Forex trading practice apps are your secret weapon to conquering the forex market without risking your hard-earned cash. These digital training grounds offer a realistic simulation of live trading, letting you hone your skills and test strategies before diving into the real thing. From virtual simulators to demo accounts linked to real brokers, these apps pack features like charting tools, risk management features, and even automated trading options. Mastering these tools is key to becoming a forex pro.

This guide dives deep into the world of forex trading practice apps, exploring their various types, essential features, and effective learning strategies. We’ll cover everything from choosing the right app to transitioning smoothly from simulated trading to live trading. Get ready to level up your forex game!

Introduction to Forex Trading Practice Apps

Forex trading, the global exchange of currencies, can be a thrilling yet risky venture. Before diving into the real market with your hard-earned cash, honing your skills and understanding risk is crucial. This is where forex trading practice apps become invaluable tools, offering a safe and controlled environment to learn the ropes and refine your strategies.

Practice apps provide a risk-free space to experiment with different trading strategies, understand market dynamics, and develop a robust trading plan without the fear of financial loss. They bridge the gap between theoretical knowledge and practical application, enabling traders to build confidence and competence before entering the live market. This allows for a smoother transition to real trading and potentially mitigates significant financial risks associated with inexperience.

Purpose and Benefits of Forex Trading Practice Apps

Forex trading practice apps serve the primary purpose of simulating real market conditions, allowing users to practice trading without risking real capital. The benefits extend beyond simply avoiding losses; they also include the opportunity to learn technical and fundamental analysis, develop risk management skills, test trading strategies, and familiarize oneself with trading platforms and their functionalities. By repeatedly practicing trades in a simulated environment, traders can improve their decision-making process, reaction time, and overall trading proficiency. This ultimately leads to increased confidence and better-informed trading decisions in the live market.

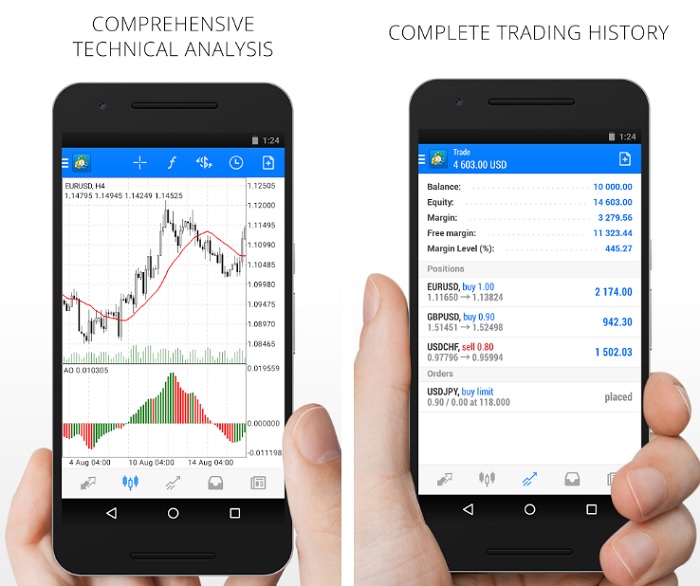

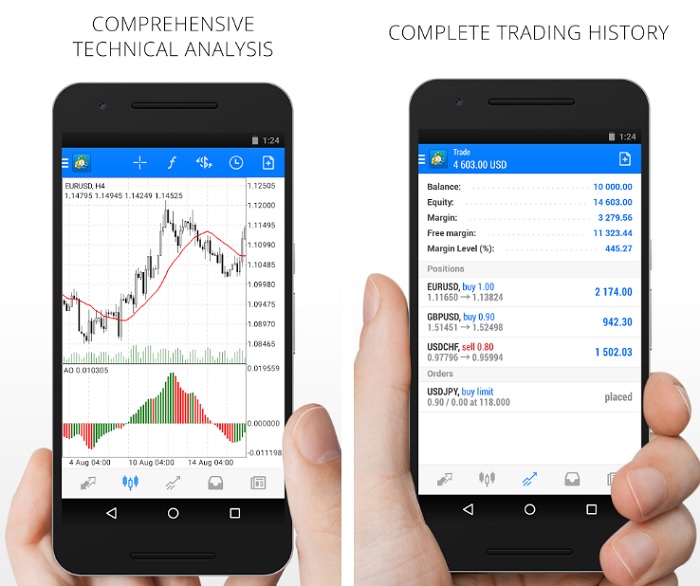

Common Features of Forex Trading Practice Apps

Many forex trading practice apps offer a range of features designed to enhance the learning experience. These typically include access to historical market data, allowing users to practice trading past events and analyze their performance against actual market movements. Most apps also provide charting tools to visualize price trends and technical indicators, helping users identify potential trading opportunities and manage risks effectively. Virtual funds are provided, enabling traders to simulate real trades without real financial consequences. Some apps also incorporate educational resources, such as tutorials and market analyses, to supplement the practical trading experience. Furthermore, many offer customizable settings to tailor the simulation to individual learning preferences and risk tolerance levels.

