Futures trading vs forex: Two titans clashing in the world of finance. Both offer the thrill of potential high returns, but each boasts a unique landscape of risks, rewards, and regulatory hurdles. Understanding the core differences – from market accessibility and contract specifications to leverage and risk management – is crucial for navigating these complex yet lucrative markets. This deep dive will equip you with the knowledge to choose your battlefield wisely.

Whether you’re a seasoned trader or just starting your financial journey, grasping the nuances of futures and forex trading is paramount. We’ll dissect the intricacies of each market, comparing their accessibility, liquidity, and the tools available to manage risk. We’ll also explore the different trading strategies applicable to each, helping you determine which platform aligns best with your trading style and risk tolerance.

Market Accessibility and Liquidity

Futures and forex markets, while both offering opportunities for substantial profit, differ significantly in their accessibility and liquidity. Understanding these differences is crucial for traders of all levels, from retail investors dipping their toes into the market to institutional giants managing billions. This section will delve into the specifics of market access, trading hours, and liquidity, providing a clearer picture of the nuances between these two powerful trading arenas.

Market Accessibility for Different Trader Types

The accessibility of futures and forex markets varies considerably depending on the trader’s type and resources. Institutional investors, with their vast capital and sophisticated trading infrastructure, enjoy seamless access to both markets. They can leverage advanced trading platforms, utilize high-frequency trading strategies, and access prime brokerage services offering preferential trading conditions. Retail traders, however, face a more complex landscape. Forex markets are generally more accessible to retail traders, with numerous online brokers offering relatively low minimum deposit requirements and user-friendly platforms. Access to futures markets, on the other hand, often requires a higher minimum account balance and a more in-depth understanding of the underlying contracts. This is largely due to the higher leverage and risk associated with futures trading. Furthermore, certain futures contracts may have stricter regulatory requirements or be available only through specific brokers.

Trading Hours and Liquidity Differences

Forex markets operate 24 hours a day, five days a week, due to the global nature of currency trading. This continuous trading provides consistent liquidity, meaning traders can readily buy or sell currencies at any time within the trading window. Futures markets, conversely, have specific trading hours determined by the exchange on which the contract is listed. This means liquidity can fluctuate significantly depending on the time of day and the specific contract being traded. While major futures contracts generally enjoy high liquidity during their core trading hours, liquidity can be thin outside of these periods. This can result in wider spreads and potentially less favorable execution prices for traders.

Examples of Major Markets and Trading Volumes

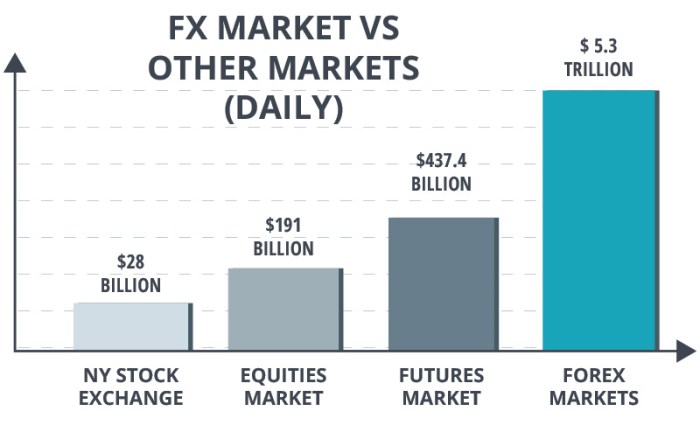

The forex market boasts an average daily trading volume exceeding $6 trillion, dwarfing the volume of most individual futures markets. Major currency pairs like EUR/USD, USD/JPY, and GBP/USD account for a significant portion of this volume. On the futures side, markets like the CME Group (Chicago Mercantile Exchange) and the ICE Futures (Intercontinental Exchange) handle vast trading volumes across various commodities, indices, and interest rates. For instance, the E-mini S&P 500 futures contract (ES) trades billions of dollars worth of contracts daily. However, even the most liquid futures contracts generally have significantly lower daily trading volumes compared to the forex market as a whole.

