A Beginner’s Guide to Forex Spread Betting: Dive into the exciting (and sometimes nerve-wracking!) world of forex spread betting. Think of it as a high-stakes guessing game, but instead of predicting the next winning lottery number, you’re predicting currency fluctuations. This guide breaks down the basics, from understanding spreads and leverage to mastering risk management and choosing the right trading strategy. Get ready to learn the ropes and navigate the thrilling – and potentially lucrative – world of global currency markets.

We’ll demystify the jargon, explain the mechanics, and arm you with the knowledge you need to approach forex spread betting with confidence (and a healthy dose of caution). We’ll cover everything from opening and closing trades to analyzing charts and managing risk, ensuring you’re equipped to make informed decisions. By the end, you’ll have a solid foundation to begin your forex journey.

Introduction to Forex Spread Betting

Forex spread betting is a way to speculate on the price movements of currency pairs without actually owning the currencies themselves. Instead of buying and selling currencies like in traditional forex trading, you’re betting on whether the price will go up or down. It’s a leveraged product, meaning you can control a larger position with a smaller initial investment, but this also magnifies both potential profits and losses. Think of it as a sophisticated form of guessing the direction of currency fluctuations, with the potential for significant returns.

Spread betting differs from traditional forex trading primarily in how profits and losses are calculated. In traditional forex trading, you buy a currency pair at one price and sell it at another, profiting from the difference. In spread betting, your profit or loss is determined by the number of points the price moves in your predicted direction, multiplied by your stake per point. You don’t own any assets; you’re simply betting on price movements.

Understanding the Spread

The “spread” in spread betting refers to the difference between the buy and sell price of a currency pair. This spread represents the broker’s commission. For example, if the GBP/USD spread is 2 pips, and you bet on the price going up, you’d only start profiting once the price moves more than 2 pips beyond your entry point. This spread eats into your potential profits, so understanding and comparing spreads across different brokers is crucial. The wider the spread, the less your potential profit.

Analogy: Gambling on a Horse Race

Imagine you’re at a horse race. In traditional forex trading, you’re buying a horse and hoping it wins, profiting from the winnings. In spread betting, you’re betting on which horse will win, with your profit determined by how much the horse’s odds change from the time you place your bet. You don’t own the horse, just the bet. The spread is like the track’s commission – it’s a fee you pay regardless of whether you win or lose. The size of your bet corresponds to your stake per point, and the winning margin (how much the horse’s odds change) determines your profit or loss.

Understanding Spreads and Leverage: A Beginner’s Guide To Forex Spread Betting

Forex spread betting, while potentially lucrative, hinges on understanding two crucial concepts: spreads and leverage. These elements directly impact your profitability and risk exposure, so grasping them is fundamental to successful trading. Let’s break them down.

Spreads in Forex Spread Betting

The spread represents the difference between the buy and sell price of a currency pair. For example, if the EUR/USD bid price is 1.1000 and the ask price is 1.1002, the spread is 0.0002. This seemingly small difference is your immediate cost of entry into a trade. In spread betting, this spread is your initial loss, regardless of the direction of your trade. Wider spreads mean higher costs, impacting your potential profit margins. Market volatility significantly influences spreads; during periods of high uncertainty or news events, spreads tend to widen, making it more expensive to enter and exit trades. Conversely, during calmer market conditions, spreads typically narrow. Understanding spread dynamics is key to minimizing trading costs and maximizing potential returns.

Leverage in Forex Spread Betting

Leverage allows you to control a larger position in the market than your initial capital would normally allow. It acts as a multiplier, magnifying both your potential profits and losses. For instance, a 1:100 leverage means that for every £1 you invest, you control £100 worth of currency. This can lead to substantial gains with relatively small initial investments. However, it’s a double-edged sword. The same leverage that amplifies profits also exponentially increases potential losses. A small movement against your position can quickly wipe out your initial capital and lead to further losses.

