Trading gold forex: Sounds intimidating, right? But picture this: you, wielding the power of global markets, potentially profiting from the ebb and flow of precious metals and currencies. This isn’t about getting rich quick schemes; it’s about understanding the intricate dance between gold’s inherent value and the fluctuating forex landscape. We’ll break down the complexities, revealing the strategies, risks, and rewards of navigating these two powerful markets.

From understanding the fundamental differences between gold and forex trading – their unique risk profiles, liquidity, and volatility – to mastering technical and fundamental analysis, we’ll equip you with the knowledge to make informed decisions. We’ll explore various trading strategies, emphasizing risk management techniques crucial for success in this dynamic environment. We’ll also examine the influence of economic factors and geopolitical events, showing you how to interpret market signals and build a robust trading plan. Get ready to unlock the potential of gold and forex trading.

Introduction to Gold and Forex Trading

Gold and forex trading, while both involving the exchange of assets for profit, differ significantly in their underlying mechanisms, risk profiles, and market dynamics. Understanding these differences is crucial for any aspiring trader to choose the market that aligns best with their risk tolerance and investment goals. This section will explore the key distinctions between these two popular trading avenues.

Fundamental Differences Between Gold and Forex Trading

Gold trading involves buying and selling physical gold or gold-backed instruments like gold futures or ETFs. The price of gold is primarily influenced by factors such as inflation, geopolitical events, and investor sentiment. Forex trading, on the other hand, involves exchanging one currency for another. Its price movements are driven by a complex interplay of economic indicators, interest rates, political stability, and market speculation. Essentially, gold is considered a safe-haven asset, while forex trading is more susceptible to macroeconomic shifts and speculative pressures.

Risk Profiles of Gold and Forex Markets

Gold trading carries a moderate risk profile. While gold prices can fluctuate, its inherent value as a precious metal provides a degree of stability. Significant price drops are less frequent compared to the forex market. Forex trading, however, is significantly more volatile. Leverage, a common tool in forex, magnifies both profits and losses, making it a high-risk, high-reward endeavor. Sudden geopolitical events or unexpected economic data releases can lead to dramatic price swings in currency pairs, potentially resulting in substantial losses if not managed carefully. For instance, the unexpected Brexit vote in 2016 caused significant volatility in the GBP/USD pair.

Liquidity and Volatility Comparison

Both gold and forex markets are highly liquid, meaning assets can be easily bought and sold without significantly impacting the price. However, the forex market boasts significantly higher daily trading volume, leading to greater liquidity. Volatility, however, is where the two diverge considerably. Forex markets exhibit significantly higher volatility than the gold market, primarily due to the constant interplay of global economic forces and speculative trading. Gold, while subject to price fluctuations, tends to exhibit less dramatic and frequent price swings.

Trading Hours, Leverage, and Transaction Costs

The following table summarizes the key operational differences between gold and forex trading:

| Feature | Gold | Forex |

|---|---|---|

| Trading Hours | Generally 24/5, though liquidity varies by exchange | 24/5, continuous trading across multiple global markets |

| Leverage Options | Available through futures and CFDs, but typically lower leverage than forex | High leverage commonly available, significantly amplifying both profits and losses |

| Typical Transaction Costs | Spreads, commissions (depending on the trading platform and instrument) | Spreads, commissions (often lower than gold trading, depending on the broker and volume) |

Market Analysis Techniques for Gold and Forex: Trading Gold Forex

Navigating the volatile worlds of gold and forex trading requires a keen understanding of market dynamics. Successful traders blend both technical and fundamental analysis to inform their decisions, leveraging various tools and strategies to predict price movements and manage risk. This section delves into the key analytical methods employed in these markets.

Technical Analysis Methods for Gold and Forex

Technical analysis focuses on interpreting past price and volume data to predict future price trends. This approach assumes that market history repeats itself, and patterns can be identified to anticipate potential price movements. Both gold and forex markets lend themselves well to technical analysis, although the specific indicators and patterns that prove most effective may vary.

- Chart Patterns: Head and shoulders, double tops/bottoms, triangles, and flags are common chart patterns that can signal potential reversals or continuations of trends. For example, a head and shoulders pattern often precedes a bearish reversal in price, suggesting a potential sell opportunity. A rising wedge, on the other hand, typically indicates a bearish continuation pattern, suggesting further price declines.

