Forex trading platforms for beginners: Think of it like this – you’re about to unlock a whole new world of financial opportunity, but navigating the landscape can feel like trying to decipher ancient hieroglyphs. This guide cuts through the jargon, offering a beginner-friendly walkthrough of choosing the right platform, understanding key terms, and even mastering the art of the demo account. Get ready to ditch the confusion and embrace the thrill of the forex market.

We’ll break down the essential features you need to look for in a platform, from user-friendly interfaces to robust security measures. We’ll also explore different platform types – web-based, mobile, desktop – helping you choose the one that best fits your lifestyle and trading style. Learning to trade forex isn’t just about charts and numbers; it’s about building a solid foundation and making informed decisions. This guide is your passport to that foundation.

Introduction to Forex Trading for Beginners

Forex trading, or foreign exchange trading, might sound intimidating, but at its core, it’s simply buying and selling different currencies to profit from their fluctuating values. Think of it like exchanging money when you travel – except instead of exchanging small amounts at an airport, you’re dealing with larger sums and aiming to make a profit based on predicted price movements. This beginner’s guide will demystify the process and equip you with the basics.

Forex trading involves speculating on the relative value of one currency against another. For example, you might buy the Euro (EUR) against the US dollar (USD), hoping the Euro will appreciate in value compared to the dollar, allowing you to sell it later at a higher price and pocket the difference. The market operates 24/5, offering continuous opportunities, but also requiring constant vigilance.

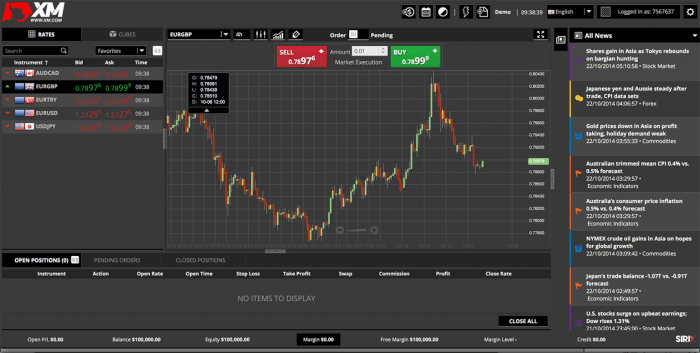

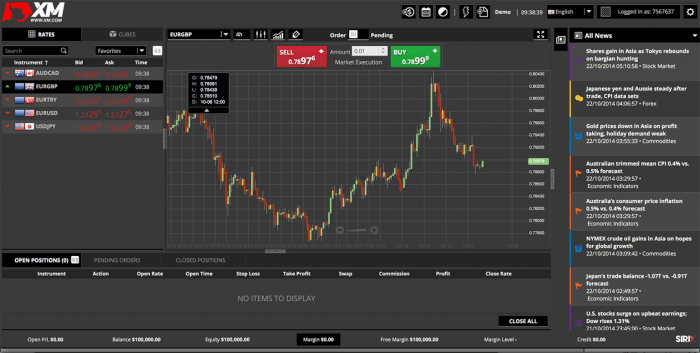

Opening a Demo Account: A Step-by-Step Guide

Before risking real money, practicing on a demo account is crucial. A demo account mirrors a live trading environment, allowing you to execute trades without financial risk. This allows you to test strategies, understand platform functionalities, and build confidence before investing your own capital. Here’s how to open one:

- Choose a Broker: Research reputable forex brokers that offer demo accounts. Consider factors like platform usability, available tools, and customer support. Many brokers offer a wide variety of educational materials and tools as well.

- Register: Visit the broker’s website and create an account. You’ll typically need to provide basic information such as your name, email address, and potentially a phone number.

- Download Platform (if necessary): Some brokers provide web-based platforms, while others require downloading software. Follow the broker’s instructions to access the trading platform.

- Fund Your Demo Account (with virtual money): Most brokers automatically credit your demo account with a virtual amount of money. This allows you to practice trading with realistic market conditions without the fear of losing your actual funds.

- Start Practicing: Begin by placing small trades to get a feel for the platform and how the market moves. Experiment with different strategies and observe the results.

