How to Maximize Profits in Forex Trading isn’t just about luck; it’s a strategic game demanding knowledge, discipline, and a healthy dose of nerve. This isn’t your grandpa’s get-rich-quick scheme; we’re diving deep into the world of currency exchange, exploring proven techniques to boost your bottom line. Get ready to unravel the secrets of successful forex trading, from mastering technical analysis to navigating the emotional rollercoaster that comes with the territory.

We’ll dissect market dynamics, build a rock-solid trading plan, and equip you with the tools to analyze charts like a pro. We’ll cover risk management strategies that aren’t just theoretical – they’re practical, actionable steps you can implement today. Think of this as your cheat sheet to navigating the forex jungle, transforming you from a novice trader to a savvy investor.

Understanding Forex Market Dynamics

The forex market, a colossal decentralized network trading currencies, operates 24/5, offering both immense opportunities and significant risks. Understanding its dynamics is crucial for maximizing profits. This involves grasping the intricate interplay of various factors influencing currency values and the impact of global events. Effective strategies, tailored to your risk tolerance and time commitment, are equally vital.

Factors Influencing Currency Exchange Rates

Several interconnected factors determine currency exchange rates. Supply and demand play a fundamental role; high demand for a currency increases its value, while abundant supply pushes it down. Interest rates, a key driver, influence investment flows. Higher interest rates attract foreign investment, strengthening the currency. Economic indicators such as GDP growth, inflation rates, and unemployment figures significantly impact a nation’s currency. Government policies, including fiscal and monetary actions, also exert considerable influence. Geopolitical events, from political instability to international conflicts, can trigger substantial volatility. Finally, market sentiment, driven by investor confidence and speculation, plays a pivotal role in daily fluctuations. For instance, positive news about a country’s economy might boost its currency, while negative news could lead to a decline.

Impact of Global Economic Events on Forex Trading

Global economic events create ripples throughout the forex market. Major announcements, such as interest rate decisions by central banks (like the Federal Reserve in the US or the European Central Bank), can cause immediate and dramatic shifts in currency values. Unexpected economic data releases, such as unexpectedly high inflation figures, can similarly trigger significant market reactions. Global crises, such as financial recessions or pandemics, can profoundly affect currency values across the board. For example, the 2008 financial crisis led to significant volatility and devaluation in many currencies worldwide. Understanding the potential impact of these events requires diligent monitoring of economic news and geopolitical developments.

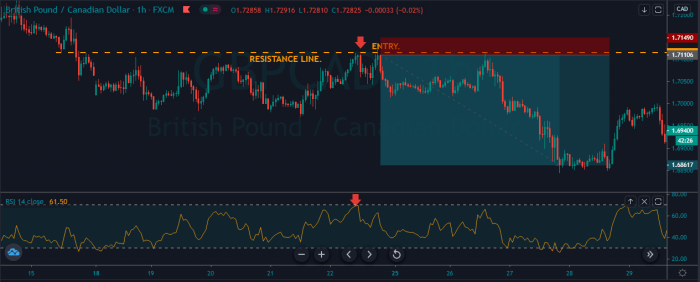

Forex Trading Strategies and Risk Profiles

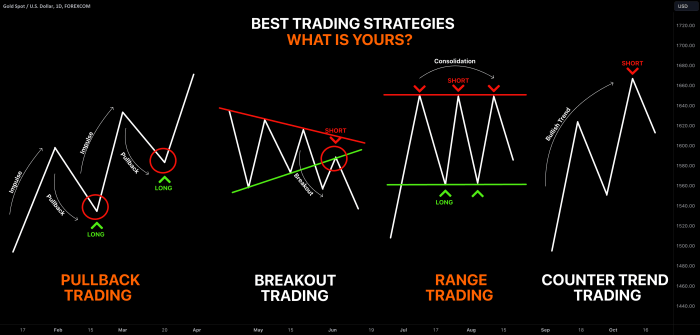

Different forex trading strategies cater to diverse risk appetites and time commitments. Choosing the right strategy is paramount for successful trading.

