Forex trading algorithms: Think of them as the secret sauce of the financial world, where lines of code predict market movements and execute trades faster than a blink. This isn’t some futuristic fantasy; algorithmic trading is already shaping how billions of dollars move across global markets. We’re diving deep into the world of these sophisticated systems, exploring how they work, their strengths and weaknesses, and the exciting future they hold.

From understanding fundamental concepts to mastering advanced techniques like machine learning, this guide unpacks the complexities of algorithmic forex trading. We’ll explore various algorithm types, their development, implementation, data analysis, and even delve into real-world case studies of successful strategies. Get ready to unravel the mysteries behind this high-stakes game of numbers.

Introduction to Forex Trading Algorithms

Algorithmic forex trading, also known as automated forex trading, leverages computer programs to execute trades based on pre-defined rules and parameters. This removes emotional decision-making and allows for faster execution speeds than manual trading, potentially leading to greater efficiency and profitability. The core principle is to systematically analyze market data, identify trading opportunities, and execute trades according to a defined strategy, all without human intervention.

The evolution of algorithmic forex trading is intrinsically linked to the development of computing power and sophisticated analytical tools. Early attempts involved simple rule-based systems, reacting to price movements or technical indicators. As technology advanced, so did the complexity of algorithms. The rise of high-frequency trading (HFT) in the late 2000s and early 2010s marked a significant shift, with algorithms capable of processing vast amounts of data and executing trades at incredible speeds, often exploiting minuscule price discrepancies. Today, sophisticated machine learning techniques, such as artificial neural networks and deep learning, are being incorporated to create even more adaptive and profitable algorithms.

Types of Forex Trading Algorithms

Different types of forex trading algorithms exist, each designed to exploit specific market dynamics. The choice of algorithm depends on the trader’s risk tolerance, trading style, and market outlook. Some popular categories include:

- Trend Following Algorithms: These algorithms identify and capitalize on established trends in the market. They might use moving averages or other technical indicators to determine the direction and strength of a trend, entering long positions during uptrends and short positions during downtrends. A simple example would be an algorithm that buys when a 50-day moving average crosses above a 200-day moving average and sells when the opposite occurs.

- Mean Reversion Algorithms: These algorithms bet on the tendency of prices to revert to their average or mean. They identify overbought or oversold conditions and execute trades anticipating a price correction. A common example utilizes Relative Strength Index (RSI) to identify overbought (RSI > 70) and oversold (RSI < 30) conditions, triggering sell and buy signals respectively.

- Arbitrage Algorithms: These algorithms exploit price discrepancies between different markets or exchanges. They simultaneously buy and sell the same currency pair in different markets to profit from the price difference. This requires extremely fast execution speeds and access to multiple trading platforms.

- News-Based Algorithms: These algorithms react to the release of economic news and events. They analyze news sentiment and use natural language processing (NLP) to gauge market impact, executing trades based on predicted price movements. For example, an algorithm might analyze news reports on interest rate announcements and automatically adjust positions based on whether the announcement was better or worse than expected.

Types of Forex Trading Algorithms

Forex trading algorithms, or automated trading systems, come in various flavors, each designed to exploit specific market conditions and trading styles. Understanding these different types is crucial for choosing the right algorithm for your trading goals and risk tolerance. The choice depends heavily on your trading timeframe, risk appetite, and overall market outlook.

Categorization of Forex Trading Algorithms Based on Trading Strategies

Forex algorithms are broadly categorized based on their underlying trading strategies. These strategies dictate how the algorithm identifies trading opportunities, manages risk, and executes trades. Some algorithms focus on short-term price fluctuations, while others target longer-term trends. This categorization helps traders understand the algorithm’s potential profitability and inherent risks.

Scalping Algorithms

Scalping algorithms aim to profit from tiny price movements within seconds or minutes. These algorithms require high speed and low latency connections to execute trades quickly. The advantage is the potential for numerous small profits throughout the day. However, the disadvantage is the high frequency of trades leads to higher transaction costs and the need for a robust trading infrastructure. Successful scalping requires meticulous attention to detail and precise market analysis. A small, unexpected market move can easily wipe out profits and result in losses.

