Forex trading Reddit: It’s a wild west out there, a digital gold rush where seasoned traders swap tips alongside hopeful newbies. Dive into the chaotic yet fascinating world of online forex discussions, where fortunes are made (and lost) based on gut feelings, complex algorithms, and the collective wisdom (or folly) of the Reddit crowd. We’ll dissect the strategies, the sentiment, and the sheer drama unfolding daily within these virtual trading pits.

From identifying the top subreddits for forex trading to analyzing the success (and failures) of popular strategies, we’ll explore the unique ecosystem of online forex communities. This isn’t just about charts and indicators; it’s about the psychology of the market, the role of risk management, and the ever-present threat of scams. Get ready for a rollercoaster ride through the highs and lows of Reddit’s forex trading scene.

Reddit’s Forex Trading Communities

Reddit hosts a vibrant ecosystem of Forex trading communities, offering a diverse range of perspectives and experiences for traders of all levels. From seasoned professionals sharing intricate strategies to newcomers seeking guidance, these online forums provide a platform for discussion, learning, and even a bit of healthy competition. Understanding the landscape of these communities is crucial for anyone looking to leverage Reddit’s resources for their Forex trading journey.

Types of Forex Trading Subreddits and User Demographics

Reddit’s Forex trading subreddits cater to a broad spectrum of users, differentiated by their trading styles, experience levels, and risk tolerances. Some communities focus on specific trading strategies, while others offer a more general discussion forum. The user demographics vary widely, encompassing students, full-time traders, and individuals supplementing their income through Forex trading. The level of expertise also ranges significantly, from complete beginners to individuals with years of experience in the market. This diversity creates a rich learning environment, but also necessitates careful discernment of advice and strategies.

Most Popular Forex Trading Subreddits

While the popularity of subreddits fluctuates, some consistently attract a large and active user base. /r/Forex is arguably the most prominent, serving as a general hub for Forex discussions. Other popular subreddits often focus on specific aspects of trading, such as specific indicators or trading styles. These communities often feature experienced traders sharing their insights and analyses, alongside newer traders seeking advice and education. The size and activity of these communities contribute to a dynamic exchange of information and perspectives.

Comparison of Discussion Tone and Style Across Subreddits

The tone and style of discussions vary significantly across different Forex trading subreddits. Some communities maintain a professional and analytical approach, focusing on technical analysis and risk management. Others adopt a more casual and informal tone, allowing for a wider range of discussions, including personal experiences and trading psychology. The level of moderation also influences the overall tone, with some subreddits enforcing stricter rules against promotional content or overly speculative discussions. This variation reflects the diverse needs and preferences of the users within each community.

Organization of Subreddits Based on Trading Style

While not explicitly categorized, many Forex trading subreddits implicitly align with specific trading styles. For example, subreddits focused on short-term trading strategies might attract scalpers and day traders, while those emphasizing long-term investments would likely attract swing traders. Communities dedicated to specific technical indicators or chart patterns also indirectly reflect a preference for certain trading styles. This implicit organization allows traders to find communities that resonate with their preferred approaches and risk profiles. Understanding these implicit categorizations can significantly enhance the effectiveness of utilizing Reddit’s resources for Forex trading.

Analysis of Trading Strategies Discussed on Reddit

Reddit’s forex trading communities are a vibrant hub of discussion, strategy sharing, and (let’s be honest) plenty of wins and losses. Analyzing the strategies frequently mentioned reveals both popular approaches and the nuanced realities of forex trading. Understanding the pros and cons, as expressed by Reddit users, provides a valuable perspective for both seasoned traders and newcomers alike.

Popular Forex Trading Strategies on Reddit

Several strategies consistently emerge as popular discussion points within Reddit’s forex trading communities. These include scalping, day trading, swing trading, and position trading. Each approach demands a different level of commitment, risk tolerance, and analytical skill.

