Forex trading vs options trading: Two titans clashing in the world of finance. Both offer the allure of hefty profits, but each demands a unique skillset and risk tolerance. This deep dive unpacks the core differences, helping you navigate this complex landscape and choose the path that aligns with your investment goals and personality. Whether you’re a seasoned trader or a curious newbie, understanding the nuances of each is crucial for success.

We’ll dissect everything from risk profiles and trading strategies to transaction costs and regulatory landscapes. Prepare for a no-nonsense comparison, stripping away the jargon to reveal the heart of forex and options trading. By the end, you’ll have a clearer picture of which arena best fits your financial prowess and appetite for risk.

Risk and Reward Profiles

Forex and options trading offer distinct risk-reward profiles, each appealing to different trading styles and risk tolerances. Understanding these differences is crucial for successful trading in either market. While both can generate substantial profits, the path to those profits and the potential for significant losses differ dramatically.

Leverage and its Impact

Leverage is a double-edged sword in both forex and options trading. It magnifies potential profits but also significantly amplifies potential losses. In forex, leverage allows traders to control larger positions with a smaller initial investment. For example, a 1:100 leverage means you can control $100,000 worth of currency with just $1,000 of your own capital. Options trading, while not directly using leverage in the same way, offers similar magnification through the use of options contracts. A small investment in a contract can control a much larger underlying asset. The higher the leverage (or the more “leverage-like” the options strategy), the greater the potential for both substantial gains and devastating losses. A small market movement can wipe out your entire investment, especially with high leverage.

Risk-Reward Ratio Comparison

The risk-reward ratio, expressed as the potential profit divided by the potential loss, varies significantly between forex and options trading. In forex, the risk-reward ratio can be more easily controlled through stop-loss orders and position sizing. However, unexpected market events or high volatility can still lead to substantial losses. Options trading offers a wider range of risk-reward profiles depending on the chosen strategy. For example, a covered call strategy offers limited risk but also limited reward, while a naked put strategy offers potentially unlimited risk but also potentially unlimited reward.

High-Risk/High-Reward Scenarios

A high-risk/high-reward scenario in forex could involve leveraging heavily on a volatile currency pair expecting a significant price movement. For instance, a trader might leverage 1:200 on the USD/JPY pair anticipating a sharp appreciation of the dollar. While a successful trade could yield substantial profits, an adverse movement could result in significant losses exceeding the initial investment. In options, a high-risk/high-reward scenario could be buying a call option on a stock expecting a large price jump before the option’s expiration date. The potential profit is theoretically unlimited (if the stock price rises significantly), but the entire premium paid for the option is the maximum loss.

Maximum Potential Loss Comparison

| Asset Class | Leverage | Maximum Loss Scenario | Example |

|---|---|---|---|

| Forex | 1:100 | Total invested capital plus potential margin calls | $1,000 invested with 1:100 leverage on EUR/USD. A large adverse movement could lead to losses exceeding $1,000 due to margin calls. |

| Options (Buying a Call) | N/A (but leverage-like effect through contract control) | Premium paid for the option | $100 premium paid for a call option. Maximum loss is $100 regardless of the underlying asset’s price movement. |

| Options (Selling a Covered Call) | N/A | Limited to the value of the underlying asset | Selling a covered call on 100 shares of a stock currently priced at $50. Maximum loss is limited to the value of the 100 shares ($5000). |

| Options (Selling a Naked Put) | N/A | Theoretically unlimited | Selling a naked put option on 100 shares of a stock. If the stock price drops significantly, the potential losses are theoretically unlimited as the seller is obligated to buy the shares at the strike price. |

Trading Strategies and Techniques: Forex Trading Vs Options Trading

Forex and options trading, while both involving financial markets, differ significantly in their strategies and techniques. Understanding these differences is crucial for success in either arena. This section will explore common approaches in each market, highlighting their unique characteristics and the analytical tools employed.

Forex trading offers a diverse range of strategies catering to various risk tolerances and time horizons. Options trading, on the other hand, provides a unique set of tools to manage risk and profit from market volatility.

