How to Succeed in Forex Trading: A Roadmap for 2025 – sounds intense, right? But navigating the forex market in 2025 doesn’t have to be a wild ride. This roadmap cuts through the noise, guiding you through the evolving landscape of AI-powered trading, risk management strategies that actually work, and the mental game that often makes or breaks traders. We’ll explore everything from traditional methods to cutting-edge tech, helping you craft a winning strategy for the future of finance.

Forget get-rich-quick schemes; this is about building a sustainable approach to forex trading. We’ll delve into technical and fundamental analysis, mastering the art of interpreting market indicators, and developing a rock-solid trading plan tailored to your risk tolerance. We’ll even tackle the often-overlooked psychological aspects, helping you conquer fear and greed to become a more disciplined and ultimately, more successful trader.

Understanding the Forex Market in 2025

The forex market in 2025 is poised for significant transformation, driven by technological advancements and evolving geopolitical landscapes. While volatility will remain a defining characteristic, the increasing sophistication of trading tools and the growing influence of algorithmic trading will reshape the playing field for both seasoned professionals and newcomers. Expect increased regulation, a focus on sustainability within financial institutions, and a continued shift towards digital currencies influencing traditional forex pairs.

The Projected Landscape of the Forex Market in 2025

The forex market in 2025 is predicted to be a more data-driven, technologically advanced, and regulated environment. Increased automation through AI and machine learning will likely lead to faster trade execution and more sophisticated risk management strategies. Geopolitical events will continue to impact currency values, but the speed and scale of these impacts will be amplified by the instantaneous nature of digital trading. We can anticipate a rise in decentralized finance (DeFi) impacting the landscape, potentially creating new trading opportunities and challenges. For example, the increasing adoption of cryptocurrencies could lead to more volatile exchange rates between fiat currencies and digital assets, creating both opportunities and risks for traders. This will require traders to adapt and develop strategies that account for these new dynamics.

The Impact of Emerging Technologies on Forex Trading Strategies

Artificial intelligence (AI) and machine learning (ML) are revolutionizing forex trading. AI-powered trading bots can analyze vast datasets, identify patterns, and execute trades with speed and precision exceeding human capabilities. Blockchain technology offers enhanced security and transparency, potentially streamlining cross-border payments and reducing fraud. However, the reliance on these technologies also introduces new vulnerabilities, such as susceptibility to hacking and algorithmic biases. For instance, an AI algorithm trained on historical data might fail to adapt to unforeseen market shifts, leading to significant losses. The integration of these technologies will necessitate a shift in trader skillsets, emphasizing data analysis, algorithmic understanding, and risk management within a complex technological environment.

Traditional vs. Technology-Driven Forex Trading Methods

The contrast between traditional and technology-driven forex trading is stark. Traditional methods rely heavily on fundamental and technical analysis, experience, and intuition. Technology-driven approaches leverage AI, high-frequency trading (HFT), and algorithmic strategies. The following table highlights the key differences:

| Method | Pros | Cons | Technological Dependence |

|---|---|---|---|

| Traditional Forex Trading | Lower initial investment, greater understanding of market fundamentals, flexibility in strategy | Time-consuming, requires significant experience, susceptible to emotional biases | Low to moderate (charting software, basic analytical tools) |

| Technology-Driven Forex Trading (Algorithmic/AI) | High speed execution, potential for higher returns, automated risk management | High initial investment in technology and expertise, vulnerability to system failures, potential for algorithmic biases | High (sophisticated software, powerful computing resources, AI algorithms) |