Comparison of Average Daily Trading Volumes

The following table illustrates the average daily trading volume for several major currency pairs and commodity futures contracts. Note that these figures can fluctuate significantly based on market conditions and time of year.

| Asset | Average Daily Trading Volume (Approximate) | Exchange | Notes |

|---|---|---|---|

| EUR/USD | $2 Trillion+ | Global OTC Market | Highly liquid, major currency pair |

| USD/JPY | $1 Trillion+ | Global OTC Market | Highly liquid, major currency pair |

| E-mini S&P 500 (ES) | Billions of contracts | CME Group | Highly liquid, major index future |

| Crude Oil (CL) | Millions of barrels | NYMEX (CME Group) | Highly liquid, major commodity future |

| Gold (GC) | Millions of ounces | COMEX (CME Group) | Highly liquid, major precious metal future |

Contract Specifications and Trading Instruments

Futures and forex trading, while both offering avenues for speculating on price movements, differ significantly in how contracts are structured and the instruments used. Futures contracts are standardized, offering a degree of predictability, while forex trading enjoys greater flexibility, allowing for tailored strategies. Understanding these differences is crucial for navigating the complexities of each market.

Futures contracts, unlike forex, are highly standardized agreements to buy or sell a specific asset at a predetermined price on a future date. This standardization simplifies trading, ensuring consistent terms across all contracts of the same type. Forex, on the other hand, offers a much more flexible trading environment, allowing traders to customize aspects like leverage, trade size, and even the specific time of execution.

Types of Futures Contracts

The futures market offers a diverse range of contracts, catering to various investment strategies and risk appetites. Index futures track the performance of a specific stock market index, allowing traders to gain exposure to the overall market movement. Commodity futures cover a wide array of raw materials, from agricultural products like corn and soybeans to precious metals like gold and silver and energy products such as crude oil and natural gas. These contracts provide investors with a way to hedge against price fluctuations in these underlying commodities. Currency futures, while related to forex, are distinct, offering standardized contracts for trading specific currency pairs on a set date.

Examples of Common Forex Pairs

The forex market primarily deals in currency pairs. A currency pair represents the exchange rate between two currencies, such as EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), USD/JPY (US Dollar/Japanese Yen), and USD/CHF (US Dollar/Swiss Franc). The first currency in the pair is called the base currency, and the second is the quote currency. Each pair exhibits unique characteristics based on the economic and political factors influencing the respective currencies. For example, EUR/USD is often considered a highly liquid and volatile pair, reflecting the economic power of the Eurozone and the United States. USD/JPY is known for its sensitivity to interest rate differentials between the US and Japan.

Key Differences in Contract Specifications, Futures trading vs forex

Let’s compare the specifications of a common futures contract, the E-mini S&P 500 (ES), with a major forex pair, the EUR/USD.

- Contract Size: ES contracts have a contract size of 50 times the index value. EUR/USD trades in lots, typically 100,000 units of the base currency (EUR).

- Tick Size: The minimum price movement for the ES is 0.25 points, while for EUR/USD it is typically 0.0001 (a pip).

- Trading Hours: ES trading hours are generally limited to specific exchange hours. EUR/USD trading is available virtually 24/5, spanning different global markets.

- Expiration Date: ES contracts have specific expiration dates, requiring traders to either close their positions before expiration or take delivery/settlement of the underlying index. EUR/USD positions can be held indefinitely.

- Standardization: ES contracts are highly standardized in terms of size, delivery, and settlement. EUR/USD trades offer more flexibility in trade size and leverage.

Leverage and Margin Requirements

Futures trading and forex trading, while both offering opportunities for substantial profit, share a common thread: leverage. This powerful tool amplifies both gains and losses, making a deep understanding of leverage and margin requirements crucial for success in either market. Let’s dive into how these aspects differ and the inherent risks involved.

Leverage essentially allows traders to control a larger position than their initial capital would normally permit. In both futures and forex, this is achieved by putting up a smaller percentage of the total trade value as a margin deposit. However, the specifics of leverage and margin vary significantly between these two markets.

Enhance your insight with the methods and methods of leverage trading forex.

Leverage in Futures and Forex Trading

Futures contracts typically offer fixed leverage ratios, often expressed as a multiple of the contract’s value. For instance, a leverage ratio of 10:1 means a trader only needs to deposit 10% of the contract’s value as margin. Forex, on the other hand, offers variable leverage, often ranging from 1:1 to as high as 1:500 (though regulations are increasingly limiting maximum leverage). The exact leverage available depends on the broker, the trader’s experience level, and regulatory constraints. This variability introduces an extra layer of complexity to risk management in forex.

