Forex option trading platform – sounds intimidating, right? Wrong! Think of it as a high-stakes game of financial chess, where you predict currency movements and potentially rake in serious profits. But before you jump in headfirst, understanding the different platforms, contract types, and strategies is crucial. This isn’t just about clicking buttons; it’s about mastering the art of calculated risk and reaping the rewards.

This guide breaks down the world of forex option trading platforms, from choosing the right platform for your needs (desktop, web, mobile – oh my!) to navigating the complexities of call and put options. We’ll equip you with the knowledge to understand risk management, explore various trading strategies, and even decipher those cryptic charts. Get ready to level up your financial game.

Introduction to Forex Option Trading Platforms

Navigating the world of forex option trading can feel like venturing into a dense jungle without a machete. But fear not, intrepid trader! The right platform can be your trusty guide, providing the tools and insights you need to chart your course to success (or at least, to avoid getting hopelessly lost). Choosing the right platform is crucial, as it directly impacts your trading experience and efficiency.

Forex option trading platforms are the digital interfaces through which you access and execute forex option trades. They provide a range of tools and features designed to facilitate efficient and informed trading decisions. Understanding the different types and their functionalities is paramount to a successful trading journey.

Types of Forex Option Trading Platforms

The forex options market offers a variety of platforms catering to diverse trader needs and preferences. These platforms differ significantly in their features, accessibility, and user experience. The key distinctions lie in their interface, functionality, and the level of customization offered.

