The Best Forex Trading Software for 2025? Forget crystal balls; we’re diving deep into the tech that’s shaping the future of forex trading. This isn’t your grandpappy’s market anymore – AI, algorithmic trading, and lightning-fast execution are the new normal. We’ll cut through the noise and show you the platforms that are truly worth your time, helping you navigate the complexities and maximize your potential in this dynamic world.

From beginner-friendly interfaces to advanced charting tools and risk management features, we’re breaking down everything you need to know to choose the perfect software for your trading style. Whether you’re a seasoned pro or just starting out, finding the right platform is crucial for success. Get ready to level up your forex game.

Introduction to Forex Trading Software in 2025

The forex market is a dynamic beast, constantly evolving with technological advancements. 2025 promises even more sophisticated trading software, offering traders a level of access and analytical power previously unimaginable. This evolution is driven by increased automation, advanced AI integration, and a relentless push for user-friendly interfaces catering to both novice and expert traders. Choosing the right software is no longer just about finding a platform; it’s about finding the perfect tool to amplify your trading strategy.

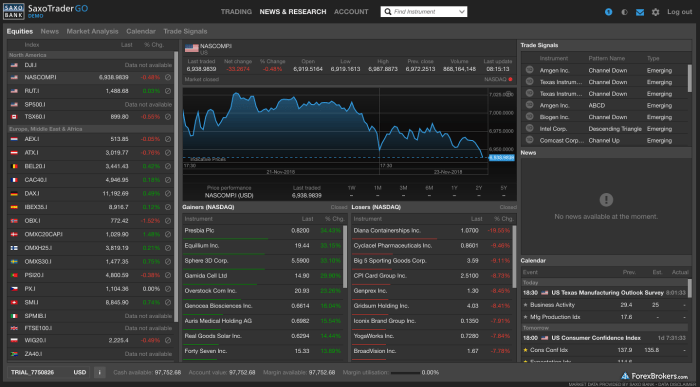

The landscape of forex trading software in 2025 is characterized by a significant shift towards integrated platforms. These platforms go beyond simple charting and order execution, incorporating features like advanced technical analysis tools, automated trading bots, risk management systems, and even social trading features. The best platforms are those that seamlessly integrate these capabilities, providing a comprehensive and streamlined trading experience. Key features separating leading platforms include speed of execution, charting capabilities (including customizable indicators and drawing tools), backtesting functionalities for strategy optimization, and the availability of real-time market data from multiple sources.

Key Features Distinguishing Leading Forex Trading Software Platforms

Leading forex trading software platforms in 2025 will be defined not only by their features but also by their ability to adapt to individual trader needs. The platforms that truly stand out will offer a high degree of customization and flexibility, allowing traders to tailor their experience to their specific trading styles and risk tolerances. This might involve customizable dashboards, the ability to integrate with third-party applications, and a wide range of order types to suit different trading strategies. For instance, a scalper might prioritize speed of execution and real-time data feeds, while a swing trader might focus on charting tools and backtesting capabilities. A day trader, on the other hand, might favor a platform with strong order management features and integrated risk management tools.

The Importance of Choosing the Right Software for Individual Trading Styles

The right forex trading software is a crucial element of a successful trading strategy. It’s not a one-size-fits-all situation. A platform perfectly suited for a high-frequency trader employing complex algorithms might be completely unsuitable for a long-term investor focusing on fundamental analysis. Consider the example of a scalper who needs millisecond execution speeds to capitalize on fleeting price movements. They would need a platform optimized for speed and low latency, perhaps with direct market access (DMA). In contrast, a value investor conducting thorough fundamental research might prioritize a platform with robust news feeds, economic calendars, and fundamental data analysis tools, perhaps less concerned with the speed of execution. Choosing the wrong software can lead to missed opportunities, increased risk, and ultimately, financial losses. Therefore, careful consideration of one’s trading style and needs is paramount before committing to any particular platform.

Essential Features of Top-Tier Forex Software

Navigating the dynamic world of forex trading in 2025 requires more than just market savvy; it demands the right technological arsenal. Top-tier forex software isn’t just a pretty interface; it’s a sophisticated toolset that empowers informed decision-making, efficient execution, and robust risk management. The features discussed below are essential for any serious trader aiming for success in the increasingly competitive forex market.