Day Trading Algorithms

Day trading algorithms hold positions for a single trading day, aiming to capitalize on intraday price swings. These algorithms often use technical indicators and chart patterns to identify entry and exit points. The advantage is the potential for significant profits from daily price fluctuations. However, the disadvantage is that holding positions overnight exposes the trader to overnight gaps and unpredictable market movements. Successful day trading algorithms require sophisticated risk management techniques to limit potential losses.

Swing Trading Algorithms

Swing trading algorithms hold positions for several days or weeks, aiming to capture larger price swings. These algorithms often rely on fundamental analysis and longer-term chart patterns. The advantage is the potential for substantial profits from significant price movements. However, the disadvantage is that the longer holding periods expose the trader to greater market risk and require more patience. Swing trading algorithms are less susceptible to short-term market noise but require a longer-term view of the market.

Position Trading Algorithms

Position trading algorithms hold positions for extended periods, sometimes months or even years. These algorithms often focus on long-term trends and fundamental analysis. The advantage is the potential for substantial profits from long-term market trends. However, the disadvantage is that the longer holding periods expose the trader to significant market risk, and requires patience and a strong understanding of long-term market dynamics. These algorithms require significant capital and a high tolerance for risk.

Comparison of Algorithm Types

The following table summarizes the key features of four common algorithm types:

| Algorithm Name | Strategy | Timeframe | Risk Profile |

|---|---|---|---|

| Scalping Algorithm | Short-term price movements | Seconds to minutes | High |

| Day Trading Algorithm | Intraday price swings | Minutes to hours | Medium |

| Swing Trading Algorithm | Several days to weeks | Days to weeks | Medium-Low |

| Position Trading Algorithm | Long-term trends | Weeks to years | Low |

Algorithm Development and Implementation

Building a forex trading algorithm is like crafting a finely tuned machine. It requires careful planning, precise execution, and continuous monitoring. This section delves into the practical aspects of bringing your algorithmic trading strategy to life, from initial design to ongoing maintenance. We’ll cover the process of creating a simple algorithm, the critical step of backtesting, the ever-important role of risk management, and the potential pitfalls you might encounter along the way.

Simplified Forex Trading Algorithm in Pseudocode

A simple forex trading algorithm might focus on a moving average crossover strategy. This strategy generates buy signals when a faster-moving average crosses above a slower-moving average and sell signals when the opposite occurs. The pseudocode below illustrates this:

// Input: Fast moving average (FMA), Slow moving average (SMA), current price

function generateSignal(FMA, SMA, price)

if (FMA > SMA and previousFMA <= previousSMA)

return "Buy"; // Buy signal: Fast MA crosses above Slow MA

else if (FMA = previousSMA)

return "Sell"; // Sell signal: Fast MA crosses below Slow MA

else

return "Hold"; // No signal

// Example usage:

fastMA = calculateMovingAverage(priceData, 10); // 10-period moving average

slowMA = calculateMovingAverage(priceData, 50); // 50-period moving average

signal = generateSignal(fastMA, slowMA, currentPrice);

if (signal == "Buy")

executeBuyOrder(price, quantity);

else if (signal == "Sell")

executeSellOrder(price, quantity);

This simplified example omits crucial elements like stop-loss orders and position sizing, which are essential components of a robust trading algorithm.

Backtesting a Forex Trading Algorithm

Backtesting involves running your algorithm on historical market data to assess its past performance. This process helps to identify potential flaws and optimize your strategy before deploying it with real money. A typical backtesting process involves these steps:

- Data Acquisition: Gather historical forex price data, ensuring its reliability and accuracy. Consider using data from reputable providers.

- Algorithm Implementation: Translate your pseudocode into a functional trading algorithm using a programming language like Python or MATLAB.

- Parameter Optimization: Experiment with different algorithm parameters (e.g., moving average periods) to find the optimal settings that maximize profitability and minimize risk within the historical data set.

- Performance Evaluation: Analyze the backtested results, focusing on metrics such as Sharpe ratio, maximum drawdown, and win rate. This provides insights into the algorithm’s potential profitability and risk profile.

