The Best Time to Trade Forex for Maximum Profit? It’s the holy grail for every forex trader, right? Think of it: unlocking the secrets to consistently beating the market, all by mastering the timing of your trades. But it’s not just about picking random hours; it’s about understanding the intricate dance of global economics, market sentiment, and the overlapping trading sessions of major financial centers. This isn’t some get-rich-quick scheme; it’s about strategic timing, informed decisions, and a healthy dose of risk management. Let’s dive in and uncover the best times to trade forex.

We’ll explore the crucial factors influencing forex price swings – from those pesky economic indicators and unpredictable geopolitical events to the ever-shifting market sentiment. We’ll analyze the impact of different time zones, showing you how to capitalize on overlapping trading hours and navigate periods of high volatility and low liquidity. We’ll even arm you with strategies to handle unexpected news and build a personalized trading plan tailored to your goals. Prepare to optimize your forex trading and potentially boost your profits.

Understanding Forex Market Dynamics

The forex market, a colossal decentralized network trading currencies, operates 24/5, presenting both immense opportunities and significant challenges. Understanding its dynamic nature is crucial for successful trading. Price movements are not random; they’re driven by a complex interplay of factors, requiring traders to be well-informed and adaptable.

Forex price movements are influenced by a confluence of economic, political, and psychological factors. Economic indicators, such as interest rate announcements, inflation data, and employment figures, often trigger significant price swings. Geopolitical events, including wars, political instability, and international relations, can dramatically shift market sentiment and currency values. Market sentiment itself, the overall feeling of optimism or pessimism among traders, plays a powerful role, often amplified by news events and social media trends. Analyzing these elements is key to anticipating potential price shifts.

Economic Indicators and Their Influence

Economic data releases are pivotal moments in forex trading. For example, a surprise increase in US interest rates might strengthen the US dollar (USD) against other currencies, as higher rates attract foreign investment. Conversely, weaker-than-expected employment numbers could weaken the USD. These indicators are regularly scheduled and widely anticipated, creating predictable moments of volatility that experienced traders leverage. Understanding the economic calendar and the likely market reaction to different data points is essential.

Geopolitical Events and Market Volatility

Geopolitical events introduce significant uncertainty into the forex market. A sudden escalation of international tensions, a political upheaval in a major economy, or a natural disaster can all lead to sharp currency fluctuations. The impact depends on the event’s severity and its perceived consequences for global trade and economic stability. For instance, the 2014 annexation of Crimea by Russia significantly impacted the value of the Russian ruble (RUB) against major currencies. Traders need to stay informed about global events and assess their potential implications for specific currency pairs.

