Trading forex with Thinkorswim? Let’s dive in! This powerful platform offers a suite of tools specifically designed to help you navigate the volatile world of foreign exchange trading. From its intuitive interface and customizable charts to its robust backtesting capabilities and advanced order management features, Thinkorswim provides everything you need to craft and execute your forex trading strategies effectively. We’ll explore its key features, walk you through setting up your trading charts, and uncover the strategies that can give you a competitive edge.

We’ll cover everything from understanding the platform’s layout and mastering its charting tools to implementing effective trading strategies and managing risk. Think of this as your ultimate cheat sheet to conquering the forex market with Thinkorswim – no prior experience necessary (though it definitely helps!).

Thinkorswim Platform Overview for Forex Trading

Thinkorswim, developed by TD Ameritrade, is a powerful and versatile trading platform offering a comprehensive suite of tools specifically designed for forex trading. Its robust features, coupled with an intuitive (though initially steep learning curve) interface, make it a popular choice among both novice and experienced forex traders. This overview will delve into its key features and functionalities relevant to forex trading.

Thinkorswim’s Key Features for Forex Trading

Thinkorswim provides a wide array of tools beneficial for forex trading. These include advanced charting capabilities with numerous technical indicators and drawing tools, real-time market data feeds, customizable watchlists for tracking multiple currency pairs, and a sophisticated order entry system allowing for various order types like limit orders, stop-loss orders, and trailing stops. The platform also integrates with news feeds and economic calendars, providing traders with crucial market context. Backtesting capabilities allow traders to test their strategies before deploying them with real capital. Finally, the platform supports automated trading strategies through its ThinkScript programming language.

Thinkorswim’s User Interface and Navigation for Forex Trading

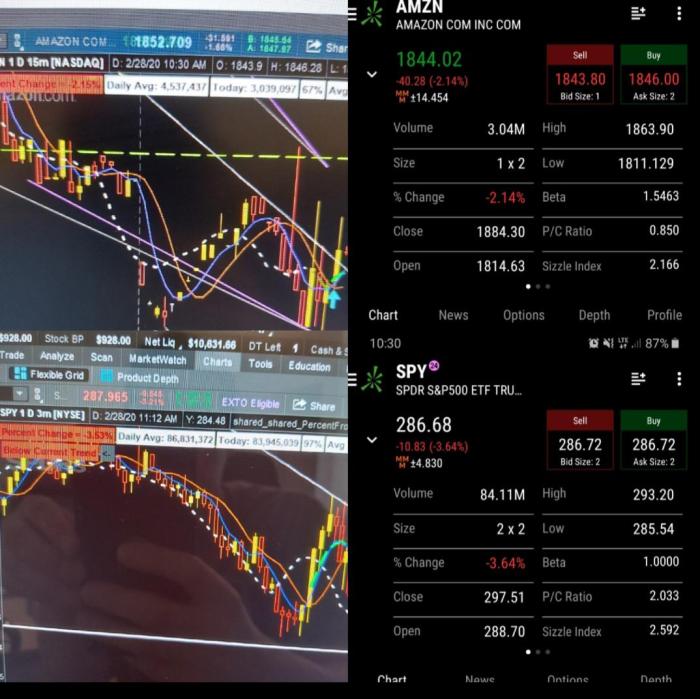

The Thinkorswim interface, while initially complex, is highly customizable. Traders can arrange their workspace with multiple charts, watchlists, and order entry panels, tailoring it to their specific trading style and needs. Navigation is primarily achieved through menus, toolbars, and drag-and-drop functionality. Finding specific forex pairs is straightforward through the search function or by browsing the available currency pairs within the platform. The platform’s layout prioritizes information density, allowing traders to access a large amount of data at a glance. However, this density can be overwhelming for new users. Mastering the keyboard shortcuts significantly improves navigation efficiency.

Thinkorswim’s Chart Types and Applications in Forex Analysis

Thinkorswim offers a variety of chart types, each serving a distinct purpose in forex analysis. These include candlestick charts, bar charts, line charts, and Renko charts. Candlestick charts, for instance, provide a visual representation of price action over a specific time period, revealing information about opening, closing, high, and low prices. Bar charts present similar information but in a different visual format. Line charts emphasize price trends, while Renko charts focus on price movements of a predetermined size, filtering out minor fluctuations. The choice of chart type depends on the trader’s individual preferences and analytical approach. Combining multiple chart types can offer a more holistic view of the market.

