Thinkorswim forex trading isn’t just about charts and graphs; it’s about mastering the global currency market. This platform, packed with powerful tools and insightful features, empowers traders of all levels to navigate the exciting (and sometimes volatile) world of forex. From its intuitive charting capabilities to its robust order management system, thinkorswim provides a comprehensive ecosystem for strategizing, executing, and managing your forex trades. Prepare to unlock the potential of this dynamic market, one trade at a time.

We’ll delve into specific strategies, risk management techniques, and the educational resources available to help you sharpen your forex trading skills within the thinkorswim environment. Whether you’re a seasoned pro or just starting, we’ll equip you with the knowledge and insights to confidently navigate the complexities of the forex market using thinkorswim’s powerful features. Get ready to level up your trading game!

Thinkorswim Platform Features for Forex Trading

Thinkorswim, developed by TD Ameritrade, offers a robust platform for forex trading, boasting a comprehensive suite of tools and functionalities designed to cater to both novice and experienced traders. Its strength lies in its advanced charting capabilities, powerful order management system, and a wide array of analytical tools, making it a compelling choice for navigating the dynamic forex market. However, its complexity can be a barrier to entry for some users.

Thinkorswim Forex Trading Features Compared to Other Platforms

A direct comparison highlights Thinkorswim’s strengths and weaknesses relative to other popular platforms. The following table compares four key features across several platforms, offering a snapshot of the competitive landscape. Note that features and offerings can change over time, so it’s always recommended to check the latest information directly from the platform providers.

| Feature | Thinkorswim | MetaTrader 4 (MT4) | cTrader | TradingView |

|---|---|---|---|---|

| Charting Capabilities | Extensive customizable charts, numerous indicators and drawing tools, advanced charting studies | Solid charting, good range of indicators, relatively less customization | Modern, clean interface, good charting features, focus on automation | Highly customizable, vast library of indicators and scripts, social trading features |

| Order Management | Advanced order types, including OCO (One Cancels Other), bracket orders, and complex conditional orders; multiple order entry methods. | Standard order types, some advanced orders available through brokers, relatively simple order management. | Advanced order types, strong automation capabilities, algorithmic trading support. | Order management is broker-dependent, integrated with various brokers. |

| Analytical Tools | Wide array of technical indicators, fundamental data integration (with potential subscription fees), backtesting capabilities. | Good selection of built-in indicators, limited fundamental data, backtesting available with some brokers. | Focus on algorithmic and automated trading, integration with various analytics providers. | Extensive indicator library, user-created scripts, screeners, and alerts. |

| Ease of Use | Steep learning curve, powerful but complex interface, many features may be overwhelming for beginners. | Relatively user-friendly, intuitive interface, suitable for both beginners and experienced traders. | User-friendly interface, designed for ease of use and automation. | User-friendly interface for charting, but order management is broker-dependent. |

Thinkorswim’s Superior Charting Capabilities for Forex Analysis

Thinkorswim’s charting capabilities are considered by many to be superior for forex analysis due to its extensive customization options and the sheer number of technical indicators available. Traders can create highly personalized charts using various chart types such as candlestick, bar, line, Renko, Kagi, and Point & Figure charts. Furthermore, the platform supports a vast library of technical indicators, including moving averages (simple, exponential, weighted), RSI, MACD, Bollinger Bands, Fibonacci retracements, and many more, allowing for in-depth market analysis. For instance, combining a candlestick chart with the RSI and MACD indicators can help identify potential overbought or oversold conditions, providing valuable insights for trading decisions. The ability to overlay multiple indicators and drawing tools simultaneously enhances the analytical process, enabling traders to develop a comprehensive understanding of price action and market trends.

