquid and popular currency pair for trading.

This simulated trade demonstrates a common short-term trading strategy focusing on identifying and capitalizing on short-term price movements. We’ll track the trade from entry to exit, analyzing the reasoning behind each step.

Trade Setup and Market Analysis

My simulated trading platform showed a bearish engulfing candlestick pattern forming on the EUR/USD 15-minute chart. This pattern, coupled with a recent break below a key support level at 1.1050, suggested a potential downward move. Furthermore, the Relative Strength Index (RSI) indicator was showing overbought conditions, reinforcing the bearish sentiment. My analysis indicated a high probability of a short-term price decline. I felt confident in my assessment but acknowledged that market conditions can change rapidly.

Entry Point and Position Sizing, Forex trading simulator

Based on my analysis, I decided to enter a short position (selling EUR/USD) at 1.1045. My risk management strategy dictated a position size that would risk only 1% of my simulated account balance on this trade. This meant that my stop-loss order would be placed at 1.1060, representing a risk of 15 pips (1 pip = 0.0001). This approach ensured that a potential losing trade wouldn’t significantly impact my overall account balance. My emotional response was a mix of cautious excitement and controlled anticipation. I felt prepared for both positive and negative outcomes.

Exit Strategy and Trade Management

My initial target for the trade was a 2:1 risk-reward ratio. Therefore, my take-profit order was placed at 1.1015, representing a profit target of 30 pips. As the price moved towards my take-profit, I felt a slight surge of anticipation but remained disciplined. I didn’t adjust my orders based on emotions, sticking to my pre-determined plan. The price reached my take-profit order, and the trade was automatically closed.

Outcome and Post-Trade Analysis

The trade resulted in a profit of 30 pips, achieving my 2:1 risk-reward target. This successful outcome reinforced the validity of my initial analysis and risk management strategy. However, I also conducted a post-trade analysis to identify any areas for improvement. While the trade was successful, I noted that the initial bearish signal could have been a false signal, highlighting the importance of constantly reviewing and refining my trading plan. This simulated experience was invaluable for practicing disciplined trading habits.

Conclusion

So, there you have it – a comprehensive guide to conquering the forex trading simulator world. Remember, practice makes perfect, and a simulator is your key to unlocking consistent profitability. While it won’t perfectly mirror real-market volatility, it’s the closest thing you’ll get to risk-free learning. Now go forth, experiment, and become the forex master you were always meant to be!

Get the entire information you require about forex trading plan on this page.