How to Trade Forex with a Demo Account? Think of it like this: before you jump into the shark tank of real forex trading, you get to practice in a safe, virtual pool. This isn’t some boring tutorial; it’s your chance to master the art of currency trading without risking your hard-earned cash. We’ll break down everything from understanding demo accounts and navigating trading platforms to developing winning strategies and mastering risk management. Get ready to dive in!

This guide will walk you through setting up your demo account, understanding the platform’s features, crafting a trading strategy, practicing risk management, analyzing your performance, and finally, making the leap to live trading. We’ll demystify the jargon, simplify complex concepts, and give you the confidence to conquer the forex market. No prior experience? No problem. We’ve got you covered.

Understanding Demo Accounts

So, you’re thinking about diving into the exciting (and sometimes terrifying) world of forex trading? Before you risk your hard-earned cash, let’s talk about the unsung hero of forex education: the demo account. Think of it as your personal forex training ground, a risk-free environment where you can hone your skills and experiment with different strategies without the sting of real-world losses.

Demo accounts offer a plethora of benefits for beginners. They allow you to familiarize yourself with the forex platform, understand how trades work, and develop your trading strategy without any financial risk. It’s a chance to learn from your mistakes without losing money – a valuable opportunity that shouldn’t be underestimated. You can test various trading indicators, practice your chart analysis, and even simulate different market conditions to prepare for real-world scenarios. Essentially, it’s your chance to become a forex ninja before facing the real battlefield.

Demo Account versus Live Trading Account

The key difference between a demo and a live account lies in the use of virtual versus real money. A demo account uses virtual funds provided by the broker; you can “trade” with these funds without risking any personal capital. Conversely, a live account uses your own money, and any trades made result in real profits or losses. The emotional impact is drastically different; demo accounts allow you to focus on strategy and technical analysis without the pressure of financial risk. Live trading, on the other hand, introduces the psychological element of managing risk and dealing with the emotional rollercoaster of potential wins and losses. This emotional component is a crucial aspect of successful trading, but it’s best learned gradually, starting with the safety net of a demo account.

Features and Limitations of Demo Account Providers, How to Trade Forex with a Demo Account

Different brokers offer demo accounts with varying features and limitations. Some might offer realistic market data, while others may use simulated data that doesn’t perfectly mirror live market conditions. The leverage offered, the number of tradable instruments, and the platform’s functionalities can also differ. For example, one broker might offer a wider range of currency pairs and trading tools than another. Some may limit the duration of your demo account, while others offer indefinite access. Before choosing a broker, thoroughly research their demo account offerings and compare them based on your specific needs and trading style. Consider factors like platform user-friendliness, the availability of educational resources, and the broker’s overall reputation. A reliable broker will provide a demo account that accurately reflects the features and functionality of their live trading platform.

Opening a Demo Account with a Reputable Broker

Choosing a reputable broker is crucial for a positive learning experience. Look for brokers regulated by established financial authorities. Once you’ve selected a broker, opening a demo account is typically a straightforward process. It usually involves:

- Visiting the broker’s website and navigating to the “Demo Account” or “Practice Account” section.

- Completing a simple registration form, providing basic personal information such as your name, email address, and potentially a phone number.

- Choosing your preferred trading platform (e.g., MetaTrader 4 or 5).

- Selecting the amount of virtual currency you want to start with (this is usually a preset amount offered by the broker).

- Downloading and installing the trading platform (if necessary).

- Logging in and starting to practice!

Remember, the demo account is your playground. Experiment, learn, and refine your trading strategies before venturing into the live market. Don’t be afraid to make mistakes; that’s how you learn!

