Forex options trading platform access opens a world of opportunity, but navigating this complex landscape requires the right knowledge. This isn’t just about buying and selling; it’s about understanding the nuances of different option types, mastering platform features, and developing a robust trading strategy. From analyzing charts and managing risk to understanding the regulatory environment and leveraging educational resources, we’ll equip you with the insights you need to confidently navigate the forex options market.

We’ll delve into the key features to look for in a platform, comparing user interfaces, trading tools, and security protocols of popular choices. We’ll also explore how to utilize platform-specific tools to boost your trading performance, manage risk effectively, and understand the costs involved. Think of this as your comprehensive playbook for success in the dynamic world of forex options trading.

Introduction to Forex Options Trading Platforms

Forex options trading platforms are the digital gateways to the exciting, yet complex, world of forex options. They provide traders with the tools and access necessary to buy and sell options contracts on currency pairs, offering leveraged opportunities for profit or hedging against potential losses. Understanding these platforms is crucial for successful forex options trading, as their features directly impact a trader’s efficiency and decision-making process.

These platforms offer a variety of tools, from charting packages to sophisticated order management systems, all designed to help traders analyze market trends, execute trades, and manage their risk. The core functionality revolves around providing real-time market data, enabling traders to monitor price fluctuations and react accordingly. Different platforms offer varying levels of sophistication and customization, catering to both novice and experienced traders.

Types of Forex Options Available for Trading

Forex options trading involves several distinct contract types, each with its own characteristics and implications. Understanding these differences is vital for choosing the right option strategy based on individual trading goals and risk tolerance.

- European Options: These options can only be exercised at the expiration date. This simplicity makes them easier to price and understand, but limits flexibility in reacting to market changes before expiry.

- American Options: Unlike European options, American options can be exercised at any time before the expiration date. This added flexibility provides traders with more control, but also increases complexity in pricing and risk management.

- Asian Options: These options’ payoff is determined by the average price of the underlying currency pair over a specified period. This feature helps mitigate the impact of short-term price volatility.

- Barrier Options: These options are activated or deactivated depending on whether the underlying asset price reaches a predetermined barrier level. They offer a way to manage risk by limiting potential losses or maximizing potential gains.

Key Features of a Forex Options Trading Platform

Choosing the right platform is paramount for successful forex options trading. Traders should prioritize platforms that offer a comprehensive suite of features to support their trading strategies and risk management protocols.

- Real-time Market Data: Access to accurate and up-to-the-second market data is essential for informed decision-making. Delays can lead to missed opportunities or losses.

- Advanced Charting Tools: Robust charting capabilities, including various technical indicators and drawing tools, are vital for analyzing market trends and identifying potential trading opportunities. A platform with customizable charts and multiple timeframes is highly beneficial.

- Order Management System: A user-friendly order management system allows for efficient execution and management of trades. Features such as stop-loss orders, take-profit orders, and trailing stops are crucial for risk management.

- Backtesting Capabilities: The ability to backtest trading strategies using historical data is invaluable for evaluating their effectiveness and refining trading approaches before risking real capital.

- Educational Resources: Many reputable platforms offer educational resources, such as tutorials, webinars, and market analysis reports, to help traders improve their knowledge and skills. This is especially helpful for beginners.

- Customer Support: Reliable and responsive customer support is essential for addressing any technical issues or questions that may arise. Consider platforms with multiple support channels, such as phone, email, and live chat.

Platform Functionality and Features

Navigating the world of forex options trading requires a solid understanding of the platform you’re using. The right platform can significantly enhance your trading experience, while the wrong one can be a frustrating obstacle. This section delves into the functionality and features of popular platforms, highlighting key differences and providing a practical guide to trading.

