Best Forex Trading Strategies for 2025: Navigating the ever-shifting sands of the forex market requires a keen eye and a smart strategy. 2025 promises a landscape shaped by technological advancements and evolving economic forces. This guide dives deep into the most effective trading strategies, blending technical analysis with fundamental insights to help you navigate this exciting and potentially lucrative world. We’ll unpack the mechanics of scalping, day trading, and swing trading, exploring the risks and rewards of each. Get ready to level up your trading game.

From mastering technical indicators like moving averages and RSI to understanding the impact of geopolitical events on currency fluctuations, we’ll cover it all. We’ll also explore the crucial role of risk management, algorithmic trading, and the best platforms to use. Whether you’re a seasoned trader or just starting, this comprehensive guide is your roadmap to success in the dynamic world of forex trading in 2025.

Introduction to Forex Trading in 2025

The forex market, already a behemoth, is poised for even more dramatic change in 2025. Technological advancements, evolving geopolitical landscapes, and shifting economic priorities are reshaping how traders approach this dynamic market. Understanding these shifts is crucial for navigating the complexities and maximizing opportunities in the years to come. This section provides a glimpse into the evolving forex trading landscape and the strategies likely to thrive in 2025.

The forex market, where currencies are traded against each other, is characterized by its immense liquidity and 24/5 availability. Traders utilize two primary methods of analysis: fundamental and technical. Fundamental analysis focuses on macroeconomic factors like interest rates, inflation, and political stability to predict currency movements. For example, a surprise interest rate hike by a central bank could strengthen its currency. Technical analysis, on the other hand, uses historical price and volume data to identify patterns and predict future price movements, relying on charts and indicators like moving averages and relative strength index (RSI).

Technological Advancements in Forex Trading

Technological advancements are revolutionizing forex trading strategies. Artificial intelligence (AI) and machine learning (ML) algorithms are increasingly used for high-frequency trading (HFT), enabling rapid execution of trades based on complex market analyses. Imagine an AI system analyzing millions of data points in milliseconds to identify fleeting arbitrage opportunities – this is the reality of HFT. Furthermore, algorithmic trading, which uses pre-programmed instructions to execute trades, is becoming more sophisticated, allowing for more complex strategies and risk management. The rise of robo-advisors, which use algorithms to provide automated investment advice, is also impacting the landscape, potentially making forex trading more accessible to less experienced individuals. However, it’s crucial to remember that while technology offers powerful tools, it also introduces new risks, including the potential for algorithmic errors and vulnerabilities to cyberattacks. Sophisticated traders will need to adapt to these changes and integrate new technologies effectively to remain competitive.

Fundamental Analysis in 2025

Geopolitical events will continue to significantly influence currency values. For example, unexpected political shifts in major economies, such as changes in government or significant policy announcements, can trigger substantial currency fluctuations. Similarly, global economic events, like shifts in energy prices or major trade agreements, will continue to impact currency pairs. Effective fundamental analysis in 2025 will require a deep understanding of global economics and geopolitics, coupled with the ability to quickly interpret and react to breaking news. Traders will need access to real-time data feeds and credible news sources to make informed decisions.

Technical Analysis in 2025

Technical analysis will continue to play a vital role, but its application will be enhanced by AI and ML. These technologies can help identify subtle patterns and correlations in vast datasets that might be missed by human analysts. For example, an AI-powered system might identify a previously unknown correlation between a specific technical indicator and the price movement of a particular currency pair. However, over-reliance on automated systems can be risky. Human judgment and experience will still be crucial in interpreting signals, managing risk, and adapting to unexpected market events. Effective technical analysis in 2025 will involve a blend of human expertise and advanced technological tools.

Popular Forex Trading Strategies

Navigating the forex market requires a strategic approach. Success hinges on understanding different trading styles and adapting them to your risk tolerance and available time. This section delves into three popular forex trading strategies: scalping, day trading, and swing trading, outlining their mechanics, risk profiles, and the tools employed.

Scalping

Scalping involves profiting from minuscule price fluctuations within seconds or minutes. Traders open and close positions rapidly, aiming for small but frequent gains. This high-frequency approach necessitates quick reflexes, precise execution, and a low-latency trading platform. The strategy thrives on volatility, but also carries significant risk due to the rapid pace of trades.

