Forex currency trading basics: Dive into the thrilling world of global finance! Think you need a PhD in economics to understand it? Think again. This isn’t your grandpa’s stuffy investment club; forex trading is dynamic, accessible (with the right knowledge, of course!), and potentially incredibly lucrative. We’ll break down the core concepts, from understanding currency pairs to mastering basic trading strategies, all in a way that’s both informative and, dare we say, fun.

We’ll demystify the jargon, explore different trading styles, and even show you how to manage risk – because let’s face it, smart investing isn’t just about making money; it’s about protecting what you have. Get ready to unlock the secrets of this exciting market and take your first steps towards financial freedom (or at least, a better understanding of how the global economy works!).

What is Forex Currency Trading?

Forex trading, or foreign exchange trading, is the global marketplace where currencies are bought and sold. It’s a massive, decentralized market operating 24/5, connecting banks, corporations, governments, and individual traders across the globe. Unlike a stock exchange with a central location, forex transactions happen electronically, making it incredibly accessible but also requiring a strong understanding of its dynamics. Think of it as a constantly shifting landscape of global economic activity, reflected in the fluctuating values of different currencies.

Forex trading involves speculating on the price movements of currency pairs. Traders aim to profit from the difference between the buying and selling price of a currency, anticipating whether a currency will appreciate or depreciate against another. The sheer volume and constant activity of the forex market mean opportunities for profit are plentiful, but so are the risks.

Currency Pairs

Currency pairs are the foundation of forex trading. They represent the exchange rate between two currencies. For example, EUR/USD represents the Euro against the US dollar. The first currency listed (EUR in this case) is called the base currency, and the second (USD) is the quote currency. The exchange rate shows how many units of the quote currency are needed to buy one unit of the base currency. There are countless pairs traded, but some of the most popular include:

- Major Pairs: These involve the US dollar (USD) paired with other major global currencies like the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Swiss Franc (CHF), Canadian Dollar (CAD), and Australian Dollar (AUD). These pairs are highly liquid and experience significant trading volume.

- Minor Pairs: These pairs exclude the USD, often involving crosses between other major currencies such as EUR/GBP or GBP/JPY. They typically have lower liquidity than major pairs.

- Exotic Pairs: These involve pairing a major currency with the currency of a less developed economy, such as USD/MXN (US Dollar/Mexican Peso) or EUR/TRY (Euro/Turkish Lira). These pairs are often subject to higher volatility and less liquidity.

Understanding the different types of currency pairs and their relative liquidity and volatility is crucial for risk management and developing a trading strategy.

Opening a Forex Trading Account

Opening a forex trading account is relatively straightforward, but requires careful consideration. Here’s a step-by-step guide:

- Research Brokers: Find a regulated and reputable forex broker. Consider factors like trading platform, fees, customer support, and educational resources offered. Check reviews and compare different brokers before making a decision. Don’t just go for the flashy ads; look for solid regulation and a proven track record.

- Account Registration: Once you’ve chosen a broker, you’ll need to register an account. This usually involves providing personal information, such as your name, address, and contact details. You may also need to provide identification documents for verification purposes.

- Funding Your Account: After your account is verified, you’ll need to deposit funds to start trading. Most brokers offer various funding methods, including bank transfers, credit/debit cards, and electronic payment systems. Start with a small amount to practice and gain experience before investing significant capital.

- Platform Familiarization: Familiarize yourself with the trading platform provided by your broker. Most brokers offer user-friendly platforms with charting tools, technical indicators, and order execution features. Practice using the platform with a demo account before trading with real money.

- Start Trading (Cautiously): Begin with small trades to test your strategies and manage risk effectively. Forex trading involves significant risk, and it’s essential to develop a robust risk management plan before committing large amounts of capital.

Remember, thorough research and careful planning are essential before venturing into the world of forex trading. It’s a complex market, and understanding the risks involved is paramount.