Navigating the Trading Platform

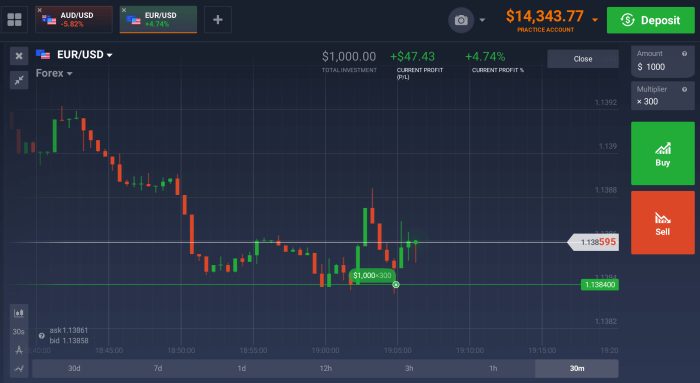

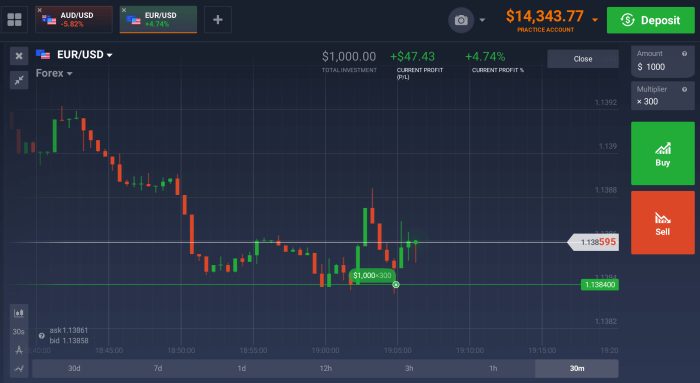

So, you’ve got your demo account set up – congrats! Now, let’s dive into the heart of the forex trading experience: the platform itself. Think of your trading platform as your cockpit – it’s where you’ll monitor the markets, execute trades, and ultimately, test your strategies. Understanding its features is crucial for successful (even demo) trading.

Key Features of a Forex Trading Platform

A typical forex trading platform is packed with tools designed to help you navigate the complexities of the market. Let’s break down some of the essential components.

| Feature Name | Function | Importance | Example |

|---|---|---|---|

| Charting Package | Provides visual representations of price movements over time, allowing for technical analysis. | Essential for identifying trends, support/resistance levels, and potential trading opportunities. | Candlestick charts, line charts, bar charts, with adjustable timeframes (e.g., 1-minute, 1-hour, daily). |

| Order Entry Window | Allows traders to place and manage various types of orders. | Crucial for executing trades according to your strategy and managing risk. | Provides fields for specifying order type (market, limit, stop), volume, and stop-loss/take-profit levels. |

| Technical Indicators | Mathematical calculations applied to price data to generate trading signals. | Helps identify potential trend reversals, overbought/oversold conditions, and momentum changes. | Moving averages, Relative Strength Index (RSI), MACD, Bollinger Bands. |

| Economic Calendar | Provides a schedule of upcoming economic news releases that can impact forex markets. | Essential for anticipating market volatility and adjusting trading strategies accordingly. | Displays events like interest rate announcements, employment data, and inflation reports, along with their potential impact. |

Placing Different Order Types

Mastering order types is fundamental to effective trading. Let’s explore the most common ones:

Market Orders: These are executed immediately at the best available market price. They’re ideal for traders who want to enter a position quickly, but they carry the risk of slippage (the difference between the expected price and the actual execution price). For example, if you place a market order to buy EUR/USD, it will be executed at the current ask price.

Limit Orders: These orders are executed only when the price reaches a specified level. They’re useful for entering a position at a more favorable price or for setting a target price for profit-taking. For example, you might place a limit order to buy EUR/USD at 1.1000, ensuring you don’t pay more than that price.

Stop-Loss Orders: These orders are designed to limit potential losses. They automatically close a position when the price moves against you to a predetermined level. For instance, if you buy EUR/USD at 1.1050 and set a stop-loss at 1.1000, your position will be closed automatically if the price falls to 1.1000, limiting your loss.

Utilizing Charting Tools and Technical Indicators

Charting tools and technical indicators are your analytical arsenal. They allow you to visually identify patterns and trends, and to generate trading signals based on historical price data. Effective use requires practice and understanding of different indicators’ strengths and limitations. For example, a moving average can help smooth out price fluctuations and identify the overall trend, while the RSI can indicate overbought or oversold conditions, potentially signaling a trend reversal.

Customizing the Platform Interface

Personalizing your trading platform is key to maximizing efficiency. Most platforms allow you to customize aspects like chart layouts, indicator settings, and even color schemes. Experiment to find a setup that suits your trading style and enhances your focus. This could involve arranging frequently used tools prominently, choosing a color scheme that reduces eye strain, and adjusting font sizes for optimal readability.

Developing Trading Strategies: How To Trade Forex With A Demo Account

Developing a robust trading strategy is crucial for success in forex trading, even within the safe confines of a demo account. A well-defined strategy helps you make consistent, informed decisions, minimizing emotional trading and maximizing your learning experience. This section will guide you through creating a simple strategy, backtesting it, and implementing effective risk management.