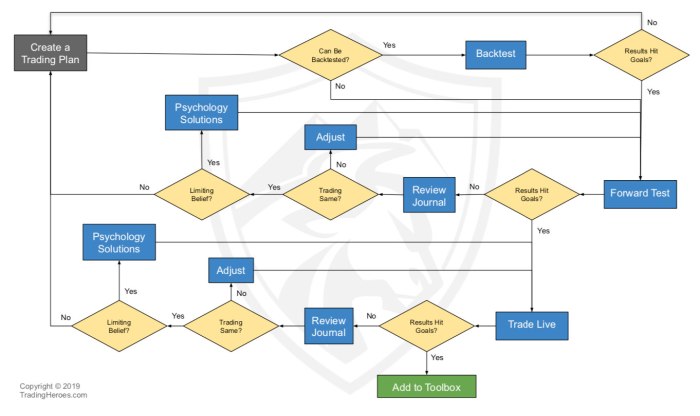

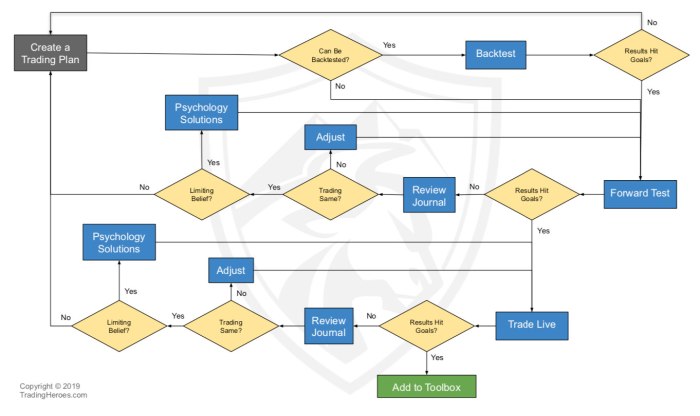

Developing a Robust Trading Plan

Navigating the forex market successfully in 2025 requires more than just understanding market dynamics; it demands a meticulously crafted trading plan. Think of your trading plan as your roadmap – it guides your decisions, keeps you disciplined, and ultimately, protects your capital. Without a solid plan, you’re essentially sailing a ship without a compass, leaving yourself vulnerable to the unpredictable currents of the market.

A robust trading plan acts as your personal financial bodyguard, safeguarding your investments from emotional impulses and market volatility. It’s the bedrock upon which consistent profitability is built, allowing you to adapt to changing market conditions and maintain a level-headed approach even during periods of significant price swings. Remember, forex trading is a marathon, not a sprint; a well-defined plan is crucial for long-term success.

Defining Trading Goals and Objectives

Clearly defined goals are essential for effective forex trading. Without them, you risk aimless trading, leading to inconsistent results and potentially significant losses. Your goals should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). For example, instead of vaguely aiming to “make money,” a SMART goal would be: “To achieve a consistent monthly profit of 5% on my trading capital by the end of the year, through swing trading the EUR/USD pair.” This provides a clear target and allows for progress tracking. Defining your risk tolerance—how much you’re willing to lose on any given trade—is also a critical part of this process. This helps determine the appropriate trade size and leverage to use.

Risk Management Strategies

Risk management is paramount in forex trading. It’s not just about protecting your capital; it’s about ensuring your long-term survival in the market. Implementing robust risk management techniques involves several key strategies. A crucial aspect is determining your stop-loss order, which automatically exits a trade when the price moves against you by a predetermined amount, limiting potential losses. Similarly, take-profit orders automatically close a trade when the price reaches your target profit level, securing your gains. Position sizing, which involves calculating the appropriate amount to invest in each trade based on your risk tolerance, is equally vital. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. Diversification across multiple currency pairs can also help reduce overall risk.

Trading Styles and Their Suitability

Choosing the right trading style aligns with your personality, risk tolerance, and available time. Different styles demand different levels of commitment and expertise.

Understanding the nuances of each style is critical for success. Here are a few examples:

- Scalping: This involves taking advantage of very short-term price fluctuations, holding positions for only seconds or minutes. It requires intense focus, quick decision-making, and low spreads. Risks: High frequency of trades increases the potential for accumulating small losses that can quickly erode capital. Requires significant technical expertise and a fast internet connection.

- Day Trading: Positions are opened and closed within the same trading day. This requires constant monitoring of the market and involves a medium-risk profile. Risks: Requires significant time commitment and can be emotionally draining. Unforeseen news or market events can lead to significant losses if not managed effectively.

