Trading simulator forex isn’t just another app; it’s your personal playground for mastering the forex market. Before risking real cash, dive into the thrilling world of virtual trading, honing your skills and strategies without the sting of real losses. Think of it as forex boot camp, but way more fun.

From understanding basic order placement to navigating complex charting tools and risk management techniques, forex simulators offer a comprehensive learning environment. This guide unpacks everything you need to know, from choosing the right simulator to mastering advanced trading strategies and ultimately, transitioning smoothly to live trading.

Introduction to Forex Trading Simulators

Forex trading, the global marketplace for exchanging currencies, can be a thrilling but risky venture. Before diving headfirst into the real market with your hard-earned cash, a forex trading simulator offers a crucial safety net and invaluable learning experience. Think of it as a virtual playground where you can hone your skills without the fear of substantial financial losses.

A forex trading simulator is a software program that replicates the forex market environment. It allows users to practice trading strategies, analyze market trends, and test different approaches without risking real money. The primary purpose is to provide a risk-free environment for learning and developing trading skills. This is especially important for beginners who are still navigating the complexities of technical analysis, fundamental analysis, and risk management.

Benefits of Forex Trading Simulators for Beginners

Forex trading simulators offer several key advantages for those new to the market. They eliminate the financial pressure associated with real-world trading, allowing beginners to focus on learning and developing their trading strategies without the fear of significant losses. This removes a significant psychological barrier to entry, allowing individuals to experiment freely and make mistakes without facing immediate financial consequences. Through repeated practice, beginners can build confidence and develop a deeper understanding of market dynamics. Moreover, simulators provide a platform to test different trading strategies and refine their approach before committing real capital.

Key Features of Forex Trading Simulators

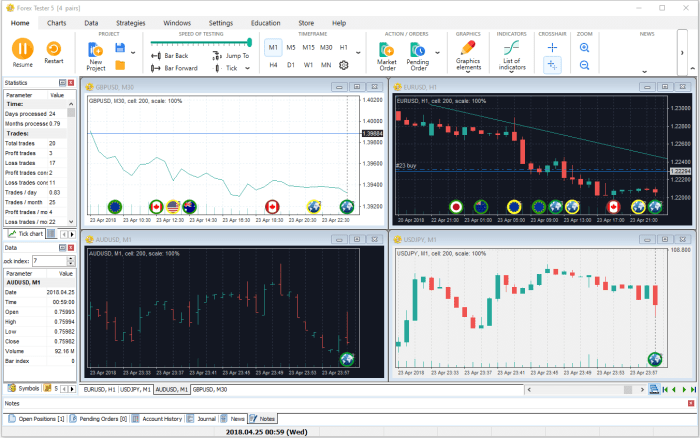

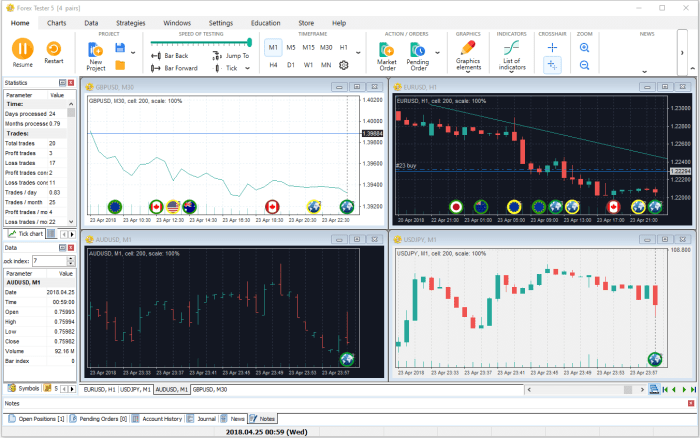

Different forex trading simulators offer varying features, catering to different needs and skill levels. Some key features that distinguish them include the range of currency pairs available for trading, the accuracy of their price data mirroring real-market conditions, the availability of charting tools and technical indicators, and the inclusion of educational resources. Simulators may also offer different levels of customization, allowing users to adjust parameters like leverage and account sizes to tailor their practice sessions. Advanced features might include backtesting capabilities, allowing users to test strategies on historical data, and simulated news events to mimic real-world market volatility.