Day Trading

Day trading focuses on holding positions for a single trading day. Trades are opened and closed before the market closes, eliminating overnight risk. This strategy requires constant market monitoring and a keen understanding of technical analysis to identify short-term trends and reversals. While offering the potential for significant daily returns, day trading demands discipline, focus, and a tolerance for potentially large losses if trades go against expectations. Successful day traders often employ a combination of technical indicators and chart patterns to identify optimal entry and exit points.

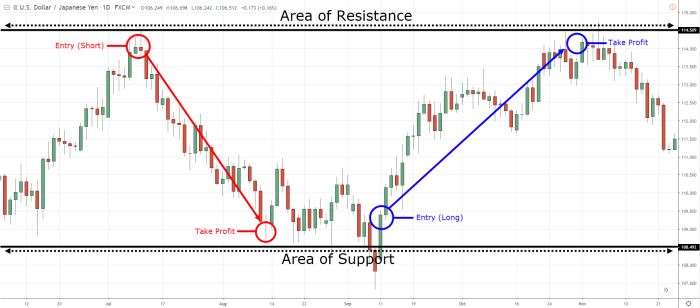

Swing Trading

Swing trading involves holding positions for several days or weeks, capitalizing on medium-term price swings. This strategy is less demanding in terms of time commitment compared to scalping and day trading. Traders leverage technical and fundamental analysis to identify potential trends, aiming to capture substantial price movements. While the risk is comparatively lower than scalping, swing trading requires patience and the ability to withstand short-term price fluctuations without prematurely exiting positions.

Comparison of Strategies

The following table summarizes the key differences between scalping, day trading, and swing trading:

| Strategy | Indicators | Timeframe | Risk Management |

|---|---|---|---|

| Scalping | Moving averages (short-term), RSI, MACD (fast settings), candlestick patterns | Seconds to minutes | Tight stop-losses, small position sizes, strict risk-reward ratios (e.g., 1:1 or 1:2) |

| Day Trading | Moving averages (short-to-medium term), RSI, MACD, Bollinger Bands, support/resistance levels, pivot points | Minutes to hours | Stop-losses, position sizing based on account equity, risk-reward ratios (e.g., 1:1.5 or 1:2) |

| Swing Trading | Moving averages (medium-to-long term), RSI, MACD, Bollinger Bands, Fibonacci retracements, support/resistance levels, trendlines, fundamental analysis | Days to weeks | Stop-losses, position sizing based on account equity, risk-reward ratios (e.g., 1:2 or 1:3) |

Technical Analysis Strategies for 2025

Technical analysis remains a cornerstone of successful Forex trading, even in the rapidly evolving landscape of 2025. While market dynamics shift, the fundamental principles of charting and indicator analysis continue to provide valuable insights into price action and potential trading opportunities. Mastering these techniques is crucial for navigating the complexities of the Forex market and making informed trading decisions. This section will delve into key technical analysis tools and demonstrate how to integrate them into a robust trading strategy.

Moving Averages, RSI, and MACD

Moving averages (MAs), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are among the most widely used technical indicators. Moving averages smooth out price fluctuations, helping traders identify trends. The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions, potentially signaling trend reversals. The MACD, a trend-following momentum indicator, highlights changes in the strength, direction, momentum, and duration of a trend by comparing two moving averages. Each indicator provides a unique perspective on market sentiment and momentum, and combining them can enhance trading accuracy. For instance, a bullish crossover of a fast MA over a slow MA, coupled with an RSI above 50 and a rising MACD, could suggest a strong upward trend. Conversely, bearish signals might emerge when these indicators align negatively.

A Combined Technical Indicator Trading Strategy, Best Forex Trading Strategies for 2025

A practical trading strategy could combine the 20-period Exponential Moving Average (EMA), the 14-period RSI, and the MACD. The 20-period EMA provides a relatively sensitive measure of the short-term trend. The RSI helps identify overbought and oversold conditions, while the MACD provides insights into momentum shifts.

This strategy would involve:

* Entry: A long position would be considered when the price crosses above the 20-period EMA, the RSI is above 30 (avoiding oversold conditions), and the MACD shows a bullish crossover. A short position would be taken when the price crosses below the 20-period EMA, the RSI is below 70 (avoiding overbought conditions), and the MACD shows a bearish crossover.

* Exit: Positions would be closed when the opposite conditions are met, or when a stop-loss order is triggered, limiting potential losses. A trailing stop-loss, adjusted as the price moves favorably, can help protect profits. Alternatively, a target profit level could be pre-determined based on risk management principles.

This is a simplified example, and risk management, including appropriate stop-loss and take-profit levels, is crucial. Backtesting this strategy on historical data is strongly recommended before live trading.