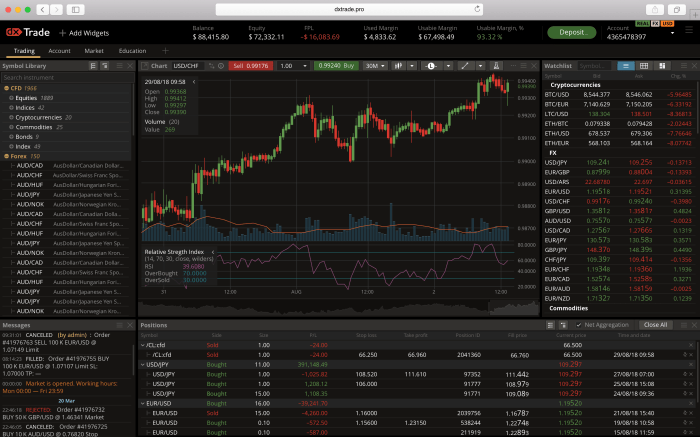

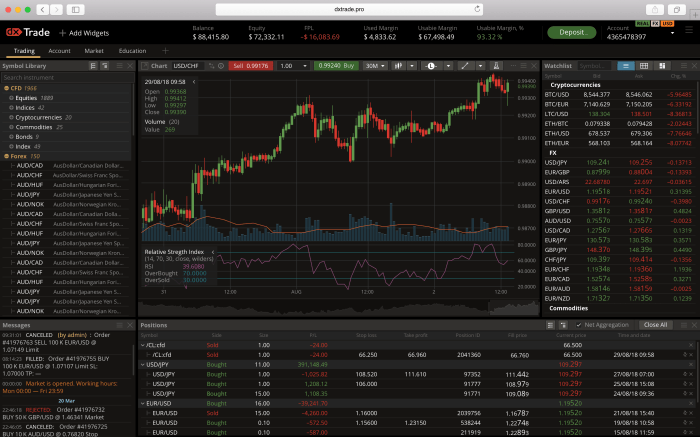

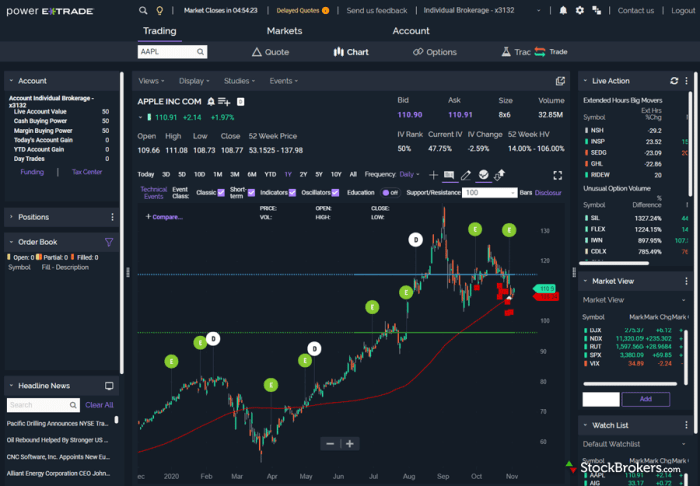

Key Features and Functionalities of a Typical Platform

A robust forex option trading platform typically offers a comprehensive suite of features designed to enhance the trading experience. These features often include real-time market data feeds, charting tools with various technical indicators, order management systems, news feeds, and risk management tools. Many platforms also integrate educational resources and analytical tools to help traders improve their skills and decision-making processes. The availability of automated trading tools (expert advisors or EAs) is also a common feature in advanced platforms, enabling traders to execute trades based on pre-defined algorithms. Customer support, accessible via phone, email, or live chat, is another vital component, ensuring assistance when needed.

Comparison of Desktop, Web-Based, and Mobile Forex Option Trading Platforms

The choice between desktop, web-based, and mobile platforms depends largely on individual trading preferences and technological access. Desktop platforms generally offer the most comprehensive features and customization options, providing a powerful and stable trading environment. Web-based platforms offer accessibility from any device with an internet connection, sacrificing some features for convenience. Mobile platforms prioritize portability and ease of use, ideal for quick trades and market monitoring on the go. However, they typically offer a more limited feature set compared to desktop or web-based counterparts.

Comparison of Forex Option Trading Platforms

Choosing the right platform can be challenging given the wide array of options available. The following table compares four popular platforms, highlighting their strengths and weaknesses:

| Platform | Pros | Cons | Best For |

|---|---|---|---|

| MetaTrader 4 (MT4) | Widely used, extensive charting tools, large community support, automated trading capabilities | Can be overwhelming for beginners, interface may feel dated to some | Experienced traders, those seeking advanced charting and automation |

| MetaTrader 5 (MT5) | Improved upon MT4, more advanced order types, enhanced charting, broader market access | Steeper learning curve than MT4, not as widely adopted | Experienced traders seeking advanced features and broader market access |

| cTrader | Fast execution speeds, intuitive interface, excellent charting capabilities | Smaller community compared to MT4/MT5, fewer third-party indicators | Traders prioritizing speed and a clean interface |

| TradingView | Excellent charting tools, social trading features, wide range of indicators and drawing tools, available as web-based and mobile app | Limited order execution capabilities, primarily a charting and analysis platform | Traders focused on technical analysis and market research |

Understanding Forex Option Contracts

Forex options, unlike outright forex trading, offer a way to bet on future price movements without the immediate commitment of buying or selling currency pairs. They provide a level of control and risk management that traditional forex trading might lack, making them attractive to both experienced and novice traders. Understanding the mechanics of these contracts is crucial before diving in.

Forex options contracts essentially give the buyer the *right*, but not the *obligation*, to buy (call option) or sell (put option) a specific amount of a currency pair at a predetermined price (strike price) on or before a specific date (expiration date). The seller, or writer, of the option is obligated to fulfill the contract if the buyer exercises their right. The price the buyer pays for this right is called the premium.

Types of Forex Option Contracts

There are two main types of forex options: calls and puts. A call option gives the buyer the right to buy the base currency at the strike price, while a put option gives the buyer the right to sell the base currency at the strike price. These options can be used to speculate on price movements or to hedge against potential losses in existing forex positions. For example, a trader might buy a call option on EUR/USD if they believe the euro will appreciate against the dollar. Conversely, a put option would be purchased if the trader anticipates a depreciation of the euro.

