Forex trading taxes: Navigating the world of currency trading can be exhilarating, but the tax implications? Not so much. Suddenly, those hefty profits feel a little less hefty when Uncle Sam (or your country’s equivalent) comes knocking. Understanding how taxes affect your forex trading income is crucial, not just for avoiding penalties, but for actually *keeping* more of your hard-earned cash. This guide breaks down everything you need to know, from record-keeping to reporting, so you can trade with confidence – and keep more of your winnings.

This isn’t just about filling out forms; it’s about strategically managing your finances. We’ll explore different income types, allowable deductions, and the tax implications of various trading strategies. Whether you’re a seasoned pro or just starting, mastering forex trading taxes is key to long-term success. Get ready to level up your trading game – and your tax game.

Understanding Forex Trading Income: Forex Trading Taxes

Navigating the world of forex trading can be lucrative, but understanding the tax implications of your earnings is crucial. This section breaks down the different types of income generated from forex trading and how they’re treated for tax purposes. Accurate record-keeping is key to avoiding potential tax issues down the line.

Types of Forex Trading Income

Forex trading income isn’t just about the profits you make on successful trades. Several income streams can contribute to your overall taxable income. Understanding these different categories is the first step to correctly reporting your earnings.

Profit from Currency Trades

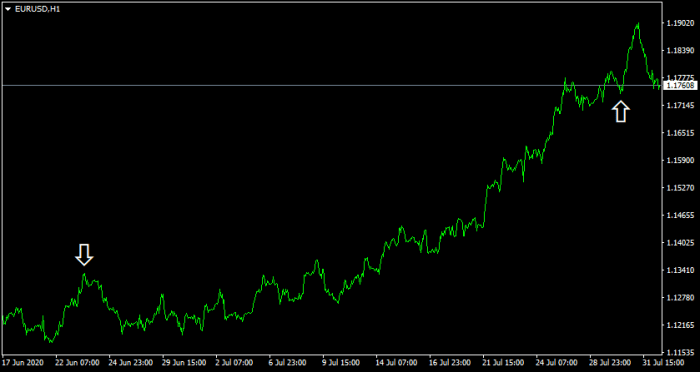

This is the most straightforward type of forex income. It represents the difference between the buying and selling price of a currency pair, after accounting for any commissions or fees. Profits are generally considered taxable income in most jurisdictions. For example, if you bought 1,000 EUR/USD at 1.10 and sold it at 1.12, your profit is 20 USD (before commissions). This profit will be subject to income tax according to your applicable tax bracket.

Commissions

Brokerage commissions are fees charged by your forex broker for facilitating your trades. These are usually considered a deductible business expense, reducing your overall taxable income. Keep meticulous records of all commission payments. For instance, if you paid $10 in commissions on a trade, this amount can potentially reduce your taxable income. However, regulations vary by location, so confirming with your tax advisor is essential.

Bonuses and Rebates

Some brokers offer bonuses or rebates on trading volume or specific activities. These incentives are generally considered taxable income and should be reported accordingly. For example, a $50 bonus received from a broker for meeting a trading volume target should be included in your total forex trading income.

Table of Forex Income Types and Tax Treatments

The tax treatment of forex income can vary significantly depending on your location and specific circumstances. Consulting a tax professional is highly recommended for personalized advice. The following table provides a general overview and should not be considered exhaustive or a substitute for professional tax advice.

| Income Type | Source | Taxable Status | Relevant Tax Regulations |

|---|---|---|---|

| Profit from Currency Trades | Difference between buy and sell price | Generally Taxable | Varies by jurisdiction; consult local tax laws |

| Commissions | Brokerage fees | Potentially Deductible | Varies by jurisdiction; check local tax regulations on business expenses |

| Bonuses and Rebates | Broker incentives | Generally Taxable | Varies by jurisdiction; consult local tax laws |

Record Keeping for Forex Taxes

Navigating the world of forex trading can be thrilling, but understanding the tax implications is crucial for long-term success. Accurate record-keeping isn’t just about avoiding penalties; it’s about gaining a clear picture of your trading performance and making informed decisions. Think of it as building a solid foundation for your financial future.

