Forex trading simulator free? Yeah, you heard that right. Before you risk your hard-earned cash in the volatile world of forex, why not test your mettle (and your strategies) in a risk-free environment? Free forex trading simulators offer a fantastic opportunity to learn the ropes, hone your skills, and develop a winning trading plan without the fear of losing your shirt. We’re diving deep into the world of these invaluable tools, exploring their features, limitations, and how they can supercharge your forex education.

From understanding the nuances of different trading platforms and order types to mastering technical analysis, free simulators are your secret weapon. This guide will equip you with the knowledge to choose the perfect simulator for your skill level, helping you navigate the complexities of forex trading with confidence. Get ready to unlock the power of simulated trading!

Popularity and Availability of Free Forex Trading Simulators: Forex Trading Simulator Free

The forex market, with its potential for high returns and inherent risks, attracts a diverse range of participants. Beginners often seek low-risk environments to hone their skills before risking real capital, while even experienced traders utilize simulators to test strategies and refine their approach. Free forex trading simulators play a crucial role in this process, offering accessible platforms for learning and practice. Their popularity stems from their cost-effectiveness and the opportunity to experiment without financial repercussions.

Free forex trading simulators are readily available, catering to different levels of trading experience. However, it’s crucial to understand their features, limitations, and user feedback before selecting one. The quality and functionality vary significantly across platforms.

Popular Free Forex Trading Simulators and Their Characteristics, Forex trading simulator free

The availability of free forex trading simulators significantly lowers the barrier to entry for aspiring traders. Several platforms offer robust simulation environments, each with its own strengths and weaknesses. Below is a table comparing five popular options:

| Name | Features | Limitations | User Reviews Summary |

|---|---|---|---|

| MetaTrader 4 (MT4) Demo Account | Widely used platform, extensive charting tools, various indicators, automated trading (Expert Advisors), large community support. | Limited historical data in some demo accounts, potential for lag depending on internet connection. | Generally positive; praised for its comprehensive features and large community, but some users report occasional glitches and slow loading times. |

| MetaTrader 5 (MT5) Demo Account | Similar to MT4 but with enhanced features, including more advanced order types and market depth. | Steeper learning curve compared to MT4, some features may be less intuitive for beginners. | Mixed reviews; many appreciate the advanced features, but some find the interface less user-friendly than MT4. |

| TradingView Paper Trading | User-friendly interface, excellent charting tools, access to a wide range of indicators and drawing tools, integrated with various brokers. | Limited backtesting capabilities compared to dedicated platforms, fewer advanced order types. | Mostly positive; praised for its intuitive interface and excellent charting, but some users wish for more sophisticated backtesting options. |

| FXCM Demo Account | Access to a variety of currency pairs, educational resources, and realistic market conditions. | May have limitations on the number of open positions or strategies available in the demo account. | Positive feedback regarding realistic market conditions and educational materials; some users mention limitations on certain account features. |

| Oanda Practice Account | Access to a wide range of instruments, including forex, precious metals, and indices, and a user-friendly platform. | May lack the advanced charting tools and indicators found in other platforms. | Generally positive; users appreciate the platform’s simplicity and access to various instruments; some find the charting tools less comprehensive than competitors. |

Examples of User Reviews

Here are some examples illustrating the range of user experiences:

MetaTrader 4: “MT4’s demo account is a lifesaver for beginners. The platform is powerful, yet accessible. The large community support is invaluable. However, I did experience some occasional lag during peak trading hours.” – Positive aspect: Powerful and accessible platform with great community support. Negative aspect: Occasional lag.

TradingView: “TradingView’s paper trading is fantastic for charting and analysis. The interface is incredibly intuitive. I wish it had more robust backtesting capabilities, though.” – Positive aspect: Intuitive interface and excellent charting. Negative aspect: Limited backtesting capabilities.

FXCM: “FXCM’s demo account accurately reflects real market conditions, which is crucial for practice. The educational resources are also a big plus. However, I found some limitations on the number of open positions I could have.” – Positive aspect: Realistic market conditions and helpful educational resources. Negative aspect: Limitations on open positions.