Forex Trading Strategies

Forex trading strategies are broadly categorized by their time horizon. Scalping involves profiting from small price movements within seconds or minutes. Day trading focuses on holding positions throughout a single trading day, while swing trading aims to capitalize on medium-term price swings, holding positions for several days or weeks. Each strategy requires different skills and risk management approaches. Scalping necessitates rapid decision-making and a keen understanding of short-term market dynamics. Day trading demands intense focus and discipline, while swing trading necessitates patience and the ability to analyze longer-term market trends.

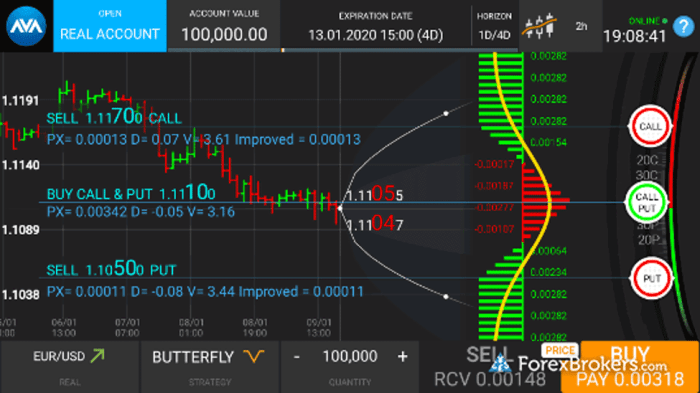

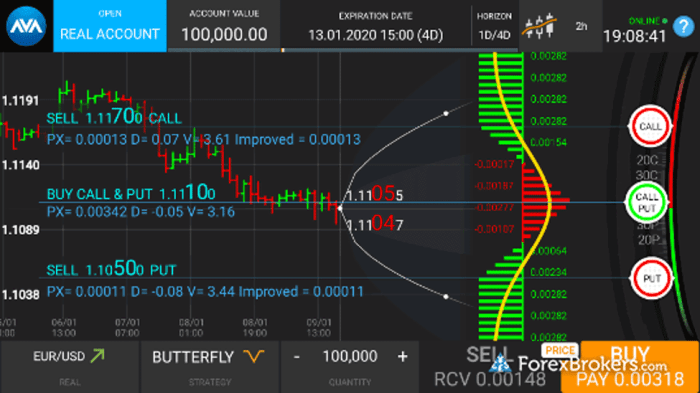

Options Trading Strategies

Options trading offers a wider array of strategies, allowing traders to tailor their approach to specific market outlooks. Covered calls involve selling call options on shares already owned, generating income while limiting upside potential. Protective puts offer insurance against potential losses in a stock portfolio by purchasing put options. Straddles involve simultaneously buying a call and a put option with the same strike price and expiration date, profiting from significant price movements in either direction. These strategies offer sophisticated risk management tools, allowing traders to define their risk and reward profiles precisely.

Technical Analysis in Forex and Options Trading

Technical analysis, using indicators to identify trends and predict future price movements, plays a crucial role in both markets. However, its application differs. In forex, moving averages, relative strength index (RSI), and MACD are frequently used to identify momentum and potential trend reversals. These indicators help traders determine entry and exit points, managing risk through stop-loss orders. In options trading, technical analysis helps determine the probability of price reaching specific levels before option expiration. This is crucial for determining the optimal strike price and expiration date for options strategies, impacting the overall profitability. For example, a trader might use Bollinger Bands to gauge market volatility and identify potential breakouts, informing their options strategy choice.

Knowledge and Skills Required

Success in either market requires a specific skill set. The following lists highlight the essential knowledge and skills:

- Forex Trading: Fundamental analysis (macroeconomic factors), technical analysis (chart patterns, indicators), risk management (stop-loss orders, position sizing), understanding of currency pairs and their relationships, market psychology.

- Options Trading: Understanding of options contracts (calls, puts, spreads), options pricing models (Black-Scholes), risk management (hedging, defining risk profiles), probability and statistics, understanding of implied volatility and its impact on option pricing.

Market Volatility and Liquidity

Forex and options trading, while both offering avenues for financial gain, present distinct landscapes in terms of market volatility and liquidity. Understanding these differences is crucial for navigating the inherent risks and maximizing potential returns in each market. Both volatility and liquidity directly impact trading strategies, execution speed, and ultimately, profitability.