Scalping: Quick Profits, High Risk

Scalpers aim for small profits on numerous trades throughout the day, capitalizing on minor price fluctuations. Reddit discussions often highlight the intense focus and speed required. Pros include the potential for quick returns and the ability to react to rapidly changing market conditions. However, cons include the high stress levels, the need for extremely low spreads and fast execution speeds, and the increased risk of accumulating losses from frequent trades. One Reddit user recounted a successful scalping session where they profited from a news-driven spike in EUR/USD, earning $50 in under an hour. Conversely, another user described a losing streak where they failed to manage risk properly, leading to a significant loss within a single day.

Day Trading: Intraday Opportunities

Day traders hold positions for a single trading day, aiming to profit from price movements within that timeframe. Reddit users frequently discuss the importance of technical analysis and risk management in day trading. The pros include the potential for substantial gains and the ability to avoid overnight market risks. However, the cons include the need for constant market monitoring and a high level of discipline to avoid emotional trading decisions. A successful trade example from Reddit involved a day trader capitalizing on a bullish trend in GBP/USD, realizing a profit of $200. A contrasting example shows a trader’s loss due to a sudden market reversal that they failed to anticipate.

Swing Trading: Riding the Waves

Swing traders hold positions for several days or weeks, capitalizing on medium-term price swings. Reddit conversations often emphasize the importance of fundamental analysis and chart patterns. The pros include less time commitment compared to day trading and scalping, and the potential for larger profits. However, the cons include the higher risk of adverse price movements over extended periods and the need for patience. A successful swing trade described on Reddit involved a trader holding a long position in USD/JPY for a week, profiting from a significant upward trend. Conversely, a user recounted a loss incurred after holding a short position during an unexpected market rally.

Position Trading: Long-Term Perspective

Position traders maintain positions for weeks, months, or even years, focusing on long-term market trends. Reddit discussions often revolve around fundamental analysis, economic indicators, and geopolitical events. The pros include potentially high returns and a lower time commitment compared to shorter-term strategies. The cons include the high risk of prolonged losses and the need for significant capital. One Reddit post detailed a successful position trade in gold, held for over six months, resulting in a substantial profit. Conversely, another post highlighted a significant loss incurred due to an unforeseen global event impacting the market.

Comparison of Forex Trading Strategies

| Strategy | Risk Tolerance | Time Commitment | Potential Profitability |

|---|---|---|---|

| Scalping | High | High | Moderate to High (per trade, but many trades needed) |

| Day Trading | Medium to High | High | Medium to High |

| Swing Trading | Medium | Medium | Medium to High |

| Position Trading | Low to Medium | Low | High (potential, but long timeframe) |

Sentiment and Market Psychology on Reddit

Reddit, with its vibrant forex trading communities, offers a unique window into the collective psyche of traders. Analyzing the sentiment expressed within these online forums can provide valuable, albeit imperfect, insights into market psychology and potential price movements. While not a foolproof predictor, understanding the nuances of Reddit sentiment can add another layer to a trader’s decision-making process.

The correlation between Reddit sentiment and actual market movements is complex and not always straightforward. While a predominantly bullish sentiment might suggest upward pressure on a particular currency pair, numerous factors can influence the final outcome, including macroeconomic news, geopolitical events, and the actions of large institutional investors. Therefore, relying solely on Reddit sentiment for trading decisions is risky.

Reddit Sentiment as a Market Predictor

Several instances exist where Reddit sentiment accurately predicted market trends. For example, during periods of heightened uncertainty surrounding a specific geopolitical event, a consistently negative sentiment expressed on forex subreddits often preceded a downturn in the affected currency pair. This is because the collective anxieties of many traders, reflected in their online discussions, can act as a leading indicator of broader market trends. Conversely, periods of strong, widespread optimism can sometimes precede upward price movements, albeit often followed by corrections.

