Trading forex options: It sounds complex, maybe even a little intimidating. But what if I told you it’s a world of strategic maneuvering, potential profit, and the thrill of predicting global market shifts? This isn’t just about buying and selling currencies; it’s about understanding risk, leveraging opportunities, and mastering the art of the deal. We’re diving deep into the world of forex options, unraveling the mysteries and equipping you with the knowledge to navigate this exciting financial landscape.

From understanding the basics of calls and puts to crafting winning strategies and managing risk effectively, this guide will equip you with the tools and insights needed to succeed. We’ll cover different contract types, explore various trading strategies, and even analyze real-world scenarios to show you exactly how forex options work in action. Get ready to level up your trading game!

Introduction to Forex Options Trading

Forex options trading offers a unique way to participate in the foreign exchange market, providing traders with a flexible approach to managing risk and potentially profiting from currency fluctuations. Unlike outright buying or selling currencies, forex options give you the *right*, but not the *obligation*, to buy or sell a specific currency pair at a predetermined price (the strike price) on or before a specific date (the expiration date). This added layer of control makes them a powerful tool for sophisticated traders.

Forex options differ significantly from other forex trading instruments like spot trading or futures contracts. Spot trading involves the immediate exchange of currencies at the current market price, exposing you to immediate market volatility. Futures contracts obligate you to buy or sell a currency pair at a future date at a predetermined price, locking you into a position regardless of market movements. Forex options, however, offer a conditional commitment, allowing you to profit from favorable market movements while limiting potential losses.

Forex Options Terminology

Understanding the key terminology is crucial for navigating the world of forex options trading. A grasp of these terms allows you to effectively analyze market conditions and make informed trading decisions.

- Call Option: A call option gives the buyer the right, but not the obligation, to *buy* a base currency at a specific price (the strike price) on or before the expiration date.

- Put Option: A put option gives the buyer the right, but not the obligation, to *sell* a base currency at a specific price (the strike price) on or before the expiration date.

- Strike Price: The predetermined exchange rate at which the option buyer can buy (call) or sell (put) the base currency.

- Expiration Date: The date on which the option contract expires, after which the option is no longer valid.

- Premium: The price paid by the option buyer to acquire the option contract. This represents the cost of the right to buy or sell the currency at the strike price.

- Underlying Asset: The currency pair that the option contract is based on (e.g., EUR/USD, GBP/JPY).

Types of Forex Options

Forex options are categorized into two main types, each serving different trading strategies:

- European Options: These options can only be exercised on the expiration date itself.

- American Options: These options can be exercised at any time before or on the expiration date.

The choice between European and American options depends largely on the trader’s risk tolerance and trading strategy. American options offer greater flexibility but might also incur higher premiums due to this flexibility.

Profit and Loss in Forex Options Trading

The potential profit or loss from forex options trading depends on several factors, including the strike price, the market price of the underlying currency pair at expiration, and the premium paid. For example, a call option buyer profits if the market price rises above the strike price at expiration, while a put option buyer profits if the market price falls below the strike price at expiration. Conversely, the buyer loses the premium paid if the option expires out-of-the-money. A detailed profit/loss calculation involves considering the premium paid and the difference between the strike price and the market price at expiration. For instance, if a trader buys a EUR/USD call option with a strike price of 1.10 and a premium of $0.01, and the EUR/USD rate at expiration is 1.12, the trader profits $0.01 (1.12-1.10) less the premium of $0.01, resulting in a break-even scenario. However, if the rate is 1.13, the trader profits $0.02 less the $0.01 premium, resulting in a $0.01 profit.

Types of Forex Options Contracts

Navigating the world of forex options can feel like stepping into a labyrinth, but understanding the different contract types is key to unlocking its potential. This section breaks down the core types, explaining their payoff structures and the factors that influence their prices. Think of it as your decoder ring for the forex options market.

