How to Trade Forex on a Budget? Think you need a fat bank account to dive into the world of foreign exchange trading? Think again! This guide breaks down how to navigate the forex market even with limited capital, turning your dreams of financial freedom into a realistic possibility. We’ll explore strategies for choosing the right broker, managing risk effectively, and developing a sustainable trading plan that fits your budget.

From understanding basic forex terminology to mastering risk management and utilizing free resources, we’ll equip you with the knowledge and tools to succeed. We’ll also delve into the psychological aspects of trading, helping you stay disciplined and avoid common pitfalls. Get ready to unlock the potential of forex trading, no matter your starting capital.

Understanding Forex Trading Basics on a Budget

Forex trading, or foreign exchange trading, might seem intimidating, but with a smart approach, it’s entirely possible to dip your toes in without breaking the bank. This guide will walk you through the essentials, focusing on how to navigate the world of forex on a budget. We’ll cover the fundamental concepts, explore different account types and their costs, and compare brokers to help you find the best fit for your financial situation.

Forex Trading Terminology

Understanding the jargon is key to successful forex trading. Here are some fundamental terms to get you started. A pip (point in percentage) is the smallest price movement in a currency pair, usually the fourth decimal place. The spread is the difference between the bid (the price at which you sell) and the ask (the price at which you buy) price. Leverage allows you to control a larger position with a smaller amount of capital, magnifying both profits and losses. Lots represent the amount of currency you’re trading; a standard lot is 100,000 units of the base currency. Finally, a margin is the amount of money you need to keep in your account to maintain an open position.

Forex Trading Account Types and Costs

Several account types cater to different trading styles and budgets. Micro accounts require minimal deposits, perfect for beginners testing the waters. Mini accounts offer slightly higher leverage and lot sizes. Standard accounts provide the full range of trading capabilities but usually require larger deposits. Each account type comes with varying commission structures and spreads, influencing your overall trading costs. Some brokers offer commission-free trading, offsetting costs through wider spreads. Others charge commissions alongside tighter spreads. The best choice depends on your trading strategy and risk tolerance.

Broker Comparison: Fees and Commissions

Choosing the right broker is crucial for budget-conscious traders. Different brokers offer varying minimum deposit requirements, spreads, and commission structures. It’s vital to compare these factors before committing to a platform. Here’s a comparison of four popular brokers (Note: Spreads and commissions are dynamic and can change; this is for illustrative purposes only. Always check the broker’s website for the most up-to-date information):

| Broker | Minimum Deposit | Spread (Example EUR/USD) | Commission Structure |

|---|---|---|---|

| Broker A | $100 | 1.0 pip | Commission-free |

| Broker B | $500 | 0.8 pip | $5 per lot |

| Broker C | $250 | 1.2 pip | Commission-free |

| Broker D | $1000 | 0.5 pip | $3 per lot |

Choosing a Budget-Friendly Forex Broker

So, you’re ready to dive into the exciting (and potentially lucrative) world of forex trading, but you’re working with a limited budget. Don’t worry, it’s entirely possible to get started without breaking the bank. The key lies in choosing the right forex broker – one that offers competitive pricing, robust security, and the tools you need to succeed, all without emptying your wallet.

Choosing a forex broker is like choosing a partner – you need to find one you can trust and rely on. A bad broker can quickly drain your account, while a good one can provide the stability and support you need to learn and grow as a trader. Let’s explore the essential criteria to ensure you make the right choice.

Broker Regulation and Security Measures

Regulation is paramount when selecting a forex broker. A regulated broker operates under the oversight of a financial authority, providing an extra layer of protection for your funds. This regulation ensures the broker adheres to specific rules and standards, minimizing the risk of fraud or mismanagement. Look for brokers regulated by reputable bodies like the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, or the Australian Securities and Investments Commission (ASIC) in Australia. These organizations enforce rules and regulations to protect investors, ensuring brokers maintain adequate capital reserves and operate transparently. Security measures, such as two-factor authentication and encryption, are equally crucial to safeguard your account and personal information from unauthorized access. A reputable broker will invest in robust security systems to protect your data and funds.