A Simple Forex Trading Strategy: EUR/USD Moving Average Crossover

This strategy uses two moving averages – a fast moving average (e.g., 10-period) and a slow moving average (e.g., 20-period) – applied to the EUR/USD currency pair. The core principle is to identify potential buy and sell signals based on the crossovers of these averages. When the fast moving average crosses above the slow moving average, it generates a buy signal; conversely, a crossover of the fast moving average below the slow moving average signals a sell opportunity. This strategy is simple to understand and implement, making it ideal for beginners practicing on a demo account. Remember, this is a simplified example and more sophisticated strategies exist.

Backtesting a Trading Strategy

Backtesting involves applying your strategy to historical price data to assess its potential profitability and identify weaknesses. Most demo trading platforms provide access to historical price charts. To backtest the moving average crossover strategy, you would first select the EUR/USD pair and apply the 10 and 20-period moving averages to the chart. Then, you’d visually analyze past price movements, noting instances where the fast MA crossed above the slow MA (buy signals) and vice-versa (sell signals). You would then record the entry and exit points of each trade, calculating the resulting profit or loss for each trade. Finally, you’d aggregate these results to determine the overall performance of your strategy over the backtested period. Remember that past performance is not necessarily indicative of future results.

Risk Management and Position Sizing

Effective risk management is paramount, even when trading with demo funds. It protects your capital and helps you develop disciplined trading habits. One common technique is to limit risk per trade to a small percentage of your total capital (e.g., 1-2%). This ensures that even a series of losing trades won’t significantly impact your overall account balance. Another approach is using stop-loss orders. These automatically close your position if the price moves against you by a predetermined amount, limiting potential losses. For instance, if you buy EUR/USD at 1.1000, you might set a stop-loss order at 1.0980, limiting your potential loss to 20 pips (0.0020). Take profit orders, conversely, automatically close your position when it reaches a predetermined profit target. For example, you might set a take profit order at 1.1030, aiming for a 30-pip profit.

Common Beginner Mistakes in Demo Account Strategy Development

Many beginners fall into the trap of over-optimizing their strategies on demo accounts. This involves tweaking parameters until the strategy appears highly profitable in backtesting, creating a false sense of security. This often leads to disappointment when the strategy is applied to live trading. Another common mistake is neglecting risk management. Demo accounts offer a risk-free environment, tempting traders to take excessive risks. However, developing sound risk management habits early on is essential for long-term success. Finally, ignoring market context is a pitfall. Strategies that work well in one market condition might fail miserably in another. It’s important to consider broader market trends and economic factors when developing and testing trading strategies.

Practicing Risk Management

Mastering forex trading isn’t just about predicting market movements; it’s about intelligently managing risk. A demo account provides the perfect sandbox to hone these crucial skills without risking real capital. Let’s explore how to effectively implement risk management strategies within your simulated trading environment.

Effective risk management is the cornerstone of consistent profitability in forex trading. It’s about protecting your capital while maximizing potential gains. A demo account offers a risk-free environment to practice and refine your risk management techniques before venturing into live trading.

Stop-Loss and Take-Profit Orders in Action

Consider this scenario: You believe the EUR/USD pair will appreciate. You enter a long position (buying EUR/USD) at 1.1000. To limit potential losses, you set a stop-loss order at 1.0950 – a 50-pip stop. This means if the price drops to 1.0950, your trade will automatically close, limiting your loss to 50 pips. Simultaneously, you set a take-profit order at 1.1075 – a 75-pip target. If the price reaches 1.1075, your trade will close automatically, securing a 75-pip profit. This simple example demonstrates how stop-loss and take-profit orders protect your capital and lock in profits. The key is to determine appropriate stop-loss and take-profit levels based on your trading strategy and risk tolerance.

Leverage and its Impact

Leverage magnifies both profits and losses. In a demo account, you can experiment with different leverage levels to understand their impact. For example, a 1:100 leverage means that for every $1 you invest, you control $100 worth of currency. A small price movement can result in a significant gain or loss. While leverage can amplify profits, it also significantly increases the risk of substantial losses. Careful consideration of your risk tolerance and trading strategy is paramount when using leverage. It’s crucial to avoid over-leveraging, as this can quickly lead to substantial losses even with small market movements. Practice with different leverage levels in your demo account to find a comfortable and sustainable approach.