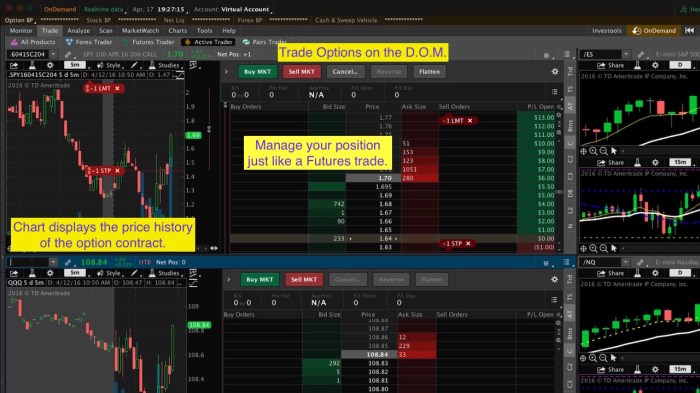

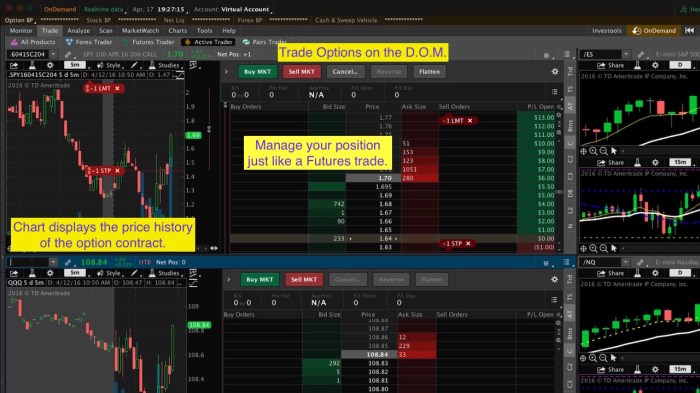

Thinkorswim’s Forex Order Management System

Thinkorswim’s order management system offers a wide range of order types, including market orders, limit orders, stop orders, OCO orders (One Cancels Other), and bracket orders. This flexibility allows traders to execute trades precisely according to their strategy and risk tolerance. The ability to place complex conditional orders, such as trailing stops, further enhances risk management. However, the sheer number of features and options can be overwhelming for new users, requiring a significant learning curve to master. While the advanced order types provide powerful tools, the complexity might be a disadvantage for less experienced traders who may find simpler platforms easier to navigate.

Forex Trading Strategies on Thinkorswim

Thinkorswim, with its robust charting tools and backtesting capabilities, provides a fertile ground for developing and refining various forex trading strategies. Understanding how to leverage its features is key to successful trading. This section explores three distinct strategies, illustrating how Thinkorswim’s tools can be applied for effective implementation and analysis.

Three Forex Trading Strategies on Thinkorswim

Thinkorswim offers a versatile environment for implementing a range of forex trading strategies. Here, we explore three distinct approaches: a moving average crossover strategy, a breakout strategy using candlestick patterns, and a trend-following strategy employing the Relative Strength Index (RSI). Each strategy utilizes different indicators and chart patterns available within the Thinkorswim platform.

- Moving Average Crossover Strategy: This classic strategy uses two moving averages (e.g., a 50-period and a 200-period simple moving average) to identify potential buy and sell signals. A buy signal is generated when the shorter-term moving average crosses above the longer-term moving average, suggesting an upward trend. Conversely, a sell signal occurs when the shorter-term moving average crosses below the longer-term moving average. Thinkorswim’s charting tools make it easy to visualize these crossovers and set alerts for them. Successful implementation requires understanding market context and managing risk appropriately.

- Breakout Strategy Using Candlestick Patterns: This strategy focuses on identifying breakouts from established price ranges or consolidation patterns. Candlestick patterns, such as engulfing patterns or morning/evening stars, can signal potential breakouts. Thinkorswim’s charting tools allow traders to easily identify these patterns and draw trendlines to define support and resistance levels. Traders can combine candlestick analysis with volume analysis to confirm breakout signals and manage risk. A strong breakout often accompanies increased trading volume.

- Trend-Following Strategy Using RSI: The Relative Strength Index (RSI) is a momentum indicator that oscillates between 0 and 100. This strategy utilizes the RSI to identify overbought and oversold conditions. A reading above 70 is generally considered overbought, suggesting a potential price reversal, while a reading below 30 is considered oversold, suggesting a potential price bounce. Thinkorswim allows traders to customize RSI settings and combine it with other indicators for confirmation. This strategy is best suited for trending markets and requires careful risk management to account for false signals.