Effective Risk Management for Beginners

Successful forex trading is not just about making profits; it’s equally about protecting your capital. Effective risk management is paramount, especially for beginners.

Never risk more than you can afford to lose.

This is the golden rule. Beginners should adopt conservative strategies and avoid over-leveraging. Leverage magnifies both profits and losses, so using it improperly can quickly lead to substantial losses. Consider these points:

- Set Stop-Loss Orders: A stop-loss order automatically closes a trade when the price reaches a predetermined level, limiting potential losses.

- Use Take-Profit Orders: A take-profit order automatically closes a trade when the price reaches a predetermined level, securing profits.

- Diversify Your Trades: Don’t put all your eggs in one basket. Spread your investments across different currency pairs to reduce risk.

- Maintain a Trading Journal: Track your trades, analyzing both successes and failures to improve your strategies and risk management techniques.

Choosing the Right Forex Trading Platform

Navigating the world of forex trading can feel like stepping into a bustling marketplace – exciting, but potentially overwhelming. One of the first, and most crucial, decisions you’ll make is selecting the right trading platform. Your platform will be your command center, your window into the market, and the tool you use to execute your trades. Choosing wisely can significantly impact your trading experience and, ultimately, your success.

Forex Trading Platform Comparison

Selecting a forex trading platform requires careful consideration of various features. Different platforms cater to different trading styles and levels of experience. Below, we compare three popular platforms, highlighting their strengths and weaknesses to help you make an informed decision.

| Platform Name | Key Features | Pros | Cons |

|---|---|---|---|

| MetaTrader 4 (MT4) | Extensive charting tools, automated trading (Expert Advisors), wide range of technical indicators, large community support, mobile accessibility. | User-friendly interface, highly customizable, vast resources and educational materials available, widely used and trusted. | Can feel outdated compared to newer platforms, some features may require third-party add-ons. |

| MetaTrader 5 (MT5) | Improved charting capabilities compared to MT4, more advanced order types, economic calendar integration, enhanced backtesting tools, wider range of order execution types. | More sophisticated than MT4, offers a wider array of tools for advanced traders, supports hedging. | Steeper learning curve than MT4, some traders find the interface less intuitive. |

| cTrader | Focus on speed and execution, advanced charting tools, low latency, excellent for scalping and high-frequency trading, direct market access (DMA). | Exceptional speed and execution, intuitive interface, strong charting capabilities. | Smaller community compared to MT4/MT5, fewer educational resources readily available. |

Essential Features for Beginner Forex Traders

For beginners, certain platform features are paramount. Prioritizing these elements ensures a smoother learning curve and reduces the risk of costly mistakes.

A beginner-friendly platform should offer:

* Intuitive Interface: Easy navigation and clear presentation of information are essential for focusing on learning trading strategies rather than deciphering a complex platform.

* Educational Resources: Access to tutorials, webinars, or guides can significantly accelerate the learning process.

* Demo Account: A risk-free environment to practice trading strategies and familiarize yourself with the platform’s functionality is invaluable.

* Reliable Customer Support: Prompt and helpful customer support is crucial when encountering technical issues or needing guidance.

* Basic Charting Tools: The platform should provide essential charting tools, allowing you to analyze price movements and identify potential trading opportunities.

Importance of User-Friendly Interface and Navigation

A user-friendly interface is not merely a convenience; it’s a critical component of successful forex trading, especially for beginners. A confusing or cluttered platform can lead to errors in placing trades, misinterpreting market data, and ultimately, financial losses. Easy navigation allows traders to quickly access the information they need, make informed decisions, and react swiftly to market changes. A streamlined interface minimizes distractions and allows beginners to concentrate on developing their trading skills without the added frustration of navigating a complex system. Think of it like this: a well-designed cockpit makes flying a plane easier; similarly, a user-friendly platform simplifies the complexities of forex trading.

Understanding Forex Trading Terminology: Forex Trading Platforms For Beginners

Navigating the world of forex trading can feel like learning a new language. Understanding the jargon is crucial for making informed decisions and avoiding costly mistakes. This section breaks down some of the most common terms you’ll encounter, explaining their significance and how they impact your trading strategy. Think of it as your essential forex dictionary.