- Swing Trading: Holding positions for several days or weeks, capitalizing on intermediate-term price swings. This style allows for a more relaxed approach, needing less constant monitoring. Risks: While less demanding than day trading, swing trading still requires active management and awareness of market shifts. Larger price movements can significantly impact profits or losses over the holding period.

Mastering Technical and Fundamental Analysis

Forex trading, in its thrilling unpredictability, demands a multifaceted approach. Successfully navigating the turbulent waters of the currency market hinges on a deep understanding of both technical and fundamental analysis. These two powerful tools, when used in concert, provide a robust framework for informed decision-making, significantly enhancing your chances of success in the ever-evolving landscape of 2025.

Technical Indicators in Forex Trading

Technical analysis uses price charts and indicators to predict future price movements. By identifying patterns and trends, traders can anticipate potential opportunities and mitigate risks. Several key indicators provide valuable insights into market sentiment and momentum.

| Indicator | Calculation | Interpretation | Strengths/Weaknesses |

|---|---|---|---|

| Moving Average (MA) | Average of closing prices over a specified period (e.g., 50-day MA, 200-day MA). Simple Moving Average (SMA) is a common calculation. | Used to identify trends; a rising MA suggests an uptrend, while a falling MA indicates a downtrend. Crossovers between different MAs (e.g., a 50-day MA crossing above a 200-day MA) can signal trend changes. | Strengths: Simple to calculate and understand; good for identifying trends. Weaknesses: Lagging indicator; can generate false signals in choppy markets. |

| Relative Strength Index (RSI) | A momentum indicator calculated using the average gains and losses over a specified period (typically 14 days). The formula involves smoothing the gains and losses and calculating the relative strength. | Measures the speed and change of price movements. Readings above 70 generally suggest overbought conditions (potential for a price reversal), while readings below 30 indicate oversold conditions (potential for a price bounce). | Strengths: Identifies overbought and oversold conditions; useful for identifying potential reversals. Weaknesses: Can generate false signals; its effectiveness varies across different assets and timeframes. |

| MACD (Moving Average Convergence Divergence) | Calculated using the difference between two exponential moving averages (EMAs) and a signal line (a further EMA of the difference). | Identifies changes in momentum; bullish signals occur when the MACD line crosses above the signal line, and bearish signals when it crosses below. Divergence between the MACD and price can also indicate potential trend reversals. | Strengths: Useful for identifying trend changes and potential reversals. Weaknesses: Can generate false signals; requires understanding of its nuances. |

| Bollinger Bands | Calculated using a moving average and standard deviation. The bands typically consist of three lines: a middle line (moving average) and two outer bands (typically two standard deviations above and below the moving average). | Indicates volatility and potential support and resistance levels. Price bounces off the upper band might suggest overbought conditions, while bounces off the lower band might suggest oversold conditions. Breakouts outside the bands can signal strong price movements. | Strengths: Visual representation of volatility and potential support/resistance; identifies potential breakouts. Weaknesses: Can generate false signals; effectiveness varies depending on market conditions and chosen parameters. |

Fundamental Analysis in Forex Trading

Fundamental analysis involves examining macroeconomic factors that influence currency values. Understanding these factors is crucial for long-term trading success. Key economic indicators provide insights into a country’s economic health and its currency’s potential.

Examples of relevant economic indicators include:

* Gross Domestic Product (GDP): A measure of a country’s economic output. Strong GDP growth usually supports the currency.

* Inflation Rate: A measure of the rate at which prices are rising. High inflation typically weakens a currency.

* Interest Rates: The rates at which central banks lend money. Higher interest rates generally attract foreign investment, strengthening the currency.

* Unemployment Rate: A measure of the percentage of the labor force that is unemployed. Low unemployment usually supports the currency.

* Trade Balance: The difference between a country’s exports and imports. A trade surplus (exports exceeding imports) typically strengthens the currency.

* Government Debt: High levels of government debt can weaken a currency.

Comparing Technical and Fundamental Analysis

Technical and fundamental analysis offer distinct perspectives on the forex market. Technical analysis focuses on price action and chart patterns, while fundamental analysis examines underlying economic factors. Their strengths and weaknesses manifest differently depending on market conditions.

