Forex trading how to get started? Think Wall Street, but from your couch. It’s the wild, wild west of finance, where trillions of dollars change hands daily based on fluctuating currency values. Sounds daunting? Maybe a little. But with the right knowledge and a sprinkle of caution, conquering the forex market is within reach. This guide will walk you through the essentials, from understanding basic terms like pips and leverage to crafting a winning trading strategy.

We’ll demystify the world of forex brokers, helping you choose a platform that suits your style and risk tolerance. We’ll dive into both technical and fundamental analysis, giving you the tools to predict market movements. And most importantly, we’ll stress the crucial role of risk management – because even the most seasoned traders know that losses are part of the game. Get ready to unlock the secrets of forex trading and potentially build a profitable career.

Understanding Forex Trading Basics

Forex trading, or foreign exchange trading, might sound intimidating, but it’s essentially buying and selling currencies to profit from their fluctuating values. Think of it like any other market, but instead of stocks or bonds, you’re trading currencies. Understanding the basics is key before diving in, and this section will break down the essentials for you.

Forex trading operates on a decentralized, global market, meaning there’s no single exchange. Transactions happen electronically between banks, institutions, and individuals 24/5. This constant activity creates opportunities, but also demands constant vigilance.

Explore the different advantages of trading de divisas forex that can change the way you view this issue.

Currency Pairs

Currency pairs are the foundation of forex trading. You always buy one currency while simultaneously selling another. These are represented as three-letter codes, such as EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), or USD/JPY (US Dollar/Japanese Yen). The first currency is the “base currency,” and the second is the “quote currency.” The exchange rate shows how much of the quote currency you need to buy one unit of the base currency. For example, if EUR/USD is 1.10, it means one Euro costs 1.10 US Dollars.

Pips

A pip (point in percentage) is the smallest price movement in a currency pair. For most pairs, a pip is the fourth decimal place. So, a move from 1.1000 to 1.1001 is one pip. Understanding pips is crucial for calculating profits and losses.

Leverage

Leverage is the ability to control a larger position with a smaller amount of capital. For example, a 1:100 leverage means you can control $100,000 worth of currency with only $1,000 of your own money. Leverage amplifies both profits and losses, making it a double-edged sword. It’s essential to understand leverage before using it, as it can lead to significant losses if not managed carefully.

Forex Order Types

Different order types allow you to execute trades based on your strategy and risk tolerance.

Choosing the right order type is critical for effective forex trading. Understanding the nuances of each type ensures your trades align with your market expectations and risk management plan.

| Order Type | Description | Example | Risk/Reward |

|---|---|---|---|

| Market Order | Executed immediately at the current market price. | Buy EUR/USD at the current market price. | High speed execution, but price may be less favorable. |

| Limit Order | Executed only when the price reaches a specified level. | Buy EUR/USD only if the price drops to 1.0900. | Potential for better price, but may not be executed if the price doesn’t reach the limit. |

| Stop Order | Executed when the price reaches a specified level (usually to limit losses). | Sell EUR/USD if the price rises to 1.1100. | Protects against significant losses, but may trigger prematurely. |

Opening a Demo Trading Account

A demo account is a risk-free environment to practice forex trading. Most brokers offer demo accounts with virtual money, allowing you to learn the ropes without risking real capital.

- Choose a Broker: Research and select a reputable forex broker that offers a demo account.

- Registration: Complete the broker’s registration process, usually requiring an email address and potentially other personal information.

- Account Setup: Follow the broker’s instructions to set up your demo account. This may involve choosing a platform and account type.

- Practice Trading: Use the demo account to practice trading different currency pairs and order types. Experiment with various strategies and get comfortable with the platform’s interface.

Forex Broker Account Types

Different brokers offer various account types with varying features and minimum deposit requirements.

Choosing the right account type depends on your trading experience, capital, and trading style. Consider the features and costs associated with each type before making a decision.

