Top Forex Brokers to Use in 2025: Navigating the ever-evolving world of forex trading requires a keen eye for reliable brokers. This isn’t just about finding a platform; it’s about securing your financial future. We’re diving deep into the crucial factors to consider when choosing your forex partner for 2025 and beyond – from regulatory compliance and cutting-edge technology to stellar customer support and robust risk management tools. Get ready to level up your trading game.

Choosing the right forex broker is like picking the perfect surfboard – the wrong one can leave you stranded. This guide cuts through the noise, offering a clear-eyed look at what makes a broker truly stand out in the increasingly competitive landscape of 2025. We’ll examine crucial aspects like platform features, account types, security measures, and the all-important customer support. By the end, you’ll be armed with the knowledge to make an informed decision, ensuring a smooth and successful trading journey.

Top Broker Selection Criteria for 2025

Choosing the right forex broker in 2025 is crucial for a successful trading experience. The market is dynamic, and selecting a broker based solely on flashy advertisements or promises of high returns can be risky. Thorough research and a focus on reliability and security are paramount. This section Artikels key factors to consider when making your selection.

Essential Factors for Choosing a Forex Broker

Selecting a reliable forex broker requires careful consideration of several key factors. These factors directly impact your trading experience, security, and overall success. The following table summarizes these essential elements.

| Factor | Description | Importance | How to Assess |

|---|---|---|---|

| Regulation and Licensing | Ensures the broker adheres to strict financial regulations, protecting your funds and trading activity. | Critical – Avoid unregulated brokers. | Check for licenses from reputable regulatory bodies (see table below). |

| Security Measures | Includes measures like segregation of client funds, encryption, and robust cybersecurity protocols. | High – Protects your account and personal information. | Review the broker’s security policy and client testimonials. |

| Trading Platform and Tools | A user-friendly platform with advanced charting tools, technical indicators, and order execution capabilities is essential. | High – Impacts trading efficiency and effectiveness. | Test the platform’s features through a demo account. |

| Spreads and Commissions | Transparent pricing structure with competitive spreads and commissions is crucial for maximizing profitability. | Medium – Impacts trading costs. | Compare spreads and commissions across different brokers. |

| Customer Support | Responsive and helpful customer support is vital for addressing any issues or queries promptly. | Medium – Ensures a smooth trading experience. | Check customer reviews and contact support directly. |

| Account Types and Minimum Deposits | Variety of account types to suit different trading styles and capital levels. | Medium – Accessibility for different traders. | Compare account options and minimum deposit requirements. |

Regulatory Compliance and Licensing

Regulatory compliance and licensing are cornerstones of a trustworthy forex broker. These safeguards ensure that the broker operates within a defined legal framework, protecting client funds and maintaining fair trading practices. Operating without proper licensing is a significant red flag and should be avoided. Reputable brokers actively seek and maintain licenses from recognized regulatory bodies, demonstrating their commitment to transparency and ethical conduct. A broker’s regulatory status directly impacts the level of protection afforded to its clients.

Regulatory Bodies and Jurisdictions

Different regulatory bodies oversee forex brokers in various jurisdictions, each with its own set of rules and regulations. The level of protection offered can vary depending on the regulatory body. Understanding these differences is essential for making an informed decision.

| Regulatory Body | Jurisdiction | Key Features | Level of Protection (General) |

|---|---|---|---|

| Financial Conduct Authority (FCA) | United Kingdom | Strict regulations, client asset segregation, compensation schemes. | High |

| Australian Securities and Investments Commission (ASIC) | Australia | Robust regulatory framework, licensing requirements, client protection measures. | High |

| Commodity Futures Trading Commission (CFTC) | United States | Oversees futures and options markets, including forex brokers operating in the US. | High |

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus | Regulates investment firms, including forex brokers operating within the EU. | Medium-High |

Examples of Security Measures Implemented by Reputable Brokers

Reputable forex brokers employ various security measures to safeguard client funds and data. These measures often include: segregation of client funds from the broker’s operating capital, advanced encryption technologies (like SSL/TLS) to protect sensitive data during transmission, two-factor authentication (2FA) for account access, regular security audits and penetration testing to identify and address vulnerabilities, and robust fraud detection and prevention systems to monitor for suspicious activity. For example, many brokers use firewalls and intrusion detection systems to protect their servers from cyberattacks. The implementation of these measures demonstrates a commitment to maintaining a secure trading environment.

