Best EA for Forex Trading: Ready to ditch the spreadsheets and let robots handle your forex trading? The allure of automated trading is undeniable, promising consistent profits and freeing up your time. But navigating the world of Expert Advisors (EAs) can feel like entering a minefield. This guide cuts through the jargon, helping you understand what makes an EA truly “best,” how to evaluate performance, and the crucial risks to consider before automating your forex journey. From understanding different trading styles to choosing the right platform, we’ll equip you with the knowledge to make informed decisions.

We’ll explore various EA types, their strengths and weaknesses, and the importance of backtesting and forward testing. We’ll also delve into the development process, highlighting the programming languages used and best practices for optimization. Finally, we’ll examine real-world examples of successful and unsuccessful EA implementations, offering valuable lessons learned. This isn’t just about finding the *perfect* EA; it’s about understanding how to leverage them effectively and responsibly.

Defining “Best” in Forex EA Context

Finding the “best” Forex EA is a quest many traders undertake, but the definition of “best” is highly subjective and depends heavily on individual trading goals, risk tolerance, and market conditions. There’s no single EA that reigns supreme for everyone.

The perception of a “best” forex EA is influenced by a complex interplay of factors. Profitability, of course, is paramount, but consistent profitability over extended periods, across varying market conditions, is far more significant than short-term gains. Risk management features are equally crucial; a highly profitable EA that exposes a trader to unacceptable levels of drawdown is ultimately a poor choice. Ease of use and customization options also play a vital role, as do the reliability and reputation of the EA’s developer. Finally, the trading style the EA employs must align with the trader’s own approach and risk profile.

Essential Features Considered When Selecting a Forex EA

Traders prioritize several key features when evaluating Forex EAs. These features are often interconnected and influence each other’s importance. For instance, a robust backtesting system is vital for evaluating an EA’s historical performance and potential profitability, but this data needs to be interpreted cautiously and shouldn’t be the sole deciding factor. Similarly, a strong money management system is crucial to limit potential losses, but it needs to be configured appropriately to the trader’s risk tolerance and account size. Transparency in the EA’s code and algorithm is also highly desirable, allowing traders to understand its decision-making processes and identify potential weaknesses.

Trading Styles and EA Suitability

Different trading styles demand different EA characteristics. Scalping EAs, for example, require extremely fast execution speeds and tight spreads to capitalize on small price movements. These EAs often employ aggressive strategies and are prone to higher transaction costs. Day trading EAs typically focus on intraday price action, using technical indicators and momentum strategies. They generally require less frequent monitoring than scalping EAs but still need a robust risk management system to avoid significant losses. Swing trading EAs, on the other hand, hold positions for several days or even weeks, capitalizing on larger price swings. These EAs usually involve less frequent trades and are less sensitive to short-term market noise.

Comparison of Key Features of Different EA Types

| Feature | Scalping EA | Day Trading EA | Swing Trading EA |

|---|---|---|---|

| Trading Frequency | Very High | High | Low |

| Position Holding Time | Minutes | Hours | Days/Weeks |

| Risk Tolerance | High | Medium | Low |

| Spread Sensitivity | Very High | Medium | Low |

Types of Forex EAs

Forex Expert Advisors (EAs) aren’t a one-size-fits-all solution. They come in various flavors, each employing different trading strategies and carrying unique risk profiles. Understanding these differences is crucial for choosing an EA that aligns with your trading goals and risk tolerance. This section breaks down the main categories of Forex EAs based on their underlying strategies.

Choosing the right EA type depends heavily on your trading style and risk appetite. Some traders prefer consistent, small profits, while others are willing to accept higher risk for potentially larger gains. Understanding the advantages and disadvantages of each type will help you make an informed decision.

Trend Following EAs

Trend-following EAs, also known as momentum EAs, capitalize on established market trends. They identify the direction of a trend and place trades accordingly, aiming to ride the trend for maximum profit. These EAs often utilize indicators like moving averages and MACD to identify trends. A key advantage is their potential for substantial profits during strong trends. However, they can suffer significant losses during market corrections or periods of sideways movement. The risk profile is considered moderate to high, depending on the specific EA’s parameters and risk management settings. A poorly designed trend-following EA might lead to significant losses if the trend reverses unexpectedly.