Emotional Discipline in Simulated Trading

Emotional discipline is often the most challenging aspect of forex trading. Fear and greed can lead to impulsive decisions that jeopardize your trading plan. A demo account provides a safe space to confront these emotions. By consistently practicing disciplined trading in a risk-free environment, you can build resilience and learn to control emotional impulses. This includes resisting the urge to overtrade, chasing losses, or holding onto losing positions for too long.

Strategies for Managing Fear and Greed

Managing fear and greed requires a structured approach. One effective strategy is to develop a pre-defined trading plan that includes clear entry and exit points, stop-loss and take-profit orders, and position sizing. Adhering to this plan regardless of emotional impulses is critical. Furthermore, keeping a detailed trading journal can help identify emotional triggers and patterns in your trading behavior. Regularly reviewing your journal allows for self-reflection and improvement. Another helpful technique is to practice mindfulness and meditation to improve emotional regulation and decision-making skills. Consistent practice within the safe confines of a demo account allows you to develop these essential emotional control strategies without the pressure of financial risk.

Analyzing Trading Performance

So, you’ve been diligently practicing your forex trading skills on a demo account. Now it’s time to move beyond simply executing trades and start analyzing your performance to identify areas for improvement. Understanding your strengths and weaknesses is crucial for refining your strategy and ultimately achieving success in live trading. This involves tracking key metrics, using a trading journal, and interpreting the data to inform your future trading decisions.

Analyzing your demo account performance isn’t just about looking at your overall profit or loss. It’s about dissecting your trading activity to pinpoint patterns, identify biases, and refine your approach. This deep dive will help you understand what works, what doesn’t, and how to improve your trading strategy for greater consistency and profitability.

Methods for Tracking and Analyzing Trading Performance Metrics

Tracking your trading performance involves monitoring several key metrics. These metrics provide a quantitative view of your trading success, enabling you to identify trends and make data-driven decisions. Regular monitoring is essential for continuous improvement.

Three crucial metrics to track are your win rate, average trade size, and profit factor. Your win rate represents the percentage of trades that resulted in a profit. Average trade size refers to the average amount of currency you traded per transaction. The profit factor measures the ratio of your gross profits to your gross losses. A profit factor greater than 1 indicates profitable trading, while a factor less than 1 suggests losses outweigh gains.

Identifying Strengths and Weaknesses in Trading Strategies

By carefully examining these metrics, you can pinpoint both the strengths and weaknesses of your trading strategy. For instance, a high win rate but low average trade size might indicate a strategy that’s consistently profitable but lacks the potential for significant gains. Conversely, a high average trade size with a low win rate could signify a high-risk, low-reward approach. Identifying these imbalances allows for strategic adjustments.

Analyzing your trading performance also helps identify patterns in your trading behavior. Do you tend to overtrade during certain market conditions? Do you consistently exit trades too early or hold onto losing positions for too long? Recognizing these tendencies is a critical step towards improving discipline and making more rational trading decisions.

Remember to click How to Use Stochastic Oscillator in Forex Trading to understand more comprehensive aspects of the How to Use Stochastic Oscillator in Forex Trading topic.

Using a Trading Journal to Record Trades, Analyze Results, and Improve Trading Skills

Maintaining a detailed trading journal is invaluable for analyzing your performance. A trading journal should include the date and time of each trade, the currency pair traded, your entry and exit points, the rationale behind your trade decisions, and the resulting profit or loss. This meticulous record-keeping enables you to track your progress over time, identify recurring patterns, and refine your trading strategy.

Regularly reviewing your journal allows you to reflect on your successes and failures. You can identify situations where your strategy worked exceptionally well and those where it faltered. This process helps you develop a deeper understanding of market dynamics and refine your trading approach based on concrete evidence from your own trading experience.

Do not overlook explore the latest data about Understanding Forex Market Liquidity.