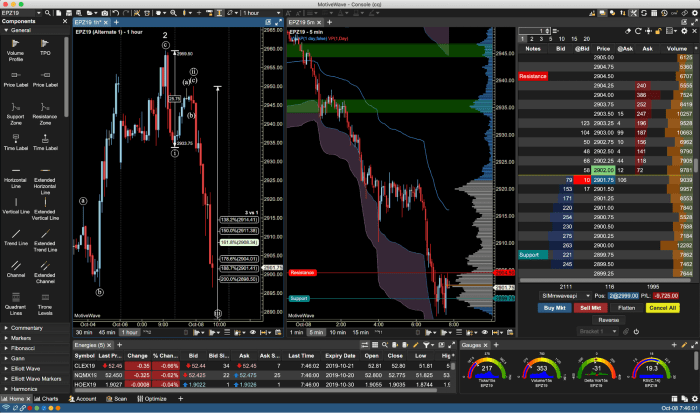

Charting and Technical Analysis Tools

Sophisticated charting capabilities are paramount for technical analysis. Top platforms offer a wide array of chart types (candlestick, bar, line), customizable indicators (RSI, MACD, Bollinger Bands), drawing tools (Fibonacci retracements, trend lines), and advanced charting features like multiple timeframes and customizable layouts. These tools allow traders to identify trends, patterns, and potential trading opportunities, forming the basis of many successful trading strategies. For instance, a trader might use candlestick patterns and RSI to identify potential entry and exit points, or overlay Fibonacci retracements on a chart to pinpoint potential support and resistance levels. The ability to easily switch between different timeframes, from one-minute charts to monthly charts, allows traders to analyze market movements across various time scales.

Order Execution Methods

Different platforms offer a variety of order execution methods, each with its own advantages and disadvantages. Market orders execute immediately at the best available price, ideal for quick trades. Limit orders allow traders to specify the price at which they want to buy or sell, offering control but the risk of the order not being filled if the price doesn’t reach the specified level. Stop orders are triggered when the price reaches a certain level, often used to limit losses or secure profits. Stop-limit orders combine the features of stop and limit orders, offering greater control over execution. Advanced platforms may also offer trailing stop orders, which automatically adjust the stop price as the market moves in a favorable direction, protecting profits while allowing for further price appreciation. The choice of execution method depends on the trader’s risk tolerance and trading style.

Risk Management Features

Effective risk management is crucial for long-term success in forex trading. Top platforms offer features such as stop-loss orders (automatically closing a trade when a certain loss threshold is reached), take-profit orders (automatically closing a trade when a certain profit target is reached), position sizing calculators (helping traders determine the appropriate trade size based on their risk tolerance), and margin monitoring tools (providing real-time updates on margin levels to prevent account blowouts). For example, a trader might set a stop-loss order to limit potential losses to 2% of their account balance on any single trade, regardless of market fluctuations. These features are not merely safety nets; they are integral components of a well-defined trading plan.

Comparison of Forex Trading Platforms

| Feature | Platform A | Platform B | Platform C | Platform D |

|---|---|---|---|---|

| Charting Capabilities | Extensive, customizable, multiple timeframes | Good selection of indicators and tools | Basic charting, limited customization | Advanced charting with AI-powered analysis |

| Order Types | Market, Limit, Stop, Stop-Limit, Trailing Stop | Market, Limit, Stop | Market, Limit | Market, Limit, Stop, Stop-Limit, Trailing Stop, OCO |

| Risk Management Tools | Stop-loss, Take-profit, Position Sizing Calculator, Margin Monitoring | Stop-loss, Take-profit | Stop-loss, Take-profit (limited functionality) | Stop-loss, Take-profit, Position Sizing Calculator, Margin Monitoring, advanced risk alerts |

Software Categories and Their Suitability

Choosing the right forex trading software depends heavily on your experience level and trading style. A beginner will need a platform that’s intuitive and easy to navigate, while an advanced trader might prefer a highly customizable platform with advanced charting tools and automated trading capabilities. This section breaks down forex software into categories based on user experience and trading strategy.

Software Categorization by User Experience Level

Forex trading software isn’t a one-size-fits-all solution. Different platforms cater to various levels of trading expertise, ensuring a smoother learning curve and better overall experience. Mismatched software and skill level can lead to frustration and potentially poor trading decisions.