Setting Up a Forex Trading Chart on Thinkorswim: A Step-by-Step Guide

1. Launch Thinkorswim: Open the Thinkorswim platform.

2. Select Currency Pair: Use the search bar or browse the available currency pairs to find the desired pair (e.g., EUR/USD).

3. Add to Chart: Drag and drop the selected currency pair onto a chart window.

4. Customize Chart: Choose a chart type (candlestick, bar, line, etc.) and adjust the timeframe (e.g., 1-minute, 5-minute, daily).

5. Add Indicators: Add technical indicators (e.g., moving averages, RSI, MACD) from the “Studies” menu to enhance analysis.

6. Adjust Settings: Modify chart properties like colors, fonts, and gridlines for optimal readability.

7. Save Layout: Save the customized chart layout for future use.

Comparison of Thinkorswim’s Forex Charting Tools with Other Platforms

| Feature | Thinkorswim | MetaTrader 4 | TradingView |

|---|---|---|---|

| Chart Types | Candlestick, Bar, Line, Renko, etc. | Candlestick, Bar, Line | Candlestick, Bar, Line, Heikin-Ashi, etc. |

| Indicators | Extensive library of built-in and custom indicators | Large selection of built-in indicators | Vast library of built-in and custom indicators |

| Drawing Tools | Fibonnacci retracements, trend lines, Gann lines, etc. | Basic drawing tools | Advanced drawing tools and pattern recognition |

| Customization | Highly customizable layouts and settings | Moderate customization options | Highly customizable layouts and settings |

Forex Trading Strategies within Thinkorswim: Trading Forex With Thinkorswim

Thinkorswim, with its robust charting tools and backtesting capabilities, offers a powerful platform for implementing a wide range of forex trading strategies. Whether you’re a seasoned trader or just starting out, understanding how to leverage Thinkorswim’s features is key to success. This section explores popular strategies, technical indicators, backtesting, and risk management tools available within the platform.

Popular Forex Trading Strategies on Thinkorswim

Thinkorswim allows for the execution of various forex trading strategies, from simple moving average crossovers to more complex algorithmic approaches. Many traders utilize strategies based on price action, technical indicators, or a combination of both. For example, a simple moving average crossover strategy involves identifying buy signals when a shorter-term moving average crosses above a longer-term moving average and sell signals when the opposite occurs. Another popular strategy is the use of candlestick patterns, where traders look for specific formations on the price chart to predict future price movements. Scalping, day trading, and swing trading are all readily implemented within the Thinkorswim environment, each requiring different timeframes and risk management approaches.

Technical Indicators in Thinkorswim for Forex Trading, Trading forex with thinkorswim

Thinkorswim provides a comprehensive library of technical indicators, empowering traders to analyze market trends and identify potential trading opportunities. Moving averages (simple, exponential, weighted), for example, smooth out price fluctuations and help identify trend direction. The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions, potentially signaling reversals. The Moving Average Convergence Divergence (MACD) indicator, which combines moving averages to generate buy/sell signals, is another widely used tool. Bollinger Bands, which display price volatility through standard deviation bands around a moving average, help traders identify potential breakouts or reversals. Effective use of these indicators requires understanding their limitations and combining them with other forms of analysis.

Backtesting Forex Trading Strategies in Thinkorswim

Thinkorswim’s powerful backtesting engine allows traders to evaluate the historical performance of their forex strategies. This involves simulating trades on historical data to assess profitability, risk, and drawdowns. Backtesting allows traders to refine their strategies, optimize parameters, and identify potential weaknesses before risking real capital. It’s crucial to remember that backtested results don’t guarantee future performance, as market conditions are constantly changing. However, it provides a valuable tool for assessing the potential viability of a trading strategy. For example, a trader might backtest a strategy using different moving average periods to determine the optimal settings for their chosen timeframe.

Hypothetical Forex Trading Plan Using Thinkorswim

Let’s consider a hypothetical forex trading plan using Thinkorswim. A trader might focus on the EUR/USD pair, using a combination of the 20-period and 50-period exponential moving averages (EMAs) as a trend-following system. They’ll use the RSI to identify potential overbought or oversold conditions, confirming signals generated by the moving averages. Their risk management strategy will involve limiting each trade to 1% of their account equity and utilizing stop-loss orders to control potential losses. They’ll use Thinkorswim’s backtesting feature to evaluate the historical performance of this system and adjust parameters as needed before live trading. This is just one example; countless variations are possible depending on individual trading styles and risk tolerance.