Factors Influencing the Popularity of Free Forex Simulators

The popularity of free forex simulators is driven by several factors. For beginners, the low barrier to entry is paramount; they can learn the basics and experiment without risking their finances. The ability to test strategies in a risk-free environment is attractive to both beginners and experienced traders alike. Experienced traders use simulators to backtest new strategies, refine existing ones, and familiarize themselves with new platforms or indicators before deploying them in live trading. The availability of extensive charting tools, indicators, and historical data allows for in-depth analysis and strategy development. Furthermore, the ability to simulate various market conditions, including high volatility periods, helps traders prepare for real-world scenarios. The accessibility and user-friendliness of many free simulators further contribute to their widespread adoption.

Features and Functionality of Free Forex Simulators

Free forex trading simulators offer a valuable tool for aspiring traders to hone their skills and test strategies without risking real capital. However, the features and functionality offered can vary significantly between platforms, impacting the quality of the simulated trading experience. Understanding these differences is crucial for selecting the right simulator to meet individual needs.

Charting Tools and Indicators

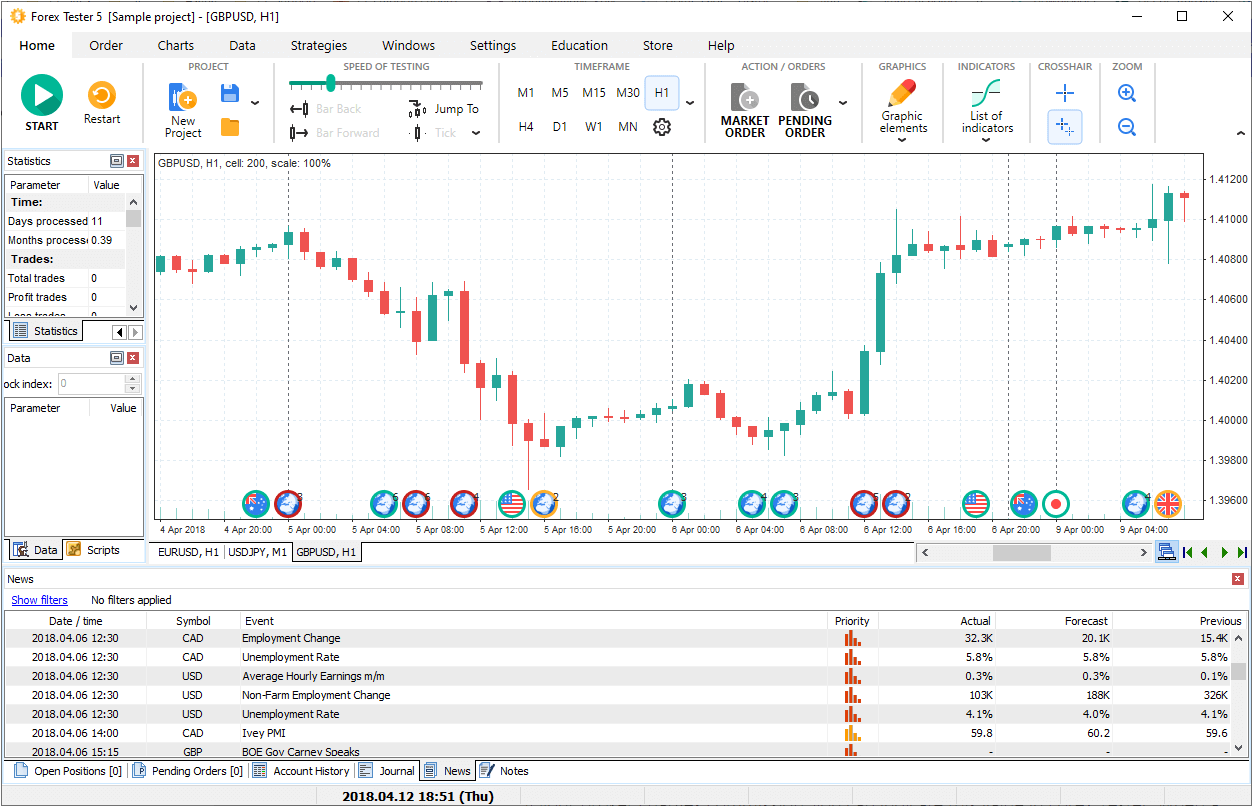

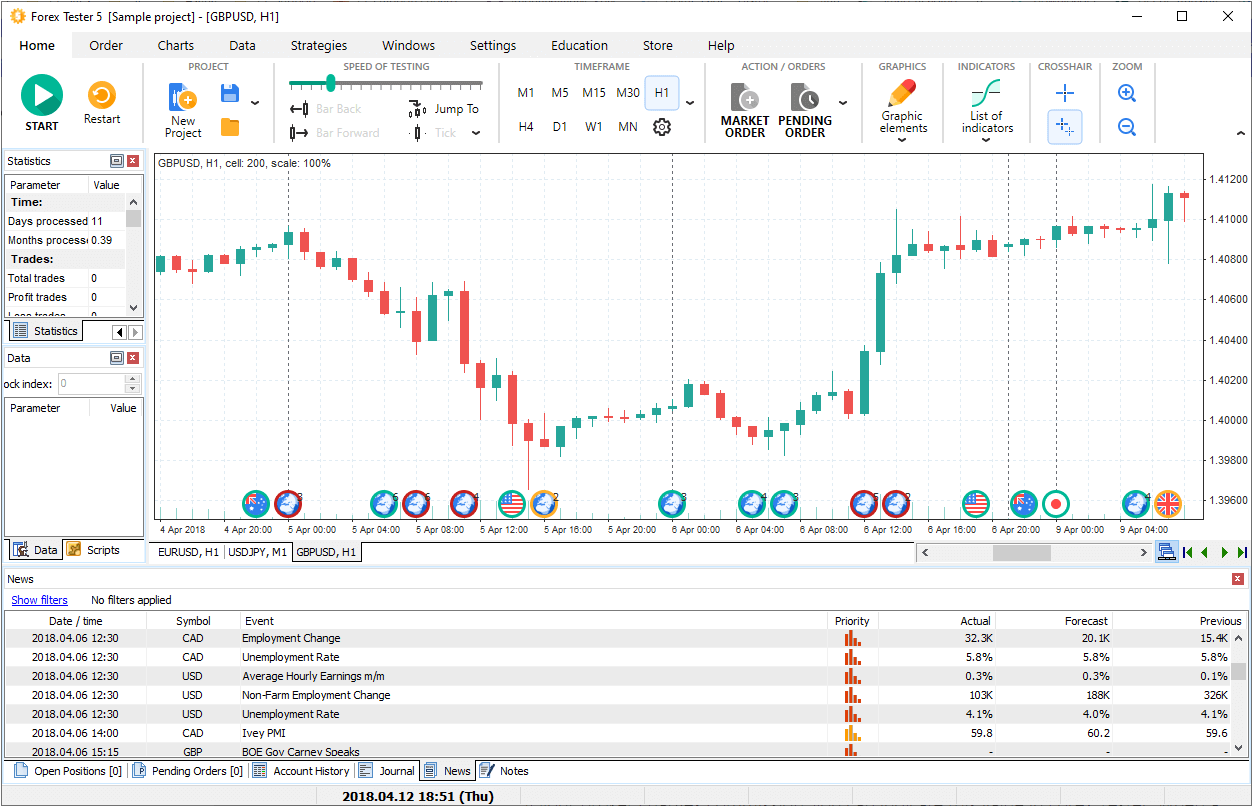

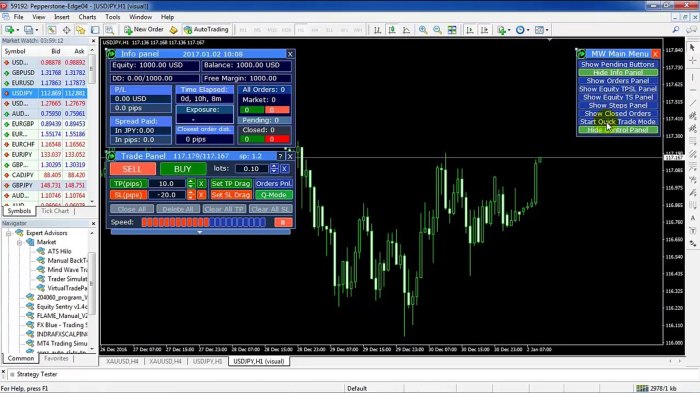

The charting capabilities of a forex simulator are fundamental to its effectiveness. Different simulators provide varying levels of customization and analytical tools. For example, MetaTrader 4 (MT4), often available as a free simulator, offers a wide array of customizable charts, including various timeframes and chart types (candlestick, bar, line). It also boasts a vast library of built-in technical indicators like moving averages, RSI, MACD, and Bollinger Bands. In contrast, a simpler simulator might offer only basic charting options with a limited selection of indicators. Finally, some platforms, such as those offered by certain brokers, may integrate proprietary charting tools and indicators that are not available elsewhere. These proprietary tools might offer unique analytical perspectives or advanced features not found in more generic simulators.

