Automatic forex trading: Sounds futuristic, right? It’s actually a powerful way to potentially boost your trading game, leveraging algorithms and software to execute trades based on pre-defined strategies. But before you jump in headfirst, understand that this isn’t a get-rich-quick scheme. It’s a complex world of automated systems, sophisticated software, and the ever-shifting sands of the forex market. This guide breaks down the essentials, from choosing the right platform to managing risk and navigating the legal landscape.

We’ll explore various automated trading systems, from simple moving average crossovers to more complex AI-powered strategies. We’ll also delve into the crucial aspects of backtesting, optimization, and risk management – because even with automation, smart decisions are paramount. Think of this as your survival guide to the wild world of automated forex trading. Ready to dive in?

Introduction to Automatic Forex Trading

Forex trading, the global exchange of currencies, has always been a fast-paced, high-stakes game. But the rise of technology has revolutionized the market, introducing the exciting world of automated forex trading, also known as algorithmic trading or automated forex systems. This involves using computer programs to execute trades based on pre-defined rules and algorithms, eliminating the need for constant human intervention. This approach offers significant advantages, potentially leading to increased efficiency, reduced emotional biases, and the ability to analyze vast amounts of market data in real-time.

Automated forex trading offers several key advantages. Firstly, it allows for round-the-clock trading, capturing opportunities that might be missed by human traders constrained by time zones and sleep schedules. Secondly, it eliminates emotional decision-making, a common pitfall for human traders who might panic-sell during market downturns or over-invest during periods of exuberance. Algorithmic systems, by contrast, adhere strictly to their programmed rules, promoting consistent and disciplined trading. Finally, these systems can process and analyze significantly more market data than any human trader, identifying subtle patterns and opportunities that might otherwise go unnoticed. The speed and efficiency of automated systems can be a game-changer in a market as dynamic as forex.

Types of Automated Trading Systems

Automated trading systems vary widely in their complexity and approach. They can range from simple systems based on basic technical indicators, such as moving averages and relative strength index (RSI), to highly sophisticated systems employing machine learning and artificial intelligence to identify complex patterns and predict future price movements. Some systems focus on short-term trading strategies, aiming for quick profits from small price fluctuations, while others employ longer-term strategies, holding positions for days, weeks, or even months. The choice of system depends on the trader’s risk tolerance, investment goals, and level of technical expertise. For example, a simple moving average crossover system might automatically buy when a short-term moving average crosses above a long-term moving average and sell when the opposite occurs. More advanced systems might incorporate multiple indicators, news sentiment analysis, and even machine learning models to generate trading signals.

A Brief History of Algorithmic Trading in Forex

The use of algorithms in forex trading isn’t a recent phenomenon. While the widespread adoption is a more recent development fueled by increased computing power and readily available data, the seeds of algorithmic trading were sown decades ago. Early forms involved simple rule-based systems implemented using early computer technology. The evolution has been marked by the increasing sophistication of algorithms, driven by advancements in computing power and the development of new analytical techniques. The rise of high-frequency trading (HFT) in recent years exemplifies this evolution, with algorithms executing thousands or even millions of trades per second, exploiting minuscule price discrepancies for profit. This rapid evolution has also led to increased regulatory scrutiny and the need for robust risk management strategies within these automated systems. The availability of sophisticated software and readily accessible market data has further fueled the growth and adoption of automated forex trading strategies by both individual traders and large institutional investors.

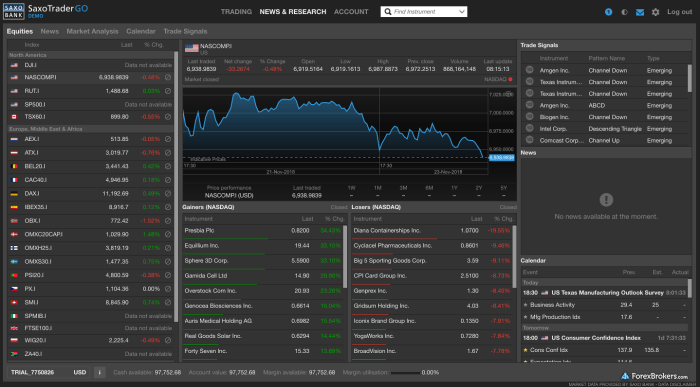

Software and Platforms for Automated Forex Trading

Stepping into the world of automated forex trading requires choosing the right tools. The software and platforms you select will significantly impact your trading experience, from ease of use to the sophistication of your strategies. This section explores some popular options and their key features, helping you navigate the choices available.