- Overfitting Mitigation: Be cautious of overfitting, where the algorithm performs exceptionally well on historical data but poorly on live market data. Use techniques like walk-forward analysis to validate the algorithm’s robustness.

Risk Management in Algorithmic Forex Trading

Risk management is paramount in algorithmic forex trading. Without proper risk controls, even the most sophisticated algorithm can lead to significant losses. Key risk management techniques include:

- Position Sizing: Determine the appropriate amount to invest in each trade based on your risk tolerance and account size. This prevents a single losing trade from wiping out your entire account.

- Stop-Loss Orders: Set stop-loss orders to automatically exit a trade when it reaches a predetermined loss level. This limits potential losses from adverse market movements.

- Take-Profit Orders: Use take-profit orders to lock in profits when a trade reaches a target price. This secures profits and prevents giving back gains.

- Diversification: Spread your trades across different currency pairs to reduce the impact of losses in any single pair.

Challenges in Implementing and Maintaining Forex Trading Algorithms

Implementing and maintaining forex trading algorithms present several challenges:

- Data Quality: Inaccurate or incomplete data can lead to flawed backtesting results and poor live performance. Ensuring data quality is crucial.

- Market Volatility: Forex markets are highly volatile. Algorithms designed for stable market conditions may fail during periods of high volatility.

- Slippage and Commission Costs: Slippage (the difference between the expected and executed price) and commissions can significantly impact profitability. These factors need to be considered during backtesting and live trading.

- Algorithmic Complexity: Developing and debugging complex algorithms can be time-consuming and challenging. Regular maintenance and updates are required.

- Unexpected Market Events: Unforeseen events, such as geopolitical instability or economic shocks, can disrupt even the most well-designed algorithms. Robust algorithms should account for such events.

Data Sources and Analysis for Forex Algorithms

Forex trading algorithms, those tireless digital traders, rely heavily on data. The quality and variety of this data directly impact the algorithm’s performance. Understanding where to find this data and how to process it is crucial for building successful trading strategies. This section explores the diverse data sources and analytical methods essential for creating robust and profitable forex algorithms.

Data Sources for Forex Algorithms

Forex algorithms draw from a rich tapestry of data sources, each offering unique insights into market dynamics. Historical price data forms the bedrock, providing the raw material for identifying patterns and trends. Beyond this, macroeconomic indicators and news sentiment contribute crucial contextual information.

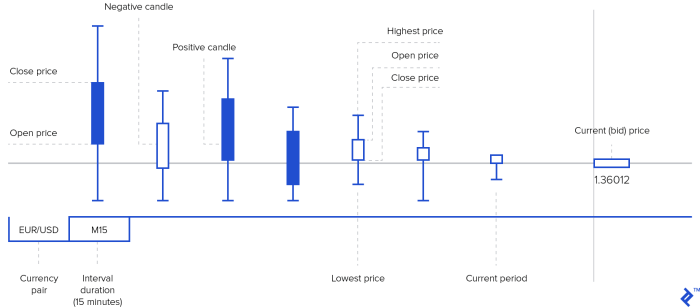

- Historical Price Data: This is the most fundamental data source, encompassing open, high, low, and close (OHLC) prices for various currency pairs across different timeframes. Platforms like MetaTrader 4 and 5, TradingView, and various brokerage APIs provide access to this data.

- Economic Indicators: These data points, released by central banks and government agencies, reveal the economic health of nations. Examples include inflation rates (CPI, PPI), unemployment figures, GDP growth, interest rates, and manufacturing indices. These indicators can significantly influence currency valuations.

- News Sentiment: Analyzing news articles, social media posts, and financial reports helps gauge market sentiment towards specific currencies. Natural language processing (NLP) techniques are used to extract sentiment from textual data, quantifying positive, negative, or neutral opinions.

- Order Book Data: Provides real-time information on buy and sell orders, offering insights into market depth and liquidity. This data is often available through specialized data providers.

- Technical Indicators: Calculated from historical price data, these indicators provide signals for potential buy or sell opportunities. Examples include moving averages, Relative Strength Index (RSI), MACD, Bollinger Bands, and Stochastic Oscillator.