Factors Influencing Forex Option Prices

Several factors interact to determine the price of a forex option. The most significant are the current spot price of the currency pair, the strike price, the time to expiration, and the implied volatility. The spot price represents the current market exchange rate. The closer the strike price is to the spot price, the more valuable the option. Time decay, also known as theta, erodes the value of an option as its expiration date approaches. Implied volatility, a measure of market expectation of price fluctuations, significantly impacts option pricing; higher volatility generally leads to higher option premiums. Interest rate differentials between the two currencies also play a role, influencing the value of carrying a long or short position.

Risks and Rewards of Forex Option Trading

Forex options trading, like any financial instrument, carries inherent risks. The primary risk is the potential loss of the premium paid for the option if it expires out-of-the-money (meaning the option’s strike price is unfavorable compared to the market price at expiration). However, the potential reward is unlimited for call options (in theory, the currency could appreciate infinitely) and limited to the strike price for put options. The risk is capped at the premium paid for the buyer. For the seller, the risk is theoretically unlimited for written call options and limited to the strike price for written put options. Effective risk management strategies, including diversification and proper position sizing, are crucial for mitigating potential losses. Furthermore, a thorough understanding of market dynamics and the chosen option strategy is essential for successful trading.

Payoff Profiles of Different Option Strategies

Imagine a graph with the x-axis representing the underlying currency pair’s price at expiration and the y-axis representing the profit or loss.

A simple call option: The graph would show a flat line at -Premium until the price reaches the strike price, then a line sloping upwards at a 45-degree angle, reflecting the profit earned above the strike price, minus the premium.

A simple put option: This graph would show a flat line at -Premium until the price reaches the strike price, then a line sloping upwards, reflecting the profit from the price falling below the strike price, minus the premium.

A long straddle (buying both a call and a put with the same strike price and expiration date): This would appear as a V-shaped graph, with losses limited to the total premium paid but profits increasing proportionally to the distance the price moves in either direction from the strike price at expiration.

A short straddle (selling both a call and a put with the same strike price and expiration date): This would show an inverted V-shape, with potential unlimited losses if the price moves significantly in either direction, but maximum profit limited to the total premium received. This strategy profits most when the price remains close to the strike price at expiration. These visual representations help illustrate the potential profit and loss scenarios associated with different option strategies, highlighting the varying risk-reward profiles.

Trading Strategies and Techniques

Forex option trading, while potentially lucrative, demands a nuanced understanding of various strategies and robust risk management. Navigating the complexities requires a strategic approach, combining knowledge of market dynamics with disciplined execution. This section delves into common strategies, risk mitigation techniques, and order types to equip you with the tools for successful trading.

Forex Option Trading Strategies

Several strategies leverage the unique characteristics of forex options to achieve specific trading objectives. Understanding these strategies is crucial for tailoring your approach to market conditions and risk tolerance. These strategies are not mutually exclusive and can be combined depending on the trader’s risk appetite and market outlook.

- Straddle: A straddle involves simultaneously buying a call option and a put option with the same strike price and expiration date. This strategy profits most when the price of the underlying currency pair moves significantly in either direction, exceeding the combined cost of the options. For example, a trader might buy a straddle on EUR/USD if they anticipate high volatility, regardless of the direction. If the EUR/USD moves significantly up or down, the profit from one option offsets the loss from the other, leading to an overall profit.

- Strangle: Similar to a straddle, a strangle involves buying a call and a put option, but with different strike prices. The call option has a higher strike price than the put option. This strategy is less expensive than a straddle but requires a larger price movement to be profitable. A strangle might be employed when a trader expects significant price movement but is less certain about the direction. If the price moves substantially in either direction beyond the strike prices, the strangle will generate a profit.

Risk Management Techniques

Effective risk management is paramount in forex option trading. Uncontrolled risk can lead to significant losses. Implementing these strategies will help minimize potential downsides.

- Position Sizing: Determine the appropriate amount of capital to allocate to each trade, limiting exposure to any single trade. Never risk more than a predetermined percentage of your trading capital on any single trade. For example, a conservative approach might limit risk to 1-2% per trade.