In volatile markets dominated by short-term speculation, technical analysis often provides more immediate signals. However, in calmer, longer-term trends, fundamental analysis provides a more robust foundation for investment decisions. A successful forex trader often integrates both approaches, using fundamental analysis to identify long-term trends and technical analysis to pinpoint optimal entry and exit points. For example, a trader might use fundamental analysis to identify a currency likely to appreciate due to strong economic growth, and then use technical analysis to determine the best time to buy and sell based on chart patterns and indicators.

Risk Management and Money Management

Navigating the volatile world of forex trading requires more than just technical prowess; it demands a robust strategy for managing risk and preserving capital. Ignoring this crucial aspect can quickly transform potential profits into substantial losses. This section Artikels essential risk and money management techniques to help you navigate the market effectively and sustainably.

Successful forex trading hinges on a disciplined approach to risk and money management. These aren’t optional extras; they’re the bedrock of long-term success. Without them, even the most accurate predictions can be wiped out by a single ill-fated trade. This section will delve into practical strategies for safeguarding your capital and maximizing your chances of consistent profitability.

You also can understand valuable knowledge by exploring Can Forex Trading Be a Full-Time Job?.

Stop-Loss Orders and Position Sizing

Stop-loss orders are your safety net. They automatically close a trade when the price reaches a predetermined level, limiting potential losses. Position sizing, on the other hand, determines how much capital you allocate to each trade. Effective position sizing prevents a single losing trade from decimating your account. A common strategy is to risk no more than 1-2% of your trading capital on any single trade. For example, with a $10,000 account, a 1% risk tolerance allows for a maximum loss of $100 per trade. This necessitates careful calculation of stop-loss levels and lot sizes.

Emotional Discipline in Forex Trading

The forex market is emotionally taxing. Fear and greed can lead to impulsive decisions, eroding profits and amplifying losses. Maintaining emotional discipline requires self-awareness, planning, and consistent practice. Techniques like journaling trades, analyzing mistakes objectively, and taking regular breaks can help manage emotional responses. Developing a trading plan and sticking to it, regardless of market fluctuations, is crucial for emotional control. For instance, a trader might pre-determine to exit a trade if it moves against them by a specific percentage, irrespective of their feelings about the market’s potential reversal.

Sample Money Management Plan

A robust money management plan integrates risk tolerance and capital preservation. Consider the following example:

| Parameter | Value |

|---|---|

| Account Size | $5,000 |

| Risk Tolerance | 1% per trade |

| Maximum Loss per Trade | $50 |

| Stop-Loss Placement | Calculated based on technical analysis and risk tolerance |

| Trade Frequency | 2-3 trades per week (depending on market conditions) |

| Profit Target | 1:2 Risk/Reward Ratio (Aiming for $100 profit per trade) |

| Regular Review | Monthly review of performance and adjustments to the plan as needed |

“Successful trading is not about making money on every trade, but about managing risk and consistently profiting over the long term.”

Utilizing Trading Tools and Platforms

Navigating the forex market effectively in 2025 requires leveraging the right tools and platforms. The sheer volume of data and the speed at which the market moves necessitate efficient, user-friendly technology. Choosing the right platform is crucial for both beginners and experienced traders, impacting everything from order execution speed to the quality of your analysis. This section explores various platforms and essential tools to enhance your trading strategy.

Choosing a forex trading platform is a critical decision. The platform you select will directly influence your trading experience, affecting everything from ease of use to the speed of order execution. Consider your trading style, technical analysis preferences, and budget when making your selection. Many platforms offer demo accounts, allowing you to test their features before committing to a live account.