Understanding Currency Pairs and Quotes

Navigating the forex market requires a solid grasp of how currencies are traded and priced. This section delves into the mechanics of currency pairs, their quotes, and the factors that influence their values. Understanding these fundamentals is crucial for any aspiring forex trader.

Currency Pair Composition and Quotes

Forex trading involves exchanging one currency for another. These exchanges are represented as currency pairs, where the first currency is the base currency and the second is the quote currency. For example, in the EUR/USD pair, the euro (EUR) is the base currency and the US dollar (USD) is the quote currency. A quote, such as EUR/USD = 1.1000, means that 1 euro can be exchanged for 1.1000 US dollars. The bid price represents the price at which a market maker is willing to buy a currency, while the ask price is the price at which they are willing to sell it. The difference between these two prices is the spread, a crucial factor in determining trading costs.

Factors Influencing Exchange Rates

Numerous factors influence currency exchange rates, creating a dynamic and often volatile market. These factors include: economic indicators (like GDP growth, inflation, and unemployment rates); government policies (such as interest rate changes and fiscal measures); geopolitical events (wars, political instability); market sentiment (investor confidence and speculation); and supply and demand (the relative availability and demand for a particular currency). For example, a rise in US interest rates generally strengthens the US dollar relative to other currencies, as investors seek higher returns. Conversely, negative news about a country’s economy might weaken its currency.

Major, Minor, and Exotic Currency Pairs

Forex currency pairs are categorized into three main types: major, minor, and exotic. Major pairs involve the US dollar paired with a highly traded currency like the euro (EUR/USD), Japanese yen (USD/JPY), or British pound (GBP/USD). These pairs are highly liquid and have tight spreads due to their high trading volume. Minor pairs involve two major currencies where neither is the US dollar, such as EUR/GBP or EUR/JPY. These pairs usually exhibit moderate liquidity and spreads. Exotic pairs consist of one major currency and one emerging market currency, like USD/MXN (US dollar/Mexican peso) or EUR/TRY (euro/Turkish lira). These pairs often have wider spreads and lower liquidity due to their less frequent trading.

Examples of Currency Pairs

| Pair Type | Example | Composition | Typical Volatility |

|---|---|---|---|

| Major | EUR/USD | Euro / US Dollar | Moderate to High |

| Major | USD/JPY | US Dollar / Japanese Yen | Moderate |

| Minor | EUR/GBP | Euro / British Pound | Moderate |

| Exotic | USD/MXN | US Dollar / Mexican Peso | High |

Forex Trading Terminology

Navigating the world of forex trading requires understanding its unique vocabulary. This section clarifies some essential terms, providing a foundation for more advanced trading strategies. Mastering these definitions is crucial for comprehending market dynamics and managing risk effectively.

Forex trading involves specific terminology that differs from other financial markets. Familiarizing yourself with these terms is paramount to successful trading. This section will break down key concepts, providing clear definitions and examples.

Learn about more about the process of best currency pairs for forex trading in the field.

Pip

A pip, or point in percentage, is the smallest price movement a currency pair can make. For most currency pairs, a pip is 0.0001. For example, if EUR/USD moves from 1.1000 to 1.1001, that’s a one-pip movement. Understanding pips is fundamental to calculating profits and losses. Some currency pairs, like those involving the Japanese Yen (JPY), have a pip value of 0.01.

Lot, Forex currency trading basics

A lot represents the unit of currency traded in a forex transaction. A standard lot is 100,000 units of the base currency. There are also mini-lots (10,000 units), micro-lots (1,000 units), and nano-lots (100 units), allowing traders of varying capital levels to participate. The size of the lot directly impacts the potential profit or loss on a trade. For instance, trading one standard lot of EUR/USD means you’re buying or selling 100,000 Euros.

Leverage

Leverage is the ability to control a larger position with a smaller amount of capital. It magnifies both profits and losses. A leverage ratio of 1:100 means you can control $100,000 with $1,000 of your own money. While leverage can significantly amplify returns, it also increases the risk of substantial losses if the market moves against your position. For example, a 1% adverse movement in the market with 1:100 leverage would wipe out your entire initial investment.