Scalping EAs

Scalping EAs aim for small, quick profits by exploiting tiny price fluctuations. These EAs typically hold positions for very short periods, often just seconds or minutes. The advantage lies in the frequency of trades, leading to potentially consistent, albeit small, profits. The disadvantage is the high frequency of transactions which can incur higher brokerage fees and require a very stable and fast internet connection. The risk profile is generally considered moderate, as the short holding periods limit potential losses, but consistent small losses can still accumulate over time.

News Trading EAs

News trading EAs are designed to capitalize on market volatility surrounding major economic news releases. These EAs leverage news sentiment and often employ sophisticated algorithms to predict price movements based on anticipated news impacts. The advantage is the potential for large profits if the news event moves the market as predicted. The disadvantage is the high risk associated with news events, which can be unpredictable and highly volatile. The risk profile is high due to the unpredictable nature of news events and the potential for significant, rapid price swings.

Arbitrage EAs

Arbitrage EAs seek to profit from price discrepancies between different markets or brokers. They simultaneously buy and sell the same currency pair on different platforms to exploit even minor price differences. The advantage is the potential for consistent, risk-free profits. The disadvantage is the difficulty in finding and exploiting these price discrepancies, and the requirement of multiple brokerage accounts. The risk profile is generally considered low to moderate, provided the EA is well-designed and accounts for potential slippage and latency issues.

Mean Reversion EAs

Mean reversion EAs operate on the principle that prices will eventually revert to their average. These EAs identify overbought or oversold conditions and place trades anticipating a price correction. The advantage is the potential for profits during periods of market consolidation or after significant price swings. The disadvantage is that mean reversion strategies can fail if the trend continues in one direction for an extended period. The risk profile is considered moderate, as the potential losses are limited by stop-loss orders, but prolonged trends can lead to losses.

Popular EA Trading Strategies and Core Principles

Understanding the core principles behind popular strategies is key to selecting an appropriate EA.

- Moving Average Crossover: This strategy uses the crossover of two moving averages (e.g., a fast and slow moving average) to generate buy and sell signals. A crossover above indicates a buy signal, while a crossover below suggests a sell signal.

- Relative Strength Index (RSI): RSI is a momentum oscillator that measures the speed and change of price movements. Overbought (RSI > 70) and oversold (RSI < 30) conditions are used to generate trading signals.

- Bollinger Bands: Bollinger Bands consist of three lines: a simple moving average and two standard deviation bands above and below the moving average. Price breakouts from the bands often signal trend changes.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that identifies changes in the strength, direction, momentum, and duration of a trend. Crossovers of the MACD line and signal line, along with divergence analysis, are used to generate trading signals.

Evaluating EA Performance Metrics

So, you’ve got your shiny new Forex EA, ready to churn out profits like a money-printing machine, right? Hold your horses! Before you unleash it on your live account, a thorough evaluation is crucial. This isn’t about blind faith; it’s about smart money management. We’re diving deep into the metrics that truly reveal an EA’s potential – and its pitfalls.

Understanding an EA’s performance requires more than just looking at its overall profit. We need a robust set of key performance indicators (KPIs) to paint a complete picture of its capabilities and risks. Think of it as a comprehensive health check for your robotic trader. Ignoring these metrics is like driving a car without checking the oil – a recipe for disaster.