Explore the different advantages of best indicator for forex trading that can change the way you view this issue.

| Account Type | Minimum Deposit | Spreads | Leverage |

|---|---|---|---|

| Standard Account | $100 – $500 | Variable, typically higher | 1:50 – 1:200 |

| Mini Account | $50 – $100 | Variable, typically higher | 1:50 – 1:200 |

| Micro Account | $10 – $50 | Variable, typically higher | 1:100 – 1:500 |

| ECN/STP Account | $500+ | Raw spreads, typically lower | 1:50 – 1:200 |

Choosing a Forex Broker

So, you’ve grasped the basics of forex trading. Now comes the crucial step: selecting the right broker. This isn’t just about picking the first flashy ad you see; it’s about finding a partner that aligns with your trading style, risk tolerance, and long-term goals. The wrong broker can severely impact your trading experience, from frustrating platform glitches to questionable regulatory oversight. Choosing wisely is paramount to your success.

Broker Regulation and Security

Choosing a regulated broker is non-negotiable. Regulation provides a layer of protection against fraudulent activities and ensures the broker adheres to certain standards. Look for brokers regulated by reputable bodies like the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, or the Australian Securities and Investments Commission (ASIC) in Australia. These regulatory bodies oversee brokers’ operations, ensuring client funds are segregated and protected, and that the broker operates transparently. Security measures, such as two-factor authentication and encryption, are also vital for protecting your account and personal information from unauthorized access. A reputable broker will clearly display their regulatory information on their website. Ignoring this step can expose you to significant financial risk.

Comparing Broker Features: Spreads, Platforms, and More

Forex brokers differ significantly in their offerings. Spreads, the difference between the bid and ask price, directly impact your profitability. Lower spreads are generally preferred, but be wary of brokers offering unrealistically low spreads – this could be a red flag. Trading platforms are equally crucial. Some brokers offer proprietary platforms, while others integrate with popular MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Consider factors like user-friendliness, charting tools, and the availability of automated trading features (Expert Advisors or EAs) when evaluating platforms. Beyond these, examine account types (standard, ECN, etc.), leverage options, educational resources, and customer support responsiveness. Each broker will have a unique combination of features, and the best choice depends on your individual needs.

Broker Types: Market Makers vs. ECNs

| Feature | Market Maker | ECN (Electronic Communication Network) |

|---|---|---|

| Spread | Generally wider, as the broker acts as the counterparty. | Typically tighter, as trades are executed directly between other traders. |

| Execution | Order execution is faster, often instantaneous. | Order execution speed depends on market liquidity. Can be slightly slower, but offers more transparency. |

| Transparency | Less transparent; you don’t see the other side of the trade. | More transparent; you see the order book and other traders’ orders. |

| Cost | Potentially higher due to wider spreads, but generally simpler fee structure. | Potentially lower due to tighter spreads, but may involve commissions. |

Choosing a Forex Broker: A Checklist

Before signing up, meticulously review the following:

- Regulation: Is the broker regulated by a reputable financial authority?

- Spreads and Commissions: What are the typical spreads and any associated commissions?

- Trading Platform: Is the platform user-friendly and equipped with the tools you need?

- Account Types: What types of accounts are available, and what are their requirements?

- Leverage: What leverage levels are offered, and are they appropriate for your risk tolerance?

- Security Measures: Does the broker employ robust security measures to protect client funds and data?

- Customer Support: How responsive and helpful is their customer support team?

- Educational Resources: Does the broker provide educational materials to help you learn and improve your trading skills?

Remember, thorough research is key. Don’t rush into choosing a broker. Take your time, compare different options, and choose the one that best fits your individual trading needs and risk profile.

Developing a Trading Plan

So, you’ve grasped the basics of Forex and chosen your broker. Now comes the crucial part: creating a solid trading plan. Think of it as your roadmap to navigating the often turbulent waters of the currency market. Without a well-defined plan, you’re essentially sailing blind, susceptible to emotional trading and potentially significant losses. A comprehensive plan provides structure, discipline, and a clear path to achieving your trading goals.

A trading plan is more than just a collection of ideas; it’s a detailed, personalized strategy outlining your trading approach, risk management techniques, and overall financial goals. It acts as your guide, helping you make consistent, informed decisions, even during periods of market volatility. Consistency is key in Forex, and a solid plan ensures you remain consistent with your approach.