The Impact of Time Zones on Trading Opportunities

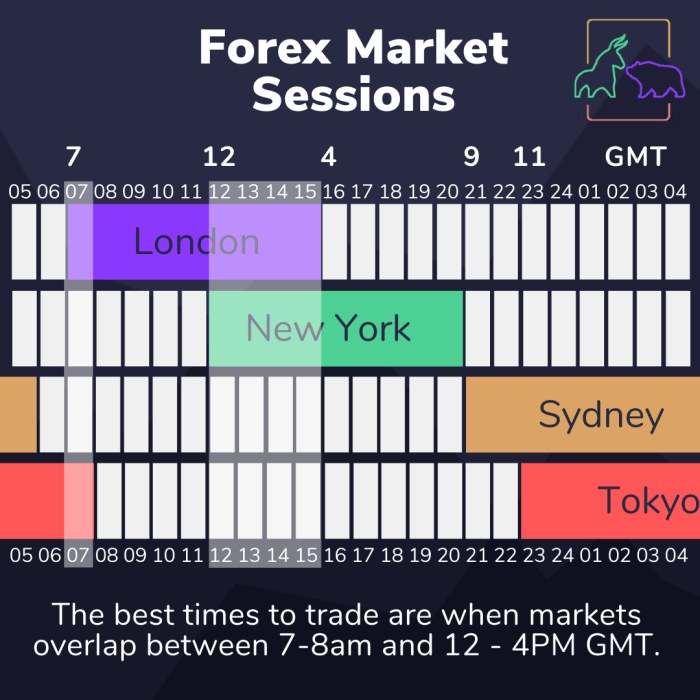

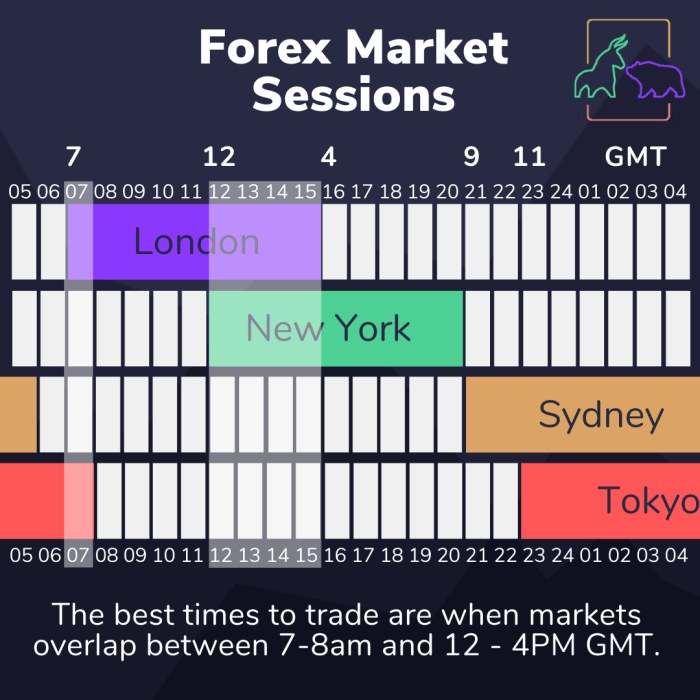

The forex market’s global nature means trading opportunities are spread across different time zones. The market opens in Sydney, moves to Tokyo, then London, and finally New York, creating a continuous trading cycle. This allows traders to capitalize on price movements occurring in various markets throughout the day. For example, a significant news event in Asia during the Asian trading session might influence prices during the European and North American sessions.

Historical Forex Events and Their Impact on Trading Times

Several historical events highlight the influence of time zones on trading. The “Flash Crash” of 2010, where the USD briefly plummeted against other currencies, occurred during the overlap between the Asian and European trading sessions, demonstrating how market events in one region can quickly impact others. Similarly, major announcements from the US Federal Reserve, typically made during the North American trading session, often trigger significant price swings across all time zones.

Trading Volumes Across Different Time Zones

The trading volume for major currency pairs varies significantly across different time zones. Generally, volume is highest during the overlap periods when multiple major financial centers are active.

| Currency Pair | Asian Session (High Volume) | European Session (High Volume) | North American Session (High Volume) |

|---|---|---|---|

| EUR/USD | Moderate | High | High |

| USD/JPY | High | Moderate | Moderate |

| GBP/USD | Low | High | High |

| AUD/USD | High | Moderate | Moderate |

Identifying Optimal Trading Hours

Timing is everything in forex trading, and understanding the global market’s rhythm is crucial for maximizing profits. The forex market operates 24/5, meaning opportunities are constantly emerging across different time zones. However, certain periods offer more favorable conditions than others, depending on factors like liquidity and volatility. Smart traders leverage this knowledge to optimize their trading strategies.

The forex market’s continuous nature presents both advantages and disadvantages. Understanding these nuances is key to successful trading.

Overlapping Trading Hours of Major Financial Centers

The overlapping hours of major financial centers—London, New York, and Tokyo—represent periods of heightened activity and liquidity. During these overlaps, trading volume significantly increases, resulting in tighter spreads and better price execution. However, this increased activity can also lead to higher volatility, making it a double-edged sword. For example, the overlap between the London and New York sessions often sees dramatic price swings as traders from both centers react to news and market trends. While this presents opportunities for significant gains, it also increases the risk of substantial losses if positions aren’t managed effectively. Careful risk management and a robust trading plan are essential during these periods.

