Best forex trading platform for beginners? Navigating the wild world of forex can feel like trying to decipher ancient hieroglyphs, but it doesn’t have to be. This guide cuts through the jargon and reveals the secrets to finding the perfect platform for your first foray into the exciting (and sometimes terrifying) realm of currency trading. We’ll demystify the process, showing you how to choose a platform that’s not only user-friendly but also packed with the tools and resources you need to succeed.

From understanding the basics of forex trading to mastering the art of risk management, we’ll equip you with the knowledge to make informed decisions. We’ll compare popular platforms, highlighting their strengths and weaknesses, so you can confidently select the one that aligns with your skill level and trading style. Get ready to ditch the confusion and embrace the thrill of forex trading – the smart way.

Introduction to Forex Trading for Beginners

Forex trading, or foreign exchange trading, might sound intimidating, but at its core, it’s simply the buying and selling of different currencies. Think of it like exchanging money when you travel – you trade your dollars for euros, for example. The forex market is the largest and most liquid financial market globally, with trillions of dollars changing hands every day. Understanding the basics can open doors to exciting opportunities, but remember, it also carries risks.

Forex trading involves speculating on the value of one currency against another. Profits are made when you buy a currency at a lower price and sell it at a higher price, or vice versa. The market is decentralized, meaning there’s no single physical location; it operates 24 hours a day, five days a week, across various global financial centers. Major participants include banks, corporations, governments, and individual traders like yourself. These entities engage in forex trading for various reasons, from hedging against currency risks to speculating on exchange rate movements.

Understanding Currency Pairs

Currency pairs are the foundation of forex trading. They represent the exchange rate between two currencies. For example, EUR/USD represents the Euro against the US dollar. The first currency (EUR in this case) is called the base currency, and the second (USD) is the quote currency. The price quoted shows how many units of the quote currency are needed to buy one unit of the base currency. So, if EUR/USD is quoted at 1.10, it means one euro can be exchanged for 1.10 US dollars. Understanding how these pairs move and the factors influencing their movement is crucial for successful trading.

Opening a Demo Account: A Step-by-Step Guide

Before risking real money, it’s essential to practice with a demo account. A demo account simulates real forex trading conditions but uses virtual money. This allows you to learn the platform, experiment with different strategies, and develop your trading skills without financial risk. Here’s how to typically open one:

- Choose a Broker: Research and select a reputable forex broker offering demo accounts. Look for brokers with user-friendly platforms, educational resources, and good customer support.

- Visit the Broker’s Website: Navigate to the broker’s website and locate the section for demo accounts or practice accounts.

- Register: You’ll typically need to provide some basic information, such as your name, email address, and potentially a phone number. This process varies slightly between brokers.

- Download and Install (If Necessary): Some brokers require you to download and install trading software. Others offer web-based platforms accessible directly through your browser.

- Log In and Start Trading: Once your account is set up, log in and you’ll have access to virtual funds to practice trading. Many brokers provide tutorials and educational materials within the platform to help you get started.

Remember, a demo account is a valuable tool for learning. Use it to gain experience and confidence before committing your own capital to live trading. Don’t expect to immediately become profitable; focus on learning the mechanics of trading and developing a consistent strategy.

Key Features of Beginner-Friendly Forex Platforms

Choosing the right forex trading platform is crucial, especially for beginners. A platform that’s both powerful and easy to navigate can significantly impact your learning curve and overall trading experience. The right tools can make the difference between feeling overwhelmed and feeling empowered. Let’s explore the key features that make a platform truly beginner-friendly.

A user-friendly interface, integrated educational resources, and robust charting tools are essential for a smooth learning journey into the world of forex trading. These features not only ease the initial learning process but also support continued growth and improvement as a trader.

User-Friendly Interfaces

Navigating a complex trading platform can be daunting for newcomers. A beginner-friendly platform prioritizes simplicity and intuitive design. Clear menus, easily accessible tools, and a visually uncluttered layout are paramount. Imagine trying to learn to drive a car with a confusing dashboard – it’s distracting and unproductive. Similarly, a cluttered interface can hinder a beginner’s ability to focus on learning the fundamentals of forex trading. Instead, a well-designed platform should guide users through the process, making it easy to place trades, monitor positions, and access important information. This ease of use reduces frustration and allows beginners to concentrate on learning the intricacies of the forex market rather than battling with the platform itself. The platform should feel like a helpful guide, not an obstacle.