Order Execution Methods

Free forex simulators typically support a range of order types to mirror real-world trading scenarios. Most platforms support market orders, which execute trades at the best available price immediately. Limit orders allow traders to specify the exact price at which they want to buy or sell, ensuring they only enter a position at their desired level. Stop-loss orders are crucial for risk management, automatically closing a trade if the price moves against the trader’s position by a predetermined amount. Many free simulators also include take-profit orders, which automatically close a trade when it reaches a specified profit target. The specific nuances in how these orders are executed and the level of customization available (e.g., setting trailing stop-losses) can differ between platforms.

Data Accuracy and Historical Data Coverage

The accuracy and completeness of historical data are critical for backtesting trading strategies and evaluating their performance. The following table compares these aspects across four popular (or representative) free forex simulators. Note that the data presented here is based on general observations and may vary depending on the specific version and provider of the simulator. Always verify data accuracy independently before relying on it for critical trading decisions.

| Simulator | Data Accuracy (General Assessment) | Historical Data Coverage (Years) |

|---|---|---|

| MetaTrader 4 (Free Versions) | Generally considered accurate, but verification is recommended. | Varies by broker, often 5+ years. |

| cTrader (Demo Account) | High accuracy, typically aligns with market data providers. | Typically 5+ years. |

| NinjaTrader (Free Trial) | High accuracy; known for robust data handling. | Often extensive, sometimes exceeding 10 years. |

| Generic Broker Simulators | Accuracy can vary significantly; careful evaluation is necessary. | Can range widely, from a few months to several years. |

Educational Value and Limitations of Free Simulators