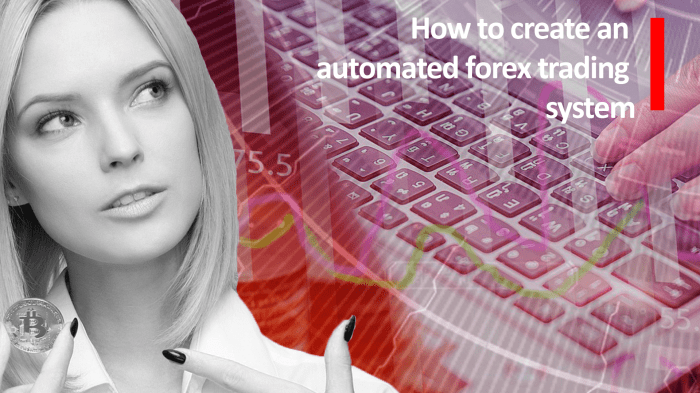

Popular Forex Trading Platforms Supporting Automation, Automatic forex trading

Several platforms cater to automated forex trading, each with its strengths and weaknesses. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are industry stalwarts, known for their extensive functionality and large community support. cTrader offers a more modern interface and advanced charting capabilities, while NinjaTrader is a favorite among more experienced traders due to its powerful backtesting features. Choosing the right platform depends on your trading style, technical expertise, and specific automation needs.

Features and Functionalities of Automated Trading Software

Automated trading software generally offers a range of core features. These include the ability to develop and execute Expert Advisors (EAs) or custom scripts, backtesting capabilities to evaluate strategy performance on historical data, order management tools for efficient trade execution and monitoring, and charting packages for visualizing market trends and price action. Advanced features may include real-time market data feeds, news integration, and risk management tools. The level of sophistication varies significantly between platforms. For example, some platforms provide pre-built EAs or templates to simplify the process for less experienced users, while others offer a more hands-on approach, requiring coding expertise to create customized strategies.

Comparison of Key Features of Forex Trading Platforms

| Platform Name | Cost | Ease of Use | Supported Automation Features |

|---|---|---|---|

| MetaTrader 4 (MT4) | Generally free, broker fees may apply | Moderate; user-friendly interface, extensive documentation available | Expert Advisors (EAs), custom indicators, automated trading signals |

| MetaTrader 5 (MT5) | Generally free, broker fees may apply | Moderate to High; more advanced than MT4, broader functionality | Expert Advisors (EAs), custom indicators, automated trading signals, more advanced order types |

| cTrader | Generally free, broker fees may apply | High; intuitive interface, strong focus on speed and efficiency | cBots (similar to EAs), advanced charting tools, automated order placement |

| NinjaTrader | Free version available, paid subscriptions for advanced features | Moderate to Low; powerful but steeper learning curve | Automated trading strategies, advanced backtesting capabilities, sophisticated order management |

Developing Trading Strategies for Automation

Automating your forex trading involves meticulously crafting strategies that a computer can execute flawlessly. This requires a deep understanding of market dynamics and the ability to translate those insights into precise, executable code. Success hinges on choosing the right strategy, implementing it correctly, and rigorously backtesting to ensure robustness. Let’s explore the key aspects of this crucial process.