Margin

Margin is the amount of money you must deposit in your trading account to open and maintain a leveraged position. It acts as collateral for the broker. The required margin depends on the leverage ratio and the size of the trade. Insufficient margin can lead to a margin call, where the broker demands additional funds to maintain your position, or even a forced liquidation of your trade. Maintaining adequate margin is crucial for risk management.

Spread

The spread is the difference between the bid price (the price at which you can sell a currency pair) and the ask price (the price at which you can buy a currency pair). It represents the broker’s commission. Spreads vary depending on the currency pair, market volatility, and the broker. A tighter spread means lower trading costs, making it more advantageous for traders. For example, if the bid price for EUR/USD is 1.1000 and the ask price is 1.1002, the spread is 2 pips.

Glossary of Common Forex Terms

Here’s a concise glossary summarizing key terms for quick reference:

| Term | Definition | Example |

|---|---|---|

| Base Currency | The first currency in a currency pair. | In EUR/USD, EUR is the base currency. |

| Counter Currency | The second currency in a currency pair. | In EUR/USD, USD is the counter currency. |

| Bid Price | The price at which a broker is willing to buy a currency pair. | If the bid price for GBP/USD is 1.2500, the broker will buy GBP at that rate. |

| Ask Price | The price at which a broker is willing to sell a currency pair. | If the ask price for GBP/USD is 1.2502, the broker will sell GBP at that rate. |

| Long Position | Buying a currency pair with the expectation that its value will increase. | Buying EUR/USD expecting the Euro to appreciate against the US Dollar. |

| Short Position | Selling a currency pair with the expectation that its value will decrease. | Selling EUR/USD expecting the Euro to depreciate against the US Dollar. |

| Rollover | The process of carrying a position overnight. Usually involves a small fee or interest payment. | Holding a long position in GBP/USD overnight may incur a small rollover fee. |

| Swap | The interest rate differential between two currencies in a position held overnight. | The swap rate reflects the interest rate difference between the two currencies involved. |

Basic Forex Trading Strategies

Forex trading offers a diverse range of strategies, each with its own set of risks and rewards. Choosing the right strategy depends heavily on your trading personality, risk tolerance, and available time commitment. Let’s explore some popular approaches.

Scalping

Scalping involves taking advantage of very small price fluctuations in the market. Traders who scalp aim to make many small profits throughout the day, rather than holding positions for extended periods. This strategy requires intense focus, quick reflexes, and access to low-latency trading platforms.

- Advantages: Potential for quick profits, relatively low risk per trade (due to small position sizes).

- Disadvantages: Requires significant discipline and focus, high transaction costs can eat into profits, emotionally taxing due to the high volume of trades.

Day Trading

Day traders open and close all their positions within a single trading day. Unlike scalpers, day traders might hold positions for minutes, hours, or the entire day, depending on their strategy and market conditions. Technical analysis is frequently employed by day traders to identify short-term trends and entry/exit points.

- Advantages: Allows for flexibility in trading schedule, potential for significant profits in trending markets, avoids overnight risks associated with holding positions.

- Disadvantages: Requires constant market monitoring, can be stressful, requires a deep understanding of technical analysis and market dynamics.

Swing Trading

Swing trading involves holding positions for several days or even weeks, aiming to capture larger price swings. Swing traders often use a combination of technical and fundamental analysis to identify potential trade setups. They look for opportunities to capitalize on short-term trends within the context of longer-term market movements.

- Advantages: Less time-consuming than scalping or day trading, allows for greater flexibility in managing trades, can capture larger price movements.

- Disadvantages: Higher risk compared to scalping, requires a good understanding of both technical and fundamental analysis, can be impacted by unexpected news events or market shifts.

Risk Management in Forex Trading

Forex trading, while potentially lucrative, is inherently risky. Ignoring risk management is akin to sailing a ship without a compass – you might get lucky, but you’re far more likely to crash. Effective risk management isn’t about avoiding losses entirely; it’s about controlling them, ensuring that any losses are within your tolerance and don’t wipe out your trading capital. This allows you to stay in the game long enough to profit from winning trades.