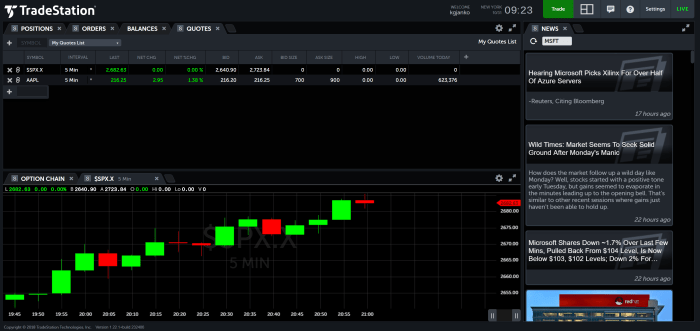

User Interface Comparison of Popular Forex Options Platforms

Different platforms offer vastly different user experiences. Some prioritize a clean, minimalist design, while others pack in a multitude of tools and indicators, potentially overwhelming new traders. MetaTrader 4 (MT4), for example, is known for its customizability and vast library of indicators, but this can be daunting for beginners. Conversely, platforms like cTrader often boast a more streamlined and intuitive interface, better suited for those focusing on core trading functions. Think of it like choosing between a sports car (MT4) and a comfortable sedan (cTrader) – both get you to your destination, but the journey is quite different. Ultimately, the best platform depends on your individual trading style and experience level.

Step-by-Step Guide to Placing a Forex Options Trade on MetaTrader 4

Let’s walk through placing a simple forex options trade on MetaTrader 4 (MT4), a widely used platform. First, you’ll need to locate the “Market Watch” window, where you can find the currency pairs you want to trade. Right-click on your chosen pair (e.g., EUR/USD) and select “Options.” This opens the options trading window. Next, specify the option type (call or put), strike price, expiration date, and the number of contracts you want to buy or sell. Carefully review the details, including the premium cost and potential profit/loss. Once you’re satisfied, click “Buy” or “Sell” to execute the trade. Remember to always set appropriate stop-loss and take-profit orders to manage your risk.

Risk Management Tools Offered by Forex Options Platforms

Effective risk management is paramount in forex options trading. Platforms offer a range of tools to help traders mitigate potential losses. These include stop-loss orders (automatically closing a trade when it reaches a specified loss level), take-profit orders (automatically closing a trade when it reaches a specified profit level), and trailing stops (dynamically adjusting the stop-loss order as the trade moves in your favor). Some platforms also provide margin calls (warnings when your account balance is approaching a critical level) and position sizing tools (helping you determine the appropriate trade size based on your risk tolerance).

Comparison of Risk Management Tools Across Leading Platforms

| Feature | MetaTrader 4 | cTrader | NinjaTrader |

|---|---|---|---|

| Stop-Loss Orders | Yes, customizable | Yes, customizable, including trailing stops | Yes, highly customizable with advanced order types |

| Take-Profit Orders | Yes, customizable | Yes, customizable, including trailing stops | Yes, highly customizable with advanced order types |

| Trailing Stops | Yes, but limited functionality | Yes, robust and easily configurable | Yes, extensive customization options |

| Margin Calls | Yes | Yes | Yes, with customizable alert levels |

| Position Sizing Tools | Limited built-in tools, relies on third-party indicators | Some built-in tools, generally requires manual calculation | Advanced position sizing tools and calculators available |

Trading Tools and Indicators

Forex options trading platforms are more than just order entry systems; they’re sophisticated analytical workbenches. The integrated tools and indicators available significantly impact a trader’s ability to analyze market trends, identify potential opportunities, and manage risk effectively. Choosing the right platform often hinges on the quality and variety of its built-in analytical capabilities.

The availability of charting tools and technical indicators varies across platforms. Some offer basic candlestick charts with a limited selection of indicators, while others provide advanced charting packages with hundreds of technical studies, drawing tools, and customizable layouts. These tools allow traders to visualize price action, identify patterns, and generate trading signals based on technical analysis principles. Sophisticated platforms might even include algorithmic trading capabilities, allowing automated execution based on pre-defined parameters.

Charting Tools and Technical Indicators Overview

Many platforms offer a range of charting tools, including line charts, candlestick charts, bar charts, and Renko charts. Technical indicators, like moving averages (simple moving average (SMA), exponential moving average (EMA)), relative strength index (RSI), MACD, Bollinger Bands, and stochastic oscillators, are frequently integrated. The ability to overlay multiple indicators on a single chart allows traders to confirm signals and identify potential trade setups. For instance, a trader might use a 20-period EMA and a 50-period EMA to identify potential trend reversals, confirmed by an RSI reading in oversold or overbought territory. More advanced platforms might include wave analysis tools, Fibonacci retracements, and other Elliott Wave Theory-based indicators.

