Best forex trading platforms for beginners? Dive into the exciting world of forex trading, where fortunes are made and lost with the click of a button. This isn’t your grandpa’s investment strategy; it’s fast-paced, globally connected, and brimming with potential. But before you jump in headfirst, choosing the right platform is crucial. This guide navigates the maze of options, highlighting the best platforms designed to make your forex journey smoother, safer, and – dare we say – even enjoyable.

We’ll unpack the key features to look for in a beginner-friendly platform, from intuitive interfaces to robust educational resources. We’ll compare top contenders, analyzing their fees, spreads, and minimum deposits. We’ll also cover the importance of demo accounts, risk management, and understanding trading costs. Get ready to learn how to navigate this thrilling market and find the perfect platform to match your trading style.

Introduction to Forex Trading for Beginners: Best Forex Trading Platforms For Beginners

Forex trading, or foreign exchange trading, is the global marketplace where currencies are bought and sold. It’s a decentralized, over-the-counter (OTC) market, meaning there’s no central location; trading happens electronically between participants worldwide. The core concept revolves around exchanging one currency for another, aiming to profit from fluctuations in their relative values. These fluctuations are influenced by a myriad of factors, including economic news, political events, and market sentiment.

Forex trading offers the potential for significant profits due to its high leverage and 24/5 availability. The ability to trade with borrowed capital (leverage) magnifies both gains and losses. The market’s continuous operation allows traders flexibility and the chance to capitalize on global events around the clock. However, this high leverage also presents substantial risks. Losses can quickly escalate, potentially exceeding initial investments. The volatile nature of the market demands careful analysis, risk management, and a solid understanding of trading strategies. Beginners should approach forex trading with caution and a commitment to continuous learning.

Forex Trading Account Types for Beginners

Choosing the right forex trading account is crucial for beginners. Different account types cater to varying levels of experience and trading styles. The key differences often lie in the minimum deposit requirements, leverage offered, and the types of trading tools and educational resources provided. A thorough understanding of these variations is essential for a successful start.

- Micro Accounts: These accounts typically require a small minimum deposit, often as low as $50 or less. They offer lower leverage compared to standard accounts, making them ideal for beginners who want to learn the ropes with minimal risk exposure. The smaller lot sizes allow for smaller trades, reducing potential losses.

- Standard Accounts: Standard accounts usually require a higher minimum deposit than micro accounts, typically ranging from a few hundred to a few thousand dollars. They offer higher leverage, potentially leading to greater profits but also larger losses. Standard accounts are better suited for traders with more experience and a higher risk tolerance.

- Mini Accounts: Mini accounts are a middle ground between micro and standard accounts. They typically require a minimum deposit somewhere between the two, offering a balance between leverage and risk. They provide a stepping stone for traders progressing from micro accounts to standard accounts.

Essential Features of Beginner-Friendly Forex Platforms

Navigating the forex market can feel like stepping into a whirlwind of complex charts, fluctuating currencies, and technical jargon. But the right platform can significantly ease your entry into this exciting world. Choosing a platform designed with beginners in mind is crucial for a smooth and less stressful learning experience. The right tools can transform a daunting task into an engaging journey of financial discovery.

A beginner-friendly forex platform isn’t just about pretty visuals; it’s about empowering you with the tools and resources to confidently take your first steps. This means intuitive design, readily available learning materials, and responsive support—all working together to create a supportive environment for your forex trading journey.

User-Friendly Interfaces and Intuitive Navigation

A platform’s interface is its face to the world. For beginners, a clean, uncluttered design is paramount. Overwhelming users with too many buttons, complex menus, or confusing layouts can lead to frustration and potentially costly mistakes. Beginner-friendly platforms prioritize simplicity. Think clear visual representations of data, easy-to-locate tools, and straightforward order placement processes. Imagine a dashboard where key information—like your account balance, open positions, and recent trades—is readily visible without requiring extensive searching. The best platforms use color-coding and clear labeling to make sense of the data, allowing you to quickly grasp essential information at a glance. Complex functions are often hidden behind easily accessible menus or clearly labeled tabs, preventing accidental activation of advanced tools before you’re ready.

Educational Resources

Learning the ropes of forex trading shouldn’t be a solo endeavor. Top-tier beginner-friendly platforms recognize this and provide extensive educational resources. These might include tutorials, webinars, glossaries of forex terms, or even simulated trading environments (demo accounts). These resources serve as a virtual mentor, guiding you through the intricacies of forex trading without the pressure of risking real capital. A good demo account, for instance, allows you to practice trading strategies and get familiar with the platform’s features without any financial risk. The ability to review past trades and analyze your performance is invaluable for beginners learning to understand market dynamics. Access to a glossary of terms simplifies understanding the technical jargon often associated with forex trading.