Maintaining meticulous records of your forex trading activities is paramount. The IRS (or your country’s equivalent tax authority) requires detailed documentation to verify your reported income and expenses. Without accurate records, you risk facing audits, penalties, and even legal issues. This section Artikels best practices for keeping your forex tax records organized and readily accessible.

Detailed Transaction Records

Comprehensive transaction records are the cornerstone of accurate forex tax reporting. Each trade should be documented with specific details. This includes the date of the transaction, the amount invested or withdrawn in your base currency, the currency pair traded (e.g., EUR/USD, GBP/JPY), the exchange rate at the time of the transaction, the profit or loss incurred, and any associated fees or commissions. Failure to document these details comprehensively can lead to significant discrepancies during tax season.

Methods for Tracking Forex Trading Activity, Forex trading taxes

Several methods exist for tracking forex trading activity, each with its own advantages and disadvantages. Choosing the right method depends on your trading volume, complexity, and personal preferences.

- Spreadsheets: Spreadsheets like Microsoft Excel or Google Sheets offer a flexible and customizable way to track your trades. You can create custom formulas to calculate profits, losses, and overall performance. However, managing large volumes of trades in a spreadsheet can become cumbersome.

- Dedicated Trading Software: Many forex brokers provide trading platforms with built-in reporting features. These platforms often automatically generate reports summarizing your trading activity, making tax preparation simpler. However, the level of detail and customization can vary depending on the software.

- Accounting Software: Accounting software designed for small businesses or self-employed individuals can also be used to track forex trading income and expenses. These programs often offer features for generating tax reports and managing financial statements.

Sample Record-Keeping System

A well-structured record-keeping system ensures you capture all necessary information. Consider using a system similar to this:

- Trade Date: (YYYY-MM-DD)

- Currency Pair: (e.g., EUR/USD)

- Transaction Type: (Buy/Sell)

- Units Traded: (Number of units)

- Entry Price: (Price per unit in base currency)

- Exit Price: (Price per unit in base currency)

- Base Currency Amount Invested: (Amount invested in your base currency)

- Profit/Loss in Base Currency: (Calculated profit or loss in your base currency)

- Fees and Commissions: (Brokerage fees, platform fees, etc.)

- Notes: (Any relevant information, such as market conditions or trading strategy)

Remember to keep all your trade confirmations and statements from your broker. These documents serve as crucial supporting evidence for your tax filings.

Deductions and Expenses in Forex Trading

Navigating the world of forex trading taxes can feel like charting a course through a stormy sea. But understanding allowable deductions can significantly reduce your tax burden, making those profits even sweeter. Knowing what you can deduct and how to properly document those deductions is key to a smoother tax season. Let’s dive into the specifics.

The IRS allows deductions for expenses directly related to generating income from your forex trading activities. This isn’t a free-for-all, though; the key is demonstrating a direct connection between the expense and your trading. Casual traders may have fewer deductions than full-time forex professionals, but careful record-keeping can maximize deductions for everyone.

Obtain direct knowledge about the efficiency of forex trading profit per day through case studies.

Allowable Deductions for Forex Traders

Several expenses are commonly deductible for forex traders. Proper documentation is crucial for each deduction. Keep detailed records, including invoices, receipts, and bank statements, to support your claims.

- Software Subscriptions: The cost of charting software, trading platforms (like MetaTrader 4 or 5), and other specialized forex software is generally deductible. This includes subscription fees and any one-time purchase costs.

- Educational Courses and Seminars: Expenses related to improving your forex trading skills are deductible. This includes courses, workshops, seminars, and books directly related to forex trading strategies, technical analysis, or risk management. General business courses might be partially deductible depending on their relevance to your forex trading.

- Office Supplies: If you have a dedicated home office for your forex trading, you can deduct a portion of your home expenses, including utilities, rent, or mortgage interest, as well as the cost of office supplies such as printer ink, paper, and stationery. The percentage of your home dedicated to forex trading must be accurately determined and documented.

- Professional Fees: Fees paid to tax advisors specializing in forex trading, financial advisors who provide forex-related advice, or other professionals directly assisting in your forex trading activities are deductible.