Hypothetical Trading Strategy Using Specific Indicators

Let’s imagine a trader using the MetaTrader 4 (MT4) platform. This platform is known for its extensive library of technical indicators and customizability. Our hypothetical trader might employ a strategy combining the MACD and RSI indicators. The strategy would involve:

1. Identifying a potential long position: The trader waits for the MACD histogram to cross above the zero line, indicating a bullish momentum shift.

2. Confirming the signal: The RSI indicator must be above 30, suggesting the asset is not oversold and potentially ready for an upward move.

3. Setting stop-loss and take-profit orders: The stop-loss order would be placed below a recent swing low, while the take-profit order would be placed at a predetermined price target based on technical analysis or risk management principles. For example, the target could be a Fibonacci retracement level or a previous resistance level.

4. Monitoring and managing the trade: The trader monitors the trade’s progress and adjusts their stop-loss order based on price action. If the market moves against the trade, the stop-loss order limits potential losses.

This is a simplified example, and successful trading requires careful risk management and a deep understanding of market dynamics.

Utilizing Platform-Specific Tools for Enhanced Trading Performance

Many platforms offer tools beyond basic charting and indicators. For example, some platforms provide automated trading systems (Expert Advisors or EAs in MT4), allowing traders to automate their strategies and execute trades based on pre-defined rules. Others offer backtesting capabilities, allowing traders to simulate their strategies on historical data to evaluate their potential performance before risking real capital. Alert systems, which notify traders of specific price movements or indicator crossovers, can also improve trading performance by ensuring timely entry and exit decisions. Finally, some platforms integrate economic calendars and news feeds, providing traders with real-time market information that can inform their trading decisions. Effective use of these tools requires thorough understanding and careful testing.

Security and Regulation

Navigating the world of forex options trading requires a keen eye for security and a solid understanding of regulatory frameworks. Your money and personal information are at stake, so choosing a regulated platform is paramount. This section will delve into the crucial aspects of security and regulation in forex options trading.

Regulatory bodies play a vital role in ensuring the integrity and fairness of forex options platforms. Their oversight helps protect traders from fraudulent activities and promotes a stable market environment. Understanding their roles is crucial for informed decision-making.

Regulatory Bodies and Their Roles, Forex options trading platform

Different regions have different regulatory bodies overseeing forex options platforms. For instance, in the United States, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) are key players. The CFTC sets regulations, while the NFA oversees compliance and handles trader complaints. In the UK, the Financial Conduct Authority (FCA) holds a similar role, ensuring platforms adhere to strict standards and protect investor interests. Other countries have their own regulatory bodies with varying levels of oversight. Choosing a platform regulated by a reputable body offers a greater degree of security and protection against potential scams.

Verifying a Platform’s Security Measures

Before entrusting your funds to any platform, thoroughly investigate its security protocols. Look for evidence of encryption (like SSL certificates, indicated by a padlock icon in your browser’s address bar), robust firewalls, and two-factor authentication (2FA). Check for regular security audits and penetration testing reports. Transparency regarding security measures is a key indicator of a trustworthy platform. Reputable platforms will openly share information about their security practices on their websites. A lack of transparency should raise a red flag.

Security Protocol Comparison: Platform A vs. Platform B

Let’s hypothetically compare two platforms, Platform A and Platform B. Platform A boasts a robust security infrastructure, including 2FA, SSL encryption, and regular penetration testing by an independent third-party firm. Their security policies are clearly Artikeld on their website, and they actively communicate security updates to their users. Platform B, on the other hand, only mentions basic security measures on their website, offering limited transparency regarding their security practices. While they claim to use SSL encryption, they lack details on other security protocols, such as penetration testing or independent audits. This lack of transparency presents a higher risk to users compared to Platform A’s comprehensive security approach. The difference highlights the importance of due diligence when choosing a platform.

Educational Resources and Support

Navigating the complex world of forex options trading requires more than just technical skills; it demands a solid understanding of market dynamics and risk management. Reputable platforms recognize this and provide a range of educational resources and support to empower traders of all levels. This support isn’t just a nice-to-have; it’s a crucial component of responsible and potentially profitable trading.

Many platforms understand that successful trading hinges on continuous learning. Therefore, the availability and quality of educational materials are key differentiators. Let’s explore the resources and support systems commonly offered.