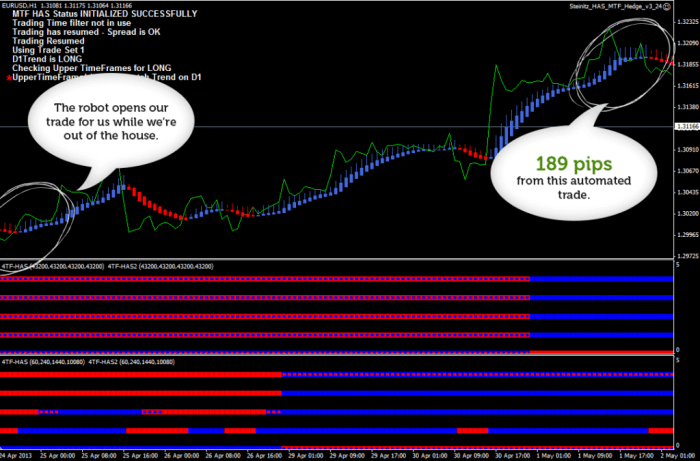

Simple Moving Average Crossover Strategy

A simple moving average (SMA) crossover strategy is a classic example of an automated trading strategy. It involves calculating two SMAs of different periods (e.g., a 50-period SMA and a 200-period SMA) for a given currency pair. When the shorter-period SMA crosses above the longer-period SMA, it generates a buy signal; conversely, a cross below generates a sell signal. This strategy capitalizes on momentum changes indicated by the moving average convergence and divergence. The automated system would execute trades based on these crossover events, automatically placing buy orders when the shorter SMA crosses above the longer SMA and sell orders when the opposite occurs. This simplicity allows for easy implementation in various trading platforms, making it an ideal starting point for aspiring automated traders.

Risks and Rewards of Automated Trading Strategies

Different automated trading strategies present varying levels of risk and reward. High-frequency trading (HFT) strategies, for example, aim for small profits on numerous trades, relying on speed and volume. While potentially highly profitable, HFT carries significant risk due to its reliance on extremely short-term market fluctuations and the potential for significant losses if market conditions change rapidly. Conversely, strategies based on longer-term trends, like those using moving averages, generally involve lower frequency trading and potentially lower returns but also reduced risk exposure. The inherent volatility of the forex market means that no strategy is risk-free. Careful consideration of risk tolerance is paramount when choosing and implementing an automated trading strategy. For instance, a strategy relying solely on a single indicator might perform poorly during periods of high market volatility or unexpected news events. Diversification across multiple strategies or asset classes can help mitigate some of these risks.

Common Indicators in Automated Forex Trading Systems

Many indicators aid in developing automated forex trading systems. These indicators provide quantifiable signals based on market data, allowing for objective trading decisions. The Relative Strength Index (RSI), for instance, measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A high RSI value suggests an overbought market, potentially indicating a sell signal, while a low value might signal an oversold market and a potential buy signal. The MACD (Moving Average Convergence Divergence) indicator compares two moving averages to identify momentum changes and potential trend reversals. Bollinger Bands, another popular indicator, measure volatility and price deviations from a moving average, providing potential entry and exit points based on price band breakouts or retraces. The effectiveness of these indicators varies depending on market conditions and the specific trading strategy employed. A well-designed automated trading system often combines several indicators to generate more robust and reliable trading signals.

Backtesting and Optimization of Automated Systems: Automatic Forex Trading

Building a killer automated forex trading system isn’t just about slapping together some code; it’s about rigorously testing and refining your strategy to ensure it performs as expected in real-world market conditions. This involves a crucial process called backtesting, followed by optimization to fine-tune its performance. Think of it as taking your trading bot to the gym before letting it loose in the real forex arena.

Backtesting is essentially a simulation of your automated trading strategy using historical market data. It allows you to see how your system would have performed in the past, identifying potential weaknesses and areas for improvement before risking real capital. This is far more than just a theoretical exercise; it’s a vital step in mitigating risk and boosting your chances of success.

The Backtesting Process

The backtesting process typically involves several steps. First, you’ll need to select a period of historical data that is relevant to your strategy. This data should include price information, volume, and any other indicators your strategy relies on. Next, you’ll run your automated trading system on this data, simulating trades based on the system’s logic. The system will then generate a performance report showing key metrics such as profitability, maximum drawdown, Sharpe ratio, and win rate. Analyzing these metrics helps you understand the strengths and weaknesses of your strategy. For instance, a high Sharpe ratio suggests consistent returns with lower risk, while a high maximum drawdown indicates significant potential losses. Remember, a successful backtest doesn’t guarantee future success, but it significantly improves your odds.