Stop-Loss Orders and Position Sizing

Stop-loss orders are your safety net. They automatically close a trade when the price moves against you by a predetermined amount, limiting your potential losses. Position sizing, on the other hand, dictates how much capital you allocate to each trade. These two work in tandem. A well-defined stop-loss combined with careful position sizing ensures that even if a trade goes south, your losses remain manageable. For example, if you’re risking 2% of your account per trade and your account is $1000, your maximum loss per trade would be $20. You would then set your stop-loss order accordingly. This ensures that even a series of losing trades won’t devastate your account.

Leverage and its Impact

Leverage is a double-edged sword. It magnifies both profits and losses. While it allows you to control larger positions with smaller amounts of capital, it also significantly increases the risk. A 1:100 leverage means you control $100,000 with $1,000 of your own money. A small price movement against you can quickly lead to substantial losses. Imagine a 1% price movement against you; that’s a 10% loss of your initial capital. Conversely, a 1% movement in your favor only yields a 1% profit. Therefore, understanding and carefully managing leverage is crucial. Never use leverage beyond your risk tolerance and always be prepared for potential losses.

Calculating Position Size

Calculating position size is crucial for risk management. A common approach involves determining your risk tolerance (e.g., 2% of your account) and your stop-loss distance (in pips). The formula is relatively straightforward:

Position Size = (Account Risk Amount / Stop Loss in Pips) * 10,000

Let’s say your account is $1000, your risk tolerance is 2%, and your stop-loss is 20 pips.

Position Size = ($20 / 20 pips) * 10,000 = 10,000 units

This calculation suggests that you should trade 10,000 units of the currency pair to limit your potential loss to $20, or 2% of your account, if the price moves against you by 20 pips. Remember that this is a simplified example, and variations exist depending on the specific broker and currency pair. Always double-check with your broker’s specifications.

Fundamental and Technical Analysis in Forex

Forex trading, like any market, relies on predicting future price movements. Two primary approaches exist: fundamental and technical analysis. Understanding their differences and how to use them effectively is crucial for successful trading. While they seem disparate, a skilled trader often integrates both for a more holistic view.

Fundamental Analysis in Forex

Fundamental analysis focuses on macroeconomic factors influencing currency values. It involves examining economic data, political events, and market sentiment to anticipate how these factors will impact supply and demand for a specific currency. By understanding the underlying economic health of a country, you can better predict its currency’s future performance. This is a long-term approach, often less focused on daily price fluctuations.

Examples of Fundamental Indicators

Fundamental indicators provide insights into a country’s economic strength and stability. Examples include:

- Interest Rates: Higher interest rates generally attract foreign investment, increasing demand for the currency and strengthening its value. For instance, if the US Federal Reserve raises interest rates, the US dollar (USD) might appreciate against other currencies.

- Gross Domestic Product (GDP): A strong GDP growth rate usually signals a healthy economy, boosting investor confidence and currency value. A country with robust GDP growth often sees its currency strengthen.

- Inflation Rates: High inflation erodes purchasing power and can weaken a currency. Conversely, low and stable inflation is generally positive for a currency’s value. For example, consistently high inflation in a country might lead to its currency depreciating.

- Government Debt: High levels of government debt can create uncertainty and potentially weaken a currency. Countries with unsustainable debt levels might experience currency devaluation.

- Geopolitical Events: Political instability, wars, or major policy changes can significantly impact a currency’s value. For example, a major political upheaval in a country could cause its currency to plummet.

Technical Analysis in Forex

Technical analysis focuses on price charts and historical data to identify patterns and predict future price movements. It assumes that all relevant information is already reflected in the price, eliminating the need for fundamental analysis. This is a short-term to medium-term approach, often concentrating on daily or weekly price action.

