How to Stay Profitable with Forex Trading in 2025? It’s the million-dollar question, right? The forex market is a wild beast, constantly shifting with global events, tech advancements, and regulatory changes. This guide navigates the turbulent waters of 2025’s forex landscape, arming you with the strategies, tools, and mindset needed to not just survive, but thrive. We’ll dissect technical and fundamental analysis, explore risk management like pros, and even delve into the psychology of successful trading. Get ready to level up your forex game.

From understanding the evolving economic climate and its impact on currency pairs to mastering technical indicators and leveraging the power of automated trading systems, we’ll cover it all. We’ll explore how to navigate geopolitical uncertainty, adapt to technological advancements, and stay ahead of the regulatory curve. This isn’t just about charts and graphs; it’s about building a sustainable, profitable trading strategy that stands the test of time – and the volatility of the forex market.

Understanding the Forex Market in 2025

Navigating the forex market in 2025 requires a keen understanding of the evolving global economic landscape, geopolitical shifts, and technological advancements. The interplay of these factors will significantly influence currency valuations and trading strategies, presenting both opportunities and challenges for traders.

The anticipated economic landscape of 2025 is likely to be characterized by continued uncertainty. Global inflation, while potentially easing from its 2023 peak, might still remain a concern in many regions. The ongoing energy transition and its impact on economies, particularly those heavily reliant on fossil fuels, will continue to create volatility. Furthermore, the persistent effects of the pandemic and ongoing supply chain disruptions could lead to unexpected market fluctuations. These macroeconomic factors will significantly influence currency strength and weakness, making accurate forecasting crucial for successful forex trading. For instance, a country experiencing high inflation might see its currency depreciate against those with lower inflation rates, offering opportunities for currency pairs trading.

Geopolitical Events and Their Impact on Currency Pairs, How to Stay Profitable with Forex Trading in 2025

Major geopolitical events will undoubtedly shape the forex market in 2025. Ongoing tensions between nations, potential conflicts, and shifts in global alliances will all create volatility. For example, escalating trade wars could weaken involved currencies, while unexpected political upheavals in key economies could trigger significant market swings. The ongoing situation in Eastern Europe, for example, will continue to have ripple effects on global currency markets, influencing pairs like EUR/USD and GBP/USD. The impact of these events will depend on their severity and duration, and traders need to stay informed about geopolitical developments to mitigate potential risks. A sudden escalation of a conflict could lead to a flight to safety, strengthening safe-haven currencies like the Japanese Yen or Swiss Franc.

Technological Advancements in Forex Trading

Technological advancements will continue to reshape the forex trading landscape in 2025. The rise of artificial intelligence (AI) and machine learning (ML) will likely lead to more sophisticated trading algorithms and predictive models. These tools can analyze vast datasets to identify patterns and predict market movements, potentially offering traders an edge. However, it’s important to note that AI and ML are not foolproof and require careful monitoring and validation. Furthermore, the increased use of blockchain technology could enhance transparency and security in forex transactions, potentially reducing counterparty risk. For instance, decentralized finance (DeFi) platforms could offer new avenues for forex trading, though regulatory uncertainty remains a significant factor.

Regulatory Changes Affecting Forex Trading Practices

Regulatory changes are expected to influence forex trading practices in 2025. Increased scrutiny of forex brokers and stricter regulations regarding leverage and client protection are likely in several jurisdictions. These changes aim to protect retail investors and promote market integrity. For instance, stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations will likely become more stringent, requiring more thorough verification processes for traders. Furthermore, regulatory bodies might introduce new rules regarding algorithmic trading and high-frequency trading (HFT), potentially impacting the strategies employed by some traders. Staying updated on these regulatory changes is crucial for compliance and avoiding potential penalties.

Developing a Profitable Trading Strategy

Navigating the forex market successfully in 2025 requires more than just understanding its intricacies; it demands a meticulously crafted trading strategy underpinned by robust risk management and insightful market analysis. This section will delve into the essential components of building a profitable and sustainable forex trading approach.