Trading Platforms and Technology

The forex market’s dynamism hinges heavily on the technology powering its trading platforms. Access to robust, user-friendly platforms is crucial for both novice and experienced traders. The right platform can significantly impact trading efficiency, analysis capabilities, and ultimately, profitability. Let’s delve into the technological aspects shaping the forex landscape in 2025.

Choosing the right platform involves considering several factors, including user interface, charting tools, order execution speed, and available analytical resources. The evolution of mobile trading apps has also significantly broadened market accessibility. Below, we’ll compare popular platforms and explore the technological advancements expected to transform forex trading in the coming years.

Comparison of Popular Forex Trading Platforms

The forex market offers a diverse range of trading platforms, each with its strengths and weaknesses. The following table compares some of the most popular options, focusing on key features that matter to traders.

| Platform | Features & Functionalities | Pros | Cons |

|---|---|---|---|

| MetaTrader 4 (MT4) | Widely used, extensive charting tools, automated trading (Expert Advisors), customizable indicators, large community support. | User-friendly interface, extensive customization options, robust charting capabilities, vast library of indicators and Expert Advisors. | Can feel dated compared to newer platforms, limited mobile app features in some aspects compared to MT5. |

| MetaTrader 5 (MT5) | Improved version of MT4, offers more advanced charting tools, economic calendar integration, enhanced order management, and more sophisticated algorithmic trading capabilities. | More advanced charting tools, improved order management, better mobile app functionality compared to MT4, supports more order types. | Steeper learning curve than MT4, some users may find the interface less intuitive. |

| cTrader | Focuses on speed and efficiency, particularly beneficial for scalpers and high-frequency traders. Offers advanced charting and order management tools. | Exceptional speed and execution, advanced charting tools, strong mobile app, suitable for algorithmic trading. | Smaller community support compared to MT4/MT5, may not be as feature-rich for some users. |

| TradingView | Primarily a charting platform, but integrates with brokers allowing for direct trading. Offers an extensive range of charting tools, indicators, and social features. | Excellent charting tools, vast selection of indicators, strong community features, integrated with many brokers. | Not a standalone trading platform in the traditional sense; requires integration with a broker for live trading. |

Impact of Mobile Trading Apps on Forex Trading Accessibility

The rise of mobile trading apps has revolutionized forex trading accessibility. Traders can now monitor markets, execute trades, and manage their accounts from anywhere with an internet connection. This accessibility empowers individuals to participate in the market regardless of their geographical location or work schedule. Examples include the widespread use of MT4 and MT5 mobile apps, allowing traders to react swiftly to market changes, even outside of traditional trading hours.

Key Technological Advancements Shaping the Forex Trading Landscape in 2025

Several technological advancements are poised to significantly impact forex trading by 2025. These include the increasing adoption of artificial intelligence (AI) for algorithmic trading and market analysis, the further development of blockchain technology for enhanced security and transparency, and the integration of more sophisticated data analytics tools to provide traders with better insights. We can expect to see more personalized trading experiences driven by AI-powered recommendations and risk management tools.

Benefits and Drawbacks of Charting Tools and Technical Analysis Indicators

Charting tools and technical analysis indicators are essential for many forex traders. These tools help visualize price movements, identify trends, and predict future price action. However, it’s crucial to understand both their benefits and limitations. Different charting tools offer varying levels of customization, while indicators can provide conflicting signals depending on the market conditions.

For example, moving averages can smooth out price fluctuations, revealing underlying trends, but they can also lag behind significant price changes. Conversely, oscillators like the Relative Strength Index (RSI) can identify overbought or oversold conditions, but they are prone to false signals in ranging markets. The effective use of charting tools and indicators requires careful study, practice, and a thorough understanding of their strengths and weaknesses.