Key Performance Indicators for Forex EA Effectiveness

Several key metrics are essential for assessing a Forex EA’s effectiveness. These KPIs provide a holistic view, going beyond simple profit and loss. Ignoring any of these can lead to a skewed perception of the EA’s true capabilities.

| KPI | Description | Interpretation | Impact on Overall Assessment |

|---|---|---|---|

| Profit Factor | Ratio of gross profit to gross loss. A higher profit factor indicates better risk-adjusted returns. Calculated as: Total Gross Profit / Total Gross Loss |

A profit factor above 1.0 is generally desirable. Higher values suggest more consistent profitability. | A crucial indicator of overall profitability. A low profit factor, even with high returns, suggests high risk. |

| Sharpe Ratio | Measures risk-adjusted return. It considers the excess return relative to the risk-free rate, divided by the standard deviation of returns. A higher Sharpe ratio is better. | A Sharpe ratio above 1.0 is generally considered good. Values above 2.0 are excellent. | Reflects the efficiency of the EA in generating returns relative to its volatility. Higher is better, but context matters. |

| Maximum Drawdown | The largest peak-to-trough decline during a specific period. It indicates the maximum potential loss an investor could have experienced. | Lower maximum drawdown is preferred. It reflects the risk tolerance of the strategy. | A critical measure of risk. High drawdown can be devastating, even if the overall profit is positive. |

| Win Rate | The percentage of winning trades out of the total number of trades. | While a high win rate is desirable, it’s not the sole indicator of success. A low win rate with high average winning trades can still be profitable. | Provides insight into the consistency of the EA’s trading decisions. Should be considered alongside average win/loss. |

| Average Trade Duration | The average length of time a trade remains open. | This metric can reveal the trading style of the EA (scalping, day trading, swing trading, etc.). | Impacts risk management and capital utilization. Longer trades generally carry higher risk. |

Backtesting and Forward Testing in EA Evaluation

Backtesting involves simulating the EA’s performance on historical data. It’s like a trial run, but crucial to remember that it doesn’t guarantee future success. Forward testing, on the other hand, involves running the EA on live market data with a small amount of capital. It’s the real test, assessing the EA’s performance in actual market conditions.

Backtesting results can be misleading if not interpreted carefully. Over-optimization, where the EA is tweaked to fit past data too closely, can lead to unrealistic expectations. Using a walk-forward analysis, which divides the historical data into distinct periods for testing and optimization, can help mitigate this issue. Forward testing, even with a small account, provides a far more realistic assessment of the EA’s performance in real-world conditions. It helps identify unforeseen issues and validate the backtesting results. A successful EA should perform reasonably well in both backtesting and forward testing, with the forward testing results providing a more reliable indicator of future performance.

EA Development and Customization

Building your own Forex Expert Advisor (EA) offers unparalleled control and customization, allowing you to tailor trading strategies to your specific risk tolerance and market analysis. This process, while demanding technical expertise, unlocks potential for significant returns (or losses, if not carefully managed). Let’s delve into the nuts and bolts.

Developing a custom Forex EA involves a multi-stage process that combines programming skills with a deep understanding of financial markets. The journey from initial concept to a fully functional, backtested, and optimized EA requires meticulous planning and rigorous testing. Ignoring any of these steps can lead to significant financial losses.

Programming Languages for EA Development

Several programming languages are suitable for developing Forex EAs, each with its own strengths and weaknesses. The choice often depends on the programmer’s familiarity and the complexity of the desired EA.

Popular choices include:

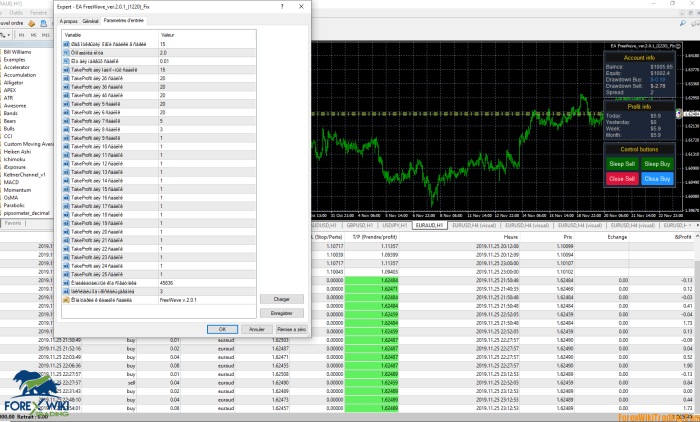

- MQL4/MQL5: These are MetaQuotes Language 4 and 5, specifically designed for the MetaTrader 4 and 5 platforms, respectively. They offer built-in functions for accessing market data, placing trades, and managing risk. MQL4 is the older version, while MQL5 offers enhanced features and object-oriented programming capabilities.