Reliable Customer Support

When you’re new to forex trading, questions are inevitable. A responsive and helpful customer support system is crucial. Beginner-friendly platforms understand this and provide multiple avenues for support, such as phone, email, and live chat. The ability to reach out to a knowledgeable representative who can quickly address your queries is a significant advantage. Quick response times and helpful solutions can prevent minor issues from escalating into major problems. Imagine the peace of mind knowing that if you encounter a technical glitch or have a question about a trade, there’s a readily available support team to assist you. This ensures a smooth and stress-free learning experience, allowing you to focus on mastering the intricacies of the forex market.

Demo Accounts and Simulated Trading

Before diving into the real market with your hard-earned money, the ability to practice in a risk-free environment is essential. Beginner-friendly platforms offer demo accounts loaded with virtual funds, allowing you to test different strategies and familiarize yourself with the platform’s features without any financial consequences. This allows you to experiment with various trading styles, understand how orders are placed and managed, and gain a feel for the market’s dynamics without any real-world risks. It’s like a training ground where you can make mistakes and learn from them without losing any capital. The experience gained through simulated trading is invaluable and significantly reduces the learning curve for beginners.

Order Placement and Execution

The process of placing and executing trades should be simple and straightforward. A beginner-friendly platform will feature an intuitive order entry system, making it easy to specify the currency pair, trade size, and order type (market order, limit order, stop-loss order, etc.). Clear visual representations of the order details, before confirmation, are essential to avoid accidental errors. The platform should also provide real-time updates on order execution and trade status. A transparent and efficient order execution process instills confidence and allows you to focus on your trading strategy rather than getting bogged down in complex technicalities.

Comparison of Top Forex Platforms

Choosing the right forex platform is crucial for beginners. The market offers a plethora of options, each with its own strengths and weaknesses. Understanding the key differences, particularly in fees, spreads, and minimum deposits, is essential for making an informed decision and avoiding unnecessary costs. This comparison focuses on three popular platforms to illustrate these key distinctions.

Top Forex Platforms: A Feature Comparison

The following table compares three leading forex platforms—MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader—based on their trading fees, spreads, and minimum account requirements. Remember that these figures can change, so always check the broker’s website for the most up-to-date information. Spreads are dynamic and vary based on market conditions and the specific asset being traded.

| Platform Name | Minimum Deposit | Spreads (Example: EUR/USD) | Fees |

|---|---|---|---|

| MetaTrader 4 (MT4) | Varies by broker; often as low as $100 | Varies by broker; typically from 1 pip | Varies by broker; may include commissions or rollover fees. |

| MetaTrader 5 (MT5) | Varies by broker; often as low as $100 | Varies by broker; generally similar to MT4, but can be slightly tighter in some cases. | Varies by broker; similar fee structure to MT4. |

| cTrader | Varies by broker; often as low as $100 | Generally competitive with MT4 and MT5; often expressed in pips. | Usually commission-based, with spreads often tighter than those offering commission-free accounts. |