Forex options, unlike forex spot trading, give you the *right*, but not the obligation, to buy or sell a specific currency pair at a predetermined price (the strike price) on or before a specific date (the expiration date). This flexibility is what makes them so appealing to sophisticated traders.

Call and Put Options

Call and put options are the fundamental building blocks of forex options trading. A call option grants the buyer the right to *buy* a base currency at the strike price, while a put option grants the buyer the right to *sell* the base currency at the strike price. The seller (or writer) of the option is obligated to fulfill the buyer’s decision if the option is exercised. The payoff profile for a call option is significantly different from that of a put option. For a call option, the profit increases as the price of the base currency rises above the strike price, while for a put option, the profit increases as the price of the base currency falls below the strike price. Imagine you buy a call option on EUR/USD with a strike price of 1.10. If the EUR/USD rises to 1.12, your call option becomes profitable. Conversely, if you buy a put option and the EUR/USD falls to 1.08, your put option becomes profitable.

European and American Options

The distinction between European and American options lies in *when* they can be exercised. European options can only be exercised at the expiration date, offering a simpler, more predictable payoff profile. American options, on the other hand, can be exercised at any time before or on the expiration date, providing greater flexibility but also increased complexity. This flexibility comes with a price premium; American options generally cost more than their European counterparts. For example, a trader might choose an American option if they anticipate a significant price movement before the expiration date and want the ability to lock in profits early. A European option might suit a trader with a more long-term outlook and a preference for a simpler trading strategy.

Factors Influencing Forex Option Prices

Several factors interact to determine the price of a forex option. These include the current spot exchange rate, the strike price, the time to expiration, the implied volatility of the underlying currency pair, and interest rate differentials between the two currencies. A higher implied volatility, reflecting greater uncertainty about future price movements, generally leads to higher option prices. Similarly, a longer time to expiration also increases the price, as there’s a greater chance for significant price fluctuations. Interest rate differentials influence the cost of carrying the underlying currency, impacting option pricing models. For instance, if interest rates are significantly higher in one currency than the other, the option price will be affected to reflect this difference. These factors are intricately linked and constantly shift, making option pricing a dynamic and complex process.

Strategies for Forex Options Trading

Forex options trading offers a diverse range of strategies, each with its own risk-reward profile. Understanding these strategies is crucial for navigating the complexities of the forex market and achieving your trading goals. Successful implementation requires careful consideration of market conditions, your risk tolerance, and your overall trading objectives.

Different strategies cater to different market outlooks and risk appetites. Some strategies aim for limited profits with limited risk, while others target larger gains but accept higher potential losses. Choosing the right strategy depends entirely on your individual circumstances and market analysis.

Find out about how forex trading signal can deliver the best answers for your issues.

Common Forex Options Trading Strategies

Several common strategies leverage the unique characteristics of forex options to manage risk and potentially profit from market movements. These strategies use combinations of calls and puts to create specific risk profiles.

Below, we’ll examine some of the most popular strategies, focusing on their mechanics and inherent risk-reward dynamics.

Further details about forex trading indicators is accessible to provide you additional insights.

| Strategy | Description | Risk | Reward |

|---|---|---|---|

| Straddle | Buying a call and a put option with the same strike price and expiration date. Profits if the price moves significantly in either direction. | High | High |

| Strangle | Buying a call and a put option with different strike prices (call above the current price, put below) and the same expiration date. Profits if the price moves significantly in either direction, but less profitable than a straddle for smaller moves. | Moderate | Moderate |

| Bull Call Spread | Buying a call option and simultaneously selling a higher strike price call option with the same expiration date. Profits if the price rises, but limited profit potential. | Low | Low |

| Bear Put Spread | Buying a put option and simultaneously selling a lower strike price put option with the same expiration date. Profits if the price falls, but limited profit potential. | Low | Low |

Implementing a Bull Call Spread Strategy

Let’s illustrate a bull call spread using a hypothetical scenario. Assume the EUR/USD exchange rate is currently at 1.1000. We are bullish on the Euro and expect it to appreciate against the US dollar.