Comparison of Different App Types: Simulator vs. Demo Account Linked

Forex trading practice apps generally fall into two main categories: standalone simulators and apps linked to demo accounts provided by forex brokers. Standalone simulators offer a self-contained practice environment, often with simplified market conditions and limited functionalities. They are ideal for beginners who want to grasp the basics of forex trading without the complexities of a full brokerage platform. Conversely, demo accounts linked to a broker’s platform provide a more realistic trading experience, mirroring the actual trading environment more closely. They usually offer access to a wider range of instruments, advanced charting tools, and more sophisticated order types. The choice between these app types depends on the user’s experience level and specific learning goals. Beginners might find standalone simulators easier to use initially, while more experienced traders might benefit from the realism of a demo account linked app.

Key Features of Effective Practice Apps: Forex Trading Practice App

So, you’re ready to dive into the forex market, but the real thing feels a little… daunting? That’s where practice apps come in. A good forex trading simulator isn’t just a toy; it’s a crucial tool for honing your skills and building confidence before risking real capital. Choosing the right one, however, requires understanding what makes it truly effective.

A truly effective forex practice app needs more than just a chart and some buy/sell buttons. It needs to accurately reflect the complexities and nuances of the actual market, providing a realistic training ground. This means simulating not only price movements but also the psychological pressures and decision-making processes involved in live trading.

Realistic Market Data Simulation

The foundation of any worthwhile forex practice app lies in its ability to accurately simulate market conditions. This goes beyond simply displaying historical price data; it requires sophisticated algorithms that replicate the volatility, trends, and unexpected market shifts that define real-world trading. A good app will use a variety of data sources and models to ensure that its simulations are as close to reality as possible. For instance, it might incorporate news events and economic indicators to trigger price fluctuations, mirroring the impact of real-world factors. An app failing to offer this realistic simulation risks training traders on a simplified, and ultimately misleading, version of the market. The consequence? A trader ill-prepared for the unpredictable nature of actual forex trading.

Risk Management Tools

Risk management isn’t just an afterthought; it’s the bedrock of successful forex trading. A practice app should integrate powerful risk management tools to teach proper trading habits from the start. This might include features like setting stop-loss and take-profit orders, visualizing potential profit and loss scenarios, and enforcing position sizing rules based on the trader’s risk tolerance. For example, a user might be limited to only trading a certain percentage of their virtual capital per trade, mimicking the constraints of real-world trading. Without these built-in safeguards, a practice app risks fostering risky behavior that could prove disastrous in live trading. The app should emphasize the importance of calculated risk and responsible trading.

Ideal Practice App Feature Set

An ideal forex practice app would combine the above features with several others to create a comprehensive learning environment. This would include:

- Multiple Account Types: Allowing users to experiment with different account types (e.g., demo, micro, standard) to understand the implications of leverage and margin.

- Advanced Charting Tools: Offering a variety of charting tools and indicators to analyze price movements and identify trading opportunities.

- Educational Resources: Integrating tutorials, glossary of terms, and educational materials to enhance learning and understanding of forex concepts.

- Performance Tracking: Providing detailed performance statistics and analytics to track progress and identify areas for improvement. This could include win/loss ratios, average trade duration, and profit/loss percentages.

- Simulated News Feeds: Incorporating simulated news feeds and economic calendar events that impact market movements, enhancing the realism of the simulation.

This hypothetical feature set represents a comprehensive approach to forex practice, offering a robust and realistic simulation environment coupled with essential learning tools. It’s a blend of practical application and theoretical knowledge, crucial for developing a well-rounded forex trader.

App Selection and User Experience

Choosing the right forex trading practice app can significantly impact your learning journey. A well-designed app provides a seamless and intuitive experience, fostering engagement and effective skill development. Conversely, a poorly designed app can lead to frustration and hinder progress. The key lies in understanding the nuances of different apps and identifying features that align with your learning style and goals.