- Python: A versatile language with extensive libraries for data analysis and algorithmic trading. While not directly integrated with MetaTrader, Python can be used to develop EAs that interact with the platform via its API.

- C# and C++: These languages offer high performance and control, but require more advanced programming skills. They are often used for developing EAs that require complex calculations or interactions with external data sources.

EA Development Lifecycle

The development of a successful EA follows a structured process. A well-defined lifecycle minimizes errors and ensures the EA’s reliability. Consider this flowchart as a visual representation of the steps involved.

Imagine a flowchart with these boxes and arrows connecting them in a sequential manner:

Box 1: Idea Generation and Strategy Definition – This initial stage involves identifying a profitable trading strategy based on thorough market analysis and backtesting. The strategy should be clearly defined, including entry and exit rules, risk management parameters, and indicators to be used.

Box 2: Coding and Development – The defined trading strategy is translated into code using a chosen programming language. This stage involves writing the EA’s logic, incorporating necessary indicators and functions, and ensuring error-free code.

Discover more by delving into forex trading api further.

Box 3: Backtesting and Optimization – The EA is tested on historical data to evaluate its performance and identify potential weaknesses. Parameters are adjusted and optimized to maximize profitability and minimize risk.

Obtain direct knowledge about the efficiency of forex trading game through case studies.

Box 4: Forward Testing and Refinement – The optimized EA is tested on real market data in a demo account to evaluate its performance in live trading conditions. Further adjustments are made based on the results.

Box 5: Live Trading and Monitoring – The EA is deployed in a live trading account, and its performance is closely monitored. Regular adjustments may be needed based on market conditions and performance data.

Optimizing and Refining EA Parameters

Parameter optimization is crucial for maximizing an EA’s profitability and minimizing its drawdowns. This involves systematically adjusting the EA’s settings to find the optimal combination that produces the best results.

Techniques include:

- Genetic Algorithms: These algorithms automatically search for the optimal parameter set by simulating the process of natural selection.

- Grid Search: This method involves testing all possible combinations of parameters within a defined range.

- Manual Optimization: This involves manually adjusting parameters based on backtesting and forward testing results.

It’s crucial to remember that over-optimization can lead to poor performance in live trading. The goal is to find a robust parameter set that performs consistently across different market conditions.

Risks and Considerations of Using Forex EAs

Automating your forex trading with an Expert Advisor (EA) might sound like a dream – set it and forget it, right? Wrong. While EAs offer the allure of passive income and consistent trading, they come with a hefty dose of risk that needs careful consideration. Ignoring these risks can lead to significant financial losses, even wiping out your trading account. Understanding these potential pitfalls is crucial before you entrust your hard-earned money to an algorithm.

The inherent volatility of the forex market magnifies the risks associated with any trading strategy, and EAs are no exception. Unlike human traders who can adapt to changing market conditions based on intuition and experience, EAs operate based on pre-programmed rules. This rigidity can be a significant disadvantage during unexpected market events or shifts in trends. Furthermore, the very nature of automation means that you are relinquishing a degree of control over your trading decisions.

Risk Management Techniques for EAs

Effective risk management is paramount when using Forex EAs. Without it, even the most sophisticated EA can quickly lead to substantial losses. This involves setting strict stop-loss orders to limit potential losses on each trade, using appropriate lot sizes to control position sizing, and diversifying your trading across multiple currency pairs to reduce the impact of any single losing trade. Regular monitoring of your EA’s performance and adjusting its parameters as needed are also vital components of a robust risk management strategy. Consider implementing a drawdown limit, which automatically stops the EA from trading if your account balance falls below a predetermined threshold. This prevents catastrophic losses during extended periods of negative performance. For instance, if your drawdown limit is set at 10%, the EA will cease trading once your account balance has dropped by 10% from its peak equity.