- Computer Hardware and Software: The cost of computers, monitors, and other hardware used exclusively for forex trading can be depreciated over time. Similarly, software directly used for trading is deductible. However, personal use of these assets will limit the deductible amount.

Rules and Limitations for Claiming Deductions

While the expenses listed above are generally deductible, there are important limitations. The IRS scrutinizes forex trading deductions, so meticulous record-keeping is paramount. The most crucial aspect is proving the direct relationship between the expense and your forex trading income.

Check forex trading 2024 to inspect complete evaluations and testimonials from users.

For example, a general business course might only be partially deductible if only a portion of the course directly applies to forex trading. Similarly, home office deductions require a dedicated and exclusively used workspace. Expenses for personal use, such as entertainment or travel unrelated to forex trading, are not deductible.

Documentation Needed to Support Deduction Claims

The IRS requires thorough documentation to support any deduction. Simply stating an expense was incurred isn’t enough. You need concrete evidence.

- Receipts: Keep all receipts for software subscriptions, educational courses, office supplies, and other expenses.

- Invoices: For larger purchases or services, obtain invoices that clearly detail the expense and its purpose.

- Bank Statements: Your bank statements serve as proof of payment for various expenses.

- Log of Trading Activities: A detailed log of your trading activities, including dates, trades, and profits/losses, is crucial to demonstrate the connection between your expenses and your income.

Comparison of Deductibility for Different Expenses

The deductibility of expenses depends on their direct relation to your forex trading activities. Software subscriptions and educational courses directly related to forex are easily deductible, whereas personal expenses are not. Home office deductions require a specific calculation based on the percentage of your home used for trading. Professional fees are deductible if the services directly relate to your forex trading. It’s vital to maintain clear records to support each deduction.

Tax Reporting for Forex Traders

Navigating the tax implications of forex trading can feel like navigating a labyrinthine maze, especially for those new to the game. But understanding the process is crucial to avoid potential penalties and ensure you’re complying with tax regulations. This section provides a straightforward guide to reporting your forex trading income and expenses accurately.

Reporting Forex Trading Income and Expenses

The process of reporting forex trading activities on your tax return involves meticulously documenting all transactions and accurately categorizing them as either income or expenses. This ensures a precise calculation of your taxable income. Remember, the IRS (or your country’s equivalent tax authority) considers forex trading profits as taxable income, subject to your individual tax bracket. Losses, on the other hand, can be used to offset gains, but specific rules apply, which vary by jurisdiction.

Relevant Tax Forms and Schedules

In the United States, forex traders typically use Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), to report their trading activities. This form requires detailed information on your forex trading income and expenses. If you operate as a partnership or corporation, different forms apply. It’s essential to consult with a tax professional or refer to the IRS instructions for the most accurate and up-to-date information relevant to your specific tax situation. Other countries will have their own equivalent forms. For example, in the UK, self-employed individuals would likely use the Self Assessment tax return.

Calculating Taxable Income from Forex Trading

Calculating your taxable income from forex trading involves a simple yet crucial formula: Total Income – Total Expenses = Taxable Income. Total income represents the sum of all profits realized from your forex trades throughout the tax year. Total expenses encompass all legitimate business-related costs incurred during the same period. Accurate record-keeping is paramount for precise calculation. For instance, if your total trading profits for the year were $10,000, and your documented expenses amounted to $2,000, your taxable income would be $8,000. This figure is then used to calculate your tax liability based on your applicable tax bracket.

Information Required for Accurate Tax Reporting

Proper record-keeping is the cornerstone of accurate tax reporting. Failing to maintain comprehensive records can lead to significant complications during tax season. Here’s a list of essential information you need to gather:

- Brokerage Statements: These statements provide a detailed record of all your forex transactions, including dates, buy/sell prices, currency pairs traded, and any commissions or fees.

- Trade Confirmation Statements: These documents corroborate the details presented in your brokerage statements, offering an additional layer of verification.

- Expense Records: This includes receipts and documentation for all expenses related to your forex trading, such as software subscriptions, educational courses, internet access, and any other relevant costs.