- Stop-Loss Orders: These orders automatically close a position when the price reaches a predetermined level, limiting potential losses. Setting stop-loss orders is crucial for managing risk and preventing substantial losses during adverse market movements.

- Diversification: Don’t put all your eggs in one basket. Diversify across different currency pairs and strategies to reduce the impact of any single unfavorable outcome.

Forex Option Order Types

Understanding the different order types is essential for precise execution and risk management. Each order type offers specific advantages depending on your trading strategy and market outlook.

- Market Orders: These orders are executed immediately at the best available market price. They are suitable for traders who want to enter a position quickly, but they may not get the exact price they desire.

- Limit Orders: These orders are executed only when the price reaches a specified level. They allow traders to buy or sell at a specific price or better, offering more control over the entry price. This is beneficial for traders seeking to capitalize on specific price levels.

Executing a Simple Forex Option Trade

Let’s Artikel a step-by-step process for executing a simple forex option trade. This example uses a limit order for a call option.

- Analyze the Market: Identify a currency pair with a potential for upward movement. Research relevant economic indicators and news events.

- Choose an Option: Select a call option with a strike price above the current market price and an appropriate expiration date. Consider your risk tolerance and profit objectives.

- Set a Limit Order: Place a limit order to buy the call option at a price you’re willing to pay. This ensures you don’t overpay for the option.

- Monitor the Trade: Track the market price and the option’s value. Consider adjusting your stop-loss order if necessary.

- Manage the Trade: Close the position before expiration either by selling the option or letting it expire worthless depending on the price movement and your strategy.

Platform Features and Tools: Forex Option Trading Platform

Navigating the world of forex option trading requires more than just understanding contracts and strategies; it demands the right tools. A robust trading platform is your cockpit, providing the real-time data and analytical capabilities crucial for informed decision-making. The features available significantly impact your trading experience, from identifying opportunities to executing trades efficiently.

Choosing the right platform hinges on understanding its core functionalities. Essential tools are not just nice-to-haves; they’re necessities for successful trading. A lack of proper tools can lead to missed opportunities, poor risk management, and ultimately, financial losses. Let’s explore some key features.

Charting Tools and Technical Indicators

Charting tools are the visual heart of any forex platform. They present price movements over time, allowing traders to identify trends, support and resistance levels, and potential entry and exit points. Common chart types include candlestick charts, bar charts, and line charts. Technical indicators, such as moving averages (e.g., simple moving average, exponential moving average), Relative Strength Index (RSI), and MACD, are overlaid on these charts to provide additional insights into momentum, overbought/oversold conditions, and potential trend reversals. These indicators help traders filter noise and identify statistically significant patterns, improving their predictive power. For instance, a bullish crossover of a short-term moving average above a long-term moving average might signal a potential buying opportunity, while a divergence between price and RSI could suggest a weakening trend.

Real-Time Data and Market Analysis Tools

Real-time data is paramount in forex trading, as even small delays can significantly impact trading decisions. The speed at which you receive information can be the difference between a profitable trade and a loss. Market analysis tools, integrated into many platforms, provide access to news feeds, economic calendars, and fundamental data, allowing traders to consider broader market contexts beyond technical analysis. A platform providing real-time quotes and news updates on major currency pairs, coupled with tools that analyze economic indicators (like inflation rates or interest rate announcements), empowers traders to make informed decisions by understanding the underlying factors influencing currency movements. For example, if the US Federal Reserve announces an unexpected interest rate hike, real-time data would immediately reflect this, enabling traders to capitalize on the resulting price fluctuations.