Identifying Entry and Exit Points Using Candlestick Patterns

Candlestick patterns offer visual clues about potential price reversals or continuations. Combining candlestick patterns with indicator signals enhances the accuracy of entry and exit point identification. For example, a bullish engulfing pattern, confirming a bullish crossover of the 20-period EMA, and an RSI above 30, would significantly increase the confidence in a long entry. Conversely, a bearish engulfing pattern, coupled with a bearish crossover of the EMA and an RSI above 70, could signal a high-probability short entry. Similarly, identifying patterns like hammer or shooting star candlestick patterns near support or resistance levels can help pinpoint potential reversal points. A combination of these candlestick patterns with indicator signals provides a comprehensive approach to identifying high-probability entry and exit points, minimizing risk and maximizing potential gains.

Fundamental Analysis Strategies for 2025

Fundamental analysis in forex trading involves examining the underlying economic and political factors that influence currency values. Unlike technical analysis which focuses on chart patterns, fundamental analysis delves into the bigger picture, considering macroeconomic indicators and global events to predict future price movements. In 2025, this approach remains crucial, especially given the ongoing global economic uncertainties and geopolitical shifts.

Understanding the interplay of these factors is key to successful forex trading. By combining economic data with geopolitical insights, traders can make informed decisions about which currencies are likely to appreciate or depreciate. This approach, while requiring more in-depth research, offers the potential for significant returns.

Key Economic Indicators and Events Influencing Forex Markets

Economic indicators provide a snapshot of a country’s economic health, directly impacting its currency’s value. Strong economic data usually leads to a stronger currency, while weak data can signal a decline. Several key indicators are consistently monitored by forex traders. For example, Gross Domestic Product (GDP) growth reflects the overall economic output. A rise in GDP typically strengthens a nation’s currency, while a decline weakens it. Inflation rates, measured by Consumer Price Index (CPI) and Producer Price Index (PPI), also play a crucial role. High inflation can erode purchasing power, potentially leading to currency devaluation, unless countered by strong interest rate hikes. Employment data, like unemployment rates and non-farm payroll figures, offer insights into labor market conditions, which influence economic growth and consequently, currency value. Interest rate decisions made by central banks significantly impact currency exchange rates. Higher interest rates attract foreign investment, strengthening the currency, while lower rates can weaken it. Trade balances, the difference between a country’s exports and imports, also affect currency valuations. A consistent trade surplus generally boosts a currency’s value.

Impact of Geopolitical Events on Currency Exchange Rates

Geopolitical events, such as wars, political instability, and changes in government, can dramatically influence currency markets. Unexpected political developments can cause significant volatility, leading to rapid currency fluctuations. For example, a sudden escalation of international tensions might lead investors to seek safe havens, driving demand for currencies like the US dollar or Swiss franc, while potentially weakening riskier currencies. Similarly, changes in government policies, especially those affecting trade or economic regulations, can significantly impact currency exchange rates. Sanctions imposed on a country can severely weaken its currency, while positive developments in international relations can have the opposite effect. Consider the impact of the ongoing war in Ukraine; the conflict has created significant uncertainty in global markets, causing volatility in numerous currencies. The Euro, for example, experienced fluctuations due to the war’s impact on energy prices and trade relations with Russia.

Interpreting News and Economic Data to Inform Trading Decisions

Interpreting news and economic data requires a critical and nuanced approach. It’s not enough to simply react to headlines; traders need to understand the context and implications of the information. For instance, a positive GDP report might initially strengthen a currency, but if inflation is also high, the central bank might raise interest rates to combat inflation, potentially negating the positive impact of the GDP growth. Traders need to analyze the data in relation to market expectations. If the data exceeds expectations, the currency might experience a stronger reaction than if it merely meets forecasts. Similarly, analyzing the reaction of other market participants to news events is crucial. Observing how other traders and investors are reacting to specific news releases can provide valuable insights into potential future price movements. For example, a significant drop in a currency after a negative news report might indicate a selling pressure that could continue for some time.

Risk Management and Money Management

Forex trading, while potentially lucrative, is inherently risky. Success hinges not just on picking winning trades, but on effectively managing risk and preserving your capital. Ignoring this crucial aspect can quickly lead to devastating losses, wiping out your account balance before you even have a chance to profit consistently. Proper risk and money management are your safety nets, ensuring you stay in the game long enough to ride out the inevitable losing streaks and capitalize on winning ones.