- Moving Averages: Moving averages, such as simple moving averages (SMA) and exponential moving averages (EMA), smooth out price fluctuations and highlight underlying trends. Traders often use multiple moving averages to identify support and resistance levels, as well as potential crossover signals (e.g., a shorter-term EMA crossing above a longer-term SMA could signal a buy signal).

- Technical Indicators: A vast array of indicators, including RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands, provide additional insights into momentum, trend strength, and potential overbought/oversold conditions. For instance, an RSI reading above 70 often suggests an overbought market, potentially signaling a price correction, while a reading below 30 might indicate an oversold market, suggesting a potential bounce.

Fundamental Analysis Techniques for Gold and Forex

Fundamental analysis examines macroeconomic factors and market sentiment to assess the intrinsic value of an asset. For gold, this involves considering factors such as inflation, interest rates, geopolitical events, and investor sentiment. In forex, fundamental analysis involves assessing economic indicators (GDP growth, inflation rates, unemployment figures, etc.) of different countries to predict exchange rate movements.

- Gold Pricing Factors: Inflation is a significant driver of gold prices; as inflation rises, gold often appreciates as a hedge against inflation. Interest rate changes also influence gold’s price, as higher interest rates typically increase the opportunity cost of holding gold (which doesn’t yield interest). Geopolitical instability often leads to increased demand for gold as a safe-haven asset.

- Forex Exchange Rate Factors: Interest rate differentials between countries play a crucial role in determining exchange rates. A country with higher interest rates tends to attract foreign investment, increasing demand for its currency and strengthening its exchange rate. Economic growth prospects also influence exchange rates; a country with strong economic growth typically sees its currency appreciate.

Sentiment Analysis in Gold and Forex Markets

Sentiment analysis gauges the overall market mood towards a particular asset. In both gold and forex markets, sentiment can be assessed through various sources, including news articles, social media trends, and trader surveys. While sentiment analysis is not a standalone trading strategy, it can provide valuable context and confirm or contradict signals from technical and fundamental analysis. For instance, overwhelmingly bullish sentiment in gold might suggest a potential price correction despite strong technical indicators. Similarly, consistently negative sentiment towards a particular currency might signal an oversold condition, even if fundamental indicators appear weak.

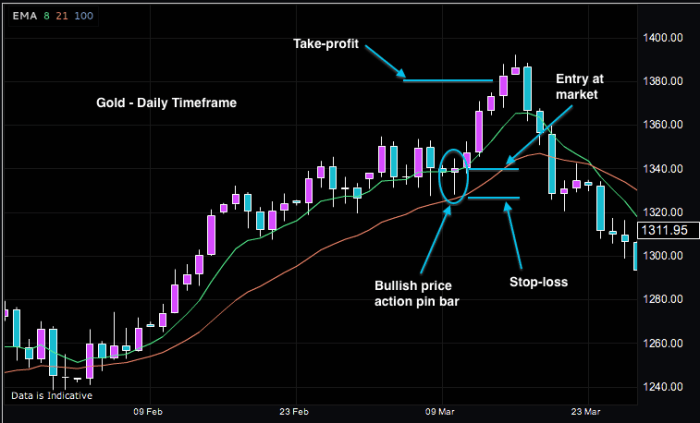

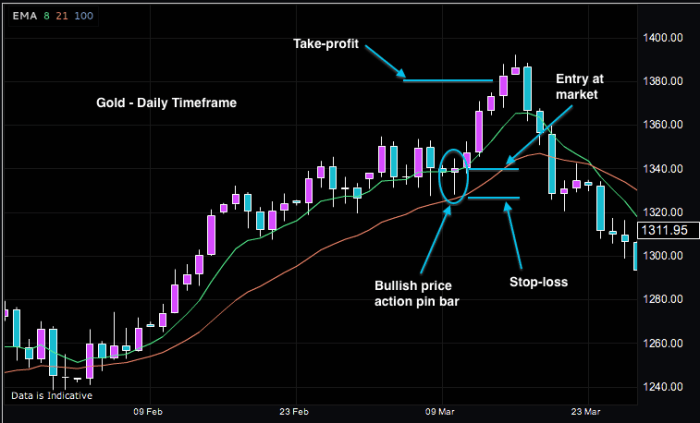

Hypothetical Trading Strategy: Gold

This strategy combines technical and fundamental analysis for gold trading. We’ll focus on identifying long-term investment opportunities.