Forex trading involves a unique vocabulary. Grasping these core concepts is the first step to becoming a successful trader. Let’s demystify some of these terms.

Key Forex Terminology Definitions

Here’s a breakdown of essential terms, explained simply and clearly. These definitions are fundamental to your understanding of forex trading mechanics.

- Pip (Point in Percentage): A pip is the smallest price movement in a forex pair. For most currency pairs, a pip is 0.0001. For example, if EUR/USD moves from 1.1000 to 1.1001, that’s a one-pip movement. Understanding pips is crucial for calculating profits and losses.

- Lot: A lot represents the number of units of a currency pair you’re trading. Standard lots are typically 100,000 units, while mini-lots are 10,000 and micro-lots are 1,000. The size of your lot directly impacts your potential profit or loss. For instance, a one-pip movement on a standard lot of EUR/USD would be $10 (assuming a 1:100 leverage, discussed below).

- Leverage: Leverage allows you to control a larger position with a smaller amount of capital. It’s expressed as a ratio, such as 1:100 or 1:500. This means that for every $1 you deposit, you can control $100 or $500 respectively. Leverage amplifies both profits and losses, so it’s crucial to understand and manage risk effectively. For example, with 1:100 leverage and a $1000 deposit, you can trade positions worth $100,000.

- Spread: The spread is the difference between the bid price (the price at which you can sell a currency pair) and the ask price (the price at which you can buy a currency pair). Spreads vary depending on the currency pair and market conditions. The spread represents a transaction cost; it’s the broker’s profit. A smaller spread is generally more favorable to the trader.

- Margin: Margin is the amount of money you need to deposit in your trading account to open and maintain a position. It’s a percentage of the total position value, determined by your leverage. Maintaining sufficient margin is essential to avoid a margin call, which occurs when your account equity falls below the required margin level, leading to the forced closure of your position.

Glossary of Essential Forex Terminology

This glossary provides concise definitions for quick reference. Keep this handy as you delve deeper into the forex market.

In this topic, you find that forex trading with leverage is very useful.

| Term | Definition |

|---|---|

| Bid Price | The price at which a market maker is willing to buy a currency pair. |

| Ask Price | The price at which a market maker is willing to sell a currency pair. |

| Currency Pair | A pair of currencies traded against each other (e.g., EUR/USD, GBP/JPY). |

| Forex (FX) | Foreign exchange market; the global decentralized market for exchanging national currencies. |

| Long Position | Buying a currency pair with the expectation that its value will rise. |

| Short Position | Selling a currency pair with the expectation that its value will fall. |

| Order Book | A record of all pending buy and sell orders for a particular currency pair. |

| Slippage | The difference between the expected price of a trade and the actual execution price. |

| Stop-Loss Order | An order to automatically close a position if the price moves against you by a certain amount. |

| Take-Profit Order | An order to automatically close a position if the price moves in your favor by a certain amount. |

Demo Accounts and Practice Trading

Diving into the forex market with real money right away can be a risky proposition, akin to jumping into a deep end without knowing how to swim. That’s where demo accounts become your life raft – a safe space to learn the ropes and hone your trading skills before risking your hard-earned cash. Think of it as your personal forex training ground, where mistakes are lessons, not losses.

Demo accounts provide a risk-free environment mirroring real market conditions. You get to experience the thrill (and sometimes the chill) of trading without the financial consequences. This allows you to test strategies, experiment with different indicators, and develop your trading intuition without the pressure of potential monetary losses. Mastering this virtual playground is crucial before venturing into the live market.

Benefits of Using a Demo Account

Utilizing a demo account offers several significant advantages. Firstly, it eliminates the financial risk associated with live trading, allowing you to focus on developing your skills and understanding market dynamics. Secondly, it provides a safe space to experiment with various trading strategies and indicators without the fear of losing capital. Thirdly, it helps build confidence and familiarity with the trading platform’s interface and functionalities. Finally, it enables you to refine your risk management techniques in a controlled environment before applying them to real trades. This reduces the likelihood of making costly errors when you transition to live trading.