Proper risk management is about safeguarding your trading capital, while money management focuses on how much capital you allocate to each trade and how you manage your overall portfolio. Both are intertwined and essential for long-term success. Failing to implement effective strategies in either area can significantly increase your chances of failure.

Position Sizing and Stop-Loss Orders

Position sizing determines the amount of capital you risk on each trade. It’s a crucial element of risk management, aiming to limit potential losses to a manageable percentage of your overall trading account. Stop-loss orders are automatically triggered when the price moves against your position, limiting your losses to a predetermined level. For example, if you have a $10,000 account and decide on a 2% risk per trade, your maximum loss per trade would be $200. You would then adjust your position size to ensure that a stop-loss order at your predetermined level results in a maximum loss of $200. A stop-loss order placed at a specific price point automatically closes your position when that price is reached, preventing further losses. Without stop-loss orders, a single losing trade could wipe out your entire account.

Risk Management Techniques

Effective risk management involves a multi-faceted approach. Here are some techniques traders use:

- Diversification: Don’t put all your eggs in one basket. Spread your investments across different currency pairs to reduce the impact of a single losing trade. For example, instead of focusing solely on EUR/USD, diversify into GBP/USD, USD/JPY, and AUD/USD.

- Hedging: This involves taking offsetting positions to reduce risk. For example, if you’re long on EUR/USD, you might simultaneously take a short position on a correlated pair to mitigate potential losses if the EUR weakens significantly.

- Trailing Stop-Losses: These adjust your stop-loss order as the price moves in your favor, locking in profits while minimizing potential losses. As your trade becomes profitable, the stop-loss moves with the price, protecting your gains.

- Risk-Reward Ratio: This considers the potential profit versus the potential loss for each trade. A favorable risk-reward ratio, such as 1:2 or 1:3, means that your potential profit is at least twice or thrice your potential loss. This helps to ensure that your wins outweigh your losses over time.

Psychological Aspects of Forex Trading

Forex trading is as much a psychological battle as it is a financial one. Emotional biases like greed, fear, and overconfidence can significantly impair judgment and lead to poor trading decisions.

- Fear of Missing Out (FOMO): This can lead to impulsive trades, chasing already-moving markets without proper analysis, resulting in losses.

- Overconfidence: A string of successful trades can lead to overconfidence, causing traders to take on excessive risk, potentially resulting in significant losses when the market turns against them. For example, a trader who has had several profitable trades might increase their position size significantly without considering the increased risk involved.

- Revenge Trading: This is the act of taking more risks after suffering losses in an attempt to quickly recoup those losses. This often leads to further losses, creating a vicious cycle.

To mitigate these biases, traders can employ techniques like:

- Sticking to a Trading Plan: A well-defined trading plan, including risk management rules and entry/exit strategies, helps to keep emotions in check and avoid impulsive decisions.

- Keeping a Trading Journal: Recording trades, including the rationale behind them and the outcomes, helps to identify patterns in your trading behavior and improve self-awareness.

- Seeking Mentorship or Education: Learning from experienced traders or taking courses can provide valuable insights into effective risk management and emotional control.

Algorithmic and Automated Trading

In the fast-paced world of forex trading, where milliseconds can mean the difference between profit and loss, algorithmic and automated trading systems are increasingly becoming essential tools. These systems, often employing sophisticated software and expert advisors (EAs), allow traders to execute trades based on pre-programmed rules and strategies, removing emotional biases and enabling round-the-clock market monitoring. This section delves into the mechanics, advantages, and disadvantages of this increasingly popular approach.

Automated trading systems, often referred to as Expert Advisors (EAs) in the forex context, are software programs designed to execute trades based on pre-defined parameters. These parameters typically involve technical indicators, price action analysis, and risk management rules. EAs continuously monitor the market, identify potential trading opportunities based on their programmed logic, and execute trades automatically without human intervention. This allows for consistent execution of a trading strategy, even during periods when a human trader might be unavailable or prone to emotional decision-making.

Advantages and Disadvantages of Automated Trading Systems

Automated trading systems offer several compelling advantages. The most significant is the elimination of emotional trading. Human traders are susceptible to fear, greed, and other psychological biases that can lead to poor trading decisions. EAs, on the other hand, execute trades strictly according to their programmed logic, eliminating emotional interference. Furthermore, EAs can monitor the market 24/7, identifying and capitalizing on opportunities that a human trader might miss. This constant market surveillance can lead to increased trading frequency and potentially higher returns. However, automated systems are not without their drawbacks. The primary disadvantage is the risk of unforeseen market events or unexpected changes in market dynamics. A strategy that performs well under certain conditions might fail dramatically under others. Furthermore, the development and maintenance of effective EAs require specialized skills and knowledge. The initial investment in software and the ongoing costs of monitoring and adjusting the system can also be significant. Finally, the reliance on a single system can be risky; a bug or unexpected market event could lead to significant losses.