Risk Management Plan

A solid risk management plan is the bedrock of consistent profitability in forex trading. It’s not about eliminating risk entirely – that’s impossible – but about controlling it and preventing catastrophic losses. This involves setting clear stop-loss and take-profit orders for every trade. Stop-loss orders automatically sell a currency pair when it reaches a predetermined price, limiting potential losses. Conversely, take-profit orders automatically sell when a target profit is reached, securing gains. Determining appropriate stop-loss and take-profit levels requires careful consideration of factors like volatility and your personal risk tolerance. A common strategy is to risk only a small percentage (e.g., 1-2%) of your trading capital on any single trade.

Choosing Suitable Currency Pairs

Selecting the right currency pairs is crucial for successful forex trading. Market analysis plays a vital role here. Consider factors such as economic indicators (inflation rates, interest rates, GDP growth), geopolitical events, and technical chart patterns. For example, the EUR/USD pair, representing the Euro against the US dollar, is often favored due to its high liquidity and volatility, offering frequent trading opportunities. However, higher volatility also means higher risk. Pairs like the USD/JPY (US dollar against the Japanese yen) might be chosen for their relatively stable nature, suitable for lower-risk strategies. Thorough research and understanding of the economic and political landscapes affecting each currency are essential for informed pair selection.

Technical Analysis Methods

Technical analysis uses historical price and volume data to predict future price movements. Several methods are applicable in 2025. Moving averages, for example, smooth out price fluctuations to identify trends. Support and resistance levels, representing price areas where buying or selling pressure is expected to be strong, can help determine potential entry and exit points. Relative Strength Index (RSI) and MACD (Moving Average Convergence Divergence) are indicators used to gauge momentum and potential trend reversals. Combining multiple technical indicators can provide a more comprehensive view of market sentiment and potential price movements. Remember, technical analysis is not foolproof; it should be used in conjunction with other forms of analysis.

Fundamental Analysis Techniques

Fundamental analysis focuses on macroeconomic factors influencing currency values. Analyzing economic data, such as interest rate announcements, inflation reports, and employment figures, can reveal potential trading opportunities. For instance, an unexpected increase in interest rates might strengthen a currency, creating a buying opportunity. Conversely, negative economic news could weaken a currency, providing a selling opportunity. Geopolitical events, such as political instability or international conflicts, also significantly impact currency values.

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Interest Rate Differentials | Comparing interest rates between two countries. A higher interest rate typically attracts foreign investment, strengthening the currency. | Relatively straightforward to understand and implement. Often a strong predictor of long-term trends. | Can be influenced by other economic factors; doesn’t always predict short-term fluctuations. |

| Inflation Rates | Analyzing inflation rates in different countries. Higher inflation generally weakens a currency. | Provides a clear indication of a country’s economic health. | Can be lagging indicator; doesn’t always reflect immediate market reactions. |

| GDP Growth | Analyzing the growth rate of a country’s Gross Domestic Product. Stronger GDP growth usually strengthens the currency. | A comprehensive measure of economic performance. | Can be influenced by various factors and may not reflect short-term market dynamics. |

| Geopolitical Events | Assessing the impact of political events and global tensions on currency values. | Can significantly influence currency pairs in the short term. | Highly unpredictable; difficult to forecast with precision. |

Mastering Technical and Fundamental Analysis

Navigating the forex market successfully in 2025 requires a deep understanding of both technical and fundamental analysis. These two approaches, while distinct, are complementary and, when used effectively, can significantly enhance your trading strategy and profitability. Mastering both is key to consistently identifying promising opportunities and mitigating risk.

Technical analysis focuses on interpreting price charts and historical data to predict future price movements. Fundamental analysis, conversely, examines macroeconomic factors and economic indicators to understand the underlying value of a currency. A robust trading strategy will skillfully integrate both.

Technical Indicator Comparison

Technical indicators are mathematical calculations based on market data, designed to signal potential buy or sell opportunities. Different indicators offer unique perspectives and are often used in combination to confirm trading signals. For example, the Relative Strength Index (RSI) measures momentum, identifying overbought and oversold conditions. The Moving Average Convergence Divergence (MACD) identifies changes in momentum by comparing two moving averages. Conversely, the Bollinger Bands show price volatility and potential reversals. While RSI focuses on momentum, MACD analyzes trend changes, and Bollinger Bands highlight volatility. A trader might use the RSI to identify an overbought condition, confirmed by a bearish divergence on the MACD, suggesting a potential short opportunity, while the Bollinger Bands provide context for the volatility of the move.