Types of Educational Resources

Forex options trading platforms typically offer a variety of learning materials designed to cater to different learning styles and experience levels. These resources aim to bridge the knowledge gap and equip traders with the tools they need to make informed decisions.

- Beginner-friendly tutorials and guides: These often cover fundamental concepts like understanding options contracts, defining risk tolerance, and interpreting market data. They are usually presented in a simple, step-by-step manner, ideal for newcomers to the forex market.

- Advanced trading strategies and techniques: For experienced traders, platforms might offer in-depth analysis of complex strategies, including options spreads, hedging techniques, and advanced risk management methodologies. These resources often include case studies and real-world examples to illustrate practical applications.

- Webinars and seminars: Many platforms host live webinars and recorded seminars presented by experienced traders or financial analysts. These interactive sessions offer opportunities for Q&A and direct engagement with experts, fostering a sense of community and shared learning.

- Glossary of terms and definitions: A comprehensive glossary helps traders understand the jargon associated with forex options trading. This resource is invaluable for clarifying confusing terminology and ensuring clear communication.

- Economic calendars and market news: Access to up-to-the-minute economic calendars and market news feeds allows traders to stay informed about events that can significantly impact forex prices. This data is essential for making informed trading decisions.

Customer Support Channels

The level and quality of customer support are critical factors when choosing a forex options trading platform. Platforms should offer multiple channels to cater to diverse needs and preferences.

- Email support: This provides a written record of inquiries and responses, allowing traders to refer back to past communications. Email support is often suitable for non-urgent questions or issues requiring detailed explanations.

- Live chat support: Live chat offers immediate assistance for urgent queries or technical problems. The real-time interaction ensures prompt resolution of issues, minimizing disruptions to trading activities.

- Phone support: Phone support provides a direct line of communication with customer service representatives. This method is particularly helpful for traders who prefer a more personal and immediate interaction.

- FAQ section and knowledge base: A well-organized FAQ section and comprehensive knowledge base can answer many common questions, reducing the need to contact customer support directly. This self-service option allows traders to find answers quickly and efficiently.

Value of Educational Materials in Successful Forex Options Trading

Access to high-quality educational resources is not merely beneficial; it’s essential for success in forex options trading. A strong understanding of market dynamics, risk management principles, and trading strategies significantly reduces the risk of losses and increases the probability of achieving profitable outcomes. For instance, a trader who understands options pricing models and risk-reward ratios is better equipped to manage their positions effectively, potentially avoiding costly mistakes. Furthermore, continuous learning enables traders to adapt to changing market conditions and implement new strategies as they emerge. In essence, consistent education is an investment in long-term trading success.

Cost and Fees

Navigating the world of forex options trading involves understanding the often-complex landscape of costs and fees. These charges can significantly impact your overall profitability, so it’s crucial to carefully compare different platforms before committing your capital. Ignoring these costs can lead to unexpected losses, eroding your potential gains.

Different platforms employ various pricing models, encompassing spreads, commissions, and other miscellaneous fees. Spreads represent the difference between the bid and ask price of a currency pair, while commissions are direct fees charged per trade. Other charges might include inactivity fees, overnight financing costs, or fees for specific services. Understanding these nuances is key to making informed decisions.

For descriptions on additional topics like forex algo trading, please visit the available forex algo trading.

Platform Fee Comparison

The following table compares the fee structures of two hypothetical platforms, “Platform A” and “Platform B,” to illustrate the potential variations. Note that these are illustrative examples and actual fees can vary depending on the specific account type, trading volume, and other factors. Always check the latest fee schedule directly with the broker.

Examine how arbitrage trading forex can boost performance in your area.

| Fee Type | Platform A | Platform B | Notes |

|---|---|---|---|

| Spread (USD/JPY) | 0.8 pips | 1.2 pips | Typical spread for this currency pair. |

| Commission (per standard lot) | $7 | $0 | Platform A charges a commission, while Platform B incorporates it into the spread. |

| Inactivity Fee (monthly) | $10 (if no trades) | $0 | Illustrates potential charges for inactive accounts. |

| Overnight Financing | Variable, depends on currency pair and position | Variable, depends on currency pair and position | These fees are typically applied for holding positions overnight. |

| Withdrawal Fee | $5 per withdrawal | Free for bank transfers, $10 for wire transfers | Illustrates different fee structures for withdrawals. |

Impact of Trading Costs on Profitability

Trading costs can dramatically affect your bottom line. Even small differences in spreads or commissions can accumulate over time, significantly reducing your profits or increasing your losses. For instance, a 0.4 pip difference in spread on a 100,000 USD trade translates to a $4 difference per trade. Imagine trading 100 such trades per month; the cumulative cost would be $400. This highlights the importance of selecting a platform with competitive pricing and transparent fee structures.