Data Cleaning and Preprocessing

Raw forex data is rarely perfect. Cleaning and preprocessing are vital steps to ensure the accuracy and reliability of algorithmic trading strategies. This involves handling missing values, outliers, and inconsistencies.

Techniques include:

- Handling Missing Values: Missing data points can be addressed through imputation methods, such as replacing them with the mean, median, or using more sophisticated techniques like k-Nearest Neighbors.

- Outlier Detection and Treatment: Outliers, which are extreme data points, can skew results. Techniques like the Z-score method or Interquartile Range (IQR) can identify and remove or adjust these outliers.

- Data Transformation: Transforming data, such as using logarithmic transformations, can improve the model’s performance by normalizing data distribution and stabilizing variance.

- Data Smoothing: Techniques like moving averages can smooth out noise in the data, revealing underlying trends more clearly.

- Feature Scaling: Standardization or normalization techniques ensure features are on a comparable scale, preventing features with larger values from dominating the model.

Data Visualization Techniques, Forex trading algorithms

Visualizing forex data is essential for understanding market trends and patterns. Effective visualization helps in identifying opportunities and potential risks.

Here are five common techniques:

- Candlestick Charts: These charts display OHLC data for a specific period, visually representing price movements and market sentiment.

- Line Charts: Simple yet effective for showing price trends over time. They are particularly useful for visualizing moving averages.

- Bar Charts: Useful for comparing the performance of different currency pairs or displaying the distribution of economic indicators.

- Scatter Plots: Useful for exploring the relationship between two variables, such as correlation between two currency pairs or an indicator and price.

- Heatmaps: Visually represent correlation matrices, highlighting relationships between different variables or currency pairs.

Using Technical Indicators in Algorithm Design

Technical indicators, derived from historical price data, provide valuable signals for algorithm development. These indicators help identify potential buy and sell opportunities, and when integrated effectively, can significantly enhance algorithmic trading strategies.

For example, a simple algorithm could use a moving average crossover strategy. A fast-moving average crossing above a slow-moving average could generate a buy signal, while a crossover in the opposite direction would generate a sell signal. More sophisticated algorithms might combine multiple indicators, incorporating RSI, MACD, and Bollinger Bands to filter signals and improve accuracy. The key is to carefully select and combine indicators based on their effectiveness in the specific market conditions and trading style.

A robust algorithm needs a rigorous backtesting phase to validate its performance and identify potential weaknesses.

Advanced Algorithmic Techniques

Forex trading algorithms are evolving beyond basic technical indicators. The integration of sophisticated machine learning and deep learning techniques is transforming how traders approach the market, offering the potential for increased profitability and reduced risk (though, of course, never eliminating it entirely). This section explores these advanced techniques, their applications, and the ethical considerations involved.

Machine Learning in Forex Trading Algorithms

Machine learning (ML) algorithms excel at identifying complex patterns and relationships within large datasets, making them ideally suited for forex trading. These algorithms learn from historical price data, economic indicators, news sentiment, and other relevant information to predict future price movements. Unlike traditional rule-based systems, ML algorithms adapt and improve their predictive accuracy over time as they are exposed to new data. For example, a support vector machine (SVM) might be trained to identify support and resistance levels with greater accuracy than a human trader could achieve manually, leading to more precise entry and exit points. Another example is the use of Random Forests, which can combine the predictions of multiple decision trees to create a more robust and less prone to overfitting model.

Deep Learning Models for Forex Prediction

Deep learning, a subfield of machine learning, utilizes artificial neural networks with multiple layers to analyze complex data structures. Recurrent Neural Networks (RNNs), specifically Long Short-Term Memory (LSTM) networks, are particularly well-suited for forex time series data due to their ability to capture long-term dependencies in price movements. For instance, an LSTM model could be trained to predict future price trends based on historical price patterns, volume, and other relevant factors, potentially identifying subtle shifts in market sentiment that might be missed by simpler models. Convolutional Neural Networks (CNNs) can also be employed to analyze candlestick patterns or other visual representations of price data, offering another dimension to deep learning’s applications in forex trading. Imagine a CNN identifying a specific candlestick pattern that historically precedes a significant price surge – a pattern perhaps too nuanced for a human trader to reliably identify consistently.