- Tax Identification Number (TIN): This is crucial for filing your tax return correctly and avoiding delays or complications.

- Foreign Currency Exchange Rates: Accurate exchange rates are essential for converting foreign currency transactions into your local currency for tax reporting purposes.

Tax Implications of Different Forex Trading Strategies

Understanding the tax implications of your forex trading strategy is crucial for minimizing your tax liability. The frequency of your trades and the length of time you hold positions significantly impact how your profits are taxed. This section breaks down the tax implications of various common forex trading strategies.

Tax Treatment of Different Forex Trading Strategies

The tax treatment of your forex trading profits depends heavily on your chosen strategy. Scalping, day trading, and swing trading all have different implications due to the varying holding periods involved. For example, a scalper might hold a position for mere seconds, while a swing trader could hold for weeks or even months. This dramatically alters the classification of your gains—and consequently, your tax rate.

Short-Term vs. Long-Term Capital Gains

In the US, short-term capital gains (assets held for one year or less) are taxed at your ordinary income tax rate, which can be significantly higher than the rates for long-term capital gains. Long-term capital gains (assets held for more than one year) are taxed at preferential rates, generally lower than your ordinary income tax rate. This difference makes holding periods a critical factor in forex tax planning. For instance, a trader realizing $10,000 in short-term gains might pay a much higher tax than a trader realizing the same amount in long-term gains.

Impact of Holding Periods on Tax Liability

The holding period directly determines whether your forex trading profits are classified as short-term or long-term capital gains. As previously stated, short-term gains are taxed at your ordinary income tax rate, while long-term gains enjoy lower tax rates. A trader holding a position for less than a year will face a potentially higher tax burden than a trader holding the same position for over a year, even if the profit amounts are identical. This highlights the importance of careful planning and record-keeping to optimize your tax strategy.

Tax Implications Summary Table

| Strategy | Holding Period | Capital Gains Type | Tax Rate |

|---|---|---|---|

| Scalping | Seconds to minutes | Short-Term | Ordinary Income Tax Rate |

| Day Trading | Same-day trades | Short-Term | Ordinary Income Tax Rate |

| Swing Trading | Days to weeks | Short-Term or Long-Term | Varies based on holding period; Ordinary Income Tax Rate or Long-Term Capital Gains Rate |

| Position Trading | Weeks to months or years | Long-Term | Long-Term Capital Gains Rate |

Tax Implications of Forex Trading Across Borders

Navigating the world of forex trading can be thrilling, but the thrill doesn’t end with a profitable trade. The complexities of international tax laws significantly impact your bottom line, especially when trading across borders. Understanding these implications is crucial to avoid unexpected tax liabilities and penalties. This section delves into the multifaceted tax landscape of cross-border forex trading.

Forex trading, by its very nature, transcends geographical boundaries. Profits and losses generated from transactions involving currencies of different countries trigger tax implications in multiple jurisdictions. This makes it essential for traders to understand the tax laws of their country of residence, as well as the tax laws of any countries whose currencies they trade. Failure to comply with these regulations can lead to significant financial repercussions.

Tax Treaties and International Tax Laws

International tax laws and treaties play a vital role in determining the tax treatment of cross-border forex trading income. These agreements aim to prevent double taxation, a scenario where income is taxed twice – once in the country of residence and again in the country where the income was generated. Tax treaties typically Artikel rules for determining which country has the right to tax specific types of income, often based on the residency of the trader or the location of the trading activity. The specific provisions of these treaties vary widely depending on the countries involved. For instance, a tax treaty between the United States and Canada might have different provisions regarding forex trading income compared to a treaty between the United States and Japan. Understanding the relevant treaty is critical for accurate tax reporting.

Jurisdictional Differences in Tax Treatment

Different countries treat forex trading income and expenses differently. Some countries may consider forex trading profits as capital gains, taxed at a lower rate than ordinary income, while others might classify it as business income, subject to higher tax rates. Similarly, the deductibility of trading expenses, such as brokerage fees, software subscriptions, and educational courses, varies considerably across jurisdictions. Some countries allow for the full deduction of these expenses, while others impose limitations or restrictions. Furthermore, the definition of “trader” itself can vary, influencing how income is classified and taxed. A trader who actively trades forex daily might be considered a professional trader in one jurisdiction but a casual investor in another. This difference in classification directly impacts the applicable tax rates and allowable deductions.