Features Beneficial to Budget Traders

Budget-conscious traders need brokers that offer competitive pricing and don’t impose hefty fees. Low spreads (the difference between the buy and sell price of a currency pair) are essential, as they directly impact your profitability. Look for brokers that offer commission-free trading or those with minimal commissions, especially if you’re planning on trading smaller volumes. Access to educational resources, such as webinars, tutorials, and market analysis, can be invaluable for beginners. Many brokers offer these resources for free, allowing you to enhance your trading skills without additional costs. Demo accounts are also a great way to practice your trading strategies without risking real money, and many brokers provide free demo accounts with virtual funds. Finally, consider the availability of mobile trading apps. These apps provide flexibility, allowing you to monitor your trades and make adjustments from anywhere.

Checklist for Selecting a Budget-Friendly Forex Broker

Before committing to a forex broker, use this checklist to ensure you’re making an informed decision:

- Regulation: Is the broker regulated by a reputable financial authority?

- Spreads and Commissions: Are the spreads competitive and are commissions minimal or non-existent?

- Account Minimums: What is the minimum deposit required to open an account? Choose a broker with low minimum deposit requirements.

- Educational Resources: Does the broker offer free educational resources to help you learn?

- Demo Account: Does the broker provide a free demo account to practice trading?

- Security Measures: Does the broker employ robust security measures to protect your funds and personal information?

- Customer Support: Is customer support readily available and responsive?

- Trading Platform: Is the trading platform user-friendly and easy to navigate?

Remember, thorough research is crucial before choosing a forex broker. Don’t rush into a decision. Take your time to compare different brokers, read reviews, and ensure the broker aligns with your trading style and budget. A well-chosen broker can significantly impact your trading journey.

Developing a Low-Capital Trading Strategy

Forex trading on a budget requires a disciplined approach, prioritizing risk management and strategic planning above all else. Success isn’t about hitting home runs; it’s about consistently making small, calculated gains while minimizing losses. This section Artikels strategies and steps to help you navigate the forex market effectively with limited capital.

Risk Management in Low-Capital Trading

Effective risk management is paramount when trading forex with a small account. A single bad trade can wipe out a significant portion of your capital, potentially ending your trading journey prematurely. Therefore, understanding and implementing sound risk management techniques is crucial for survival and eventual success. This involves setting strict stop-loss orders to limit potential losses on each trade. Never risk more than 1-2% of your total account balance on any single trade. This percentage can be adjusted based on your personal risk tolerance and trading strategy but should never exceed 5%. For example, with a $1000 account, a 1% risk equates to a maximum loss of $10 per trade.

Simple and Effective Trading Strategies for Small Accounts

Several simple strategies are well-suited for small accounts. Scalping, for instance, involves profiting from small price movements within short timeframes (minutes or hours). This strategy requires close monitoring and quick decision-making but can generate consistent profits if executed correctly. Another option is swing trading, where you hold positions for several days or weeks, capitalizing on larger price swings. Swing trading requires more patience but can yield higher returns. Both strategies demand thorough market analysis and a clear understanding of your chosen asset’s price action. The key is consistency and discipline, sticking to your chosen strategy and risk management rules regardless of market fluctuations.

Leverage and Small Accounts: Benefits and Drawbacks

Leverage magnifies both profits and losses. While it can seem attractive for growing a small account quickly, it also significantly increases the risk of substantial losses. Using high leverage with limited capital is extremely risky and can lead to account liquidation quickly. Therefore, leverage should be used cautiously and responsibly. It’s advisable to start with low leverage (e.g., 1:10 or 1:20) and gradually increase it as your trading skills and confidence improve and your account grows. The goal is to use leverage strategically to enhance potential profits without jeopardizing your entire capital. It is crucial to understand that while leverage amplifies returns, it also amplifies losses. A small mistake with high leverage can lead to significant financial consequences.

Developing a Personalized Trading Plan

Creating a personalized trading plan is essential for success in forex trading, regardless of your account size. This plan should include:

- Defining your trading goals: What are you hoping to achieve with forex trading? Set realistic, achievable goals, avoiding unrealistic expectations of quick riches.

- Choosing your trading style: Will you be a scalper, day trader, or swing trader? Select a style that aligns with your personality, risk tolerance, and available time.