Leverage Levels and Associated Risks

The following table illustrates the relationship between leverage levels, potential profit, potential loss, and risk. Note that these are illustrative examples and actual outcomes can vary significantly based on market conditions and trading strategy.

| Leverage Ratio | Potential Profit | Potential Loss | Risk Level |

|---|---|---|---|

| 1:10 | 10% increase in the underlying asset price results in a 100% return on your investment. | 10% decrease in the underlying asset price results in a 100% loss on your investment. | Moderate |

| 1:50 | 10% increase in the underlying asset price results in a 500% return on your investment. | 10% decrease in the underlying asset price results in a 500% loss on your investment. | High |

| 1:100 | 10% increase in the underlying asset price results in a 1000% return on your investment. | 10% decrease in the underlying asset price results in a 1000% loss on your investment. | Extremely High |

| 1:200 | 10% increase in the underlying asset price results in a 2000% return on your investment. | 10% decrease in the underlying asset price results in a 2000% loss on your investment. | Extremely High |

Always remember that leverage is a double-edged sword. While it can amplify profits, it also significantly increases the risk of substantial losses. Careful risk management is paramount when using leverage.

Opening and Closing Trades

So, you’ve grasped the basics of forex spread betting – understanding spreads, leverage, and the market’s nuances. Now, let’s dive into the practical side: actually placing and closing your trades. This is where the rubber meets the road, and where you’ll start to see your knowledge translate into potential profits (or losses, let’s be realistic!).

Opening a forex spread bet involves a few straightforward steps, but understanding the different order types is crucial for maximizing your chances of success. Think of it like choosing the right weapon for a specific battle – the wrong choice can cost you dearly.

Market Orders

A market order is the simplest type of trade. You’re essentially saying, “I want to buy/sell this currency pair right now, at the best available price.” It’s quick and efficient, perfect for when you need to act fast on a market opportunity. However, because you’re not specifying a price, you might not get the exact rate you were hoping for, especially in volatile market conditions. The price you get will be the current market bid or ask price at the moment your order is executed. For example, if the EUR/USD bid is 1.1000 and the ask is 1.1005, a buy market order will execute at 1.1005, and a sell market order will execute at 1.1000.

Limit Orders

Limit orders offer more control. Here, you specify the exact price at which you want to buy or sell. If the market reaches your specified price, your order will be executed. If it doesn’t, your order remains open until it’s either filled or you cancel it. This is a great strategy for managing risk and securing a specific entry or exit point. Imagine you believe the GBP/USD will rise to 1.3000. You could place a buy limit order at 1.2995. If the price reaches that level, your order will be executed; otherwise, it won’t. This helps you avoid overpaying.

Closing a Trade and Realizing Profits or Losses

Closing a trade is the mirror image of opening one. To close a position, you simply place an opposite order of the same size. For example, if you bought 10 lots of EUR/USD, you’d close the trade by selling 10 lots of EUR/USD. The profit or loss is calculated based on the difference between your entry and exit prices, taking into account the spread and any leverage used. Let’s say you bought 1 lot of EUR/USD at 1.1000 and closed it at 1.1010. Ignoring the spread for simplicity, you’ve made a profit of 10 pips (1 pip = 0.0001). The actual profit in monetary terms will depend on your stake per pip. Conversely, if you closed at 1.0990, you’d have a loss of 10 pips. Remember, leverage magnifies both profits and losses, so responsible risk management is vital.

Risk Management Strategies

Forex spread betting, while offering the potential for significant profits, also carries substantial risk. Understanding and implementing effective risk management strategies is crucial for long-term success and preventing substantial financial losses. Without a robust plan, even the most well-researched trades can quickly turn sour. This section will Artikel key strategies to help you navigate the inherent volatility of the forex market.

Successful forex spread betting isn’t just about making winning trades; it’s about consistently managing risk to protect your capital. Ignoring risk management is akin to sailing a ship without a rudder – you might get lucky for a while, but ultimately, you’re likely to crash. A well-defined risk management plan should be an integral part of your trading strategy, helping you to define your risk tolerance, limit potential losses, and ultimately, maximize your chances of long-term profitability.

Remember to click How to Trade Forex on a Budget to understand more comprehensive aspects of the How to Trade Forex on a Budget topic.