Thinkorswim Tools for Forex Risk Management

Thinkorswim offers several built-in tools crucial for managing risk in forex trading. Stop-loss orders automatically exit a trade when the price reaches a predetermined level, limiting potential losses. Take-profit orders automatically close a trade when the price reaches a specified profit target, securing gains. Thinkorswim also allows for the setting of trailing stop orders, which adjust the stop-loss order as the price moves in a favorable direction, protecting profits while allowing for greater price movement. Position sizing tools help traders determine the appropriate amount to risk on each trade, ensuring that losses remain within acceptable limits. Finally, the platform provides detailed account statements and performance reports to track overall trading activity and assess risk exposure.

Order Execution and Management in Thinkorswim

Thinkorswim, TD Ameritrade’s powerful trading platform, offers a robust suite of tools for executing and managing forex trades. Its intuitive interface and diverse order types empower traders of all levels to effectively participate in the foreign exchange market. Understanding these tools is crucial for optimizing your trading strategy and minimizing risk.

Thinkorswim provides a streamlined process for placing and managing forex trades, from order entry to position monitoring. The platform’s sophisticated order types allow for precise control over entry and exit points, enabling traders to tailor their strategies to specific market conditions. This detailed exploration will cover the various order types, the execution process, and the effective use of risk management tools within the Thinkorswim environment.

Thinkorswim’s Forex Order Types

Thinkorswim offers a wide array of order types to cater to different trading styles and risk tolerances. These orders allow for precise control over trade execution, helping traders to manage risk and capitalize on opportunities. Understanding the nuances of each order type is essential for successful forex trading.

- Market Orders: These orders are executed immediately at the best available price. They are suitable for traders who prioritize speed of execution over price. However, slippage (the difference between the expected price and the actual execution price) can occur, especially during volatile market conditions.

- Limit Orders: These orders are only executed if the market price reaches a specified price or better. They are ideal for traders who want to buy at a lower price or sell at a higher price. Limit orders reduce the risk of overpaying or underselling.

- Stop Orders: These orders are triggered when the market price reaches a specified price. They are primarily used to limit losses (stop-loss orders) or to secure profits (stop-limit orders). Stop orders are crucial for risk management.

- Stop-Limit Orders: A combination of a stop order and a limit order. The order becomes a limit order once the stop price is reached. This helps to mitigate the risk of slippage associated with pure stop orders.

- Trailing Stop Orders: These orders automatically adjust the stop price as the market moves in a favorable direction, locking in profits while minimizing losses. The trailing stop moves with the price, following it by a specified distance (the trailing amount).

Placing and Managing Forex Trades

The process of placing a trade in Thinkorswim is generally straightforward. Traders select the currency pair, choose an order type, specify the order quantity (lot size), and set the entry price (for limit and stop orders). Once the order is submitted, it appears in the “Open Orders” section of the platform. Trades can be monitored and managed from this section, allowing for easy modification or cancellation. The platform also provides real-time updates on trade execution and market conditions.

Using Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for risk management in forex trading. A stop-loss order automatically closes a trade when the price moves against your position by a predetermined amount, limiting potential losses. A take-profit order automatically closes a trade when the price reaches a specified target, securing profits.

For example, if a trader buys EUR/USD at 1.1000 and sets a stop-loss at 1.0980 and a take-profit at 1.1020, the trade will automatically close if the price falls to 1.0980 (stop-loss) or rises to 1.1020 (take-profit). This strategy helps to manage risk and protect against significant losses. Thinkorswim makes it easy to set these orders during trade placement or subsequently through order modification.

Thinkorswim’s Order Management Features

Thinkorswim’s order management features provide a comprehensive overview of open positions, allowing traders to easily monitor their trades and make informed decisions. The platform displays key information such as entry price, current price, profit/loss, and open order details. This real-time monitoring enables traders to react quickly to changing market conditions and adjust their positions as needed. Thinkorswim’s ability to manage multiple trades simultaneously is particularly useful for active traders.

Thinkorswim Order Execution Speed Compared to Other Platforms

Thinkorswim generally boasts competitive order execution speeds. While precise comparisons are difficult due to varying market conditions and network latency, Thinkorswim’s reputation suggests reliable and fast execution, particularly important in fast-moving forex markets. However, the actual speed experienced can depend on factors such as internet connection, server load, and market liquidity. A direct comparison would require controlled testing under identical conditions across different platforms, which is beyond the scope of this discussion.