- Beginner: Platforms designed for beginners prioritize simplicity and ease of use. They often feature user-friendly interfaces, educational resources, and limited, yet essential, functionalities. Examples include MetaTrader 4 (MT4) with its simplified interface and readily available tutorials, or cTrader, known for its clean design and straightforward order placement. These platforms lack advanced features but provide a safe space to learn the ropes. A weakness might be a lack of customization options for more experienced traders who might outgrow the platform quickly.

- Intermediate: Intermediate-level software builds upon the foundation of beginner platforms, adding more advanced features such as customizable charts, multiple indicators, and potentially automated trading strategies (Expert Advisors or EAs). Think of MetaTrader 5 (MT5) as an example; it offers a wider range of indicators and tools than MT4, allowing for more complex analysis. However, its increased complexity might initially overwhelm users who aren’t familiar with more technical aspects of trading. A weakness is the potential for information overload for those still developing their trading skills.

- Advanced: Advanced platforms are highly customizable and offer a wide array of tools and features for experienced traders. These platforms might include algorithmic trading capabilities, advanced charting packages, and integration with other financial data providers. NinjaTrader is an example of a powerful platform frequently used by advanced traders for its extensive customization options and its ability to support complex trading strategies. The downside is the steep learning curve; mastering such a platform requires significant time and effort. Another potential weakness is the higher cost associated with these advanced features.

Software Categorization by Trading Strategy

The optimal software choice is also significantly influenced by your preferred trading strategy. Scalpers, day traders, and swing traders all have different needs and requirements from their trading platforms.

- Scalping: Scalping requires extremely fast execution speeds and access to real-time market data. Platforms like Interactive Brokers, known for its speed and low latency, are well-suited for this strategy. However, the high transaction costs associated with frequent trades should be considered. A potential weakness could be the platform’s complexity for those not focusing solely on scalping.

- Day Trading: Day trading demands robust charting tools, real-time market data, and the ability to execute trades quickly. Platforms like TradingView, with its comprehensive charting capabilities and various technical indicators, are popular choices. However, reliance on real-time data necessitates a stable and reliable internet connection. A potential weakness is the absence of advanced automated trading features, which some day traders might find useful.

- Swing Trading: Swing trading often involves holding positions for several days or weeks. Therefore, the focus shifts from speed of execution to in-depth analysis and risk management tools. Platforms like Sierra Chart, known for its backtesting capabilities and customizability, are well-suited for this style. However, the initial setup and learning curve might be steeper compared to simpler platforms. A potential weakness is the absence of dedicated features specifically tailored for short-term trading strategies.

Evaluating and Selecting the Right Platform

Choosing the right forex trading software is crucial for success. It’s like picking the right tools for a job – the wrong ones will slow you down and potentially lead to costly mistakes. This section will guide you through a systematic process to ensure you select a platform that aligns with your trading style and goals. Remember, the best software isn’t a one-size-fits-all solution; it’s the one that best fits *you*.

The process of selecting forex trading software involves careful consideration of several key factors, each contributing to a successful and efficient trading experience. A methodical approach, combining research, testing, and realistic expectations, is essential to avoid disappointment and maximize your chances of profitability.

Platform Evaluation Checklist

A comprehensive checklist is essential for objectively comparing different platforms. This ensures you don’t overlook crucial features and helps you make an informed decision.

- Cost: Consider subscription fees, commission structures, and any hidden charges. Compare pricing across different platforms to find the best value for your needs. For example, some platforms offer tiered pricing based on features and trading volume.

- Reliability and Uptime: A platform’s stability is paramount. Research its historical uptime and look for reviews mentioning any significant outages or technical issues. A platform with frequent downtime can lead to missed opportunities and frustration.

- Customer Support: Assess the quality and responsiveness of customer support. Check if they offer multiple support channels (e.g., phone, email, live chat) and the typical response times. Excellent customer support is vital, especially during critical trading moments.

- Security: Forex trading involves sensitive financial information. Ensure the platform uses robust security measures, such as encryption and two-factor authentication, to protect your data and funds. Look for certifications and security protocols.

- Features and Functionality: Evaluate the platform’s features based on your trading style and needs. Does it offer the charting tools, indicators, and order types you require? Consider features like automated trading, backtesting capabilities, and mobile accessibility.

- User Interface and Experience (UI/UX): A user-friendly interface is crucial for efficient trading. Test the platform’s navigation, ease of order placement, and overall intuitiveness. A cluttered or confusing interface can hinder your trading performance.