Economic Indicator Influence on Currency Values

Understanding economic indicators is crucial for fundamental analysis. These indicators, released by governments and central banks, reflect the overall health of an economy and influence currency values. For example, a higher-than-expected inflation rate might weaken a currency, as it suggests potential central bank intervention to raise interest rates. Conversely, strong employment data could strengthen a currency, reflecting economic strength and investor confidence. Key indicators include Gross Domestic Product (GDP), inflation rates (CPI and PPI), unemployment rates, and interest rates. A rise in US GDP might strengthen the USD against other currencies, reflecting increased economic activity and investment appeal.

Interpreting Economic News Releases and Their Impact on Trading Decisions

Economic news releases can significantly impact currency values. Traders need to quickly interpret these releases and adjust their trading strategies accordingly. For example, a surprise interest rate cut by a central bank can cause a sharp decline in the value of its currency, creating a short-term opportunity for traders who anticipate this move. Successful interpretation relies on understanding the context of the release, considering market expectations, and assessing the potential impact on the economy. A better-than-expected jobs report, for example, might initially push a currency higher, but this positive sentiment could quickly reverse if investors begin to worry about increased inflation pressures.

Chart Patterns and Candlestick Formations in Identifying Trading Signals

Chart patterns and candlestick formations offer visual cues about potential price movements. Head and shoulders patterns, for example, suggest a potential trend reversal. Candlestick patterns like the engulfing pattern can signal a strong trend continuation or reversal. Recognizing these patterns allows traders to anticipate potential price movements and time their entries and exits more effectively. A bullish engulfing pattern, characterized by a large green candle completely encompassing the previous red candle, often suggests a potential upward trend reversal. Conversely, a bearish engulfing pattern could indicate a downward reversal. These patterns are often used in conjunction with other technical indicators to confirm trading signals and reduce risk.

Utilizing Trading Tools and Technologies

In the fast-paced world of Forex trading, leveraging the right tools and technologies is crucial for staying ahead of the curve and maintaining profitability in 2025. This isn’t just about having access to the market; it’s about harnessing the power of automation, sophisticated platforms, and strategic order management to optimize your trading performance. The right tools can significantly reduce manual effort, improve accuracy, and ultimately boost your bottom line.

Automated Trading Systems (Expert Advisors)

Expert Advisors (EAs) are automated trading programs that execute trades based on pre-programmed algorithms. They analyze market data, identify trading opportunities, and execute trades without human intervention. This frees up your time, allows for consistent execution even during periods of market volatility, and eliminates emotional biases that can often hinder decision-making. However, it’s crucial to thoroughly backtest and monitor any EA before deploying it with real capital. A poorly designed EA can lead to significant losses. For example, an EA designed for a trending market might perform poorly during periods of consolidation, highlighting the need for careful selection and ongoing monitoring.

Forex Trading Platforms

Popular Forex trading platforms offer a range of features designed to streamline the trading process. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are industry standards, known for their robust charting capabilities, extensive technical indicators, and automated trading capabilities. cTrader is another popular platform, particularly favored for its advanced charting tools and speed of execution. These platforms typically offer features like one-click trading, customizable charts, and access to real-time market data, all contributing to a more efficient and informed trading experience. Choosing the right platform often depends on individual trading styles and preferences; some traders prefer the simplicity of MT4, while others might find the advanced features of MT5 or cTrader more appealing.

Order Types: Market, Limit, and Stop Orders

Understanding different order types is fundamental to effective risk management. Market orders execute immediately at the current market price, offering speed but potentially less price control. Limit orders are placed at a specific price, ensuring you only buy or sell at your desired level, but there’s no guarantee of execution if the price doesn’t reach your limit. Stop orders, on the other hand, are triggered when the market reaches a specific price, often used to limit losses or secure profits. For example, a stop-loss order automatically sells a position if the price falls below a predetermined level, preventing further losses. The selection of the order type should align with the trader’s risk tolerance and overall trading strategy.

Utilizing Economic Calendars and News Feeds

Economic calendars and news feeds provide crucial information on upcoming economic events that can significantly impact currency markets. By monitoring these resources, traders can anticipate potential price movements and adjust their strategies accordingly. A step-by-step guide might look like this:

1. Identify Key Economic Events: Consult reputable economic calendars (like those provided by Forex brokers) to identify upcoming events like interest rate announcements, employment data releases, or inflation reports.