Analyzing Forex Market Data with Thinkorswim

Thinkorswim offers a robust suite of tools for analyzing forex market data, empowering traders to make informed decisions. Its comprehensive platform allows access to real-time information, fundamental data, and news feeds, all crucial for understanding market dynamics and identifying potential trading opportunities. This section will delve into the specifics of utilizing these features for effective forex trading.

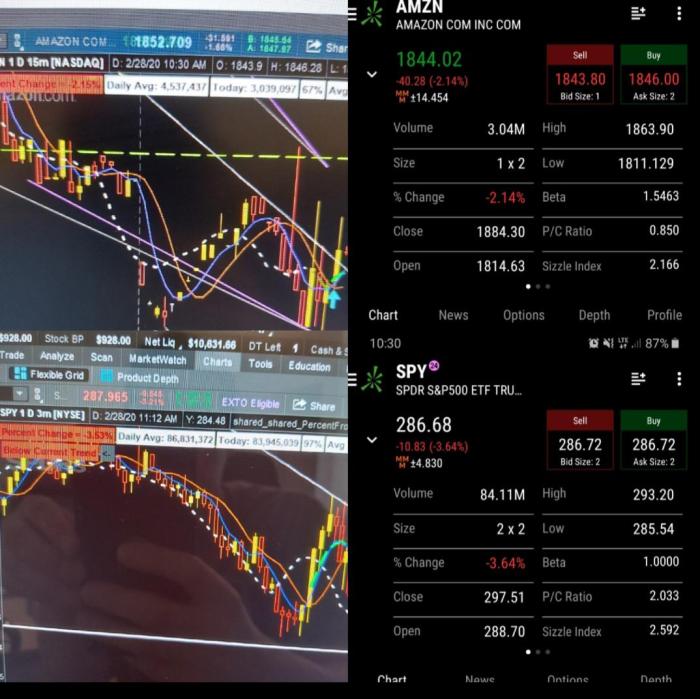

Real-time Forex Market Data Access and Interpretation

Thinkorswim provides real-time forex quotes and charts, displaying bid and ask prices, spreads, and volume. Traders can customize chart settings to include various technical indicators, such as moving averages, RSI, and MACD, overlaying them onto price charts for a comprehensive technical analysis. Interpreting this data involves identifying trends, support and resistance levels, and potential reversal points. For example, a significant price break above a strong resistance level might signal a bullish trend, prompting a long position. Conversely, a breakdown below support could indicate a bearish trend, suggesting a short position. The ability to adjust timeframes (from one-minute charts to daily or even weekly) allows for versatile analysis, catering to different trading styles and time horizons.

Fundamental Data and Economic Calendars

Thinkorswim integrates economic calendars and fundamental data, providing insights into macroeconomic events impacting forex markets. This data includes announcements like interest rate decisions, inflation reports, and employment figures. Understanding how these announcements influence currency values is vital. For instance, a surprise increase in interest rates might strengthen a country’s currency, while disappointing economic data could weaken it. Thinkorswim’s calendar allows traders to schedule upcoming events, allowing for proactive strategy adjustments before significant news releases. Traders can anticipate market volatility surrounding these events and adjust their positions accordingly, potentially profiting from price swings.

Utilizing Thinkorswim’s News Feeds for Forex Trading Strategies

Thinkorswim’s integrated news feeds provide real-time updates on global economic and political events impacting forex markets. Analyzing these news items allows traders to gauge market sentiment and anticipate potential price movements. For example, a geopolitical crisis in a specific region might weaken the currency of a country involved, presenting shorting opportunities. Conversely, positive news about a country’s economic performance might strengthen its currency, presenting long opportunities. Combining news analysis with technical indicators provides a holistic approach to forex trading.

Key Data Points for Forex Market Analysis

Several key data points within Thinkorswim are crucial for forex market analysis. These include:

- Bid/Ask Spread: Indicates the difference between the buying and selling price of a currency pair, affecting trading costs.

- Volume: Shows the trading activity for a currency pair, indicating market strength or weakness.

- Open/High/Low/Close (OHLC) Data: Provides the price range of a currency pair over a specific period, aiding in trend identification.

- Technical Indicators: Moving averages, RSI, MACD, and other indicators help identify trends, momentum, and potential reversal points.

Understanding and interpreting these data points is fundamental to making informed trading decisions.

Utilizing Thinkorswim’s Scanning Tools for Forex Trading Opportunities

Thinkorswim’s scanning tools allow traders to automatically identify potential trading opportunities based on predefined criteria. Traders can create custom scans based on technical indicators, price patterns, or fundamental data. For example, a trader might set a scan to identify currency pairs that have broken above a 20-day moving average with increasing volume, suggesting a potential bullish breakout. Another scan might look for currency pairs exhibiting bearish divergence between price and an oscillator like the RSI, potentially indicating a price reversal. These scans help traders quickly filter through numerous currency pairs, focusing on those meeting their specific trading criteria. This significantly reduces the time spent manually analyzing charts, allowing for more efficient trading.