- Educational Resources: Some platforms offer educational resources like webinars, tutorials, or market analysis. The availability of such resources can be beneficial, especially for beginners.

The Importance of Demo Accounts and Thorough Testing

Before committing to a paid subscription, utilizing a demo account is absolutely essential. A demo account allows you to test the platform’s features, familiarize yourself with the interface, and practice your trading strategies without risking real money. Think of it as a test drive before buying a car.

Consider using the demo account to simulate various market conditions and trading scenarios. This will help you identify any limitations or shortcomings of the platform before investing your capital. For instance, you can test the speed of order execution during periods of high volatility or practice using different charting tools and indicators. Only after thorough testing and a comfortable understanding of the platform’s functionalities should you proceed with a paid subscription.

Advanced Features and Integrations

Stepping up your forex trading game in 2025 means embracing the power of advanced features and seamless integrations. The best software goes beyond basic charting and order execution; it empowers you with tools to automate strategies, connect to other financial platforms, and even build custom solutions. This section dives into the specifics of these advanced capabilities and how they can significantly improve your trading performance.

Automated Trading Systems and Algorithmic Strategies

Automated trading, or algo-trading, leverages pre-programmed rules and algorithms to execute trades automatically. This removes emotional bias and allows for consistent execution of trading strategies, even during volatile market conditions. Benefits include the ability to backtest strategies rigorously, identify and capitalize on fleeting opportunities, and manage risk more effectively. However, it’s crucial to remember that even the most sophisticated algorithms are not foolproof and require careful monitoring and adjustment. A well-designed automated system, paired with robust risk management, can be a powerful asset, but poor implementation can lead to significant losses. For instance, a system designed to exploit small price discrepancies might fail during periods of high market volatility, leading to unexpected losses. Careful selection and parameterization of the algorithm are key to success.

Advantages and Disadvantages of Integrating Forex Software with Other Financial Tools

Integrating your forex software with other financial tools, such as portfolio management software or economic data providers, offers significant advantages. A unified view of your entire financial landscape allows for better risk assessment and more informed decision-making. For example, integrating with a news aggregator can provide real-time market insights, potentially triggering automated trades based on breaking news. Conversely, linking to a portfolio management tool offers a complete picture of your assets, enabling better diversification and risk mitigation. However, integration can introduce complexities. Data synchronization issues, compatibility problems, and security concerns are potential drawbacks. Choosing reliable and well-integrated platforms is essential to minimize these risks.

Using API Integrations for Custom Solutions

Application Programming Interfaces (APIs) are the backbone of custom solutions in forex trading. They allow you to connect your chosen software to external data sources, custom-built algorithms, and other applications. This flexibility enables the creation of tailored trading solutions perfectly suited to your individual needs and trading style. For example, you could use an API to pull data from a specialized economic indicator provider, integrate this data into your trading strategy, and automatically execute trades based on the resulting analysis. This level of customization offers a significant competitive advantage, allowing you to refine your strategies and potentially achieve superior returns. However, developing and maintaining custom API integrations requires technical expertise. If you lack the necessary skills, consider outsourcing this aspect to a qualified developer.

Security and Regulatory Compliance

Navigating the forex market requires more than just sharp trading skills; it demands a robust understanding of security and regulatory compliance. Choosing a trading platform that prioritizes these aspects is paramount to protecting your investments and ensuring a safe trading environment. Ignoring security can lead to devastating consequences, including account breaches, financial losses, and data theft. Therefore, understanding the importance of security features and regulatory oversight is crucial for every forex trader.

The security of your forex trading platform is directly linked to the safety of your funds and personal information. A secure platform employs multiple layers of protection to safeguard against unauthorized access and cyber threats. Regulatory compliance, on the other hand, ensures the platform operates within a legal framework designed to protect traders from fraudulent activities and manipulative practices. Together, security and regulatory compliance form the bedrock of a trustworthy and reliable forex trading experience.

Security Features in Forex Trading Software

Selecting a secure forex trading platform involves careful consideration of several key security features. These features act as multiple layers of defense, minimizing the risk of data breaches and financial losses.

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a second verification method, such as a code sent to your phone or email, in addition to your password. This significantly reduces the risk of unauthorized access, even if your password is compromised.