Stop-Loss Orders and Position Sizing

Stop-loss orders are your safety net. They automatically close a trade when the price reaches a predetermined level, limiting your potential losses. For example, if you’re betting on the EUR/USD rising and set a stop-loss at 1%, your trade will automatically close if the price falls by 1% from your entry point. This prevents larger losses if the market moves against your prediction. Position sizing complements this by determining the amount of capital you allocate to each trade. A general rule of thumb is to risk no more than 1-2% of your total trading capital on any single trade. This helps to ensure that even a series of losing trades won’t wipe out your account.

Key Risk Management Techniques

Implementing a diverse range of risk management techniques is key to navigating the unpredictable nature of forex spread betting. The following techniques, when used in conjunction, offer a comprehensive approach to safeguarding your capital and promoting sustainable trading.

Browse the multiple elements of Swing Trading Strategies for Forex to gain a more broad understanding.

- Stop-Loss Orders: Automatically closes a trade when the price reaches a predefined level, limiting potential losses. The level should be determined based on your risk tolerance and market analysis.

- Take-Profit Orders: These orders automatically close a trade when the price reaches a specified profit target, securing your gains. Setting a take-profit order helps to lock in profits and prevent giving back gains due to market fluctuations.

- Position Sizing: Determining the appropriate amount of capital to allocate to each trade, typically a small percentage (1-2%) of your total trading capital. This prevents a single losing trade from significantly impacting your account balance.

- Diversification: Spreading your trades across different currency pairs and asset classes reduces the impact of losses on any single trade. Don’t put all your eggs in one basket, so to speak.

- Regular Review and Adjustment: Consistently reviewing your trading performance, risk management strategies, and market conditions is essential for adaptation and improvement. What works today might not work tomorrow, so flexibility is key.

Different Trading Strategies

Forex spread betting offers a diverse range of trading strategies, each with its own set of advantages and disadvantages. The best strategy for you will depend on your risk tolerance, available time, and trading goals. Choosing wisely is crucial for success.

Three common strategies are scalping, day trading, and swing trading. These differ significantly in their timeframe, risk profile, and the level of commitment required.

Scalping

Scalping involves taking advantage of very small price movements in the forex market. Traders aim to profit from tiny price fluctuations, often holding positions for only seconds or minutes. This requires constant monitoring of the market and lightning-fast reflexes. Scalpers use technical analysis extensively, focusing on chart patterns and indicators to identify short-term opportunities. The high frequency of trades means that even small profits can accumulate significantly over time, but losses can mount just as quickly.

Day Trading

Day trading focuses on holding positions throughout a single trading day. Trades are opened and closed within the same day, eliminating overnight risk. Day traders typically use technical analysis to identify short-term trends and momentum shifts. This strategy demands a significant time commitment and requires a deep understanding of market dynamics. While potential profits can be substantial, the inherent risk is also high due to the rapid price changes throughout the day.

Swing Trading

Swing trading involves holding positions for several days, weeks, or even months. Traders capitalize on intermediate-term price swings, often using a combination of technical and fundamental analysis. This approach requires less constant monitoring compared to scalping and day trading, allowing for more flexibility. While swing trading can yield significant profits, it requires patience and the ability to withstand potential short-term drawdowns. Market analysis is crucial for determining entry and exit points, with a longer time horizon meaning that patience is key.

Comparison of Trading Strategies

The following table summarizes the key differences between scalping, day trading, and swing trading:

| Strategy Name | Timeframe | Risk Level | Suitability for Beginners |

|---|---|---|---|

| Scalping | Seconds to minutes | High | Not suitable |

| Day Trading | Within a single trading day | High | Not suitable |

| Swing Trading | Days to weeks/months | Medium | Potentially suitable with proper training and risk management |

Analyzing Forex Charts and Indicators

Deciphering the cryptic language of forex charts and indicators is crucial for successful trading. Understanding these tools allows you to identify potential trends, predict price movements, and ultimately, make more informed trading decisions. This section will equip you with the knowledge to interpret common chart types and utilize popular technical indicators to gain a competitive edge in the forex market.