We decide to implement a bull call spread with the following parameters:

- Buy one EUR/USD call option with a strike price of 1.1100 and an expiration date of one month. Assume the premium is $0.01 per unit.

- Sell one EUR/USD call option with a strike price of 1.1200 and the same expiration date. Assume the premium received is $0.005 per unit.

Our net premium paid is $0.005 per unit ($0.01 – $0.005). If the EUR/USD rate rises above 1.1200 at expiration, our profit is limited to the difference between the strike prices ($0.01) minus the net premium paid ($0.005), resulting in a maximum profit of $0.005 per unit. If the rate remains below 1.1100, our loss is limited to the net premium paid ($0.005) per unit. Any price between 1.1100 and 1.1200 results in a profit that gradually increases as the price approaches 1.1200.

This strategy limits both our potential profit and loss, offering a defined risk profile. The success of this strategy hinges on the accuracy of our market outlook and the timing of the trade.

Risk Management in Forex Options Trading

Forex options trading, while offering lucrative potential, is inherently risky. Understanding and mitigating these risks is crucial for successful and sustainable trading. Ignoring risk management can lead to significant financial losses, quickly eroding your trading capital. This section will explore the key risks and strategies for effectively managing them.

Potential Risks in Forex Options Trading

Forex options trading exposes traders to several significant risks. These include the risk of losing the entire premium paid for the option if it expires out-of-the-money, the risk of adverse market movements impacting the option’s value, and the risk of failing to adequately manage position sizing and leverage. Furthermore, understanding the complexities of option pricing models and market dynamics is essential to avoid miscalculations and subsequent losses. The unpredictable nature of global events and economic shifts can also drastically affect option prices, requiring constant vigilance and adaptation.

Mitigating Risks Through Stop-Loss Orders

Stop-loss orders are a fundamental risk management tool in forex options trading. These orders automatically close your position when the market reaches a predetermined price, limiting potential losses. For example, if you buy a call option on EUR/USD with a strike price of 1.1000 and set a stop-loss at 1.0900, your position will be automatically closed if the EUR/USD falls to 1.0900, preventing further losses beyond a defined threshold. The effectiveness of stop-loss orders depends on their appropriate placement and consideration of market volatility. Tight stop-losses might trigger prematurely, while overly loose ones might not offer sufficient protection.

Mitigating Risks Through Position Sizing

Effective position sizing is crucial for risk management. This involves determining the appropriate amount of capital to allocate to each trade, preventing any single trade from wiping out your entire account. A common approach is to risk only a small percentage (e.g., 1-2%) of your trading capital on any single trade. For instance, with a $10,000 trading account, a 1% risk tolerance would limit your maximum loss per trade to $100. This strategy allows for absorbing losses and continuing trading even after a series of unsuccessful trades.

Risk Management Best Practices Checklist, Trading forex options

Before engaging in any forex options trade, a comprehensive risk management plan is essential. This plan should include:

- Thorough Market Analysis: Conduct comprehensive research and analysis before entering any trade, considering fundamental and technical factors.

- Defined Risk Tolerance: Clearly define your risk tolerance and stick to it. This will prevent emotional trading decisions.

- Diversification: Diversify your portfolio across different currency pairs and option strategies to reduce risk.

- Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade.

- Position Sizing Strategy: Implement a robust position sizing strategy that limits risk per trade.

- Regular Monitoring: Continuously monitor your trades and adjust your strategy as needed.

- Paper Trading: Practice with a demo account before using real capital.

- Continuous Learning: Stay updated on market trends and refine your trading strategies.

Factors Affecting Forex Option Prices

Forex option prices, unlike the seemingly straightforward world of buying and selling currencies directly, are a dynamic dance influenced by a complex interplay of factors. Understanding these influences is crucial for anyone venturing into forex options trading, as they directly impact the profitability (or loss) of your positions. This section will delve into some of the key drivers shaping the prices of these financial instruments.