Forex Market Volatility

Forex market volatility is generally considered moderate to high, influenced by a multitude of interconnected global factors. Economic data releases (like inflation reports or interest rate decisions), geopolitical events (wars, political instability), and market sentiment (investor confidence) all contribute to significant price swings. For example, unexpected news regarding a major central bank’s monetary policy can cause dramatic fluctuations in currency pairs within minutes. The sheer size and 24/5 trading nature of the forex market also amplify the impact of news and sentiment, creating a constantly shifting environment.

Options Market Volatility, Forex trading vs options trading

Options markets, on the other hand, exhibit volatility levels that are often amplified compared to the underlying asset. This is because options prices are directly influenced not only by the price movements of the underlying asset (e.g., a stock or index) but also by factors like time to expiration and implied volatility. Implied volatility, a measure of market expectation of future price swings, can significantly inflate or deflate option prices, leading to greater volatility than observed in the underlying market itself. A sudden increase in fear, for instance, might drive up implied volatility, increasing option prices even if the underlying asset’s price remains stable.

Factors Influencing Volatility: Forex vs. Options

Several key factors differentiate the volatility drivers in forex and options markets. In forex, macroeconomic events and geopolitical shifts play a dominant role. Options markets, however, are more sensitive to market sentiment and the perceived risk of the underlying asset, with implied volatility acting as a major amplifier of price fluctuations. While both markets react to news, the options market’s reaction often exhibits a more pronounced and immediate response due to the leveraged nature of options contracts.

Forex Market Liquidity

The forex market boasts exceptionally high liquidity, meaning it’s relatively easy to buy or sell currencies with minimal price slippage. The sheer volume of trading (trillions of dollars daily) ensures that there are always buyers and sellers available, allowing for quick and efficient trade execution. This high liquidity generally translates into tighter spreads (the difference between the bid and ask price), offering traders favorable pricing.

Options Market Liquidity

Liquidity in the options market varies considerably depending on the underlying asset, the specific option contract (strike price and expiration date), and market conditions. While highly liquid options contracts (e.g., those on major indices or widely traded stocks) offer relatively tight spreads and easy execution, less liquid contracts can experience significant slippage and wider spreads, making it challenging to enter or exit positions quickly at desired prices. This liquidity disparity is especially noticeable during periods of low trading volume or market stress.

Liquidity’s Impact on Trade Execution and Pricing

High liquidity, as seen in the forex market, allows for precise order execution at or near the desired price. Conversely, low liquidity in certain options contracts can lead to significant price slippage (the difference between the expected price and the actual execution price) and wider spreads, increasing transaction costs and potentially impacting profitability. Traders need to be acutely aware of liquidity conditions when choosing their trading instruments and strategies in both markets.

Transaction Costs and Fees

Navigating the world of forex and options trading requires a keen understanding of the costs involved. While both markets offer lucrative opportunities, the fees and commissions can significantly impact your overall profitability. Understanding these differences is crucial for making informed trading decisions and maximizing your returns. Let’s delve into the specifics.

Transaction costs in both forex and options trading primarily consist of spreads, commissions, and potentially other fees. Spreads represent the difference between the bid and ask prices, while commissions are explicit charges levied by brokers. Additional fees might include overnight financing charges (swap fees in forex), regulatory fees, or inactivity fees, depending on your broker and trading strategy.

Check what professionals state about forex trading affiliate programs and its benefits for the industry.

Comparison of Transaction Costs in Forex and Options Trading

The following table compares the typical transaction costs associated with forex and options trading. Note that these are general examples, and the actual costs can vary significantly depending on the broker, the asset traded, and the trading volume.

| Fee Type | Forex Trading Cost | Options Trading Cost | Notes |

|---|---|---|---|

| Spread | Typically a few pips (e.g., 1-3 pips for major currency pairs). Can be wider for less liquid pairs. | Implicitly included in the option’s price. The spread between bid and ask prices for options contracts is often wider than for underlying assets. | Spreads are the most common cost in forex trading. Options pricing incorporates the spread implicitly. |

| Commissions | Can range from zero to a percentage of the trade value, or a fixed fee per trade. Many brokers offer commission-free forex trading, but spreads might be wider to compensate. | Usually a per-contract fee, which can vary significantly based on the underlying asset and the option’s type (e.g., calls, puts). | Commission structures vary greatly among brokers for both forex and options. Compare carefully. |

| Other Fees | Overnight financing charges (swap fees), inactivity fees, potential margin calls if trading on margin. | Assignment fees (if the option is exercised), early exercise fees (depending on the contract), regulatory fees. | These additional fees can add up, especially for long-term positions or frequent trading. |