Backtesting Forex Strategies on Thinkorswim

Backtesting allows traders to simulate the performance of a trading strategy on historical data. Thinkorswim’s backtesting tool provides a powerful way to evaluate the effectiveness of a strategy before implementing it with real money.

To illustrate, let’s consider a hypothetical backtesting scenario: We’ll test the moving average crossover strategy (50-period and 200-period SMA) on the EUR/USD pair from January 1, 2022, to December 31, 2022. Within Thinkorswim, we’d select the EUR/USD chart, add the 50 and 200-period SMAs, and then use the platform’s backtesting functionality to simulate trades based on the crossover signals generated during this period. The backtest would provide key metrics such as profitability, maximum drawdown, win rate, and Sharpe ratio, offering insights into the strategy’s performance under various market conditions. Analyzing these results helps refine the strategy or identify potential flaws before risking capital.

Comparison of Scalping, Day Trading, and Swing Trading on Thinkorswim

Thinkorswim’s features support various trading timeframes, making it suitable for different trading styles. Here’s a comparison of scalping, day trading, and swing trading within the Thinkorswim environment:

- Scalping: Scalpers aim for small profits on numerous trades within short timeframes (seconds to minutes). Thinkorswim’s tools, like its advanced charting and order entry features, are crucial for executing rapid trades. Scalping often relies on technical indicators with high sensitivity to price changes. Risk management is paramount due to the frequency of trades.

- Day Trading: Day traders hold positions for a single trading day, aiming for profits from intraday price fluctuations. Thinkorswim’s charting and analysis tools are essential for identifying short-term trends and patterns. Day traders may utilize a wider range of indicators and strategies than scalpers, but still focus on intraday price action.

- Swing Trading: Swing traders hold positions for several days to weeks, profiting from larger price swings. Thinkorswim’s backtesting capabilities are valuable for evaluating swing trading strategies over longer periods. Swing traders often rely on longer-term indicators and chart patterns to identify potential entry and exit points. They might use indicators like RSI or MACD alongside trendline analysis.

Risk Management in Thinkorswim Forex Trading

Forex trading, while potentially lucrative, carries inherent risks. Successfully navigating the forex market demands a robust risk management strategy. Thinkorswim, with its comprehensive suite of tools, empowers traders to implement effective risk mitigation techniques, enhancing their chances of long-term success. This section delves into the practical application of risk management features within the Thinkorswim platform.

Setting Up Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are fundamental risk management tools. A stop-loss order automatically closes a trade when the price reaches a predetermined level, limiting potential losses. Conversely, a take-profit order closes a trade when the price reaches a specified profit target, securing gains. In Thinkorswim, these orders are easily set during order placement or modified after a trade is open.

Imagine you’re buying EUR/USD at 1.1000. To set a stop-loss at 1.0950 and a take-profit at 1.1050, you would first select the EUR/USD pair and choose a “Buy to Open” order type. Within the order ticket, you’ll find fields for “Stop” and “Limit” prices. Input 1.0950 into the “Stop” field (this becomes your stop-loss) and 1.1050 into the “Limit” field (your take-profit). A visual representation on the chart would show these orders as horizontal lines at the specified price levels. Thinkorswim’s intuitive interface makes this process straightforward. If the price falls to 1.0950, your stop-loss will automatically trigger, closing the position and limiting your loss. If the price rises to 1.1050, your take-profit will execute, securing your profit. The exact placement of these order entry fields may vary slightly depending on your Thinkorswim version and layout preferences, but the core functionality remains consistent.

Thinkorswim’s Risk Management Tools

Thinkorswim offers a range of tools beyond simple stop-loss and take-profit orders. These include features such as trailing stops, which dynamically adjust the stop-loss order as the price moves favorably, locking in profits. Another valuable tool is the ability to set alerts based on price movements or other market indicators. These alerts can notify you of potential opportunities or risks, allowing for proactive management of your positions. Furthermore, Thinkorswim allows for the creation of custom studies and indicators which can be integrated into your risk management strategy. For example, a trader might develop an indicator to identify periods of high volatility, prompting them to adjust their position sizing or tighten their stop-loss orders accordingly. This level of customization empowers traders to tailor their risk management approach to their specific trading style and risk tolerance.