Candlestick Charts and Bar Charts

Candlestick and bar charts are fundamental tools for visualizing price movements over time. Both display the open, high, low, and close (OHLC) prices for a specific period, but they present this information differently. Candlestick charts use distinct shapes to represent price action, making it easier to visually identify trends and patterns. Bar charts, on the other hand, use vertical lines to represent the price range.

A candlestick displays the open and close prices as the body of the candle, while the wicks (or shadows) represent the high and low prices. A green (or white) candle indicates a closing price higher than the opening price (a bullish candle), while a red (or black) candle signifies a closing price lower than the opening price (a bearish candle). Bar charts use a vertical line to represent the high-low range, with a small horizontal mark indicating the open and close prices. By comparing the lengths of the bodies and wicks, traders can identify potential reversals or continuations of trends. For instance, a long green candle with a small wick suggests strong buying pressure, whereas a long red candle with a small wick suggests strong selling pressure.

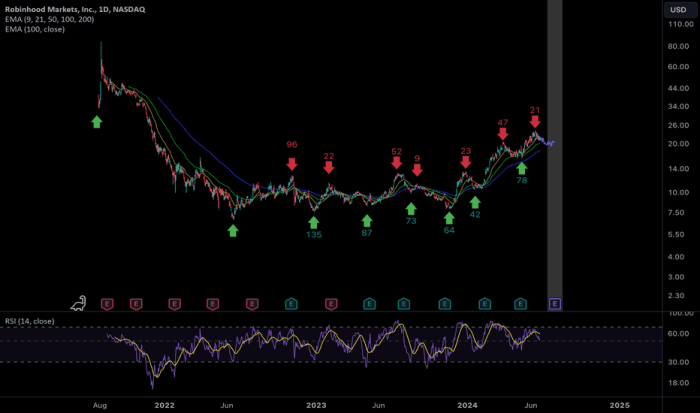

Moving Averages

Moving averages smooth out price fluctuations, making it easier to identify trends. They are calculated by averaging the price over a specific period. Common types include simple moving averages (SMA), exponential moving averages (EMA), and weighted moving averages (WMA). The period used (e.g., 20-day, 50-day, 200-day SMA) determines the sensitivity of the average to recent price changes. Shorter-period moving averages are more responsive to recent price action, while longer-period moving averages provide a smoother, less volatile representation of the trend. Traders often use multiple moving averages with different periods to identify potential buy or sell signals; for example, a “golden cross” (when a short-term moving average crosses above a long-term moving average) is often interpreted as a bullish signal, while a “death cross” (the opposite) is seen as bearish.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. The RSI is typically displayed as a line ranging from 0 to 100. Readings above 70 are generally considered overbought, suggesting a potential price reversal to the downside. Conversely, readings below 30 are generally considered oversold, suggesting a potential price reversal to the upside. It’s important to note that the RSI is not a perfect indicator and can generate false signals. Therefore, it’s best used in conjunction with other technical indicators and chart patterns to confirm potential trading opportunities. For example, a stock with an RSI above 70 might still continue its upward trend if supported by other bullish indicators.

Common Chart Patterns

Chart patterns represent recurring formations in price action that can offer clues about future price movements. Identifying these patterns can help traders anticipate potential price reversals or continuations.

Head and Shoulders Pattern

The head and shoulders pattern is a bearish reversal pattern characterized by three peaks, with the middle peak (the “head”) being the highest. The two peaks on either side of the head are the “shoulders.” A neckline connects the lows of the two shoulders. A break below the neckline is considered a bearish signal, indicating a potential downward price movement. The target price is often estimated by measuring the distance between the head and the neckline and projecting that distance downwards from the neckline break.

Double Top Pattern

The double top pattern is another bearish reversal pattern. It consists of two successive peaks at roughly the same price level, followed by a lower trough. A break below the trough between the two peaks is considered a bearish signal, suggesting a potential downward price movement. Similar to the head and shoulders pattern, the target price is often estimated by measuring the distance between the high of the double top and the trough, and projecting that distance downwards from the break below the trough.