News-Driven Trading and its Implications for Timing

Major economic news releases, such as Non-Farm Payroll reports or interest rate decisions, significantly impact currency values. News-driven trading involves capitalizing on the volatility created by these announcements. The timing of these events is crucial; the period immediately surrounding a news release often sees dramatic price swings, offering both high-risk and high-reward opportunities. For instance, the release of the US Consumer Price Index (CPI) can trigger sharp movements in the US dollar, creating short-term trading opportunities for experienced traders. However, unpredictable reactions can also lead to losses, emphasizing the importance of thorough analysis and risk mitigation. A clear understanding of market sentiment before and after news events is essential for successful news-driven trading.

Capitalizing on Periods of High Volatility and Low Liquidity

High volatility periods, often associated with news releases or geopolitical events, can present lucrative trading opportunities. However, low liquidity periods, typically occurring outside of major market overlaps, can lead to wider spreads and difficulties in executing trades. Strategies for capitalizing on high volatility include employing shorter-term trading strategies like scalping or day trading, focusing on quick profits from small price movements. Conversely, during low liquidity periods, traders might focus on longer-term strategies, reducing the frequency of trades and focusing on broader market trends. It’s crucial to adapt trading strategies based on the prevailing market conditions.

Visual Representation of the Global Trading Day and Optimal Trading Windows

Imagine a circular clock face representing the 24-hour trading day. Each segment represents a major financial center’s trading hours – Tokyo (early morning), London (mid-morning to afternoon), and New York (afternoon to evening). The overlaps between these segments, especially the London/New York overlap, are highlighted in a brighter color to visually represent periods of high liquidity and volatility, indicating optimal trading windows for many traders. The less brightly colored segments represent periods of lower liquidity, suggesting a more cautious approach. The clock clearly illustrates the continuous nature of the market and the varying levels of activity throughout the day, helping traders visualize the optimal times to engage in trading based on their risk tolerance and trading style.

Analyzing Market Volatility and Liquidity

Forex trading isn’t just about knowing the right time; it’s about understanding the market’s temperament. Volatility and liquidity are the twin forces that shape your potential profits (and losses). High volatility means prices swing wildly, offering big gains but also significant risks. High liquidity, on the other hand, means you can easily buy or sell without significantly impacting the price – crucial for smooth executions. Understanding their interplay at different times is key to maximizing your trading success.

Volatility and liquidity are intrinsically linked, often moving in tandem. Periods of high economic uncertainty or major news releases frequently see increased volatility alongside generally higher liquidity as more traders participate. Conversely, quieter periods often mean lower volatility and potentially thinner liquidity, making it harder to enter or exit positions without affecting the price.

Major Currency Pair Volatility and Liquidity Comparison

The major currency pairs (like EUR/USD, GBP/USD, USD/JPY) exhibit varying volatility and liquidity levels throughout the day. Generally, liquidity is highest during the overlapping trading sessions of major financial centers. For example, the London and New York sessions overlapping provides the highest liquidity for most pairs. Volatility tends to increase during these periods due to increased trading activity, but it’s not always a direct correlation. Unexpected news events can spike volatility regardless of the time of day.

Periods of Higher and Lower Volatility

London’s open (around 8 AM GMT) often sees a surge in activity, increasing both volatility and liquidity. The overlap of London and New York sessions (1 PM to 4 PM GMT) is typically the most volatile period for many pairs. Conversely, the Asian trading hours (before the London open) often see lower volatility and liquidity, although this can vary depending on specific news releases. The quietest period is usually during the overnight hours when major markets are closed. However, remember that significant global events can disrupt these patterns.

Economic Indicators and Their Impact

Understanding the release schedule of major economic indicators is crucial. These announcements can significantly impact volatility and liquidity.

Here’s a glimpse into some key indicators and their potential market effects:

- Non-Farm Payrolls (NFP): Released monthly by the U.S., this report on job creation can dramatically affect the USD. Expect high volatility around the release time.

- Interest Rate Decisions: Announcements from central banks (like the Federal Reserve or the European Central Bank) regarding interest rate changes always cause significant market movements. Volatility is exceptionally high during and immediately after these announcements.

- GDP Reports: Quarterly reports on a country’s economic growth significantly influence its currency’s value. Expect increased volatility and liquidity around their release.

