Easy forex trading? Sounds too good to be true, right? While the allure of quick riches is tempting, the reality of forex trading is a bit more nuanced. This guide cuts through the marketing hype and gives you a realistic look at what it takes to navigate the forex market, focusing on strategies and platforms designed for beginners. We’ll explore the misconceptions surrounding easy forex trading, highlighting the tools and resources that can make the process more manageable. Get ready to demystify the world of currency exchange and discover if easy forex trading is right for you.

We’ll delve into practical strategies, user-friendly platforms, and essential risk management techniques, all while emphasizing the importance of continuous learning and responsible trading. Forget the get-rich-quick schemes; we’re here to build a solid foundation for your forex journey. Whether you’re a complete novice or just looking to streamline your approach, this guide provides the essential knowledge and insights to help you confidently navigate the exciting, yet challenging, world of forex trading.

Defining “Easy Forex Trading”

The allure of “easy forex trading” is a powerful siren song, attracting newcomers with promises of quick riches and effortless profits. However, the reality often clashes sharply with this enticing image, leaving many disillusioned and financially worse off. Understanding the difference between the perception and the reality is crucial for anyone considering venturing into the forex market.

The perception of ease is carefully cultivated, often through misleading marketing and a lack of realistic education. Many believe that forex trading is a get-rich-quick scheme, requiring minimal effort and knowledge to generate substantial returns. This misconception stems from several contributing factors, including simplified tutorials, exaggerated success stories, and the inherent complexity of the market itself being masked by user-friendly trading platforms.

Misconceptions Surrounding “Easy Forex Trading”

The idea of “easy forex trading” often leads to several critical misunderstandings. Many beginners believe that consistent profits are guaranteed, that losses are easily avoidable, and that technical analysis or fundamental understanding is unnecessary. This naive view ignores the inherent risks and complexities of the forex market, where even experienced traders can face significant losses. The illusion of simplicity is particularly harmful, leading to poor risk management and impulsive trading decisions.

Factors Contributing to the Perception of Ease

Several factors contribute to the widespread belief that forex trading is easy. Firstly, many online brokers and educational platforms actively promote this perception, using attractive visuals and simplified explanations to attract new clients. Secondly, the abundance of automated trading systems and robots (often marketed as “easy-to-use”) creates the illusion of passive income generation. Finally, the accessibility of forex trading through user-friendly platforms and mobile apps further reinforces this notion of ease. These factors combine to create a misleading picture of forex trading as a simple and straightforward path to wealth.

Reality Versus Perception of Forex Trading

The reality of forex trading is far more nuanced and challenging than its perceived ease suggests. While the entry barrier is relatively low, mastering the market requires significant time, effort, and a deep understanding of various factors including economic indicators, geopolitical events, and technical analysis. Consistent profitability demands rigorous discipline, effective risk management, and a constant learning process. The emotional toll of managing losses and resisting impulsive decisions is often underestimated. The market is volatile and unpredictable, and even the most sophisticated strategies can fail. Success in forex trading is rarely “easy,” and requires dedication, resilience, and a willingness to learn from mistakes.

Examples of Marketing Materials Promoting “Easy” Forex Trading

Many marketing materials employ tactics to portray forex trading as easy. For instance, advertisements might feature images of luxurious lifestyles, implying effortless wealth generation through forex trading. Some websites showcase testimonials of individuals claiming to have made significant profits with minimal effort, often omitting the potential downsides and risks involved. Other marketing materials might highlight the simplicity of the trading platform’s interface, downplaying the complexities of the market itself. These examples illustrate how marketing strategies contribute to the widespread misconception of easy forex trading.

Platforms and Tools for Easy Forex Trading

Navigating the world of forex trading doesn’t have to be a daunting task. The right platform and tools can significantly simplify the process, making it accessible even to beginners. Choosing the right platform is crucial for a smooth and efficient trading experience. This section will explore some popular options and highlight features designed for ease of use.