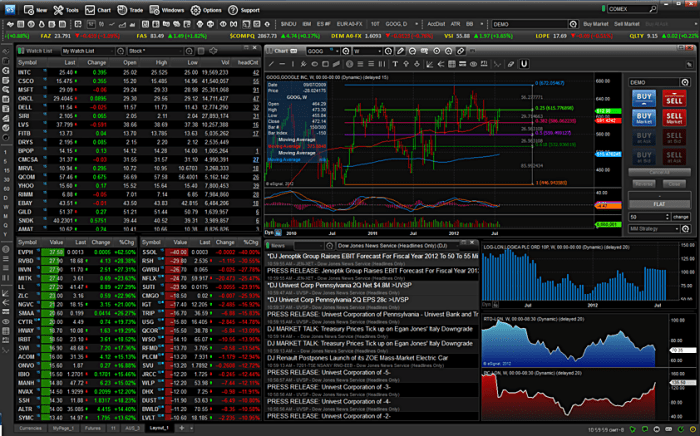

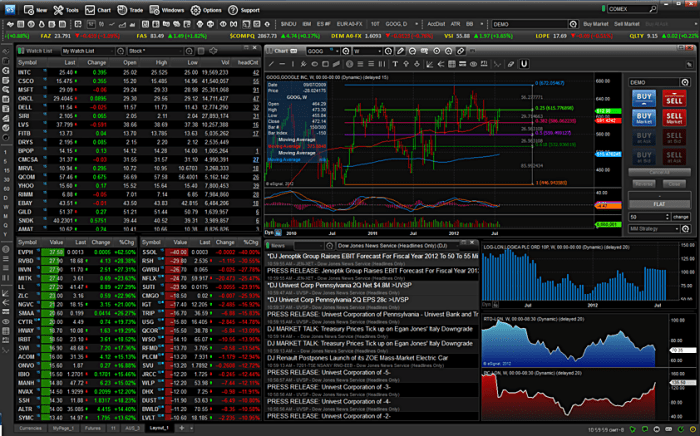

Platforms with Robust Charting Tools and Technical Analysis Indicators

Choosing a platform with advanced charting capabilities is vital for technical analysis. Both MT4 and MT5 are known for their extensive libraries of technical indicators and charting tools. These platforms allow users to customize charts, overlay various indicators (like moving averages, RSI, MACD), and conduct detailed technical analysis. For instance, traders can use Fibonacci retracements on MT4 to identify potential support and resistance levels, or employ candlestick patterns analysis on MT5 to predict future price movements. cTrader also offers a comprehensive suite of charting tools and indicators, often integrated with advanced order management systems, providing a competitive alternative. The specific features available may depend on the broker offering the platform. Remember that while powerful tools are available, effective technical analysis requires skill and practice.

Demo Accounts and Simulated Trading

So, you’re ready to dive into the exciting (and potentially lucrative) world of forex trading, but the thought of risking real money makes you a little… nervous. Totally understandable! That’s where demo accounts come in – your risk-free training ground before you hit the real market. Think of it as your forex practice field, where you can hone your skills and build confidence without losing a single cent.

Demo accounts provide a virtual environment mirroring the actual forex market. You’ll get to use the same trading platform, charts, and tools, but with virtual funds instead of your hard-earned cash. This allows you to experiment with different strategies, test your risk management techniques, and get comfortable with the platform’s features without any financial repercussions. It’s the ultimate sandbox for learning and perfecting your forex game.

Opening and Utilizing a Demo Account

Opening a demo account is usually a straightforward process. Most forex brokers offer them for free. Typically, you’ll need to register with the broker, providing basic personal information. Once registered, you’ll be able to select the “demo account” option during the account creation process. The broker will then credit your account with a virtual sum of money, allowing you to start trading immediately. Many platforms even offer tutorials and educational resources to guide you through the initial steps. After you’ve opened your demo account, you can practice trading various currency pairs, using different order types (market orders, limit orders, stop-loss orders, etc.), and experimenting with various trading strategies without fear of losing money. The key is to treat it as seriously as you would a real account; this will help you develop realistic trading habits.

Risk Management in Simulated Trading

Even in a demo account, developing and practicing effective risk management is crucial. Risk management isn’t just about protecting your money; it’s about protecting your trading psychology. It teaches discipline and emotional control, skills that are just as vital in simulated trading as they are in live trading. For instance, you should set stop-loss orders to limit potential losses on each trade, regardless of whether you’re using real or virtual funds. This practice helps you develop the discipline to stick to your trading plan, preventing emotional decisions that can lead to significant losses in real trading. Furthermore, you can experiment with position sizing techniques to determine how much capital to allocate to each trade. In a demo account, you can test different position sizing strategies to find what works best for your risk tolerance and trading style. This way, when you transition to live trading, you’ll already have a robust risk management plan in place. For example, you could start by risking only 1% of your virtual capital on each trade. If a trade goes against you, you’ll experience the consequences within the simulated environment and learn from the experience without the financial sting.

Understanding Spreads and Trading Costs

Navigating the world of forex trading successfully means understanding not just the market movements, but also the often-overlooked costs associated with each trade. These costs, primarily represented by spreads and various fees, can significantly impact your overall profitability. Ignoring them can lead to unpleasant surprises and potentially derail your trading strategy.

Spreads are the difference between the bid and ask prices of a currency pair. Essentially, it’s the price you pay to buy (ask) versus the price you receive when selling (bid). A smaller spread translates to lower trading costs, making it more beneficial for traders. These spreads are constantly fluctuating based on market volatility and liquidity. Understanding how spreads affect your potential profits is crucial for successful forex trading. Think of it like a commission built into the price, constantly changing depending on market conditions.

Types of Forex Trading Fees

Forex brokers employ various methods to generate revenue, and these methods directly impact your trading costs. Knowing these different fee structures helps you compare brokers effectively and choose one that aligns with your trading style and risk tolerance.

- Spreads: As previously explained, the spread is the core cost in most forex trades. It’s the difference between the buying and selling price of a currency pair. Tight spreads (small differences) are generally preferred.