Step-by-Step Guide to Effective Demo Account Utilization

Effectively using a demo account involves a structured approach. First, choose a reputable forex broker offering a demo account with realistic market data. Then, familiarize yourself with the platform’s interface, including order placement, chart analysis tools, and account management features. Next, start with paper trading, simulating trades based on your research and analysis. Focus on executing trades precisely as you would in a live environment, paying close attention to order entry and management. Gradually increase the complexity of your trades as your confidence grows. Regularly review your trading performance, analyzing both profitable and unprofitable trades to identify areas for improvement. Finally, remember that the goal is not just to make virtual profits, but to refine your trading strategies and risk management techniques.

Designing a Practice Trading Strategy with Risk Management

A successful practice trading strategy emphasizes risk management above all else. Begin by defining your risk tolerance – how much of your (virtual) capital are you willing to lose on any single trade? A common rule of thumb is to risk no more than 1-2% of your account balance per trade. Next, identify your entry and exit points for trades based on technical or fundamental analysis. For example, you might use a combination of moving averages and support/resistance levels to determine entry points, and set stop-loss orders to limit potential losses. Furthermore, consider using take-profit orders to secure profits when your targets are reached. Document every trade, including your rationale, entry/exit points, and the outcome. Regularly review your trading journal to identify patterns and areas for improvement in your risk management approach. For instance, if you consistently experience losses on trades exceeding your predetermined risk tolerance, adjust your strategy accordingly. This iterative process is key to developing a robust and profitable trading system.

Different Types of Forex Trading Platforms

Choosing the right forex trading platform is crucial for a successful trading journey. The platform you select will significantly impact your trading experience, from ease of use to the tools available. Different platforms cater to different needs and preferences, so understanding the key distinctions is essential before you dive in.

Web-Based Forex Trading Platforms, Forex trading platforms for beginners

Web-based platforms are accessed through a web browser, eliminating the need for downloads or installations. This accessibility is a major advantage, allowing traders to access their accounts from any device with an internet connection. Think of it like checking your email – you don’t need special software, just a browser.

- Advantages: Accessibility from any device with an internet connection, easy to use, often require less powerful hardware.

- Disadvantages: Dependent on a stable internet connection, potentially slower performance compared to desktop platforms, limited access to advanced charting tools in some cases.

- User Experience: Generally intuitive and user-friendly, especially for beginners. The interface is typically clean and straightforward, focusing on essential trading functions.

Desktop Forex Trading Platforms

Desktop platforms are downloaded and installed directly onto your computer. They usually offer more advanced features and customization options than web-based platforms. These platforms are designed for serious traders who spend significant time analyzing charts and managing their trades. Imagine a professional-grade graphic design program – powerful, but requiring more setup.

- Advantages: Faster execution speeds, more advanced charting and analytical tools, offline access to some features (depending on the platform), greater customization options.

- Disadvantages: Requires download and installation, limited to the device where it’s installed, may require more powerful hardware for optimal performance.

- User Experience: Can be more complex than web-based platforms, offering a wider range of tools and features but requiring a steeper learning curve. The interface is often more customizable, allowing traders to tailor it to their specific needs.

Mobile Forex Trading Platforms

Mobile platforms are designed for trading on smartphones and tablets. These platforms provide convenience and flexibility, allowing traders to monitor and manage their trades on the go. Think of it as having your trading room in your pocket.

- Advantages: Portability and convenience, allows for quick responses to market changes, access to essential trading functions from anywhere with a mobile internet connection.

- Disadvantages: Smaller screen size can limit charting and analysis capabilities, potential for slower performance compared to desktop platforms, may lack some advanced features found in desktop platforms.

- User Experience: Designed for ease of use on smaller screens, typically focusing on essential trading functions. The interface is usually simplified to ensure efficient navigation and quick order placement.

Security and Regulation of Forex Trading Platforms

Navigating the world of forex trading requires a keen eye for both opportunity and risk. While the potential for profit is enticing, it’s crucial to prioritize security and ensure you’re working with a reputable platform. Choosing a platform that prioritizes your financial well-being is paramount, and understanding the regulatory landscape is key to making an informed decision.