First, we’ll perform fundamental analysis to assess the long-term outlook for gold. This involves analyzing inflation expectations, interest rate trends, and geopolitical risks. If the fundamental analysis suggests a positive outlook for gold (e.g., rising inflation and geopolitical uncertainty), we’ll proceed to technical analysis. We’ll identify potential entry points using a combination of moving averages (e.g., a 200-day SMA) and chart patterns (e.g., a bullish flag or a breakout from a consolidation pattern). Stop-loss orders will be placed below the identified support level to manage risk. Profit targets will be determined based on technical analysis (e.g., reaching a specific resistance level) and the overall market outlook. This strategy prioritizes long-term investment and risk management.

Trading Strategies for Gold and Forex

Navigating the volatile worlds of gold and forex trading requires a well-defined strategy. Success hinges not just on understanding market analysis, but on choosing and effectively implementing a trading approach that aligns with your risk tolerance, time commitment, and financial goals. Different strategies cater to different trading styles and market conditions.

Gold Trading Strategies

Gold, often considered a safe haven asset, presents unique opportunities for traders. Its price is influenced by a complex interplay of factors including inflation, geopolitical events, and investor sentiment. This volatility provides both significant potential rewards and substantial risks.

Swing Trading Gold

Swing trading involves holding positions for several days or weeks, capitalizing on price swings. Traders look for intermediate-term trends, using technical indicators like moving averages and relative strength index (RSI) to identify potential entry and exit points. The risk lies in holding positions through unexpected market shifts, potentially leading to significant losses. However, successful swing trading can yield substantial profits if trends are correctly identified. For example, a trader might identify a bullish trend based on increasing trading volume and a rising 50-day moving average, entering a long position and exiting when the trend reverses or a pre-determined profit target is reached.

Day Trading Gold

Day trading involves opening and closing positions within the same trading day. This strategy requires close monitoring of market movements and a high level of discipline. The potential for quick profits is high, but so is the risk of substantial losses if trades are not managed effectively. Day traders often rely on chart patterns and technical indicators to identify short-term price fluctuations. A successful day trade might involve identifying a short-term price reversal pattern, entering a short position, and exiting when the price moves against the trader’s prediction, or a pre-determined loss limit is reached.

Forex Trading Strategies

The forex market, characterized by its high liquidity and 24-hour trading, offers a wide range of strategies. Understanding the nuances of currency pairs, economic indicators, and geopolitical factors is crucial for successful forex trading.

Scalping Forex

Scalping involves profiting from very small price movements, holding positions for only seconds or minutes. This strategy requires extremely quick reflexes and a deep understanding of technical analysis. While the profit potential per trade is relatively small, the high frequency of trades can accumulate significant gains over time. The risk, however, is equally high, as even minor market shifts can lead to losses if not acted upon swiftly. For instance, a scalper might enter and exit multiple trades within a minute based on minor price fluctuations indicated by candlestick patterns and volume changes.

Carry Trade Forex

The carry trade involves borrowing money in a low-interest-rate currency and investing it in a high-interest-rate currency. The profit comes from the interest rate differential, but this strategy is exposed to exchange rate risk. If the exchange rate moves against the trader, the losses could outweigh the interest earned. For example, a trader might borrow Japanese Yen (low interest rate) and invest in the Australian Dollar (high interest rate), profiting from the interest rate differential as long as the exchange rate between the two currencies remains relatively stable.

Comparison of Trading Strategies

| Strategy | Risk Level | Time Commitment | Typical Profit Potential |

|---|---|---|---|

| Gold Swing Trading | Medium | Days to Weeks | Medium to High |

| Gold Day Trading | High | Hours | High (but also high potential for loss) |

| Forex Scalping | High | Minutes to Seconds | Low per trade, potentially high overall |

| Forex Carry Trade | Medium to High | Weeks to Months | Medium (dependent on interest rate differential and exchange rate fluctuations) |

Risk Management in Gold and Forex Trading

Navigating the volatile worlds of gold and forex trading requires a robust risk management strategy. Without it, even the most brilliant trading plan can quickly unravel. This section delves into the essential techniques for safeguarding your capital and ensuring long-term success in these markets. Understanding and implementing these strategies is not just advisable; it’s crucial for survival.