Interest Rate Differentials

Interest rate differentials between the two currencies in a forex option pair significantly influence option prices. Higher interest rates in the base currency (the currency you’re buying) generally lead to higher prices for call options (the right to buy) and lower prices for put options (the right to sell). Conversely, higher interest rates in the quote currency (the currency you’re selling) will have the opposite effect. This is because higher interest rates make that currency more attractive to hold, influencing the expected future exchange rate and consequently, the option’s value. For instance, if the US dollar has a higher interest rate than the Euro, call options on EUR/USD (Euro against US dollar) will be cheaper, and put options more expensive, reflecting the market’s expectation of a strengthening US dollar.

Volatility

Volatility, a measure of how much the price of an asset fluctuates, plays a paramount role in determining forex option prices. Higher volatility generally leads to higher option prices. This is because higher volatility increases the chance that the option will finish in the money (meaning it becomes profitable to exercise the option). Think of it this way: if the price of a currency is wildly swinging, an option giving you the right to buy or sell at a specific price becomes more valuable, as the potential for profit increases. Conversely, in periods of low volatility, option prices tend to be lower because the likelihood of significant price movements is reduced. For example, during times of geopolitical uncertainty, increased volatility often leads to a surge in option premiums across the board.

Macroeconomic Events

Macroeconomic events, such as interest rate announcements by central banks, GDP releases, inflation data, and political developments, can significantly impact forex option prices. These events often create uncertainty in the market, leading to increased volatility and, subsequently, higher option prices. Unexpected positive economic news for a particular country might lead to its currency appreciating, boosting the value of call options on that currency and reducing the value of put options. For example, a surprise interest rate hike by the Federal Reserve often leads to a surge in the value of the US dollar, affecting option prices across various currency pairs. Conversely, negative news, such as a significant decline in GDP, might cause the currency to depreciate, affecting option prices in the opposite direction.

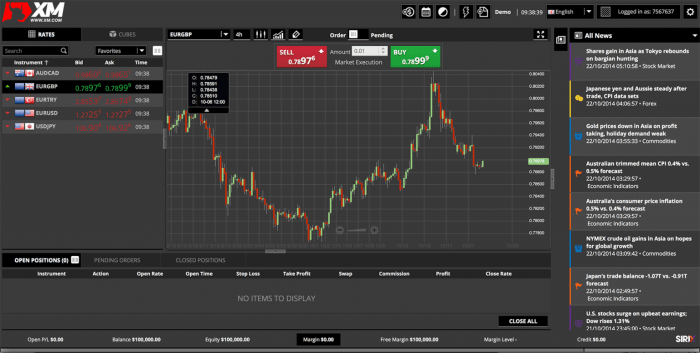

Trading Platforms and Tools

Navigating the world of forex options trading requires the right tools and platforms. The platform you choose significantly impacts your trading experience, from order execution speed to the availability of advanced analytical tools. Selecting a platform that aligns with your trading style and needs is crucial for success. This section will explore some popular platforms and the essential tools they offer.

Popular Forex Options Trading Platforms

Choosing a forex options trading platform depends on your individual needs and preferences. Some traders prioritize ease of use, while others require advanced charting and analytical capabilities. The following table compares some popular platforms:

| Platform | Pros | Cons | Best For |

|---|---|---|---|

| MetaTrader 4 (MT4) | Widely used, extensive charting tools, large community support, many brokers offer it. | Can feel dated compared to newer platforms, limited options for automated trading strategies compared to some competitors. | Beginners and intermediate traders who value community support and a wide range of indicators. |

| MetaTrader 5 (MT5) | Improved charting, more advanced order types, built-in economic calendar, better backtesting capabilities. | Steeper learning curve than MT4, not as widely adopted by brokers. | Intermediate to advanced traders seeking sophisticated tools and features. |