Triangle Pattern

Triangle patterns are continuation patterns, indicating a potential continuation of the existing trend. There are three main types: symmetrical, ascending, and descending triangles. Symmetrical triangles show a narrowing range of price fluctuations, with the price oscillating between converging trendlines. Ascending triangles show a flat upper trendline and a rising lower trendline, indicating a potential bullish breakout. Descending triangles show a falling upper trendline and a flat lower trendline, suggesting a potential bearish breakout. Breakouts above or below the triangle’s trendlines can confirm the continuation of the existing trend.

Account Management and Funding

Navigating the world of forex spread betting requires a solid understanding of how to manage your trading account and efficiently move funds. This section will guide you through the process of opening an account, understanding different account types, and managing your deposits and withdrawals. Proper account management is crucial for a successful and stress-free trading experience.

Opening a spread betting account is generally a straightforward process. Most brokers offer online application forms that require you to provide personal details, address verification, and financial information to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. You’ll also need to choose your account type and funding method. Expect a verification process, which may involve providing identification documents like a passport or driver’s license. The entire process usually takes a few days, but it can vary depending on the broker and the verification speed.

Account Types and Features

Spread betting brokers offer a variety of account types, each designed to cater to different trader needs and experience levels. These often include standard accounts, premium accounts, and sometimes even Islamic accounts, which adhere to Sharia law by prohibiting interest. Standard accounts typically offer basic trading tools and access to the market, while premium accounts might include enhanced features such as advanced charting tools, personalized support, and educational resources. Islamic accounts are designed to meet the specific religious requirements of some traders, eliminating interest-based charges. The features and associated fees will vary significantly between brokers, so it’s vital to compare options carefully before making a decision.

Depositing Funds

Depositing funds into your spread betting account is usually a quick and easy process. Most brokers offer a range of secure payment methods, including credit/debit cards, bank transfers, e-wallets (such as PayPal, Skrill, or Neteller), and sometimes even cryptocurrency options. The minimum deposit amount varies by broker, so it’s essential to check their terms and conditions. Once you choose your preferred method, you’ll typically be guided through a secure online portal to complete the transaction. It’s always advisable to use secure payment methods and ensure the broker’s website uses encryption (look for “https” in the address bar). For example, using a credit card often offers additional buyer protection.

Withdrawing Funds

Withdrawing funds from your spread betting account is generally similar to depositing. You’ll typically select your preferred withdrawal method from the options available on your broker’s platform. The processing time for withdrawals can vary depending on the chosen method; bank transfers can take several business days, while e-wallets are often much faster. Withdrawal requests are subject to the broker’s verification process, ensuring the security of your funds. Before initiating a withdrawal, carefully review the broker’s terms and conditions regarding withdrawal fees and minimum withdrawal amounts. For example, some brokers might charge a small fee for withdrawals via certain methods. Keep in mind that the withdrawal method might need to match your deposit method for security reasons.

Understanding Market Influences

Forex trading isn’t just about technical analysis; understanding the broader economic and political landscape is crucial for successful trading. Market movements are often driven by significant events and shifts in global power dynamics, making it essential for traders to stay informed and adapt their strategies accordingly. Ignoring these factors can lead to significant losses, highlighting the importance of fundamental analysis in a forex trader’s toolkit.

Economic News and Events

Economic news releases, such as inflation reports, interest rate decisions, and employment figures, significantly impact currency values. A surprise increase in inflation, for instance, might strengthen a currency if the market anticipates the central bank will raise interest rates to combat it. Conversely, weaker-than-expected economic data can trigger a currency’s decline. The impact of these events can be immediate and dramatic, creating both opportunities and risks for traders. The speed and magnitude of the reaction depend on several factors, including the size of the surprise, the market’s expectations, and the overall economic climate. For example, a positive surprise in US employment data might cause the US dollar to appreciate against other currencies, as investors seek higher returns in the US market.

Geopolitical Factors

Geopolitical events, ranging from political instability in a particular region to international conflicts, exert a considerable influence on forex markets. Political uncertainty often leads to increased risk aversion among investors, causing them to move their capital into safer haven currencies like the US dollar or Japanese yen. Major international events, such as trade wars or sanctions, can drastically shift currency valuations. For example, escalating tensions between two major economies might cause a sharp depreciation in the currencies of both countries as investors flee to safety. The ongoing war in Ukraine, for instance, has significantly impacted global markets, affecting currency pairs involving the ruble, euro, and dollar.