For example, a forex trader buying 100,000 units of EUR/USD with a spread of 2 pips would pay a cost of approximately $20 (assuming 1 pip equals $1). Conversely, an options trader purchasing one contract of a stock option with a $1 commission would pay that fixed fee, regardless of the contract’s price. The cumulative impact of these costs across multiple trades can significantly affect profitability. A seemingly small spread can quickly accumulate over many trades, and similarly, options commissions can become substantial when trading multiple contracts.

Notice forex trading contest for recommendations and other broad suggestions.

Regulatory Environment and Compliance

Navigating the world of forex and options trading requires understanding the complex regulatory landscape. These markets, while offering significant potential for profit, are subject to varying degrees of oversight depending on your location and the specific instruments you trade. Non-compliance can lead to severe penalties, highlighting the importance of thorough research and adherence to regulations.

The regulatory frameworks governing forex and options trading differ significantly across jurisdictions. Some countries have robust regulatory bodies overseeing these markets, while others have less stringent rules or even lack specific regulations altogether. This disparity necessitates careful consideration of your trading location and the legal implications of your activities.

Forex Trading Regulation

Forex trading, also known as foreign exchange or FX trading, is largely decentralized, meaning it doesn’t operate through a central exchange. This decentralized nature makes regulation more challenging. However, most jurisdictions regulate aspects of forex trading, particularly concerning brokers and their activities. For example, in the United States, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) oversee forex brokers operating within the country. These bodies set rules concerning capital adequacy, client segregation of funds, and anti-money laundering (AML) compliance. Similarly, the UK’s Financial Conduct Authority (FCA) regulates forex brokers operating within the UK, enforcing strict rules on transparency and client protection. Failure to comply with these regulations can result in hefty fines, license revocation, and even criminal charges. A broker failing to segregate client funds, for instance, could face severe penalties and legal action from affected clients.

Options Trading Regulation

Options trading, on the other hand, is typically more centralized, with exchanges like the Chicago Board Options Exchange (CBOE) and the Intercontinental Exchange (ICE) playing a crucial role. This centralized nature often leads to stricter regulatory oversight. In the US, the Securities and Exchange Commission (SEC) regulates options trading on exchanges, overseeing market integrity and protecting investors. Similar regulatory bodies exist in other countries, ensuring fair trading practices and preventing market manipulation. These bodies enforce regulations related to margin requirements, reporting obligations, and insider trading. Violation of these regulations can result in substantial fines, trading suspensions, and even imprisonment in severe cases. A trader engaging in insider trading, for example, could face significant legal repercussions, including hefty fines and jail time.

Regulatory Compliance Requirements

Adherence to regulatory requirements is paramount for both forex and options traders. These requirements vary depending on the jurisdiction and the specific trading activity. Common requirements include maintaining accurate trading records, adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, and complying with reporting obligations. Brokers are typically required to meet stringent capital adequacy standards and maintain client funds in segregated accounts. Traders themselves must ensure they understand and comply with the rules governing their trading activities, including tax obligations and reporting requirements.

Consequences of Non-Compliance

The consequences of non-compliance with forex and options trading regulations can be severe. These consequences range from financial penalties and trading restrictions to criminal charges and imprisonment. Regulatory bodies actively monitor market activity and investigate potential violations. They have the power to impose significant fines, revoke trading licenses, and even pursue criminal prosecution in cases of fraud or serious misconduct. The specific penalties will vary depending on the nature and severity of the violation, the jurisdiction involved, and the trader’s history. Therefore, understanding and complying with relevant regulations is crucial for protecting your assets and avoiding legal repercussions.

Suitable Trader Profiles

Choosing between forex and options trading isn’t just about market mechanics; it’s about finding the right fit for your personality and trading style. Understanding your own risk tolerance, time commitment, and experience level is crucial in determining which market better suits your needs. Let’s delve into the ideal trader profiles for each.