Key Components of a Comprehensive Trading Plan

A robust trading plan encompasses several critical elements. Firstly, it should clearly define your trading goals – are you aiming for long-term growth or short-term profits? Secondly, it needs to specify your trading style, whether you prefer scalping, day trading, or swing trading (we’ll explore these strategies below). Thirdly, and perhaps most importantly, it must incorporate a comprehensive risk management strategy, outlining your acceptable risk per trade and overall account risk. Finally, the plan should detail your entry and exit strategies, including specific technical indicators or fundamental analysis techniques you’ll use to identify trading opportunities and determine when to close positions.

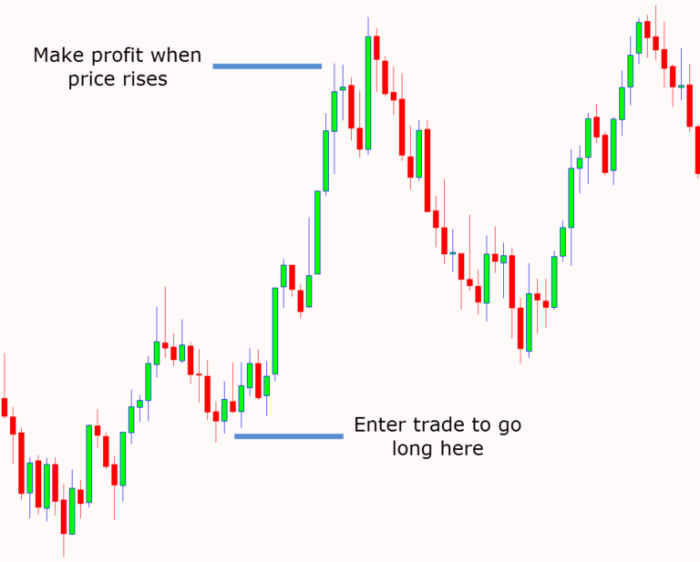

Trading Strategies: Scalping, Day Trading, and Swing Trading

Different trading strategies cater to different time horizons and risk tolerances. Scalping involves holding positions for very short periods, often just seconds or minutes, aiming for small, frequent profits. Day trading, as the name suggests, sees traders opening and closing positions within a single trading day, aiming for slightly larger profits than scalpers. Swing trading, on the other hand, involves holding positions for several days or even weeks, capitalizing on larger price swings.

Scalping requires lightning-fast reflexes and a deep understanding of market microstructure. Day trading demands intense focus and discipline throughout the trading day. Swing trading, while less demanding in terms of time commitment, requires patience and the ability to withstand short-term market fluctuations. The choice of strategy depends on your personality, risk tolerance, and available time.

Creating a Personal Trading Journal

Maintaining a detailed trading journal is essential for tracking your performance, identifying areas for improvement, and refining your trading strategy. Here’s a step-by-step process:

1. Choose a Journal Format: You can use a spreadsheet, a dedicated trading journal app, or even a simple notebook.

2. Record Each Trade: Include the date, time, currency pair, entry price, exit price, profit/loss, reason for entry, and reason for exit.

3. Analyze Your Trades: Regularly review your journal to identify patterns in your successes and failures. What strategies worked well? Where did you make mistakes?

4. Adapt Your Strategy: Based on your analysis, adjust your trading plan to improve your performance.

Consistent journaling provides invaluable insights into your trading behavior and allows for continuous improvement.

Calculating Position Size Based on Risk Tolerance

Determining the appropriate position size is crucial for effective risk management. A common approach is to limit your risk per trade to a small percentage of your total account balance, typically 1% to 2%. This prevents significant losses from wiping out your account.

For example, if you have a $10,000 account and your risk tolerance is 1%, your maximum loss per trade should be $100. You can calculate your position size using the following formula:

Position Size = (Account Balance x Risk Percentage) / Stop Loss in Pips

Where “Stop Loss in Pips” is the distance in pips between your entry price and your predetermined stop-loss order. Let’s say your stop loss is 20 pips. Then, your position size would be:

Position Size = ($10,000 x 0.01) / 20 = 5 units

This calculation ensures you won’t lose more than your predetermined risk percentage, even if the trade goes against you. Remember, this is a simplified example; factors like leverage and the specific currency pair’s pip value can influence the actual position size calculation. Always use a position size calculator provided by your broker to ensure accuracy.