Navigating the plethora of forex trading practice apps available can feel overwhelming. Each app boasts unique features and user interfaces, making the selection process crucial. A user-friendly interface is paramount; it should be intuitive and easy to navigate, even for beginners. Factors such as chart functionality, order placement mechanisms, and the overall visual appeal all contribute to a positive user experience. Let’s delve into a comparison of some popular options.

Forex Practice App Comparison

The following table compares several popular forex trading practice apps, highlighting key features, user ratings (based on aggregated reviews from various app stores), and overall impressions. Remember that user ratings and impressions are subjective and can vary depending on individual preferences and experiences.

| App Name | Key Features | User Rating (Average) | Overall Impression |

|---|---|---|---|

| MetaTrader 4 (MT4) Practice Account | Wide range of indicators, expert advisors, charting tools, extensive historical data. | 4.5/5 | Highly regarded for its comprehensive features and robust functionality; can have a steeper learning curve for beginners. |

| TradingView | Powerful charting tools, numerous indicators, backtesting capabilities, educational resources, social trading features. | 4.7/5 | Excellent for charting and technical analysis; less emphasis on simulated trading but offers a strong learning environment for chart reading. |

| Myfxbook AutoTrade | Automated trading strategies testing, portfolio management, and performance analysis tools. | 4.2/5 | Strong focus on automated trading; less ideal for beginners learning fundamental analysis or manual trading techniques. |

| FXCM Practice Account | Access to various trading platforms, educational resources, and demo accounts mirroring real market conditions. | 4.3/5 | User-friendly interface; good for beginners; provides a realistic trading simulation experience. |

Examples of Good and Bad User Experiences

Positive user experiences often involve intuitive navigation, responsive interfaces, and a clear presentation of information. For example, an app with clearly labeled buttons, easily accessible help menus, and visually appealing charts contributes to a positive learning environment. Conversely, a poorly designed app might have cluttered interfaces, confusing terminology, or slow loading times, leading to frustration and a negative learning experience. Imagine trying to execute a trade on an app with unresponsive buttons during a volatile market – that’s a recipe for disaster and a bad user experience.

Factors to Consider When Choosing a Practice App

Selecting the right forex practice app requires careful consideration of several factors. The app’s features, user interface, educational resources, and overall reputation all play a significant role in determining its suitability for your needs.

Obtain direct knowledge about the efficiency of best forex trading training course through case studies.

Users should prioritize apps with:

- Intuitive interface and easy navigation.

- Realistic market simulation with accurate price feeds.

- Comprehensive charting tools and technical indicators.

- Access to educational resources and tutorials.

- A strong reputation and positive user reviews.

- Adequate customer support.

Learning Strategies and Practice Techniques

Mastering forex trading isn’t about luck; it’s about strategic practice. A forex trading practice app is your virtual playground, allowing you to hone your skills without risking real capital. By employing effective learning strategies and realistic practice techniques, you can significantly accelerate your learning curve and build confidence before entering the live market.

Effective practice isn’t just about randomly placing trades. It’s about focused learning, replicating real-world scenarios, and systematically testing different strategies. This section details how to maximize your app’s potential for skill development.

Developing a Scalping Strategy Using a Practice App

Scalping, a high-frequency trading style, demands quick decision-making and precise execution. A practice app provides the ideal environment to refine your scalping skills. Let’s Artikel a step-by-step approach:

- Define Your Parameters: Start by selecting a currency pair (e.g., EUR/USD) and a timeframe (e.g., 1-minute chart). Determine your entry and exit criteria, focusing on small price movements. For instance, you might aim for a 2-pip profit target and a 1-pip stop-loss.

- Identify Trading Signals: Choose technical indicators suited for scalping, such as moving averages (e.g., 5-period and 20-period) or the Relative Strength Index (RSI). Practice identifying clear buy and sell signals based on these indicators. For example, a bullish crossover of the 5-period MA over the 20-period MA might signal a buy, while a bearish divergence between price and RSI might indicate a sell opportunity.

- Simulate Trades: Using your defined parameters and chosen indicators, simulate trades within the app. Focus on precise order placement and swift execution. Note your trades, including entry and exit points, profit/loss, and the rationale behind each decision.