| Strategy Name | Time Horizon | Risk Level | Typical Profit Targets |

|---|---|---|---|

| Scalping | Minutes to hours | High | Small, frequent profits |

| Day Trading | Hours to a day | Medium to High | Moderate profits |

| Swing Trading | Days to weeks | Medium | Larger profits |

| Position Trading | Weeks to months | Low to Medium | Significant profits, but requires patience |

Scalping involves rapidly entering and exiting trades, aiming for small profits from minute price fluctuations. Day trading focuses on capturing intraday price movements, closing all positions before the market closes. Swing trading holds positions for several days or weeks, capitalizing on short-term trends. Position trading maintains positions for extended periods, profiting from long-term market direction. Each strategy carries a unique risk profile; scalping and day trading involve higher risk due to frequent trades, while swing and position trading offer lower risk but potentially slower profit generation. The selection should align with your risk tolerance and trading goals.

Developing a Profitable Trading Plan

Crafting a robust forex trading plan isn’t about getting rich quick; it’s about building a sustainable strategy that navigates the market’s inherent volatility. Think of it as your roadmap to consistent profitability, minimizing losses while maximizing gains. A well-defined plan acts as your safety net, guiding your decisions and preventing impulsive trades driven by fear or greed.

A comprehensive forex trading plan integrates several crucial elements: thorough market analysis, a clearly defined trading style (scalping, day trading, swing trading, etc.), precise entry and exit strategies, and, most importantly, a rigorous risk management framework. Without a solid plan, you’re essentially gambling, not trading.

Risk Management Strategies

Effective risk management is the cornerstone of long-term success in forex trading. It’s about protecting your capital and preventing catastrophic losses. This involves setting realistic profit targets, defining acceptable loss levels, and adhering to predetermined stop-loss orders. Ignoring risk management is like sailing a ship without a compass – you might get lucky, but you’re far more likely to crash. Successful traders don’t just aim for profits; they prioritize capital preservation above all else. A single poorly managed trade can wipe out weeks or months of gains.

Money Management Techniques

Money management techniques dictate how much capital you risk on each trade. This isn’t just about preserving capital; it’s about optimizing your trading strategy to ensure consistent growth over time. Different strategies suit various risk tolerances and trading styles. Overly aggressive money management can lead to rapid losses, while overly conservative strategies can limit potential profits. Finding the right balance is key.

Position Sizing and Stop-Loss Orders

Position sizing determines the number of units you trade for a given currency pair. This is directly linked to your risk tolerance and overall trading capital. Stop-loss orders automatically close a trade when the price moves against you, limiting potential losses. They’re not a guarantee against losses, but they’re a crucial tool for controlling risk. Imagine a stop-loss order as a safety belt in a car; you hope you never need it, but it’s essential to have in case of an accident.

The following Artikels five different position sizing techniques:

- Fixed Fractional Position Sizing: This involves risking a fixed percentage of your trading capital on each trade, regardless of market conditions. For example, risking 1% on each trade means if you have $10,000, your maximum loss per trade would be $100.

- Fixed Ratio Position Sizing: This method determines position size based on a fixed ratio between your stop-loss and your trading capital. For example, a 1:10 ratio means your stop-loss should be 1/10th of your trading capital.

- Percentage Risk Position Sizing: This involves determining position size based on the percentage risk you are willing to take on a particular trade. For instance, a trader might only risk 2% of their capital on a high-probability trade and 1% on a lower-probability trade.

- Volatility-Based Position Sizing: This approach adjusts position size based on the volatility of the currency pair. More volatile pairs warrant smaller position sizes to mitigate risk.

- Martingale System (Caution Advised): This involves doubling your position size after a loss to recover quickly. While potentially lucrative, it carries extreme risk and is not recommended for inexperienced traders due to the potential for catastrophic losses. The system can lead to a rapid depletion of trading capital if a series of losses occurs.

Mastering Technical Analysis: How To Maximize Profits In Forex Trading

Technical analysis is the cornerstone of successful forex trading. It involves studying past market data—price charts and volume—to identify patterns and predict future price movements. While fundamental analysis focuses on economic factors, technical analysis relies on chart patterns and indicators to spot profitable trading opportunities. Mastering this skill significantly enhances your ability to time entries and exits, optimizing your trading strategy.