Mastering Technical Analysis

Technical analysis is the art of forecasting future price movements by studying past market data, specifically price and volume. It’s a crucial skill for any Forex trader, providing valuable insights that can complement fundamental analysis and improve decision-making. Unlike fundamental analysis which focuses on economic indicators, technical analysis focuses on chart patterns and indicators to identify potential trading opportunities.

Common Technical Indicators

Technical indicators are mathematical calculations applied to price and volume data to generate signals that suggest potential changes in market trends. Understanding and interpreting these signals is key to successful technical analysis. Three of the most commonly used indicators are Moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). Moving averages smooth out price fluctuations, helping to identify trends. The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. The MACD shows the relationship between two moving averages, providing signals of momentum changes.

Moving Averages

Moving averages calculate the average price over a specific period. Common types include simple moving averages (SMA), exponential moving averages (EMA), and weighted moving averages (WMA). SMAs give equal weight to each data point, while EMAs give more weight to recent data, making them more responsive to price changes. Traders often use multiple moving averages with different periods to identify support and resistance levels, trend direction, and potential buy/sell signals. For example, a crossover of a short-term moving average above a long-term moving average could be interpreted as a bullish signal.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100. Readings above 70 are generally considered overbought, suggesting a potential price reversal, while readings below 30 are considered oversold, suggesting a potential price bounce. However, it’s crucial to remember that RSI divergences (where the price makes a new high but the RSI fails to confirm) can also provide valuable trading signals. For instance, a bearish divergence where the price makes a new high, but the RSI makes a lower high, might indicate weakening bullish momentum.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two exponential moving averages. It consists of a MACD line (the difference between two EMAs) and a signal line (a moving average of the MACD line). Crossovers of the MACD line above the signal line can suggest bullish signals, while crossovers below the signal line can suggest bearish signals. MACD histograms, which represent the difference between the MACD and signal lines, can also provide additional insights into momentum. A widening histogram could indicate strengthening momentum in the prevailing trend.

Chart Patterns

Chart patterns are recurring formations on price charts that can help predict future price movements. Recognizing these patterns requires practice and experience, but they can provide valuable clues about potential trading opportunities.

Head and Shoulders Pattern

The head and shoulders pattern is a reversal pattern that often signals the end of an uptrend. It consists of three peaks: a central peak (the “head”) that is higher than the two peaks on either side (“shoulders”). A neckline connects the troughs between the peaks. A break below the neckline confirms the pattern and signals a potential downtrend.

Double Tops/Bottoms

Double tops and double bottoms are reversal patterns that resemble the letter “M” (double top) and “W” (double bottom). They indicate a potential change in trend. A break above the resistance level in a double bottom or below the support level in a double top confirms the pattern. For example, a successful break above the resistance level in a double bottom pattern might signal a potential uptrend.

Technical Indicators in Different Market Conditions

| Indicator | Uptrend | Downtrend | Sideways/Consolidation |

|---|---|---|---|

| Moving Averages | Higher highs and higher lows; short-term MA above long-term MA | Lower highs and lower lows; short-term MA below long-term MA | MA lines close together, little directional bias |

| RSI | Above 50, may reach overbought levels (70+) | Below 50, may reach oversold levels (30-) | Oscillating around 50 |

| MACD | Above zero line, positive divergence, histogram positive | Below zero line, negative divergence, histogram negative | Near zero line, crossing zero line frequently, histogram fluctuating around zero |

Candlestick Patterns

Candlestick patterns provide visual representations of price action over a specific period. Interpreting these patterns can reveal information about buyer and seller pressure, and potential trend reversals.

Fundamental Analysis in Forex

Forex trading isn’t just about charting patterns; it’s also about understanding the global economy. Fundamental analysis helps you predict currency movements by examining the economic and political factors influencing a country’s currency. By understanding these forces, you can make more informed trading decisions.

Economic news and global events are the driving forces behind currency fluctuations. Positive economic news generally strengthens a currency, while negative news weakens it. This is because investors are always looking for the best returns, and a strong economy signals higher potential profits. Conversely, economic instability makes a currency less attractive. Think of it like this: would you rather invest in a company with a stable profit record or one constantly facing losses? The same principle applies to national economies and their currencies.

Key Economic Indicators and Their Impact

Understanding key economic indicators is crucial for fundamental analysis. These indicators provide insights into a country’s economic health and can significantly impact its currency’s value. A consistent pattern of positive indicators usually boosts investor confidence, leading to higher demand and appreciation of the currency.