The security and regulation of your chosen forex trading platform are not optional extras; they are fundamental to protecting your investments and ensuring a fair trading environment. A lack of proper security measures can leave your funds vulnerable to theft or fraud, while the absence of regulatory oversight can expose you to manipulative practices and unfair trading conditions. Therefore, careful due diligence is essential before committing your capital.

Regulatory Oversight and Licensing

Regulatory bodies play a vital role in protecting traders from fraudulent activities and ensuring fair market practices. These organizations establish rules and regulations, conduct audits, and investigate complaints against forex brokers. Trading with a broker licensed by a reputable regulatory body significantly reduces the risk of encountering scams or unethical trading practices. The presence of a license doesn’t guarantee absolute safety, but it provides a significant layer of protection. Choosing a broker without proper licensing exposes traders to considerably higher risks.

Key Factors for Assessing Platform Security

Several factors contribute to a forex trading platform’s overall security. These factors should be carefully considered before entrusting your funds to any platform.

- Data Encryption: A secure platform employs robust encryption protocols, such as SSL/TLS, to protect sensitive data transmitted between your computer and the platform’s servers. This prevents unauthorized access to your personal and financial information during transactions.

- Security Protocols: Strong security protocols, including firewalls and intrusion detection systems, are essential to protect the platform from cyberattacks and unauthorized access. These systems monitor network traffic and identify potential threats, helping to prevent data breaches and protect user accounts.

- Fund Security: Reputable platforms often segregate client funds from their operating capital. This means your money is kept in separate accounts, reducing the risk of losing your funds if the brokerage faces financial difficulties. Look for platforms that clearly state their policies regarding client fund segregation.

- Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone or email, in addition to your password. This significantly reduces the risk of unauthorized access even if your password is compromised.

Examples of Reputable Regulatory Bodies

Several reputable regulatory bodies oversee forex brokers globally. These organizations vary in their specific regulations and enforcement mechanisms, but they all aim to maintain market integrity and protect traders’ interests. Some examples include:

- Financial Conduct Authority (FCA) – UK: The FCA is a well-respected regulatory body in the UK, known for its stringent regulations and robust enforcement actions.

- Australian Securities and Investments Commission (ASIC) – Australia: ASIC is the primary regulatory body for financial services in Australia, including forex brokers operating within the country.

- Commodity Futures Trading Commission (CFTC) – USA: The CFTC regulates futures and options markets in the United States, including forex trading.

- Financial Services Authority (FSA) – Japan: The FSA is the regulatory body for financial services in Japan, overseeing forex brokers operating within the country’s jurisdiction.

Essential Tools and Resources for Beginners

Navigating the forex market successfully requires more than just understanding the basics; it demands the right tools and resources to stay informed and make informed decisions. This section will equip you with the essential arsenal needed to confidently approach your forex trading journey. From reliable educational materials to indispensable analytical tools, we’ll cover everything you need to get started.

Equipping yourself with the right tools and resources is crucial for success in forex trading. A combination of educational materials, analytical tools, and up-to-the-minute market information will provide a solid foundation for your trading decisions.

Helpful Resources for Forex Education

Numerous resources are available to help you learn about forex trading. These resources range from beginner-friendly websites to in-depth books written by experienced traders. Choosing the right resources will depend on your learning style and the depth of knowledge you’re seeking.

You also will receive the benefits of visiting forex trading reddit today.

- Websites: Babypips, Forex.com’s educational section, and Investopedia offer a wealth of free educational content, including tutorials, articles, and glossary terms.

- Books: “Japanese Candlestick Charting Techniques” by Steve Nison is a classic for technical analysis, while “Trading in the Zone” by Mark Douglas focuses on the psychological aspects of trading. Many other excellent books are available depending on your specific trading style and interests.

- Online Courses: Platforms like Udemy and Coursera offer structured forex trading courses taught by experienced professionals. These courses often include practical exercises and quizzes.