Margin Requirements and Risk Management

Margin requirements represent the amount of capital a trader must maintain in their account to support open positions. In futures, margin requirements are set by exchanges and are relatively standardized for each contract. Failure to maintain the minimum margin level triggers a margin call, requiring the trader to deposit additional funds to meet the requirement. In forex, margin requirements are determined by the broker and can fluctuate based on market volatility and the specific currency pair traded. Similar to futures, a margin call in forex demands immediate action from the trader to replenish their margin account. Effective risk management strategies in both markets necessitate a careful calculation of position sizing, considering both the leverage used and the potential for adverse price movements. Stop-loss orders are essential tools to limit potential losses.

Risks Associated with High Leverage

The allure of high leverage lies in its potential to magnify profits. However, this inherent amplification also significantly increases the risk of substantial losses. In both futures and forex, a small adverse price movement can quickly wipe out a trader’s account when high leverage is employed. For example, a 1% adverse movement in a highly leveraged forex trade could result in a 10% or even greater loss of the trader’s capital. Similarly, a relatively small price drop in a futures contract can lead to a margin call and potentially the liquidation of the position if the trader fails to meet the call. Therefore, responsible leverage usage is paramount, requiring careful consideration of risk tolerance and the implementation of robust risk management techniques.

Margin Calls and Their Effects

A margin call signals that a trader’s account equity has fallen below the required margin level. In both futures and forex, this necessitates immediate action. The trader must either deposit additional funds to meet the margin requirement or reduce their open positions to bring their account equity back above the minimum level. Failure to respond to a margin call can lead to the forced liquidation of positions by the broker, resulting in significant losses. The speed at which a margin call occurs and the subsequent liquidation can be particularly swift in highly volatile markets, leaving little time for the trader to react. The severity of the outcome depends on the size of the shortfall, the speed of the market movement, and the trader’s ability to respond effectively.

Risk Management and Hedging Strategies

Navigating the volatile worlds of futures and forex trading requires a robust risk management plan. Without it, even the most promising trades can quickly turn sour. This section explores key risk mitigation techniques and hedging strategies applicable to both markets, emphasizing the crucial role of proactive planning in preserving capital and achieving consistent profitability.

Stop-Loss Orders and Other Risk Mitigation Strategies

Stop-loss orders are a cornerstone of risk management in both futures and forex trading. They automatically close a position when the price reaches a predetermined level, limiting potential losses. In futures, this might involve setting a stop-loss order at a specific price per contract, while in forex, it’s typically expressed as a pip value relative to the entry price. Beyond stop-loss orders, other crucial strategies include position sizing (carefully determining the amount of capital allocated to each trade to avoid overexposure), diversification (spreading investments across multiple assets to reduce the impact of any single loss), and thorough market analysis (understanding market trends, news events, and economic indicators to make informed trading decisions). Effective risk management also necessitates adhering to a well-defined trading plan and maintaining emotional discipline to avoid impulsive decisions driven by fear or greed. For example, a trader might allocate only 2% of their capital to any single futures trade and diversify across different commodities to mitigate the risk of significant losses.

Hedging with Futures Contracts

Futures contracts offer powerful hedging capabilities for businesses exposed to price fluctuations in commodities or financial instruments. For instance, an airline anticipating rising jet fuel prices can purchase futures contracts to lock in a future price, protecting its profit margins. Similarly, a farmer expecting to sell their harvest in the future can use futures contracts to secure a minimum price, safeguarding against potential price drops. The effectiveness of hedging depends on several factors, including the accuracy of price forecasts and the correlation between the hedged asset and the futures contract. For example, a wheat farmer might buy wheat futures contracts to protect against a potential fall in wheat prices between harvest and sale. This locks in a price, protecting against price fluctuations.

Hedging Strategies Using Forex for Businesses with International Operations

Businesses with international operations frequently use forex hedging to manage currency risk. Suppose a US company is expecting a large payment in Euros. To mitigate the risk of the Euro depreciating against the dollar, the company could buy Euro futures contracts or utilize a forward contract to lock in an exchange rate, ensuring they receive the equivalent dollar amount they anticipated. Conversely, if a European company is importing goods from the US, they might use forex futures or options to hedge against the dollar strengthening against the Euro. This ensures that their costs remain predictable, regardless of currency fluctuations. These strategies are crucial for maintaining financial stability and accurate budgeting in a globalized economy. For instance, a company importing goods from the UK could use a currency swap to exchange a fixed amount of GBP for USD at a predetermined rate over a specific period.