Examples of Cross-Border Forex Trading Scenarios

Let’s illustrate with a few examples. Imagine a US resident who regularly trades EUR/USD pairs. Their profits are likely to be considered capital gains in the US, potentially subject to a lower tax rate than ordinary income. However, if this same trader also engages in transactions involving the Japanese Yen (JPY) and holds significant assets in a Japanese bank account, they may need to comply with reporting requirements in Japan, depending on the specific amount and nature of their transactions. Another example: a UK resident trading GBP/USD pairs might find that their profits are taxed as business income if they engage in high-frequency trading, potentially facing higher tax rates and different rules regarding allowable expenses compared to a trader with fewer transactions. Conversely, a trader residing in a country with a favorable tax regime for forex trading might strategically locate their trading activities and assets to minimize their overall tax burden, always within the bounds of legal compliance. These examples highlight the importance of professional advice tailored to individual circumstances.

Seeking Professional Tax Advice

Navigating the complex world of forex trading taxes can be daunting, even for experienced traders. The intricacies of capital gains, deductions, and international regulations often necessitate expert guidance to ensure compliance and maximize tax efficiency. Seeking professional tax advice isn’t just a good idea; it’s often a crucial step to protect your financial well-being.

The benefits of working with a tax professional specializing in forex trading are numerous. They possess in-depth knowledge of the specific tax laws and regulations that apply to this unique trading environment. This expertise allows them to identify potential tax savings opportunities that a regular tax preparer might miss, ultimately leading to significant financial advantages. Furthermore, their understanding of forex trading strategies allows for tailored tax planning that minimizes your tax liability while remaining fully compliant with the law.

Situations Requiring Professional Tax Advice

Professional tax advice is particularly crucial in several scenarios. High-frequency traders, for example, often face unique challenges in tracking and reporting their numerous transactions. Traders operating across multiple jurisdictions need expert guidance to navigate the complexities of international tax laws. Similarly, individuals who experience significant profits or losses require professional help to ensure accurate reporting and to optimize their tax strategy. The complexity surrounding wash sales, holding periods, and different types of accounts also necessitates expert guidance. Finally, anyone facing an IRS audit related to their forex trading activities should immediately seek professional legal and tax assistance.

Questions to Ask a Tax Professional

Before engaging a tax professional, it’s essential to ask clarifying questions to ensure they’re the right fit for your needs. Inquire about their experience specifically with forex traders, their familiarity with relevant tax laws and regulations, and their approach to tax planning and optimization. Ask for examples of successful tax strategies they have implemented for clients with similar trading styles and volumes. Clarify their fees and payment structure, and ensure you understand their process for communication and record-keeping. Lastly, ask about their contingency plan should an audit occur.

Considerations When Selecting a Tax Advisor

Choosing the right tax advisor is a critical decision. Look for someone with demonstrable experience in forex trading taxation, preferably with certifications or specializations in this area. Check their professional credentials and online reviews to assess their reputation and client satisfaction. Ensure they possess a thorough understanding of different trading platforms and strategies, enabling them to accurately assess your tax liability. Their communication style and responsiveness should be a priority – you need someone accessible and willing to answer your questions clearly and concisely. Finally, consider their approach to proactive tax planning, not just reactive compliance. A good advisor will work with you to develop a long-term strategy to minimize your tax burden while remaining fully compliant.

Outcome Summary

So, there you have it – a clearer picture of the often-murky world of forex trading taxes. Remember, accurate record-keeping is your best friend. Understanding the tax implications of your chosen trading strategy is crucial for maximizing your profits. And, if you’re ever feeling overwhelmed, don’t hesitate to seek professional help. By mastering these aspects, you’ll not only stay compliant but also optimize your financial success in the exciting – and sometimes complex – world of forex trading. Happy trading (and tax planning!)