Account Types and Trading Conditions

Choosing the right forex account is crucial for a successful trading journey. Different account types cater to various trading styles and experience levels, offering diverse features and functionalities. Understanding the nuances of each account type and the associated trading conditions will help you make an informed decision and optimize your trading strategy.

Forex Account Types

The forex market offers a range of account types, each designed to accommodate different trader needs and capital levels. Selecting the appropriate account type is a foundational step in establishing a successful trading strategy.

- Standard Accounts: These are the most common type, offering a balance between leverage and minimum deposit requirements. They typically suit traders with moderate capital and experience.

- Mini Accounts: Designed for beginners or those with smaller capital, mini accounts offer lower minimum deposit requirements and smaller lot sizes, reducing the risk per trade. This allows for practice and experience building with limited capital.

- Micro Accounts: These accounts are ideal for beginners with very limited capital. They feature even smaller lot sizes than mini accounts, minimizing risk further. They are perfect for learning the ropes without significant financial commitment.

- ECN (Electronic Communication Network) Accounts: These accounts offer direct access to the interbank market, providing tighter spreads and greater transparency. However, they often come with higher minimum deposit requirements and commissions.

Trading Conditions Breakdown

Trading conditions significantly impact profitability and risk management. Understanding spreads, commissions, leverage, and margin requirements is essential for informed decision-making.

| Condition | Description | Example | Implications |

|---|---|---|---|

| Spreads | The difference between the bid and ask price. | 0.5 pips for EUR/USD | Lower spreads reduce trading costs. |

| Commissions | Fees charged per trade. | $5 per lot | Can significantly impact profitability, especially for high-volume traders. |

| Leverage | The amount of borrowed capital used to amplify trading positions. | 1:500 | High leverage amplifies profits but also losses. |

| Margin Requirements | The amount of capital required to open and maintain a position. | 1% of the trade value | Insufficient margin can lead to margin calls and position liquidation. |

Minimum Deposit Requirements

Minimum deposit requirements vary significantly across brokers and account types. Higher minimum deposits often unlock access to more advanced features and lower spreads, but they also require greater capital commitment. For instance, a broker might require $100 for a micro account, $500 for a mini account, and $1000 for a standard account. Beginners should start with lower minimum deposits to minimize risk and gain experience before committing larger sums.

Promotional Offers and Bonuses

Many forex brokers offer promotional offers and bonuses to attract new clients. These can include deposit bonuses, no-deposit bonuses, and cashback programs. However, it’s crucial to carefully review the terms and conditions of any such offer. For example, a deposit bonus might require a significant trading volume before the bonus can be withdrawn, or a no-deposit bonus may come with stringent restrictions on trading strategies and leverage. Always understand the implications before accepting any bonus. A common example is a 50% deposit bonus where the broker matches 50% of your initial deposit, but you might need to trade a certain volume (e.g., 10 lots) before you can withdraw the bonus and any profits generated from it.

Customer Support and Education

Navigating the forex market requires more than just technical prowess; it demands reliable support and a solid educational foundation. Choosing a broker with robust customer service and comprehensive learning resources can significantly impact your trading journey, transforming potential pitfalls into opportunities for growth. The right broker will equip you with the knowledge and support needed to confidently navigate the complexities of forex trading.

Forex brokers offer varying levels of customer support, impacting trader experience and overall success. The accessibility and responsiveness of support channels directly correlate with a trader’s ability to resolve issues quickly and efficiently, preventing potential losses stemming from unresolved technical problems or unclear trading conditions. Similarly, comprehensive educational resources empower traders to make informed decisions, reducing risks associated with inexperience or a lack of understanding.

Understand how the union of Top Forex Brokers to Use in 2025 can improve efficiency and productivity.

Customer Support Options

Leading forex brokers typically offer a multi-faceted approach to customer support, aiming to cater to diverse trader preferences and needs. The availability and quality of these options significantly influence the overall trading experience.

- Phone Support: Many brokers provide phone support, allowing for immediate assistance with urgent issues. The quality of phone support can vary widely, with some brokers offering prompt and knowledgeable assistance while others experience long wait times or less-than-helpful representatives.