Comparison of Popular Forex Trading Simulators

Choosing the right forex trading simulator depends on individual needs and preferences. Below is a comparison of three popular options, highlighting their strengths and weaknesses. Remember, the “best” simulator is subjective and depends on your specific learning style and goals.

| Feature | Simulator A (Example: MetaTrader 4/5 Demo Account) | Simulator B (Example: TradingView Paper Trading) | Simulator C (Example: Myfxbook AutoTrade Simulator) |

|---|---|---|---|

| Accuracy of Market Data | High, directly linked to live market data | High, real-time data feeds | High, uses historical data for backtesting |

| Range of Currency Pairs | Extensive, includes majors and minors | Extensive, customizable selection | Limited to those supported by the strategy being tested |

| Charting Tools & Indicators | Comprehensive, customizable charts and indicators | Very comprehensive, wide selection of indicators and drawing tools | Dependent on the strategy, usually limited to those used in the strategy |

| Educational Resources | Limited, mostly relies on external resources | Limited, mostly focused on charting | Limited, focused on strategy testing |

| Strengths | Real-time data, wide range of features | User-friendly interface, extensive charting capabilities | Excellent for backtesting and strategy optimization |

| Weaknesses | Can be complex for beginners | Limited educational resources | Limited in real-time trading simulation |

Functionality and Features of Forex Trading Simulators

Forex trading simulators are powerful tools that let you practice your trading strategies without risking real money. They offer a realistic environment to hone your skills, experiment with different approaches, and build confidence before entering the live market. Think of them as a virtual trading playground where the stakes are low, but the learning is high.

They replicate many aspects of real-world forex trading, allowing you to test your mettle against market fluctuations without the financial anxieties. This functionality is crucial for both beginners navigating the complexities of forex and seasoned traders refining their techniques.

Order Placement

Forex trading simulators faithfully reproduce the order placement process found on live platforms. You can execute various order types, such as market orders (immediate execution at the current market price), limit orders (executed only when the price reaches a specified level), and stop orders (triggered when the price moves beyond a certain point). This feature allows you to practice precise entry and exit strategies, crucial for managing risk and maximizing potential profits. For instance, you might practice placing a buy limit order on EUR/USD at 1.1000, ensuring you only enter the trade if the price reaches your target level.

Charting Tools

A key feature of any robust forex trading simulator is its charting capabilities. These tools are vital for technical analysis, allowing traders to identify trends, patterns, and potential trading opportunities. Simulators typically offer a wide array of chart types, including candlestick charts, bar charts, and line charts, each providing a unique perspective on price movements.

Types of Charting Tools

Many simulators provide various indicators and drawing tools. These include moving averages (smoothing price data to identify trends), Relative Strength Index (RSI) (measuring momentum), Fibonacci retracements (identifying potential support and resistance levels), and trend lines (visually highlighting price trends). You can overlay these indicators on your chosen chart type to gain a comprehensive view of market dynamics. For example, using a 20-period moving average alongside RSI can help you identify potential buy or sell signals with more confidence.

When investigating detailed guidance, check out trading signals forex now.

Risk Management Features

Effective risk management is paramount in forex trading, and simulators provide a safe space to practice these crucial techniques. Many simulators incorporate features such as setting stop-loss orders (automatically closing a trade when it reaches a predetermined loss level) and take-profit orders (automatically closing a trade when it reaches a predetermined profit level). These features help you define your risk tolerance and prevent significant losses. Furthermore, simulators often allow you to set account balances and leverage levels, mirroring the conditions of a live trading environment. This allows you to experiment with different risk management strategies and observe their impact on your simulated trading performance.

Hypothetical Trading Scenario

Let’s imagine a scenario where you’re using a forex simulator to practice trading the GBP/USD pair. You notice a bullish trend forming on the daily chart, supported by positive economic news releases from the UK. You decide to place a buy order at 1.3000, setting a stop-loss order at 1.2950 (limiting potential losses to 50 pips) and a take-profit order at 1.3100 (targeting a 100-pip profit). As the price moves, you monitor the charts, adjusting your strategy if necessary. The simulator allows you to see the impact of your decisions on your virtual account balance, providing valuable feedback and enhancing your trading skills. This hands-on experience helps you develop the discipline and intuition required for successful forex trading in a real-world setting.