The Importance of Historical Data

Using reliable and accurate historical data is paramount in backtesting. Garbage in, garbage out, as they say. The quality of your backtest is directly tied to the quality of your data. You need data that accurately reflects real market conditions, including periods of high volatility and significant market events. Using manipulated or incomplete data will lead to inaccurate results and could cause you to deploy a flawed strategy. Reputable data providers offer historical forex data that meets stringent quality standards. These providers ensure data integrity and accuracy, minimizing the risk of skewed backtest results. Consider factors like data frequency (e.g., tick data, 1-minute, 5-minute, etc.) and the length of the historical period to choose the data that best suits your strategy’s requirements. A longer historical period generally provides a more robust backtest, but it also increases computational requirements.

Optimization Techniques for Automated Trading Systems

Once you’ve backtested your strategy, the next step is optimization. This involves fine-tuning the parameters of your trading system to improve its performance. Optimization techniques can range from simple adjustments to complex algorithms. For example, you might adjust parameters like stop-loss levels, take-profit targets, or the entry and exit criteria of your strategy. However, it’s crucial to avoid over-optimization, where you tweak your strategy so much that it fits the historical data perfectly but fails to generalize to future market conditions. This often leads to disappointing real-world performance. Techniques like walk-forward analysis, which involves dividing the historical data into in-sample and out-of-sample periods, can help mitigate over-optimization. The in-sample data is used for optimization, while the out-of-sample data is used for validation. This approach helps to assess the generalizability of your optimized strategy. Furthermore, robust optimization methods, such as genetic algorithms or simulated annealing, can help to explore the parameter space more efficiently and identify optimal settings without overfitting.

Risk Management in Automated Forex Trading

Automating your forex trading can significantly boost efficiency, but it also amplifies the potential for losses if not managed correctly. Effective risk management isn’t just about minimizing losses; it’s about ensuring the longevity and profitability of your automated trading system. Without a robust risk management strategy, even the most sophisticated algorithm can quickly wipe out your account.

Successful automated forex trading hinges on a carefully crafted approach to risk. This means understanding your tolerance for loss, implementing strict controls, and continuously monitoring your system’s performance. It’s about building a system that can weather market storms and still deliver consistent, albeit potentially modest, returns over the long term.

Stop-Loss Orders and Take-Profit Orders

Stop-loss orders automatically close a trade when the price moves against your position by a predetermined amount, limiting potential losses. Take-profit orders, conversely, automatically close a trade when it reaches a specified profit target, securing your gains. These are fundamental risk management tools in any automated trading system. For instance, a trader might set a stop-loss order at 2% below their entry price and a take-profit order at 3% above it, creating a defined risk-reward ratio of 2:3. This ensures that even if multiple trades lose, the cumulative losses remain controlled.

Position Sizing Strategies

Position sizing determines the amount of capital allocated to each trade. A common approach is to risk a fixed percentage of your account balance on each trade, regardless of the asset’s volatility. For example, a trader might risk only 1% of their account on any single trade. If their account balance is $10,000, they would only risk $100 on each trade. This approach helps to prevent a single losing trade from significantly impacting the overall account balance. Another strategy involves adjusting position size based on the volatility of the asset; higher volatility warrants smaller positions.

Monitoring and Adjustment

Continuously monitoring the performance of your automated trading system is crucial. This involves tracking key metrics such as win rate, average win/loss ratio, maximum drawdown, and overall profitability. Regularly reviewing these metrics allows for timely adjustments to the system’s parameters, including stop-loss levels, take-profit targets, and position sizing strategies. Identifying periods of underperformance and adapting accordingly is key to long-term success. For example, if the system experiences a prolonged period of losses, it may be necessary to temporarily suspend trading, re-evaluate the trading strategy, or adjust risk parameters.

Avoiding Common Pitfalls

Over-optimization is a significant risk. Over-optimizing a trading strategy to historical data can lead to poor performance in live trading. The strategy might fit perfectly to past data but fail to adapt to current market conditions. Similarly, neglecting to account for market events, such as news announcements or economic data releases, can lead to unexpected losses. Automated systems should ideally incorporate mechanisms to handle such events, potentially by pausing trading during periods of high volatility or incorporating event-driven logic into the trading rules. Finally, relying solely on backtested results without rigorous out-of-sample testing can lead to a false sense of security. Backtesting should be supplemented by testing on data not used in the optimization process to ensure the robustness of the system.