- Analyze Performance: Regularly review your simulated trades. Identify patterns in successful and unsuccessful trades. Analyze your risk management: Did you stick to your stop-loss? Did you allow emotions to influence your decisions? This crucial step highlights areas for improvement.

- Refine Your Strategy: Based on your analysis, refine your scalping strategy. Adjust your entry/exit criteria, indicators, or risk management approach. Iterative refinement is key to optimizing your performance.

Practicing Swing Trading Strategies

Swing trading involves holding positions for several days or weeks, capitalizing on medium-term price swings. Unlike scalping, swing trading requires a different approach to risk management and technical analysis.

- Identify Swing Points: Practice identifying potential swing highs and lows using candlestick patterns (e.g., head and shoulders, double tops/bottoms) and support/resistance levels. A break above a resistance level might signal a long position, while a break below a support level might suggest a short position.

- Employ Indicators: Utilize indicators like the MACD or Bollinger Bands to confirm potential swing points and gauge momentum. For example, a MACD bullish crossover might signal a potential buying opportunity, while a price break below the lower Bollinger Band might indicate a potential sell signal.

- Manage Risk: Develop a robust risk management plan, defining your position size and stop-loss orders based on your risk tolerance. For instance, you might risk only 1-2% of your simulated account balance on each trade.

- Backtesting and Forward Testing: Use the app’s historical data to backtest your swing trading strategy. Then, apply the refined strategy to current market conditions using the app’s simulated trading environment. This iterative process helps you refine your strategy and assess its effectiveness.

Realistic Trading Scenarios for Practice

To make your practice sessions more effective, simulate real-world market events. For example:

- News Events: Practice trading during periods of high volatility triggered by economic news releases (e.g., Non-Farm Payroll data). Observe how news impacts price action and adapt your strategy accordingly.

- Market Corrections: Simulate market corrections or pullbacks. Practice identifying potential support levels and managing your positions during periods of uncertainty.

- Gaps: Practice navigating market gaps, understanding how they can affect your trades and adjusting your strategy to minimize risk.

Risk Management and Simulated Trading

Simulated trading, while not mirroring the emotional rollercoaster of live forex, offers an invaluable training ground for mastering risk management. Ignoring risk management in your practice sessions is like practicing basketball without a hoop – you might develop some skills, but you’ll never truly master the game. Effective risk management is crucial for long-term success in forex, and a practice app is the perfect place to hone this vital skill without risking real capital.

Risk management in simulated trading allows you to experiment with various strategies and observe their impact without the fear of significant financial loss. This iterative process is key to developing a robust trading plan that aligns with your risk tolerance and trading style. By systematically testing different approaches in a safe environment, you can identify what works best for you and avoid costly mistakes down the line. Think of it as a controlled experiment where you’re the scientist, your trading strategy is the hypothesis, and your simulated account is the lab.

Defining and Implementing Risk Management Strategies

Effective risk management hinges on understanding and controlling your potential losses. This involves defining your risk tolerance – how much of your trading capital you’re willing to lose on any single trade – and sticking to it religiously. A common approach is to limit risk to a small percentage (e.g., 1-2%) of your total account balance per trade. Practice apps typically allow you to set stop-loss orders, which automatically close a trade when the price reaches a predetermined level, limiting potential losses. By setting these stop-losses, you’re essentially drawing a line in the sand, protecting your capital from significant erosion. For example, if you have a $1000 simulated account and a 1% risk tolerance, your maximum loss per trade should be $10.

Testing Different Risk Management Techniques

Your practice app provides a sandbox to experiment with various risk management strategies. You can test different stop-loss levels, position sizing techniques, and risk-reward ratios. Let’s say you want to test a strategy with a 1:2 risk-reward ratio. This means that for every $1 you risk, you aim for a $2 profit. You can use your practice app to execute several trades with this ratio, observing the outcome and adjusting your strategy accordingly. You might discover that your chosen risk-reward ratio works well in certain market conditions but not in others, allowing you to refine your approach. Similarly, you can test different position sizing methods to see how they affect your overall portfolio performance under varying market volatility.

Avoiding Common Beginner Mistakes

Many beginners fall into the trap of neglecting risk management in simulated trading, viewing it as “practice money” and taking excessive risks. This undermines the entire purpose of the exercise. Another common mistake is failing to adjust position sizing based on market volatility. During periods of high volatility, maintaining the same position size can lead to disproportionately large losses, even with stop-losses in place. Additionally, some beginners ignore their predetermined stop-loss levels, hoping for a price reversal, often resulting in significant losses. Finally, ignoring proper journaling and post-trade analysis hinders learning from mistakes. Record each trade, including the rationale, risk management parameters, and the outcome. Analyze what went right and, more importantly, what went wrong. This reflective process is crucial for improvement.