Free forex trading simulators offer a fantastic opportunity for aspiring traders to dip their toes into the market without risking real money. They provide a sandbox environment where you can experiment with different strategies, learn about market mechanics, and develop your trading skills at your own pace. This risk-free environment is invaluable, especially for beginners who might otherwise be intimidated by the potential for financial loss. The learning curve can be steep in forex trading, and simulators offer a crucial stepping stone before committing capital.

Free simulators allow you to hone your skills in a controlled setting, letting you focus on refining your approach without the emotional rollercoaster of real-world trading. You can practice your technical analysis, experiment with different indicators, and get comfortable with the platform’s interface without the pressure of financial consequences. This iterative process of learning and refinement is key to developing a consistent and profitable trading strategy. However, it’s important to acknowledge that free simulators, while beneficial, have inherent limitations.

Limitations of Free Forex Simulators

While free simulators provide valuable educational benefits, they inevitably fall short of the real-market experience and the features offered by paid platforms. One major limitation is the lack of realistic market conditions. Free simulators often use historical data or simplified models that may not accurately reflect the volatility and complexities of live trading. The emotional aspect of trading – the fear of loss and the thrill of profit – is largely absent in a simulated environment. This can lead to a false sense of security and potentially inaccurate assessments of trading strategies. Furthermore, free simulators often lack advanced features found in professional platforms, such as algorithmic trading capabilities or sophisticated backtesting tools. The data quality and the speed of execution might also differ significantly from a real-time trading environment. These limitations highlight the importance of supplementing simulator practice with other learning resources and eventually transitioning to live trading with small, manageable amounts of capital.