Monitoring and Maintenance of Automated Systems

Setting your forex robot to trade and then forgetting about it is a recipe for disaster. Think of it like leaving a self-driving car on autopilot without ever checking the dashboard – you might end up in a ditch! Continuous monitoring and regular maintenance are crucial for the long-term success and survival of your automated forex trading system. Ignoring this aspect can lead to significant losses and even the complete failure of your strategy.

Automated forex trading systems, while seemingly autonomous, require vigilant oversight. Unexpected market events, software glitches, or even simple coding errors can quickly derail even the most meticulously designed system. Proactive monitoring allows you to identify and address these issues before they escalate, minimizing potential losses and maximizing profitability. This involves regularly checking key performance indicators, analyzing trade logs, and staying abreast of any market shifts that could impact your system’s performance.

Error Identification and Resolution

Identifying and resolving errors in automated forex trading systems involves a systematic approach. First, you need a robust logging system within your trading software to record every trade, every signal, and every error encountered. This log provides invaluable data for troubleshooting. When an error occurs, carefully examine the log files to pinpoint the source of the problem. This might involve checking for incorrect parameter settings, unexpected market conditions that triggered an error, or even bugs in the code itself. If the problem lies within the code, you’ll need to debug it, testing your fixes thoroughly before redeploying the system. If the issue stems from external factors, you might need to adjust your trading strategy or even temporarily suspend automated trading. For example, if a significant news event is anticipated that could dramatically affect the market, it’s prudent to pause your automated system to avoid potentially disastrous trades.

Regular Maintenance Checklist

Regular maintenance is essential for ensuring the continued optimal performance of your automated trading system. Think of it as regular servicing for your trading “machine.” A proactive approach prevents small problems from becoming major issues.

- Log File Review: Regularly review your trading logs to identify any patterns, errors, or unexpected behavior. Aim for at least a daily review.

- Backtesting and Optimization: Periodically backtest your strategy with updated market data to ensure it’s still performing as expected. Adjust parameters as needed to optimize performance.

- Software Updates: Keep your trading software and any related libraries updated to benefit from bug fixes, performance improvements, and new features. Regularly check for updates from your broker as well.

- Hardware Check: If you’re running your system on a dedicated server, ensure the hardware is functioning correctly. This includes checking for sufficient RAM, storage space, and network connectivity.

- Security Audit: Regularly assess the security of your trading system and account to prevent unauthorized access or malicious activity.

- Strategy Review: Periodically review your overall trading strategy. Market conditions change, and your strategy may need adjustments to remain effective.

Legal and Regulatory Aspects

Navigating the world of automated forex trading requires a keen understanding of the legal and regulatory landscape. Failure to comply with relevant laws can lead to significant financial penalties and reputational damage. This section Artikels key legal considerations and compliance issues inherent in automated forex trading.

The legal and regulatory environment surrounding automated forex trading varies significantly depending on your location. Brokers and traders must be aware of the specific rules and regulations applicable to their jurisdiction. Ignoring these regulations can expose individuals and businesses to substantial risks.

Jurisdictional Differences in Forex Regulation

Forex trading is a globally decentralized market, meaning regulatory oversight differs considerably across countries. Some jurisdictions have robust regulatory frameworks for forex trading, while others have less stringent rules. For example, the UK’s Financial Conduct Authority (FCA) has comprehensive rules for forex brokers, including requirements for capital adequacy and client segregation of funds. In contrast, some offshore jurisdictions may have less oversight, potentially leading to higher risks for traders. Understanding these differences is crucial for selecting a broker and operating legally.

Compliance with Anti-Money Laundering (AML) Regulations

Automated forex trading systems, due to their high-speed and high-volume nature, can be vulnerable to exploitation for money laundering activities. Compliance with AML regulations is therefore paramount. This typically involves implementing robust Know Your Customer (KYC) procedures, monitoring transactions for suspicious activity, and reporting any potentially illicit activity to the relevant authorities. Failure to comply with AML regulations can result in severe penalties, including hefty fines and even criminal prosecution. A robust AML compliance program should be integrated into the design and operation of any automated forex trading system.