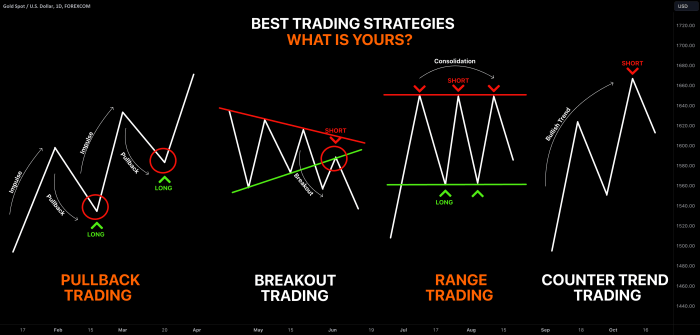

Key Technical Indicators and Their Applications

Technical indicators are mathematical calculations based on price and/or volume data, designed to provide insights into market momentum, trend strength, and potential reversals. Understanding how to interpret these indicators is crucial for informed decision-making.

Several popular indicators offer valuable perspectives. Moving averages (MAs), for example, smooth out price fluctuations, revealing underlying trends. A simple moving average (SMA) calculates the average price over a specified period, while an exponential moving average (EMA) gives more weight to recent prices. The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions, suggesting potential reversals. The Moving Average Convergence Divergence (MACD) compares two moving averages to identify momentum shifts and potential trend changes. By combining these indicators, traders can gain a more comprehensive understanding of market dynamics.

Check How to Use Moving Averages in Forex Trading to inspect complete evaluations and testimonials from users.

Chart Patterns and Their Predictive Power

Chart patterns are recurring formations on price charts that often precede specific price movements. Recognizing these patterns can provide valuable clues about potential future price action. While not foolproof, they significantly increase the probability of successful trades when combined with other analytical tools.

The “head and shoulders” pattern, for instance, is a bearish reversal pattern. It’s characterized by three peaks, with the middle peak (the “head”) being the highest. A breakout below the neckline confirms the pattern, suggesting a downward price movement. Conversely, an “inverse head and shoulders” pattern is a bullish reversal pattern with the middle trough being the lowest. A breakout above the neckline signals a potential upward trend. Double tops and double bottoms are other significant patterns indicating potential trend reversals. A double top suggests a bearish reversal after two similar price peaks, while a double bottom signals a bullish reversal after two similar price troughs.

Expand your understanding about Forex Trading Terminology: Key Terms You Must Know with the sources we offer.

Candlestick Patterns and Trading Opportunities

Candlestick patterns provide visual representations of price action over a specific period, offering insights into market sentiment and potential price movements. Understanding these patterns enhances your ability to identify high-probability trading setups.

The following table illustrates some common candlestick patterns and their implications:

| Pattern Name | Bullish Signal | Bearish Signal |

|---|---|---|

| Hammer | A small real body with a long lower shadow, suggesting buyers stepped in to prevent further price decline. Imagine a small candle with a long wick at the bottom, suggesting buyers fought off the sellers. | Inverted Hammer: A small real body with a long upper shadow, suggesting sellers overwhelmed buyers. Visualize a small candle with a long wick at the top. |

| Engulfing Pattern | A large green candle completely engulfs a preceding smaller red candle, indicating a shift in buyer dominance. Picture a large green candle completely covering a smaller red one. | A large red candle completely engulfs a preceding smaller green candle, suggesting sellers have taken control. Imagine a large red candle engulfing a smaller green one. |

| Morning Star | A three-candle pattern consisting of a down candle followed by a small body candle and then a large up candle, suggesting a potential bullish reversal. Visualize a downward candle, followed by a small candle, then a large upward candle. | Evening Star: The reverse of the Morning Star, suggesting a bearish reversal. This would show an upward candle, followed by a small candle, and then a large downward candle. |

Utilizing Fundamental Analysis

Fundamental analysis in forex trading is all about understanding the bigger picture – the economic and political forces that drive currency values. It’s not just about charting price movements; it’s about anticipating shifts in supply and demand based on real-world events and data. While technical analysis focuses on price patterns, fundamental analysis delves into the underlying reasons behind those patterns. Mastering this aspect can significantly enhance your trading strategies and profitability.