| cTrader | Excellent charting and order execution speed, strong focus on algorithmic trading, user-friendly interface. | Smaller community compared to MT4/MT5, fewer brokers support it. | Algorithmic traders and those who prioritize speed and efficiency. |

| TradingView | Powerful charting and analysis tools, social features, wide range of data sources, available as a standalone platform or integrated with brokers. | Not a full-fledged trading platform; requires a separate brokerage account for execution. | Traders who prioritize in-depth technical analysis and community interaction. |

Functionalities of Trading Tools

Forex options trading platforms offer a variety of tools to enhance trading performance. These tools can range from basic indicators to sophisticated algorithms for automated trading. Effective use of these tools is key to informed decision-making.

Many platforms offer technical indicators such as moving averages (simple moving average, exponential moving average), Relative Strength Index (RSI), Bollinger Bands, and MACD. These indicators help traders identify potential trends, support and resistance levels, and overbought/oversold conditions. Furthermore, platforms often include drawing tools for creating trend lines, support/resistance levels, and Fibonacci retracements. Some platforms also offer advanced tools like automated trading robots (Expert Advisors or EAs in MT4/MT5) which execute trades based on pre-programmed rules. These can help automate strategies and manage risk. Finally, many platforms integrate news feeds and economic calendars, allowing traders to stay informed about market-moving events.

Importance of Reliable Charting Tools

Reliable charting tools are fundamental to successful forex options trading. Charts visually represent price movements over time, allowing traders to identify patterns, trends, and potential trading opportunities. High-quality charting tools offer various chart types (candlestick, bar, line), customizable timeframes, and a wide range of technical indicators. The ability to overlay indicators and drawing tools on charts is essential for technical analysis. For example, a trader might use a candlestick chart with a 20-period moving average to identify potential trend reversals. Accurate and responsive charting is crucial for timely decision-making in the fast-paced forex market. A laggy or inaccurate chart can lead to missed opportunities or incorrect trading decisions.

Illustrative Examples of Forex Option Trades

Understanding forex options requires seeing them in action. Let’s explore both successful and unsuccessful trades, dissecting the decision-making process and the market forces at play. Remember, these are simplified examples for illustrative purposes and real-world trading involves significantly more complexity and risk.

Profitable EUR/USD Call Option Trade

This scenario depicts a trader anticipating a rise in the EUR/USD exchange rate. The trader purchases a EUR/USD call option with a strike price of 1.1000 and an expiration date one month out. The premium paid was $50 per contract.

The trader’s reasoning: Recent economic data suggested strong Eurozone growth, potentially pushing the EUR higher against the USD. Technical analysis also indicated an upward trend, with indicators suggesting a breakout above 1.1000 was likely.

Step-by-step breakdown:

1. Market Analysis: Positive economic news and technical indicators suggested a bullish trend for EUR/USD.

2. Option Selection: A call option was chosen to profit from a price increase above the strike price. The one-month expiration allows time for the anticipated price movement.

3. Entry Point: The option was purchased at a premium of $50 per contract.

4. Market Movement: As predicted, the EUR/USD exchange rate rose to 1.1200 before the expiration date.

5. Exit Point: The trader exercised the option, buying EUR at 1.1000 and immediately selling it at the market price of 1.1200.

6. Profit Calculation: The profit is calculated as (1.1200 – 1.1000) * contract size – premium. Assuming a contract size of 10,000 EUR, the profit would be (0.0200 * 10,000) – $50 = $150.

Visual Representation: Imagine a graph showing the EUR/USD price steadily rising from around 1.0900 to 1.1200 over the month. The option value would mirror this rise, starting at $50 and increasing to approximately $200 at the peak, reflecting the increasing intrinsic value.