- Encryption: All data transmitted between your computer and the trading platform should be encrypted using robust protocols like SSL/TLS. This ensures that your sensitive information, including your trading activity and personal details, remains confidential and protected from eavesdropping.

- Secure Servers and Data Centers: The platform’s servers should be housed in secure data centers with robust physical and cybersecurity measures in place to prevent unauthorized access and data breaches. These measures might include firewalls, intrusion detection systems, and regular security audits.

- Regular Security Audits and Penetration Testing: Reputable platforms undergo regular security audits and penetration testing to identify and address vulnerabilities before they can be exploited by malicious actors. These assessments help maintain the platform’s security posture and prevent potential breaches.

- Fraud Detection Systems: Advanced platforms utilize sophisticated fraud detection systems to monitor trading activity for suspicious patterns and potential fraudulent behavior. This helps protect traders from scams and manipulative practices.

The Role of Regulatory Bodies

Regulatory bodies play a critical role in ensuring the safety and fairness of forex trading platforms. These organizations establish and enforce rules and regulations to protect traders from fraud, manipulation, and other unethical practices. Choosing a platform regulated by a reputable body provides an additional layer of security and confidence.

Examples of prominent regulatory bodies include the Commodity Futures Trading Commission (CFTC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the Australian Securities and Investments Commission (ASIC) in Australia. These organizations set standards for platform security, financial stability, and ethical conduct, offering traders a measure of protection. Trading with a regulated broker significantly reduces the risk of encountering fraudulent or unreliable platforms. The presence of such regulation provides a higher degree of trust and accountability within the forex trading ecosystem.

Cost and Pricing Models: The Best Forex Trading Software For 2025

Navigating the world of forex trading software can feel like deciphering a financial code, especially when it comes to understanding the various cost structures. Different platforms employ diverse pricing models, each with its own set of advantages and hidden pitfalls. Understanding these nuances is crucial for making an informed decision that aligns with your trading style and budget.

Choosing the right forex trading software often hinges on a careful evaluation of its cost. Prices can vary wildly, depending on the features offered, the level of customer support provided, and the overall sophistication of the platform. Some providers offer transparent, straightforward pricing, while others might bury additional fees within the fine print. Let’s dissect the common pricing models and uncover potential hidden costs.

Pricing Models Comparison

Forex trading software providers typically utilize subscription-based models, tiered pricing structures, or commission-based systems. Subscription models offer a fixed monthly or annual fee for access to the platform’s features. Tiered pricing structures offer various packages with escalating features and costs, allowing traders to choose a plan that matches their needs and budget. Commission-based models charge a fee per trade executed through the platform. Each model has its pros and cons. Subscription models provide predictable costs, while tiered models offer flexibility. Commission-based models can be cost-effective for high-volume traders but can be unpredictable for less active traders. Direct comparison requires examining specific platforms’ offerings. For example, a platform like MetaTrader 4 might offer a free version with limited features, while a more advanced platform may require a significant annual subscription fee.

Hidden Costs

Beyond the upfront costs, several hidden expenses can significantly impact the overall cost of using forex trading software. These often include data fees for real-time market data feeds, additional charges for advanced features or add-ons, and fees for customer support beyond basic assistance. Some platforms might also charge for withdrawals or deposits, while others might have inactivity fees if the account remains dormant for a prolonged period. It’s crucial to carefully read the terms and conditions and understand all associated fees before committing to a platform. For instance, while a platform might advertise a low monthly fee, the cost of premium add-ons, like advanced charting tools or automated trading robots, can quickly escalate the total expenditure.

Typical Cost Components

Understanding the typical cost components of forex trading software is essential for budget planning. The following list Artikels common cost elements:

- Software License Fee: This is the primary cost, often a recurring subscription or a one-time purchase depending on the platform.

- Data Fees: Real-time market data feeds are often a separate cost, charged monthly or annually.

- Brokerage Fees: These are separate from the software costs and depend on your chosen broker.

- Add-on Costs: Advanced features, indicators, or expert advisors often come at an extra cost.

- Customer Support Fees: Some platforms charge extra for premium customer support services.

- Transaction Fees: Some platforms may charge fees for deposits and withdrawals.

- Inactivity Fees: Some platforms might charge fees if your account remains inactive for a prolonged period.

Future Trends in Forex Trading Software

The forex market is constantly evolving, driven by technological advancements and shifting trader demands. This dynamic landscape necessitates continuous innovation in forex trading software, pushing platforms towards greater efficiency, intelligence, and user-friendliness. The future of forex trading software is being shaped by several key emerging technologies, promising a more sophisticated and accessible trading experience.