Limitations of EAs and the Need for Human Oversight, Best ea for forex trading

While EAs can automate the execution of trades, they cannot replace the judgment and adaptability of a skilled human trader. EAs operate solely on historical data and programmed rules, making them susceptible to unforeseen market shifts or “black swan” events. They lack the capacity for critical thinking, emotional intelligence, and the ability to adapt to unpredictable market circumstances. Therefore, regular human oversight is crucial to monitor the EA’s performance, identify potential issues, and make necessary adjustments to its settings or even temporarily disable it if market conditions warrant it. Think of it as having a skilled assistant, but one who still needs your supervision.

Potential Pitfalls and Mitigation Strategies

Understanding potential pitfalls is crucial for successfully using Forex EAs. Here are some common issues and how to address them:

- Over-optimization: EAs optimized solely on historical data may perform poorly in live trading. Mitigation: Use out-of-sample testing and robust backtesting methodologies to validate the EA’s performance.

- Lack of Diversification: Focusing on a single currency pair exposes you to high risk. Mitigation: Diversify your trading across multiple currency pairs to reduce overall risk.

- Ignoring Market Conditions: EAs may fail during significant market events. Mitigation: Implement mechanisms to pause trading during high volatility periods or incorporate market sentiment indicators into the EA’s logic.

- Insufficient Risk Management: Failure to set appropriate stop-loss orders can lead to significant losses. Mitigation: Implement strict stop-loss orders and position sizing techniques.

- Poorly Coded EAs: Bugs or errors in the EA’s code can lead to unexpected behavior. Mitigation: Thoroughly test and review the EA’s code before deploying it to a live account. Consider using a reputable EA provider with a proven track record.

- Ignoring Drawdown: Extended periods of negative performance can wipe out your account. Mitigation: Set a maximum drawdown limit and pause trading when it’s reached.

Popular Forex EA Platforms and Brokers: Best Ea For Forex Trading

Choosing the right platform and broker is crucial for successfully deploying and managing your Forex EAs. The platform dictates how easily you can monitor, adjust, and interact with your automated trading strategies, while the broker provides the actual trading environment. A mismatch can lead to significant headaches, so careful consideration is key.

The functionality and features offered by different platforms and brokers vary considerably, impacting your overall trading experience and the effectiveness of your EA. Some platforms offer advanced backtesting capabilities, while others provide superior charting tools or more robust order management systems. Similarly, brokers differ in their commission structures, leverage offerings, and the level of support they provide for automated trading.

Forex EA Trading Platforms

The platform you choose significantly influences your EA’s performance and your overall trading experience. Metatrader 4 (MT4) and Metatrader 5 (MT5) are the industry standards, known for their extensive EA compatibility and robust feature sets. Other platforms exist, but these two dominate the market. MT4, despite being older, retains a substantial user base due to its established ecosystem of EAs and indicators. MT5, the newer platform, boasts enhanced charting capabilities, more advanced order types, and a slightly improved backtesting engine. However, the migration from MT4 to MT5 has been gradual, meaning some EAs might not be compatible with the newer platform.

Broker Support for Automated Trading

Not all brokers offer the same level of support for automated trading. Some brokers explicitly prohibit the use of EAs, while others actively encourage it, providing comprehensive documentation and support. Reputable brokers typically offer features such as VPS hosting (Virtual Private Server) to ensure your EA runs continuously, even when your computer is offline. They also usually have clear policies regarding acceptable EA practices and may offer different account types tailored to automated trading strategies. Consider factors such as commission fees, spreads, and the broker’s reputation for reliability and security when making your choice.