Automated Trading Tools and Algorithms

Automated trading, also known as algorithmic trading, leverages pre-programmed rules and algorithms to execute trades automatically. This removes emotional biases and allows for faster reaction times to market changes. Features like automated order placement (stop-loss, take-profit orders), trailing stops, and automated trading bots are becoming increasingly popular. However, it’s crucial to understand that while automation offers advantages, it also carries risks. Poorly designed algorithms can lead to significant losses. Successful algorithmic trading requires careful planning, thorough backtesting, and ongoing monitoring. For example, an algorithm might be designed to automatically buy a currency pair when a specific technical indicator reaches a predetermined threshold and sell when another indicator signals a reversal, optimizing entry and exit points based on pre-defined rules.

Using a Charting Tool: Identifying Potential Trading Opportunities

Let’s consider a candlestick chart with a 20-period simple moving average (SMA) and a 50-period SMA. Imagine the price is trending upwards. If the 20-period SMA crosses above the 50-period SMA (a “golden cross”), it’s often interpreted as a bullish signal, suggesting a potential upward trend continuation. This crossover, combined with other bullish indicators like increasing trading volume and a positive RSI, could signal a potential long position (buying the currency pair). Conversely, a “death cross” (20-period SMA crossing below the 50-period SMA) might indicate a bearish trend, suggesting a potential short position (selling the currency pair). It is important to note that this is a simplified example, and traders should always consider multiple factors and risk management strategies before entering any trade. Confirmation from other technical indicators and fundamental analysis is essential before making a trading decision.

Regulatory Considerations and Security

Navigating the world of forex option trading requires a keen awareness of the regulatory landscape. Understanding the rules and choosing a secure platform is crucial for protecting your investments and personal data. Ignoring these aspects can lead to significant financial losses and potential fraud. This section clarifies the importance of regulatory compliance and Artikels steps to safeguard your trading experience.

The forex market is globally decentralized, meaning it’s not governed by a single regulatory body. Instead, different jurisdictions have their own rules and regulations for forex brokers and platforms. This variation can make it challenging for traders to determine which platforms are legitimate and trustworthy. Some regions have stricter regulations than others, offering greater protection to traders. The lack of a unified global regulator emphasizes the importance of due diligence before selecting a platform.

Regulatory Bodies and Their Roles

Regulatory bodies like the Commodity Futures Trading Commission (CFTC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the Australian Securities and Investments Commission (ASIC) in Australia play a vital role in overseeing forex brokers and ensuring fair market practices. These bodies set standards for capital adequacy, client segregation of funds, and reporting requirements. A regulated broker operating under the purview of a reputable authority offers a greater degree of security compared to an unregulated entity. Choosing a broker regulated by one of these bodies significantly reduces the risk of fraud and ensures a higher level of protection for traders’ funds.

Importance of Choosing a Regulated and Secure Platform

Selecting a regulated forex option trading platform is paramount for minimizing risk. A regulated platform adheres to strict rules and regulations designed to protect traders’ interests. These regulations typically mandate the segregation of client funds from the broker’s operational funds, reducing the risk of loss in case of broker insolvency. Furthermore, regulated platforms are subject to regular audits and inspections, ensuring transparency and accountability. Conversely, unregulated platforms often lack these safeguards, leaving traders vulnerable to scams and potential financial losses. The peace of mind provided by a regulated platform is invaluable in the often-volatile forex market.

Protecting Your Accounts and Data

Protecting your trading account and personal data is a multifaceted process. Strong passwords, employing two-factor authentication, and regularly reviewing account statements are fundamental steps. Be wary of phishing emails or suspicious links, and never share your login credentials with anyone. Utilize robust antivirus software and keep your operating system updated to minimize the risk of malware attacks. Furthermore, understanding the platform’s security measures, such as encryption protocols and data storage practices, is essential. Regularly updating your security settings and staying informed about potential threats are crucial elements of a secure trading strategy.

Checklist for Choosing a Secure Forex Option Trading Platform

Before engaging with any forex option trading platform, carefully consider these factors:

- Regulation: Verify the platform’s regulatory status with the relevant authorities in its jurisdiction.

- Security Measures: Assess the platform’s security protocols, including encryption, firewalls, and data protection policies.