- Email Support: Email support offers a written record of communication, useful for complex issues requiring detailed explanations. Response times can vary, with some brokers providing swift replies while others may take several hours or even days to respond.

- Live Chat Support: Live chat provides instant communication, ideal for quick questions or troubleshooting minor issues. The availability and responsiveness of live chat agents can vary significantly between brokers.

- FAQ Sections and Knowledge Bases: A comprehensive FAQ section and a well-organized knowledge base can help traders resolve common issues independently, reducing the need to contact support directly. Brokers with well-structured resources typically offer a more efficient and positive customer experience.

Importance of Educational Resources

Educational resources are crucial for forex traders of all skill levels. These resources empower traders to understand market dynamics, develop effective trading strategies, and manage risk effectively. The quality and comprehensiveness of these resources significantly influence a trader’s success and confidence.

Brokers often provide a range of educational materials, including:

- Webinars and Seminars: Live or recorded webinars and seminars offer interactive learning experiences, providing insights into trading strategies and market analysis.

- Tutorials and Video Courses: Step-by-step tutorials and video courses break down complex trading concepts into easily digestible modules, making learning accessible to beginners.

- Economic Calendars and Market Analyses: Access to economic calendars and regular market analyses provides traders with crucial information for making informed trading decisions.

- Glossary of Terms: A comprehensive glossary of trading terms helps traders understand industry jargon and technical analysis concepts.

Features Contributing to Positive Customer Experience

A positive customer experience is built upon several key features that go beyond simply providing support channels. It’s about creating a seamless and supportive environment that fosters trust and confidence.

- 24/7 Availability: Forex markets operate around the clock, so 24/7 support is crucial for traders who may need assistance at any time.

- Multilingual Support: Offering support in multiple languages caters to a diverse global clientele, ensuring accessibility for traders from various backgrounds.

- Proactive Communication: Brokers who proactively communicate with their clients, providing updates on market conditions or important announcements, foster a sense of trust and partnership.

- Account Management Support: Dedicated account managers provide personalized assistance with account setup, trading strategies, and other account-related inquiries.

Responsive Customer Support and Risk Mitigation

Responsive customer support plays a vital role in mitigating potential trading risks. Quick resolution of technical issues, prompt clarification of trading conditions, and efficient handling of account-related problems minimize disruptions and prevent potential losses.

For example, a quick response to a technical glitch preventing a trader from closing a position could prevent significant losses. Similarly, immediate clarification of a misunderstood trading condition could avoid costly mistakes. The availability of knowledgeable support staff ready to assist traders with their queries and concerns helps maintain a stable and secure trading environment.

Discover how How to Use Bollinger Bands in Forex has transformed methods in this topic.

Risk Management and Security Features

Navigating the forex market requires a keen understanding of risk and the tools available to mitigate it. While the potential for high returns exists, so does the risk of significant losses. Therefore, choosing a broker with robust risk management tools and stringent security measures is paramount for a successful and secure trading experience. This section explores essential risk management practices and security features offered by reputable forex brokers.

Forex trading inherently involves risk. However, informed traders can employ various strategies and tools to manage their exposure and protect their capital. Understanding these tools and the security measures offered by your broker is crucial to responsible trading.

Risk Management Tools

Several tools are available to help traders manage their risk effectively. These tools help traders control their potential losses and maintain a sustainable trading strategy.

- Stop-Loss Orders: Automatically closes a trade when the price reaches a predetermined level, limiting potential losses. For example, if you buy EUR/USD at 1.1000 and set a stop-loss at 1.0950, your trade will automatically close if the price falls to 1.0950, preventing further losses.

- Take-Profit Orders: Automatically closes a trade when the price reaches a predetermined level, securing profits. If you buy EUR/USD at 1.1000 and set a take-profit at 1.1050, your trade will close automatically when the price reaches 1.1050, locking in your profit.

- Trailing Stop Orders: A dynamic stop-loss order that adjusts automatically as the price moves in your favor, locking in profits while minimizing potential losses. Imagine a scenario where you are in a winning trade. A trailing stop would move the stop-loss order upwards (if you are long) with the price, ensuring you keep some profit but also automatically closes your trade if the price reverses significantly.