Data Protection and Privacy Regulations

Automated forex trading systems often collect and process large amounts of personal and financial data. Compliance with data protection and privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, is essential. This includes obtaining appropriate consent for data processing, ensuring data security, and providing individuals with access to their data. Breaches of data protection regulations can result in substantial fines and damage to reputation. Therefore, secure data storage and processing practices are vital components of a legally compliant automated forex trading system.

Tax Implications of Automated Forex Trading

The tax implications of automated forex trading can be complex and vary depending on the jurisdiction. Profits from forex trading are generally considered taxable income. It is crucial to maintain accurate records of all transactions and consult with a qualified tax advisor to ensure compliance with all relevant tax laws. Failure to accurately report and pay taxes on forex trading profits can lead to significant penalties and legal repercussions. Proper record-keeping is therefore a critical aspect of responsible and legal automated forex trading.

Case Studies of Successful and Unsuccessful Automated Systems

The world of automated forex trading is littered with both spectacular successes and catastrophic failures. Understanding these contrasting outcomes is crucial for anyone venturing into this complex field. By examining real-world examples, we can glean valuable insights into what constitutes a robust, profitable system and what pitfalls to avoid. This section will delve into specific case studies, highlighting the strategies employed, the results achieved, and the factors contributing to success or failure.

Successful Automated Trading System: The Mean Reversion Scalper

This system, deployed by a proprietary trading firm (let’s call it “AlphaQuant”), focused on short-term mean reversion strategies within the EUR/USD pair. It utilized a sophisticated algorithm that identified overbought and oversold conditions based on a combination of moving averages and Relative Strength Index (RSI). The system placed small, frequent trades, aiming to profit from the price’s tendency to revert to its mean. AlphaQuant’s system incorporated rigorous risk management, including stop-loss orders and position sizing based on volatility. Over a three-year period, the system consistently generated positive returns, averaging 15% annually with a Sharpe ratio exceeding 1.5. Its success was attributed to a well-defined trading strategy, meticulous backtesting, and robust risk management. The algorithm’s adaptability to changing market conditions also played a significant role. While specific details of the algorithm remain proprietary, the success highlights the potential of carefully designed mean reversion strategies.

Successful Automated Trading System: The Trend Following System

A different approach was taken by “QuantMetrics,” a firm specializing in long-term trend-following strategies. Their automated system focused on identifying and capitalizing on major trends in various currency pairs. The system used a combination of moving averages, MACD, and volume analysis to identify trend changes. Unlike the scalping system, this strategy held positions for longer periods, sometimes weeks or even months. Risk management was crucial, with stop-loss orders placed well beyond recent price fluctuations to account for potential market corrections. Over a five-year period, this system generated an average annual return of 20%, demonstrating the effectiveness of a well-executed trend-following strategy in a volatile market. The system’s resilience during periods of high volatility proved to be a key factor in its success.

Unsuccessful Automated Trading System: The Over-Optimized System

“BetaTech,” a smaller firm, developed an automated system based on a complex algorithm that was heavily optimized to historical data. The system achieved impressive results during backtesting, exhibiting exceptionally high returns. However, when deployed in live trading, the system experienced significant losses. The reason? Over-optimization. The algorithm had adapted so perfectly to the historical data that it failed to adapt to the changing dynamics of the live market. The system’s performance deteriorated rapidly, leading to substantial losses and ultimately its abandonment. This case highlights the danger of overfitting and the importance of robust out-of-sample testing.