Position Sizing and Diversification Strategies

Effective risk management hinges on proper position sizing and diversification. Position sizing dictates the amount of capital allocated to each trade. Diversification involves spreading investments across different currency pairs to reduce the impact of losses in any single trade. Thinkorswim facilitates both strategies. For position sizing, traders can utilize various methods, such as fixed fractional position sizing (allocating a fixed percentage of capital to each trade), or volatility-based position sizing (adjusting position size based on market volatility). Diversification can be achieved by trading multiple currency pairs simultaneously, ensuring that losses in one pair are offset by gains in others.

| Position Sizing Method | Risk Profile | Description | Example |

|---|---|---|---|

| Fixed Fractional | Moderate | A fixed percentage of capital is risked on each trade. | Risking 1% of your account balance on each trade. |

| Fixed Dollar Amount | Moderate to High | A fixed dollar amount is risked on each trade, regardless of account size. | Risking $100 on each trade. |

| Volatility-Based | Low to Moderate | Position size is adjusted based on the volatility of the asset. | Reducing position size during periods of high volatility. |

| Martingale (Generally Discouraged) | High | Doubling the position size after a loss; highly risky. | Doubling the bet after each loss, leading to potentially large losses. |

Thinkorswim Forex Education and Resources

Conquering the forex market requires more than just chart-watching; it demands a solid understanding of the intricacies of global finance and the tools at your disposal. Thinkorswim, with its robust platform, offers a wealth of educational resources to empower traders of all levels. But the learning journey doesn’t stop there; supplementing the platform’s offerings with external resources can significantly enhance your forex trading prowess.

Thinkorswim’s built-in educational tools provide a strong foundation for forex trading. These resources are designed to be accessible, covering everything from fundamental concepts to advanced strategies. The platform’s intuitive interface makes navigating these learning materials a breeze, even for beginners.

Thinkorswim’s Internal Forex Education Resources

Thinkorswim provides a range of internal educational resources directly within the platform. These resources are designed to help traders of all skill levels improve their understanding of forex trading. These resources are integrated seamlessly into the platform’s workflow, allowing for a practical, hands-on learning experience. Key examples include:

- Interactive Tutorials: Step-by-step guides covering basic forex concepts and platform navigation. These tutorials often include quizzes to test understanding and reinforce learning.

- Educational Videos: Short, focused videos explaining complex forex topics in a clear and concise manner. These videos often demonstrate practical applications of trading strategies within the Thinkorswim platform itself.

- Webinars and Seminars (archived): Access to recordings of past webinars and seminars covering various aspects of forex trading. These resources often feature industry experts and experienced traders sharing their insights and strategies.

- Paper Trading Functionality: A risk-free environment to practice forex trading strategies and test different approaches without risking real capital. This is invaluable for honing skills and building confidence before live trading.

External Forex Education Resources Complementing Thinkorswim

While Thinkorswim provides a strong foundation, external resources can significantly broaden your knowledge and perspectives. These resources offer diverse viewpoints and learning styles, complementing the platform’s internal offerings.

- Online Forex Courses: Numerous online platforms offer comprehensive forex courses, ranging from beginner to advanced levels. These courses often cover fundamental analysis, technical analysis, risk management, and trading psychology in greater detail than Thinkorswim’s built-in materials.

- Forex Books and E-books: A vast library of books and ebooks provides in-depth knowledge on forex trading strategies, market analysis, and risk management. These resources often offer a more theoretical and comprehensive understanding of market dynamics.

- Forex Trading Communities and Forums: Engaging with online forex communities allows for peer-to-peer learning, sharing of experiences, and exposure to diverse trading perspectives. However, it’s crucial to critically evaluate information obtained from these sources.

- Financial News Websites and Blogs: Staying updated on global economic events and market trends through reputable financial news sources is essential for informed decision-making. This helps contextualize your trading strategies within the broader economic landscape.