Ignoring fundamental analysis is like navigating a ship without a map. You might stumble upon some islands of profit, but you’re far more likely to crash into unforeseen economic storms. By understanding the economic health of nations and the geopolitical landscape, you can make more informed decisions about which currencies are likely to appreciate or depreciate.

Impact of Economic Data on Currency Valuations

Economic data releases, such as inflation rates, interest rates, and GDP growth figures, significantly influence currency values. Strong economic indicators typically boost a currency’s value, attracting foreign investment and increasing demand. Conversely, weak data often leads to a currency’s depreciation. For example, unexpectedly high inflation might cause a central bank to raise interest rates, making the currency more attractive to investors seeking higher returns. This increased demand, in turn, pushes the currency’s value upward. Conversely, lower-than-expected GDP growth might signal economic weakness, leading to a decline in the currency’s value.

Geopolitical Events and Currency Fluctuations

Geopolitical events, ranging from political instability to international conflicts, can dramatically impact currency valuations. Uncertainty and risk aversion often drive investors towards safer haven currencies like the US dollar or the Swiss franc. Conversely, positive geopolitical developments, such as the signing of a major trade agreement, can boost the value of the currencies involved. For instance, during periods of global uncertainty, investors often flock to the US dollar, driving its value higher. Conversely, a sudden escalation of a geopolitical conflict might trigger a sharp decline in the value of the involved nations’ currencies.

Interpreting Economic News Releases

Interpreting economic news releases requires careful consideration of several factors. You need to analyze the data itself, compare it to expectations (market consensus), and assess the potential impact on monetary policy. A release that beats expectations is generally positive for the associated currency, while a miss can lead to a decline. Consider the context – is the data a one-off anomaly or a sign of a larger trend? For example, if the US unemployment rate unexpectedly drops, it might signal a strong economy, leading to an increase in the value of the US dollar. However, if this is followed by a sharp rise in inflation, the positive impact on the dollar might be offset by the need for the Federal Reserve to raise interest rates.

Major Economic Indicators and Their Influence

Understanding the influence of key economic indicators is crucial for effective fundamental analysis. Here are five major indicators and their typical impact on currency pairs:

- Inflation Rate (CPI): High inflation erodes purchasing power and can lead to currency depreciation. Low and stable inflation is generally positive for a currency.

- Interest Rates: Higher interest rates attract foreign investment, increasing demand for the currency and strengthening its value. Lower interest rates can have the opposite effect.

- Gross Domestic Product (GDP): Strong GDP growth indicates a healthy economy and usually supports currency appreciation. Weak GDP growth suggests economic weakness and can lead to depreciation.

- Unemployment Rate: Low unemployment signifies a strong labor market and typically boosts a currency’s value. High unemployment often indicates economic weakness and can lead to depreciation.

- Trade Balance: A trade surplus (exports exceeding imports) is generally positive for a currency, while a trade deficit can put downward pressure on its value.

Risk Management and Emotional Control

Forex trading, while potentially lucrative, is inherently risky. Success isn’t just about identifying profitable trades; it’s about consistently managing risk and keeping your emotions in check. Ignoring these crucial aspects can quickly wipe out even the most meticulously crafted trading strategy. This section delves into practical strategies for safeguarding your capital and maintaining a level-headed approach to trading.

Risk management isn’t about avoiding losses entirely – that’s impossible. It’s about limiting potential losses to a manageable level, ensuring you can withstand inevitable losing trades without jeopardizing your entire trading account. Emotional control, similarly, isn’t about becoming a robot; it’s about recognizing and mitigating the impact of fear and greed, two powerful forces that can lead to impulsive and ultimately detrimental decisions.

Strategies for Managing Risk

Effective risk management involves several key strategies. A crucial aspect is determining your position size. This refers to the amount of capital you allocate to each trade. A common approach is to risk no more than 1-2% of your trading capital on any single trade. For example, if you have a $10,000 trading account, a 1% risk would limit your potential loss to $100 per trade. This ensures that a series of losing trades won’t decimate your account. Another critical element is setting stop-loss orders. These are automated orders that automatically close a trade when it reaches a predetermined loss level, protecting you from potentially catastrophic losses. Finally, diversifying your trades across different currency pairs reduces the impact of any single trade going against you.