Practical Exercises for Beginners

It’s crucial to use free simulators effectively to maximize their educational value. Here are five practical exercises a beginner can perform to improve their trading skills:

- Practice Order Execution: Focus solely on placing and managing orders. Get comfortable with different order types (market orders, limit orders, stop-loss orders, take-profit orders) and learn how to adjust them in response to market fluctuations. This helps build muscle memory and reduces errors when trading with real money.

- Backtesting Simple Strategies: Use historical data to test basic trading strategies, such as moving average crossovers or simple support/resistance trading. Analyze the results, identifying potential flaws and areas for improvement. This allows for systematic testing before deploying a strategy in live trading.

- Risk Management Practice: Experiment with different position sizing techniques and risk management strategies (e.g., setting stop-loss orders, determining appropriate lot sizes). Focus on preserving capital rather than solely on profit maximization. This is a critical aspect of long-term trading success.

- Indicator Experimentation: Explore different technical indicators (e.g., RSI, MACD, Bollinger Bands) and their applications. Test how these indicators perform under various market conditions and identify which ones best suit your trading style. This helps develop an understanding of technical analysis and its limitations.

- Journaling Trading Decisions: Keep a detailed record of your trades in the simulator, noting the rationale behind each decision, the results, and any lessons learned. Regularly reviewing your trading journal allows you to identify patterns in your successes and failures, leading to better decision-making in the future.

Impact of Free Simulators on Forex Trading Education

The rise of free forex trading simulators has dramatically reshaped the landscape of forex education, making previously inaccessible learning opportunities readily available to aspiring traders worldwide. This accessibility has significantly lowered the barrier to entry, empowering individuals to experiment with trading strategies and gain practical experience without risking real capital. This democratization of learning has profound implications for the overall skill level and understanding within the forex trading community.

The ease of access to free simulators has demonstrably shortened the learning curve for many aspiring traders. Instead of relying solely on theoretical knowledge from books or expensive courses, beginners can immediately apply concepts and develop practical skills through hands-on simulation. This iterative process of learning by doing accelerates the acquisition of essential trading skills, such as order placement, risk management, and technical analysis interpretation. The immediate feedback loop provided by the simulator allows for rapid identification and correction of mistakes, fostering a faster learning pace compared to traditional methods.

Comparison of Learning Outcomes: Free Simulators vs. Other Methods

Free forex simulators offer a unique learning experience compared to traditional methods like books and paid courses. While books provide a strong theoretical foundation and courses offer structured learning, free simulators bridge the gap between theory and practice. Books might explain technical indicators, but a simulator allows a trader to observe their application in real-time market conditions. Courses might teach risk management principles, but a simulator lets a trader test different risk management strategies and witness their consequences firsthand, without financial repercussions. Therefore, the learning outcomes differ significantly; simulators provide practical, experiential learning, whereas books and courses primarily offer theoretical knowledge. The ideal scenario combines all three, creating a well-rounded educational experience.

Integrating Free Simulators into a Comprehensive Forex Education Plan

A comprehensive forex education plan for beginners should strategically incorporate free simulators to maximize their educational value. The plan should start with a strong theoretical foundation built through reputable books and educational resources focusing on fundamental and technical analysis, risk management, and trading psychology. Once a foundational understanding is established, the free simulator becomes an invaluable tool for practical application. Beginners should start with paper trading, using the simulator to practice order placement and get accustomed to the trading platform’s interface. Gradually, they can increase the complexity of their trading strategies, testing different approaches and refining their skills. Regular review and analysis of simulated trading performance are crucial to identify areas for improvement and adapt strategies accordingly. This iterative process, combining theoretical knowledge with practical application via the simulator, significantly enhances the overall learning experience and prepares beginners for the challenges of real-market trading.