Key Performance Metrics and Their Interpretation

| Metric Name | Definition | Calculation | Interpretation |

|---|---|---|---|

| Win Rate | Percentage of profitable trades | (Number of winning trades / Total number of trades) * 100% | Higher win rate indicates better strategy selection and risk management. A win rate above 50% is generally considered good. |

| Average Trade Size | Average amount traded per transaction | Total amount traded / Total number of trades | Larger average trade size can lead to higher potential profits but also higher risk. |

| Profit Factor | Ratio of gross profits to gross losses | Total gross profit / Total gross loss | A profit factor greater than 1 indicates profitable trading; a factor below 1 indicates losses outweigh gains. Higher profit factors are preferable. |

| Average Trade Duration | Average time a position is held | Sum of all trade durations / Total number of trades | Helps identify optimal holding periods for different strategies and market conditions. |

Transitioning to Live Trading

So, you’ve conquered the demo account. You’ve charted your course through the virtual waters of forex trading, developed a strategy, and honed your skills. Now comes the big leap: live trading. It’s a thrilling, yet nerve-wracking, transition. The difference between simulated and real money trading isn’t just about the numbers; it’s a significant shift in the psychological game.

The psychological impact of trading with real money is substantially different from using a demo account. The emotional stakes are dramatically higher, leading to potential decision-making biases that can significantly impact your trading performance. This transition requires careful planning and a solid understanding of your own emotional responses under pressure.

Key Differences Between Demo and Live Trading Psychology

The primary difference lies in the emotional weight. Demo accounts offer a risk-free environment where mistakes are inconsequential. Live trading, however, involves real financial risk, triggering stronger emotional responses like fear, greed, and anxiety. This can lead to impulsive decisions, deviating from a well-defined trading plan, and ultimately impacting profitability. For example, a small loss on a demo account might be easily dismissed, but the same loss in a live account can trigger panic selling. Conversely, a small win on a demo account might not feel significant, but the same win in a live account can fuel overconfidence and lead to riskier trades.

Steps to Take Before Transitioning to a Live Account

Before diving into live trading, several crucial steps must be taken. First, ensure your trading strategy is robust and thoroughly backtested on historical data. This involves meticulously documenting your entry and exit points, risk management rules, and overall performance metrics. Second, define your risk tolerance accurately. Determine the maximum percentage of your capital you’re willing to lose on any single trade or within a specific period. Third, familiarize yourself with your broker’s platform, including order execution speeds and any potential slippage. Finally, start with a small amount of capital, allowing you to gain experience in a real market environment without risking significant financial losses. Think of it as a gradual immersion, not a sudden plunge.

Importance of a Well-Defined Trading Plan Before Live Trading

A well-defined trading plan is your lifeline in the turbulent waters of live trading. It acts as your compass, guiding your decisions and keeping emotions in check. This plan should encompass your trading strategy, risk management rules, position sizing techniques, and clear entry and exit points for every trade. For instance, your plan might specify that you will only trade currency pairs with low volatility during specific market hours, and will never risk more than 2% of your capital on a single trade. Without a plan, your emotions will dictate your trades, leading to inconsistent results and potential losses. A detailed trading plan is crucial for maintaining discipline and objectivity, regardless of market conditions.

Emotional Challenges of Demo Versus Live Trading

The emotional challenges are vastly different. Demo trading allows for a detached, almost game-like approach. Losses are easily shrugged off, and wins don’t feel as impactful. Live trading, on the other hand, triggers intense emotions. Fear of loss can lead to hesitant trading or premature exits, while greed can encourage over-leveraging and risky trades. For example, a trader might be comfortable taking a larger position in a demo account, while the same position size would cause significant anxiety in a live account. The difference is the real financial consequences attached to live trading. Managing these emotions requires discipline, self-awareness, and potentially professional guidance.

Last Point

So, there you have it – your roadmap to conquering the forex world, starting with the safety net of a demo account. Remember, consistent practice, smart strategy, and ironclad discipline are your keys to success. Don’t just passively read this; actively engage with the concepts, experiment, and learn from your mistakes. The forex market is a challenging yet rewarding arena, and with the right approach and preparation, you can navigate it with confidence and potentially achieve your financial goals. Now go forth and trade (virtually, for now!).

FAQ Corner

What’s the best demo account provider?

There’s no single “best” provider; it depends on your needs. Look for brokers with reputable regulation, user-friendly platforms, and realistic market data.

How long should I practice on a demo account?

There’s no magic number. Practice until you consistently achieve your trading goals in a simulated environment and feel comfortable with risk management.

Can I use a demo account forever?

While demo accounts are great for learning, they don’t perfectly replicate live market conditions (emotional factors, for example). Transitioning to a live account, even with small amounts, is crucial for true mastery.

Are demo account profits real?

No, profits made in a demo account are virtual. They don’t represent actual monetary gains.