Forex Trading Platforms Compared

Selecting the right platform is paramount for a positive trading experience. Different platforms cater to various skill levels and preferences. The following table compares several popular options based on their user-friendliness and key features.

| Platform Name | Ease of Use Rating (1-5, 5 being easiest) | Key Features | Mobile App Availability |

|---|---|---|---|

| MetaTrader 4 (MT4) | 4 | Widely used, extensive charting tools, automated trading (Expert Advisors), large community support. | Yes, for iOS and Android |

| MetaTrader 5 (MT5) | 4 | Improved version of MT4, more advanced charting tools, economic calendar, wider range of order types. | Yes, for iOS and Android |

| cTrader | 4 | Known for its speed and advanced charting capabilities, focuses on algorithmic trading. | Yes, for iOS and Android |

| TradingView | 5 | Primarily a charting platform, excellent for technical analysis, integrates with many brokers. | Yes, for iOS and Android |

| eToro | 5 | Social trading platform, copy trading feature, user-friendly interface, educational resources. | Yes, for iOS and Android |

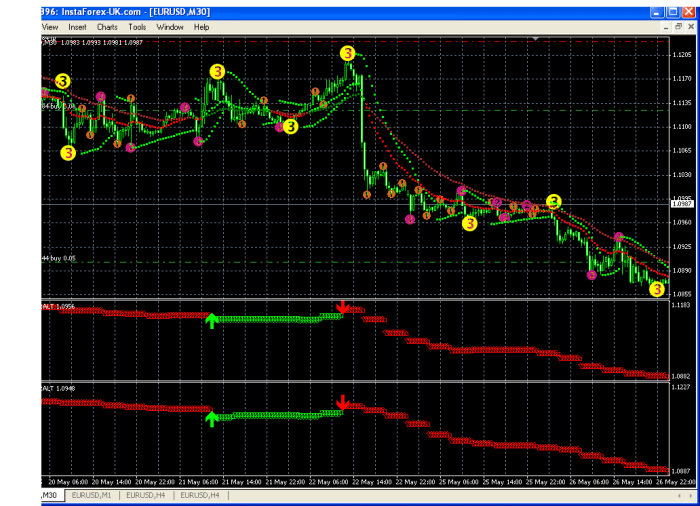

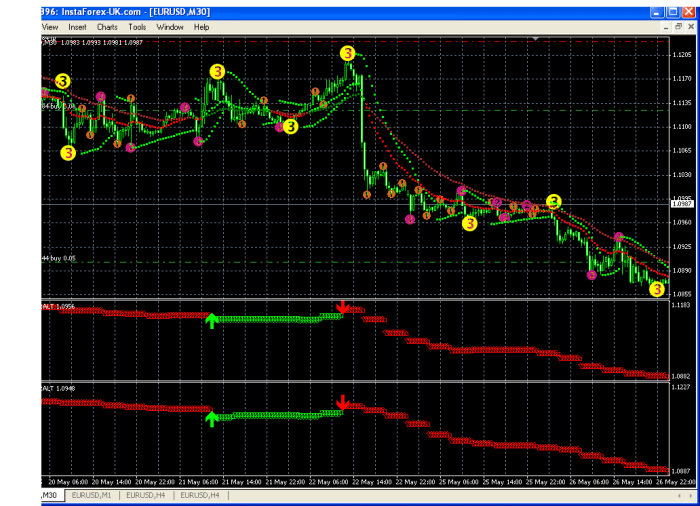

Step-by-Step Guide: Using MetaTrader 4 (MT4)

MetaTrader 4, despite its advanced capabilities, is surprisingly user-friendly. Here’s a simplified guide for beginners:

1. Download and Installation: Download the MT4 platform from your chosen broker’s website and follow the installation instructions.

2. Account Setup: Open a demo account to practice risk-free. This allows you to familiarize yourself with the platform without risking real money.

3. Navigating the Interface: The main window displays charts, order tickets, and the market watch. The top menu provides access to various functions.