2. Assess Potential Impact: Analyze the historical impact of similar events on the relevant currency pairs.

3. Develop a Trading Plan: Based on your analysis, formulate a trading strategy that anticipates the potential market reaction. This could involve taking a position before the event, adjusting existing positions, or avoiding trading altogether during periods of high volatility.

4. Monitor Market Reaction: Observe market movements in real-time after the event to assess the accuracy of your prediction and adjust your strategy as needed.

5. Document and Learn: Keep a detailed record of your trades, noting the economic events that influenced them and the outcomes. This helps refine your strategy over time. For instance, if an interest rate hike is anticipated, you might prepare to buy the currency of the country expected to raise rates.

Managing Risk and Emotions in Forex Trading

The forex market is notorious for its volatility and emotional rollercoaster. Successfully navigating this landscape requires a robust risk management plan and a disciplined approach to controlling emotional biases. Ignoring these aspects can quickly lead to significant losses, even with a well-developed trading strategy. This section will Artikel practical strategies for mitigating risk and managing the emotional challenges inherent in forex trading.

Emotional control is paramount in forex trading. Fear and greed are powerful forces that can cloud judgment and lead to impulsive, irrational decisions. A successful trader learns to recognize and manage these emotions, treating trading as a business rather than a gamble.

Examine how The Best Forex Trading Software for 2025 can boost performance in your area.

Strategies for Managing Emotional Biases

Effective emotional management involves self-awareness and proactive strategies. Understanding your personal biases—whether it’s fear of missing out (FOMO), confirmation bias (seeking information that confirms pre-existing beliefs), or overconfidence—is the first step. Keeping a trading journal, documenting trades, emotions, and rationales, can help identify patterns and triggers for emotional trading. Techniques like mindfulness and meditation can also improve emotional regulation, fostering a calmer, more rational approach to decision-making. Consider incorporating stress-reduction techniques into your daily routine to maintain mental clarity and avoid impulsive reactions to market fluctuations.

Controlling Position Sizing and Leverage

Position sizing and leverage are fundamental risk management tools. Position sizing refers to the amount of capital allocated to each trade, while leverage magnifies both profits and losses. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. For example, with a $10,000 account and a 1% risk tolerance, the maximum loss per trade should be $100. Leverage should be used cautiously, as it can quickly amplify losses. Beginners should generally avoid high leverage and gradually increase it as their experience and risk management skills improve. Always calculate your potential losses before entering a trade to ensure they align with your risk tolerance.

Maintaining Discipline and Avoiding Impulsive Trades

Discipline is crucial for consistent profitability. Impulsive trades, often driven by emotions or FOMO, are frequently the source of significant losses. To maintain discipline, develop a well-defined trading plan that Artikels entry and exit strategies, risk management rules, and emotional checkpoints. Sticking to the plan, even during periods of market uncertainty or emotional distress, is paramount. Avoid chasing quick profits or trying to “get even” after a loss. These actions often lead to further losses and erode trading capital. Regularly review your trading journal to identify areas where discipline faltered and learn from past mistakes.

Regular Portfolio Reviews and Adjustments

Regular portfolio reviews are essential for adapting to changing market conditions and evaluating the effectiveness of your trading strategy. These reviews should involve analyzing past performance, identifying areas for improvement, and making necessary adjustments to your trading plan. This includes reassessing your risk tolerance, position sizing, and leverage based on your current financial situation and market dynamics. Consider conducting weekly or monthly reviews to ensure your portfolio remains aligned with your overall goals and risk appetite. For instance, if a particular trading strategy consistently underperforms, consider adjusting or replacing it. A flexible approach, grounded in data-driven analysis, is key to long-term success.

Continuous Learning and Adaptation: How To Stay Profitable With Forex Trading In 2025

The forex market is a dynamic beast, constantly shifting and evolving. To remain profitable in 2025 and beyond, continuous learning and adaptation aren’t just beneficial – they’re essential for survival. Ignoring this crucial aspect will likely lead to outdated strategies and ultimately, losses. This section details how to cultivate a mindset of ongoing improvement and stay ahead of the curve.