- Selecting your trading instruments: Which currency pairs will you focus on? Begin with a few major pairs to gain experience before diversifying.

- Developing your trading strategy: Artikel your entry and exit points, stop-loss and take-profit levels. This strategy should be based on thorough market analysis and backtested to ensure its effectiveness.

- Implementing risk management rules: Define your maximum risk per trade (e.g., 1-2% of your account balance). Stick to these rules religiously.

- Keeping a trading journal: Record your trades, including entry and exit points, profits and losses, and reasons for your decisions. This journal will help you identify your strengths and weaknesses and refine your strategy over time.

- Regularly reviewing and adjusting your plan: The forex market is dynamic. Your trading plan should be reviewed and adjusted periodically to reflect changing market conditions and your evolving trading skills.

Following these steps and adhering to a well-defined plan will significantly increase your chances of success in forex trading with a small account. Remember that consistency, discipline, and continuous learning are key to long-term profitability.

Essential Tools and Resources for Budget Forex Traders

Forex trading doesn’t require breaking the bank. Smart budgeting and leveraging free or low-cost resources can significantly boost your trading journey without compromising your learning or analytical capabilities. This section explores essential tools and resources readily available to budget-conscious forex traders, helping you navigate the market effectively.

Free and Low-Cost Resources for Forex Market Analysis and Education

Numerous free and affordable resources can provide invaluable insights into the forex market. These resources, ranging from educational platforms to analytical tools, are crucial for building a solid foundation and making informed trading decisions without substantial financial investment. Utilizing these resources effectively is key to maximizing your budget and minimizing unnecessary expenses.

- Free Educational Websites and Blogs: Many websites and blogs offer free forex education, covering topics from basic concepts to advanced strategies. These often include articles, tutorials, and webinars, providing a structured learning path. Look for reputable sources with experienced authors and a focus on practical application.

- YouTube Channels: Numerous YouTube channels dedicated to forex trading offer free educational content, ranging from beginner tutorials to in-depth market analysis. Be discerning in your selection, prioritizing channels with a proven track record and a focus on realistic trading strategies.

- Forex Forums and Communities: Online forums and communities provide a platform for interaction with experienced traders, enabling you to learn from others’ experiences and gain insights into market trends. However, always approach information critically, verifying its accuracy before implementation.

Utilizing Free Charting Software and Technical Indicators

Free charting software, while often lacking the advanced features of paid platforms, provides sufficient tools for basic technical analysis. Mastering the use of these tools is crucial for budget traders. Effective use of even basic indicators can greatly improve your trading decisions.

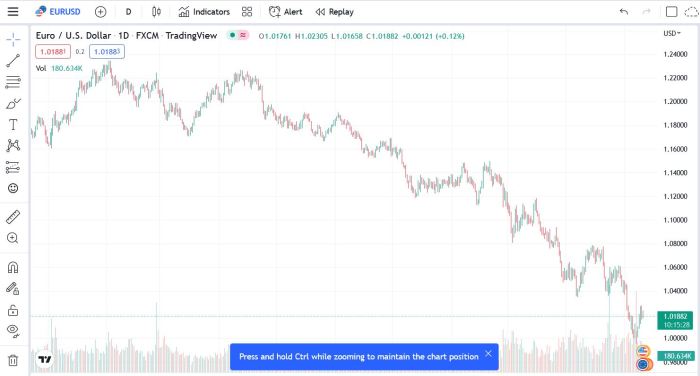

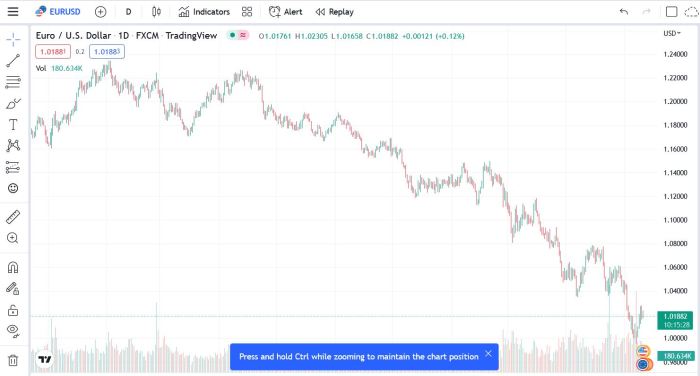

- Free Charting Platforms: Several platforms offer free charting services, providing access to real-time price data and basic technical indicators. These platforms may have limitations on historical data or advanced features, but they serve as excellent starting points for learning technical analysis. Familiarize yourself with the platform’s functionalities and limitations before relying on it for trading decisions.