Thinkorswim’s Educational Resources for Forex Traders

Thinkorswim, beyond its powerful charting and trading tools, offers a surprisingly robust suite of educational resources specifically designed to help forex traders of all levels improve their skills and knowledge. From beginner-friendly tutorials to advanced webinars, Thinkorswim provides a comprehensive learning pathway to navigate the complexities of the forex market. This educational ecosystem, coupled with its practical tools, makes it a valuable platform for both novice and seasoned traders.

Thinkorswim’s educational materials are a key differentiator, setting it apart from many other trading platforms. The platform understands that successful forex trading requires a blend of technical proficiency and market understanding, and its resources cater to both aspects. This commitment to education empowers traders to make informed decisions and develop sustainable trading strategies.

Examples of Thinkorswim’s Forex Educational Resources

Thinkorswim offers a variety of educational materials tailored to forex trading. These resources include video tutorials covering fundamental and technical analysis concepts specific to currency pairs, webinars presented by experienced traders and analysts delving into specific trading strategies and market events, and interactive learning modules that test your understanding of key forex principles. For instance, a video tutorial might cover the impact of macroeconomic news announcements on specific currency pairs, while a webinar might focus on applying a particular technical indicator like the Relative Strength Index (RSI) to identify potential forex trading opportunities. These resources are readily accessible within the Thinkorswim platform itself, making learning seamless and integrated into the trading workflow.

Benefits of Thinkorswim’s Paper Trading Feature for Forex Practice

Thinkorswim’s paper trading functionality is invaluable for forex traders, especially those new to the market. It allows you to simulate real-world trading conditions without risking real capital. You can practice executing trades, testing strategies, and familiarizing yourself with the platform’s interface without the financial consequences of potential losses. This risk-free environment enables traders to develop confidence and refine their trading plans before committing real money. For example, a new trader could practice executing trades based on technical indicators identified during a learning module, receiving immediate feedback on their strategy’s performance without financial repercussions. This iterative process allows for continuous learning and improvement.

Thinkorswim’s Community Features and Their Value for Forex Traders

Thinkorswim fosters a vibrant community of traders through its various features. The platform facilitates interaction and knowledge sharing among users. This community aspect provides a unique opportunity to learn from others’ experiences, exchange ideas, and gain insights into different trading approaches. For example, users can participate in forums where experienced traders discuss their strategies and share market analysis. The collective intelligence of the community can significantly enhance a trader’s understanding of the forex market and provide valuable perspectives. This peer-to-peer learning complements the platform’s formal educational resources.

External Resources Complementing Thinkorswim’s Forex Trading Education

While Thinkorswim provides a strong foundation, supplementing its educational resources with external materials can further enhance a trader’s knowledge. This could include reputable financial news websites like ForexLive or DailyFX, which provide market analysis and insights. Books on forex trading strategies and technical analysis, such as those by authors like John J. Murphy or Alexander Elder, can also offer valuable supplementary information. Furthermore, attending industry conferences and webinars hosted by independent financial educators can broaden a trader’s perspective and keep them updated on market trends.

Accessing and Utilizing Thinkorswim’s Educational Materials

Accessing Thinkorswim’s educational resources is straightforward. First, log in to your Thinkorswim account. Then, navigate to the platform’s “Education” or “Learning Center” section (the exact location may vary slightly depending on the platform version). Here, you’ll find a categorized list of video tutorials, webinars, and other learning materials. You can filter these resources by topic, skill level, or asset class (including forex). Select the resources relevant to your learning goals and start watching, reading, or interacting with the modules. Many materials offer quizzes or assessments to gauge your understanding and reinforce learning. Remember to utilize the search function within the educational section to find specific topics of interest.

Ending Remarks

Mastering forex trading requires dedication, strategy, and the right tools. Thinkorswim empowers you with all three. By understanding its features, leveraging its analytical tools, and practicing diligently, you can significantly enhance your trading journey. Remember, consistent learning and disciplined risk management are your keys to success. So, are you ready to unlock the potential of Thinkorswim and take your forex trading to the next level?

Find out about how forex trading contest can deliver the best answers for your issues.

Do not overlook explore the latest data about forex trading how to read charts.