- Gross Domestic Product (GDP): GDP measures a country’s total economic output. A strong and consistently growing GDP indicates a healthy economy, often leading to currency appreciation. For example, a surprise increase in US GDP might strengthen the US dollar against other currencies because investors see increased potential for returns.

- Inflation: Inflation measures the rate at which prices for goods and services are increasing. High inflation erodes purchasing power and can weaken a currency. If a country experiences unexpectedly high inflation, its central bank might raise interest rates to combat it, which could potentially strengthen the currency in the short term but may also negatively impact economic growth.

- Interest Rates: Interest rates set by a country’s central bank influence borrowing costs and investment flows. Higher interest rates generally attract foreign investment, increasing demand for the currency and strengthening its value. For instance, if the European Central Bank (ECB) raises interest rates significantly, the Euro might appreciate against currencies with lower interest rates, as investors seek higher returns.

Political Events and Their Influence

Political stability and policy decisions significantly impact currency markets. Unexpected political events, such as elections, regime changes, or geopolitical tensions, can cause significant volatility.

For example, the unexpected Brexit vote in 2016 caused a sharp decline in the value of the British pound as investors reacted to the uncertainty surrounding the UK’s departure from the European Union. Similarly, major political shifts in a country, like a change in government or policy, can cause immediate and substantial currency fluctuations. Investors constantly assess the political risk associated with different countries, influencing their investment decisions and consequently, currency values.

Identifying Trading Opportunities Using Fundamental Analysis

Fundamental analysis allows you to identify potential trading opportunities by anticipating how economic and political factors will affect currency values. By analyzing economic data releases and geopolitical events, you can predict potential shifts in currency pairs.

For example, if you anticipate that a country’s central bank will raise interest rates, you might consider buying its currency in anticipation of appreciation. Conversely, if you foresee a significant negative economic event, you might consider shorting that country’s currency, expecting its value to decrease. Remember, however, that fundamental analysis is not foolproof, and unexpected events can always impact market movements. Combining fundamental analysis with technical analysis provides a more comprehensive approach to forex trading.

Risk Management and Money Management

Forex trading, while potentially lucrative, is inherently risky. Ignoring risk management is like sailing a yacht without a map – you might get lucky, but you’re far more likely to crash. Successful forex traders aren’t just lucky; they’re disciplined, employing robust strategies to protect their capital and maximize their chances of long-term profitability. This section explores crucial risk management and money management techniques to help you navigate the volatile waters of the forex market.

Risk management isn’t about avoiding losses entirely; it’s about controlling them. It’s about establishing a framework that allows you to take calculated risks, limiting potential damage while preserving your ability to trade another day. A well-defined risk management plan is the bedrock of successful forex trading, preventing emotional decisions that can wipe out your account.

Stop-Loss Orders and Position Sizing, Forex trading how to get started

Stop-loss orders are your safety net. They automatically close a trade when the price reaches a predetermined level, limiting your potential losses. Imagine you’re buying EUR/USD at 1.1000 and set a stop-loss at 1.0950. If the price drops to 1.0950, your trade will automatically close, preventing further losses. The crucial aspect here is choosing the right stop-loss level. It shouldn’t be too tight (limiting potential profits) or too loose (exposing you to excessive risk). Position sizing complements stop-losses. It determines how much capital you allocate to each trade. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. If your account is $10,000, a 1% risk means risking a maximum of $100 per trade. This ensures that even if a trade goes against you, you won’t suffer catastrophic losses.

Managing Emotions and Avoiding Impulsive Trading

The forex market is an emotional rollercoaster. Fear and greed are powerful forces that can lead to impulsive decisions and poor trading outcomes. A crucial element of successful trading is developing emotional discipline. This involves maintaining a detached, analytical approach, regardless of market fluctuations. Techniques like journaling your trades, regularly reviewing your trading plan, and taking breaks when feeling overwhelmed can help manage emotional biases. Sticking to your trading plan, even when facing temporary setbacks, is paramount. Avoid chasing quick wins or letting losses dictate your next move. Remember that consistent, disciplined trading is far more effective than chasing sporadic, high-risk opportunities.