Instances of Misleading Reddit Sentiment

However, relying solely on Reddit sentiment can be misleading. The “wisdom of the crowd” effect, often cited in market analysis, doesn’t always hold true in online forums. Echo chambers, where traders reinforce each other’s biases, can lead to overly optimistic or pessimistic outlooks that deviate significantly from reality. Furthermore, the presence of experienced traders alongside novice ones can skew the overall sentiment, making it difficult to discern genuine market insights from noise. For instance, a sudden surge in negative sentiment might reflect panic selling by less experienced traders, rather than a fundamental shift in market dynamics.

Hypothetical Scenario: Sentiment Analysis in Trading Decisions

Imagine a scenario where a major central bank is expected to announce an interest rate decision. Leading up to the announcement, a significant portion of the discussions on r/Forex are overwhelmingly bearish on the Euro, citing concerns about potential negative implications of the upcoming decision. A trader employing sentiment analysis might interpret this as a potential short-selling opportunity, provided their own fundamental analysis supports this bearish outlook. However, the trader would also need to consider the possibility of a “contrarian” effect – the possibility that the widespread bearish sentiment is already priced into the market, potentially leading to a surprise positive reaction following the announcement. This trader would need to carefully weigh this information against other market signals before executing any trades.

Risk Management and Education on Reddit

Reddit’s Forex trading communities offer a mixed bag when it comes to risk management and education. While some users champion responsible trading practices, others highlight the pitfalls of impulsive decision-making. This duality reflects the inherent risks of Forex trading and the diverse levels of experience and knowledge among participants. Understanding these dynamics is crucial for anyone considering engaging with these online communities.

The common risk management techniques discussed revolve around the core principles of capital preservation. Position sizing, stop-loss orders, and diversification are frequently mentioned. Users often share their personal experiences, illustrating both successful implementations and costly mistakes. The level of detail varies considerably, ranging from simple explanations to sophisticated strategies incorporating advanced indicators and algorithms. The emphasis on risk management is often intertwined with discussions about psychological resilience and emotional control, acknowledging the significant impact of fear and greed on trading decisions.

Common Risk Management Techniques

Redditors frequently emphasize the importance of proper position sizing. This involves calculating the appropriate amount of capital to allocate to each trade, limiting potential losses to a manageable percentage of the overall trading account. Stop-loss orders, automatically exiting a trade when a predetermined price level is reached, are also heavily discussed as a crucial tool for mitigating risk. Diversification, spreading investments across different currency pairs or trading strategies, is often recommended to reduce the impact of losses on any single trade. However, the level of sophistication in applying these techniques varies widely. Some users apply these methods rigorously, while others seem to adopt a more casual approach, often leading to significant losses.

Examples of Responsible and Irresponsible Trading Practices

A responsible trader on Reddit might meticulously document their trades, including entry and exit points, risk-reward ratios, and the rationale behind their decisions. They’ll often discuss their stop-loss and take-profit levels, showcasing a clear understanding of risk management principles. They might share charts illustrating their trading strategies, focusing on risk-defined entries and exits, highlighting the calculated nature of their approach. In contrast, an irresponsible trader might boast about high-risk, high-reward trades without detailing their risk management strategy. Their posts might lack crucial information like stop-loss levels, revealing a disregard for capital preservation. These users often focus on quick profits rather than sustainable growth, sometimes leading to significant losses and disillusionment. Examples of irresponsible practices often include chasing losses, ignoring stop-losses, and over-leveraging their accounts.

Approaches to Forex Education on Reddit

Reddit users approach Forex education through a variety of methods. Many rely on self-learning, using free online resources and educational materials to acquire knowledge. Others participate in discussions, learning from the experiences and insights shared by other users. Mentorship is also sometimes observed, with experienced traders guiding newer participants. However, it’s crucial to approach such mentorship with caution, verifying the credibility and track record of the mentor. The quality of education varies greatly; some users demonstrate a deep understanding of technical and fundamental analysis, while others rely on unsubstantiated claims and trading signals. The platform’s decentralized nature means that filtering credible information from misleading content requires critical thinking and due diligence.