- Commissions: Some brokers charge a commission per trade in addition to the spread. This is a transparent fee that is added to the cost of your trade. This commission structure is often preferred by high-volume traders as the overall cost per trade might be lower even with wider spreads.

- Overnight Swaps (Rollover Fees): Holding a forex position overnight incurs a swap fee, reflecting the interest rate differential between the two currencies in the pair. This fee can be positive (you receive payment) or negative (you pay a fee), depending on the interest rates and the direction of your trade. These fees are particularly relevant for long-term trades.

Impact of Spread Size on Profit and Loss, Best forex trading platforms for beginners

Let’s illustrate how different spread sizes affect a sample trade. Imagine buying 1,000 units of EUR/USD. The impact on profit and loss will vary depending on the spread.

| Spread (pips) | Entry Price (EUR/USD) | Exit Price (EUR/USD) | Profit/Loss (USD) before spread | Spread Cost (USD) | Net Profit/Loss (USD) |

|---|---|---|---|---|---|

| 1 pip | 1.1000 | 1.1010 | 10 | 1 | 9 |

| 2 pips | 1.1000 | 1.1010 | 10 | 2 | 8 |

| 3 pips | 1.1000 | 1.1010 | 10 | 3 | 7 |

| 5 pips | 1.1000 | 1.1010 | 10 | 5 | 5 |

Note: This table assumes a 10-pip profit before accounting for the spread. The spread cost is calculated based on the number of pips and the trade size (1,000 units in this example). A pip in EUR/USD is generally 0.0001. Real-world scenarios will vary depending on the specific currency pair and market conditions.

Regulatory Compliance and Security

Navigating the forex market requires understanding the regulatory landscape and the security measures protecting your investments. Choosing a broker that prioritizes compliance and security is crucial for mitigating risks and safeguarding your funds. This section Artikels key regulatory bodies and security protocols to consider.

Reputable forex brokers operate under the watchful eye of various regulatory bodies worldwide. These organizations establish and enforce rules designed to protect traders from fraudulent activities and ensure fair market practices. The strength and effectiveness of these regulations vary significantly depending on the jurisdiction.

Key Regulatory Bodies and Their Importance

Regulatory bodies play a vital role in maintaining the integrity of the forex market. They set standards for broker conduct, capital adequacy, and client fund segregation, among other crucial aspects. Examples of prominent regulatory bodies include the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, the Australian Securities and Investments Commission (ASIC) in Australia, and the Monetary Authority of Singapore (MAS). These bodies conduct regular audits and investigations, imposing penalties for non-compliance. Trading with a broker regulated by a reputable body provides a significant layer of protection for traders.

Security Measures Employed by Reputable Forex Platforms

Reputable forex platforms implement a range of security measures to protect client funds and data. These measures often include segregation of client funds from the broker’s operating capital, meaning your money is kept separate and protected even if the broker faces financial difficulties. Robust encryption protocols protect sensitive data transmitted between the trader and the platform, safeguarding against unauthorized access. Two-factor authentication (2FA) adds an extra layer of security, requiring a second verification step beyond just a password. Regular security audits and penetration testing further enhance the platform’s resilience against cyber threats. These measures demonstrate a commitment to client security and build trust.

Importance of Choosing a Regulated Broker

Selecting a regulated broker is paramount for minimizing risks in forex trading. Regulation provides a framework of accountability, ensuring brokers adhere to specific standards of conduct and financial stability. This reduces the likelihood of encountering fraudulent brokers or experiencing significant losses due to negligence or malicious intent. Furthermore, regulated brokers are often subject to stricter capital requirements, providing an additional layer of financial security for clients. In the event of disputes or problems, regulated brokers are accountable to the regulatory body, providing a recourse for traders seeking redress. Choosing a regulated broker significantly reduces the risks inherent in forex trading and promotes a more trustworthy and transparent trading environment.

Educational Resources and Support

Navigating the forex market as a beginner can feel like venturing into a dense jungle without a map. The right forex platform doesn’t just offer trading tools; it provides the educational resources and support needed to confidently chart your course. Access to quality learning materials significantly reduces the risk of costly mistakes and accelerates your learning curve. A supportive platform acts as your guide, helping you avoid pitfalls and build a strong foundation for successful trading.

A beginner-friendly platform recognizes the importance of comprehensive education. This goes beyond basic tutorials; it encompasses a range of resources designed to cater to different learning styles and experience levels. The availability and quality of these resources are key indicators of a platform’s commitment to its users’ success.