- Inflation Data (CPI, PPI): Consumer Price Index (CPI) and Producer Price Index (PPI) reports influence monetary policy decisions, thus impacting currency values. Increased volatility is common around these releases.

Using Volatility and Liquidity Data for Trading Decisions

Effective traders use volatility and liquidity data to refine their strategies. High liquidity periods are ideal for executing trades swiftly with minimal slippage. During high volatility periods, traders might employ tighter stop-loss orders to manage risk or focus on shorter-term trades to capitalize on price swings. Conversely, low volatility periods might be suitable for longer-term strategies where gradual price movements are anticipated. It’s important to note that while high liquidity generally allows for easier entry and exit, high volatility introduces more risk, potentially leading to larger losses if the market moves against your position. Careful risk management is crucial in all trading conditions.

Impact of Global Events on Trading

The forex market, a global behemoth fueled by trillions of dollars in daily transactions, isn’t immune to the tremors of world events. Major economic announcements and geopolitical shifts can dramatically alter currency values, creating both lucrative opportunities and significant risks for traders. Understanding this interplay is crucial for navigating the market effectively and maximizing profit potential. Ignoring these external forces is akin to sailing a ship without a compass – you might get lucky, but the odds are stacked against you.

Economic announcements, such as interest rate decisions by central banks and employment reports, often trigger significant and immediate market reactions. These events provide a snapshot of a nation’s economic health, directly influencing investor sentiment and currency valuations. For example, an unexpected interest rate hike might strengthen a currency as it attracts foreign investment seeking higher returns, while a disappointing jobs report could weaken it. The timing of these announcements is critical, as the period immediately surrounding the release is usually characterized by heightened volatility.

Influence of Major Economic Announcements on Trading Times, The Best Time to Trade Forex for Maximum Profit

Interest rate decisions, typically announced by central banks, are prime examples of events that significantly impact trading. The announcement itself is usually scheduled for a specific time, and the period immediately before and after the announcement often sees increased trading activity and volatility. For example, the US Federal Reserve’s announcements frequently cause significant swings in the USD against other major currencies. Similarly, employment reports, like the Non-Farm Payroll (NFP) report in the US, often lead to sharp market movements depending on whether the figures meet or exceed expectations. Traders need to be acutely aware of the scheduled release times of these reports and adjust their trading strategies accordingly. They might choose to hold off on major trades until the market settles after the news, or, for experienced traders, they might use the volatility to their advantage through carefully managed trades.

Geopolitical Events and Forex Market Activity

Geopolitical events, from international conflicts to political instability, can significantly influence currency values. For example, escalating tensions between nations can lead to a “flight to safety,” where investors move their money into perceived safe-haven currencies like the Japanese Yen or Swiss Franc. This increased demand for these currencies can cause their value to appreciate, while other currencies might depreciate as investors sell them off. Unexpected political events, such as a sudden change in government or a major policy shift, can also create significant market volatility and impact optimal trading windows. These events are often unpredictable, requiring traders to maintain a keen awareness of global affairs and be prepared for rapid market shifts.

Examples of Unexpected News Events and Their Impact

The 2016 Brexit referendum serves as a stark example of an unexpected event that sent shockwaves through the forex market. The vote to leave the European Union resulted in a sharp and immediate decline in the value of the British Pound, creating significant losses for some traders and opportunities for others. Similarly, the COVID-19 pandemic initially triggered a massive sell-off in global markets, as investors reacted to the uncertainty and economic disruption caused by the virus. However, this initial downturn also created opportunities for traders who correctly anticipated the subsequent market recovery. These examples highlight the importance of adaptability and risk management in navigating the forex market.

Strategies for Managing Risk During Periods of High Market Uncertainty

Periods of high market uncertainty, often triggered by global events, necessitate a cautious and well-defined risk management strategy.

- Reduce Leverage: Lowering the amount of leverage used in your trades can significantly reduce your potential losses during volatile periods.

- Increase Stop-Loss Orders: Setting wider stop-loss orders can help protect your capital from significant losses if the market moves unexpectedly against your position.