Stop-Loss Orders and Position Sizing

Stop-loss orders are your safety net. They automatically close a trade when the price moves against you by a predetermined amount, limiting potential losses. Position sizing, on the other hand, dictates how much capital you allocate to each trade. It’s about determining the appropriate amount to risk on any single trade, based on your overall trading capital and risk tolerance. A well-defined stop-loss, combined with prudent position sizing, forms the bedrock of effective risk management. For example, if your account balance is $10,000 and you have a risk tolerance of 1%, you should only risk $100 on any single trade. This ensures that even if the trade goes completely against you, your losses remain within your acceptable limit.

Risk Management Strategies: Gold vs. Forex

While the core principles of risk management remain consistent across both gold and forex trading, there are nuances. Gold, generally considered a safe-haven asset, tends to exhibit lower volatility than many forex pairs. This allows for potentially larger position sizes with the same risk percentage compared to highly volatile currency pairs. However, gold’s price can still experience significant swings, particularly during geopolitical uncertainty. Forex trading, with its multitude of currency pairs and varying levels of volatility, demands a more nuanced approach. Diversification across different currency pairs can help mitigate risk, as can focusing on lower-volatility pairs when starting out. Effective risk management in forex often involves utilizing more sophisticated techniques, such as hedging and correlation analysis, to minimize losses across multiple positions.

Leverage and its Impact on Risk

Leverage magnifies both profits and losses. In both gold and forex trading, leverage allows traders to control larger positions with a smaller amount of capital. While leverage can significantly amplify returns, it also exponentially increases risk. A small adverse price movement can quickly wipe out your trading account if you’re highly leveraged. For instance, a 1% move against you on a 10x leveraged position results in a 10% loss of your capital. This underscores the critical importance of using leverage responsibly and only if you fully understand its implications. Beginners should generally avoid high leverage and gradually increase their leverage as they gain experience and refine their risk management skills. A conservative approach to leverage is essential for long-term success.

Economic Factors Influencing Gold and Forex

The shimmering allure of gold and the ever-shifting sands of the forex market are far from immune to the winds of economic change. Macroeconomic forces, geopolitical tremors, and key economic indicators all play a significant role in shaping the prices of both gold and various currencies. Understanding these influences is crucial for navigating these complex markets successfully.

Macroeconomic Factors and Gold Prices

Inflation, interest rates, and economic growth are intertwined players in the gold market drama. High inflation, often a sign of a weakening currency, typically boosts gold’s appeal as a hedge against inflation. Investors seek refuge in gold, believing its value will hold steady or even increase while the purchasing power of fiat currencies erodes. Conversely, rising interest rates can dampen gold’s luster. Higher rates make holding non-interest-bearing assets like gold less attractive, as investors can earn a return on their money through interest-bearing instruments. Strong economic growth, signaling a healthy economy, can also reduce the demand for gold as a safe haven, pushing prices lower. However, unexpectedly slow growth or recessionary fears can send investors flocking back to the perceived safety of gold, causing prices to rise.

Geopolitical Events and Market Volatility, Trading gold forex

Geopolitical events – think international conflicts, political instability, and trade wars – are potent catalysts for both gold and forex markets. Uncertainty breeds volatility. When global tensions rise, investors often rush to the safety of gold, driving its price upward. Simultaneously, these events can trigger significant fluctuations in currency exchange rates. For example, a sudden escalation of a geopolitical crisis might lead investors to seek the safety of the US dollar (USD), causing the USD to appreciate against other currencies. Conversely, a perceived reduction in global risk can lead to a decline in gold prices and shifts in currency values based on investor sentiment and reassessments of economic strength.

Key Economic Indicators

Traders meticulously monitor several key economic indicators to gauge the health of economies and predict future market movements. For forex, these include inflation rates (CPI, PPI), interest rate decisions from central banks (like the Federal Reserve’s announcements), Gross Domestic Product (GDP) growth figures, unemployment rates, and consumer confidence indices. For gold, in addition to these macroeconomic indicators, the US dollar index (DXY) is a particularly important factor, as gold is typically priced in USD. A strong dollar tends to put downward pressure on gold prices, while a weakening dollar often supports gold prices. Other indicators relevant to both markets include manufacturing PMI (Purchasing Managers’ Index) and trade balances, which provide insights into the overall health and direction of global and national economies.