Types of Educational Materials

Effective educational resources are diverse and accessible. Platforms often provide a combination of learning materials to cater to various learning preferences. For example, visual learners might benefit from video tutorials demonstrating trading strategies, while those who prefer a more structured approach might appreciate detailed trading guides. Interactive webinars offer the advantage of real-time interaction with instructors and fellow traders, fostering a sense of community and encouraging peer learning.

- Webinars: Live online sessions covering specific topics, often featuring Q&A segments with experienced traders or platform representatives.

- Tutorials: Step-by-step guides, often in video or text format, covering fundamental concepts like order placement, risk management, and chart analysis.

- Trading Guides: Comprehensive documents that delve deeper into specific strategies, market analysis techniques, or risk management principles. These can serve as valuable references for traders of all levels.

- Glossary of Terms: A readily available resource defining common forex terminology, helping beginners understand the language of the market.

- Economic Calendars: Tools that highlight upcoming economic events that can significantly impact currency prices, allowing traders to anticipate market movements.

Indicators of Strong Customer Support

Beyond educational materials, robust customer support is crucial. A platform’s responsiveness and helpfulness can significantly impact a beginner’s trading journey. Several key features indicate a platform prioritizes its users’ needs.

- Multiple Support Channels: Access to support via phone, email, and live chat ensures users can get help when they need it, regardless of their preferred communication method.

- Fast Response Times: Quick resolution of queries and issues demonstrates efficiency and a commitment to user satisfaction. A platform that responds promptly builds trust and confidence.

- Knowledgeable Support Staff: Support agents should be well-versed in forex trading and the platform’s features. They should be able to provide clear, concise, and helpful answers to user questions.

- Comprehensive FAQ Section: A well-organized FAQ section can address common questions, reducing the need for direct contact with support staff and providing instant answers.

- Community Forums: Online forums allow users to connect with each other, share experiences, and ask questions. This peer-to-peer support can be invaluable for beginners.

Mobile Trading Apps and Accessibility

The forex market never sleeps, and neither should your trading strategy. Mobile trading apps have revolutionized how beginners and seasoned traders alike access and manage their accounts, offering unparalleled convenience and flexibility. This section explores the advantages of mobile forex trading, compares popular app features, and guides you through accessing key functionalities.

Mobile trading apps offer several key advantages. The most obvious is accessibility. You can monitor your trades, place orders, and adjust your strategies from virtually anywhere with an internet connection. This constant connectivity allows for quicker reactions to market changes and reduces the risk of missing out on lucrative opportunities. Beyond convenience, many apps provide streamlined interfaces, making complex trading tasks easier to manage on a smaller screen. Furthermore, mobile apps often incorporate features designed for on-the-go trading, like customizable alerts and simplified charting tools.

Mobile App Feature Comparison

A comparison of popular forex trading apps reveals a range of features and user experiences. Some platforms excel in their intuitive design, offering a simple, user-friendly interface ideal for beginners. Others prioritize advanced charting capabilities and technical analysis tools, catering to more experienced traders. The availability of educational resources within the app also varies significantly. Some platforms integrate tutorials and market analysis directly into the app, while others might direct users to external resources. Finally, the level of customer support offered through the app (e.g., live chat, email) can differ substantially between providers. For instance, MetaTrader 4’s mobile app is known for its robust charting capabilities, while other platforms might focus on a simpler, more streamlined design.

Accessing and Using Key Mobile App Features

Imagine you’re using a hypothetical mobile forex trading app. To access your account, you’d typically enter your username and password, often with an added security layer like two-factor authentication. Once logged in, you’ll see your account dashboard, displaying your balance, open positions, and recent trading activity. To place a new trade, you would select the currency pair, specify the order type (e.g., market order, limit order), enter the volume, and set your stop-loss and take-profit levels. These parameters control your risk and profit targets. Many apps allow you to save frequently used order templates for faster execution. Monitoring your open positions is crucial. Your app will display the current price, your profit/loss, and the overall position size. Most apps provide real-time charts, allowing you to track price movements and analyze market trends. Finally, many apps offer news feeds and market analysis directly within the application, keeping you informed about significant events affecting the forex market. You can customize your alerts to receive notifications about specific price movements or news headlines.

Ultimate Conclusion

So, there you have it – a roadmap to conquering the forex market. Remember, success in forex trading isn’t just about finding the best platform; it’s about continuous learning, smart risk management, and a healthy dose of patience. While the platforms we’ve highlighted offer excellent starting points, your ultimate success hinges on your dedication to understanding the market and honing your trading skills. Start with a demo account, practice your strategies, and remember that consistent learning is key to navigating the dynamic world of forex trading.

You also can investigate more thoroughly about trading bots forex to enhance your awareness in the field of trading bots forex.

Understand how the union of forex robot trading can improve efficiency and productivity.