Forex Trading Platforms: A Comparison

The forex market offers a wide array of trading platforms, each with its own strengths and weaknesses. Selecting the right platform depends heavily on individual needs and preferences. Here’s a comparison of some popular choices:

| Platform | Key Features | Cost | User Friendliness |

|---|---|---|---|

| MetaTrader 4 (MT4) | Extensive charting tools, automated trading (Expert Advisors), wide range of indicators, large community support, mobile accessibility. | Varies depending on broker; often free. | Generally user-friendly, but can be overwhelming for beginners. Many tutorials and resources are available. |

| MetaTrader 5 (MT5) | Improved version of MT4 with enhanced charting capabilities, more advanced order types, and economic calendar integration. Supports algorithmic trading. | Varies depending on broker; often free. | Similar to MT4 in terms of user-friendliness; the added features may have a steeper learning curve. |

| cTrader | Fast order execution, advanced charting, excellent for algorithmic and automated trading, user-friendly interface. | Varies depending on broker; often free. | Known for its intuitive design and ease of use, particularly for those focused on automated trading. |

| TradingView | Powerful charting tools, social trading features, vast range of indicators and drawing tools, access to market news and analysis. Not a brokerage platform itself. | Free version with limited features, paid subscriptions for advanced tools and data. | Highly user-friendly interface, even for beginners. Excellent for charting and technical analysis. |

Charting Tools and Technical Analysis

Charting tools are indispensable for technical analysis in forex trading. They allow traders to visualize price movements, identify trends, and predict future price action. Different chart types (candlestick, bar, line) and timeframes offer various perspectives on market behavior. Essential charting tools include trendlines, support and resistance levels, indicators (RSI, MACD, moving averages), and Fibonacci retracements. These tools help traders identify potential entry and exit points, manage risk, and ultimately improve their trading decisions. For example, identifying a clear uptrend using a moving average and then placing a buy order near a support level is a common technical trading strategy.

Automated Trading Systems and Associated Risks

Automated trading systems, also known as Expert Advisors (EAs) or robots, execute trades based on pre-programmed algorithms. They can automate trading strategies, freeing up traders’ time and potentially improving consistency. However, relying solely on automated systems carries significant risks. Market conditions can change rapidly, rendering even well-designed algorithms ineffective. EAs may not adapt to unexpected market events, potentially leading to substantial losses. Thorough backtesting and careful monitoring are crucial when using automated trading systems. Furthermore, the selection of a reliable and well-tested EA is paramount. A poorly designed EA can easily lead to significant financial losses.

Continuous Learning and Adaptation

The forex market is a dynamic beast, constantly shifting and evolving. Success in this arena isn’t a destination; it’s a continuous journey of learning, adapting, and refining your approach. Ignoring this crucial aspect is a recipe for disaster, no matter how brilliant your initial strategy might seem. Staying ahead requires a commitment to lifelong learning and a willingness to embrace change.

The forex landscape is in perpetual motion, influenced by global economic events, geopolitical shifts, and technological advancements. To thrive, you need to be a lifelong student of the market, continuously updating your knowledge and adapting your strategies accordingly. This isn’t about chasing the next “holy grail” trading system; it’s about building a flexible and resilient approach that can weather the inevitable storms.

Key Resources for Continuous Forex Education, How to Succeed in Forex Trading: A Roadmap for 2025

Continuous learning in forex trading requires a multi-faceted approach. Leveraging various resources provides a well-rounded understanding of market dynamics and trading strategies. Ignoring this aspect significantly hinders your progress.

- Books: Classic texts like “Japanese Candlestick Charting Techniques” by Steve Nison provide foundational knowledge. More contemporary works offer insights into specific trading strategies and market analysis techniques. Regularly exploring new books keeps you updated with the latest trends and methodologies.

- Courses: Online platforms offer structured courses covering various aspects of forex trading, from beginner tutorials to advanced strategies. These courses often include interactive exercises and mentorship opportunities, accelerating the learning process. Choosing reputable platforms is crucial to ensure quality education.

- Webinars: Webinars provide real-time access to expert insights and market analyses. Many brokers and financial institutions host free webinars, offering valuable perspectives on current market trends and trading opportunities. Attending regularly helps you stay ahead of the curve.

Staying Updated on Market News and Events

Staying informed about global events and their impact on currency pairs is paramount. Major economic announcements, political shifts, and even natural disasters can significantly influence currency valuations. Ignoring these factors can lead to substantial losses.