Transitioning from Practice to Live Trading

So, you’ve conquered your demo account, racking up virtual profits and feeling like a Forex guru? Congratulations! But the real game starts now. Moving from the simulated world of practice apps to the volatile reality of live trading requires more than just confidence; it needs a strategic approach and a healthy dose of self-awareness. The thrill of real money, the pressure of potential losses, and the sheer unpredictability of the market can significantly alter your trading style and mindset. This transition isn’t just about clicking buttons differently; it’s about adapting your entire approach.

The psychological shift from simulated to real market conditions is perhaps the most significant hurdle. In a demo account, mistakes are cost-free, fostering a riskier, more experimental approach. Live trading introduces the emotional weight of real financial consequences. Fear of loss can lead to hesitant trading or impulsive decisions driven by panic, while the allure of quick profits might encourage overtrading and disregard for risk management strategies perfected in the practice phase. Understanding and managing these emotions is crucial for long-term success.

Psychological Aspects of Live Trading

The emotional rollercoaster of live trading is real. The adrenaline rush of a winning trade can be intoxicating, while the sting of a losing one can be demoralizing. This emotional volatility can significantly impact trading decisions, leading to inconsistencies and potentially significant losses. Experienced traders develop strategies to manage these emotions, such as setting daily profit targets and stop-loss orders to limit potential losses, and employing mindfulness techniques to stay focused and calm under pressure. For example, a trader might visualize their trading plan before entering a trade, helping to reduce impulsive decisions driven by fear or greed. Consistent journaling of trades, including emotional responses, can help identify patterns and improve emotional regulation over time.

Checklist for Transitioning to Live Trading

Before diving headfirst into live trading, a meticulous checklist can significantly reduce the risk of costly errors. This isn’t about avoiding risk altogether—it’s about managing it effectively.

A well-defined trading plan is paramount. This plan should detail your trading strategy, risk tolerance, money management rules, and entry/exit points. It should also Artikel your emotional management strategies, such as how you will handle winning and losing streaks. For instance, a trader might allocate only 2% of their capital per trade, regardless of market conditions. This prevents a single loss from wiping out a substantial portion of their account.

Find out further about the benefits of automated forex trading that can provide significant benefits.

Start with a small account. Don’t throw your life savings into the market immediately. Begin with a small amount you’re comfortable losing, allowing you to gain experience and refine your strategies without significant financial repercussions. This approach allows for learning from mistakes without severe consequences. For example, starting with $500 instead of $5000 provides a buffer for experimentation and minimizes the emotional impact of losses.

Thorough market research and analysis are essential. Your practice may have involved simulated trading, but real-world market conditions require a deeper understanding of fundamental and technical analysis. Stay updated on global economic news, political events, and any other factors that could impact the markets. For example, understanding the impact of a central bank’s interest rate decision on currency pairs is crucial for informed trading.

Consistent journaling and review of trades is crucial for identifying patterns and improving your strategy. Record your trades, including your reasoning, entry/exit points, and the outcome. Analyze your wins and losses to identify recurring themes and refine your approach. This systematic approach helps in improving decision-making over time.

Seek guidance from experienced traders or mentors. Their insights and experiences can be invaluable in navigating the complexities of live trading. Mentorship provides access to alternative perspectives and strategies, accelerating the learning curve and minimizing potential errors.

Advanced Features and Functionality

Stepping up your forex trading game often means leveraging advanced tools beyond basic chart analysis and order placement. Many practice apps offer features that mirror the capabilities of professional trading platforms, allowing you to hone your skills in a risk-free environment and prepare for the complexities of live trading. These advanced features aren’t just bells and whistles; they’re crucial for developing a robust and adaptable trading strategy.

Many sophisticated forex practice apps go beyond simple chart reading and simulated trades. They incorporate features that allow for in-depth analysis and the testing of automated trading strategies, providing a significantly more realistic and comprehensive learning experience. This enables traders to identify and refine their approach, leading to improved performance when they transition to live trading.