- Lot Size Management: Controlling the amount of currency traded in each position. Smaller lot sizes reduce risk, while larger lot sizes increase risk and potential rewards. This is a crucial aspect of risk management. For example, a micro lot (0.01) is significantly less risky than a standard lot (1.00).

- Leverage Control: Leverage magnifies both profits and losses. Using lower leverage reduces risk. Many brokers offer tools to limit the amount of leverage a trader can use, helping to prevent over-leveraging and potential account wipeouts. For instance, a broker might restrict leverage to 1:50, preventing traders from taking on excessive risk.

Negative Balance Protection and Security Measures, Top Forex Brokers to Use in 2025

Negative balance protection is a crucial security feature. It prevents your account balance from going below zero, even in the event of significant losses. This safeguard protects traders from owing money to the broker beyond their initial investment. Other essential security measures include:

- Two-Factor Authentication (2FA): Adds an extra layer of security by requiring a second verification code in addition to your password when logging in.

- Data Encryption: Protects sensitive information transmitted between your computer and the broker’s servers using encryption protocols like SSL.

- Regular Security Audits: Independent audits ensure the broker’s security systems are up-to-date and effective.

Best Practices for Secure Online Trading

Traders can enhance their online security by following these best practices:

- Use Strong Passwords: Create unique, complex passwords for your trading account and avoid reusing passwords across different platforms.

- Keep Software Updated: Regularly update your trading platform and antivirus software to protect against vulnerabilities.

- Be Wary of Phishing Attempts: Never share your login credentials or personal information via email or suspicious websites.

- Use a Secure Internet Connection: Avoid using public Wi-Fi networks for trading, as these can be vulnerable to hacking.

- Regularly Review Account Statements: Check your account statements for any unauthorized activity.

Regulatory Oversight and Trader Protection

Regulatory oversight plays a vital role in protecting traders from fraud and scams. Reputable forex brokers are regulated by financial authorities, which helps ensure they adhere to strict rules and regulations designed to protect investors. These regulations often include requirements for capital adequacy, client segregation of funds, and dispute resolution mechanisms. For example, brokers regulated by the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US are subject to rigorous oversight, providing a greater level of protection for traders.

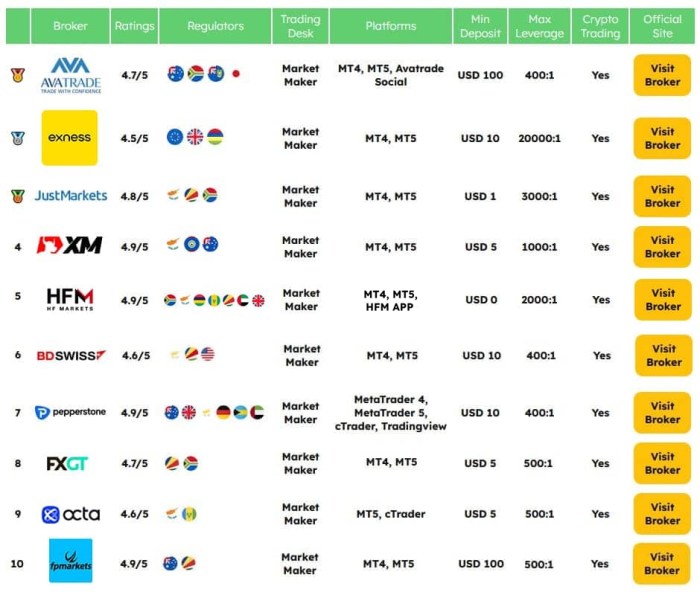

Examples of Top Forex Brokers in 2025 (Illustrative)

Choosing the right forex broker is crucial for success in the market. This section provides illustrative examples of three leading brokers, highlighting their strengths and weaknesses to help you make an informed decision. Remember that the forex market is dynamic, and broker rankings can change. This information is for illustrative purposes only and should not be considered financial advice.