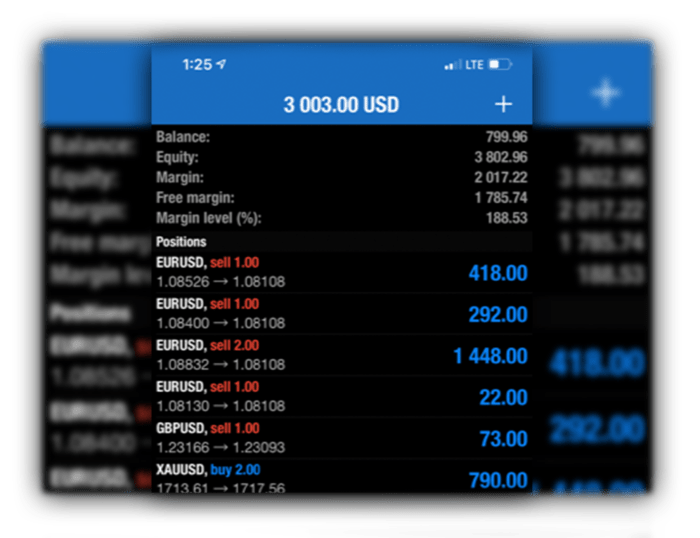

4. Placing a Trade: Select the currency pair you want to trade, specify the order type (buy or sell), volume (lot size), and stop-loss and take-profit levels. Click “Place Order.”

5. Monitoring Trades: The “Terminal” window shows your open trades, their profit/loss, and other details.

6. Charting Tools: Explore the various charting tools, such as trend lines, Fibonacci retracements, and indicators, to analyze price movements.

User-Friendly Charting Tools and Indicators

Many platforms offer a wide range of pre-built indicators and charting tools. For example, Moving Averages (MA) smooth out price fluctuations to identify trends, while Relative Strength Index (RSI) measures the speed and change of price movements to identify overbought or oversold conditions. These tools are visually represented on the chart, making it easier to interpret market behavior. A candlestick chart, for instance, visually displays price action over a period, providing insights into market sentiment.

Automated Trading Tools

Automated trading, or algorithmic trading, involves using pre-programmed rules to execute trades automatically. Expert Advisors (EAs) in platforms like MT4 and MT5 allow traders to automate their strategies, potentially saving time and improving efficiency. However, it’s crucial to thoroughly test and understand any automated system before using it with real money. A poorly designed EA could lead to significant losses. Automated trading is not a guaranteed path to riches; careful planning and monitoring remain essential.

Strategies for Simplified Forex Trading

Forex trading, while potentially lucrative, doesn’t need to be overly complex. Beginners can achieve success with straightforward strategies, consistent discipline, and a solid understanding of risk management. This section Artikels some simple approaches and emphasizes the importance of safeguarding your capital.

Simple Forex Trading Strategies for Beginners

Choosing the right strategy is crucial for a smooth start in forex trading. Here are three beginner-friendly options that focus on simplicity and ease of understanding. Remember, consistent application and discipline are key to success with any trading strategy.

- Trend Following: This strategy involves identifying and trading in the direction of established trends. Beginners can use simple indicators like moving averages to spot trends. Buy when the price is trending upwards and sell when it’s trending downwards. This requires patience and discipline, as trends can reverse unexpectedly.

- Support and Resistance Trading: This strategy focuses on price levels where the price has historically struggled to break through (resistance) or bounced off (support). Traders buy near support levels anticipating a price bounce and sell near resistance levels anticipating a price drop. Identifying these levels accurately requires chart analysis practice.

- Range Trading: This strategy involves trading within a defined price range. When the price consolidates between support and resistance, range traders look for opportunities to buy low and sell high within that range. This strategy requires careful observation of price action and a good understanding of support and resistance levels.

Risk Management Techniques for Safe Forex Trading

Risk management is paramount, especially for beginners. It’s not about avoiding losses entirely (that’s impossible), but about limiting them and protecting your capital. Without proper risk management, even the best strategy can lead to significant losses.

- Stop-Loss Orders: These automatically close a trade when the price reaches a predetermined level, limiting potential losses. Setting a stop-loss order is crucial for managing risk and preventing substantial losses.

- Take-Profit Orders: These automatically close a trade when the price reaches a predetermined profit target, securing your gains. Using take-profit orders helps to lock in profits and avoid giving back gains due to market reversals.

- Position Sizing: This involves determining the appropriate amount of capital to allocate to each trade. Never risk more than a small percentage (e.g., 1-2%) of your trading capital on any single trade. This ensures that even a losing trade won’t significantly impact your overall account balance.