Developing a robust plan for continuous professional development is paramount. Forex trading isn’t a “set it and forget it” endeavor; it requires consistent effort to hone skills and stay informed. This involves dedicating time to learning, actively seeking new knowledge, and critically evaluating your performance. Without this commitment, your trading approach will stagnate, leaving you vulnerable to market shifts.

A Plan for Continuous Professional Development

A structured approach to learning is crucial. This could involve setting aside specific time each week for studying market analysis, reviewing past trades, or exploring new trading techniques. Consider setting realistic goals, such as mastering a new indicator each month or completing a specific online course. Regularly track your progress and adjust your learning plan based on your strengths and weaknesses. For example, if you struggle with risk management, dedicate more time to studying risk-reward ratios and position sizing techniques. Regular self-assessment and adjustment are vital for consistent improvement.

Valuable Resources for Staying Updated

Staying informed about market trends and developments is crucial. Fortunately, a wealth of resources exists to assist in this endeavor. Reputable financial news websites, such as Bloomberg and Reuters, provide real-time market updates and analysis. Economic calendars highlight upcoming economic announcements that can significantly impact currency pairs. Furthermore, educational platforms offer online courses, webinars, and trading simulations that can enhance your skills. Following influential forex traders and analysts on social media (while always critically evaluating their information) can also provide valuable insights, though independent verification is essential. Finally, subscribing to market research reports from reputable firms can offer deeper analyses and predictions.

Benefits of Mentorship and Guidance

Seeking mentorship from experienced traders can significantly accelerate your learning curve. An experienced mentor can provide personalized guidance, offer insights into market psychology, and help you avoid common pitfalls. They can also share their trading strategies and risk management techniques, providing a shortcut to mastering concepts that might otherwise take years to learn independently. This guidance can save time, money, and frustration. Finding a mentor through online communities or local forex trading groups can be a valuable step in accelerating your progress.

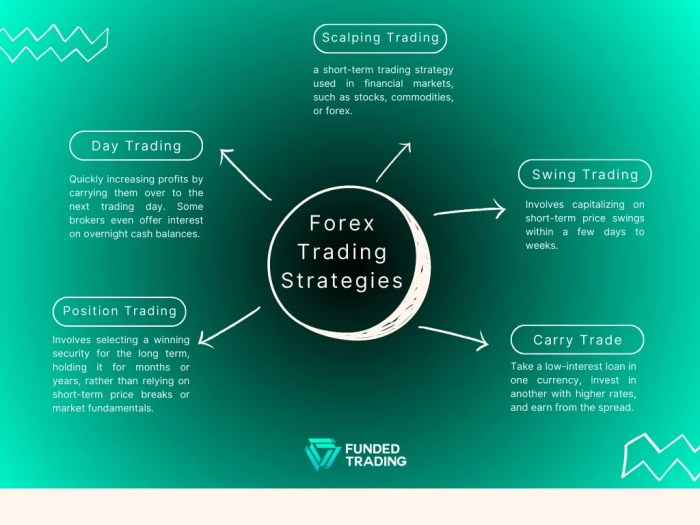

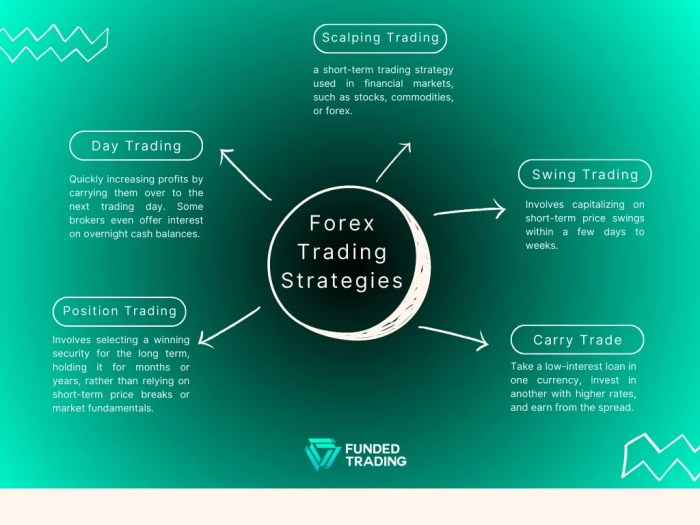

Adapting Trading Strategies to Changing Market Conditions

The forex market is notoriously volatile. What works well in one market condition might be disastrous in another. Therefore, adapting your trading strategies based on changing market conditions is non-negotiable. For instance, a strategy that performs well during periods of high volatility might fail miserably during periods of low volatility. Regularly review your trading performance and identify areas for improvement. Be prepared to adjust your entry and exit points, stop-loss levels, and even your overall trading approach based on the prevailing market dynamics. Consider utilizing different trading styles (e.g., scalping, day trading, swing trading) depending on market conditions. Flexibility and adaptability are key to long-term success.