Integrated Educational Resources

Many beginner-friendly platforms recognize the importance of education and incorporate learning resources directly into their interface. These resources might include tutorials, webinars, glossary of terms, and even simulated trading environments. Access to this information within the platform eliminates the need to search for external resources, keeping the learning process streamlined and efficient. For example, a platform might offer interactive lessons explaining concepts like pip values, leverage, and margin calls. These integrated resources provide a structured learning path, guiding beginners through the complexities of forex trading in a digestible manner. This hands-on approach, coupled with practical examples, accelerates the learning process and reduces the risk of costly mistakes.

Robust Charting Tools

Technical analysis is a cornerstone of forex trading, and understanding charts is essential for successful trading. Beginner-friendly platforms often provide a range of charting tools, but with a focus on usability. While advanced platforms may overwhelm beginners with countless indicators and drawing tools, a beginner-friendly platform will offer a curated selection of essential tools, making it easier to learn and apply technical analysis. This might include common indicators like moving averages and RSI, as well as tools for drawing trend lines and support/resistance levels. The ability to customize chart views and save preferred settings allows beginners to personalize their trading experience and focus on developing their analytical skills without being distracted by unnecessary complexity. Clear and easily accessible charting tools are a crucial part of a beginner’s learning journey.

Comparison of Popular Forex Platforms

Choosing the right forex trading platform is crucial, especially for beginners. A user-friendly interface, comprehensive educational resources, and reliable customer support can significantly impact your learning curve and trading success. This section compares three popular platforms to help you make an informed decision.

Platform Feature Comparison

The following table summarizes key features of three popular forex trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are chosen for their widespread use and varying levels of beginner-friendliness. Note that specific features and offerings might change over time, so always check the platform’s official website for the most up-to-date information.

| Platform Name | Ease of Use | Educational Resources | Customer Support |

|---|---|---|---|

| MetaTrader 4 (MT4) | Relatively easy to learn, with a straightforward interface. However, some advanced features might require a steeper learning curve. | Offers built-in tutorials and access to numerous third-party educational resources. Many online communities and forums dedicated to MT4 provide support and learning opportunities. | Support varies depending on the broker. Some brokers offer excellent 24/7 support, while others may have limited options. |

| MetaTrader 5 (MT5) | More complex than MT4, offering a wider range of features and tools, but potentially more challenging for absolute beginners. | Similar to MT4, it provides built-in resources and access to a vast amount of online learning materials. However, the learning curve might be steeper. | Broker-dependent, with varying levels of support availability and responsiveness. |

| cTrader | Known for its intuitive and modern interface, considered very user-friendly even for beginners. The clean design reduces clutter and simplifies navigation. | Provides access to educational materials and resources, though possibly less extensive than MT4 or MT5’s community-driven support. | Typically offers good customer support, but the specific quality and availability can depend on the broker. |