Backtesting Capabilities, Forex trading practice app

Backtesting allows you to test your trading strategies on historical market data. Imagine you’ve developed a complex system involving multiple indicators and specific entry/exit points. Instead of deploying it live and risking capital, you can feed historical data into the app’s backtesting engine. This simulates the performance of your strategy over a chosen period, showing you potential profits, losses, and drawdowns. This process is invaluable for identifying weaknesses in your strategy before real money is involved. For example, a strategy might perform exceptionally well during a bull market but fail miserably during periods of high volatility. Backtesting helps expose such vulnerabilities. The results aren’t a guarantee of future success, but they provide a much clearer picture of your strategy’s potential and limitations.

Automated Trading Strategy Development and Testing

Some advanced forex practice apps allow you to develop and test automated trading strategies using programming languages like MQL4 or Python. This involves creating algorithms that define your entry and exit rules, risk management parameters, and other aspects of your trading system. These algorithms are then tested using the app’s backtesting engine or simulated trading environment. For instance, you could program a strategy that automatically enters a long position when a specific moving average crosses above another, and exits when a predetermined stop-loss or take-profit level is reached. This feature is extremely powerful for traders who want to explore algorithmic trading without the initial risks associated with live trading. The process involves designing the logic, coding it, backtesting, refining based on the results, and then potentially implementing a portion of it in live trading after thorough testing.

Economic Calendar Integration and News Sentiment Analysis

Many sophisticated practice apps integrate with real-time economic calendars and news feeds. This allows you to simulate trading based on actual news events and economic data releases, mimicking the real-world environment more accurately. For example, you can observe how your strategy reacts to a surprise interest rate hike or a significant geopolitical event. Furthermore, some apps offer sentiment analysis tools, which gauge the market’s overall reaction to news events. This provides valuable context for understanding price movements and refining your trading decisions. By incorporating real-world events and market sentiment, the practice becomes far more realistic and helps you prepare for the unpredictable nature of forex trading.

Illustrative Examples of Successful Practice

Mastering forex trading requires diligent practice. A well-designed practice app allows you to test strategies and refine your approach without risking real capital. Let’s examine some hypothetical scenarios illustrating successful application of learned techniques.

Successful practice isn’t about consistently winning trades, but about consistently applying your strategy and learning from both successes and failures. The examples below highlight the importance of risk management, market analysis, and disciplined execution.

EUR/USD Long Position After Breakout

This scenario involves a bullish breakout on the EUR/USD pair. Prior to the breakout, the pair had been consolidating in a tight range between 1.0900 and 1.0950 for several days. Using a practice app, a trader identified strong support at 1.0900 and noticed increasing volume near the upper boundary of the range. The trader placed a buy order at 1.0955, just above the resistance level, with a stop-loss order at 1.0900 (55 pips). Once the price broke through 1.0950, the price rapidly moved to 1.1020, at which point the trader took profit, securing a 65-pip gain. The practice app accurately simulated the slippage and commissions associated with the trade.

GBP/USD Short Position Following Bearish Engulfing Pattern

A bearish engulfing candlestick pattern formed on the GBP/USD daily chart. This pattern, coupled with negative economic news regarding the UK, suggested a potential downward trend. Using the practice app’s charting tools, the trader confirmed the pattern and identified a resistance level at 1.2300. A short position was entered at 1.2295, with a stop-loss order at 1.2320 (25 pips). The price subsequently dropped to 1.2200, allowing the trader to close the position for a 95-pip profit. The practice app allowed the trader to visualize the trade execution and its impact on their simulated account balance.

USD/JPY Scalping Strategy

This example showcases a scalping strategy on the USD/JPY pair. The trader, using the app’s one-minute chart, identified a series of small price movements. Employing a strategy based on identifying support and resistance levels within a short timeframe, the trader placed multiple small trades, capitalizing on minor price fluctuations. While each individual trade resulted in a small profit (5-10 pips), the cumulative effect of multiple successful trades over a short period generated a significant overall profit of 50 pips, demonstrating the effectiveness of a consistent scalping approach within the simulated environment. The app’s charting tools facilitated quick identification of entry and exit points.

Outcome Summary

So, are you ready to transform from forex newbie to confident trader? A forex trading practice app is your first step. By utilizing the right app and employing effective learning strategies, you can build a solid foundation, master risk management, and confidently transition to live trading. Remember, practice makes perfect, and these apps provide the safe space you need to refine your skills and achieve forex success. Start practicing today!