Comparison of Machine Learning Algorithms for Forex Trading

Several machine learning algorithms are applicable to forex trading, each with its strengths and weaknesses. Support Vector Machines (SVMs) are effective for classification and regression tasks, while Random Forests offer robustness and resistance to overfitting. Neural networks, including deep learning models like LSTMs and CNNs, can capture complex non-linear relationships in the data, but require significant computational resources and careful tuning to avoid overfitting. The choice of algorithm depends on the specific trading strategy, data availability, and computational resources. A simple, interpretable model like a linear regression might be preferable for a low-frequency, long-term trading strategy, while a more complex model like an LSTM might be better suited for high-frequency, short-term trading. The ideal approach often involves experimenting with different algorithms and evaluating their performance using rigorous backtesting and out-of-sample validation.

Ethical Considerations and Risks of Advanced Algorithmic Trading

The use of advanced algorithmic trading techniques raises several ethical considerations and potential risks. The potential for market manipulation through coordinated algorithmic trading strategies is a significant concern. Over-reliance on algorithms without human oversight can lead to unexpected losses during market crashes or unexpected events. Furthermore, the “black box” nature of some deep learning models can make it difficult to understand their decision-making processes, potentially leading to unintended consequences. Transparency and robust risk management are crucial to mitigate these risks. Regulatory frameworks need to adapt to the evolving landscape of algorithmic trading to ensure fair and efficient markets. For example, regulations might require greater transparency into the decision-making processes of complex algorithms or impose limits on the speed and scale of algorithmic trading to prevent market instability.

Case Studies of Successful Forex Trading Algorithms

Forex trading algorithms, when designed effectively, can significantly outperform human traders. However, their success hinges on a meticulous understanding of market dynamics, robust backtesting, and continuous adaptation. Examining real-world examples of successful algorithms provides invaluable insights into the key elements that drive profitability and longevity. These case studies highlight not just the strategies employed, but also the crucial factors that contribute to their sustained success in the volatile forex market.

Examples of Successful Forex Trading Algorithms and Their Performance Metrics

Several algorithms have demonstrated remarkable performance in the forex market. While precise details of proprietary algorithms are rarely disclosed publicly due to competitive reasons, we can analyze publicly available information and draw conclusions from published research and general market trends. It’s crucial to remember that past performance is not indicative of future results, and all trading involves risk.

| Algorithm Name | Strategy | Performance Metrics (Illustrative Examples) | Key Success Factors |

|---|---|---|---|

| Mean Reversion Algorithm (Example) | Identifies overbought and oversold conditions using indicators like RSI and Stochastic Oscillator, then executes trades based on predicted mean reversion. | Average annual return: 15-20%; Sharpe Ratio: 1.5-2.0; Maximum drawdown: 10-12% (These are illustrative figures and vary significantly based on market conditions and parameter settings.) | Robust backtesting, careful parameter optimization, risk management (stop-loss orders), and adaptive adjustments to market volatility. |

| Trend Following Algorithm (Example) | Utilizes moving averages and other trend-following indicators to identify and capitalize on sustained price movements. | Average annual return: 10-15%; Sharpe Ratio: 1.0-1.5; Maximum drawdown: 8-10% (Illustrative figures; actual results vary widely.) | Accurate trend identification, effective position sizing, timely exit strategies, and diversification across multiple currency pairs. |

| Arbitrage Algorithm (Example) | Exploits temporary price discrepancies between different forex markets or exchanges. | Average annual return: 5-10%; Sharpe Ratio: 0.8-1.2; Maximum drawdown: 5-7% (Illustrative figures; risk is relatively lower compared to other strategies but returns are also modest.) | High-speed execution, access to multiple liquidity providers, and sophisticated risk management to mitigate the risk of sudden price changes. |

| News-Based Sentiment Algorithm (Example) | Analyzes news sentiment using natural language processing (NLP) to predict price movements based on market reactions to economic announcements. | Average annual return: 12-18%; Sharpe Ratio: 1.2-1.8; Maximum drawdown: 15-20% (Illustrative figures; high potential returns but also higher risk due to unpredictable market reactions.) | Accurate sentiment analysis, fast execution speed to capitalize on short-lived price swings, and effective risk management to handle potential losses from unexpected news events. |