Examples of Technical Indicators

Technical indicators are mathematical calculations based on price and volume data. These tools help traders identify trends, support and resistance levels, and potential buy or sell signals. Examples include:

- Moving Averages: These smooth out price fluctuations, revealing underlying trends. A common example is the 20-day moving average. A price crossing above the 20-day MA could be seen as a bullish signal.

- Relative Strength Index (RSI): This measures the speed and change of price movements. RSI values above 70 are often considered overbought, while values below 30 are considered oversold. These levels can signal potential trend reversals.

- Support and Resistance Levels: These are price levels where the price has historically struggled to break through. Support is a price floor, while resistance is a price ceiling. A break above resistance can be a strong bullish signal.

- Candlestick Patterns: These patterns formed by price action on candlestick charts can provide insights into potential price movements. For instance, a hammer candlestick pattern can signal a potential bottom in the market.

Comparison of Fundamental and Technical Analysis

| Feature | Fundamental Analysis | Technical Analysis |

|---|---|---|

| Focus | Economic and political factors | Price charts and historical data |

| Time Horizon | Long-term | Short- to medium-term |

| Strengths | Identifies underlying value; can predict long-term trends | Identifies potential entry and exit points; relatively easy to learn |

| Weaknesses | Can be slow to react to market changes; requires extensive knowledge of economics and geopolitics | Can generate false signals; susceptible to market manipulation; ignores fundamental factors |

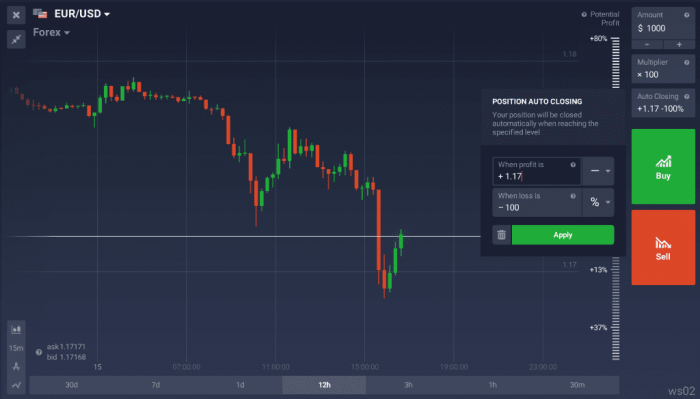

Using Forex Trading Platforms

Navigating the world of forex trading requires a robust and reliable platform. These platforms act as your gateway to the global currency market, allowing you to execute trades, monitor market movements, and manage your positions. Choosing the right platform is crucial for a successful trading journey.

A typical forex trading platform offers a comprehensive suite of tools and features designed to streamline the trading process. These features empower traders to analyze market trends, execute trades efficiently, and manage risk effectively. Understanding these features is key to maximizing your trading potential.

Platform Features

Forex trading platforms are typically packed with features to help traders. These features range from charting tools to news feeds, all designed to aid in informed decision-making. Key features include customizable charts with various technical indicators, real-time market data feeds displaying live currency prices and trading volume, order placement and management tools allowing traders to easily buy, sell, and modify existing trades, and risk management tools such as stop-loss and take-profit orders to help limit potential losses and secure profits. Many platforms also offer economic calendars, news feeds, and educational resources.

Placing and Managing Trades

The process of placing a trade is generally straightforward. First, you select the currency pair you wish to trade. Then, you specify the trade size (lot size), which determines the amount of currency you are buying or selling. Next, you set your entry price, and finally, you confirm your order. Managing trades involves monitoring your open positions, adjusting stop-loss and take-profit orders as market conditions change, and closing trades when your objectives are met or if risk levels become unacceptable. Many platforms offer one-click trading for experienced traders who prefer speed and efficiency. For example, if a trader anticipates a price increase in EUR/USD, they would place a ‘buy’ order. Conversely, if they anticipate a price decrease, they would place a ‘sell’ order. Careful monitoring and adjustment of orders are essential to adapt to dynamic market situations.