Furthermore, consider the example of a trader consistently making small profits on individual trades but facing high commissions. These commissions might easily outweigh the small gains, leading to overall losses despite technically profitable trades. Conversely, a platform with lower fees could turn marginally profitable trades into consistent gains. Careful consideration of these factors is crucial for long-term success in forex options trading.

Mobile Accessibility and User Experience: Forex Options Trading Platform

The ability to trade forex options on the go is crucial in today’s fast-paced market. Mobile accessibility isn’t just a convenience; it’s a necessity for staying competitive. A well-designed mobile platform should mirror the functionality of its desktop counterpart, offering a seamless and intuitive trading experience. Let’s dive into what makes a mobile forex options platform truly user-friendly.

Mobile forex options trading platforms offer a range of features designed for convenient trading on smartphones and tablets. These typically include real-time market data, charting tools, order placement and management functionalities, account management capabilities, and access to news and analysis. The best platforms prioritize speed and reliability, ensuring smooth execution of trades even with fluctuating network conditions. They also usually offer push notifications for important market updates or alerts based on user-defined parameters.

Mobile Platform User Experience: MetaTrader 4 Mobile

MetaTrader 4 (MT4) boasts a long-standing reputation for its robust desktop platform, and its mobile app largely reflects this strength. The interface is clean and relatively intuitive, with easily accessible charts and order entry forms. Navigation is straightforward, allowing users to quickly switch between different sections, such as charts, order history, and account information. The app provides access to a comprehensive range of technical indicators and charting tools, allowing for in-depth market analysis. While some might find the layout slightly dense, especially for novice traders, the overall experience is generally smooth and efficient. The ability to customize the layout and choose preferred indicators contributes to a personalized trading experience.

Comparison of Mobile App Experiences: MetaTrader 4 vs. cTrader

Comparing MT4’s mobile app with cTrader’s mobile offering highlights some key differences in user experience. While MT4 prioritizes a familiar and comprehensive feature set, potentially leading to a slightly more cluttered interface for beginners, cTrader opts for a cleaner, more minimalist design. cTrader’s app is often praised for its intuitive layout and smooth navigation, making it particularly appealing to newer traders. However, some advanced charting tools or indicators might be less readily available compared to MT4. Ultimately, the “better” platform depends on individual preferences and trading styles. Experienced traders who require extensive charting capabilities might prefer MT4’s comprehensive features, whereas beginners might find cTrader’s simplicity more beneficial.

Platform Integration and API Access

Unlocking the true potential of your forex options trading strategy often involves seamlessly integrating your chosen platform with other financial tools and services. This allows for automation, enhanced data analysis, and a more streamlined trading experience. API access is the key that opens this door, providing a powerful bridge between your trading platform and the wider financial ecosystem.

API access allows for automated trading strategies, significantly increasing efficiency and potentially reducing emotional biases that can impact decision-making. Imagine a system that automatically executes trades based on pre-defined parameters, reacting to market changes in milliseconds – that’s the power of automated trading. This level of sophistication requires a robust and reliable API.

API Access Benefits for Automated Trading

Automated trading, facilitated by API access, offers several key advantages. It allows for the implementation of algorithmic trading strategies, backtesting of those strategies against historical data, and the execution of trades at optimal times, all without constant manual intervention. This frees up the trader to focus on other aspects of their portfolio or business. The speed and precision of automated systems can also be crucial in fast-moving markets, potentially leading to better trade execution. For example, an algorithm could be programmed to automatically sell a position if the price drops below a certain threshold, limiting potential losses.