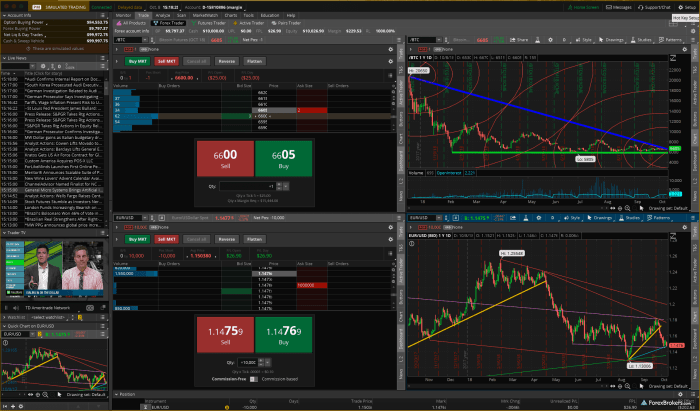

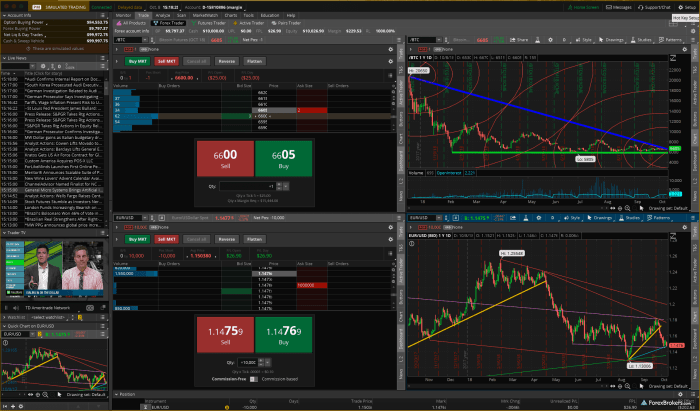

Interface Complexity Visualization

Imagine three screens representing the interfaces of these platforms. MT4’s screen would show a relatively uncluttered workspace with easily accessible menus and charts. MT5’s screen would display a more complex layout, with additional tools and windows, potentially appearing overwhelming for a beginner. Finally, cTrader’s screen would showcase a clean, modern design with a simplified layout, prioritizing ease of navigation and clear visual presentation of data. The visual difference reflects the platforms’ varying levels of complexity, highlighting MT4’s balance between functionality and simplicity, MT5’s comprehensive but potentially daunting feature set, and cTrader’s focus on user-friendliness through a streamlined interface.

Account Types and Fees

Choosing the right forex trading account is crucial for beginners. Different account types cater to various trading styles and capital levels, while fees can significantly impact your profitability. Understanding these aspects is key to a successful start in forex trading. Let’s break down the common account types and associated costs.

Forex brokers typically offer a range of account types designed to accommodate different trader needs and financial resources. These options vary in minimum deposit requirements, leverage levels, and the types of trading tools available. Fees also differ significantly between account types and brokers, so careful comparison is essential.

Expand your understanding about copy forex trading with the sources we offer.

Account Types

The most common account types offered by forex brokers include:

- Micro Accounts: These accounts require a small initial deposit, often as low as $50 or less, making them ideal for beginners with limited capital. They allow traders to practice with real money while minimizing risk. Traders can experiment with smaller lot sizes, which reduces the potential for substantial losses. Leverage is typically available, but it’s important to manage risk effectively.

- Standard Accounts: Standard accounts are suitable for traders with moderate capital. They offer a balance between access to a wider range of tools and features, and manageable minimum deposit requirements (usually between $100 and $1000). Leverage is often higher than micro accounts, but risk management remains crucial.

- Mini Accounts: Similar to standard accounts but with smaller lot sizes, making them suitable for those wanting to trade with less capital exposure than a standard account but with more than a micro account. Minimum deposit requirements are generally between a micro and a standard account.

- ECN/STP Accounts: These accounts provide direct access to the interbank market, offering tighter spreads and better pricing transparency. However, they often require higher minimum deposits and may charge commissions in addition to spreads. These accounts are generally more suitable for experienced traders due to their complexity.

- Islamic Accounts (Swap-Free): Designed for Muslim traders, these accounts comply with Islamic finance principles by eliminating overnight interest (swap) charges. The terms and conditions may vary across brokers.

Fees, Best forex trading platform for beginners

Several fees can impact your forex trading profits. Understanding these is essential for effective budget management and maximizing your returns.

Obtain recommendations related to forex trading algorithms that can assist you today.

- Spreads: The spread is the difference between the bid (selling) and ask (buying) price of a currency pair. It’s the most common fee in forex trading. Lower spreads are generally preferable as they reduce trading costs. Spreads can vary depending on market volatility and the account type.

- Commissions: Some brokers, particularly those offering ECN/STP accounts, charge commissions per lot traded. This fee is in addition to the spread. The commission amount varies across brokers.

- Overnight Financing (Swap): Holding positions open overnight often incurs a swap fee, which compensates for the interest rate differential between the two currencies in the pair. This fee can be positive or negative, depending on the direction of your trade and the interest rate difference.

- Inactivity Fees: Some brokers charge inactivity fees if your account remains dormant for a certain period.