Forex Trader Profile

The ideal forex trader often possesses a blend of patience, discipline, and a keen understanding of global economics. They’re typically comfortable with longer-term trades, acknowledging the inherent volatility but maintaining a steady approach. Their risk tolerance is generally moderate to high, recognizing that significant gains are often accompanied by the potential for substantial losses. A substantial time commitment is often required, as forex markets operate 24/5, demanding consistent monitoring and analysis. Experience levels vary, with beginners often starting with smaller accounts and focusing on learning fundamental and technical analysis before scaling up their trading activity. Successful forex traders often have a strong grasp of macroeconomic indicators, geopolitical events, and technical charting patterns.

Options Trader Profile

In contrast, the ideal options trader often thrives on higher risk and higher reward scenarios. Options trading requires a strong understanding of probability, risk management, and sophisticated strategies like hedging and options spreads. They’re generally comfortable with shorter-term trades, potentially profiting from quick market movements. A higher risk tolerance is often necessary, as options can expire worthless, leading to a total loss of the premium paid. The time commitment can vary greatly depending on the chosen strategy, ranging from active day trading to longer-term position holding. Experience is critical; options trading involves complex calculations and risk profiles, making it unsuitable for beginners without significant prior market knowledge. Successful options traders are adept at interpreting market sentiment, volatility, and understanding the Greeks (delta, gamma, theta, vega) that influence options pricing.

Comparison of Ideal Trader Profiles

While both forex and options trading offer potential for profit, the ideal trader profiles differ significantly. Forex traders generally exhibit higher patience and a longer-term perspective, focusing on fundamental and technical analysis to identify trends. Options traders, on the other hand, often prioritize quicker, higher-risk trades, employing sophisticated strategies to leverage market volatility. Forex trading often requires a moderate to high risk tolerance, while options trading demands a higher risk tolerance due to the potential for total loss. The time commitment also varies, with forex often requiring more consistent monitoring than options trading, which can involve both short-term and long-term strategies. Ultimately, the “best” market depends entirely on the individual trader’s skills, experience, and risk appetite.

Educational Resources and Learning Curve

Navigating the worlds of forex and options trading requires a significant investment of time and effort in learning. The sheer volume of information available, coupled with the inherent complexities of these markets, means a structured approach to education is crucial for success. The availability and quality of resources, along with the steepness of the learning curve, differ considerably between these two trading arenas.

The learning curve in both forex and options trading is undeniably steep, demanding consistent dedication and a willingness to embrace continuous learning. However, the specific challenges and the path to proficiency vary depending on the market chosen. Understanding these differences is vital for prospective traders to manage expectations and plan their educational journey effectively.

Forex Trading Educational Resources

Forex boasts a vast ocean of educational materials. Numerous online courses, webinars, books, and trading platforms offer tutorials, analyses, and strategies. Many resources are free, ranging from introductory guides to more advanced technical analysis courses. However, quality varies significantly. Some free resources may lack depth or accuracy, while premium courses can be expensive and may not guarantee success. The sheer volume of information can also be overwhelming for beginners, making it challenging to filter out reliable sources from the noise. Reputable brokers often provide educational resources as part of their services, but it’s crucial to critically evaluate the information’s objectivity and potential bias.

Options Trading Educational Resources

Compared to forex, options trading educational resources are somewhat more specialized. While general finance websites and books cover options, dedicated resources focusing on options strategies and risk management are often more advanced and require a stronger foundation in financial markets. Understanding options pricing models, Greeks, and various strategies requires a higher level of mathematical and financial literacy. Many educational resources focus on specific options strategies, like covered calls or straddles, requiring traders to piece together a comprehensive understanding from multiple sources. Again, quality and cost vary considerably, with some high-quality resources requiring significant financial investment.

Typical Learning Curve Comparison

The learning curve for forex is generally considered less steep initially. The basic concepts of currency pairs, charting, and technical analysis are relatively easier to grasp than the complexities of options pricing and strategies. However, mastering forex trading, including risk management and consistent profitability, requires years of experience and continuous learning. Options trading presents a steeper initial learning curve. Understanding options contracts, pricing models (like the Black-Scholes model), and the various Greeks (delta, gamma, theta, vega) requires a strong mathematical and financial background. Developing effective options trading strategies and managing risk effectively requires considerable time and effort. Many traders find options trading more challenging and riskier than forex trading, particularly in the beginning.