The Importance of Continuous Learning and Practice in Forex Trading

Forex trading is a dynamic and ever-evolving field. Continuous learning and practice are not merely beneficial—they are absolutely essential for long-term success. The market constantly shifts, requiring traders to adapt their strategies and refine their understanding. Thinkorswim facilitates this process by providing a platform for continuous learning and practical application. The paper trading feature, coupled with the readily available educational resources, creates an ideal environment for consistent improvement. Regularly reviewing market analysis, testing new strategies, and adapting to changing market conditions are all key components of successful forex trading. The platform’s tools enable traders to track performance, analyze trades, and continuously refine their approach.

Thinkorswim Forex Trading and Market Analysis

Thinkorswim offers a robust platform for forex traders seeking to combine fundamental and technical analysis for informed decision-making. Its integrated tools allow for a seamless workflow, bridging the gap between macroeconomic indicators and price chart patterns. This powerful combination empowers traders to develop comprehensive trading strategies.

Successful forex trading hinges on a sophisticated understanding of both fundamental and technical analysis. Fundamental analysis examines economic factors influencing currency values, such as interest rates, inflation, and political stability. Technical analysis, conversely, focuses on price charts and trading volume to identify trends and patterns. Thinkorswim facilitates the integration of these approaches, allowing traders to gain a holistic perspective of the market.

Combining Fundamental and Technical Analysis on Thinkorswim

Thinkorswim’s strength lies in its ability to seamlessly integrate fundamental and technical analysis. For example, a trader might identify a potential long position in the EUR/USD based on positive economic news regarding the Eurozone (fundamental analysis). They would then confirm this analysis by examining the EUR/USD chart on Thinkorswim, looking for technical indicators like a bullish breakout from a consolidation pattern or positive RSI divergence (technical analysis). Only when both fundamental and technical analyses align would the trader consider entering the trade. This reduces reliance on either method alone, mitigating risk. The platform’s integrated news feed and charting tools make this process efficient and straightforward.

Conducting Market Analysis Using Thinkorswim’s Forex Charting and News Features

A step-by-step guide to conducting market analysis on Thinkorswim begins with identifying the currency pair of interest. Next, access the charting tools and select the desired timeframe (e.g., daily, hourly, or 5-minute chart). Apply relevant technical indicators such as moving averages, RSI, MACD, or Bollinger Bands. Simultaneously, utilize Thinkorswim’s integrated news feed to monitor economic announcements relevant to the selected currency pair. For instance, if analyzing EUR/USD, one would focus on Eurozone economic data like inflation figures or interest rate decisions from the European Central Bank. By comparing the technical indicators’ signals with the fundamental news, traders can form a more complete market outlook. For example, if the chart shows a bullish trend and upcoming economic data is expected to be positive, this would reinforce the bullish outlook.

Interpreting Economic News Releases and Their Impact on Forex Markets, Thinkorswim forex trading

Thinkorswim provides real-time access to economic news releases, allowing traders to promptly assess their impact on forex markets. The platform’s news feed provides details on each release, including the actual value versus the forecast. A significant deviation from the forecast often leads to immediate market reactions. For example, if the US Non-Farm Payroll report significantly exceeds expectations, the US dollar might strengthen rapidly due to increased investor confidence in the US economy. Thinkorswim’s charting tools allow traders to visually observe these price movements in real-time, providing valuable insight into market sentiment and volatility. Traders can also use the platform to backtest their strategies based on historical news releases and their corresponding market reactions, refining their understanding of cause and effect. Understanding these relationships allows traders to anticipate potential market movements and adjust their positions accordingly.

Last Point

Conquering the forex market requires more than just luck; it demands strategy, discipline, and the right tools. Thinkorswim provides that arsenal, equipping traders with the resources to analyze, execute, and manage their trades effectively. By mastering its features and understanding the inherent risks, you can unlock the potential for significant returns while mitigating potential losses. So, dive in, explore the platform, and begin your journey to forex trading mastery with thinkorswim as your trusted companion.

Do not overlook explore the latest data about automated trading bots forex.

You also can understand valuable knowledge by exploring free ai forex trading software.