Methods for Controlling Emotions

Fear and greed are the enemies of rational trading. Fear can lead to cutting winning trades short, while greed can result in holding onto losing trades for too long, hoping for a reversal that may never come. Developing emotional control requires self-awareness and discipline. One technique is to create a detailed trading plan that Artikels your entry and exit strategies, including pre-determined stop-loss and take-profit levels. Sticking to this plan, regardless of your emotional state, helps to remove emotion from the decision-making process. Another helpful practice is to maintain a consistent trading routine, avoiding impulsive decisions made under stress or during periods of heightened market volatility. Regular breaks from trading, even short ones, can help to refresh your perspective and prevent emotional fatigue.

Maintaining a Trading Journal

A trading journal is an invaluable tool for tracking your performance, identifying patterns in your trading, and improving your overall strategy. It allows you to objectively analyze your successes and failures, providing insights that can lead to more informed decisions. By meticulously documenting each trade, you can identify recurring mistakes, refine your risk management approach, and ultimately improve your profitability.

Sample Trading Journal, How to Maximize Profits in Forex Trading

| Date | Trade | Profit/Loss | Notes |

|---|---|---|---|

| 2024-10-27 | EUR/USD Long | +$50 | Followed trading plan; good entry and exit |

| 2024-10-28 | GBP/USD Short | -$75 | Stop-loss triggered; market moved unexpectedly |

| 2024-10-29 | USD/JPY Long | +$120 | Excellent risk-reward ratio; strong technical signals |

| 2024-10-30 | AUD/USD Short | -$20 | Missed exit point due to impatience |

Choosing the Right Broker and Platform

Selecting the right forex broker and trading platform is crucial for maximizing your profits. The wrong choice can lead to higher costs, limited functionality, and even security risks, ultimately hindering your trading success. Choosing wisely, however, empowers you with the tools and environment necessary to execute your trading strategy effectively and efficiently.

Choosing a forex broker involves careful consideration of several key factors. A poorly chosen broker can significantly impact your trading experience and profitability. Understanding the nuances of spread, commission structures, leverage options, and regulatory compliance is paramount. Similarly, the trading platform itself needs to be user-friendly, reliable, and offer the tools necessary for your chosen trading style.

Broker Comparison: Spreads, Commissions, Leverage, and Regulation

Different forex brokers offer varying terms and conditions. Spreads, the difference between the bid and ask price, directly impact your profitability. Lower spreads translate to lower trading costs. Commissions, charged per trade, add to your overall expenses. Leverage, allowing you to control larger positions with smaller capital, magnifies both profits and losses. Regulatory oversight ensures the broker operates within a legal framework, protecting your funds and mitigating risks. For example, a broker regulated by the FCA (Financial Conduct Authority) in the UK generally offers a higher level of investor protection than an unregulated broker. Comparing brokers based on these factors – using websites like ForexPeaceArmy for reviews and comparisons – is essential before committing. Consider brokers offering competitive spreads, transparent commission structures, reasonable leverage options, and strong regulatory oversight.

Trading Platform Features and Functionalities

The trading platform is your interface to the market. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. MT4, a veteran in the industry, boasts a vast library of indicators, expert advisors (EAs), and charting tools, making it suitable for both beginners and experienced traders. Its user-friendly interface and extensive customization options contribute to its popularity. cTrader, known for its speed and advanced charting capabilities, is favored by scalpers and those who prioritize execution speed. MT5, the successor to MT4, offers enhanced features like a built-in economic calendar and improved charting tools. The choice depends on your individual needs and trading style. A platform with robust charting tools, a wide array of indicators, and a user-friendly interface is generally preferred.

Checklist for Selecting a Reliable Forex Broker

Before selecting a broker, a thorough evaluation is necessary. This checklist ensures you choose a reliable and trustworthy partner.

- Regulation and Licensing: Verify the broker’s regulatory status with the relevant financial authorities. A regulated broker offers a higher level of security and protection.

- Spreads and Commissions: Compare spreads and commissions offered by different brokers. Opt for a broker with competitive pricing.

- Leverage Options: Evaluate the leverage offered and choose a level that aligns with your risk tolerance.

- Trading Platform: Assess the features and functionality of the trading platform. Ensure it meets your trading needs.