- Withdrawal Fees: Some brokers may charge fees for withdrawing funds from your trading account.

Risk Management for Beginners

Forex trading, while potentially lucrative, carries significant risk. For beginners, understanding and implementing robust risk management strategies is paramount to avoid substantial losses and build a sustainable trading career. Ignoring risk management is like sailing a ship without a compass – you might get lucky, but you’re far more likely to crash.

Risk management in forex trading isn’t about avoiding losses altogether; it’s about controlling them. It’s about setting limits to protect your capital and ensuring that even losing trades don’t derail your entire trading journey. This involves carefully considering your risk tolerance, diversifying your investments, and utilizing tools like stop-loss orders and position sizing.

Stop-Loss Orders and Position Sizing

Stop-loss orders are your safety net. They automatically close a trade when the price reaches a predetermined level, limiting your potential losses. Setting a stop-loss order requires careful consideration of your trading strategy and the market’s volatility. For instance, a more volatile currency pair might require a wider stop-loss order to account for larger price swings. Position sizing, on the other hand, determines how much capital you allocate to each trade. It’s crucial to ensure that even with a stop-loss order in place, a losing trade won’t wipe out a significant portion of your account.

Calculating Appropriate Position Sizes

Determining the appropriate position size involves a straightforward calculation that balances risk tolerance with account balance. A common approach is to risk a fixed percentage of your account balance on each trade. For example, a trader with a $1000 account and a 2% risk tolerance would risk $20 on each trade. This risk amount is then translated into the number of units to trade, considering the pip value of the currency pair. Let’s say the pip value for a specific pair is $1 per pip. If the trader’s stop-loss is set at 20 pips, the maximum loss would be $20 (20 pips x $1/pip). This calculation ensures that a single losing trade doesn’t exceed their predetermined risk tolerance.

The formula for calculating position size is: Position Size = (Account Balance * Risk Percentage) / (Stop Loss in Pips * Pip Value)

For instance, with a $1000 account, a 2% risk tolerance, a 20-pip stop loss, and a $1 pip value, the calculation would be: (1000 * 0.02) / (20 * 1) = 0.1 lots. This means the trader should only trade 0.1 lots to stay within their risk tolerance. Remember, this is a simplified example, and the actual pip value can vary depending on the currency pair and leverage used. It’s important to use a position size calculator to ensure accurate calculations. Using a calculator will also help you to avoid manual calculation errors which could potentially lead to significant losses.

Demo Accounts and Simulated Trading

Before you dive headfirst into the thrilling (and sometimes terrifying) world of real-money forex trading, think of a demo account as your personal forex training ground. It’s a risk-free environment where you can hone your skills, test strategies, and get comfortable with the platform without jeopardizing your hard-earned cash. Essentially, it’s like a flight simulator for your trading career.

Using a demo account allows you to experience the forex market’s dynamics without the pressure of financial losses. You can experiment with different trading styles, indicators, and strategies to find what works best for you. This practice period is invaluable in building confidence and developing a solid trading plan before committing real capital. Think of it as your chance to learn from your mistakes without paying the price.

Benefits of Using Demo Accounts

Practicing with a demo account offers several significant advantages. It allows you to familiarize yourself with the trading platform’s interface, understand order execution, and develop your trading strategies without financial risk. This risk-free environment is crucial for beginners to build confidence and refine their approach before transitioning to live trading. The learning curve is significantly smoother, and you can avoid costly mistakes that often accompany inexperience. Furthermore, it provides a realistic simulation of market conditions, enabling you to adapt to the volatility and dynamic nature of the forex market.

Utilizing a Demo Account Effectively

Effectively utilizing a demo account involves a structured approach. First, choose a reputable forex broker offering a demo account with realistic market data. Next, familiarize yourself with the platform’s interface and features, including order placement, chart analysis tools, and risk management settings. Then, start with paper trading – simulating trades without actually placing orders – to get a feel for the platform. Gradually increase the complexity of your trades, testing different strategies and analyzing your results. Finally, keep detailed records of your trades, noting your successes and failures to identify areas for improvement.