Hypothetical Scenario: A Major Global Recession

Imagine a scenario where a major global recession hits, triggered by a combination of factors such as a severe energy crisis and a sharp downturn in global trade. This would likely lead to:

- A significant increase in gold prices. Investors, fearing asset devaluation and economic uncertainty, would flock to gold as a safe haven, driving up demand and prices.

- Increased volatility in the forex market. Currencies of countries heavily exposed to global trade would likely depreciate sharply against more stable currencies like the US dollar or the Swiss franc. Safe-haven currencies would see increased demand and appreciation.

- Central banks worldwide would likely respond by lowering interest rates to stimulate economic activity. This could further contribute to gold price increases, as lower rates reduce the opportunity cost of holding gold.

This hypothetical scenario illustrates the interconnectedness of macroeconomic events, geopolitical risks, and the performance of gold and forex markets. Understanding these relationships is crucial for making informed trading decisions.

Tools and Resources for Gold and Forex Trading

Navigating the dynamic worlds of gold and forex trading requires more than just market knowledge; it demands access to the right tools and resources. These tools empower traders to make informed decisions, analyze market trends effectively, and ultimately, manage risk more successfully. From reliable data sources to sophisticated trading platforms, the right arsenal can significantly impact your trading journey.

Reputable Sources for Real-Time Market Data

Access to accurate and timely market data is crucial for successful gold and forex trading. Delays can cost you money, and unreliable data can lead to poor decisions. Therefore, relying on reputable sources is paramount.

- Major Financial News Outlets: Bloomberg, Reuters, and Yahoo Finance provide real-time quotes, news, and analysis for both gold and forex markets. These sources often offer free basic information, with premium subscription options unlocking more in-depth data and analytical tools.

- Brokerage Platforms: Many reputable online brokers provide real-time market data as part of their services. The quality and depth of this data can vary depending on the broker, so it’s essential to choose a broker known for its reliable data feeds.

- Specialized Financial Data Providers: Companies like Refinitiv and FactSet offer comprehensive financial data solutions, including real-time gold and forex prices, along with advanced analytical tools. These are often used by professional traders and financial institutions due to their cost and complexity.

Types of Trading Platforms and Their Features

Trading platforms are the interface between you and the market. Choosing the right platform can significantly improve your trading experience and efficiency.

- Web-Based Platforms: These platforms are accessible through any web browser, offering convenience and flexibility. They typically have fewer advanced features than desktop platforms but are suitable for beginners and those who prefer simplicity.

- Desktop Platforms: These platforms offer a more robust and feature-rich trading experience, often including advanced charting tools, technical indicators, and automated trading capabilities. They usually require a download and installation but provide greater customization and functionality.

- Mobile Trading Apps: Mobile apps allow traders to monitor markets and execute trades on the go. These apps usually offer a streamlined version of the desktop platform, focusing on essential trading functions.

Educational Resources for Gold and Forex Traders

Continuous learning is essential for success in any trading market. Fortunately, many excellent resources are available to help traders expand their knowledge and skills.

- Online Courses and Webinars: Many reputable online platforms offer comprehensive courses on gold and forex trading, covering topics from fundamental analysis to advanced trading strategies. Coursera, Udemy, and Babypips are examples of platforms offering such courses.

- Trading Books and Ebooks: Numerous books and ebooks delve into the intricacies of gold and forex trading, providing valuable insights and practical strategies. Look for books authored by experienced traders and financial professionals.

- Trading Communities and Forums: Online forums and communities provide a platform for traders to connect, share knowledge, and discuss market trends. However, it’s crucial to critically evaluate the information shared, as not all advice is reliable.

Importance of Reliable Charting Software for Technical Analysis

Technical analysis relies heavily on charting software to identify patterns and trends in price movements. Choosing reliable software is crucial for accurate analysis and informed trading decisions.