Importance of Reliable and Regulated Brokers

Choosing a reliable and regulated broker is paramount. A regulated broker operates under the oversight of a financial authority, ensuring adherence to specific rules and regulations designed to protect traders’ funds and prevent fraudulent activities. These regulations often mandate the segregation of client funds from the broker’s operational funds, minimizing the risk of losing your investment if the broker encounters financial difficulties. Furthermore, regulated brokers are usually subject to audits and inspections, providing an additional layer of security and transparency. Examples of regulatory bodies include the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and the Australian Securities and Investments Commission (ASIC) in Australia. Choosing a broker regulated by a reputable authority is a crucial step in mitigating risk and ensuring a secure trading environment.

Illustrative Example: A Sample Forex Trade: Forex Currency Trading Basics

Let’s walk through a hypothetical forex trade to illustrate the process from start to finish. We’ll consider a scenario involving the EUR/USD pair, a highly liquid and frequently traded currency pair. This example will simplify some aspects of real-world trading for clarity.

This example showcases a long position (buying) on the EUR/USD, anticipating an increase in the Euro’s value against the US dollar. Remember, this is a simplified example and actual trading involves more complex considerations.

Market Conditions and Trade Setup

Our hypothetical trade begins on a day when the EUR/USD is trading around 1.1000. Recent economic data suggests a potential increase in Eurozone interest rates, leading many analysts to predict a stronger Euro. Technically, the pair has broken through a key resistance level at 1.0980, accompanied by increasing trading volume, confirming the bullish momentum. This combination of fundamental (economic data) and technical (chart patterns) analysis provides a compelling case for a long position.

Position Sizing and Order Placement

Let’s assume we have a trading account with $10,000. A prudent risk management strategy dictates risking only 1-2% of our account capital per trade. We’ll risk 1%, or $100. With a stop-loss order placed at 1.0980 (just below the broken resistance level), our risk is defined. The distance between our entry point (1.1000) and our stop-loss (1.0980) is 20 pips (a pip is the smallest price movement in a currency pair, typically 0.0001). To determine the lot size (the amount of currency traded), we can use a position size calculator, which, given our risk tolerance and stop-loss, would suggest a trade size of approximately 0.5 lots. We place a buy order for 0.5 lots of EUR/USD at 1.1000.

Trade Management and Exit Strategy

Our trade moves in our favor, and the EUR/USD rises to 1.1050. We could choose to take partial profits here, securing some gains while letting the rest of the position run. Alternatively, we could set a take-profit order at 1.1050, based on our initial risk/reward ratio. Let’s assume we decide to take profits at 1.1050.

Profit Calculation

The profit on this trade is calculated as follows:

Profit = (Take-Profit Price – Entry Price) x Lot Size x Pip Value

Profit = (1.1050 – 1.1000) x 0.5 x 10 USD (Pip Value for 0.5 lot) = $25

This represents a 2.5% return on our risked capital ($100), exceeding our initial target.

Visual Representation on a Candlestick Chart

Imagine a candlestick chart showing the EUR/USD. The candlestick representing the period of our trade would be a green (bullish) candlestick, indicating a closing price higher than the opening price. The body of the candlestick would extend from 1.1000 (our entry) to 1.1050 (our exit). The wick (or shadow) at the bottom would extend down to 1.0980 (our stop-loss). The 1.0980 level would be clearly marked as a significant support level, now broken. 1.1050 would be highlighted as the take-profit level. Simple moving averages or other technical indicators might be overlaid to confirm the trend.

Last Word

So, there you have it – a crash course in forex currency trading basics. Remember, this is just the tip of the iceberg. The forex market is vast and complex, constantly evolving. But by understanding the fundamentals, developing a solid trading strategy, and practicing responsible risk management, you’ll be well-equipped to navigate this exciting and potentially profitable world. Now go forth, learn, and maybe, just maybe, make some serious moves in the global currency market!

Check forex trading brokers in south africa to inspect complete evaluations and testimonials from users.