Differences Between Demo and Live Trading Environments

While demo accounts provide a valuable training ground, it’s crucial to understand the differences between demo and live trading. The most significant difference lies in the psychological aspect. The lack of real financial risk in demo trading can lead to overly aggressive or reckless trading behavior, which may not translate to success in live trading where emotional control is paramount. Additionally, while most brokers strive for realistic market data in demo accounts, there can be slight differences in slippage, execution speed, and overall market conditions compared to live trading. Finally, the emotional impact of potential losses is absent in demo trading, a crucial element that significantly affects trading decisions in live markets. The adrenaline and pressure of managing real money are factors that cannot be fully replicated in a simulated environment.

Educational Resources and Support: Best Forex Trading Platform For Beginners

Navigating the forex market as a beginner can feel like charting uncharted waters. Fortunately, many reputable platforms offer a wealth of educational resources designed to equip newcomers with the knowledge and confidence they need. Beyond the platform itself, seeking out external resources is crucial for a well-rounded understanding. Robust customer support is also vital, acting as a safety net when challenges arise.

Choosing a forex trading platform with comprehensive educational resources is paramount for success. These resources shouldn’t just be a collection of dry manuals; they should be engaging, informative, and readily accessible. Understanding the various support channels available will also impact your overall trading experience.

Types of Educational Resources on Beginner-Friendly Platforms

Beginner-friendly forex platforms typically offer a range of educational materials to cater to different learning styles. These resources aim to demystify forex trading concepts and empower beginners to make informed decisions. Access to these resources often varies depending on the platform and the type of account held.

- Video Tutorials: Many platforms offer step-by-step video tutorials covering fundamental concepts like understanding currency pairs, using trading platforms, and implementing basic trading strategies. These videos often break down complex topics into easily digestible chunks, making them ideal for visual learners.

- Webinars: Live or recorded webinars provide interactive learning experiences. Experts often host these sessions, answering questions in real-time and offering insights into current market trends. They’re a great way to engage with the platform’s community and learn from others’ experiences.

- Ebooks and Guides: Comprehensive ebooks and downloadable guides provide in-depth explanations of forex trading principles, risk management techniques, and market analysis methods. These resources often serve as valuable references, allowing beginners to revisit key concepts at their own pace.

- Glossary of Terms: A readily accessible glossary defines common forex jargon, ensuring beginners understand the terminology used throughout the platform and in market analysis.

- Practice Quizzes and Assessments: Interactive quizzes and assessments help beginners test their knowledge and identify areas needing further study. This reinforcement of learning is crucial for retention and application.

Finding Reliable Educational Resources Outside of Trading Platforms

While platform-provided resources are invaluable, supplementing your learning with external sources broadens your perspective and helps you develop a more critical understanding of the market.

- Reputable Financial Websites and Blogs: Sites like Investopedia, BabyPips, and DailyFX offer a wealth of articles, tutorials, and analysis. Always verify the credibility of the source before relying on the information.

- Books on Forex Trading: Many excellent books cover forex trading strategies, risk management, and market psychology. Look for books written by experienced traders with a proven track record.

- Online Courses and Certifications: Reputable online learning platforms offer structured forex trading courses, some leading to certifications that can enhance your credibility.

- Financial News Outlets: Stay updated on market news and events through reliable sources like Bloomberg, Reuters, and the Financial Times. Understanding global economic events is crucial for successful forex trading.

Customer Support Channels and Their Importance

Reliable customer support is essential, especially for beginners who may encounter technical difficulties or have questions about the platform’s features. A responsive support team can significantly reduce frustration and ensure a smooth trading experience.

- Email Support: Provides a written record of your inquiries and responses, useful for complex issues requiring detailed explanations.

- Live Chat Support: Offers immediate assistance for urgent queries or technical problems, providing quick solutions.

- Phone Support: Allows for direct communication, ideal for complex situations needing immediate clarification.

- FAQ Section: A comprehensive FAQ section addresses common questions, often providing quick answers to frequently asked queries.

Conclusive Thoughts

So, there you have it – your roadmap to conquering the forex market as a beginner. Remember, choosing the right platform is just the first step. Consistent learning, smart risk management, and a dash of patience are your secret weapons. Don’t be afraid to start with a demo account, practice your strategies, and gradually build your confidence. The world of forex trading awaits – are you ready to dive in?