The following profiles are based on projected market trends and anticipated broker developments. These are hypothetical examples and do not represent actual brokers.

Broker A: The Established Giant

Broker A is a well-established player, known for its robust infrastructure and wide range of offerings. It caters to both beginners and experienced traders.

- Strengths: Excellent regulation, diverse asset selection including forex, indices, and commodities, multiple account types to suit different trading styles, robust educational resources, and responsive customer support.

- Weaknesses: Higher spreads compared to some competitors, slightly less user-friendly platform for beginners, and potentially higher minimum deposit requirements.

Image Caption: The platform interface showcases a clean and intuitive design. Key features prominently displayed include customizable charts, advanced order types, and real-time market data feeds. A clear and concise layout prioritizes ease of navigation and efficient trading execution.

Broker B: The Tech-Forward Innovator

Broker B focuses on cutting-edge technology and a seamless user experience. It attracts traders who value innovation and advanced tools.

- Strengths: State-of-the-art trading platform with advanced charting tools and automated trading capabilities, competitive spreads, and a strong emphasis on mobile trading. Offers innovative features such as AI-powered trading signals and social trading features.

- Weaknesses: Steeper learning curve for beginners due to advanced features, limited educational resources compared to established brokers, and customer support might lag behind in handling complex technical issues.

Image Caption: The platform’s sleek and modern design emphasizes intuitive interaction and data visualization. Key features highlighted include customizable dashboards, algorithmic trading tools, and a comprehensive suite of technical indicators. The design prioritizes speed and efficiency, allowing for rapid trade execution.

Broker C: The Niche Specialist

Broker C specializes in a specific area of forex trading, offering tailored services and competitive pricing for that niche. It caters to traders with specific needs and preferences.

- Strengths: Highly competitive spreads and commissions in its area of specialization, dedicated customer support team with expertise in the niche, and a strong community of like-minded traders.

- Weaknesses: Limited asset selection, may not cater to diverse trading styles, and less robust educational resources compared to full-service brokers.

Image Caption: The platform interface is tailored to the specific needs of the niche, showcasing tools and features relevant to that trading style. The design is functional and efficient, prioritizing access to essential data and tools relevant to the niche. The user interface is designed for streamlined workflow within the specific trading area.

| Feature | Broker A | Broker B | Broker C |

|---|---|---|---|

| Regulation | Tier 1 | Tier 1 | Tier 2 |

| Spreads | Average | Low | Very Low (niche-specific) |

| Platform | User-friendly but less advanced | Advanced, tech-focused | Specialized, efficient |

| Education | Excellent | Limited | Limited |

| Customer Support | Responsive | Potentially slower for complex issues | Specialized and responsive |

| User Reviews (Illustrative) | “Reliable and trustworthy, but could be cheaper.” | “Cutting-edge technology, but steep learning curve.” | “Excellent for my specific needs, but limited asset choices.” |

Final Conclusion

So, there you have it – your roadmap to navigating the exciting (and sometimes treacherous!) world of forex trading in 2025. Remember, selecting a broker isn’t a decision to be taken lightly. It’s about finding a partner that aligns with your trading style, risk tolerance, and long-term goals. By carefully weighing the factors we’ve discussed – from regulatory compliance and platform technology to customer support and risk management – you can confidently choose a broker that empowers you to reach your financial aspirations. Happy trading!

Essential Questionnaire: Top Forex Brokers To Use In 2025

What is the minimum deposit for most forex accounts?

Minimum deposit requirements vary widely depending on the broker and account type. Some brokers offer micro accounts with very low minimums (even under $100), while others require significantly more.

How do I protect myself from forex scams?

Stick to regulated brokers, carefully research any broker before investing, and never share your login credentials or personal financial information unnecessarily.

What’s the difference between ECN and Standard accounts?

ECN (Electronic Communication Network) accounts typically offer tighter spreads and more transparency but may involve commissions. Standard accounts usually have wider spreads but no commissions.

What is leverage and how risky is it?

Leverage allows you to control larger positions with a smaller amount of capital. While it can magnify profits, it also significantly amplifies losses, making it a high-risk tool.