- Diversify Your Portfolio: Spreading your investments across different currency pairs can help reduce overall risk exposure.

- Increase Position Sizing: Smaller position sizes limit the potential for significant losses on any single trade.

- Stay Informed: Continuously monitoring news and developments can help you anticipate potential market movements and adjust your trading strategy accordingly.

Developing a Personalized Trading Plan

Crafting a personalized forex trading plan isn’t about finding a holy grail strategy; it’s about building a system that aligns with your personality, risk tolerance, and understanding of the market. This involves defining your trading goals, choosing a strategy, and rigorously managing risk – all while considering the optimal trading hours we discussed earlier. A well-defined plan is your compass in the often-turbulent world of forex.

A successful trading plan is a living document, constantly evolving based on your experiences and market changes. It should be detailed enough to guide your decisions consistently, yet flexible enough to adapt to unexpected circumstances. Think of it as your personal forex playbook, meticulously crafted for your unique style of play.

Discover the crucial elements that make 10 Forex Trading Tips for Beginners the top choice.

Defining Trading Goals and Risk Tolerance

Before diving into specific strategies, you need to establish clear, measurable goals. Are you aiming for consistent small profits, or are you comfortable with higher risk for potentially larger returns? Defining your risk tolerance is crucial. This involves determining the maximum percentage of your trading capital you’re willing to lose on any single trade or within a specific period. For instance, a conservative trader might risk only 1% per trade, while a more aggressive trader might risk 2-3%. Remember, preserving your capital is paramount; without capital, there’s no trading.

Choosing a Trading Strategy and Timeframe

Your chosen strategy should align with your goals and risk tolerance, as well as your available time. Different strategies suit different timeframes.

For example, a scalper might utilize a very short-term strategy focusing on small price movements within minutes, ideally during periods of high liquidity. This requires constant monitoring and quick decision-making. Conversely, a swing trader might employ a longer-term strategy, holding positions for days or weeks, capitalizing on larger trends. Their optimal trading hours might be less critical as they are less concerned with intraday fluctuations.

Check The Pros and Cons of Trading Forex Full-Time to inspect complete evaluations and testimonials from users.

Here are a few examples:

- Scalping: Focuses on very short-term price movements, often using technical indicators like moving averages and RSI. Optimal trading hours often align with high liquidity periods in major currency pairs.

- Day Trading: Involves opening and closing positions within the same trading day. Strategies might involve technical analysis, chart patterns, or news-based trading.

- Swing Trading: Holds positions for several days or weeks, capitalizing on intermediate-term trends. Fundamental analysis often plays a larger role here.

- Position Trading: Holds positions for months or even years, based on long-term market forecasts. This strategy is less concerned with daily fluctuations.

Risk Management and Position Sizing

Risk management is not just about setting stop-loss orders; it’s about integrating risk into every aspect of your trading plan, including your choice of trading hours. High-volatility periods, even during optimal trading hours, may require smaller position sizes to mitigate potential losses. Position sizing is the process of determining how much capital to allocate to each trade. A common approach is to risk a fixed percentage of your account balance on each trade, regardless of the trading time. For example, if you risk 1% and your account balance is $10,000, your maximum loss per trade should be $100.

Backtesting Your Strategy

Backtesting involves testing your trading strategy on historical data to evaluate its performance under various market conditions. This is crucial for identifying potential weaknesses and refining your approach. When backtesting, pay close attention to the performance of your strategy during different times of the day. Did it perform better during the London session, the New York session, or the Asian session? This analysis will help you fine-tune your trading plan to maximize profitability within your chosen timeframe. For example, you might find your strategy consistently outperforms during the overlap between the London and New York sessions due to increased liquidity and volatility.

Utilizing Technical Analysis for Timing

Harnessing the power of technical analysis is crucial for forex traders seeking to maximize profits. By understanding and applying various technical indicators and chart patterns, traders can significantly improve their ability to identify opportune entry and exit points, ultimately increasing their chances of success in the volatile forex market. This involves a nuanced understanding of both trend identification and momentum shifts.