Market news sources range from reputable financial news outlets like Bloomberg and Reuters to specialized forex news websites. Utilizing multiple sources provides a more comprehensive view, reducing the risk of bias. Understanding how global events affect currency pairs is crucial for informed decision-making. For instance, unexpected interest rate hikes by a central bank can trigger significant currency fluctuations, impacting trading strategies.

Adapting Trading Strategies

Adaptability is the cornerstone of successful forex trading. What works today might not work tomorrow. Market conditions change constantly, and personal experience shapes your understanding of the market’s intricacies. Ignoring market changes and personal lessons learned is a significant drawback.

The process of adapting involves continuous evaluation of your trading performance. Analyzing both successful and unsuccessful trades identifies areas for improvement. This includes reviewing market conditions during trades, assessing your risk management techniques, and evaluating the effectiveness of your chosen indicators and strategies. Adapting your approach might involve modifying your entry and exit points, adjusting your position sizing, or even completely shifting your trading strategy to align with the evolving market dynamics. For example, a trend-following strategy might need adjustment during periods of high market volatility.

The Psychological Aspect of Forex Trading

Forex trading, while potentially lucrative, is a deeply psychological game. Success isn’t solely determined by technical prowess or market analysis; emotional intelligence and self-awareness are equally crucial. Understanding and managing your psychological biases is paramount to achieving consistent profitability in the volatile world of currency trading. Ignoring this aspect can lead to devastating losses, regardless of your trading strategy.

Common Psychological Pitfalls in Forex Trading

The forex market is a breeding ground for emotional extremes. Fear, greed, and overconfidence are three common psychological pitfalls that can significantly impair a trader’s judgment and lead to poor decision-making. Fear, often manifesting as fear of missing out (FOMO) or fear of loss, can cause traders to enter trades prematurely or hold onto losing positions for too long, hoping for a reversal. Greed, on the other hand, can lead to excessive risk-taking and unrealistic profit targets, resulting in significant losses. Overconfidence, fueled by a few successful trades, can lead to complacency and a disregard for risk management principles, ultimately resulting in a significant drawdown. These emotional responses often override rational analysis, transforming a calculated risk into a reckless gamble.

Strategies for Managing Trading Emotions

Developing strategies to manage trading emotions requires conscious effort and discipline. One effective approach is to establish a strict trading plan that Artikels entry and exit points, stop-loss orders, and risk tolerance levels. Adhering to this plan, regardless of emotional impulses, helps maintain objectivity and consistency. Regular journaling of trades, including emotional states and decision-making processes, can provide valuable insights into personal biases and trigger points. Practicing mindfulness techniques, such as meditation or deep breathing exercises, can help center oneself and reduce stress during periods of market volatility. Furthermore, seeking feedback from experienced traders or mentors can offer external perspectives and identify blind spots in one’s trading approach. Remember, consistent emotional regulation is a skill that requires continuous refinement.

The Importance of Self-Reflection and Continuous Improvement in Trading Psychology

Consistent self-reflection is essential for long-term success in forex trading. Regularly reviewing past trades, analyzing both successes and failures, and identifying patterns in emotional responses can significantly improve trading psychology. This process allows for the identification of personal biases and weaknesses, paving the way for targeted improvements. Continuous learning about behavioral finance and cognitive biases can provide valuable tools for managing emotions and making more rational trading decisions. Seeking professional guidance from a psychologist or trading coach specializing in performance psychology can also offer personalized support and strategies for overcoming specific challenges. The journey to mastering trading psychology is an ongoing process of self-discovery and refinement, demanding continuous commitment and self-awareness.

Building a Sustainable Forex Trading Career

Forex trading, while potentially lucrative, isn’t just about making quick profits; it’s about building a sustainable career. This requires a long-term perspective, strategic planning, and a deep understanding of the market beyond just technical analysis. It’s about crafting a career path that aligns with your skills and ambitions within the dynamic forex landscape.

Building a successful and sustainable forex trading career involves more than just mastering charts and indicators. It necessitates a comprehensive approach that encompasses business acumen, risk management, and continuous learning. Success hinges on a combination of trading proficiency, strategic planning, and a resilient mindset capable of weathering market fluctuations.