Applying a Simple Moving Average Crossover Strategy

The simple moving average (SMA) crossover strategy is a classic and easy-to-understand technique. It involves using two SMAs (e.g., a 50-period and a 200-period SMA) to generate buy and sell signals.

A buy signal is generated when the shorter-term SMA (50-period) crosses above the longer-term SMA (200-period). A sell signal is generated when the shorter-term SMA crosses below the longer-term SMA.

Example: Let’s say the 50-day SMA of EUR/USD is at 1.1000 and the 200-day SMA is at 1.0900. If the 50-day SMA crosses above the 200-day SMA, it generates a buy signal, suggesting an upward trend. Conversely, if the 50-day SMA crosses below the 200-day SMA, it generates a sell signal, suggesting a downward trend. Remember, this is a simplified example and other factors should be considered before making trading decisions.

Comparison of Risk Management Strategies

Different risk management strategies offer various levels of protection and control. Understanding their differences is key to selecting the most appropriate approach for your trading style and risk tolerance.

| Strategy | Description | Advantages | Disadvantages |

|---|---|---|---|

| Stop-Loss Orders | Automatically closes a trade when the price reaches a predetermined level. | Limits potential losses, provides psychological comfort. | May trigger prematurely due to market volatility, potentially missing out on profits. |

| Take-Profit Orders | Automatically closes a trade when the price reaches a predetermined profit target. | Secures profits, avoids giving back gains. | May limit potential profits if the price continues to move favorably. |

| Position Sizing | Determining the appropriate amount of capital to allocate to each trade. | Protects trading capital from significant losses, allows for consistent trading. | May limit overall profit potential if position sizes are too small. |

Educational Resources for Easy Forex Trading

Navigating the world of forex trading can feel overwhelming, especially for beginners. However, with the right resources and a commitment to learning, you can build a solid foundation for successful trading. Access to quality educational materials is crucial for understanding the complexities of the market and avoiding costly mistakes. This section highlights reliable sources and provides guidance on honing your forex trading knowledge.

The internet offers a plethora of forex trading information, but not all sources are created equal. Sifting through the noise to find reputable and trustworthy resources requires a discerning eye. It’s essential to prioritize educational materials from established financial institutions, experienced traders with proven track records, and regulated educational platforms. Avoid sites that promise unrealistic returns or guarantee effortless profits; these are often red flags indicating scams or misleading information.

Reputable Websites and Educational Materials

Several reputable websites and platforms offer excellent educational resources for forex trading. These range from comprehensive courses and webinars to insightful articles and tutorials. Many brokers also provide educational materials as part of their services. Always verify the credibility of the source before relying on the information provided. Look for sources with transparent disclosure policies and a history of providing accurate and unbiased information.

- Babypips: Known for its beginner-friendly approach, Babypips offers a wealth of free educational resources, including tutorials, articles, and a forex trading simulator.

- Investopedia: This well-established financial website provides comprehensive information on various investment topics, including forex trading. Their articles and tutorials are generally accurate and well-researched.

- Forex.com (and other regulated brokers): Many regulated forex brokers offer educational resources to their clients, often including webinars, courses, and market analysis. While their materials may be geared towards their platform, they can still be valuable learning tools.

Identifying Reliable Sources of Forex Trading Information

Determining the reliability of forex trading information requires critical thinking and a healthy dose of skepticism. Look for sources that prioritize transparency, provide evidence-based analysis, and avoid making unrealistic promises. Beware of sites that aggressively promote get-rich-quick schemes or guarantee high returns. A reliable source will acknowledge the inherent risks of forex trading and emphasize the importance of proper risk management.

- Check for credentials and experience: Are the authors or instructors qualified professionals with a proven track record?

- Look for transparency and disclosure: Does the source disclose any potential conflicts of interest? Are they transparent about their methods and strategies?

- Verify information from multiple sources: Don’t rely on a single source; cross-reference information to ensure accuracy and consistency.

- Beware of hype and unrealistic promises: Legitimate sources will acknowledge the risks involved in forex trading and avoid making unrealistic guarantees.