Utilizing Forex Trading Simulators Effectively

Forex trading simulators aren’t just digital playgrounds; they’re powerful tools for honing your skills and refining your strategies before risking real capital. Mastering their use is key to transforming from a novice trader to a more confident and potentially successful one. Effective simulator usage involves a blend of strategic practice, meticulous record-keeping, and a willingness to learn from both wins and losses.

Effective strategies for practicing different trading styles within a forex simulator involve consistent, focused practice across various market conditions. Don’t just stick to one style; experiment! Try scalping, day trading, swing trading, and even longer-term strategies to understand which aligns best with your personality and risk tolerance. Simulators allow you to adjust parameters like leverage and position sizing without financial consequences, making them ideal for testing diverse approaches. Remember, consistent practice is crucial. Set aside dedicated time for simulation trading, just as you would for live trading, to build muscle memory and improve your decision-making under pressure.

Backtesting Trading Strategies

Backtesting involves testing your trading strategy on historical market data. Forex simulators typically offer this feature, allowing you to input your strategy’s rules (e.g., entry and exit signals based on indicators or price action) and see how it would have performed in the past. This helps identify potential flaws or weaknesses in your strategy before deploying it with real money. Remember that past performance isn’t necessarily indicative of future results, but backtesting provides valuable insights into your strategy’s robustness and potential profitability under different market scenarios. For example, you might backtest a moving average crossover strategy during a period of high volatility and compare its performance to a period of low volatility to assess its adaptability.

Maintaining a Trading Journal

A trading journal is your personal record of simulated trades, providing invaluable feedback for improvement. It should document not just the trade details (entry price, exit price, profit/loss), but also your reasoning behind each decision. What indicators did you use? What market conditions influenced your entry and exit points? What were your initial expectations, and how did the actual outcome compare? Thorough journaling allows you to identify patterns in your successes and failures, leading to more informed trading decisions over time. Regular review of your journal helps you recognize biases, refine your strategy, and maintain discipline.

Sample Trading Journal Entry

Date: October 26, 2023

Pair: EUR/USD

Trade Type: Long

Entry Price: 1.1000

Exit Price: 1.1050

Profit: 50 pips

Indicators Used: 20-period and 50-period moving average crossover, RSI above 30

Rationale: The 20-period MA crossed above the 50-period MA, suggesting a bullish trend. The RSI was above 30, indicating the pair wasn’t oversold. I anticipated a continuation of the upward trend.

Outcome: The trade was profitable, exceeding my initial target of 30 pips.

Lessons Learned: My initial stop-loss was too tight, limiting potential profits. Next time, I will adjust my stop-loss to allow for greater price fluctuation while still managing risk. The RSI proved to be a useful confirmation indicator.

Limitations and Considerations of Forex Trading Simulators

Forex trading simulators are invaluable tools for learning, but they’re not a perfect replica of the live market. Understanding their limitations is crucial for a successful transition to real trading. While they offer a risk-free environment to practice strategies and build confidence, relying solely on simulators can create a false sense of security and hinder your preparedness for the complexities of actual forex trading.

Simulated trading environments often fail to fully capture the emotional rollercoaster of live trading. The pressure of real money, unpredictable news events, and the constant influx of market information are absent in a simulator, leading to a potentially skewed understanding of market dynamics and personal trading psychology.

Discrepancies Between Simulated and Real Market Conditions

Simulators, while striving for accuracy, inevitably simplify the complexities of the real forex market. Slippage, for instance – the difference between the expected price and the actual execution price – is often minimized or absent in simulators. Similarly, real-time market volatility and sudden price gaps, triggered by unexpected news or events, are difficult to fully replicate. These discrepancies can lead to a disconnect between simulated trading results and actual outcomes. A strategy that performs flawlessly in a simulator might suffer significant losses in the live market due to these unanticipated factors. For example, a scalping strategy relying on tiny price movements might be highly profitable in a simulator with minimal slippage, but severely impacted by slippage and volatility in the live market.