- Essential Technical Indicators: Focus on mastering a few key technical indicators, such as moving averages (SMA, EMA), Relative Strength Index (RSI), and MACD. Understanding these indicators and how to interpret their signals will greatly enhance your trading strategies, regardless of the charting platform you use. Overcomplicating your analysis with too many indicators can lead to confusion and poor decision-making.

Economic Calendars and News Sources: Benefits and Limitations

Economic calendars and news sources provide crucial context for forex trading, highlighting events that can significantly impact currency prices. However, interpreting this information requires careful consideration and understanding of its limitations.

- Economic Calendars: Free economic calendars provide schedules of upcoming economic releases, such as interest rate decisions and employment data. Understanding the potential impact of these releases on currency pairs is essential for effective trading. However, it’s crucial to remember that these are just predictions, and actual outcomes can differ, potentially impacting market sentiment and price movements.

- News Sources: Reputable financial news sources provide real-time updates on market events and economic data. However, it’s vital to filter information carefully, separating factual reporting from opinion or speculation. The emotional response to news can lead to impulsive trading decisions; maintain a disciplined approach based on your trading plan and risk management strategy.

Essential Tools and Resources Categorized by Cost and Functionality

The following table summarizes essential tools and resources, categorized by cost and their primary function in forex trading.

| Tool/Resource | Cost | Primary Function |

|---|---|---|

| Free educational websites/blogs | Free | Forex education and market analysis |

| Free charting software (TradingView, etc.) | Free (with limitations) | Technical analysis, chart pattern identification |

| Economic calendar websites | Free | Tracking upcoming economic events |

| Reputable financial news sources (Bloomberg, Reuters, etc.) | Subscription (often costly, but free trials available) | Real-time market news and analysis |

| Paid charting software (MetaTrader 4/5, etc.) | Paid (subscription or one-time purchase) | Advanced technical analysis, automated trading |

Demo Accounts and Paper Trading for Practice

Before you risk a single penny of your hard-earned cash in the volatile world of forex trading, mastering the art of practice is crucial. Think of it like this: would you jump into a Formula 1 car without any driving lessons? Exactly. Demo accounts and paper trading are your virtual driving schools, allowing you to hone your skills and refine your strategies without the financial sting of real-world losses.

Demo accounts offer a risk-free environment to experiment with different trading strategies, test your technical analysis, and get comfortable with the trading platform. They replicate real market conditions, giving you a realistic feel for the speed and pressure of live trading. This hands-on experience is invaluable in building confidence and identifying potential weaknesses in your approach before they cost you money.

Utilizing Demo Accounts for Strategy Testing and Risk Management, How to Trade Forex on a Budget

Effective utilization of a demo account involves more than just randomly placing trades. A structured approach is key. Begin by defining clear trading goals – are you focusing on scalping, day trading, or swing trading? Then, meticulously test your chosen strategy on the demo account, keeping a detailed trading journal to track your performance. This journal should document your entry and exit points, rationale behind each trade, and the resulting profit or loss. Simultaneously, experiment with different risk management techniques, such as setting stop-loss and take-profit orders, to determine what works best for your personality and strategy. Analyze your trades to understand your successes and, more importantly, your mistakes. Consistent monitoring and adjustments are vital. For example, if your strategy consistently fails during periods of high volatility, you might need to refine it or consider alternative approaches. Remember, the goal isn’t to win every trade on your demo account, but to identify consistent patterns in your successes and failures to refine your approach.