Common Forex Trading Mistakes to Avoid

Many forex traders, especially beginners, make common mistakes that can significantly impact their trading performance. Understanding these pitfalls and learning how to avoid them is essential for long-term success. By developing a disciplined approach and focusing on consistent learning, you can mitigate these risks and improve your chances of profitable trading.

- Overtrading: Placing too many trades can lead to emotional decision-making and increased risk.

- Ignoring risk management: Failing to set stop-loss orders and manage position sizes can result in significant losses.

- Emotional trading: Letting emotions like fear and greed dictate trading decisions can lead to poor outcomes.

- Lack of a trading plan: Trading without a defined strategy and risk management plan increases the chances of failure.

- Ignoring market analysis: Trading without proper research and analysis of market trends increases the risk of losing money.

The Importance of Continuous Learning and Practice, Easy forex trading

Forex trading is a dynamic and ever-evolving field. Continuous learning and practice are crucial for staying ahead of the curve and adapting to changing market conditions. Regularly reviewing market trends, refining your trading strategies, and seeking feedback are essential components of ongoing development. Consider keeping a trading journal to track your progress and identify areas for improvement.

Understand how the union of forex trading plan can improve efficiency and productivity.

Consistent practice, through simulated trading or demo accounts, allows you to hone your skills and test different strategies in a risk-free environment. Remember, forex trading is a marathon, not a sprint. Consistent effort and a commitment to continuous learning are key to long-term success.

Obtain access to automated trading bots forex to private resources that are additional.

The Risks Involved in “Easy” Forex Trading

The allure of “easy” forex trading often overshadows the inherent risks. While simplified platforms and strategies exist, the foreign exchange market remains inherently volatile and unpredictable, making significant losses a real possibility. Understanding these risks is crucial before diving in, regardless of how user-friendly the trading tools appear. Ignoring these risks can lead to devastating financial consequences.

Forex trading, even with simplified approaches, involves substantial financial risk. The potential for substantial losses is ever-present, stemming from market fluctuations, leverage, and the trader’s own decisions. While strategies can aim to mitigate these risks, they cannot eliminate them entirely. A deep understanding of these risks and the implementation of robust risk management techniques are paramount to responsible trading.

Financial Loss Potential and Mitigation

The forex market’s volatility means prices can swing dramatically in short periods. A seemingly minor market shift can quickly wipe out a significant portion of your trading capital, especially when leverage is involved. For example, a 1% movement against your position with a high leverage ratio could result in a 10% or even greater loss of your invested funds. Mitigation strategies include setting strict stop-loss orders to limit potential losses, diversifying your portfolio across multiple currency pairs to reduce exposure to any single market movement, and never investing more capital than you can afford to lose. Regularly reviewing your trading performance and adjusting your strategy based on market conditions and your own risk tolerance is also vital.

Risk Comparison Across Forex Trading Strategies

Different forex trading strategies carry varying levels of risk. Scalping, for instance, involves taking many small profits from quick price movements. While potentially profitable, the high frequency of trades increases the likelihood of cumulative losses. Swing trading, which focuses on holding positions for several days or weeks, typically involves lower transaction frequency but exposes traders to larger price swings over longer periods. Long-term strategies, like position trading, minimize transaction costs but require significant patience and resilience to withstand prolonged periods of market stagnation or even losses. The risk profile of each strategy needs careful consideration relative to the trader’s risk tolerance and investment horizon.

Leverage and Its Impact on Risk

Leverage is a double-edged sword in forex trading. It magnifies both profits and losses. While leverage allows traders to control larger positions with a smaller initial investment, it dramatically increases the risk of substantial losses. For instance, a 1:100 leverage means that a $100 deposit can control a $10,000 position. A small adverse price movement of just 1% can lead to a 10% loss of the initial investment ($10). Understanding and carefully managing leverage is critical. Conservative leverage ratios and proper position sizing are essential to mitigating the risk associated with amplified losses. Many beginner traders fall into the trap of using excessive leverage, leading to significant financial setbacks.