Choosing the Right Free Forex Trading Simulator

Navigating the world of free forex trading simulators can feel like wading through a sea of options. Finding the perfect one depends heavily on your trading experience and specific goals. This guide helps you choose a simulator that fits your needs, maximizing your learning and minimizing frustration.

Choosing the right free forex trading simulator is crucial for effective learning and practice. The wrong simulator can lead to frustration and hinder progress, while the right one can accelerate your understanding of forex trading dynamics. Consider your skill level and desired features carefully to ensure a positive learning experience.

Simulator Selection Based on Experience Level

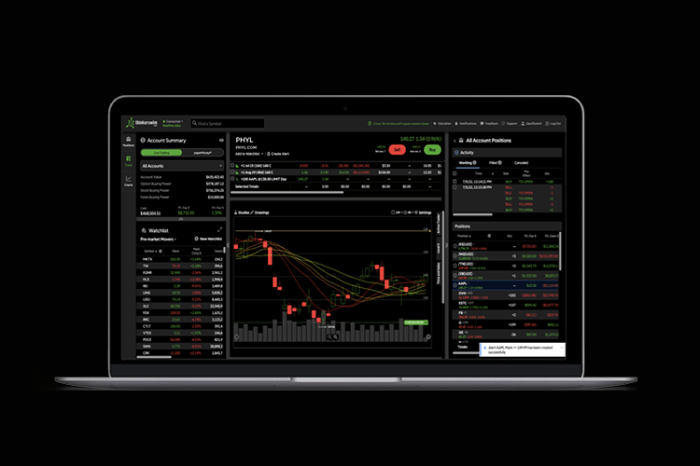

A beginner needs a simulator with a user-friendly interface and comprehensive educational resources. An advanced trader, however, might prefer a simulator that offers more sophisticated features and allows for complex trading strategies.

- Beginners: Look for simulators with simplified interfaces, built-in tutorials, and perhaps even virtual mentorship programs. A simulator that clearly explains basic concepts like leverage, margin, and pip values is ideal. Avoid simulators overloaded with advanced features that might overwhelm a new trader.

- Intermediate Traders: Intermediate traders should seek simulators offering more advanced order types, charting tools, and indicators. The ability to backtest strategies with historical data is also beneficial at this stage. The interface should be intuitive, but not overly simplified.

- Advanced Traders: Advanced traders need simulators that allow for algorithmic trading, automated strategies, and potentially even integration with external data feeds. Features like custom indicators and advanced charting capabilities are essential for this level of trading simulation.

Importance of User Interface, Customer Support, and Community Engagement

The simulator’s user interface should be intuitive and easy to navigate. A clunky or confusing interface can detract from the learning experience and lead to frustration. Reliable customer support is also crucial, especially for beginners who might encounter technical difficulties or have questions about the simulator’s features. A strong community aspect, such as a forum or online chat, can provide valuable peer-to-peer support and learning opportunities.

Consider a scenario where a beginner is struggling with understanding margin calls. A simulator with readily available tutorials and a responsive customer support team would be invaluable in this situation. Conversely, an advanced trader might prioritize a simulator with a robust API for custom indicator development and a community forum where they can discuss complex trading strategies with other experienced users.

Examples of Suitable Simulators for Different Needs

While specific product recommendations are outside the scope of this guide, we can illustrate the concept. Imagine “Simulator A” offering a simplified interface, basic charting, and built-in tutorials – ideal for beginners. Conversely, “Simulator B” could feature advanced charting, algorithmic trading capabilities, and a vibrant online community – more suitable for advanced traders. The key is to find the simulator that best matches your current skill level and future aspirations.

Closing Summary

So, there you have it – a comprehensive look at the world of free forex trading simulators. While they might not perfectly replicate the adrenaline-pumping reality of live trading, they offer an invaluable stepping stone to success. By leveraging the educational benefits and carefully choosing a simulator that suits your needs, you can significantly reduce your learning curve and boost your chances of achieving profitable trades in the real forex market. Ready to start your simulated trading journey? Let the games begin!

Discover the crucial elements that make forex trading fidelity the top choice.

You also can understand valuable knowledge by exploring ai trading bot forex.