Mitigating Emotional Biases in Forex Trading

Emotional biases are pervasive in trading. Confirmation bias (seeking out information that confirms pre-existing beliefs) and overconfidence (believing your skills are superior) are common pitfalls. To mitigate these biases, practice self-awareness. Regularly review your trading performance, identifying patterns in your decision-making and acknowledging your emotional responses. Seeking feedback from experienced traders or mentors can provide valuable external perspectives. Utilizing tools like a trading journal to document your trades and analyze your emotional state during trading can help identify triggers and patterns of impulsive behavior. Developing a pre-trade checklist to ensure you are adhering to your plan before executing any trades can help prevent emotional decisions.

Practicing and Refining Your Skills

Mastering forex trading isn’t a sprint; it’s a marathon. The theoretical knowledge you’ve gained needs practical application and consistent refinement to truly succeed. This section focuses on honing your skills and developing a sustainable trading approach. Think of it as moving from the classroom to the real-world trading floor – but with significantly lower risk.

The transition from learning to earning in forex trading involves dedicated practice, continuous learning, and adapting to market changes. Ignoring this phase can lead to significant losses and frustration. By implementing a structured approach to practice and refinement, you’ll significantly improve your trading performance and build confidence.

Demo Account Usage

A demo account is your invaluable training ground. It mirrors a real trading environment, allowing you to execute trades with virtual money without risking your capital. This lets you test your strategies, familiarize yourself with your chosen broker’s platform, and develop your trading instincts without the pressure of financial loss. By practicing on a demo account, you can identify weaknesses in your trading plan, refine your entry and exit strategies, and gain confidence before committing real funds. For example, if your strategy relies on identifying specific candlestick patterns, a demo account allows you to practice recognizing them repeatedly until it becomes second nature. Similarly, you can experiment with different order types and risk management techniques without any financial consequences. This iterative process is crucial for building a robust and reliable trading strategy.

Developing a Consistent Trading Routine

Consistency is key to successful forex trading. A well-defined routine helps you manage time effectively, maintain focus, and stick to your trading plan. This might involve setting aside specific times each day for market analysis, reviewing your trades, and executing your strategy. For example, you might dedicate 30 minutes each morning to reviewing overnight market news and updating your technical analysis charts, followed by an hour in the afternoon for actively trading based on your plan. Avoid impulsive trades outside your scheduled trading hours. A consistent routine also helps reduce emotional trading, as it promotes a disciplined approach to your trading activities. This structured approach allows you to maintain objectivity and avoid making rash decisions based on market fluctuations.

Continuous Learning and Adaptation

The forex market is dynamic and constantly evolving. Successful traders understand the importance of continuous learning and adaptation. This involves staying updated on market news, economic indicators, and geopolitical events that can impact currency prices. It also includes refining your technical and fundamental analysis skills, exploring new trading strategies, and learning from your past trading experiences – both successes and failures. For instance, attending webinars, reading trading journals, and engaging with other traders can provide valuable insights and help you stay ahead of the curve. Analyzing past trades, identifying mistakes, and adjusting your strategy accordingly is vital for improvement. The forex market is never static; therefore, continuous learning is not optional, but rather a necessity for long-term success.

A Plan for Consistent Practice and Skill Development

A structured approach to practice is crucial for consistent skill development. This could involve a phased approach: initially focusing on mastering the basics on a demo account, then gradually increasing the complexity of your trading strategies and the amount of capital used (still within the demo environment). Once you’re confident in your abilities and consistently profitable on a demo account, you can then cautiously transition to live trading with a small amount of capital. Regularly review your trading journal, noting both successful and unsuccessful trades. Identify recurring patterns in your wins and losses, allowing you to fine-tune your strategy and risk management techniques. This ongoing self-assessment and refinement are essential for continuous improvement. Remember, even experienced traders continually refine their strategies and adapt to market changes.

Epilogue: Forex Trading How To Get Started

So, there you have it – a roadmap to navigate the exciting (and sometimes treacherous!) world of forex trading. Remember, success in forex isn’t a sprint; it’s a marathon. Consistent learning, disciplined risk management, and a healthy dose of patience are your best allies. Don’t be afraid to start small, learn from your mistakes, and continuously refine your strategies. The potential rewards are significant, but only with careful planning and execution. Now go forth, and trade wisely!