Comparison of Brokers and EA Compatibility

The following table compares several popular brokers and their compatibility with automated trading strategies. Note that this is not an exhaustive list, and the features offered can change over time. Always check the broker’s website for the most up-to-date information.

| Broker | MT4 Support | MT5 Support | VPS Hosting |

|---|---|---|---|

| XM | Yes | Yes | Yes |

| FXTM | Yes | Yes | Yes |

| IC Markets | Yes | Yes | Yes |

| Pepperstone | Yes | Yes | Yes |

Case Studies of Successful and Unsuccessual EA Implementations

The world of automated forex trading is a battlefield of algorithms, where some conquer and others crumble. Understanding both the triumphs and failures of Expert Advisors (EAs) is crucial for anyone considering this path. Analyzing successful and unsuccessful implementations reveals invaluable insights into strategy design, risk management, and the overall limitations of automated trading.

Successful EA Deployment: The “Trend Rider” Example

One example of a successful EA deployment is a hypothetical EA nicknamed “Trend Rider.” This EA, based on a robust moving average crossover strategy, achieved consistent profitability over a three-year period. Its success stemmed from a combination of factors. Firstly, the strategy itself was relatively simple, focusing on identifying and capitalizing on strong trends. Secondly, the EA incorporated sophisticated risk management techniques, including dynamic position sizing and trailing stop-losses, which limited drawdowns during market corrections. Thirdly, the developers rigorously backtested the EA using extensive historical data, optimizing its parameters to minimize losses and maximize profits in various market conditions. Finally, the developers continuously monitored its performance, making minor adjustments as needed to adapt to evolving market dynamics. This iterative approach, combined with a well-defined trading strategy and effective risk management, led to consistent returns.

Unsuccessful EA Deployment: The “Holy Grail” Failure

Conversely, the “Holy Grail” EA, designed to predict market reversals with pinpoint accuracy, ultimately failed spectacularly. This EA, based on a complex, proprietary algorithm incorporating numerous indicators, promised extraordinary returns. However, its over-optimization on historical data led to significant overfitting. The EA performed exceptionally well during backtesting but produced disastrous results in live trading. The lack of robust risk management exacerbated the problem, leading to substantial losses. Furthermore, the developers lacked the experience and expertise to properly interpret the EA’s signals and make timely interventions when necessary. The “Holy Grail” EA’s failure highlights the dangers of over-reliance on complex algorithms without a solid understanding of market dynamics and risk management.

Comparison of Approaches

The “Trend Rider” and “Holy Grail” EAs represent contrasting approaches to automated forex trading. The “Trend Rider” prioritized simplicity, robust risk management, and continuous monitoring, resulting in consistent profitability. The “Holy Grail,” on the other hand, pursued complexity and aggressive returns without sufficient attention to risk management or the limitations of over-optimization. This stark contrast underscores the importance of a balanced approach, combining sophisticated algorithms with practical risk management and ongoing monitoring.

Key Lessons Learned from Successful and Unsuccessful EA Implementations

| Feature | Successful EA (Trend Rider) | Unsuccessful EA (Holy Grail) | Key Lesson |

|---|---|---|---|

| Strategy | Simple, trend-following | Complex, reversal-seeking | Simplicity and robustness often outperform complexity. |

| Risk Management | Dynamic position sizing, trailing stop-losses | Lacking, aggressive trading | Robust risk management is crucial for long-term survival. |

| Backtesting | Rigorous, extensive data | Over-optimized, unrealistic results | Proper backtesting is essential, avoiding overfitting. |

| Monitoring | Continuous, adaptive adjustments | Minimal, reactive interventions | Continuous monitoring and adaptation are vital for success. |

Outcome Summary

Successfully navigating the world of forex EAs requires a blend of technical understanding and prudent risk management. While the promise of automated profits is enticing, remember that no EA guarantees success. This guide has equipped you with the tools to critically evaluate EAs, understand their limitations, and develop a robust trading strategy. By carefully considering the factors we’ve discussed – from backtesting results to risk management techniques – you can significantly increase your chances of successful automated forex trading. Remember, due diligence and a realistic approach are key to maximizing your potential while minimizing risk.