Trading Strategies and Technical Analysis

Futures and forex trading, while sharing some similarities, present unique challenges and opportunities for traders employing various technical analysis tools and strategies. Understanding these nuances is crucial for success in either market. The application of technical analysis, the choice of trading strategy, and even the influence of fundamental analysis all play a significant role in determining profitability.

Technical Analysis Tool Applicability

Technical analysis relies on historical price and volume data to predict future price movements. Both futures and forex markets readily provide this data, making technical analysis a widely used tool in both. However, the specific indicators and their effectiveness can vary. For instance, moving averages, relative strength index (RSI), and candlestick patterns are commonly used in both markets. However, the interpretation of these indicators might need adjustments based on the specific characteristics of each market, such as the volatility differences between a highly liquid forex pair like EUR/USD and a less liquid agricultural futures contract. The timeframes used for analysis also differ, with shorter timeframes (e.g., 5-minute charts) more common in forex day trading, while longer timeframes (e.g., daily or weekly charts) might be preferred for swing trading in futures.

Trading Strategy Effectiveness

Day trading, characterized by holding positions for short periods, is prevalent in both markets. However, forex offers greater liquidity and accessibility for frequent trading, making it a more popular choice for day traders. Swing trading, involving holding positions for several days or weeks, is also applicable to both markets. The choice between day trading and swing trading depends on individual risk tolerance, time commitment, and trading style. Swing trading in futures might benefit from longer-term market trends, while forex swing trading could leverage on currency pair-specific events or economic news. Scalping, another short-term strategy, is particularly popular in forex due to the high liquidity and tight spreads. This strategy, however, demands intense focus and rapid decision-making.

Fundamental Analysis Impact

Fundamental analysis considers macroeconomic factors, economic indicators, and geopolitical events to forecast price movements. In forex, fundamental analysis plays a significant role, as currency values are directly influenced by factors like interest rate differentials, inflation rates, and political stability. For example, a surprise interest rate hike by a central bank can significantly impact the value of its currency. In futures, fundamental analysis is also important, but its impact can be more nuanced. For instance, weather patterns significantly influence agricultural futures prices, while global demand affects energy futures. Therefore, while both markets benefit from incorporating fundamental analysis, its application and weight in decision-making differ.

Typical Trading Process Flowchart

A flowchart depicting the typical trading process for both futures and forex traders would highlight the common steps involved, though specific details might vary. For both, the process generally starts with market analysis (technical and fundamental), followed by identifying trading opportunities. Then comes order placement (buy or sell), position management (monitoring and adjusting positions based on market movements), and finally, order closure (exiting the trade based on pre-defined targets or stop-loss orders). The key difference lies in the specific tools and platforms used. Forex traders might use MetaTrader 4 or 5, while futures traders often use specialized platforms provided by brokerage firms. The speed of execution and the frequency of trading would also differ, with forex traders potentially executing more trades within a shorter period compared to futures traders.

Fees and Commissions

Navigating the world of futures and forex trading involves understanding the often-complex landscape of fees and commissions. These costs can significantly impact your profitability, so it’s crucial to factor them into your trading strategy from the outset. While seemingly minor, the cumulative effect of these fees can be substantial over time, especially for frequent traders.

Brokerage Fees

Brokerage fees represent the core cost of accessing trading platforms and executing trades. These fees vary significantly depending on the broker, the type of account (e.g., individual, institutional), and the volume of trading activity. Discount brokers often offer lower fees per trade, while full-service brokers may charge higher fees but provide additional services like research and analysis. For futures trading, brokerage fees are usually charged per contract traded, while forex brokers often use a spread-based pricing model or charge commissions per lot.

Exchange Fees

In addition to brokerage fees, futures contracts also incur exchange fees. These fees are levied by the exchange where the contract is traded and are typically a small percentage of the contract value or a fixed fee per contract. Forex trading, on the other hand, typically doesn’t involve direct exchange fees in the same way. The cost is often incorporated into the spread.

Other Fees

Both futures and forex trading can involve other fees depending on your trading practices. These might include inactivity fees (charged by some brokers if your account remains inactive for a period), overnight financing fees (for holding positions open overnight), and wire transfer fees for depositing or withdrawing funds. Regulatory fees might also apply, depending on your jurisdiction.