- Customer Support: Test the responsiveness and helpfulness of the customer support team.

- Security Measures: Verify the broker’s security measures, including encryption and data protection protocols.

- Account Types and Minimum Deposits: Compare different account types and minimum deposit requirements to find one that suits your budget and trading style.

- Withdrawal Process: Understand the broker’s withdrawal policies and procedures. Ensure a smooth and efficient withdrawal process.

Continuous Learning and Adaptation

The Forex market is a dynamic beast, constantly evolving and presenting new challenges. To consistently maximize profits, a commitment to continuous learning and adapting your strategies is paramount. Stagnation in this arena is akin to standing still while the world races past – you’ll quickly fall behind. This section explores the crucial resources and methodologies that fuel consistent improvement and profitability.

The Forex market’s unpredictable nature necessitates a flexible approach. What works today might fail tomorrow, emphasizing the need for ongoing education and strategy adjustments. This adaptability isn’t just about reacting to losses; it’s about proactively anticipating market shifts and optimizing your approach for sustained success. It’s about understanding that your trading journey is a marathon, not a sprint.

Reliable Resources for Forex Education

Numerous resources exist to support continuous learning. These range from books offering in-depth theoretical knowledge to interactive courses and webinars providing practical application and real-time market analysis. Choosing the right resources depends on your learning style and current skill level.

- Books: Classic texts like “Japanese Candlestick Charting Techniques” by Steve Nison provide foundational knowledge in technical analysis. More contemporary books often focus on specific trading strategies or risk management techniques, offering tailored insights.

- Online Courses: Platforms like Udemy and Coursera offer structured courses covering various aspects of Forex trading, from beginner-level introductions to advanced topics like algorithmic trading. These often include video lectures, quizzes, and assignments.

- Webinars: Many brokers and financial institutions host free or paid webinars featuring market experts. These offer real-time analysis, trading strategies, and opportunities to engage with experienced traders.

Adapting Trading Strategies

Successful Forex traders aren’t rigid in their approaches. They understand the importance of adjusting their strategies based on evolving market conditions and personal trading experiences. This might involve modifying entry and exit points, adjusting position sizing, or even switching between different trading styles (e.g., scalping, swing trading, day trading) depending on market volatility and personal performance. For example, a strategy that thrives in a trending market might be completely unsuitable during periods of high consolidation. A successful trader constantly analyzes their performance, identifying weaknesses and areas for improvement.

The Significance of Backtesting

Backtesting is the process of evaluating a trading strategy on historical data. It allows traders to simulate the performance of their strategy under various market conditions without risking real capital. This process is crucial for identifying potential flaws in a strategy, optimizing parameters, and gaining confidence before implementing it in live trading. For example, a trader might backtest a moving average crossover strategy using years of historical data to assess its profitability and risk profile before deploying it in a live trading environment. Sophisticated backtesting software can automate this process, providing detailed performance statistics and helping refine trading strategies.

Conclusive Thoughts

Conquering the forex market isn’t a sprint; it’s a marathon. Consistent profitability hinges on a well-defined strategy, meticulous risk management, and a commitment to continuous learning. By mastering technical and fundamental analysis, honing your emotional control, and choosing the right tools, you’ll be well-equipped to navigate the complexities of forex trading and steadily increase your profits. Remember, the journey to maximizing profits is ongoing, requiring adaptability and a willingness to learn from both successes and setbacks. So, buckle up, and get ready to make your mark in the exciting world of forex trading!

Question Bank

What’s the best time of day to trade forex?

There’s no single “best” time. Trading activity is highest during overlapping market sessions (e.g., London and New York). However, the optimal time depends on your strategy and preferred currency pairs.

How much money do I need to start forex trading?

The minimum deposit varies by broker, but it’s crucial to start with an amount you’re comfortable risking and that allows for proper position sizing. Don’t invest more than you can afford to lose.

Is forex trading legal?

Yes, but it’s regulated. Ensure your broker is licensed and adheres to relevant regulations to protect your funds and avoid scams.

What are the biggest risks in forex trading?

Leverage magnifies both profits and losses, posing significant risk. Market volatility, unexpected geopolitical events, and poor risk management can all lead to substantial losses.