Major Factors Influencing Forex Prices

Understanding the key drivers of forex prices is paramount for effective trading. Here are five major factors that consistently influence currency values:

- Interest Rate Differentials: Higher interest rates generally attract foreign investment, increasing demand for the currency and strengthening its value. This is because investors seek higher returns on their investments.

- Economic Growth: Strong economic growth usually leads to a stronger currency, as it attracts investment and increases demand. Conversely, weak economic growth can weaken a currency.

- Political Stability: Political stability and sound economic policies foster investor confidence, strengthening the currency. Uncertainty or political instability can trigger capital flight and weaken the currency.

- Government Intervention: Central banks can intervene in the forex market to influence the value of their currency. They might buy or sell their currency to stabilize its value or to achieve specific economic goals.

- Market Sentiment: Investor sentiment, or the overall mood of the market, plays a significant role. Positive sentiment can push currency values higher, while negative sentiment can lead to declines.

The Importance of Education and Practice

Forex spread betting, while potentially lucrative, is a complex market demanding continuous learning and dedicated practice. Success isn’t a matter of luck; it’s a direct result of understanding the market dynamics, mastering trading strategies, and effectively managing risk. Ignoring the educational aspect is akin to sailing a ship without a map – you might get lucky, but the chances of disaster are significantly higher.

Consistent learning and refinement of your trading skills are crucial for navigating the volatile world of forex spread betting. The market is constantly evolving, with new trends and factors influencing price movements. Staying abreast of these changes requires an ongoing commitment to education and a willingness to adapt your strategies accordingly. This isn’t a get-rich-quick scheme; it’s a journey requiring patience, discipline, and a thirst for knowledge.

Resources for Further Education and Practice, A Beginner’s Guide to Forex Spread Betting

Several avenues exist for expanding your forex spread betting knowledge and honing your trading skills. Books dedicated to technical and fundamental analysis, risk management, and various trading strategies provide a solid theoretical foundation. Many reputable websites offer educational resources, including articles, tutorials, and webinars, covering a wide range of topics relevant to forex trading. Furthermore, structured online courses, often taught by experienced traders, offer a more comprehensive and guided learning experience. These resources cater to various learning styles and experience levels, ensuring accessibility for beginners and advanced traders alike.

Benefits of Using a Demo Account

Before venturing into live trading with real money, utilizing a demo account is paramount. A demo account provides a risk-free environment to practice your trading strategies, test different approaches, and familiarize yourself with the trading platform without the financial consequences of real-money trading. It allows you to experiment with leverage, analyze market fluctuations, and develop a feel for the market’s rhythm without jeopardizing your capital. This practice period is invaluable in building confidence and refining your skills before committing real funds. Think of it as a virtual driving school before getting behind the wheel of a real car. The experience gained is invaluable in mitigating potential losses and increasing the likelihood of success in live trading.

Last Recap

So, there you have it – your crash course in forex spread betting. Remember, this is a complex market with inherent risks, so thorough research and practice are crucial before diving into real trades. While the potential rewards are enticing, responsible risk management is paramount. Start with a demo account, learn the ropes, and gradually build your confidence. The world of forex awaits – are you ready to conquer it?

Question & Answer Hub

What’s the minimum deposit to start forex spread betting?

Minimum deposit requirements vary significantly between brokers. Some may allow you to start with a small amount, while others require a larger initial investment. Always check the specific requirements of your chosen broker.

How much can I realistically make from forex spread betting?

There’s no guaranteed profit in forex spread betting. Profits depend on various factors, including market conditions, your trading strategy, and risk management skills. It’s crucial to approach it with realistic expectations and a focus on managing risk.

Are there any regulations I should be aware of?

Yes, forex spread betting is regulated in most countries. It’s vital to ensure your chosen broker is licensed and authorized by the relevant regulatory bodies to protect yourself against fraudulent activities.

What are the tax implications of forex spread betting?

Tax implications vary depending on your location and the specific rules and regulations of your country. Consult a tax professional for advice on how your profits and losses are taxed.