Psychological Aspects of Trading and Simulator Use

The psychological aspect of trading is often overlooked, yet it’s a critical factor determining success. Simulators can help in some respects, allowing traders to practice discipline and risk management without the fear of immediate financial loss. However, the absence of emotional pressure in a simulated environment can hinder the development of crucial psychological skills needed for live trading. The adrenaline rush, fear of loss, and the pressure to make quick decisions are all absent, preventing the trader from developing strategies to manage these emotions effectively. A trader who consistently wins in a simulator might crumble under the pressure of real-money trading due to this lack of experience with the psychological challenges.

Transitioning from Simulator to Live Trading

A gradual transition from simulated to live trading is essential. Begin with micro-lots or small trade sizes in a live account to gain experience with real market conditions and the emotional aspects of trading. Continuously compare your live trading performance with your simulated results, identifying discrepancies and adapting your strategies accordingly. Maintaining a trading journal to track your decisions, results, and emotional responses is crucial. This provides valuable insight into your trading style and allows for continuous improvement. Regularly review and refine your risk management plan based on both simulated and live trading experiences. Remember, patience and continuous learning are key to success in forex trading.

Advanced Features and Techniques: Trading Simulator Forex

Forex trading simulators aren’t just for newbies; they’re powerful tools for seasoned traders looking to refine their strategies and explore advanced techniques. The ability to test complex systems and strategies risk-free is invaluable, allowing for iterative improvement and a deeper understanding of market dynamics. This section delves into some of the more advanced features and techniques you can utilize within a forex trading simulator.

Automated Trading Systems

Automated trading systems, or Expert Advisors (EAs), are pre-programmed trading algorithms that execute trades based on predefined rules and indicators. Forex simulators provide an ideal environment to backtest and optimize these EAs before deploying them in live markets. You can feed historical data into the simulator, run your EA, and analyze its performance, identifying potential weaknesses and areas for improvement. This process allows for iterative refinement, ensuring your EA is robust and profitable before risking real capital. For example, you might test an EA based on moving averages, adjusting parameters like the period lengths to find the optimal settings for a specific currency pair.

Advanced Charting Techniques and Indicators, Trading simulator forex

Forex simulators typically offer a wide array of charting tools and technical indicators, allowing traders to analyze price movements in detail. Beyond the basics like moving averages and RSI, you can explore more advanced tools like the Ichimoku Cloud, fractal indicators, or volume-weighted average price (VWAP). These tools can provide insights into market momentum, support and resistance levels, and potential entry and exit points. Experimenting with different combinations of indicators within the simulator helps traders identify setups that align with their trading style and risk tolerance. For instance, combining the Ichimoku Cloud with candlestick patterns can reveal high-probability trading opportunities.

Order Types

Understanding and implementing different order types is crucial for effective risk management. Forex simulators allow you to practice placing various orders without the fear of financial loss.

Visual Representation of Order Types

Imagine a price chart with a horizontal line representing the current market price.

* Market Order: This is represented by a vertical line extending from the current market price, indicating an immediate execution at the prevailing price. The trade is executed instantly, regardless of the price.

* Limit Order: This is shown as a horizontal line *above* the current market price for a buy order (or *below* for a sell order). The order will only be executed if the price reaches the specified level. Think of it as setting a “price target” for your trade.

* Stop-Loss Order: This is represented by a horizontal line *below* the current market price for a long position (or *above* for a short position). This order automatically closes your trade if the price moves against you, limiting potential losses. It acts as a safety net.

* Take-Profit Order: This is similar to a limit order, but it’s used to secure profits. It’s represented by a horizontal line *above* the current market price for a long position (or *below* for a short position), closing the trade when the price reaches the specified level.

These visual representations illustrate how each order type interacts with the market price, enabling traders to understand the implications of each choice. The simulator allows for practicing various scenarios and refining order management strategies.

Concluding Remarks

Mastering the forex market requires dedication, strategy, and practice – and a forex trading simulator provides the perfect environment to develop all three. While it can’t perfectly replicate the emotional rollercoaster of real trading, the simulated experience offers invaluable insights and builds confidence before you step onto the real trading floor. So, dive in, experiment, learn, and prepare to conquer the forex world!

Explore the different advantages of arbitrage trading forex that can change the way you view this issue.