Regulation and Legitimate Brokers

Navigating the world of forex trading requires a keen awareness of regulatory bodies and the importance of choosing a legitimate broker. Your financial security and trading success depend heavily on this crucial step. Ignoring regulation can lead to significant losses and even scams.

The forex market is largely unregulated in many parts of the world, creating a breeding ground for fraudulent activities. However, several key regulatory bodies work to protect traders in various jurisdictions. Understanding their roles and how to identify legitimate brokers is essential for anyone venturing into this exciting but potentially risky market.

Key Regulatory Bodies Overseeing Forex Trading

Several international and national organizations oversee forex trading. These bodies set standards, investigate fraudulent activities, and help protect investors. Understanding which body regulates your chosen broker is crucial for assessing their legitimacy. For example, the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and the Australian Securities and Investments Commission (ASIC) in Australia are prominent examples. Each body has its own set of rules and regulations, ensuring a level of investor protection within its jurisdiction. It’s vital to research the specific regulatory framework of the broker and the jurisdiction in which it operates.

Checklist for Identifying Legitimate and Regulated Forex Brokers

Before entrusting your funds to any forex broker, a thorough vetting process is essential. This checklist helps ensure you’re dealing with a reputable and regulated entity.

- Check for Regulatory Licenses: Verify the broker’s registration with a recognized regulatory body. Look for their license number and check it on the regulatory body’s website. Don’t rely solely on the broker’s claims; conduct independent verification.

- Transparency and Disclosure: A legitimate broker will openly disclose its regulatory status, contact information, and business address. Be wary of brokers who are vague or secretive about these details.

- Client Reviews and Testimonials: Research the broker online. Look for reviews and testimonials from other traders. However, be aware that some reviews might be fake, so consider the overall sentiment and the number of reviews.

- Security Measures: A legitimate broker will employ robust security measures to protect client funds and data. Look for information on their security protocols and data encryption methods.

- Segregation of Client Funds: Reputable brokers keep client funds separate from their operational funds. This protects your money in case the broker faces financial difficulties.

Importance of Choosing a Regulated Broker for Safe Trading

Choosing a regulated broker is paramount for safe and secure forex trading. Regulation provides a layer of protection against fraud, ensuring that brokers adhere to certain standards and are subject to oversight. This protection includes:

- Protection against Fraud: Regulated brokers are less likely to engage in fraudulent activities due to the strict oversight and potential penalties.

- Compensation Schemes: Some regulatory bodies operate compensation schemes that can reimburse traders in case of broker insolvency or fraud, up to a certain limit.

- Dispute Resolution: Regulated brokers are typically bound by a dispute resolution process, providing a mechanism to address any conflicts between the broker and the trader.

- Financial Stability: Regulated brokers are generally subject to stricter capital requirements, which enhances their financial stability and reduces the risk of bankruptcy.

Examples of Fraudulent Forex Trading Schemes and How to Avoid Them

Fraudulent forex schemes often prey on inexperienced traders. Understanding common scams helps avoid falling victim.

- Ponzi Schemes: These schemes promise high returns based on recruiting new investors, rather than actual trading profits. The early investors are paid with funds from newer investors, until the scheme collapses.

- Forex Signals Scams: These scams involve selling misleading or inaccurate trading signals, often promising unrealistic profits. The signal providers may have no actual trading expertise.

- High-Pressure Sales Tactics: Be wary of brokers who use high-pressure sales tactics to encourage immediate investment without allowing time for research and due diligence.

- Guaranteed Returns: No legitimate broker can guarantee returns in forex trading. The market is inherently risky, and any promise of guaranteed profits is a major red flag.

To avoid these scams, always conduct thorough research, be skeptical of unrealistic promises, and only invest with regulated brokers.

Closure

So, is easy forex trading a myth? Not entirely. While the market inherently carries risk, understanding the fundamentals, utilizing user-friendly platforms, and employing sound risk management strategies can significantly increase your chances of success. Remember, consistent learning, disciplined trading, and a realistic understanding of the risks are paramount. This guide has provided you with the tools and knowledge to start your forex journey on the right foot. Now, it’s time to put your newfound understanding into practice, always remembering to trade responsibly and within your means. The world of forex awaits – are you ready to take the leap?