Frequently Recommended Educational Resources

Many educational resources are frequently recommended on Reddit’s Forex trading communities. These often include:

- Online Courses: Platforms like Babypips and Udemy offer structured courses covering various aspects of Forex trading, from fundamental concepts to advanced strategies.

- Books: Classic texts on technical analysis, such as those by John J. Murphy or Martin Pring, are often cited.

- Trading Journals and Blogs: Many experienced traders maintain journals or blogs documenting their trades and insights, providing valuable learning resources.

- YouTube Channels: Several YouTube channels dedicated to Forex education offer tutorials, analyses, and market commentary.

It’s important to note that while these resources can be valuable, users should always approach them critically, verifying the credibility of the information presented and considering the potential biases of the authors. Not all information found online is accurate or suitable for every trader.

The Role of Indicators and Technical Analysis on Reddit: Forex Trading Reddit

Reddit’s forex trading communities are a vibrant hub of technical analysis, with users constantly sharing charts, strategies, and interpretations. The prevalence of technical analysis reflects its accessibility and perceived ability to predict price movements, though it’s crucial to remember that no indicator guarantees success. Understanding the common indicators and approaches used is key to navigating these discussions and forming your own informed opinions.

Commonly Discussed Technical Indicators and Their Applications

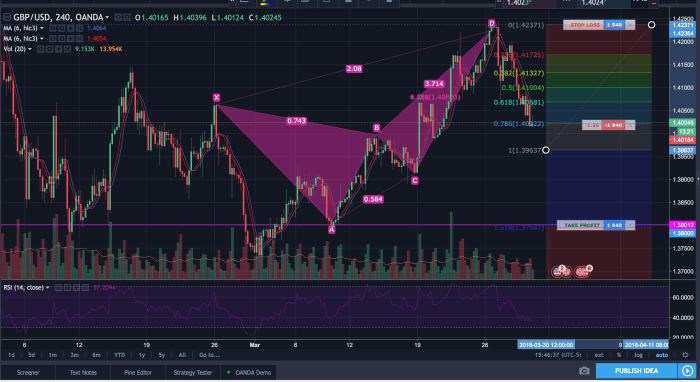

Redditors frequently utilize a range of technical indicators, each offering a unique perspective on market trends. The most popular include moving averages (MA), Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), and Bollinger Bands. Moving averages, for example, smooth out price fluctuations to identify trends, with different periods (e.g., 50-day MA, 200-day MA) providing varying levels of sensitivity. The RSI helps gauge momentum and identify overbought or oversold conditions, while the MACD highlights momentum shifts through the convergence and divergence of two moving averages. Bollinger Bands, displaying price volatility, help identify potential reversals when prices reach the upper or lower bands. Users often combine these indicators for a more comprehensive analysis.

Different Approaches to Technical Analysis on Reddit

Reddit’s forex trading discussions showcase a diversity of approaches to technical analysis. Some users rely heavily on a single indicator, believing it provides sufficient signals for profitable trades. Others employ a more holistic approach, combining multiple indicators and incorporating candlestick patterns, support and resistance levels, and Fibonacci retracements to confirm potential trade setups. Some traders focus primarily on trend-following strategies, using indicators to identify and ride prevailing market trends. Conversely, others prefer counter-trend strategies, attempting to capitalize on price reversals identified through indicator divergences or breakouts from established ranges. The choice of approach often reflects individual trading styles and risk tolerance.

Examples of Chart Interpretation and Indicator Application

Consider a hypothetical scenario: A trader observes a chart showing a downtrend, confirmed by a declining 20-day moving average. The RSI is nearing oversold territory (below 30), suggesting potential buying pressure. The MACD is showing a bullish divergence, with the price making lower lows while the MACD forms higher lows. Finally, the price has recently bounced off a significant support level. This combination of indicators and price action might lead the trader to believe a short-term price reversal is likely, prompting them to consider a long position. Conversely, a different trader might interpret the same situation differently, focusing on the continuing downtrend and ignoring the oversold RSI and MACD divergence, choosing to maintain a short position or remain out of the market.