Technical Indicators for Entry and Exit Points

Technical indicators provide quantifiable signals based on price and volume data, helping traders to objectively assess market conditions. Moving averages, for example, smooth out price fluctuations, highlighting potential trend directions. A commonly used strategy involves buying when the price crosses above a short-term moving average and selling when it crosses below. Relative Strength Index (RSI) measures momentum, identifying overbought and oversold conditions, signaling potential reversals. The MACD (Moving Average Convergence Divergence) indicator highlights shifts in momentum by comparing two moving averages, providing buy/sell signals based on crossovers and divergence from price action. By combining several indicators, traders can build a more robust trading strategy, minimizing reliance on any single signal.

Candlestick Patterns and Trading Opportunities

Candlestick patterns, formed by the opening, closing, high, and low prices of a period, provide valuable visual clues about market sentiment and potential price movements. Bullish patterns, like the hammer and bullish engulfing pattern, suggest a potential price increase, while bearish patterns, such as the hanging man and bearish engulfing pattern, indicate potential price declines. Identifying these patterns requires practice and experience in interpreting the context of the pattern within the broader market trend. For example, a hammer pattern at the bottom of a downtrend can signal a potential reversal, while the same pattern in an uptrend might simply be a minor correction. Therefore, confirming candlestick signals with other technical indicators and fundamental analysis enhances trading accuracy.

Technical Indicators for Intraday and Swing Trading

Different indicators suit different trading timeframes. For intraday trading (short-term trades within a single day), indicators with fast responses, such as the RSI, Stochastic Oscillator, and fast moving averages (e.g., 5-period or 10-period), are often preferred. These indicators quickly adapt to rapid price changes. Swing trading (holding positions for several days to weeks) benefits from indicators that filter out short-term noise, allowing traders to focus on longer-term trends. Slower moving averages (e.g., 20-period, 50-period, 200-period), MACD, and Bollinger Bands are frequently used for swing trading strategies. The choice of indicator ultimately depends on the trader’s individual trading style and risk tolerance.

Comparison of Technical Indicators

| Indicator | Timeframe | Strengths | Weaknesses |

|---|---|---|---|

| Moving Averages (SMA, EMA) | All | Identifies trends, smooths price data | Lagging indicator, prone to whipsaws in ranging markets |

| RSI | Intraday, Swing | Identifies overbought/oversold conditions, momentum shifts | Can generate false signals, prone to divergence |

| MACD | Swing, Long-term | Identifies momentum changes, confirms trends | Can be slow to react to rapid price changes |

| Bollinger Bands | All | Shows volatility, identifies potential reversals | Can generate false signals in ranging markets |

Ultimate Conclusion

Mastering the art of timing in forex trading isn’t about finding a magic formula; it’s about understanding the market’s rhythm. By combining knowledge of global market dynamics, optimal trading windows, and effective risk management, you can significantly increase your chances of success. Remember, consistent profitability comes from a blend of strategic planning, disciplined execution, and continuous learning. So, start analyzing those market trends, refine your strategies, and watch your forex trading game level up. The path to maximum profit is paved with informed decisions and smart timing – now go out there and conquer the forex world!

FAQ Section: The Best Time To Trade Forex For Maximum Profit

What are the risks involved in forex trading, even with optimal timing?

Forex trading inherently involves risk. Even with perfect timing, factors like unexpected geopolitical events or sudden shifts in market sentiment can negatively impact your trades. Proper risk management, including diversification and stop-loss orders, is crucial.

How much capital do I need to start forex trading?

The amount of capital needed depends on your risk tolerance and trading strategy. While you can start with relatively small amounts, it’s advisable to have enough capital to withstand potential losses without jeopardizing your financial stability.

Is automated forex trading a viable option?

Automated forex trading (using robots or expert advisors) can be effective but requires careful selection and monitoring. It’s crucial to understand the underlying logic and potential risks before implementing any automated system.

How important is fundamental analysis in forex trading?

Fundamental analysis plays a crucial role alongside technical analysis. Understanding economic indicators, geopolitical events, and market sentiment provides context and helps predict potential price movements, complementing technical analysis for more informed trading decisions.