A Hypothetical Algorithmic Trading Strategy

Let’s consider a hypothetical algorithmic trading strategy based on the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). This strategy aims to capitalize on short-term price movements. The RSI is a momentum oscillator that measures the speed and change of price movements. The MACD is a trend-following momentum indicator that shows the relationship between two moving averages.

The EA would be programmed to generate a buy signal when the following conditions are met:

- The RSI is below 30, indicating oversold conditions.

- The MACD line crosses above the signal line, suggesting a bullish trend reversal.

Conversely, a sell signal would be generated when:

- The RSI is above 70, indicating overbought conditions.

- The MACD line crosses below the signal line, suggesting a bearish trend reversal.

The EA would also incorporate a stop-loss order to limit potential losses and a take-profit order to secure profits. The specific values for stop-loss and take-profit levels would be determined based on risk tolerance and historical volatility. For example, a stop-loss might be set at 2% below the entry price, while a take-profit might be set at 3% above the entry price. This hypothetical strategy illustrates how multiple technical indicators can be combined to create a more robust algorithmic trading system. It is important to note that this is a simplified example and that backtesting and optimization are crucial before deploying any automated trading strategy in a live trading environment. Real-world implementation would necessitate far more complex parameters and considerations.

Trading Platforms and Tools

Navigating the forex market effectively hinges on choosing the right tools and platforms. The sheer variety available can be overwhelming, so understanding their features and capabilities is crucial for success. This section will explore popular platforms and essential tools, helping you make informed decisions to optimize your trading experience.

Choosing the right forex trading platform is like choosing the right car for a road trip – the wrong choice can make the journey far more difficult. The platform’s features directly impact your trading efficiency, speed, and overall experience. Charting tools, in particular, play a pivotal role in analyzing market trends and making informed trading decisions.

Popular Forex Trading Platforms

Several platforms dominate the forex market, each offering a unique set of features. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) remain industry stalwarts, known for their robust charting capabilities, extensive technical indicators, and automated trading options (Expert Advisors or EAs). cTrader, favoured by many algorithmic traders, is prized for its speed and advanced order management features. Other platforms, such as TradingView, cater more to charting and analysis, offering a collaborative environment with a vast community of traders. The best platform for you depends on your trading style, experience level, and specific needs. Consider factors such as ease of use, available tools, charting capabilities, and customer support when making your choice.

Charting Tools and Their Capabilities

Charting tools are the visual backbone of technical analysis. Different platforms offer various chart types (candlestick, bar, line), timeframes (from 1-minute to monthly), and drawing tools (trendlines, Fibonacci retracements, support/resistance levels). Advanced platforms often include customizable indicators, allowing traders to overlay technical studies like moving averages, Relative Strength Index (RSI), and MACD directly onto the charts. The ability to personalize charts is key, allowing traders to tailor their analysis to their specific trading strategies. For instance, a scalper might focus on 1-minute charts with high-frequency indicators, while a swing trader might prefer daily charts with longer-term trend indicators.

Essential Tools for Forex Traders

A comprehensive toolkit is vital for success in forex trading. Beyond the platform itself, several other tools enhance analysis, risk management, and overall trading efficiency.

| Tool | Description | Use Case | Provider(s) |

|---|---|---|---|

| Economic Calendar | Provides a schedule of upcoming economic news releases (e.g., Non-Farm Payroll, inflation data). | Anticipating market reactions to major economic events, adjusting trading strategies accordingly. | Many financial news websites, forex brokers. |

| Forex News Aggregator | Compiles news from various sources, providing a centralized view of market-moving events. | Staying informed about global events impacting currency pairs. | Investing.com, ForexLive, and many others. |

| Backtesting Software | Allows traders to test trading strategies on historical data. | Evaluating the performance of a trading strategy before deploying it with real money. | MetaTrader platforms, TradingView, dedicated backtesting software. |

| Spreadsheets (Excel, Google Sheets) | Used for portfolio tracking, risk management calculations, and backtesting. | Organizing trades, calculating position size, analyzing performance metrics. | Microsoft, Google. |

Illustrative Examples of Successful Strategies

Understanding forex trading success requires examining both triumphs and failures. Analyzing these examples helps refine strategies and avoid common pitfalls. Let’s explore hypothetical scenarios to illustrate key concepts.