Benefits and Limitations of Paper Trading

Paper trading, where you simulate trades without using actual funds, offers a similar learning experience to demo accounts. The primary benefit is its accessibility; you don’t need to sign up with a broker. However, paper trading lacks the emotional and psychological aspects of real trading. The lack of real financial consequences can lead to overconfidence and a disregard for risk management. Furthermore, slippage and commissions, inherent in real-market trading, are not factored into paper trading simulations. Therefore, while paper trading can be a useful supplementary tool, it shouldn’t replace the immersive experience of a demo account.

Opening and Using a Demo Account

Opening and using a demo account is usually straightforward. Most forex brokers offer them for free. Here’s a step-by-step guide:

- Choose a Broker: Research and select a reputable forex broker that offers a demo account. Consider factors like platform usability, available assets, and customer support.

- Register an Account: Visit the broker’s website and navigate to the demo account registration section. You’ll typically need to provide basic personal information.

- Account Funding (Virtual): The broker will usually automatically fund your demo account with a predetermined amount of virtual currency.

- Platform Access: Download and install the trading platform (often MetaTrader 4 or 5). Log in using your demo account credentials.

- Start Practicing: Begin by familiarizing yourself with the platform’s features. Then, start placing simulated trades, testing your strategies, and observing market reactions.

Remember, consistent practice is key to success. Treat your demo account as a serious learning environment, and don’t be afraid to make mistakes – that’s how you learn.

Managing Emotions and Psychology in Budget Forex Trading

Forex trading, even on a budget, is a rollercoaster of emotions. Limited capital amplifies these feelings, making discipline and emotional control paramount to success. Understanding and managing your emotional responses is as crucial as mastering technical analysis. Without it, even the best strategy can crumble under the pressure of fear and greed.

The psychological challenges faced by budget forex traders are intensified by the inherent risks involved in leveraged trading. The fear of losing your limited capital can lead to impulsive decisions, while the allure of quick profits can cloud judgment. Impatience, a common trait, can lead to hasty trades based on short-term market fluctuations rather than a well-defined strategy. These emotions, if left unchecked, can easily derail even the most promising trading endeavors.

Strategies for Managing Trading Emotions

Effective emotion management requires a multi-pronged approach. First, acknowledge your emotional responses. Recognizing fear, greed, and impatience as they arise is the first step towards controlling them. Next, develop coping mechanisms. This could involve taking breaks from trading when feeling overwhelmed, practicing mindfulness techniques, or keeping a trading journal to track your emotions and their impact on your decisions. Finally, remember that losses are a part of trading; accept them as learning opportunities rather than personal failures. Focusing on consistent execution of your trading plan, rather than immediate results, is key.

The Importance of Discipline and Sticking to a Trading Plan

A well-defined trading plan acts as a safety net during emotional turmoil. It provides a structured approach, preventing impulsive decisions driven by fear or greed. This plan should Artikel your entry and exit strategies, risk management rules, and position sizing based on your limited capital. Sticking to this plan, regardless of market fluctuations or emotional impulses, is crucial for long-term success. Discipline is the bedrock of consistent profitability, particularly when dealing with limited resources. Consider it your emotional armor against the market’s unpredictable nature.

Visual Representation of the Emotional Cycle in Trading

Imagine a cyclical graph. The upward swing represents periods of winning trades and the associated euphoria, marked by overconfidence and potentially reckless trading. The downward swing depicts losses, leading to fear, self-doubt, and potentially revenge trading (trying to recoup losses quickly). Breaking this negative cycle involves recognizing the patterns, acknowledging the emotions, and consciously choosing to adhere to your trading plan during both wins and losses. A disciplined approach, with clearly defined risk management parameters, will help flatten the curve, reducing the extreme highs and lows of the emotional roller coaster. Consistent, measured trading, based on your plan, replaces impulsive reactions, leading to a more stable and sustainable trading journey.

Building a Long-Term Approach to Forex Trading on a Budget: How To Trade Forex On A Budget

Forex trading, especially on a budget, isn’t a get-rich-quick scheme. It’s a marathon, not a sprint. Building a sustainable, profitable strategy requires patience, discipline, and a long-term perspective. This involves understanding how your money can grow over time and developing habits that support consistent growth, even with limited capital.