Economic Calendars and News Sources

Economic calendars and news sources provide crucial real-time data that significantly impacts forex prices. Staying informed about upcoming economic events and their potential market effects is paramount for successful trading.

Economic calendars list scheduled economic announcements, such as interest rate decisions, employment reports, and inflation figures. These events often cause significant market volatility, presenting both opportunities and risks for traders. For example, an unexpectedly strong employment report might strengthen a country’s currency, while a disappointing inflation figure might weaken it. Many forex brokers provide free access to economic calendars directly on their platforms.

Reliable news sources, such as Reuters, Bloomberg, and the Financial Times, offer up-to-the-minute reports on global economic and political events. These news sources can provide valuable context for interpreting economic data and anticipating market movements. News can impact currency values quickly, highlighting the importance of staying informed.

Charting Tools for Technical Analysis

Charting tools are essential for performing technical analysis, a method of evaluating investments by analyzing historical market data, such as price and volume. Technical analysis helps identify potential trading opportunities by looking for patterns and trends in price movements.

Most forex trading platforms offer a variety of charting tools, including different chart types (line, bar, candlestick), technical indicators (moving averages, RSI, MACD), and drawing tools (trend lines, Fibonacci retracements). Understanding how to use these tools effectively is crucial for identifying potential entry and exit points for trades. For example, a trader might use moving averages to identify support and resistance levels, while using the RSI indicator to gauge the strength of a trend. Learning to interpret chart patterns and indicators requires practice and experience but is a vital skill for successful forex trading.

Avoiding Scams and Choosing Reputable Brokers

The forex market, while offering lucrative opportunities, is also unfortunately rife with scams. Navigating this landscape requires a keen eye and a proactive approach to identifying potentially fraudulent platforms and brokers. Understanding how to conduct thorough due diligence is crucial to protecting your investment and ensuring a safe trading experience.

The allure of quick riches often masks deceptive practices. Many fraudulent forex brokers employ sophisticated tactics to lure unsuspecting traders, leading to significant financial losses. Therefore, understanding the red flags and the hallmarks of a legitimate broker is paramount.

Identifying Potential Scams

Spotting a forex scam requires vigilance and critical thinking. Scammers often use high-pressure sales tactics, promising unrealistic returns, and employing misleading marketing materials. They may claim guaranteed profits or boast exceptionally high win rates, which are statistically improbable in the forex market. Furthermore, difficulty in withdrawing funds or a lack of transparency regarding fees and regulations should raise immediate concerns. A legitimate broker will always operate with transparency and adhere to strict regulatory guidelines.

Importance of Due Diligence

Due diligence is not merely a suggestion; it’s a necessity when choosing a forex broker. This involves thoroughly researching the broker’s background, checking its regulatory status, and verifying client testimonials. Ignoring this crucial step can expose you to significant financial risks. Thorough research should include verifying the broker’s registration with relevant regulatory bodies, checking online reviews from multiple sources, and reviewing the broker’s terms and conditions meticulously. Don’t rush into a decision; take your time to ensure the broker aligns with your trading needs and risk tolerance.

Characteristics of a Legitimate and Trustworthy Forex Broker

A reputable forex broker will exhibit several key characteristics. Transparency in its operations is paramount. This includes clearly outlining fees, commissions, and trading conditions. A legitimate broker will also be regulated by a recognized financial authority, providing a layer of protection for traders. This regulatory oversight ensures adherence to specific standards and provides recourse in case of disputes. Furthermore, a trustworthy broker will offer a user-friendly platform, robust customer support, and educational resources to assist traders of all levels. They will prioritize client security and will have measures in place to protect client funds. Finally, a strong reputation built on positive client feedback and a long-standing presence in the market are also key indicators of legitimacy.

Final Review

So, you’ve taken the first step into the exciting world of forex trading. Remember, choosing the right platform is crucial for a smooth and successful journey. By understanding the key features, navigating the terminology, and utilizing demo accounts effectively, you’re setting yourself up for success. Don’t be intimidated – with the right knowledge and a bit of practice, you can confidently navigate the forex market and achieve your financial goals. Now go forth and conquer!