Unprofitable GBP/USD Put Option Trade

In this example, a trader believes the GBP/USD exchange rate will fall. They purchase a GBP/USD put option with a strike price of 1.2500 and a one-month expiration, paying a premium of $75 per contract.

The trader’s reasoning: Negative economic news from the UK and expectations of interest rate cuts led to a bearish outlook on the GBP.

Step-by-step breakdown:

1. Market Analysis: Negative economic news and anticipated interest rate cuts suggested a bearish trend for GBP/USD.

2. Option Selection: A put option was chosen to profit from a price decrease below the strike price.

3. Entry Point: The option was purchased at a premium of $75 per contract.

4. Market Movement: Contrary to expectations, positive economic data boosted the GBP, and the GBP/USD rate rose to 1.3000.

5. Exit Point: The option expires worthless because the GBP/USD rate remained above the strike price of 1.2500.

6. Loss Calculation: The trader loses the entire premium paid, which is $75 per contract.

Visual Representation: Imagine a graph showing the GBP/USD price remaining relatively stable around 1.2800, then rising to 1.3000 over the month. The option value would steadily decline from $75 to $0 at expiration, representing the loss of the entire premium.

Regulatory Considerations: Trading Forex Options

Navigating the world of forex options trading requires a keen understanding of the regulatory landscape. Ignoring these rules can lead to significant financial and legal repercussions, so understanding the governing bodies and their requirements is crucial for responsible trading. This section will Artikel key regulatory bodies and the importance of compliance.

The regulatory environment for forex options trading varies significantly depending on your location. Different countries and regions have their own regulatory bodies with specific rules and oversight. Compliance is not just about avoiding penalties; it’s about ensuring fair market practices and protecting investors.

Regulatory Bodies Overseeing Forex Options Trading

Numerous organizations worldwide regulate forex options trading. These bodies ensure market integrity, protect investors, and prevent market manipulation. The specific regulatory body depends on where the trader is located and where the broker is based. For instance, in the United States, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) play significant roles. The UK’s Financial Conduct Authority (FCA) regulates forex trading within the UK, while other regions have their own equivalent regulatory bodies like the Australian Securities and Investments Commission (ASIC) in Australia, or the Monetary Authority of Singapore (MAS) in Singapore. Traders should always confirm the regulatory status of their chosen broker to ensure they are operating within a legitimate and supervised environment.

Importance of Complying with Forex Options Trading Regulations

Compliance with forex options trading regulations is paramount for several reasons. Firstly, it protects traders from fraudulent or unethical brokers. Secondly, it ensures fair market practices, reducing the risk of manipulation and promoting transparency. Thirdly, compliance minimizes the risk of substantial financial penalties and legal action against traders who operate outside the regulatory framework. Finally, adherence to regulations builds trust and confidence in the market, encouraging participation and promoting healthy growth. This includes adhering to reporting requirements, maintaining proper records, and following Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

Consequences of Non-Compliance with Forex Options Trading Regulations

Failure to comply with forex options trading regulations can result in severe consequences. These can range from hefty financial penalties and fines imposed by regulatory bodies to the suspension or revocation of trading licenses. In severe cases, criminal charges might be filed, leading to imprisonment. Beyond the legal repercussions, non-compliance can lead to significant financial losses for traders due to operating with unregulated brokers that may engage in fraudulent activities. Furthermore, a trader’s reputation could be irreparably damaged, affecting their future ability to engage in financial markets. For example, a trader engaging with an unregistered broker in a jurisdiction with strict regulations could face substantial penalties and potential legal action from both the broker’s country and their own.

Closure

So, there you have it – a glimpse into the dynamic world of forex options trading. While it carries inherent risks, the potential rewards are significant for those who understand the market, manage risk effectively, and apply smart strategies. Remember, thorough research, continuous learning, and a disciplined approach are crucial for success. This isn’t a get-rich-quick scheme; it’s a journey of financial literacy and strategic decision-making. Are you ready to take the leap?