A Typical Chart Analysis Example

Imagine a candlestick chart showing a recent upward trend. A 50-day moving average is sloping upwards, providing support for the trend. The 200-day moving average, a longer-term indicator, lies below the 50-day MA, also trending upwards. The RSI is above 50 but below 70, indicating a relatively strong but not overbought market. Bollinger Bands show the price near the upper band, suggesting potential resistance. A trader might interpret this as a potential short-term consolidation or pullback, possibly setting a take-profit order near the lower Bollinger Band or the 50-day moving average. They might also consider placing a stop-loss order below the recent swing low to limit potential losses.

Regulatory Compliance and Legal Considerations on Reddit

Reddit’s forex trading communities, while offering a wealth of information and diverse perspectives, also serve as a breeding ground for discussions surrounding regulatory compliance and the legal pitfalls of forex trading. Navigating this landscape requires a keen awareness of the risks involved and a commitment to responsible trading practices. Understanding the regulatory framework and common scams is crucial for protecting both capital and reputation.

The prevalence of unregulated brokers and fraudulent schemes is a significant concern highlighted repeatedly across various forex-related subreddits. Many users share cautionary tales, emphasizing the importance of thorough due diligence before engaging with any broker or investment opportunity. This includes verifying the broker’s regulatory status, understanding the associated fees and risks, and scrutinizing any overly-promising investment strategies. The lack of a unified global regulatory body for forex trading exacerbates these issues, creating a landscape where scams can flourish.

Regulatory Compliance and Broker Selection

Choosing a regulated broker is paramount. Discussions on Reddit frequently emphasize the need to verify a broker’s registration with reputable financial authorities like the Commodity Futures Trading Commission (CFTC) in the US, the Financial Conduct Authority (FCA) in the UK, or the Australian Securities and Investments Commission (ASIC) in Australia. Users often share experiences where brokers operating without proper licenses have led to significant financial losses or difficulties in withdrawing funds. A regulated broker provides a degree of protection, although it doesn’t eliminate all risks. Redditors often warn against brokers operating in offshore jurisdictions with lax regulatory environments, highlighting these as high-risk areas.

Examples of User Experiences with Regulatory Issues

Several Reddit threads document instances of users losing funds due to unregulated brokers. One common narrative involves brokers promising unrealistic returns, manipulating trading platforms, or outright refusing to process withdrawal requests. These experiences underscore the need for caution and thorough research. For example, a user might describe a situation where they invested with a broker claiming to be regulated but later discovered it operated from an offshore location with no oversight, resulting in the complete loss of their investment. Another example might involve a broker employing high-pressure sales tactics, encouraging excessive leverage, and ultimately leading to significant losses for the trader.

Due Diligence and Responsible Trading Practices, Forex trading reddit

The importance of due diligence cannot be overstated. Before investing any money, Reddit users consistently advise thoroughly researching brokers, understanding trading strategies, and managing risk effectively. This includes checking reviews from multiple sources, independently verifying regulatory information, and only investing funds that one can afford to lose. Responsible trading practices, such as utilizing stop-loss orders and avoiding emotional decision-making, are frequently discussed as crucial components of mitigating risk. The emphasis is consistently on education and informed decision-making to navigate the complexities of the forex market.

Final Conclusion

So, is Reddit the ultimate guide to forex trading success? The answer, like the market itself, is complex. While the platform offers a wealth of information and diverse perspectives, it’s crucial to approach it with a healthy dose of skepticism. Remember, every trade involves risk, and blindly following Reddit’s crowd can lead to significant losses. Ultimately, success in forex trading relies on your own research, risk management, and a solid understanding of the market. Reddit can be a valuable tool, but it’s not a magic bullet. Use your head, manage your risk, and maybe, just maybe, you’ll strike it rich.

For descriptions on additional topics like forex trading basics, please visit the available forex trading basics.

Enhance your insight with the methods and methods of forex trading td ameritrade.