Typical Fee Structures

A typical futures brokerage might charge $5-$20 per contract traded, plus exchange fees ranging from $1 to $5 per contract. A forex broker might use a spread of 1-3 pips (points), meaning the difference between the bid and ask price is 1-3 pips. For example, a spread of 2 pips on a EUR/USD trade of 100,000 units (1 standard lot) would be equivalent to a cost of $2. Some forex brokers also charge commissions, which can range from a few dollars to tens of dollars per lot.

Cost Comparison: Futures vs. Forex

The following table illustrates a cost comparison of trading a specific contract in both markets. Note that these are illustrative examples and actual costs can vary significantly based on market conditions, broker selection, and contract specifications.

| Fee Type | Futures Contract (e.g., E-mini S&P 500) | Forex Trade (e.g., EUR/USD, 1 Standard Lot) |

|---|---|---|

| Brokerage Fee | $10 per contract | $5 commission + spread (assume 2 pips = $2) |

| Exchange Fee | $2 per contract | $0 |

| Overnight Financing Fee (Example) | $1 per contract (overnight) | Varies depending on the interest rate differential and position size |

| Total Estimated Cost | $13 per contract (overnight) | $7 per trade |

Regulatory Environment and Compliance: Futures Trading Vs Forex

Navigating the worlds of futures and forex trading requires a keen understanding of the regulatory landscape. These markets, while both involving the buying and selling of assets for future delivery, operate under distinct regulatory frameworks, impacting trader responsibilities and operational practices. Ignoring these regulations can lead to significant legal and financial repercussions.

The regulatory environments for futures and forex trading differ significantly, reflecting the inherent differences in the markets themselves. Futures markets, characterized by standardized contracts traded on exchanges, tend to be more heavily regulated to ensure market integrity and protect investors. Forex, on the other hand, being a decentralized over-the-counter (OTC) market, faces a more fragmented and complex regulatory picture, varying considerably across jurisdictions.

Regulatory Bodies and Their Oversight

The regulatory bodies overseeing futures and forex markets vary by region. In the United States, the Commodity Futures Trading Commission (CFTC) primarily regulates futures trading, while forex regulation is shared between the CFTC (for certain forex products) and the Securities and Exchange Commission (SEC) (for forex products offered as securities), and state-level regulators for smaller firms. The National Futures Association (NFA) acts as a self-regulatory organization (SRO) for futures brokers. In the European Union, the European Securities and Markets Authority (ESMA) plays a significant role in overseeing both markets, although specific national authorities retain considerable regulatory power. Other regions have their own dedicated regulatory bodies with varying degrees of authority and oversight. These differences in regulatory structure lead to variations in compliance requirements and enforcement actions.

Compliance Implications for Traders

Compliance with regulations is paramount for traders in both futures and forex markets. For futures traders, this involves adhering to exchange rules, maintaining accurate records, and meeting margin requirements. Failure to comply can result in fines, trading suspensions, or even legal action. Forex traders face similar, though often more complex, compliance challenges. Depending on their location and the entities they trade with, they may need to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, maintain detailed transaction records, and report suspicious activity. The regulatory burden for forex traders can be particularly significant for those operating in multiple jurisdictions or engaging in high-volume trading.

Reporting Requirements

Reporting requirements differ substantially between futures and forex markets. Futures transactions are typically reported to exchanges and regulatory bodies in a standardized manner, often through automated systems. This facilitates market surveillance and transparency. Forex reporting is less standardized, with requirements varying significantly depending on the jurisdiction, the trader’s status (individual or institutional), and the volume of transactions. Some jurisdictions may require regular reporting of trading activity, while others focus on suspicious transaction reporting. This lack of uniformity can complicate compliance for traders operating across multiple jurisdictions. For example, a US-based trader engaging in forex transactions with a non-US entity may need to comply with reporting requirements in both jurisdictions, potentially facing conflicting or overlapping obligations.

Concluding Remarks

So, futures trading or forex? The “better” market depends entirely on your individual goals, risk appetite, and trading style. Futures offer standardized contracts and hedging opportunities, while forex provides unparalleled liquidity and 24/5 access. By understanding the key differences in leverage, margin requirements, and regulatory landscapes, you can make an informed decision and confidently navigate the exciting – and sometimes turbulent – waters of these financial markets. Remember, thorough research and a well-defined trading plan are your best allies in this high-stakes game.

Explore the different advantages of forex vs day trading that can change the way you view this issue.