Integrating a Forex Options Trading Platform with Other Financial Tools

Integrating your forex options trading platform with other financial tools can significantly enhance your trading workflow. This could involve connecting your platform to a charting software for more advanced technical analysis, linking it to a news aggregator for real-time market updates, or integrating it with a portfolio management system for a holistic view of your investments. For instance, connecting your platform to a dedicated charting software might provide access to more sophisticated indicators and drawing tools, improving your ability to identify potential trading opportunities. Similarly, integration with a news aggregator could allow for immediate reaction to market-moving events.

Technical Specifications of a Platform’s API

The technical specifications of a platform’s API are crucial for successful integration. These specifications typically include details about the API’s endpoints (URLs used to access specific data or functions), the authentication methods used to secure access, the data formats (e.g., JSON, XML) used for communication, and the rate limits (the number of requests allowed per unit of time). Understanding these specifications is vital for developers who are building custom integrations. For example, a platform might use RESTful APIs with JSON data format, requiring developers to use libraries and tools compatible with these technologies. Documentation provided by the platform is key to understanding these specifics and successfully integrating external tools. The API documentation should clearly Artikel the available endpoints, request methods (GET, POST, PUT, DELETE), parameters, and response structures. This ensures developers can effectively build applications that interact with the platform.

Illustrative Example of a Trading Scenario

Let’s dive into a hypothetical forex options trade to illustrate how these platforms work in practice. This example will focus on a simple scenario to clarify the core concepts without overwhelming complexity. Remember, forex options trading involves risk, and this is purely for educational purposes.

This example demonstrates a bullish outlook on the EUR/USD pair. We’ll detail the steps involved, from initial market analysis to the final outcome.

Trade Setup and Rationale

Our hypothetical trader believes the EUR/USD exchange rate will rise significantly in the near future. This belief is based on several factors, including positive economic indicators released from the Eurozone, a weakening US dollar, and a general positive sentiment towards the Euro. To capitalize on this predicted price increase, the trader decides to use a call option.

- Market Conditions: EUR/USD is currently trading at 1.1000.

- Option Type: European-style Call Option (can only be exercised at expiration).

- Strike Price: 1.1100 (slightly above the current market price, allowing for a buffer).

- Expiration Date: One month from the trade initiation date.

- Rationale: The trader anticipates the EUR/USD rate will surpass 1.1100 within one month, making the call option profitable.

Executing the Trade

The trader uses their forex options trading platform to execute the trade. The platform allows for precise specification of the option parameters, including the type, strike price, expiration date, and the number of contracts.

- Order Placement: The trader places a market order to buy the call option at the prevailing market price. The price will depend on several factors including the time to expiration, the volatility of the EUR/USD pair, and the difference between the strike price and the current market price.

- Contract Size: The trader chooses a contract size appropriate to their risk tolerance and capital. This is typically expressed in standard lots (100,000 units of the base currency).

Monitoring the Trade and Profit/Loss

Over the next month, the trader monitors the EUR/USD exchange rate and the value of their option. The value of the option will fluctuate based on the price movements of the underlying currency pair and time decay.

- Price Movement: Let’s say the EUR/USD rises to 1.1200 before the expiration date. This is significantly above the strike price of 1.1100.

- Option Value Increase: The value of the call option increases proportionally to the price increase of the EUR/USD. This is because the option becomes more “in the money.”

Exercising or Selling the Option

At expiration, the trader has two options:

- Exercise the Option: If the EUR/USD is above the strike price (1.1100), the trader can exercise the option, buying EUR at 1.1100 and immediately selling it at the market price (1.1200), realizing a profit. This profit will be reduced by the initial premium paid for the option.

- Sell the Option: Alternatively, the trader could sell the option in the market before expiration, realizing a profit based on the increased market value of the option. This strategy avoids the risk of the EUR/USD price falling below the strike price before expiration.

Profit Calculation (Illustrative)

Let’s assume the trader bought the call option for a premium of $100 per contract and sold it for $200 per contract before expiration. The profit would be $100 per contract, minus any commissions or fees charged by the platform. The actual profit will depend on the market price of the option at the time of sale.

Summary

Mastering forex options trading requires a blend of knowledge, skill, and the right tools. Choosing the right platform is a crucial first step. By understanding the features, security measures, and costs associated with different platforms, you can significantly improve your chances of success. Remember, continuous learning and risk management are key to long-term profitability in this exciting but challenging market. So, gear up, do your research, and start your journey to forex options trading mastery!