The Power of Compounding in Forex Trading

Compounding is the snowball effect of earning returns on your initial investment *and* on the accumulated profits. Imagine you invest $100 and earn a 10% return. You now have $110. If you reinvest that $110 and earn another 10%, you’ll have $121. Notice how your second 10% return earned you $11, more than the initial $10. This exponential growth is the magic of compounding, crucial for building wealth in forex over the long term. Consistent, even small, profits reinvested consistently will significantly impact your account balance over several years. The longer you let your profits compound, the more substantial your returns become. This principle is particularly powerful for budget traders, as it maximizes the growth potential of a small initial investment.

Strategies for Consistent Growth with Limited Capital

Consistently growing a small trading account requires a disciplined approach. One effective strategy is to focus on small, consistent profits rather than chasing large, risky gains. This means setting realistic profit targets and sticking to a well-defined trading plan. Another key is meticulous risk management. Never risk more than a small percentage of your account balance on any single trade (typically 1-2%). This protects your capital from significant losses, allowing you to continue trading and compounding your profits even when facing temporary setbacks. Diversification across different currency pairs can also help mitigate risk and potentially increase overall returns. Finally, continuous learning and adaptation are vital. The forex market is constantly evolving, so staying informed about market trends and refining your strategies is crucial for long-term success.

The Importance of Patience and Perseverance

Patience and perseverance are arguably the most important qualities for long-term success in forex trading. The market fluctuates, and there will be losing trades. It’s crucial to avoid emotional decision-making, such as increasing trade sizes after wins or abandoning your strategy after losses. Instead, focus on sticking to your plan, learning from your mistakes, and trusting the process. Remember, consistency is key. Small, consistent profits compounded over time will yield significant results. The journey may be slow, but the rewards for those who persevere are substantial.

Tips for Maintaining Motivation and Avoiding Pitfalls

Maintaining motivation and avoiding common pitfalls is essential for long-term success.

- Set Realistic Goals: Avoid unrealistic expectations. Focus on gradual, consistent growth rather than aiming for overnight riches.

- Keep a Trading Journal: Document your trades, including your rationale, entry and exit points, and the outcome. This helps you identify patterns, learn from mistakes, and improve your strategy over time.

- Regularly Review Your Performance: Analyze your trading results regularly to identify areas for improvement. Are you consistently making profitable trades? Are there specific market conditions or strategies that are working particularly well (or poorly)?

- Stay Updated on Market News: Keep abreast of global economic events and news that could impact the forex market. This helps you make informed trading decisions and adapt your strategies as needed.

- Avoid Emotional Trading: Stick to your trading plan, regardless of market fluctuations or emotional impulses. Fear and greed are common pitfalls that can lead to poor decisions.

- Celebrate Small Wins: Acknowledge and celebrate your successes, no matter how small. This helps maintain motivation and reinforces positive trading habits.

- Seek Mentorship or Support: Connect with experienced traders or join online communities to share knowledge and gain support.

Last Word

So, you’re ready to trade forex without breaking the bank? Awesome! Remember, consistent learning, disciplined execution, and a long-term perspective are your greatest allies. While the path to forex success requires patience and perseverance, this guide has provided the foundation for building a solid, budget-friendly trading strategy. Start small, learn fast, and watch your trading journey unfold. The forex market awaits!

FAQ Resource

What’s the minimum deposit for most budget-friendly forex brokers?

It varies, but many brokers cater to beginners with minimum deposits as low as $5 or even less. Always check the specific requirements of your chosen broker.

How can I avoid scams when choosing a forex broker?

Research thoroughly! Look for brokers regulated by reputable authorities, read reviews from other traders, and never invest more than you can afford to lose.

Is leverage really risky for small accounts?

Yes, leverage amplifies both profits and losses. While it can boost returns, it can also quickly wipe out your account if not managed carefully. Start with low leverage until you gain experience.

How often should I review my trading plan?

Regularly! At least monthly, or even more frequently if market conditions change drastically or your trading performance isn’t meeting expectations. Adaptability is key.

Get the entire information you require about Can You Make Money with Forex Trading? The Truth Revealed on this page.

For descriptions on additional topics like The Basics of Forex Trading Risk-to-Reward Ratios, please visit the available The Basics of Forex Trading Risk-to-Reward Ratios.