Diverse Career Paths in the Forex Industry

The forex market offers diverse career paths beyond individual trading. Opportunities range from working within established financial institutions to building your own independent trading business. Some individuals find fulfillment in roles requiring deep analytical skills, while others prefer client-facing positions.

- Proprietary Trader: This involves trading for a firm using their capital. Success here depends on consistent profitability and adhering to the firm’s risk management guidelines. A proprietary trading firm might offer a salary plus performance-based bonuses.

- Forex Broker: Brokers facilitate trades between buyers and sellers. This path requires a strong understanding of regulatory compliance and client relationship management. A successful forex broker builds trust and provides excellent customer service.

- Forex Analyst: Analysts provide market insights and predictions to clients or firms. This role demands strong analytical skills, in-depth market knowledge, and the ability to communicate complex information clearly. A forex analyst might work for a bank, hedge fund, or provide independent consulting services.

- Financial Educator/Coach: Sharing knowledge and experience can be a rewarding career path. Many successful traders become mentors, offering educational resources or coaching services to aspiring traders. This involves creating educational materials, conducting workshops, or providing one-on-one coaching.

Steps to Building a Successful Forex Trading Business

Establishing a successful forex trading business requires careful planning and execution. It’s not a get-rich-quick scheme but a long-term endeavor demanding dedication, discipline, and adaptability.

- Develop a Solid Business Plan: This should include your trading strategy, risk management protocols, marketing plan, and financial projections. A well-defined business plan serves as a roadmap, guiding your actions and ensuring consistency.

- Secure Funding and Resources: Determine your capital requirements, considering trading costs, software, and marketing expenses. Explore funding options, including personal savings, loans, or attracting investors. Access to reliable trading platforms and analytical tools is crucial.

- Establish a Legal Entity: Consult with legal and financial professionals to determine the best legal structure for your business (sole proprietorship, LLC, etc.). This protects your personal assets and ensures compliance with regulations.

- Build a Strong Online Presence: Create a professional website and engage with potential clients through social media platforms. Transparency and building trust are essential in establishing credibility.

- Market Your Services: Develop a marketing strategy to attract clients. This might involve content marketing, social media engagement, or paid advertising. Focusing on a niche market can be advantageous.

The Importance of Networking and Mentorship

Networking and mentorship are crucial for navigating the complexities of the forex market and building a thriving career. Connecting with experienced traders, industry professionals, and potential clients provides invaluable support and guidance.

“Success in forex trading isn’t solely about technical skills; it’s about building relationships and learning from others’ experiences.”

Networking events, online forums, and mentorship programs offer opportunities to learn from seasoned traders, share insights, and gain access to resources. A mentor can provide valuable guidance, helping you avoid common pitfalls and accelerate your learning curve. Mentorship relationships can be formal or informal, but the shared knowledge and support are invaluable.

Conclusion

So, you want to conquer the forex market? This isn’t a get-rich-quick scheme; it’s about building a sustainable, profitable trading career. By understanding the market trends, mastering technical and fundamental analysis, implementing robust risk management, and honing your trading psychology, you can navigate the complexities of forex trading and position yourself for success in 2025 and beyond. It’s a journey, not a sprint, so buckle up and let’s get started.

Question Bank: How To Succeed In Forex Trading: A Roadmap For 2025

What’s the minimum capital needed to start forex trading?

There’s no magic number, but many brokers allow you to start with a few hundred dollars. However, remember that smaller accounts limit your trading options and risk management flexibility.

How much time should I dedicate to forex trading daily?

It depends on your trading style. Scalpers might need several hours daily, while swing traders may check the market only a few times a week. Find a balance that fits your lifestyle and trading strategy.

Are there any legal considerations for forex trading?

Yes, absolutely! Ensure you comply with all local and international regulations concerning forex trading in your jurisdiction. This includes understanding tax implications and broker regulations.

How do I choose a reliable forex broker?

Research is key! Look for brokers regulated by reputable authorities, with transparent fees, and a user-friendly platform. Read reviews and compare offerings before committing.

Check How to Calculate Forex Profits and Losses to inspect complete evaluations and testimonials from users.