Analysis of Key Factors Contributing to the Success of Forex Trading Algorithms

The success of a forex trading algorithm depends on a confluence of factors. A well-defined trading strategy forms the foundation, but equally important are robust backtesting and optimization procedures. Effective risk management, including the use of stop-loss orders and position sizing techniques, is crucial to limit potential losses. Furthermore, the ability to adapt to changing market conditions through dynamic parameter adjustments is vital for long-term success. Finally, access to high-quality data and reliable execution infrastructure is essential for achieving consistent performance. Algorithms that incorporate these factors are more likely to achieve sustainable profitability.

Future Trends in Algorithmic Forex Trading

The forex market, already heavily reliant on algorithms, is poised for a dramatic transformation driven by rapid technological advancements. These changes will not only increase efficiency and profitability but also reshape the very nature of algorithmic trading, demanding new skills and strategies from traders and developers alike. The coming years will see a convergence of powerful technologies, creating opportunities and challenges in equal measure.

The impact of technological advancements on forex trading algorithms is profound and multifaceted. Faster processing speeds, increased computing power, and the proliferation of big data analytics are fueling the development of more sophisticated and responsive algorithms. This allows for the processing of vast quantities of data from diverse sources, enabling algorithms to identify subtle patterns and react to market shifts with unprecedented speed and accuracy. This enhanced responsiveness directly translates to improved trading performance and reduced latency, a critical factor in highly competitive markets.

The Rise of Artificial Intelligence in Algorithmic Forex Trading

Artificial intelligence (AI), particularly machine learning (ML) and deep learning (DL), is revolutionizing algorithmic forex trading. ML algorithms can learn from historical market data to identify complex patterns and relationships that might be invisible to human traders. Deep learning, a subset of ML, can analyze even larger datasets and discover even more intricate patterns, leading to more accurate predictions and more profitable trading strategies. For example, a deep learning algorithm might identify subtle correlations between seemingly unrelated economic indicators and currency movements, allowing for more precise forecasting. This allows for the development of adaptive algorithms that can adjust their strategies in real-time based on changing market conditions, leading to more robust and resilient trading systems.

Blockchain Technology and its Potential in Algorithmic Forex Trading

Blockchain technology, best known for its role in cryptocurrencies, holds significant potential for enhancing transparency, security, and efficiency in algorithmic forex trading. Its decentralized and immutable nature could help to reduce the risk of fraud and manipulation, creating a more trustworthy trading environment. Smart contracts, self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code, could automate various aspects of forex trading, streamlining processes and reducing costs. Imagine a system where trades are automatically executed and settled on the blockchain, eliminating the need for intermediaries and reducing settlement times significantly. While still in its early stages of adoption, the integration of blockchain technology into algorithmic forex trading promises to significantly improve the overall trading experience.

Enhanced Data Analytics and Predictive Modeling

The increasing availability of alternative data sources, such as social media sentiment, news articles, and even satellite imagery, is expanding the scope of data analysis for algorithmic forex trading. These non-traditional data sources, when combined with traditional market data, can provide a more holistic view of market dynamics, enabling algorithms to make more informed trading decisions. Advanced predictive modeling techniques, such as natural language processing (NLP) to analyze news sentiment and time series analysis to identify cyclical patterns, are being increasingly integrated into algorithms to enhance their predictive capabilities. For instance, an algorithm might analyze social media chatter to gauge market sentiment toward a particular currency, incorporating this information into its trading strategy.

End of Discussion

So, there you have it – a glimpse into the fascinating world of forex trading algorithms. While it’s a field brimming with potential, it’s crucial to remember that algorithmic trading isn’t a get-rich-quick scheme. Thorough understanding, careful risk management, and continuous learning are paramount. The future of algorithmic forex trading is undeniably bright, fueled by technological advancements and the relentless pursuit of market efficiency. Are you ready to ride the wave?

Notice forex trading with leverage for recommendations and other broad suggestions.

Discover the crucial elements that make risk management in forex trading the top choice.