- Client Fund Segregation: Confirm that client funds are segregated from the broker’s operational funds.

- Reputation and Reviews: Research the platform’s reputation and read independent reviews from other traders.

- Customer Support: Evaluate the quality and responsiveness of the platform’s customer support.

- Transparency: Ensure the platform provides clear and transparent information about its fees, policies, and risk disclosures.

Educational Resources and Support

Navigating the world of forex option trading successfully requires more than just understanding the mechanics; it demands continuous learning and access to reliable support. A robust educational framework and responsive customer service are crucial for both beginners taking their first steps and experienced traders looking to refine their strategies. This section explores the resources and support systems available to help you thrive in this dynamic market.

Forex option trading platforms understand the importance of empowering their users with knowledge. They offer a variety of educational materials designed to cater to different learning styles and experience levels, from introductory guides to advanced webinars and expert analysis. Equally vital is the readily available customer support, providing assistance when navigating the platform or facing trading challenges.

Types of Educational Resources

Many platforms provide a wealth of educational resources. These resources aim to equip traders with the knowledge and skills necessary to make informed decisions. These resources are often categorized for easy access and comprehension.

Examples include comprehensive guides explaining fundamental concepts, video tutorials demonstrating trading platform functionalities, interactive webinars led by experienced traders, and regularly updated market analyses offering insights into current trends. Some platforms even partner with financial educators to offer more in-depth courses and certifications.

Importance of Ongoing Learning and Professional Development

The forex market is constantly evolving, influenced by global economic events, geopolitical shifts, and technological advancements. Therefore, continuous learning is not just beneficial—it’s essential for long-term success.

Staying updated on market trends, refining trading strategies based on new data, and adapting to technological changes are crucial aspects of professional development. Regularly engaging with educational resources offered by the platform, participating in webinars, and following market news keeps traders informed and competitive. This proactive approach minimizes risks and maximizes opportunities.

Customer Support Options

Effective customer support is a cornerstone of a reliable forex option trading platform. Traders need prompt and helpful assistance when encountering technical issues, clarifying trading rules, or navigating platform functionalities.

Common support options include email support, telephone hotlines, and live chat features. Many platforms also offer FAQs and comprehensive help centers containing solutions to frequently asked questions. Some platforms even provide personalized support from dedicated account managers, particularly for high-volume traders. The availability and responsiveness of customer support can significantly impact a trader’s overall experience.

Sample Educational Module for Beginners

This module is designed to introduce beginners to the fundamentals of forex option trading. It focuses on building a strong foundation before venturing into more complex strategies.

The structured approach ensures a clear understanding of core concepts and progressively introduces more advanced topics. This stepwise learning process minimizes the initial learning curve and builds confidence.

- Module 1: Introduction to Forex Options: Defining forex options, understanding the underlying asset (currency pairs), explaining option contracts (calls and puts), and illustrating basic option pricing mechanisms.

- Module 2: Understanding Option Greeks: Explaining the key option Greeks (Delta, Gamma, Theta, Vega, Rho), their impact on option pricing, and how to use them in risk management.

- Module 3: Basic Trading Strategies: Introducing simple option strategies like buying calls, buying puts, covered calls, and protective puts, with practical examples and risk/reward profiles.

- Module 4: Risk Management Techniques: Discussing essential risk management practices, including position sizing, stop-loss orders, and diversification, to mitigate potential losses.

- Module 5: Platform Navigation and Tools: A guided tour of the trading platform, highlighting key features like order placement, charting tools, and real-time market data.

Summary

So, you’ve conquered the basics of forex option trading platforms. Remember, this is a dynamic world, constantly evolving. Consistent learning, careful risk management, and a healthy dose of patience are your best allies. Don’t just chase quick wins; build a strategy, understand the market, and watch your knowledge – and potentially your portfolio – grow. The world of forex options awaits – are you ready to play?

Explore the different advantages of forex day trading that can change the way you view this issue.

For descriptions on additional topics like fidelity forex trading, please visit the available fidelity forex trading.