Illustrating Key Concepts

Let’s bring the theoretical concepts discussed earlier to life with some real-world examples. We’ll explore a hypothetical forex trading scenario, showcasing the interplay of technical and fundamental analysis, and highlight the crucial role of risk management. Understanding these practical applications will solidify your grasp of profitable forex trading strategies.

A Hypothetical Forex Trading Scenario

Examine how The Most Important Forex Trading Indicators You Should Know can boost performance in your area.

EUR/USD Trade Example: Combining Technical and Fundamental Analysis

Imagine the Euro (EUR) is trading against the US dollar (USD) at 1.1000. Fundamental analysis reveals positive economic news from the Eurozone – strong GDP growth and decreasing unemployment. This suggests increased demand for the Euro, potentially pushing its value higher. Concurrently, technical analysis, using a moving average crossover on a daily chart, shows the 50-day moving average crossing above the 200-day moving average – a bullish signal. Both fundamental and technical indicators point towards a potential upward trend for the EUR/USD pair. A trader, based on this confluence of signals, decides to buy EUR/USD at 1.1000, setting a stop-loss order at 1.0950 (0.5% risk) and a take-profit order at 1.1100 (1% profit target).

The key takeaway here is the power of combining fundamental and technical analysis. Using both approaches significantly increases the probability of making informed trading decisions.

Visual Representation of a Successful Trade

Let’s visualize the successful execution of this trade. The chart would show the EUR/USD price starting at 1.1000. A clear upward trend emerges following the trade entry. The price gradually rises, surpassing the 1.1100 take-profit target. The trader’s position is automatically closed at this point, resulting in a 100-pip profit (1.1100 – 1.1000 = 0.0100, or 100 pips). The stop-loss order at 1.0950 remains untouched, indicating successful risk management. The visual representation would clearly show the entry point at 1.1000, the take-profit at 1.1100, and the absence of a stop-loss trigger. The entire price movement would demonstrate a clear upward trend confirming the initial analysis.

Impact of Poor Risk Management

Now, let’s consider a scenario where risk management is neglected. The trader, overly confident in their analysis, enters the same EUR/USD trade at 1.1000 but without a stop-loss order. While the initial price movement is positive, unexpected negative news emerges from the US – a sudden surge in inflation, causing investors to flee the Euro in favor of the dollar. The EUR/USD pair plummets. Without a stop-loss, the trader’s losses continue to accumulate, potentially leading to a significant drawdown or even a margin call, forcing the liquidation of their trading account. This illustrates the catastrophic consequences of ignoring proper risk management. The visual representation would show a sharp downward trend after the initial price increase, with the price falling significantly below the entry point, indicating substantial losses.

Last Word

Conquering the forex market in 2025 isn’t about luck; it’s about strategic planning, disciplined execution, and a relentless pursuit of knowledge. By combining a robust trading strategy with effective risk management and a keen understanding of market dynamics, you can significantly increase your chances of consistent profitability. Remember, the journey to forex success is a marathon, not a sprint. Continuous learning, adaptation, and a healthy dose of self-awareness are your secret weapons. So, buckle up, and get ready to ride the waves of the forex market into a profitable 2025.

FAQ

What are some common mistakes new forex traders make?

Overtrading, ignoring risk management, emotional trading (letting fear and greed dictate decisions), and lack of proper education are common pitfalls.

How much capital do I need to start forex trading?

There’s no magic number, but starting with a smaller amount to practice and gradually increasing your capital as you gain experience is recommended. Never invest more than you can afford to lose.

Is forex trading legal?

Yes, but it’s crucial to trade with regulated brokers to ensure your funds are protected and you’re adhering to legal requirements in your jurisdiction.

What are some reliable resources for learning more about forex trading?

Reputable online courses, educational websites, books, and mentorship programs from experienced traders can provide valuable knowledge.