Reliable charting software should offer a range of features, including various chart types (candlestick, bar, line), technical indicators (moving averages, RSI, MACD), drawing tools (trend lines, Fibonacci retracements), and backtesting capabilities. Examples of popular charting software include TradingView and MetaTrader. The ability to customize charts and save templates is also important for efficient analysis and consistent trading strategies. Poor charting software can lead to misinterpretations of market data, resulting in poor trading decisions.

Illustrative Examples of Gold and Forex Trades

Let’s dive into some real-world scenarios to illustrate the intricacies of gold and forex trading. These examples showcase both successful and unsuccessful trades, highlighting the crucial decisions and the lessons learned along the way. Remember, trading involves inherent risk, and these examples are for illustrative purposes only. Past performance is not indicative of future results.

Successful Gold Trade

Imagine a scenario where you’re bullish on gold due to escalating geopolitical tensions and increasing inflation. You observe a clear support level at $1900 per ounce on the gold chart, indicated by a strong bounce off this price point on previous occasions. Technical indicators like the Relative Strength Index (RSI) show the gold price is oversold, suggesting a potential upward reversal. You decide to enter a long position (buying gold) at $1905 per ounce. Your initial stop-loss order is set at $1890, protecting against a significant price drop. The chart shows a clear upward trendline, adding to your confidence.

The price steadily rises, reaching $1950 per ounce over the next week. You decide to take partial profits by selling a portion of your holdings at this price, securing some gains while leaving room for further upside potential. Geopolitical tensions continue to escalate, as predicted, further pushing the gold price higher. Eventually, the price reaches $2000 per ounce, your pre-determined target price. You close your remaining position, locking in substantial profits. The visual representation would show a gold price chart with a clear upward trend, highlighting the support level at $1900, the entry point at $1905, the partial profit exit at $1950, and the final exit at $2000. The RSI indicator would show it moving from oversold territory into neutral or overbought levels during this period.

Successful Forex Trade

Let’s consider a forex trade based on fundamental analysis. You anticipate that the Euro will strengthen against the US dollar (EUR/USD) due to positive economic data released from the Eurozone, showing robust growth and low unemployment. Meanwhile, the US is experiencing higher-than-expected inflation, potentially leading to a weaker dollar. You observe the EUR/USD pair trading around 1.08. Based on your analysis, you believe it has the potential to rise to 1.12.

You place a long position (buying EUR/USD) at 1.0820. Your stop-loss is placed at 1.0750, below a recent support level. As anticipated, positive economic news from the Eurozone strengthens the Euro. The EUR/USD pair rises steadily, reaching your target of 1.1200 within a few weeks. You close your position, securing a profit. The visual representation would depict a forex chart showing the EUR/USD pair moving from 1.0820 to 1.1200, highlighting the entry and exit points, and the stop-loss level. News headlines and economic data points supporting the Euro’s strength would be referenced alongside the chart.

Losing Gold Trade

In this example, you were bearish on gold, anticipating a price drop due to a perceived overvaluation in the market and expectations of a less hawkish central bank. You decided to short sell gold (selling borrowed gold with the intention of buying it back later at a lower price) at $1980 per ounce. You set your stop-loss at $2000, anticipating a limited downside risk. However, unexpectedly, geopolitical instability flared up, creating a safe-haven demand for gold. The price of gold surged past your stop-loss, triggering a significant loss. The chart would illustrate a sharp upward movement in gold prices, exceeding the $2000 stop-loss level, resulting in a loss for the short seller. The key mistake was underestimating the impact of unexpected geopolitical events and setting a stop-loss that was too close to the current market price. The lesson learned is the importance of setting wider stop-losses to accommodate unexpected market volatility and conducting thorough fundamental analysis, including geopolitical risk assessments.

Closing Summary

So, is trading gold and forex right for you? The answer depends on your risk tolerance, your understanding of market dynamics, and your commitment to continuous learning. While the potential for profit is undeniably alluring, remember that this isn’t a get-rich-quick scheme. Successful trading requires discipline, a well-defined strategy, and a realistic assessment of risk. This guide provides a solid foundation, but further research and practice are essential. Dive in, learn the ropes, and maybe, just maybe, you’ll find your gold in this exciting world of forex and precious metals.

Find out further about the benefits of commodities forex trading that can provide significant benefits.

Find out further about the benefits of forex and commodity trading that can provide significant benefits.