A Successful Forex Trade: EUR/USD Long Position

This example showcases a successful long position on the EUR/USD pair using a combination of technical and fundamental analysis. We observed a clear bullish trend forming on the daily chart, supported by positive economic indicators for the Eurozone.

The daily chart showed a strong upward trendline, with the price consistently bouncing off this support. The Relative Strength Index (RSI) was sitting comfortably above 30, indicating the pair wasn’t oversold. The Moving Average Convergence Divergence (MACD) was showing a bullish crossover, confirming the upward momentum. Additionally, recent Eurozone economic data, particularly strong PMI figures, suggested continued economic growth, bolstering the fundamental case for a long position.

Our entry point was at 1.1000. We placed a stop-loss order at 1.0950, just below a recent swing low, to limit potential losses. Our target was 1.1150, based on previous resistance levels and the projected strength of the Euro. The trade played out as anticipated. The EUR/USD pair steadily rose, hitting our target within a week. We closed the position at 1.1150, securing a profitable trade. The chart would visually show the upward trendline, the RSI above 30, the bullish MACD crossover, and the price movement from 1.1000 to 1.1150.

A Failed Forex Trade: GBP/USD Short Position

This example highlights a failed short position on the GBP/USD pair, emphasizing the importance of risk management and acknowledging unexpected market volatility.

We entered a short position based on a bearish head and shoulders pattern forming on the four-hour chart. The pattern suggested a potential price reversal. However, we failed to account for significant geopolitical events impacting the British pound. Unexpected positive news regarding Brexit negotiations triggered a sharp and sudden rally, pushing the price significantly higher than our anticipated target. Our stop-loss order was triggered, resulting in a loss. The chart would show the head and shoulders pattern, the sudden price spike due to the unexpected news, and the stop-loss order execution point.

The key lesson learned was the importance of incorporating fundamental analysis alongside technical analysis, especially when trading volatile pairs like GBP/USD. Ignoring significant geopolitical factors led to a significant loss, highlighting the need for comprehensive market analysis.

A Successful Fundamental Trade: USD/JPY Based on Interest Rate Hike

This example illustrates a successful trade based solely on fundamental analysis. The Federal Reserve announced a surprise interest rate hike, strengthening the US dollar significantly.

Anticipating the dollar’s strength following the interest rate announcement, we took a long position on the USD/JPY pair. The rationale was simple: higher interest rates in the US would attract more foreign investment, increasing demand for the US dollar and consequently pushing the USD/JPY exchange rate higher. The trade was successful, as the USD/JPY pair rose significantly following the announcement, generating a substantial profit. While a chart might show the price movement, the core success of this trade hinged entirely on the accurate prediction of the market’s reaction to the fundamental event – the interest rate hike. No technical indicators were used in this instance.

Conclusive Thoughts: Best Forex Trading Strategies For 2025

Conquering the forex market in 2025 demands more than just luck; it requires a well-defined strategy, a cool head, and a commitment to continuous learning. This guide has equipped you with the knowledge to navigate the complexities of this exciting market, from understanding fundamental and technical analysis to mastering risk management techniques. Remember, the key to success lies in a blend of calculated risk-taking, disciplined execution, and a thorough understanding of the market forces at play. So, sharpen your skills, stay informed, and prepare to ride the waves of the forex market into 2025 and beyond.

User Queries

What is the minimum amount of capital needed to start forex trading?

There’s no fixed minimum, but starting with a smaller amount allows for more controlled risk and learning. Many brokers offer micro and mini lots for smaller accounts.

How can I avoid emotional trading biases?

Develop a strict trading plan, stick to your risk management rules, and keep detailed records of your trades to track performance objectively. Consider journaling to manage emotions.

What are some reliable sources for forex news and analysis?

Reputable financial news websites (like Bloomberg, Reuters, and Financial Times), economic calendars, and forex-focused blogs and forums can provide valuable insights. Always cross-reference information.

Are forex trading signals reliable?

Trading signals can be helpful, but they’re not foolproof. Always conduct your own research and don’t blindly follow signals without understanding the rationale.

Learn about more about the process of The Most Common Forex Trading Mistakes and How to Avoid Them in the field.

Learn about more about the process of Understanding Forex Trading Volatility in the field.