Importance of Continuous Learning and Skill Development

In both forex and options trading, continuous learning is not merely beneficial; it’s essential for long-term success. Markets are dynamic; new strategies emerge, economic conditions shift, and technological advancements influence trading tools and techniques. Staying abreast of these changes requires a commitment to ongoing education. This includes regularly reviewing market analyses, researching new trading strategies, refining risk management techniques, and adapting to evolving market conditions. Furthermore, continuous learning fosters adaptability, resilience, and the ability to learn from both successes and failures, crucial elements for navigating the unpredictable nature of financial markets. For example, a trader who relies solely on a single strategy may find their approach obsolete if market conditions change, highlighting the need for continuous adaptation and learning.

Technological Aspects and Platforms

Navigating the worlds of forex and options trading requires more than just market savvy; it demands a deep understanding of the technological landscape. The platforms and tools you use directly impact your trading efficiency, speed, and ultimately, your profitability. Choosing the right technology is as crucial as developing a solid trading strategy.

The technological infrastructure underpinning both forex and options trading has evolved significantly, offering sophisticated platforms packed with features designed to streamline the trading process. These range from simple, browser-based platforms suitable for beginners to highly customizable, professional-grade platforms offering advanced charting, algorithmic trading capabilities, and real-time data feeds. The key differences lie in the specific features and the level of sophistication offered, catering to diverse trader needs and experience levels.

Forex Trading Platforms

Forex trading platforms are typically characterized by their speed, real-time data accuracy, and a wide range of charting tools. Many platforms offer advanced order types, allowing traders to set precise entry and exit points, manage risk effectively, and automate trading strategies. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, each offering slightly different features and user interfaces. MT4 and MT5, for instance, are known for their extensive charting capabilities and the availability of expert advisors (EAs), which are automated trading programs. cTrader, on the other hand, focuses on speed and low latency, making it popular among scalpers and high-frequency traders. The choice often depends on individual trading styles and preferences.

Options Trading Platforms

Options trading platforms often integrate directly with brokerage accounts, providing access to real-time quotes, option chains, and advanced analytics tools. These platforms frequently incorporate option pricing models, allowing traders to calculate theoretical values and assess potential risks and rewards. Many platforms offer sophisticated charting capabilities, including the ability to overlay option Greeks (delta, gamma, theta, vega) onto price charts, providing a more comprehensive view of the market dynamics. Interactive Brokers’ Trader Workstation (TWS) and thinkorswim are examples of popular platforms that cater to options traders with their advanced features and extensive analytical tools. The complexity of options trading often necessitates a platform that can handle the nuances of option contracts and provide the necessary analytical tools for effective risk management.

Comparison of User-Friendliness and Functionality

While both forex and options platforms offer a range of features, the level of user-friendliness and functionality can vary significantly. Beginner-friendly platforms typically prioritize ease of navigation and intuitive interfaces, focusing on essential trading tools. More advanced platforms, aimed at experienced traders, may offer a steeper learning curve but provide greater customization and access to advanced analytical tools. The ideal platform depends on the trader’s experience level, trading style, and specific needs. For example, a beginner might find a platform like MT4’s simpler interface easier to navigate than the more complex TWS platform preferred by experienced options traders.

Importance of Reliable Technology and Data Feeds

Reliable technology and accurate, real-time data feeds are paramount in both forex and options trading. Delays or inaccuracies in data can lead to missed opportunities or, worse, significant losses. A robust platform with a reliable connection to a reputable data provider is crucial for making informed trading decisions. In fast-moving markets, even milliseconds of delay can be detrimental. For instance, a sudden news event impacting a currency pair could trigger rapid price movements, and a trader relying on delayed data could miss the opportunity to capitalize on the change or, conversely, could be caught off guard by an unexpected loss. The reliability of the platform and the quality of the data feed directly impact the trader’s ability to execute trades effectively and manage risk appropriately.

Closure

So, forex or options? The answer, ultimately, hinges on your individual circumstances. Forex trading offers a vast, liquid market with potentially lower barriers to entry, but higher leverage means higher risk. Options trading, on the other hand, provides a powerful toolkit for managing risk and generating income, but demands a deeper understanding of complex strategies. No matter your choice, thorough research, continuous learning, and a well-defined risk management plan are your keys to success in this thrilling, ever-evolving world of trading.