The integration of cutting-edge technologies is dramatically altering the forex trading landscape, impacting everything from order execution speed to risk management strategies. This evolution is not just about incremental improvements; it’s a fundamental shift in how traders interact with the market and make decisions.

Artificial Intelligence and Machine Learning in Forex Trading

AI and machine learning are poised to revolutionize forex trading software. These technologies allow platforms to analyze vast datasets, identify patterns, and predict market movements with increasing accuracy. For example, AI-powered algorithms can analyze news sentiment, economic indicators, and historical price data to generate trading signals and optimize portfolio allocation. Machine learning models can adapt and learn from new data, constantly refining their predictive capabilities. This leads to more informed decision-making and potentially higher profitability for traders. Some platforms are already incorporating AI-driven features like automated trading bots and personalized risk management tools, offering a glimpse into the future of algorithmic trading. The increased use of AI and ML also means the potential for more sophisticated fraud detection and risk mitigation capabilities within the software.

The Rise of Cloud-Based Forex Trading Platforms, The Best Forex Trading Software for 2025

Cloud computing is transforming the accessibility and scalability of forex trading software. Cloud-based platforms offer several advantages over traditional desktop applications, including enhanced accessibility from any device with an internet connection, increased security through robust data backups and disaster recovery mechanisms, and greater scalability to handle increasing data volumes and user traffic. This shift to the cloud allows for seamless integration with other financial applications and services, enhancing the overall trading experience. The ability to access trading information and execute trades from anywhere in the world is a significant advantage for modern traders. The scalability of cloud platforms also makes them well-suited to handle the increasing complexity of algorithmic trading strategies.

Enhanced User Interfaces and Personalized Experiences

Future forex trading software will prioritize user experience, offering intuitive interfaces and personalized dashboards. This means adapting to individual trader preferences and providing customized information displays, charting tools, and analytical features. We can expect to see more interactive visualizations, simplified navigation, and integration with popular mobile devices. The goal is to create a seamless and efficient trading environment that caters to both novice and experienced traders. This personalization extends beyond the visual aspects; AI could personalize risk profiles, suggesting suitable trading strategies and risk management tools based on a trader’s experience and risk tolerance.

Blockchain Technology and Decentralized Finance (DeFi)

The integration of blockchain technology and decentralized finance (DeFi) is likely to reshape the forex market in the coming years. Blockchain can enhance transparency and security in forex transactions, providing immutable records of trades and reducing the risk of fraud. DeFi protocols could offer decentralized forex trading platforms, potentially bypassing traditional intermediaries and reducing transaction costs. While still in its early stages, the integration of blockchain and DeFi into forex trading software has the potential to revolutionize the market’s structure and operations, promoting greater efficiency and accessibility. Examples of this already exist in the cryptocurrency market, providing a model for potential applications in traditional forex.

Conclusive Thoughts

So, there you have it – your roadmap to conquering the forex market in 2025 and beyond. Choosing the right trading software isn’t just about finding flashy features; it’s about aligning your strategy with the right tools, understanding the risks, and staying ahead of the curve. Remember, the best software is the one that empowers *you* to make informed decisions and achieve your financial goals. Now go forth and trade!

FAQ Section

What is the average cost of forex trading software?

Costs vary wildly, from free platforms with limited features to subscriptions costing hundreds of dollars per month for advanced tools and support. Many offer tiered pricing based on features.

Is it safe to use forex trading software?

Safety depends heavily on the platform’s security measures and regulatory compliance. Look for platforms with robust security features like two-factor authentication and encryption. Always check for regulatory licenses and certifications.

How do I choose a platform suitable for my trading style?

Consider your experience level, preferred trading strategy (scalping, day trading, swing trading), and desired features. Beginners should prioritize user-friendly interfaces and educational resources, while experienced traders might focus on advanced charting and algorithmic trading capabilities.

Can I use forex trading software on my mobile device?

Most reputable platforms offer mobile apps for iOS and Android, allowing you to trade on the go. Check the platform’s website to confirm mobile compatibility before signing up.

Get the entire information you require about The Benefits of Automated Forex Trading on this page.

Investigate the pros of accepting The Role of Interest Rates in Forex Trading in your business strategies.