Unsuccessful Automated Trading System: Lack of Risk Management

Another firm, “GammaTrade,” developed an automated system based on a relatively simple moving average crossover strategy. While the strategy itself was sound in principle, the system lacked proper risk management. It failed to incorporate adequate stop-loss orders or position sizing mechanisms. As a result, even minor adverse market movements resulted in significant drawdowns. The system eventually suffered a catastrophic loss during a period of high volatility, leading to its complete failure. This case study emphasizes the critical role of robust risk management in any automated trading system, regardless of the underlying strategy.

| System | Strategy | Results | Reasons for Success/Failure |

|---|---|---|---|

| AlphaQuant | Mean Reversion Scalping (EUR/USD) | 15% annual return, Sharpe Ratio > 1.5 (3 years) | Well-defined strategy, robust risk management, adaptability |

| QuantMetrics | Long-term Trend Following (Multiple Pairs) | 20% annual return (5 years) | Effective trend identification, robust risk management |

| BetaTech | Complex Algorithm (Over-optimized) | Significant losses in live trading | Over-optimization, failure to adapt to live market conditions |

| GammaTrade | Moving Average Crossover | Catastrophic loss | Lack of risk management, inadequate stop-losses |

The Future of Automated Forex Trading

The world of automated forex trading is poised for a dramatic transformation, driven by advancements in technology and a growing appetite for sophisticated trading strategies. The next decade will likely see a shift away from simpler rule-based systems towards more intelligent, adaptive approaches capable of navigating increasingly complex market conditions. This evolution promises both incredible opportunities and significant challenges for traders and developers alike.

The increasing sophistication of algorithmic trading is set to redefine the forex landscape. We are moving beyond basic indicators and moving averages towards systems capable of learning and adapting in real-time.

Artificial Intelligence and Machine Learning in Automated Forex Trading

Artificial intelligence (AI) and machine learning (ML) are no longer futuristic concepts; they are rapidly becoming integral components of successful automated forex trading systems. AI algorithms can analyze vast datasets – encompassing news sentiment, economic indicators, social media trends, and historical price data – to identify subtle patterns and predict market movements with greater accuracy than traditional methods. Machine learning models, particularly deep learning networks, are particularly adept at recognizing complex, non-linear relationships within market data, allowing for the development of more robust and adaptable trading strategies. For example, a deep learning model might be trained on years of forex data to identify specific chart patterns that precede significant price movements, enabling a trading bot to execute trades preemptively. This surpasses the capabilities of simpler systems relying solely on pre-programmed rules.

Emerging Trends in Automated Forex Trading

Several key trends are shaping the future of automated forex trading. One is the increasing use of cloud computing, enabling traders to access and process massive datasets and run complex algorithms without the need for expensive, high-powered hardware. Another is the rise of blockchain technology, which offers the potential for greater transparency and security in automated trading systems, reducing the risk of fraud and manipulation. Furthermore, the integration of sentiment analysis tools – which gauge market sentiment from news articles, social media posts, and other sources – allows for more nuanced and informed trading decisions. Imagine a system that not only analyzes price charts but also understands the overall market sentiment surrounding a particular currency pair, adjusting its trading strategy accordingly.

Predictions for the Future of Automated Forex Trading

Predicting the future is inherently uncertain, but based on current trends, several plausible scenarios emerge. We can anticipate a continued increase in the adoption of AI and ML in automated trading, leading to more sophisticated and profitable strategies. The development of more robust risk management tools will be crucial, mitigating the inherent volatility of the forex market. We can also expect to see a greater emphasis on explainable AI (XAI), which aims to make the decision-making processes of AI-powered trading systems more transparent and understandable. This will be essential for building trust and regulatory compliance. Finally, the rise of decentralized finance (DeFi) could lead to the emergence of new, decentralized automated trading platforms, offering greater autonomy and control to traders. For example, a DeFi-based platform might allow traders to directly access liquidity pools and execute trades without the need for intermediaries, potentially reducing transaction costs and improving efficiency.

Final Review

So, is automatic forex trading the holy grail of finance? Not quite. While it offers potential for increased efficiency and potentially higher returns, it’s not without its risks. Success hinges on meticulous strategy development, rigorous backtesting, disciplined risk management, and constant monitoring. This isn’t a set-it-and-forget-it proposition; it demands ongoing attention and adaptation. But with careful planning and a clear understanding of the market, automated forex trading can be a powerful tool in your investment arsenal. Remember to always do your research, understand the risks, and never invest more than you can afford to lose.

Check swing trading forex to inspect complete evaluations and testimonials from users.

In this topic, you find that forex trading discord is very useful.